Escolar Documentos

Profissional Documentos

Cultura Documentos

Manila Bulletin, Aug. 15, 2019, House Panel OKs Bill Lowering Corporate Income Tax PDF

Enviado por

pribhor20 notas0% acharam este documento útil (0 voto)

5 visualizações1 páginaManila Bulletin, Aug. 15, 2019, House panel OKs bill lowering corporate income tax.pdf

Título original

Manila Bulletin, Aug. 15, 2019, House panel OKs bill lowering corporate income tax.pdf

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoManila Bulletin, Aug. 15, 2019, House panel OKs bill lowering corporate income tax.pdf

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

5 visualizações1 páginaManila Bulletin, Aug. 15, 2019, House Panel OKs Bill Lowering Corporate Income Tax PDF

Enviado por

pribhor2Manila Bulletin, Aug. 15, 2019, House panel OKs bill lowering corporate income tax.pdf

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 1

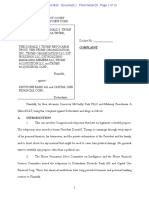

TEA NATIOITNS EADING NEWiPAPDN

THURSDAY August 15, 2019

House panel OKs bill lowering

corporate income tax

ff ffi,ffiii grant of fiscal incentives to investors Bill. The measure is the second paek-

and locators. age of the Duterte administration's

The House Committee on Ways Voting 27 f.or and 2 against,'the Comprehensive Tax Reform Program-

and Means overwhelmingly approved House panel, chaired by Albay Rep. (CTRP).

yesterday a bill seeking to reduce the Joey Salceda, passed House Bill (HB) "This is a national imperative. We

corporate income ta:r rate from 30 per- 313, the Corporate Income Tax and need to lower taxes to remain \

cent to.20 nercent anlt rati_onlize the Incentive Rationalization Act (CITIM) competitive," Sai..A", ptingi- >4

, House panel OKs... <1 who enjoyprcferential rates, to the 30percent

ClTorthe adjusted CIT ,

The bill grants the President the powbr to

pal author of the bill said, before his panel disposed of as matters ake-ady qeported upon ,

grant incentives if the project has a compre.

approved the measure and endorsed it for the approval of majorityof fhe nnEmbers of the hensive sustainable development plan and will

plenary discussion. ,committee presenf therc being a quorumn" bring in at least US$ 200 million.

HB 313 is the rrersion of the measune ap- dccordingto the House Rule. Itwill grant income incentives for a ma:ci-

prorred on third dnO nnU reading during tlie me Cmng bil was approved, a day after mum of five years, removing perpetual five-

prwious 17th Congess. It is former$ known aB the Salcnda panel passed House Bill 1026, which percent on gross income earned (GIE) and

the Tlur Reform for Athacting Better and High- seeks to raise the excise tax on alcohol products. limiting income tax holiday 0TfD,

quality Opportunities ffR"ABAIIO) bill. fire pmposed imposition of higher excise tax Tlrc measure provides that in lieu of ITII or

It yas Nueva*Ec[ia Rep. Estrellita Su- rates onalcohol pruducts'is the kckage 2 Plus B rcduced CII incentives may be extended on a

ansing vice chairman of the House Committee of the Duterte adminishation's Comprehensive per industrybasis, upon BOI approval. It also

on Ways and Means and one of the authors of Tbx Reform Pnogram CITRP). reduces the 18 percent CIT by one pereentage

the bill, who moved for the apprural of the bill . Bayan Muira party-list Rep. Carlos Isagani point every cittreryeaq and adds trvo years io

for plenary cunsideration. Zamte and Gabriela partylist Rep. Arlene incentives 0nclusive of one-year ITHP) for the

The former chairperson of the House Brosas stron$y opposed the passage of the following pmjects: those located in lagging ar-

Committee on Ways and Means during the CITINAbiU eas, in areas recovering foom armed cordict or

previous l?th Congress again invoked Rule HB 313 seeks to reduce the currentS0 per- mqior disasbrE, in agri{usinds outside major

10 Sqtion 48 of the llouse of Representatirres, cent corporate incume tax by two per two years. urban areas, and those relocatdfrom Mebo

wtrich'provides that the measunes that harre Itpursues to exempt the Home Derrelopment Manila and nearbyurban aseas.

been dpprorred'on third and final reading by the Mutual Fbnd fuom ineome taxation, given that "This bill will strive to eneourage investors

L,ower Charnberin thepreviouq Congrcss may the Social Security Sptem (SSS), Philippine and locators to reapply after the five-year or

be refened to the plenary upon the approval of Health Insuranse Corporation (PHIC), and seven-)rear period, to qualiff br another firre

'

the majority of the panel members. Corrernment Sewice Insurance System (GSIS) years of incentives, and the mqasure also

