Escolar Documentos

Profissional Documentos

Cultura Documentos

Agency MNO Pre-Closing Trial Balance For The Year Ended December 31. 2015

Enviado por

Jester LabanTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Agency MNO Pre-Closing Trial Balance For The Year Ended December 31. 2015

Enviado por

Jester LabanDireitos autorais:

Formatos disponíveis

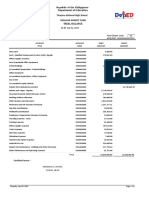

Agency MNO

Pre-Closing Trial Balance

For the Year Ended December 31. 2015

PARTICULARS

Cash-Collecting Officers

Petty Cash Fund 700,000

Cash- National Treasury - MDS 3,000,000

Cash in Bank-Local Currency-Current Account 1,600,000

Accounts Receivable 240,000

Allowance for Doubtful Accounts 40,000

Office Supplies Inventory 30,000

Other Current Assets 60,000

Investment in Stocks 800,000

Land 1,200,000

Office Buildings 1,300,000

Accumulated Depreciation - Office Building 100,000

Office Equipment 500,000

Accumulated Depreciation - Office Equipment 40,000

Furniture & Fixtures 220,000

Accumulated Depreciation - Furniture & Fixtures 20,000

IT Equipment and Software 380,000

Accumulated Depreciation - IT Equipment and Software 50,000

Accounts Payable 370,000

Due to BIR 100,000

Due to GSIS 60,000

Due to PAG-IBIG 50,000

Due to Philhealth 50,000

Other Payables 30,000

Government Equity 8,140,000

Subsidy from National Government 3,400,000

Salaries and Wages - Regular 640,000

Personnel Economic Relief Assistance (PERA) 160,000

Retirement and Life Insurance Premiums 120,000

PAG-IBIG Contributions 20,000

PHILHEALTH Contributions 20,000

Travelling Expense-Local 150,000

Office Supplies Expense 120,000

Electricity Expense 70,000

Telephone Expenses-Landline 90,000

Janitorial Services Expenses 70,000

Security Expenses 60,000

Repairs and Maintenance-Office Building 130,000

Depreciation-Office Building 30,000

Depreciation-Office Equipment 20,000

Depreciation-Furniture & Fixtures 10,000

Depreciation-IT Equipment and Software 10,000

TOTAL 12,450,000 12,450,000

Pre-Closing Trial Balance 2 | P a g e

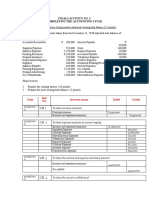

Adjusting Entries for the Year 2015

PARTICULARS ACCT. CODE DEBIT CREDIT

Depreciation - Office Building 50501040 100,000

Depreciation - Office Equipment 50501050 30,000

Depreciation - Furniture & Fixtures 50501070 12,000

Depreciation - IT Equipment and Software 50501050 28,000

Accumulated Depreciation - Office Building 10604011 100,000

Accumulated Depreciation - Office Equipment 10605011 30,000

Accumulated Depreciation - Furniture & Fixtures 10607011 12,000

Accumulated Depreciation - IT Equipment and Software 10605031 28,000

To adjust the recorded depreciation

Impairment Loss - Loans and Receivables 50503020 24,000

Allowance for Impairment - Accounts Receivables 10301011 24,000

To record Allowance for Impairment - Accounts Receivable

Closing Entries for the Year 2015

PARTICULARS ACCT. CODE DEBIT CREDIT

Subsidy from National Government 40301010 3,400,000

Revenue and Expense Summary 30301010 3,400,000

To close used Subsidy from National Government to Revenue and Expense Summary

Revenue and Expense Summary 30301010 1,914,000

Salaries and Wages-Regular 50101010 640,000

PERA 50102010 160,000

Life and Retirement Insurance Contribution 50103010 120,000

PAG-IBIG Contributions 50103020 20,000

PhilHealth Contributions 50103030 20,000

Travelling-Expenses-Local 50201010 150,000

Office Supplies Expense 50203010 120,000

Electricity Expense 50204020 70,000

Telephone Expense-Landline 50205020 90,000

Janitorial Services Expenses 50212020 70,000

