Escolar Documentos

Profissional Documentos

Cultura Documentos

Tax-May 8

Enviado por

Ella Apelo100%(1)100% acharam este documento útil (1 voto)

241 visualizações1 página1. Stark Corporation had gross income of P1,000,000 and expenses of P1,200,000 in 2014, gross income of P2,000,000 and expenses of P1,900,000 in 2015, and gross income of P3,000,000 and expenses of P2,950,000 in 2016 and 2017. In 2018, Stark Corporation had gross income of P980,000 and expenses of P500,000.

2. Vers Corporation had sales of P1,700,000 and costs of P1,050,000 in 2017 and sales of P2,300,000 and costs of P1,425,000 in 2018.

3. Shield Corporation had normal

Descrição original:

Título original

Tax-May 8.docx

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documento1. Stark Corporation had gross income of P1,000,000 and expenses of P1,200,000 in 2014, gross income of P2,000,000 and expenses of P1,900,000 in 2015, and gross income of P3,000,000 and expenses of P2,950,000 in 2016 and 2017. In 2018, Stark Corporation had gross income of P980,000 and expenses of P500,000.

2. Vers Corporation had sales of P1,700,000 and costs of P1,050,000 in 2017 and sales of P2,300,000 and costs of P1,425,000 in 2018.

3. Shield Corporation had normal

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

100%(1)100% acharam este documento útil (1 voto)

241 visualizações1 páginaTax-May 8

Enviado por

Ella Apelo1. Stark Corporation had gross income of P1,000,000 and expenses of P1,200,000 in 2014, gross income of P2,000,000 and expenses of P1,900,000 in 2015, and gross income of P3,000,000 and expenses of P2,950,000 in 2016 and 2017. In 2018, Stark Corporation had gross income of P980,000 and expenses of P500,000.

2. Vers Corporation had sales of P1,700,000 and costs of P1,050,000 in 2017 and sales of P2,300,000 and costs of P1,425,000 in 2018.

3. Shield Corporation had normal

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 1

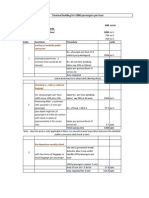

INCOME TAXATION 5.

Stark Corporation, a domestic corporation, had the following selected data:

CO-OWNERSHIP, ESTATES AND TRUSTS; PARTNERSHIP AND CORPORATION YEAR GROSS INCOME EXPENSES

TRUE OR FALSE 2014 P1,000,000 P1,200,000

1. Resident foreign corporations are taxable in the Philippines on income earned in 2015 2,000,000 1,900,000

the United States. 2016 3,000,000 2,950,000

2. If a corporation distributes its assets to its stockholders upon dissolution, this 2017 1,000,000 1,100,000

kind of corporate distribution will result in stock dividends. 2018 980,000 500,000

3. A corporation which was registered with the Bureau of Internal Revenue in May, Determine the taxable income in 2018.

2011 shall be covered by MCIT in 2014. 6. Vers Corporation has the following data:

4. If the quarterly income tax is based on MCIT from the previous taxable year/s 2017 2018

shall not be allowed to be credited. Sales P1,700,000 P2,300,000

5. The property, rights and obligations of a person which are not extinguished by Cost of sales 1,050,000 1,425,000

his death and also those which have accrued thereto since the opening of the Operating expenses 615,000 480,000

succession is called estate. a. What is the income tax payable in 2017?

6. Devisee is an heir who inherits personal property by will. b. What is the income tax payable in 2018?

7. Revocable trusts render the trustor, not the trust itself subject to income tax. 7. Shield Corporation has the following data during the year:

8. Partners of a taxable partnership are considered as shareholders thereby profits 1st Quarter 2nd Quarter

distributed to them by the partnership are considered as dividends. Normal income tax P10,000 P12,000

9. A general professional partnership is exempt from income tax but is required to Minimum corporate income tax 8,000 25,000

file an income tax return for statistical purposes. Taxes withheld during the quarter 2,000 3,000

10. If a taxable partnership sustains net operating loss, the partners shall be entitled Excess MCIT prior year 3,000

to deduct their respective shares in the net operating loss from their individual Excess withholding tax prior year 1,000

gross income. a. What is the income tax payable for the 1st quarter?

b. What is the income tax payable for the 2nd quarter?

