Escolar Documentos

Profissional Documentos

Cultura Documentos

Tax Reviewer (Mfp-2)

Enviado por

Mikaela PamatmatDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Tax Reviewer (Mfp-2)

Enviado por

Mikaela PamatmatDireitos autorais:

Formatos disponíveis

8.

Charitable and other contributions

TAX REVIEWER (Deductions) 9. Research and development

10. Pension Trusts

DEDUCTIONS

Amounts allowed by law to REDUCE the EXPENSES (allowed as deductions)

ACTUAL GROSS INCOME to TAXABLE/NET all the ordinary and necessary expenses

INCOME paid or incurred during the taxable year in

Allowed to taxpayers by legislative grace carrying on or which are directly

and the taxpayer claiming them must prove attributable to the development,

compliance with the law management, operation, and/or conduct

o In other words, burden is on the of the trade, business, or exercise of

taxpayer to show compliance with profession

law granting tax

EXCLUSIONS Expenses include: (S-T-R-E)

Pretty much the same, but as opposed to 1. Salaries, wages, and other forms of

deductions, NOT INCLUDED in ITR1 compensation

- Includes fringe benefits

Section 34 - Deductions from Gross Income 2. Travel expenses

(amended by TRAIN) - Both here and abroad as long as it’s in

pursuit of trade

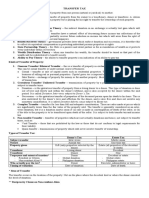

Taxpayer Deductions from Gross

3. Rentals

Income

- Includes other expenses for continued

Earning compensation NO DEDUCTIONS

use/maintenance of property

income from personal

4. Entertainment, amusement, and recreation

services under an

expenses

employer-employee

- Should not be contrary to law, morals,

relationship

and public policy

Individuals with gross OSD2 or itemized

income from business or deductions

General Requirements for Deductible Claims: (SE-

practice of profession

DC)

Corporations OSD or itemized

1. Sufficient evidence (official receipts or

deductions

other records)

2. Direct connection of the expense to the

ITEMIZED DEDUCTIONS development, management, operation, or

Expenses and losses related to trade, conduct of trade or profession

business, or practice of profession

It does NOT apply to those who earn Additional Requirements: (CIR v. Isabela) --

income with an employer-employee MEMORIZE THIS! (ON-TY-CO-S)

relationship because most likely it’s the 1. Must be ordinary and necessary

boss/company that bears the expenses and 2. Must have been paid or incurred during

losses. taxable year

3. Must have been paid/incurred in carrying

LIST of ITEMIZED DEDUCTIONS on the trade/business

1. Expenses 4. Must be supported by receipts, records, or

2. Interest other pertinent papers

3. Taxes

4. Losses Additional Notes:

5. Bad Debts

NEVER DEDUCTIBLE because ILLEGAL:

6. Depreciation

o Payments of bribes and kickbacks

7. Depletion

given to public/private person

o Paying for police protection

1

Income Tax Return (Calanoc)

2 Optional Standard Deduction

MFP - TAX I (Gruba/Ingles)

Additional Notes:

ACCRUAL METHOD - The abovesaid examples are not deductible

- Accrual of income and expense is permitted from taxable income because they are akin to

when the all-events test has been met. acquisition of capital assets, so they are

- ALL-EVENTS TEST: Know this! CAPITAL EXPENDITURES (not mere advertising

1. Fixing of a right to income or liability to expenses to promote current or future sales)

pay

2. Availability of the reasonable accurate - Litigation Expenses incurred in defense of title

determination of such income or to property also NOT deductible for being

liability capital in nature

- “Reasonable accuracy”

o Implies something less than an exact or BONUSES

completely accurate amount Bonuses to employees made in good faith and as

o Accrual is judged by the facts that a additional compensation for the services actually

taxpayer knew, or could reasonably be rendered are DEDUCTIBLE.

expected to have known, at the closing As long as the payments do NOT

of its books for the taxable year exceed reasonable compensation for

- A taxpayer authorized to deduct certain stuff for the services rendered (in addition to

the current year, BUT FAILED to do so, cannot agreed-upon salary)

deduct the same for the next year. Taxpayer has the burden of showing

- Ordinary that actual personal services have been

o Normal in relation to the biz rendered and the amount was

o Need not be recurring reasonable.

