Escolar Documentos

Profissional Documentos

Cultura Documentos

ESIC IP Interface

Enviado por

अभिजीत कुमार0 notas0% acharam este documento útil (0 voto)

82 visualizações1 páginaGgg

Título original

ESIC IP Interface (1)

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoGgg

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

82 visualizações1 páginaESIC IP Interface

Enviado por

अभिजीत कुमारGgg

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 1

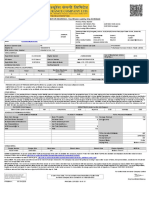

Employee Details

Login User: 3811320737

Entitlement to Benefits

Period: Current Period Report Generated on Dated: 31/07/2019 16:09:13 Hrs

Benefit Period Eligiblity

Benefit Start Date Benefit End Date Total Wages Total Working Days Paid / Payable Contribution Period From Contribution Period To

01 Jul 2019 31 Dec 2019 0.00 0 01 Oct 2018 31 Mar 2019

Eligiblity to ESIC Benefits

Benefit Type Entitlement Status Probable Reasons for Non-Entitlement to Benefits

IP/IW not in insurable employment and contributory conditions are not met in the

Medical Benefit Yes

corresponding Contribution Period.

* Not an IW.

Maternity Benefit No * Less than 9 months of insurable employment on EDD / Date of delivery.

* Less than 70 days contribution in 2 preceding Contribution Period.

* Less than 9 months of Insurable employment from the date of first appointment

* Contributed less than 78 days in the corresponding contribution penod.

Sickness Benefit No

* If entered in insurable employment for the first time in any Contribution period

and contributed for less than half no. of days of such shorter Contribution period.

* Not suffering from any of the listed 34 diseases.

* Less than two years continuous insurable employment.

Extended Sickness Benefit No * Contributed for less than 156 days in proceeding four Contribution periods (Two

years).

* Not entitled for SB in any one of the four preceding Contribution Periods.

Enhanced Sickness Benefit No Not Entitled for Sickness Benefit.

* Not completed six months of service from Date of registration.

Super Specialty For IP No

* Contributed less than 78 days in a contribution period.

* Not completed one year of service from date of registration.

Super Specialty For Family No

* Contributed less than 78 days in each of the two contribution period.

Disablement not due to Employment Injury or Occupational Disease as per the ESI

Temporary Disablement Benefit Yes

Act.

Disablement not due to Employment Injury or Occupational Disease as per the ESI

Permanent Disablment Benefit Yes

Act.

Death of the Insured person is not due to Employment Injury or Occupational

Dependent Benefit Yes

Disease as per the ESI Act.

* Not an IP/ IW on the date of loss of Insurable Employment on account of

retrenchment under ID act, closure of the factory / establishment under ID act or

R.G.S.K.Y No permanent invalidity of not less than 40% arising out of non-employment injury.

* Less than three years (One year = 156 days) contribution paid/payable prior to

loss of employment.

'Ward of IP' certificate as on 31-10-2018 - ***

*** This eligibility status is based only on the date Online Registration in the System. However, this shall be subject to change based upon further verification of other relevant documents/ records.

* The list is not exhaustive. For further details please visit nearest Branch Office or www.esic.nic.in. Eligibility status shown here is as on today's date and is further subject to Medical Certificates and/or

other conditions.

Cancel

DISCLAIMER: Content owned, maintained and updated by Employee's State Insurance Corporation. Copyright © 2009, ESIC, India. All Rights Reserved. Best viewed in 1024 x 768 pixels, Designed and Developed by Wipro LTD. IP : 81

Você também pode gostar

- Oracle FND User APIsDocumento4 páginasOracle FND User APIsBick KyyAinda não há avaliações

- Offer Letter FTE Arjee DaydayDocumento5 páginasOffer Letter FTE Arjee Daydaydragwarz05Ainda não há avaliações

- 5 Star Hotels in Portugal Leads 1Documento9 páginas5 Star Hotels in Portugal Leads 1Zahed IqbalAinda não há avaliações

- POST TEST 3 and POST 4, in ModuleDocumento12 páginasPOST TEST 3 and POST 4, in ModuleReggie Alis100% (1)

- 09 WA500-3 Shop ManualDocumento1.335 páginas09 WA500-3 Shop ManualCristhian Gutierrez Tamayo93% (14)

- DesalinationDocumento4 páginasDesalinationsivasu1980aAinda não há avaliações

- Sourcing Decisions in A Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyDocumento58 páginasSourcing Decisions in A Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyAlaa Al HarbiAinda não há avaliações

- Entitlement To Benefits Current PeriodDocumento2 páginasEntitlement To Benefits Current PeriodMARUTI MISAL0% (1)