PROBLEMS 8. Pearson, Darby, Specter and Co., CPAs (PDS & Co.), are partners of an

1. Wes died on January 1, 2015. He left a gross estate with a cost of P4,000,000 accounting firm. The 2018 financial records of the firm disclosed the following:

but valued at P3,500,000 under an administrator. During the year, the gross Service revenue P4,490,000

income derived from the business of the estate was P400,000 while the related Cost of services 1,610,000

expenses amounted to P150,000. Beneficiaries Michaela and Laurel were given Operating expenses 800,000

P100,000 each. What is the income tax due on the estate of Wes? Rental income 500,000

2. In 2018, Olenna created two separate trusts for her son Mace, and appointed Interest income from bank deposit 200,000

Loras and Margaery as trustees. The business income of the trusts are as Interest income from FCDS deposit 280,000

follows: Specter is also engaged in business with the following data for the year:

Trustee Loras Trustee Margaery Sales P2,500,000

Net Income P1,200,000 P2,000,000 Cost of sales 1,250,000

Income from trusts 500,000 750,000 Operating expenses 550,000

a. What is the consolidated taxable income of trusts? a. How much is the distributive share of each partner in the total income of

b. What are the income taxes payable of Trustee Loras and Trustee the GPP?

Margaery? b. How much is the taxable income of Specter in 2018?

3. Snow Corporation, a domestic corporation has the following records of income c. How much is the taxable income of Specter in 2018 assuming PDS & Co.

and expenses in 2018: opted to use Optional Standard deduction?

Gross income, net of 1% withholding tax P1,435,500 d. How much is the taxable income of Specter in 2018 assuming the GPP

Expenses 756,000 and the partner opted to use Optional Standard deduction?

Rent income, net of 5% withholding tax 136,800 9. Bimbam and Company, a business partnership, had the following data of income

Expenses on rent 34,600 and expenses.

Dividend from domestic corporation 25,000 Gross income P750,000

Royalty 80,000 Expenses 200,000

Interest from bank deposit with PNB, gross of tax 15,000 Dividend from a domestic corporation 75,000

a. What is the income tax payable? Interest in bank deposit (gross of tax) 10,000

b. What is the total final taxes payable? Partners Bim and Bam share profits and losses in the ratio of 55% and 45%,

4. Hessington, Inc., a resident foreign corporation, has earned the following income respectively.

during 2018. a. What is the income tax payable of Bimbam and Company?

Dividend income from: b. What are the final taxes on the respective share of Bim and Bam in the

Microsoft, a non-resident corporation P500,000 partnership income?

Intel, a resident foreign corporation 400,000 10. Ghost, Nymeria and Company, a partnership of CPAs, had a gross income of

IBM, a domestic corporation 300,000 P220,000 and expenses of P85,000 during the year.

Interest income from: Ghost Nymeria

Current account, BDO 600,000 Share in profit and loss ratio 75% 25%

Savings deposit, ABN-AMRO bank, UK 700,000 Income from other business P125,000 P325,000

US dollar deposit (FCDU)-BPI Makati 800,000 Expenses 80,000 190,000

Royalty income from various domestic corporations 100,000 Amount withdrawn from partnership 30,000 12,500

Additional information: Filing status Married Unmarried

The ratio of Microsoft’s gross income in the Philippines over Dependent children None 2

worldwide income for the past three years is 40%. a. What is the income tax payable of the partnership?

The ratio of Intel’s gross income in the Philippines over worldwide b. What is the taxable income of Ghost and Nymeria?

income for the past three years is 60%.