- Necessary BONUSES NOT DEDUCTIBLE IF:

o When it is appropriate and helpful in o Given to corporate officers out

the development of the biz of sale of corporate land when

o Intended to minimize losses and/or officers didn’t really do

maximize profits anything to effectuate the sale

ADVERTISING EXPENSES Requisites for Deductible Bonuses MEMORIZE!

Two kinds: 1. Payment of the bonus is in fact

1. Stimulates current sale of merchandise or use of compensation

services 2. Must be for personal services actually

2. Stimulates the future sale of merchandise or rendered

use of services 3. When added to salaries, are reasonable

Creates or maintains some form of when measured by the amount and quality

goodwill for the taxpayer’s trade of the services performed in relation to the

biz of the taxpayer

ADVERTISING EXPENSES

1st type: for Current Sale 2nd type: for Future Sale COST of MATERIALS

o Deductible for - Normally, for it to - If materials and supplies are on hand, taxpayer

sure be deductible, it should only include as expense the cost of

o Just ask if it’s should be spread materials and supplies only to the amount that

reasonable or out over a they are actually consumed and used in

not reasonable time operation during the year for which the return

is made.

What are NOT deductible as advertising expenses? Cost of such materials should NOT have

(based on Atlas Consolidated v. CIR) been deducted in determining the net

- Expenses for promoting sale of capital stock for income for any previous year.

acquisition of additional capital - Incidental materials on hand and not recorded

- Efforts to establish reputation to have been consumed, or where no physical

inventories at the beginning and end of the year

MFP - TAX I (Gruba/Ingles)

were taken permissible for taxpayer to If the remainder of the term of lease is

include in his expenses and deduct from gross greater than the probable life of the

income the total cost of the supplies as were building erected, or of the

purchased during the year for which return is improvements made = deduction will

made take form of allowance.

As long as the net income is clearly

reflected PROFESSIONAL EXPENSES

- Allowable deductions include:

REPAIRS Cost of supplies

- Allowable deduction as expense: cost of Expenses paid in the operation and

incidental repairs which: repair of transpo equipment used in

DON’T materially add to the value of making professional class

the property or prolong its life Due to professional societies and

But merely keep it in an ordinary subscriptions to professional journals

efficient operating condition Rent paid for offices

As long as the plant/property account Expenses for utilities on offices

is not increased by amount of the Expenses for hiring office assistants

expenditure Books, furniture, and professional

- If repairs are really in the nature of instruments with short useful life

replacement, it should be charged against - Those with a permanent character NOT

the depreciation reserves. allowable.

LEASE AGREEMENT EXPENSES SPECIAL DEDUCTIBLES FOR PRIVATE EDUCATIONAL

- The following are allowed as deductions: INSTITUTIONS

1. Allowed to deduct expenditures considered as

Kind of Lease What to deduct capital outlays of depreciable assets incurred

Leasehold is for business Aliquot part of sum for the expansion of school facilities

purposes for a specified each year, based on the 2. Allowed to capitalize the expenditure, and

sum number of years the claim deduction by way of depreciation

lease will run

Taxes paid by a tenant Amount of tax REPRESENTATION, AMUSEMENT, RECREATION

to landlord for business deductible by the EXPENSES, and ENTERTAINMENT FACILITIES

property landlord - Representation expenses incurred n connection

(counts as additional with the conduct of one’s trade, biz, or

rent; taxable income to Please cross-check profession for:

the landlord) because it seems like Entertaining, providing amusement and

recreation to, or meeting with guests

the correct answer is

At a dining place, place of amusement

it’s deductible from the

country club, theater, concert, play,

tenant, but TMLT says sporting event, and similar places

otherwise. - Registered member of a country/golf/sports

club taxpayer presumption that expenses are

fringe benefits subject to FBT

- Leasehold improvements are not considered Unless proven as representation

business expenses, but CAPITAL INVESTMENTS. expenses

An annual deduction may be made - Entertainment facilities include: yachts,

from gross income of an amount equal vacation homes or condos, or similar real

to the cost of such improvements properties used by taxpayer primarily for

divided by the number of years entertainment/recreation.