Security Services Expense 50212030 60,000

Repairs and Maintenance-Office Building 50205020 130,000

Depreciation-Office Building 50501040 130,000

Depreciation-Office Equipment 50501050 50,000

Depreciation-Furnitures and Fixtures 50501070 22,000

Depreciation-IT Equipment and Software 50501050 38,000

Impairment Loss - Loans and Receivables 50503020 24,000

To close expense/loss acccounts to Revenue and Expense Summary

Revenue and Expense Summary 30301010 1,486,000

Accumulated Surplus/Deficit 30101010 1,486,000

To close Revenue and Expense Summary to Accumulated Surplus/Deficit

Adjusting and Closing Entries for the year 2015 3 | P a g e

Agency MNO

Detailed Statement of Income and Expenses

For the Year Ended 2015

REVENUE 0

LESS OPERATING EXPENSES

Personnel Services

Salaries and Wages- Regular 50101010 640,000

Personal Economic Relief Allowance 50102010 160,000

Life and Retirement Insurance Premium 50103010 120,000

PAG – IBIG Contributions 50103020 20,000

PhilHealth Contribution 50103030 20,000

Total Personnel Services 960,000

Maintenance and Other Operating Expenses

Travelling Expenses-Local 50201010 150,000

Office Supplies Expense 50203010 120,000

Electricity Expense 50204020 70,000

Telephone Expenses- Landline 50205020 90,000

Janitorial Services Expense 50212020 70,000

Security Services Expense 50212030 60,000

Repairs and Maintenance – Office Building 50213040 130,000

Total Maintenance and Other Operating Expenses 690,000

Non – Cash Expenses

Depreciation – Office Building 50501040 130,000

Depreciation – Office Equipment 50501050 50,000

Depreciation – Furniture and Fixtures 50501070 22,000

Depreciation – IT Equipment and Software 50501050 38,000

Impairment Loss - Loans and Receivables 50503020 24000

Total Non-Cash Expenses 264,000

TOTAL CURRENT OPERATING EXPENSES 1,914,000

SURPLUS/(DEFICIT) FROM CURRENT OPERATION (1,914,000)

Financial Assistance from NGAs

Subsidy from National Government Agency 40301010 3,400,000

TOTAL FINANCIAL ASSISTANCE FROM NGAS 3,400,000

SURPLUS/(DEFICIT) FOR THE PERIOD 1,486,000

Detailed Statement of Income and Expenses for the Year 2015 4 | P a g e

Agency MNO

Detailed Statement of Financial Position

As of December 31, 2015

ASSETS

Current Assets

Cash and Cash Equivalents 6,000,000

Cash-Collecting Officers 10101010 700,000

Petty Cash 10101020 700,000

Cash-National Treasury-Modified Disbursement System 10104040 3,000,000

Cash in Bank-Local Currency-Current Account 10102020 1,600,000

Receivables 176,000

Accounts Receivable 10301010 240,000

Allowance for Impairment - Accounts Receivable 10301011 -64,000

Inventories 30,000

Office Supplies Inventory 10404010 30,000

Other Current Assets 19999990 60,000

Total Current Assets 6,266,000

Non-Current Assets

Investment 800,000

Investment in Stocks 10203010 800,000

Property, Plant and Equipment 3,220,000

Land 10601010 1,200,000

Office Building 10604010 1,300,000

Less: Accumulated Depreciation - Office Building 10604011 200,000

Book Value 1,100,000

Office Equipment 10605020 500,000

Less: Accumulated Depreciation – Office Equipment 10605011 70,000

Book Value 430,000

Furniture and Equipment 10607010 220,000

Less: Accumulated Depreciation – Furniture and Fixture 10607011 32,000

Book Value 188,000

IT Equipment and Software 10605030 380,000

Less: Accumulated Depreciation – IT Equipment and Software 10605031 78,000

Book Value 302,000

Detailed Statement of Financial Position for the Year 2015 5 | P a g e

Total Non-Current Assets 4,020,000

TOTAL ASSETS 10,286,000

LIABILITIES AND EQUITY

Liabilities

Current Liabilities:

Financial Liabilities 370,000

Accounts Payable 20101010 370,000

Inter-Agency Payables 260,000

Due to BIR 20201010 100,000

Due to GSIS 20201020 60,000

Due to PAG-IBIG 20201030 50,000

Due to PhilHealth 20201040 50,000

Total Current Liabilities 630,000

Non-Current Liabilities

Other Payables 30,000

Other Payables 29999990 30,000

Total Non-Current Liabilities 30,000

TOTAL LIABILITIES 660,000

Net Assets/Equity

Government Equity 9,626,000

TOTAL LIABILITIES AND EQUITY 10,286,000

Detailed Statement of Financial Position for the Year 2015 6 | P a g e

Journal Entries for the Transactions Occurred in the Year 2016

PARTICULARS ACCT. CODE DEBIT CREDIT

Cash-National Treasury-Modified Disbursement System 10104040 23,085,000

Subsidy from National Government 40301010 23,085,000

To record receipt of NCA net of TRA

Office Equipment 10605020 120,000

Accounts Payable 20101010 120,000

To record receipt of charge invoice for Office Equipment acquired

Advances for Payroll 19901020 640,000

Cash-National Treasury-Modified Disbursement System 10104040 640,000

To record grant of cash advance for payroll

Salaries and Wages-Regular 50101010 600,000

Personal Economic Relief Allowance 50102010 40,000

Due to BIR 20201010 192,000

Due to GSIS 20201020 72,000

Due to PAG-IBIG 20201030 18,000

Due to Philhealth 20201040 67,500

Due to Officers and Employees 20101020 290,500

To record Due to Officers and Employees and to set up salary deductions

Due to Officers and Employees 20101020 290,500

Advances for Payroll 19901020 290,500

To record liquidation of Advances for Payroll

Due to BIR 20201010 192,000

Due to GSIS 20201020 72,000

Due to PAG-IBIG 20201030 18,000

Due to Philhealth 20201040 67,500

Advances for Payroll 19901020 349,500

To record remittance of salary deductions

Retirement and Life Insurance Premiums 50103010 72,000

PAG-IBIG Contributions 50103020 18,000

Philhealth Contributions 50103030 67,500

Employees Compensation Insurance Premiums 50103040 2,000

Cash-National Treasury-Modified Disbursement System 159,500

To record remittance of government’s share

Electricity Expense 50204020 180,000

Telephone Expenses-Landline 50205020 168,000

Accounts Payable 20101010 120,000

Due to BIR 20201010 12,000

Cash-National Treasury-Modified Disbursement System 10104040 456,000

To record payment of bills from utility companies and accounts payable for Office Equipment acquired

Cash-Tax Remittance Advice 10104070 12,000

Subsidy from National Government 40301010 12,000

To record receipt of NCA for TRA

Journal Entries for the Transactions Occurred in the Year 2016 7 | P a g e

Due to BIR 20201010 12,000

Cash-Tax Remittance Advice 10104070 12,000

To record remittance of tax withheld through TRA

Cash-Collecting Officers 10101010 1,640,000

Sales Revenue 40202160 800,000

Miscellaneous Income 40609990 240,000

Permit Fees 40201010 600,000

To record collection of income and other receipts

Cash-Treasury/Agency Deposit, Regular 10104010 1,640,000

Cash-Collecting Officers 10101010 1,640,000

To record deposit of collected income and other receipts

IT Equipment and Software 10801020 120,000

Accounts Payable 20101010 120,000

To record receipt of computers

IT Equipment and Software 10801020 30,000

Accounts Payable 20101010 30,000

To record receipt of IT Software

Petty Cash 10101020 60,000

Cash-National Treasury-Modified Disbursement System 10104040 60,000

To record establishment of Petty Cash Fund for official local travel of employees