The ratio of IBM’s gross income in the Philippines over worldwide

income for the past three years is 80%.

a. How much is the total income tax expense of Hessington Inc.?

b. Assuming Hessington Inc. is a domestic corporation, how much is its total

income tax expense?

Você também pode gostar

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineAinda não há avaliações

- Incotax GT1 PDFDocumento3 páginasIncotax GT1 PDFSoahAinda não há avaliações

- Statement 2: Associations and Mutual Fund Companies, For Income Tax Purposes, Are Excluded in TheDocumento7 páginasStatement 2: Associations and Mutual Fund Companies, For Income Tax Purposes, Are Excluded in TheEdward Glenn Bagui0% (1)

- Landlord Tax Planning StrategiesNo EverandLandlord Tax Planning StrategiesAinda não há avaliações

- This Study Resource WasDocumento6 páginasThis Study Resource WasMay RamosAinda não há avaliações

- Corporation ActivityDocumento4 páginasCorporation ActivityLFGS FinalsAinda não há avaliações

- Afar 2019Documento9 páginasAfar 2019TakuriAinda não há avaliações

- Tax DeductionsDocumento4 páginasTax DeductionsAnonymous LC5kFdtcAinda não há avaliações

- AccountingDocumento9 páginasAccountingTakuriAinda não há avaliações

- Tax On Compensation, Dealings in Properties and CorporationDocumento6 páginasTax On Compensation, Dealings in Properties and CorporationOG FAM0% (1)

- Tax 1 Problem SolvingDocumento4 páginasTax 1 Problem SolvingSheila Mae Araman100% (2)

- KF Eliminations For RMYCDocumento8 páginasKF Eliminations For RMYCFranz Josef De GuzmanAinda não há avaliações

- Tax On Individuals Quiz - ProblemsDocumento3 páginasTax On Individuals Quiz - ProblemsJP Mirafuentes100% (1)

- PDF May 2017 - CompressDocumento7 páginasPDF May 2017 - Compresscasual viewerAinda não há avaliações

- PRe Departmental ReviwersDocumento7 páginasPRe Departmental ReviwersCañon, Lorenz GeneAinda não há avaliações

- TX 201Documento4 páginasTX 201Pau SantosAinda não há avaliações

- Tax On PartnershipDocumento3 páginasTax On PartnershipPrankyJellyAinda não há avaliações

- Elimination Round QuestionnairesDocumento5 páginasElimination Round Questionnairesmitakumo uwuAinda não há avaliações

- May 2017 PDF FreeDocumento7 páginasMay 2017 PDF FreeJorenz UndagAinda não há avaliações

- May 2017 PDF FreeDocumento7 páginasMay 2017 PDF FreeJorenz UndagAinda não há avaliações

- May 2017Documento7 páginasMay 2017Patrick Arazo0% (1)

- Tax Quiz 1Documento3 páginasTax Quiz 1KimbabAinda não há avaliações

- Basic Accounting - With AnswersDocumento12 páginasBasic Accounting - With AnswersMarie MeridaAinda não há avaliações

- 03 - Handout - Partnership DissolutionDocumento4 páginas03 - Handout - Partnership DissolutionJanysse CalderonAinda não há avaliações

- Advacc Midterm ExamDocumento13 páginasAdvacc Midterm ExamJosh TanAinda não há avaliações

- 6804 - Statement of Comprehensive IncomeDocumento2 páginas6804 - Statement of Comprehensive IncomeAins M. BantuasAinda não há avaliações

- Acc05 Far Handout 7Documento5 páginasAcc05 Far Handout 7Jullia BelgicaAinda não há avaliações

- Accounting CycleDocumento4 páginasAccounting CycleRommel Angelo AgacitaAinda não há avaliações

- 93-09 - Capital AssetsDocumento8 páginas93-09 - Capital AssetsJuan Miguel UngsodAinda não há avaliações

- 4.2 Assignment - Principles To Accounting Period and MethodsDocumento7 páginas4.2 Assignment - Principles To Accounting Period and MethodsRoselyn LumbaoAinda não há avaliações