remaining of the lease term. Forms part of the taxpayer’s trade, biz,

The deduction shall be in lieu of a or profession for which he claims

deduction for depreciation. depreciation or rental expense

MFP - TAX I (Gruba/Ingles)

Yacht restricted to certain employees 5. Lawyer or professional partnership rendering

or officers would amount to a fringe free legal services deduction fom the gross

benefit, subject to FBT. income the amount that could have been

collected or up to 10% of the gross income

- Not considered entertainment expenses: derived from the actual performance of the

Treated as compensation or fringe benefits profession (whichever is LOWER)

Expenses for charitable events

Expenses for bona fide meetings of INTEREST

stockholders, partners, or directors Interests paid on debts are allowable as

Expenses for attending or sponsoring an

deductions BUT:

employee to a business league meeting

o Must be incurred in connection

Expenses for events organized for

promotion, marketing, and advertising with the taxpayer’s profession,

(including concerts, conferences, seminars, trade, or biz

etc.) o Allowable deduction decreased by

Other expenses of similar nature 33% of the interest income subject

to final tax

*May still qualify as deductions under other

provisions of Sec. 34 Requisites for Deductibility of Interest Expense: (I-

IE-TY-TP-TBP-W-LD-PA-PO-CE) MEMORIZE!

Requisites of Deductibility for Entertainment, 1. There must be an indebtedness

Amusement, and Recreational Expenses: (TY-TBP-L- 2. There should be an interest expense paid or

B-AP-WP) MEMORIZE! due and demandable upon the

1. Paid or incurred during the taxable year indebtedness

2. Must be directly connected to or related to 3. Indebtedness must be that of the taxpayer

the furtherance of the development, 4. Incurred during the taxable year

management, and operation of the trade, 5. Connected with the taxpayer’s trade, biz, or

business, or profession of the taxpayer profession

3. Not contrary to law, public morals, etc. 6. Interest stipulated in writing

4. Not been a bribe or kickback paid to gov 7. Legally due

official or private individual, corp, or GPP 8. Payment arrangement must NOT be

5. Substantiated by adequate proof like between related taxpayers

receipts or invoices 9. The interest must not be incurred to finance

6. Taxes must be withheld (if applicable) and petroleum operations

paid to the BIR (if subject to final tax) 10. If incurred to acquire property used in

trade, biz, or profession, it was not treated

Ceiling for Representation, Entertainment, and as capital expenditure.

Amusement Expenses: - Taxpayer has the option to treat the

Engaged in sale of goods or properties = interest expenses as either:

0.5% of net sales 1. Deductible in full

Engaged in sale of services, including 2. As a capital expenditure and

exercise of profession, and use/lease of claim as deduction only the

properties = 1% of net revenue periodic

amortization/depreciation

OTHER BIZ EXPENSES ALLOWED BY SPECIAL LAWS

AS DEDUCTIONS No more tax arbitrage advantage because

1. Discounts granted to PWDs and senior citizens corporations used to abuse this

2. Expenses incurred by a private health and non- Interest paid or accrued on taxes related to

health facility/institution up to 2X the business or practice of profession can be

amount incurred deducted in full.

3. Expenses incurred in training schemes As long as there is interest expense

additional 50% of amount actually incurred incurred and interest income earned

4. Expenses incurred for adopting a school (subjected to final withholding tax), the

additional 50% also limitation shall apply regardless of:

MFP - TAX I (Gruba/Ingles)

o Whether or not a tax arbitrage the year, shall be allowed

scheme was entered into by the as deduction in such

taxpayer; or taxable year.

o The date when the investment was

made CASE: CIR v. Vda. de Prieto

Limitation will only apply if there is interest Late payment of tax = DEBT

income subject to final tax if NOT, then Interest on taxes is interest on indebtedness so it’s

you can deduct in full deductible!

Interest is not deductible if: TAXES

o Both the taxpayer and the person Paid or accrued within the taxable year in

to whom interest was paid are connection with the taxpayer’s trade, biz, or

related taxpayers. profession are deductible from gross

Family members income.