- ESIC IP InterfaceDocumento2 páginasESIC IP InterfaceMithlesh YadavAinda não há avaliações

- I - ESIC IP Interface ROOPADocumento1 páginaI - ESIC IP Interface ROOPAYogesh DevkareAinda não há avaliações

- Entitlement to Benefits Language/ भाषाDocumento2 páginasEntitlement to Benefits Language/ भाषाinfoprincemachinesAinda não há avaliações

- Features of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?Documento3 páginasFeatures of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?Meenu SinghAinda não há avaliações

- ICICI Guaranteed BenifitsDocumento3 páginasICICI Guaranteed BenifitsNaveen SettyAinda não há avaliações

- Thyrocare QuotationDocumento4 páginasThyrocare Quotationsnehi56Ainda não há avaliações

- INDUCTION - Accenture ATCIDocumento1 páginaINDUCTION - Accenture ATCIAparnaAinda não há avaliações

- Benefit Illustration: UIN: 104N137V02 Page 1 of 4Documento4 páginasBenefit Illustration: UIN: 104N137V02 Page 1 of 4bhavnapal74Ainda não há avaliações

- Offerletter364433 AL PASCUALDocumento16 páginasOfferletter364433 AL PASCUALJurel PascualAinda não há avaliações

- HDFC Life Smart Income Plan-Mon Oct 17 20 - 02 - 31 IST 2022Documento3 páginasHDFC Life Smart Income Plan-Mon Oct 17 20 - 02 - 31 IST 2022Teja Reddy Telugu YuvathaAinda não há avaliações

- Benefit Illustration: UIN: 104N137V02 Page 1 of 4Documento4 páginasBenefit Illustration: UIN: 104N137V02 Page 1 of 4bhavnapal74Ainda não há avaliações

- Ipru Pension 10 Year X 2 LacDocumento5 páginasIpru Pension 10 Year X 2 LacHK Option LearnAinda não há avaliações

- Quick Super Guide PDFDocumento4 páginasQuick Super Guide PDFAnnie LamAinda não há avaliações

- Benefit Illustration: UIN: 104N076V11 Page 1 of 2Documento2 páginasBenefit Illustration: UIN: 104N076V11 Page 1 of 2Vir ShahAinda não há avaliações

- What Are Benefits of This Policy?: 1. Guaranteed IncomeDocumento3 páginasWhat Are Benefits of This Policy?: 1. Guaranteed IncomeAmreen KubraAinda não há avaliações

- 4906-ICICI Pru-Lakshya-Gold Plan-One Pager-27DecDocumento2 páginas4906-ICICI Pru-Lakshya-Gold Plan-One Pager-27DecMehul Bajaj100% (1)

- Major Changes in Labour ActDocumento1 páginaMajor Changes in Labour ActMenuka SiwaAinda não há avaliações

- Full Service Payroll Set Up Checklist 2018Documento1 páginaFull Service Payroll Set Up Checklist 2018Anne EtrerozAinda não há avaliações

- Features of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?Documento3 páginasFeatures of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?ShreyaAinda não há avaliações

- Features of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)Documento3 páginasFeatures of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)ShreyaAinda não há avaliações

- Benefit Illustration: Of2 UIN: 104N076V11Documento2 páginasBenefit Illustration: Of2 UIN: 104N076V11Vir ShahAinda não há avaliações

- Benefit Illustration: UIN: 104N076V16 Page 1 of 3Documento3 páginasBenefit Illustration: UIN: 104N076V16 Page 1 of 3Viju KAinda não há avaliações

- Regd Office: 115/535, Old Mahabalipuram Road, Okkiam Thoraipakkam, Chennai - 600 097Documento9 páginasRegd Office: 115/535, Old Mahabalipuram Road, Okkiam Thoraipakkam, Chennai - 600 097Pragathi MittalAinda não há avaliações

- Workright ChecklistDocumento1 páginaWorkright ChecklistSAIFUL ADIL (Art)Ainda não há avaliações

- Illustration - 2024-04-09T114323.972Documento2 páginasIllustration - 2024-04-09T114323.972V.PrasanthAinda não há avaliações

- PNBMetlife Gauranteed Future PlanDocumento4 páginasPNBMetlife Gauranteed Future PlanManager Pnb LucknowAinda não há avaliações

- FormsDocumento16 páginasFormsSujeet kumarAinda não há avaliações

- ESICDocumento27 páginasESICHR KJSAinda não há avaliações

- BrochureDocumento11 páginasBrochuregijik28287Ainda não há avaliações

- Leave PolicyDocumento7 páginasLeave PolicyClean LabAinda não há avaliações

- Benefit Illustration For HDFC Life Sampoorn Samridhi PlusDocumento2 páginasBenefit Illustration For HDFC Life Sampoorn Samridhi PlussarthakAinda não há avaliações