- Accounting For Income TaxDocumento4 páginasAccounting For Income TaxShaira Bugayong0% (2)

- IAET TaxationDocumento2 páginasIAET TaxationRandy Manzano100% (1)

- #3 Deferred Taxes PDFDocumento3 páginas#3 Deferred Taxes PDFjanus lopezAinda não há avaliações

- 6884 - Statement of Comprehensive IncomeDocumento2 páginas6884 - Statement of Comprehensive IncomeMaximusAinda não há avaliações

- FAR ReviewDocumento9 páginasFAR ReviewJude Vincent VittoAinda não há avaliações

- Finals - III. Capital Assets - ProblemsDocumento6 páginasFinals - III. Capital Assets - ProblemsJovince Daño DoceAinda não há avaliações

- Advance Accounting Materials 2Documento4 páginasAdvance Accounting Materials 2Andrea Lyn Salonga CacayAinda não há avaliações

- ERROR CORRECTION Answer PDFDocumento3 páginasERROR CORRECTION Answer PDFreenza velasco100% (2)

- 0456Documento4 páginas0456Usman Shaukat Khan100% (1)

- TAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireDocumento15 páginasTAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireGrace Love Yzyry LuAinda não há avaliações

- Tax Computations SampleDocumento5 páginasTax Computations Samplelcsme tubodaccountsAinda não há avaliações

- Equipment Shall Be ExcludedDocumento2 páginasEquipment Shall Be ExcludedKatherine MagpantayAinda não há avaliações

- Reviewer For Final Examination - ProblemsDocumento11 páginasReviewer For Final Examination - Problemsreynald animosAinda não há avaliações

- FINALS QUIZ Fin3Documento11 páginasFINALS QUIZ Fin3Erika Larinay100% (1)

- FINALS QUIZ Fin3Documento11 páginasFINALS QUIZ Fin3Angela MartiresAinda não há avaliações

- INVESTMENTS With AnswersDocumento3 páginasINVESTMENTS With AnswersShaira BugayongAinda não há avaliações

- Cbea FAR 01 Lecture 02Documento16 páginasCbea FAR 01 Lecture 02Osirisheen Aizle CubacubAinda não há avaliações

- TAXDocumento10 páginasTAXJeana Segumalian100% (3)

- Quiz Week 2 No AnswerDocumento10 páginasQuiz Week 2 No AnswerKatherine EderosasAinda não há avaliações

- Straight Problems Income Tax Bsa2Documento2 páginasStraight Problems Income Tax Bsa2dimpy dAinda não há avaliações

- Exercise 1-1 To 1-5Documento5 páginasExercise 1-1 To 1-5Jennette ToAinda não há avaliações

- Acco 30103 Partnership Formation and Operations 04-2022Documento3 páginasAcco 30103 Partnership Formation and Operations 04-2022Zyrille Corrine GironAinda não há avaliações

- Corporation Income Tax ProblemsDocumento3 páginasCorporation Income Tax ProblemsRandy Manzano50% (2)

- 7295 - Single EntryDocumento2 páginas7295 - Single EntryJulia MirhanAinda não há avaliações

- Tax1 Q Chapter-11 12 13 With-AnswerDocumento2 páginasTax1 Q Chapter-11 12 13 With-AnswerPrincess Edelyn CastorAinda não há avaliações

- Quiz 2 KeyDocumento5 páginasQuiz 2 KeyRosie PosieAinda não há avaliações

- HO2 Partnership Dissolution and Liquidation RevisedDocumento5 páginasHO2 Partnership Dissolution and Liquidation RevisedChristianAquinoAinda não há avaliações

- Profit or Loss Distribution by Mere RatioDocumento5 páginasProfit or Loss Distribution by Mere RatiosunshineAinda não há avaliações

- 06M Midterm Quiz No. 2 Income Tax On CorporationsDocumento4 páginas06M Midterm Quiz No. 2 Income Tax On CorporationsMarko IllustrisimoAinda não há avaliações