Individual + corporation EXCEPTIONS to deductibility:

- More than 50% o PH income tax

of OS is owned o Estate tax

by the individual o Donor’s tax

2 corporations o Special assessments

- More than 50% o Income tax imposed by a foreign

of the OS of each country for income sourced

is owned by the outside the PH

other or by the Will be allowed if taxpayer

same individual doesn’t signify his desire

Grantor + fiduciary of any to enjoy any benefits of

trust the tax credit for taxes

Fiduciary of a trust + paid to foreign countries

fiduciary of another trust o Stock transaction tax

- If the fiduciary is o VAT

a grantor with o Income, war profits, and excess

respect to each profits taxes imposed by authority

trust of the foreign country

Fiduciary of a trust + Will be allowed also under

beneficiary circumstances in #5

o Indebtedness is incurred to finance For tax credits, only resident citizens and

petroleum operations domestic corps are affected.

o If an individual is on the cash basis o Members of GPP and beneficiaries

of accounting and interest is paid of estates/trusts can avail.

in advance thru discount or o NOT allowed for aliens and foreign

otherwise corps

Interest expense shall be Options for taxpayers qualified for credit:

allowed as deduction, not o Deduct foreign income tax from

in the year that the gross income

interest was paid in o Claim tax credit

advance, but the year Determining amount of tax to be credited

that the indebtedness EXAMPLE:

was paid. *Remember! All are taxable since tax credit only

But if payable in periodic applies to resident citizens and domestic corps -- so

amortization, amount of taxable worldwide talaga.

interest which

corresponds to the Income foreign country = 100k

amount of the principal Income in PH = 300k

amortized or paid during Taxable income worldwide = 400k

MFP - TAX I (Gruba/Ingles)

Income tax paid to foreign country = 40k Taxpayer has to submit a Sworn Declaration of Loss

30% Corporate Income Tax = 120k to forewarn the BIR the extent of the loss, and so

Less: Tax credit for foreign tax they can conduct their own investigation.

Otherwise, the deduction will not be allowed.

Formula: - TMLT seems to imply that if the loss was so

(Income in foreign country/worldwide taxable obvious or highly-publicized, no need for

income) SDL (Super Bowl example)

x

(30% corporate income tax) For non-resident individuals and foreign

= 30k corporations, the losses should be those

actually sustained:

(Compare it to 40k income tax paid to foreign o Within the PH

country and choose whichever is lower) o During taxable year

Claim of deductibilty for loss can no longer

Since 30k is lower than the 40k paid abroad, the be made if already deducted for estate tax

former is the allowed tax credit. Because taxpayer purposes

was supposed to pay 120k originally, the corp now Casualty

only has to pay 90k. o complete/partial destruction of

property from an identifiable event

Recommended to go for tax credit because of a sudden, unexpected or

your take-home would be more. unusual nature

o If you choose to deduct, what o NOT progressive deterioration

would happen is you just deduct through a steadily operating cause

the tax that was actually paid to Embezzlement

the foreign country , then you o Fraudulent appropriation of

apply the 30% corporate income another’s property by a person to

tax, so you end up paying more. whom it has been entrusted or

Fines and penalties for late payment of into whose hands it has lawfully

taxes not deductible. come

o Note that the interest is still Theft

deductible o Criminal appropriation of another’s

o It’s just the surcharges and property

penalties that are NOT.

SPECIAL RULES ON LOSSES

LOSSES 1. Voluntary removal of buildings, machinery,

equipment, etc.

Requisites for Deductibility of Losses (TY-NC-BP- o Basically, demolition for practical