- Salary and Leave Policy in IndiaDocumento6 páginasSalary and Leave Policy in IndiaAditya SrivastawaAinda não há avaliações

- 70014883867Documento4 páginas70014883867Manish YadavAinda não há avaliações

- ESIC IP InterfaceDocumento1 páginaESIC IP InterfaceAnonymous Lq463icf100% (2)

- Payroll ChecklistDocumento1 páginaPayroll ChecklistDummy accountAinda não há avaliações

- Benefit Illustration For ICICI Pru Saving SurakshaDocumento3 páginasBenefit Illustration For ICICI Pru Saving SurakshaVikas DubeyAinda não há avaliações

- 5e5a414c4ad34a1297701fba File PDFDocumento30 páginas5e5a414c4ad34a1297701fba File PDFVishal BothraAinda não há avaliações

- 5e5a414c4ad34a1297701fba File PDFDocumento30 páginas5e5a414c4ad34a1297701fba File PDFVishal BothraAinda não há avaliações

- 70014913388Documento4 páginas70014913388Manish YadavAinda não há avaliações

- 19c157c7-bb83-4fab-8d2d-5c792c1af156Documento7 páginas19c157c7-bb83-4fab-8d2d-5c792c1af156vonamal985Ainda não há avaliações

- YG598666Documento19 páginasYG598666AkashAinda não há avaliações

- Offer Letter - Jahir Hussain - HVAC TechDocumento1 páginaOffer Letter - Jahir Hussain - HVAC TechPrasanna Gopalrathinam100% (1)

- PNB Metlife India Insurance Company Limited Benefit Illustration - Metlife Retirement Savings PlanDocumento4 páginasPNB Metlife India Insurance Company Limited Benefit Illustration - Metlife Retirement Savings PlanNurul MalikAinda não há avaliações

- Legato Health Insurance - AdityaDocumento54 páginasLegato Health Insurance - Adityaamruta UAinda não há avaliações

- WR Kets With Description EnglishDocumento6 páginasWR Kets With Description Englishpulkit sharmaAinda não há avaliações

- Anusha AervaDocumento2 páginasAnusha Aervamrcopy xeroxAinda não há avaliações

- Benefit Illustration: UIN: 104N076V17 Page 1 of 3Documento3 páginasBenefit Illustration: UIN: 104N076V17 Page 1 of 3vipin jainAinda não há avaliações

- IllustrationDocumento2 páginasIllustrationShambhu RaulAinda não há avaliações

- Self Employed What You Need To Know 2017Documento4 páginasSelf Employed What You Need To Know 2017Razvan PorojanAinda não há avaliações

- Illustration (17) - 2023-12-16T143445.154Documento2 páginasIllustration (17) - 2023-12-16T143445.154shailendra.goswamiAinda não há avaliações

- Draft Proposal 439622778Documento19 páginasDraft Proposal 439622778nishapujari080Ainda não há avaliações

- Bharti Axa Life Monthly Income Plan +: Toll Free Helpline: 1800-22-6465 WWW - Bluechipindia.co - inDocumento6 páginasBharti Axa Life Monthly Income Plan +: Toll Free Helpline: 1800-22-6465 WWW - Bluechipindia.co - inOnline YogeshAinda não há avaliações

- Group Medical PolicyDocumento28 páginasGroup Medical PolicyMuthuchziyan KathiresanAinda não há avaliações

- KFD New E36Documento6 páginasKFD New E36Gaurav ShahAinda não há avaliações

- Age 67 12 PayDocumento5 páginasAge 67 12 PayRohit yadavAinda não há avaliações

- Appendix C - Specification For Pipeline Construction Hydrostatic Testing - A3Y0W6Documento31 páginasAppendix C - Specification For Pipeline Construction Hydrostatic Testing - A3Y0W6अभिजीत कुमारAinda não há avaliações

- E3 Charger Manual-New PDFDocumento2 páginasE3 Charger Manual-New PDFअभिजीत कुमारAinda não há avaliações

- How Do Viruses How Do Viruses How Do Viruses How Do Viruses Attack Anti Attack Anti Attack Anti Attack Anti - Virus Virus Virus Virus Programs Programs Programs ProgramsDocumento8 páginasHow Do Viruses How Do Viruses How Do Viruses How Do Viruses Attack Anti Attack Anti Attack Anti Attack Anti - Virus Virus Virus Virus Programs Programs Programs Programsअभिजीत कुमारAinda não há avaliações