- System InfrastructureDocumento13 páginasSystem InfrastructureElla ApeloAinda não há avaliações

- Factors Affecting The Academic Performance of Student Nurses: A Cross-Sectional StudyDocumento9 páginasFactors Affecting The Academic Performance of Student Nurses: A Cross-Sectional StudyElla ApeloAinda não há avaliações

- On-Line/Memo Update (And Subsequent Processing)Documento1 páginaOn-Line/Memo Update (And Subsequent Processing)Ella ApeloAinda não há avaliações

- Tax-May 2Documento1 páginaTax-May 2Ella ApeloAinda não há avaliações

- CH 11Documento43 páginasCH 11Ella ApeloAinda não há avaliações

- CH 3Documento45 páginasCH 3Ella ApeloAinda não há avaliações

- CH 4Documento73 páginasCH 4Ella ApeloAinda não há avaliações

- CH 6Documento51 páginasCH 6Ella ApeloAinda não há avaliações

- Api 4G PDFDocumento12 páginasApi 4G PDFAluosh AluoshAinda não há avaliações

- El Poder de La Disciplina El Hábito Que Cambiará Tu Vida (Raimon Samsó)Documento4 páginasEl Poder de La Disciplina El Hábito Que Cambiará Tu Vida (Raimon Samsó)ER CaballeroAinda não há avaliações

- Edu602 Ubd TemplateDocumento2 páginasEdu602 Ubd Templateapi-481192424Ainda não há avaliações

- Anna May de Leon Galono, A089 528 341 (BIA Sept. 29, 2015)Documento7 páginasAnna May de Leon Galono, A089 528 341 (BIA Sept. 29, 2015)Immigrant & Refugee Appellate Center, LLCAinda não há avaliações

- UPSC IAS Mains LAST 10 Year Papers Law OptionalDocumento42 páginasUPSC IAS Mains LAST 10 Year Papers Law Optionaljooner45Ainda não há avaliações

- Q. 15 Insurance Regulatory and Development AuthorityDocumento2 páginasQ. 15 Insurance Regulatory and Development AuthorityMAHENDRA SHIVAJI DHENAKAinda não há avaliações

- Untitled PresentationDocumento23 páginasUntitled Presentationapi-543394268Ainda não há avaliações

- Indian Board of Alternative Medicine: Partner-Pub-1166 ISO-8859-1Documento14 páginasIndian Board of Alternative Medicine: Partner-Pub-1166 ISO-8859-1vipinAinda não há avaliações

- Questions & Answers: Webinar: Leveraging Caesar Ii and Featools Featuring PRGDocumento8 páginasQuestions & Answers: Webinar: Leveraging Caesar Ii and Featools Featuring PRGMina MagdyAinda não há avaliações

- Bus Terminal Building AreasDocumento3 páginasBus Terminal Building AreasRohit Kashyap100% (1)

- IC Product Marketing Plan 8609Documento7 páginasIC Product Marketing Plan 8609Pandi IndraAinda não há avaliações

- Kenya's Top 10 Tourist SpotsDocumento23 páginasKenya's Top 10 Tourist SpotsAaron LopezAinda não há avaliações

- Jee Mathmatic PaperDocumento16 páginasJee Mathmatic PaperDeepesh KumarAinda não há avaliações

- SAmple Format (Police Report)Documento3 páginasSAmple Format (Police Report)Johnpatrick DejesusAinda não há avaliações

- Xeljanz Initiation ChecklistDocumento8 páginasXeljanz Initiation ChecklistRawan ZayedAinda não há avaliações

- PolygonsDocumento23 páginasPolygonsPietrelle Liana PuruggananAinda não há avaliações

- Question Paper Code:: (10×2 20 Marks)Documento2 páginasQuestion Paper Code:: (10×2 20 Marks)Umesh Harihara sudan0% (1)