Travelling Expenses-Local 50201010 60,000

Petty Cash 10101020 60,000

To record local travelling expenses

Rent Expenses 50299050 45,000

Cash-National Treasury-Modified Disbursement System 10104040 45,000

To record payment of rent for the last quarter

Repairs and Maintenance-Office Building 50213040 400,000

Accounts Payable 20101010 400,000

To record acquisition of materials for the general repairs of Office Building

Accounts Payable 20101010 400,000

Cash-National Treasury-Modified Disbursement System 10104040 400,000

To record full payment of materials acquired

Advances for Payroll 19901020 150,000

Due to BIR 20201010 15,000

Cash-National Treasury-Modified Disbursement System 10104040 135,000

To record the payment of the payroll

Due from NGAs 10303010 350,000

Cash-National Treasury-Modified Disbursement System 10104040 350,000

To record the transfer of cash to an Implementing Agency for a reforestation project

Journal Entries for the Transactions Occurred in the Year 2016 8 | P a g e

Cash-Tax Remittance Advice 10104070 15,000

Subsidy from National Government 40301010 15,000

To record receipt of NCA for TRA

Due to BIR 20201010 15,000

Cash-Tax Remittance Advice 10104070 15,000

To record remittance of tax withheld through TRA

Land Improvements, Reforestation Projects 10602020 350,000

Due from NGAs 10303010 350,000

To record the submission of report by the Implementing Agency after the completion of the project

Due from Officers and Employees 10305020 8,000

Cash-Collecting Officers 10101010 8,000

To record the cash shortage of the Cash Collecting Officer

Depreciation Expense-Office Building 50501040 130,000

Depreciation Expense-Office Equipment 50501050 62,000

Depreciation Expense-Furnitures and Fixtures 50501070 22,000

Depreciation Expense-IT Equipment and Software 50501050 53,000

Depreciation Expense-Land Improvements 50501020 35,000

Accumulated Depreciation-Office Building 10604011 130,000

Accumulated Depreciation-Office Equipment 10605021 62,000

Accumulated Depreciation-Furnitures and Fixtures 10607011 22,000

Accumulated Depreciation-IT Equipment and Software 10605031 53,000

Accumulated Depreciation-Land Improvements 10602021 35,000

To record year-end depreciation

Impairment Loss - Loans and Receivables 50503020 24,000

Allowance for Impairment - Accounts Receivable 10301011 24,000

To record allowance for uncollectible accounts

Journal Entries for the Transactions Occurred in the Year 2016 9 | P a g e

Você também pode gostar

- Acctg 303Documento9 páginasAcctg 303Anonymous IsEZYR1Ainda não há avaliações

- Pre Closing Trial BalanceDocumento1 páginaPre Closing Trial BalanceEli PerezAinda não há avaliações

- SeatworkDocumento10 páginasSeatworkRochelle Mae DiestroAinda não há avaliações

- Project in Government Accounting and Accounting FoDocumento11 páginasProject in Government Accounting and Accounting FoRosy MoradosAinda não há avaliações

- Panada, Terence Angelo F.-Bsma-3 3-8 Worksheet Preparation A.Rapal B.Rapal and Raod c.ORS and RAOD D.RancaDocumento30 páginasPanada, Terence Angelo F.-Bsma-3 3-8 Worksheet Preparation A.Rapal B.Rapal and Raod c.ORS and RAOD D.RancaJeth MahusayAinda não há avaliações

- Accounting 7Documento17 páginasAccounting 7Sophia Anne MonillasAinda não há avaliações

- JowanDocumento3 páginasJowanKyree VladeAinda não há avaliações

- Financial Statements PreparationDocumento6 páginasFinancial Statements Preparationana lopezAinda não há avaliações