"In case of bills or resolutions that arc are alreadyexempted. specifies that VAT treatment shall be based on

identified as priority meariunes of the House, fire measUne also seela to rcmove the op- location and export sales," Salceda said.

which were previously filed in the immediateg tion for corporations, ihcluding resident fureign He said the plenary deliberation on the

preeeding Congess and have already been corp,orations, lo avail of the 15 percerrt gross CITIRA bill is e:rpected next week (Charissa

appry,gpon ttrird reading, the same may be income tax and subject corporate taxpayers M. Luci-Atienza)

u 7:eoilr toAq€,t

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Phil. Constitution, General Information, Current EventsDocumento6 páginasPhil. Constitution, General Information, Current EventsShieliie Junio Farral78% (76)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Philippine Budget ProcessDocumento6 páginasPhilippine Budget Processdara100% (1)

- G.R. No. L-1123. March 5, 1947 DigestDocumento2 páginasG.R. No. L-1123. March 5, 1947 DigestMaritoni Roxas67% (3)

- Constitution and Amendments Cheat SheetDocumento7 páginasConstitution and Amendments Cheat SheetPrice MarshallAinda não há avaliações

- Philippine Star, Mar. 12, 2020, Sara Gets CA Nod As Army Reserve Colonel PDFDocumento1 páginaPhilippine Star, Mar. 12, 2020, Sara Gets CA Nod As Army Reserve Colonel PDFpribhor2Ainda não há avaliações

- Peoples Tonight, Mar. 12, 2020, House Speaker Alan Peter Cayetano and Former President and Speaker Gloria Macapagal-Arroyo PDFDocumento1 páginaPeoples Tonight, Mar. 12, 2020, House Speaker Alan Peter Cayetano and Former President and Speaker Gloria Macapagal-Arroyo PDFpribhor2Ainda não há avaliações

- Tempo, Mar. 12, 2020, House OKs Hike in Road Users Tax PDFDocumento1 páginaTempo, Mar. 12, 2020, House OKs Hike in Road Users Tax PDFpribhor2Ainda não há avaliações

- Peoples Tonight, Mar. 12, 2020, House OKs Creation of Department For OFWs PDFDocumento1 páginaPeoples Tonight, Mar. 12, 2020, House OKs Creation of Department For OFWs PDFpribhor2Ainda não há avaliações

- Philippine Star, Mar. 12, 2020, House OKs Bill Doubling Road Users Tax PDFDocumento1 páginaPhilippine Star, Mar. 12, 2020, House OKs Bill Doubling Road Users Tax PDFpribhor2Ainda não há avaliações

- Philippine Star, Mar. 12, 2020, House Approves OFW Department Bill PDFDocumento1 páginaPhilippine Star, Mar. 12, 2020, House Approves OFW Department Bill PDFpribhor2Ainda não há avaliações

- Philippine Star, Mar. 12, 2020, Lack of Test Kits Equipment Hamper Fight Vs COVID-19 PDFDocumento1 páginaPhilippine Star, Mar. 12, 2020, Lack of Test Kits Equipment Hamper Fight Vs COVID-19 PDFpribhor2Ainda não há avaliações

- Peoples Journal, Mar. 12, 2020, COVID-19 Patient in Caloocan Hospital A Resident of Bulacan PDFDocumento1 páginaPeoples Journal, Mar. 12, 2020, COVID-19 Patient in Caloocan Hospital A Resident of Bulacan PDFpribhor2Ainda não há avaliações

- Philippine Daily Inquirer, Mar. 12. 2020, ABS - CBN To Get Provisional License PDFDocumento1 páginaPhilippine Daily Inquirer, Mar. 12. 2020, ABS - CBN To Get Provisional License PDFpribhor2Ainda não há avaliações

- Peoples Tonight, Mar. 12, 2020, P46B Masisisngil Sa Power Firms PDFDocumento1 páginaPeoples Tonight, Mar. 12, 2020, P46B Masisisngil Sa Power Firms PDFpribhor2Ainda não há avaliações

- Philippine Daily Inquirer, Mar. 12, 2020, Duque Pressed On Social Distancing To Kiss or Not To Kiss PDFDocumento1 páginaPhilippine Daily Inquirer, Mar. 12, 2020, Duque Pressed On Social Distancing To Kiss or Not To Kiss PDFpribhor2Ainda não há avaliações

- Philippine Star, Mar. 12, 2020, Ex-Catanduanes Lawmaker Charged Over Shabu Lab PDFDocumento1 páginaPhilippine Star, Mar. 12, 2020, Ex-Catanduanes Lawmaker Charged Over Shabu Lab PDFpribhor2Ainda não há avaliações