FSS) MEMORIZE! reasons/life safety

1. Actually sustained during the taxable year o NO deduction for demolition with

2. not compensated by insurance, or another intention to construct a new

form of indemity building

3. Incurred in trade, business, or profession; 2. Loss of useful value of assets

OR o Change in business conditions

4. Of property connected with trade, business, suddenly terminates the

or profession, the loss comes from fire, usefulness of some or all of the

storm, shipwreck, or other casualty, or from capital assets may claim as

robbery, theft, or embezzlement deduction the actual loss sustained

o Amount of loss needs to take into

Declaration of loss needed within 45 DAYS account improvements,

from time of loss. depreciation, and the salvage value

Taxpayer bears burden of proof. of the property

CASE: H. Tambunting Pawnshop v. CIR

MFP - TAX I (Gruba/Ingles)

o GR: There needs to be a sale or Not less than 75% of the paid-up

other disposition of property to capital of the corporation is held

establish a loss by the same persons

o Exception: Proof of some - For MINES, other than oil and gas wells,

unforeseen causing the property to NOL without the benefit of incentives from

be prematurely discarded the Omnibus Investments Code, may be

- Examples: increase in carried over as deduction for the next 5

cost, change in years immediately following the year of

manufacture, new loss.

legislation makes it

impossible to be CASE: Paper Industries Corp. v. CA

profitable There’s a limit to the transfer of NOLCO because to

allow indiscriminate transfer would result in

corporations simply buying and benefiting from the

NET OPERATING LOSS CARRY OVER (NOLCO) operating losses of another corporation.

- What is NET OPERATING LOSS? - So even if Company A merged with

o Excess of allowable deduction over Company B, the former cannot benefit from

gross income of the business in a the losses sustained by the latter prior to

taxable year the merger.

- What is NOLCO? - General Rule: Transfer/assignment of

Net operating loss of the NOLCO arising from

business/enterprise for: merger/consolidation/combination with

- any taxable year another person does NOT give the

immediately preceding transferee/assignee a claim to the same

the current taxable year deduction.

- not been previously - Exception: When as a result, the

offset as deduction from shareholders of the transferor/assignor

the gross income gains control of:

It shall be carried over as 75% or more of the outstanding

deduction from gross income for issued shares/paid-up capital of

the next 3 consecutive taxable the transferee/assignee; OR

years immediately following the 75% or more interest in the

year of loss. business of the

In other words, mas marami yung transferee/assignee

allowable deduction mo

compared to what you earned - An individual who claims the 40% OSD

(gross income), so if you earned cannot claim deduction of NOLCO

PHP300, but your allowable simultaneously.

deduction actually reaches - Even if the NOLCO was not claimed, 3 year

PHP900, PHP600 will be deducted period keeps running.

from the next 3 YEARS - “First-in, first-out” availment

immediately after.

- Only allowed if there has been no NOT qualified for NOLCO:

substantial change in ownership of the 1. OBUs3 for a foreign banking corporation

business, meaning: and FCDUs4 of domestic banking

Not less than 75% of outstanding corporations

shares is in the name of the 2. Enterprise registered with the BOI with

corporation held by the same Income Tax Holiday Incentive

persons

3

Offshore Banking Units

4 Foreign Currency Deposit Units

MFP - TAX I (Gruba/Ingles)

3. PEZA-registered enterprise deducted shall form part of gross

4. SBMA-registered enterprise income the year it resumes.

5. Foreign corporations engaged in

international shipping/air carriage business FOREX LOSSES

in the PH - When foreign currency is acquired in the

6. Any natural or juridical person with regular course of biz, and ordinary gain or

exemption from income tax loss results from the fluctuations loss is

deductible only in the year it is sustained

CAPITAL LOSSES - If loans have not actually been paid, losses

- Losses from sales ir exchanges of capital therefrom have not been realized NOT

assets allowed as provided in Sec. 39 deductible yet

- For securities becoming worthless during - Losses sustained from the devaluation of

taxable year and are capital assets, loss will peso, but remittance of scheduled

be considered as a loss from sale/exchange amortization consisting of principal and

on the last day of the taxable year. interests payments on foreign loan has not

Not applicable for banks or trust actually been made NOT deductible yet

companies because the increase has not been realized

LOSSES FROM WASH SALES of STOCKS/SECURITIES BAD DEBTS

- NOT allowed to be claimed in sales of Amounts borrowed from taxpayer which

stock/securities if: have become worthless or uncollectible.