- Trial Balance: Saint Paul As at 31 December 2018Documento1 páginaTrial Balance: Saint Paul As at 31 December 2018Evita Faith LeongAinda não há avaliações

- Solution To Practice Question-3Documento16 páginasSolution To Practice Question-3Josh JobsAinda não há avaliações

- Cabwad CF September 2019Documento2 páginasCabwad CF September 2019EunicaAinda não há avaliações

- Afar Assign#01. H - JikDocumento5 páginasAfar Assign#01. H - JikjasonnumahnalkelAinda não há avaliações

- Activity 1.6.A: Basic Financial Statements PreparationDocumento4 páginasActivity 1.6.A: Basic Financial Statements PreparationKng PuestoAinda não há avaliações

- Zero AccountingSystemDocumento19 páginasZero AccountingSystemchristian BagoodAinda não há avaliações

- Tugas 5 - InventoryDocumento11 páginasTugas 5 - InventoryMuhammad RochimAinda não há avaliações

- (LAB) Activity - Preparation of Financial Statements Using SpreadsheetDocumento3 páginas(LAB) Activity - Preparation of Financial Statements Using SpreadsheetJUVEN LOGAGAY0% (1)

- Assignment On TaxationDocumento2 páginasAssignment On TaxationKal KalAinda não há avaliações

- Accounting GovernmentDocumento21 páginasAccounting GovernmentJolianne SalvadoOfcAinda não há avaliações

- 006-Cash Book & GL For TrainingDocumento43 páginas006-Cash Book & GL For TrainingThinzar AungAinda não há avaliações

- Pakistan Institute of Public Finance Accountants: Financial AccountingDocumento27 páginasPakistan Institute of Public Finance Accountants: Financial AccountingMuhammad QamarAinda não há avaliações

- 8.24.22 BfaDocumento6 páginas8.24.22 BfaRyben Ysabelle PadroniaAinda não há avaliações

- Suka at Patis Company Statement of Cash Flows For The Year Ended December 31, 2020Documento23 páginasSuka at Patis Company Statement of Cash Flows For The Year Ended December 31, 2020Von Andrei MedinaAinda não há avaliações

- Adjusted Trial Balance To Financial StatementsDocumento16 páginasAdjusted Trial Balance To Financial StatementsABM ST.MATTHEW Misa john carloAinda não há avaliações

- GPV & SCF (Assignment)Documento16 páginasGPV & SCF (Assignment)Mica Moreen GuillermoAinda não há avaliações

- NGA - JE ExercisesDocumento3 páginasNGA - JE ExercisesShannise Dayne ChuaAinda não há avaliações

- Peachtree Exercise Part 1Documento6 páginasPeachtree Exercise Part 1Juan Kerma67% (3)

- Financial ReportsDocumento6 páginasFinancial ReportsCatherine KimAinda não há avaliações

- COMPREHENSIVE-PROBLEM - AnswerDocumento11 páginasCOMPREHENSIVE-PROBLEM - AnswerVivian MonteclaroAinda não há avaliações

- Toaz - Info Prelim Midterm PRDocumento98 páginasToaz - Info Prelim Midterm PRClandestine SoulAinda não há avaliações

- Finals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaDocumento6 páginasFinals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaMica Mae CorreaAinda não há avaliações

- Temp 1Documento5 páginasTemp 1Ashirbad SahuAinda não há avaliações

- Cash Flow 05 With Answers Just Give SolutionsDocumento21 páginasCash Flow 05 With Answers Just Give SolutionsEdi wow WowAinda não há avaliações

- Departmental Budgeting: For The Year 2011 Departments AccountsDocumento3 páginasDepartmental Budgeting: For The Year 2011 Departments AccountsFahad IqbalAinda não há avaliações

- 4 5Documento7 páginas4 5Jyan GayAinda não há avaliações

- Cabwad CF August 2019Documento2 páginasCabwad CF August 2019EunicaAinda não há avaliações