- Passport Dispatch Intimation.: 1 MessageDocumento1 páginaPassport Dispatch Intimation.: 1 Messageअभिजीत कुमारAinda não há avaliações

- Heat Press / Fusing Machines: SLK TechnosystemsDocumento6 páginasHeat Press / Fusing Machines: SLK Technosystemsअभिजीत कुमारAinda não há avaliações

- Service Request Detail: CloseDocumento1 páginaService Request Detail: Closeअभिजीत कुमारAinda não há avaliações

- LNL Iklcqd /: Grand Total 6,943 2,124 0 0 1,521Documento1 páginaLNL Iklcqd /: Grand Total 6,943 2,124 0 0 1,521अभिजीत कुमारAinda não há avaliações

- Expectation Vs Reality: Job Order and Contract of ServiceDocumento10 páginasExpectation Vs Reality: Job Order and Contract of ServiceMikee Louise MirasolAinda não há avaliações

- MSDS - Tuff-Krete HD - Part DDocumento6 páginasMSDS - Tuff-Krete HD - Part DAl GuinitaranAinda não há avaliações

- Amerisolar AS 7M144 HC Module Specification - CompressedDocumento2 páginasAmerisolar AS 7M144 HC Module Specification - CompressedMarcus AlbaniAinda não há avaliações

- Kaitlyn LabrecqueDocumento15 páginasKaitlyn LabrecqueAmanda SimpsonAinda não há avaliações

- Ss 7 Unit 2 and 3 French and British in North AmericaDocumento147 páginasSs 7 Unit 2 and 3 French and British in North Americaapi-530453982Ainda não há avaliações

- RevisionHistory APFIFF33 To V219Documento12 páginasRevisionHistory APFIFF33 To V219younesAinda não há avaliações

- ST JohnDocumento20 páginasST JohnNa PeaceAinda não há avaliações

- Hexoskin - Information For Researchers - 01 February 2023Documento48 páginasHexoskin - Information For Researchers - 01 February 2023emrecan cincanAinda não há avaliações

- Evaluating Project Scheduling and Due Assignment Procedures An Experimental AnalysisDocumento19 páginasEvaluating Project Scheduling and Due Assignment Procedures An Experimental AnalysisJunior Adan Enriquez CabezudoAinda não há avaliações

- 4109 CPC For ExamDocumento380 páginas4109 CPC For ExamMMM-2012Ainda não há avaliações

- Business Environment Analysis - Saudi ArabiaDocumento24 páginasBusiness Environment Analysis - Saudi ArabiaAmlan JenaAinda não há avaliações

- MOTOR INSURANCE - Two Wheeler Liability Only SCHEDULEDocumento1 páginaMOTOR INSURANCE - Two Wheeler Liability Only SCHEDULESuhail V VAinda não há avaliações

- What Caused The Slave Trade Ruth LingardDocumento17 páginasWhat Caused The Slave Trade Ruth LingardmahaAinda não há avaliações

- Check Fraud Running Rampant in 2023 Insights ArticleDocumento4 páginasCheck Fraud Running Rampant in 2023 Insights ArticleJames Brown bitchAinda não há avaliações

- Doterra Enrollment Kits 2016 NewDocumento3 páginasDoterra Enrollment Kits 2016 Newapi-261515449Ainda não há avaliações

- Doas - MotorcycleDocumento2 páginasDoas - MotorcycleNaojAinda não há avaliações

- Pneumatic Fly Ash Conveying0 PDFDocumento1 páginaPneumatic Fly Ash Conveying0 PDFnjc6151Ainda não há avaliações

- MRT Mrte MRTFDocumento24 páginasMRT Mrte MRTFJonathan MoraAinda não há avaliações

- As 60068.5.2-2003 Environmental Testing - Guide To Drafting of Test Methods - Terms and DefinitionsDocumento8 páginasAs 60068.5.2-2003 Environmental Testing - Guide To Drafting of Test Methods - Terms and DefinitionsSAI Global - APACAinda não há avaliações

- Reference Template For Feasibility Study of PLTS (English)Documento4 páginasReference Template For Feasibility Study of PLTS (English)Herikson TambunanAinda não há avaliações

- Load Data Sheet: ImperialDocumento3 páginasLoad Data Sheet: ImperialLaurean Cub BlankAinda não há avaliações

- Simoreg ErrorDocumento30 páginasSimoreg Errorphth411Ainda não há avaliações

- 1SXP210003C0201Documento122 páginas1SXP210003C0201Ferenc SzabóAinda não há avaliações

- 06-Apache SparkDocumento75 páginas06-Apache SparkTarike ZewudeAinda não há avaliações