Within a period of 30 days before o Money extended as loan

the sale, and 30 days after the o Uncollectible payments of goods

sale (61 days total; important) sold or services rendered

taxpayer acquires or enters into

an option to purchase Requisites for Deductibility of Bad Debts (EI-TBP-

substantially the same TY-WU-F-RP) MEMORIZE!

stocks/securities 1. Existing indebtedness due to the taxpayer

- ALLOWED if the taxpayer is a stockbroker which is valid and legally demandable

and the sale/purchase was made in the - Not losses from investment

regular course of business 2. Connected with trade, biz, or profession of

- Basically, hindi pwede na a person sells the taxpayer

shares of Jollibee at a loss, then he buys 3. Actually ascertained to be worthless and

substantially the same amount of shares 20 uncollectible

days after the sale. 4. Charged off within the taxable year

5. Uncollectible even in the future

WAGERING LOSSES 6. Not sustained between related parties

- Allowed only to the extent of gains from

such transactions *If recovered, it shall be included as part of the

gross income during the year of recovery

ABANDONMENT LOSSES

- When a petroleum operation is CASE: Hermanos v. CIR

partially/wholly abandoned all Losses or bad debts must be ascertained to be so,

accumulated exploration and development and must be written off during taxable year.

expenses can be deducted

- Notices of abandonment should be fled NO PARTIAL DEDUCTIONS Deductible in full or

with the Commissioner. not deductible at all

- For producing wells subsequently

abandoned unamortized costs and Financial assistance lent to a corporation, if without

undepreciated costs allowed as deduction any expectation of repayment, cannot be

But in the event it resumes considered a bad debt. It becomes an investment,

production, costs previously not a loan.

MFP - TAX I (Gruba/Ingles)

CASE: CBC v. CA for taxable years prior to the

Equity investments in a subsidiary is not a bad debt. taxable year in which notice in

Neither is it an ordinary asset. Rather, they partake writing is served by the party

of capital assets. So, the rules on capital loss apply. initiating the change.

If taxpayer has alread adopted a

CASE: Philex Mining v. CIR depreciation rate without written objection

Investments in a partnership are not debts inasmuch on the CIR’s part, then it’s binding on both

as there was no unconditional obligation to return parties.

the same.

In proving worthlessness of debts, one must show Methods for Reasonable Allowance Computation

diligent efforts to collect through the ff. steps: (in 1. Straight-line method

order) MEMORIZE! 2. Declining-balance method

1. Send statement of accounts 3. Sum-of-the-years-digit method;

2. Send collection letters 4. Any other method prescribed

3. Give account to lawyer for collection

4. File collection case Only one vehicle is allowed for the use of

an official or employee.

For banks BSP shall: o Value not more than 2.4M

1. ascertain the worthlessness and uncollectibility o Taxpayer should substantiate the

2. approve writing-off of the said debt from the purchase with sufficient evidence.

bank’s books of accounts at the end of the No depreciation allowed for yachts,

taxable year helicopters, airplanes, and other vehicles

exceeding the threshold amount.

For insurance/surety companies a receivable o EXCEPTION: Taxpayer’s line of biz

may be written off and claimed as bad debt only if is transport operations/leasing and

such company has been solved due to insolvency or vehicles purchased are used in said

other similar reason by the Insurance Commission biz

Amortization of intangibles is the periodic

Worthless debts from unpaid wages, salaries, rents, process of allocating cost of an intangible,

and similar items of taxable income only and it is deductible.

deducted if included in the ITR as income for the o Examples: goodwill, right of lease,

year the bad debt was sought, or the previous year patent, trademark

DEPRECIATION CASES OF DEPRECIATION

Gradual diminuition in the useful value of Properties used directly 10 YEARS

tangible property resulting from wear and in petroleum production (straight-line or declining

tear and normal obsolescence method, at the option of

Applies to both tangible and intangible the service contractor)

property Properties used 5 YEARS

REASONABLE ALLOWANCE is deductible, in indirectly in petroleum (straight-line)

line with the rules and regulations production

prescribed by the SoF, upon recom of Properties used in If expected life is 10

Commissioner. mining operations YEARS/LESS = normal

If taxpayer and CIR come to an agreement rate of depreciation

on the useful life on which depreciation

would be based agreement in writing is If more than 10 YEARS =

BINDING notify the CIR

o Party initiating modification has For non-resident aliens Reasonable rate allowed

responsibility of establishing facts engaged in trade or only on properties

and circumstances resident foreign located in the PH

o If there are any changes to the corporations

agreement, it shall not be effective

MFP - TAX I (Gruba/Ingles)

be carried forward to succeeding

CASE: Basilan Estates v.CIR years until fully deducted.