- Peoples Tonight, Mar. 12, 2020, House Panel Approves Parking Fee Regulations PDFDocumento1 páginaPeoples Tonight, Mar. 12, 2020, House Panel Approves Parking Fee Regulations PDFpribhor2Ainda não há avaliações

- Peoples Journal, Mar. 12, 2020, Ribbon Cutting House Speaker Alan Peter Cayetano and Former President and Speaker Gloria Macapagal-Arroyo PDFDocumento1 páginaPeoples Journal, Mar. 12, 2020, Ribbon Cutting House Speaker Alan Peter Cayetano and Former President and Speaker Gloria Macapagal-Arroyo PDFpribhor2Ainda não há avaliações

- Peoples Journal, Mar. 12, 2020, Yedda Welcome Leyte Local Execs Tingog Party-List Rep. Yedda Marie K. Romualdez PDFDocumento1 páginaPeoples Journal, Mar. 12, 2020, Yedda Welcome Leyte Local Execs Tingog Party-List Rep. Yedda Marie K. Romualdez PDFpribhor2Ainda não há avaliações

- Peoples Journal, Mar. 12, 2020, House Okays Higher Road Users Tax PDFDocumento1 páginaPeoples Journal, Mar. 12, 2020, House Okays Higher Road Users Tax PDFpribhor2Ainda não há avaliações

- Peoples Journal, Mar. 12, 2020, Power Firms To Pay Debt PDFDocumento1 páginaPeoples Journal, Mar. 12, 2020, Power Firms To Pay Debt PDFpribhor2Ainda não há avaliações

- Ngayon, Mar. 12, 2020, Tricycle Ban, Maka-Mayaman - Solon PDFDocumento1 páginaNgayon, Mar. 12, 2020, Tricycle Ban, Maka-Mayaman - Solon PDFpribhor2Ainda não há avaliações

- Peoples Journal, Mar. 12, 2020, House Okays Bill Creating Department of Filipinos Overseas PDFDocumento1 páginaPeoples Journal, Mar. 12, 2020, House Okays Bill Creating Department of Filipinos Overseas PDFpribhor2Ainda não há avaliações

- Peoples Journal, Mar. 12, 2020, House Panel Approves Parking Regulation Measure PDFDocumento1 páginaPeoples Journal, Mar. 12, 2020, House Panel Approves Parking Regulation Measure PDFpribhor2Ainda não há avaliações

- Manila Bulletin, Mar. 12, 2020, House Panel Finally Okays Parking Regulation Measure PDFDocumento1 páginaManila Bulletin, Mar. 12, 2020, House Panel Finally Okays Parking Regulation Measure PDFpribhor2Ainda não há avaliações

- Manila Standard, Mar. 12, 2020, Mayor Sara Reporting For Duty As Army Colonel (Res.) PDFDocumento1 páginaManila Standard, Mar. 12, 2020, Mayor Sara Reporting For Duty As Army Colonel (Res.) PDFpribhor2Ainda não há avaliações

- Manila Standard, Mar. 12, 2020, Labor Group Slams Bill On Foreign Ownership PDFDocumento1 páginaManila Standard, Mar. 12, 2020, Labor Group Slams Bill On Foreign Ownership PDFpribhor2Ainda não há avaliações

- Manila Times, Mar. 12, 2020, Court Orders Garin Trial PDFDocumento2 páginasManila Times, Mar. 12, 2020, Court Orders Garin Trial PDFpribhor2Ainda não há avaliações

- Manila Times, Mar. 12, 2020, House Passes Bill Creating OFW Dept PDFDocumento1 páginaManila Times, Mar. 12, 2020, House Passes Bill Creating OFW Dept PDFpribhor2Ainda não há avaliações

- Manila Standard, Mar. 12, 2020, QC Court To Hear Damage Suit vs. Garin PDFDocumento1 páginaManila Standard, Mar. 12, 2020, QC Court To Hear Damage Suit vs. Garin PDFpribhor2Ainda não há avaliações

- Manila Standard, Mar. 12, 2020, Panel Sets 3 Conditions in Tax Amnesty Ok PDFDocumento1 páginaManila Standard, Mar. 12, 2020, Panel Sets 3 Conditions in Tax Amnesty Ok PDFpribhor2Ainda não há avaliações

- Manila Standard, Mar. 12, 2020, Inauguration House Speaker Alan Peter Cayetano and Former President and Speaker Gloria Macapagal Arroyo PDFDocumento1 páginaManila Standard, Mar. 12, 2020, Inauguration House Speaker Alan Peter Cayetano and Former President and Speaker Gloria Macapagal Arroyo PDFpribhor2Ainda não há avaliações