- Price Negotiator E-CommerceDocumento17 páginasPrice Negotiator E-Commerce20261A3232 LAKKIREDDY RUTHWIK REDDYAinda não há avaliações

- Feature Fusion Based On Convolutional Neural Netwo PDFDocumento8 páginasFeature Fusion Based On Convolutional Neural Netwo PDFNguyễn Thành TânAinda não há avaliações

- AIKINS v. KOMMENDADocumento6 páginasAIKINS v. KOMMENDAMENSAH PAULAinda não há avaliações

- Tutorial Letter 101/3/2019: Financial Accounting For CompaniesDocumento35 páginasTutorial Letter 101/3/2019: Financial Accounting For CompaniesPhebieon MukwenhaAinda não há avaliações

- Everyday Use AnalysisDocumento8 páginasEveryday Use AnalysisThe 3d PlanetAinda não há avaliações

- Agricultural LocationDocumento26 páginasAgricultural LocationPrince MpofuAinda não há avaliações

- Fashion Designer Research Paper ThesisDocumento4 páginasFashion Designer Research Paper Thesisafbteyrma100% (2)

- Making A Spiritual ConfessionDocumento2 páginasMaking A Spiritual ConfessionJoselito FernandezAinda não há avaliações

- Piggery BookletDocumento30 páginasPiggery BookletVeli Ngwenya100% (2)

- 19.2 - China Limits European ContactsDocumento17 páginas19.2 - China Limits European ContactsEftichia KatopodiAinda não há avaliações

- Physical Medicine Rehabilitation Brochure Bangkok 2020Documento6 páginasPhysical Medicine Rehabilitation Brochure Bangkok 2020nur yulia sariAinda não há avaliações

- Fujiwheel CatalogDocumento16 páginasFujiwheel CatalogKhaeri El BarbasyAinda não há avaliações

- Surimi Technology: Submitted To: Dr.A.K.Singh (Sr. Scientist) Submitted By: Rahul Kumar (M.Tech, DT, 1 Year)Documento13 páginasSurimi Technology: Submitted To: Dr.A.K.Singh (Sr. Scientist) Submitted By: Rahul Kumar (M.Tech, DT, 1 Year)rahuldtc100% (2)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyNo EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyNota: 4 de 5 estrelas4/5 (52)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingNo EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingNota: 5 de 5 estrelas5/5 (3)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProNo EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProNota: 4.5 de 5 estrelas4.5/5 (43)

- Tax Savvy for Small Business: A Complete Tax Strategy GuideNo EverandTax Savvy for Small Business: A Complete Tax Strategy GuideNota: 5 de 5 estrelas5/5 (1)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyAinda não há avaliações

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesNo EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesNota: 4 de 5 estrelas4/5 (9)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesAinda não há avaliações

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.No EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.Ainda não há avaliações

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthNo EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthAinda não há avaliações

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNo EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessAinda não há avaliações

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)No EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Nota: 4.5 de 5 estrelas4.5/5 (43)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesNo EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesNota: 3 de 5 estrelas3/5 (3)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessNo EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessNota: 5 de 5 estrelas5/5 (5)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCNo EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCNota: 4 de 5 estrelas4/5 (5)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionNo EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionNota: 5 de 5 estrelas5/5 (27)

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionNo EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionAinda não há avaliações

- The Payroll Book: A Guide for Small Businesses and StartupsNo EverandThe Payroll Book: A Guide for Small Businesses and StartupsNota: 5 de 5 estrelas5/5 (1)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsAinda não há avaliações

- Tax Preparation for Beginners: The Easy Way to Prepare, Reduce, and File Taxes YourselfNo EverandTax Preparation for Beginners: The Easy Way to Prepare, Reduce, and File Taxes YourselfNota: 5 de 5 estrelas5/5 (1)

- The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesNo EverandThe Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesAinda não há avaliações

![The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS Penalties](https://imgv2-1-f.scribdassets.com/img/audiobook_square_badge/711600370/198x198/d63cb6648d/1712039797?v=1)