- Statement of Cash Flows: RequiredDocumento50 páginasStatement of Cash Flows: RequiredLouise95% (20)

- Chapter 2 - Nature and Formation of PartnershipDocumento8 páginasChapter 2 - Nature and Formation of PartnershipkimberlynroqueAinda não há avaliações

- Statement of Comprehensive Income ProblemsDocumento2 páginasStatement of Comprehensive Income ProblemsDarlyn Dalida San PedroAinda não há avaliações

- Symphony Theater SolutionDocumento4 páginasSymphony Theater SolutionVinayak SinglaAinda não há avaliações

- Written Digests105 124Documento845 páginasWritten Digests105 124Hoven MacasinagAinda não há avaliações

- Iaf Problem 2Documento9 páginasIaf Problem 2Apple RoncalAinda não há avaliações

- Department of Education Tinajero National High School: Org. CodeDocumento1 páginaDepartment of Education Tinajero National High School: Org. CodeMark Yousef RegalaAinda não há avaliações

- 10 Column WorksheetDocumento5 páginas10 Column Worksheetrommel legaspi100% (1)

- TabbelDocumento2 páginasTabbelLyra EscosioAinda não há avaliações

- Total: Adjusting EntriesDocumento8 páginasTotal: Adjusting EntriesLj BesaAinda não há avaliações

- Stage 1 Ffa3Documento3 páginasStage 1 Ffa3Khalid AzizAinda não há avaliações

- Illustrative Entries For Regular Agency FundDocumento24 páginasIllustrative Entries For Regular Agency FundYixing XingAinda não há avaliações

- POWS01 - AngeladeDiosSolutions (March and April)Documento11 páginasPOWS01 - AngeladeDiosSolutions (March and April)Phaelyn YambaoAinda não há avaliações

- MODULE-5 Ac 5 inDocumento14 páginasMODULE-5 Ac 5 inBlesh Macusi75% (4)

- Proposed New Appropriation by Object of Expenditures A. Office of The Municipal MayorDocumento21 páginasProposed New Appropriation by Object of Expenditures A. Office of The Municipal MayorJohnnry MarinasAinda não há avaliações

- Disha Excel WorkDocumento4 páginasDisha Excel WorkharishAinda não há avaliações

- 2.CCMDC-GAAB-2023-SUMMARIES FINAL Report Without Oct ND DecDocumento56 páginas2.CCMDC-GAAB-2023-SUMMARIES FINAL Report Without Oct ND DecMich Ann MaryAinda não há avaliações

- Budget ProjectionsDocumento4 páginasBudget Projectionssen0viaAinda não há avaliações

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocumento6 páginasCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTOAinda não há avaliações

- Official Template For Abm ProjectDocumento17 páginasOfficial Template For Abm ProjectPersephoneeeiAinda não há avaliações

- Consolidated Programmed Appropriation and Obligation by Object of Expenditure Summary of All OfficesDocumento3 páginasConsolidated Programmed Appropriation and Obligation by Object of Expenditure Summary of All OfficespeejayAinda não há avaliações

- Finacre Assignment3 M4Documento2 páginasFinacre Assignment3 M4dexter gentrolesAinda não há avaliações

- Week 2 Requirement: Name: Puray, Ma. Lorraine M - Course: BSA-1 Class Schedule: M-F (7:00-8:50 Am)Documento10 páginasWeek 2 Requirement: Name: Puray, Ma. Lorraine M - Course: BSA-1 Class Schedule: M-F (7:00-8:50 Am)Lorraine Millama PurayAinda não há avaliações

- Nerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Documento3 páginasNerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Mica Mae Correa100% (1)

- Wiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsNo EverandWiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsNota: 2 de 5 estrelas2/5 (2)

- 4 Worked ExamplesDocumento28 páginas4 Worked ExamplesJester LabanAinda não há avaliações

- Depression - A Review: April 2012Documento10 páginasDepression - A Review: April 2012Rabya AmjadAinda não há avaliações