- Legislative Department Structure Case NotesDocumento18 páginasLegislative Department Structure Case NotesTanya PimentelAinda não há avaliações

- Trump Et Al v. Deutsche Bank Et. AlDocumento13 páginasTrump Et Al v. Deutsche Bank Et. AlJacqueline Thomsen100% (3)

- Readings 40 USA Presidential ElectionsDocumento53 páginasReadings 40 USA Presidential ElectionsS RAinda não há avaliações

- Case Digest - Rodolfo Farinas Vs Executive Secretary GR 147387 Dec. 10, 2003Documento4 páginasCase Digest - Rodolfo Farinas Vs Executive Secretary GR 147387 Dec. 10, 2003Lu CasAinda não há avaliações

- Angel Manuel Cintron Garcia v. Carlos Romero Barcelo, Etc., Partido Popular Democratico, 671 F.2d 1, 1st Cir. (1982)Documento17 páginasAngel Manuel Cintron Garcia v. Carlos Romero Barcelo, Etc., Partido Popular Democratico, 671 F.2d 1, 1st Cir. (1982)Scribd Government DocsAinda não há avaliações

- Chapt. 1-3Documento15 páginasChapt. 1-3Jarvin David ResusAinda não há avaliações

- House vs. SenateDocumento2 páginasHouse vs. Senatelilyo6wilkesAinda não há avaliações

- Annotated RulesDocumento89 páginasAnnotated RulesjonathanoharaAinda não há avaliações

- (LET REVIEWER) BSED Social Studies MajorDocumento29 páginas(LET REVIEWER) BSED Social Studies MajorBeth GuiangAinda não há avaliações

- Chapter 17Documento3 páginasChapter 17Norhida PantaranAinda não há avaliações

- Article VI Legislative DepartmentDocumento87 páginasArticle VI Legislative DepartmentDjumeil Gerard TinampayAinda não há avaliações

- Volume 43, Issue 9 - March 2, 2012Documento76 páginasVolume 43, Issue 9 - March 2, 2012BladeAinda não há avaliações

- Committee On Veterans' Affairs House of Representatives: HearingDocumento217 páginasCommittee On Veterans' Affairs House of Representatives: HearingScribd Government DocsAinda não há avaliações

- Organizational Meeting On Adoption of Committee RulesDocumento35 páginasOrganizational Meeting On Adoption of Committee RulesScribd Government DocsAinda não há avaliações

- Vol.12 Issue 23 October 5-11, 2019Documento39 páginasVol.12 Issue 23 October 5-11, 2019Thesouthasian TimesAinda não há avaliações

- 4.socrates Vs Comelec (Hagedorn)Documento25 páginas4.socrates Vs Comelec (Hagedorn)Kar EnAinda não há avaliações

- Multinational Business Finance 14th Edition Eiteman Test BankDocumento36 páginasMultinational Business Finance 14th Edition Eiteman Test Bankrecolletfirework.i9oe100% (23)

- Begun and Held in Metro Manila, On Monday, The Twenty-Third Day of July, Two Thousand EighteenDocumento15 páginasBegun and Held in Metro Manila, On Monday, The Twenty-Third Day of July, Two Thousand EighteenGlenn S. GarciaAinda não há avaliações

- James Mathew Horning ChargeDocumento9 páginasJames Mathew Horning ChargeLaw&CrimeAinda não há avaliações

- Branches of The GovernmentDocumento14 páginasBranches of The GovernmentEjay P. JuadaAinda não há avaliações

- PPG Q2 Week 1 Module 6 The ExecutiveDocumento4 páginasPPG Q2 Week 1 Module 6 The ExecutiveCarlo Troy Acelott ManaloAinda não há avaliações

- House Hearing, 113TH Congress - ''Reins Act of 2013'': Promoting Jobs, Growth and American CompetitivenessDocumento141 páginasHouse Hearing, 113TH Congress - ''Reins Act of 2013'': Promoting Jobs, Growth and American CompetitivenessScribd Government DocsAinda não há avaliações

- Gatekeepers To Opportunity - Gender Disparities in Congressional Nominations To The Military Service Academies 7.26.19Documento29 páginasGatekeepers To Opportunity - Gender Disparities in Congressional Nominations To The Military Service Academies 7.26.19Helen BennettAinda não há avaliações

- Tax Adminin L 3 CTODocumento11 páginasTax Adminin L 3 CTOZIHERAMBERE AnastaseAinda não há avaliações

- Santiago v. Guingona Jr. (1998)Documento3 páginasSantiago v. Guingona Jr. (1998)Andre Philippe Ramos100% (2)

- The Pledge - Letter To Democratic CandidatesDocumento3 páginasThe Pledge - Letter To Democratic CandidatesMarkforCongressAinda não há avaliações