- Accounting September Memo 2016Documento18 páginasAccounting September Memo 2016Jester LabanAinda não há avaliações

- 2020 Unit Exam 4Documento9 páginas2020 Unit Exam 4Jester LabanAinda não há avaliações

- Reviewer - FinAcc & TaxDocumento13 páginasReviewer - FinAcc & TaxJester LabanAinda não há avaliações

- 2 Worked ExamplesDocumento20 páginas2 Worked ExamplesJester LabanAinda não há avaliações

- In One of His ArgumentsDocumento3 páginasIn One of His ArgumentsJester LabanAinda não há avaliações

- Linear Programming FinalDocumento9 páginasLinear Programming FinalJester LabanAinda não há avaliações

- Solution Chapter 12Documento15 páginasSolution Chapter 12xxxxxxxxx100% (1)

- One of The Movers of The Reform MovementDocumento2 páginasOne of The Movers of The Reform MovementJester LabanAinda não há avaliações

- MethodologyDocumento1 páginaMethodologyJester LabanAinda não há avaliações

- Agency MNO Pre-Closing Trial Balance For The Year Ended December 31. 2015Documento8 páginasAgency MNO Pre-Closing Trial Balance For The Year Ended December 31. 2015Jester LabanAinda não há avaliações

- AudDocumento13 páginasAudKenneth RobledoAinda não há avaliações

- FifteenDocumento4 páginasFifteenrash_anne01Ainda não há avaliações

- Mgtscie Case StudyDocumento5 páginasMgtscie Case StudyJester LabanAinda não há avaliações

- Answers - V2Chapter 3 2012 PDFDocumento17 páginasAnswers - V2Chapter 3 2012 PDFkea paduaAinda não há avaliações

- Case StudyDocumento30 páginasCase StudyJester LabanAinda não há avaliações

- Solution Chapter 18Documento61 páginasSolution Chapter 18KUROKOAinda não há avaliações

- 2Documento15 páginas2Charo Santos LeyvaAinda não há avaliações

- Solution Chapter 17Documento68 páginasSolution Chapter 17xxxxxxxxx100% (6)

- CH 15Documento35 páginasCH 15Clarize R. MabiogAinda não há avaliações

- Answers - V2Chapter 1 2012Documento10 páginasAnswers - V2Chapter 1 2012Christopher Diaz0% (1)

- Acctg Solution Chapter 19Documento17 páginasAcctg Solution Chapter 19xxxxxxxxx33% (3)

- Correction 12 19Documento2 páginasCorrection 12 19libraolrackAinda não há avaliações

- Sample ch01 PDFDocumento39 páginasSample ch01 PDFdomingasAinda não há avaliações

- Solution Chapter 16Documento85 páginasSolution Chapter 16Pancit CantonAinda não há avaliações

- Transferring of ConsiderationDocumento26 páginasTransferring of ConsiderationRose CastilloAinda não há avaliações

- Solution Chapter 13Documento22 páginasSolution Chapter 13xxxxxxxxx100% (3)

- Corrections: Volume II Chapters 12 To 15: Office - P135,000 Instead of P135,000 Accounts Receivable - P43,000 InsteadDocumento1 páginaCorrections: Volume II Chapters 12 To 15: Office - P135,000 Instead of P135,000 Accounts Receivable - P43,000 InsteadRose CastilloAinda não há avaliações

- GFLK Qu VGK Yes 5 Ud 5Documento4 páginasGFLK Qu VGK Yes 5 Ud 5Shree HedaooAinda não há avaliações

- Motivation Letter To Study in HungaryDocumento2 páginasMotivation Letter To Study in Hungaryrita sulis100% (3)

- Special ExamDocumento3 páginasSpecial ExamAdoree Ramos50% (2)

- Chapter 15 IT Controls Part I: Sarbanes Oxley & IT GovernanceDocumento49 páginasChapter 15 IT Controls Part I: Sarbanes Oxley & IT GovernanceDesiree De OcampoAinda não há avaliações

- Chapter No. 1 - Financial Accounting & Accounts/Finance FunctionsDocumento13 páginasChapter No. 1 - Financial Accounting & Accounts/Finance FunctionsBalachandran RamachandranAinda não há avaliações

- PPT7-Elimination of Unrealized Gains and Losses On Intercompany Sales of Plant and PropertyDocumento50 páginasPPT7-Elimination of Unrealized Gains and Losses On Intercompany Sales of Plant and PropertyRifdah SaphiraAinda não há avaliações

- Measuring The Quality of EarningsDocumento15 páginasMeasuring The Quality of EarningstshimaarAinda não há avaliações

- Assignment 4 SolutionDocumento5 páginasAssignment 4 SolutionBracu 2023Ainda não há avaliações

- AfarDocumento11 páginasAfarWilsonAinda não há avaliações

- FactSheet HDIPFA2 HB V.1 2019 24082018 PDFDocumento25 páginasFactSheet HDIPFA2 HB V.1 2019 24082018 PDFBunang RasodiAinda não há avaliações

- Akuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADocumento8 páginasAkuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADedep0% (1)

- Charter of The Audit CommiteeDocumento18 páginasCharter of The Audit Commiteevivi irsamAinda não há avaliações

- Topic 3 Subsidiary LedgersDocumento6 páginasTopic 3 Subsidiary LedgersCunanan, Malakhai JeuAinda não há avaliações

- Folleto GA1-240202501-AA2-EV01Documento2 páginasFolleto GA1-240202501-AA2-EV01Katherine Zapata33% (3)

- CFO Finance VP in Orange County CA Resume Peter HernandezDocumento2 páginasCFO Finance VP in Orange County CA Resume Peter HernandezPeterHernandezAinda não há avaliações

- Accounting 221Documento8 páginasAccounting 221Princess ArceAinda não há avaliações

- Accounting Sample QuestionsDocumento6 páginasAccounting Sample QuestionsScholarsjunction.comAinda não há avaliações

- Representing Your Enterprise StructureDocumento85 páginasRepresenting Your Enterprise Structuredsgandhi6006Ainda não há avaliações

- ch04 A CONCEPTUAL FRAMEWORKDocumento38 páginasch04 A CONCEPTUAL FRAMEWORKtest459874Ainda não há avaliações

- Debit and Credit EnteriesDocumento18 páginasDebit and Credit EnteriesSuffian NaeemAinda não há avaliações

- Solution 786526Documento38 páginasSolution 786526Anvesha AgarwalAinda não há avaliações

- AT.3401 - The Professional Practice of AccountancyDocumento6 páginasAT.3401 - The Professional Practice of AccountancyMonica GarciaAinda não há avaliações

- Auditing Problems Lecture On Correction of ErrorsDocumento6 páginasAuditing Problems Lecture On Correction of Errorskarlo100% (3)

- 7 Advantages and Disadvantages of Forensic AccountingDocumento13 páginas7 Advantages and Disadvantages of Forensic AccountingWagner AdugnaAinda não há avaliações

- Teresita Buenaflor ShoesDocumento30 páginasTeresita Buenaflor ShoesHannah Pearl Flores Villar100% (1)

- Risk AssessmentDocumento9 páginasRisk AssessmentAshley Levy San PedroAinda não há avaliações

- Ignou Eco - 2 Solved Assignment 218-19Documento34 páginasIgnou Eco - 2 Solved Assignment 218-19NEW THINK CLASSESAinda não há avaliações

- Accounting Standard Board (IASB)Documento20 páginasAccounting Standard Board (IASB)AbhishekAinda não há avaliações

- Lembar Kerja Unit 3 - PT Prima ElektronikDocumento12 páginasLembar Kerja Unit 3 - PT Prima ElektronikNi'matul Mukarromah100% (1)

- Principles of Financial AccountingDocumento7 páginasPrinciples of Financial Accountinghnoor94Ainda não há avaliações