A company has the right to claim depreciation, but Taxpayer’s election to deduct the E&D

NOT beyond its acquisition cost. expenditures is irrevocable and binding in

succeeding tax years.

DEPLETION

Oil and gas wells or mines are allowed a CHARITABLE AND OTHER CONTRIBUTIONS

reasonable allowance for depletion and Donations are partially deductible if made

amortization computed using the COST- to the following: MEMORIZE!

DEPLETION METHOD. 1. Government, exclusively for public

Allowance for depletion = capital invested purposes

no further allowance shall be granted 2. Accredited domestic

After production in commercial quantities corporations/associations,

has started, certain intangible exploration organized and operated exclusively

and drilling costs: for religious, charitable, scientific,

o will be deducted in the year youth and sports development,

incurred if such were incurred for cultural, or educational purposes,

non-producing wells or mines; or or for rehabilitation of veterans, no

o these may be capitalized or part of the net income of which

amortized if such were incurred for inures to the benefit of any private

producing wells/mines in the same stockholder or individual

contract area 3. Social welfare institutions

Non-resident aliens/resident foreign corps 4. Non-accredited NGOs

allowance for depletion is limited to oil The amount deducted should NOT exceed:

wells and mines in the PH o 10% for individuals

Intangible costs in petroleum operations o 5% for corporations

o any cost incurred in petroleum of the taxpayer’s taxable income

operations which in itself has no derived from trade, biz, or profession

salvage value, and which is BEFORE deduction for contributions

incidental to and necessary for the and donations

drilling and preparation of wells for

production Two things you look at, then see which is

o said costs DO NOT include lower between them:

acquisition or improvement of 1. Charitable contributions

property of a character subject to 2. 10% / 5% (as the case may be) of

the allowance for depreciation your taxable income

Buzz word: COST OF A WASTING ASSET

CASE: Roxas v. CTA

FORMULA FOR RATE OF DEPLETION (not sure if this Contributions to Christmas funds of City Police NOT

is really important) deductible because they were considered to be

Christmas gifts to the families of the police. not

Cost of mine property for public purpose exclusively

Estimated ore deposit

Donations are FULLY DEDUCTIBLE if made

Extra notes from codal: to the ff: MEMORIZE!

For deduction of exploration and 1. Government, exclusively to finance

development expenditures: government priority activities in

o Shall not exceed 25% of net (ie education, youth, health, sports

income from mining operations development, human settlements,

computed without the benefit of science and culture, and in

any tax incentives economic development according

o Actual expenditures minus 25% of to NEDA)

the net income from mining shall

MFP - TAX I (Gruba/Ingles)

2. Certain foreign institutions or foster child deduction to the

international organizations agencies extent of

3. Accredited NGOs amount given

4. Via special laws

RESEARCH AND DEVELOPMENT

NGOs Can be treated as ordinary and necessary

o Non-profit domestic corporations expenses as long as: MEMORIZE!

organized and operated exclusively o Incurred during taxable year

for scientific research, education, o In connection with trade or biz

etc., where NO PART of the net Taxpayer can either fully deduct or

income inures to the benefit of amortize the deductions.

any private individual NOT applicable to expenses:

o Admin expenses cannot exceed o For acquisition/improvement of

30% of the total expenses land or property to be used in

o Must utilize contributions NOT connection with R&D

LATER THAN the 15th day of the 3rd o Incurred for the purpose of

month after the close of the ascertaining the existence,

taxable year when donations were location, extent of quality of any

received deposit of minerals and oil

o Philippine Council for NGO

Certification accredits PENSION TRUSTS

2 KINDS OF DEDUCTIONS FOR EMPLOYER:

For exemption from DONOR’S TAX and full 1. Contributions to such trust to

deduction of donation to qualified donee: cover under pension liability during

o Donor engaged in business must the year

give a NOTICE of DONATION on 2. Reasonable amount paid to the

every donation worth at least trust in excess of such

PHP50k to the RDO5 with contributions

jurisdiction over his place of biz The employer who established the pension

within 30 days after receipt of trust for his employee’s benefit can

duly issued Certificate of deduct, subject to the following conditions:

Donation, attached to the said 1. Amount paid to trustee is

notice. reasonable

o Notice should state that not more 2. Must not have been previously

than 30% of the said donation/gifts allowed for deduction (no double

for the taxable year shall be used deduction)

by the accredited NGO/institution 3. Must be apportioned equally over

for administration purposes a period of 10 consecutive years,

starting with the year the

SPECIAL LAWS payment is made

Gifts and Exempt from Allowable as When employer contributes to employee’s

donations to donor’s tax deduction up to PERA6, employer can claim the amount as a

UP 150% of the deduction but only to the extent of the

value of the employee’s contribution that would

donation complete the maximum allowable PERA

Contributions Exempt from Allowable as contribution of an employee

to the National donor’s tax deduction up to

Book Trust 150% of the ADDITIONAL REQUIREMENTS FOR DEDUCTIBILITY

Fund value of the Taxpayers claiming deductions for expenses

donation (subject to withholding tax), must prove

Donations to Allowed as

5 Revenue District Officer 6 Personal Equity and Retirement Account

MFP - TAX I (Gruba/Ingles)

that said deductions were really subjected price/cost to produce the

to proper withholding. merch and all expenses

o If no withholding was made, directly incurred in

deduction will not be allowed. bringing them to their

No deduction allowed even if withholding present location and use

tax payments were made at the time of o In case of sellers of services, gross

audit investigation or receipts minus sales returns,

reinvestigation/reconsideration in cases discounts, and allowances and cost

where no withholding of tax was made in of services

accordance. Cost of services include all

o So what should you do? Withhold direct costs and expenses

and pay before the audit necessarily incurred to

investigation in order to claim provide the services

deduction required by customers

and clients

OPTIONAL STANDARD DEDUCTION

Individuals can elect a standard deduction, The following are NOT ALLOWED to use OSD and

not exceeding 40% of gross sales/gross have to use itemized deductions:

receipts during the taxable year 1. For corporations, partnerships, and other

o Same rule applies to corporations non-individuals:

as regards their gross income a. Those exempt under Tax Code and

during the taxable year other special laws, with no other

o EXCEPTION: Non-resident aliens taxable income

and non-resident corporations b. Those with income subject to

Those who can claim include partnerships special preferential rates

and taxable estate and trust c. Those with income subject to

income tax under 27(A) and

NOTE: Under TRAIN, GPPs and the partners 28(A)(1) and with

comprising the partnership may only use OSD special/preferential tax rates

once, either as GPP itself or the partners 2. For individuals:

comprising the partnership. a. Those exempt under Tax Code and

- If GPP avails of OSD, partners cannot other special laws, with no other

anymore. taxable income

b. Those with income subject to

For individuals, the following rules apply: special preferential rates

o If one uses the accrual basis of c. Those with income subject to

accounting for income OSD shall income tax under 24 and

be based on gross sales during special/preferential tax rates

taxable year

o If cash basis is used OSD shall be IMPOSITION OF CEILINGS BY THE SOF

based on his gross receipts during SoF can impose ceilings on deductions after

the taxable year a public hearing

o Cost of sales/services not allowed Ceiling won’t apply to OSD

to be deducted for purposes of

determining the basis of OSD NON-DEDUCTIBLE EXPENSES

No need to substantiate with receipts General non-deductible stuff: MEMORIZE!

For corporate taxpayers, the following 1. Personal, living, or family expenses

rules apply: 2. Any amount paid for new buildings

o Gross income means gross sales or for permanent improvements

minus sales returns, discounts, and increasing the value of

allowances and cost of goods sold property/estate

Cost of goods sold 3. Any amount spent in restoring the

includes the purchase property or in making good the

MFP - TAX I (Gruba/Ingles)

exhaustion for which an allowance

has been made

4. Premiums paid on any life

insurance policy covering the life of

any officer, or employee if the

taxpayer is directly/indirectly a

beneficiary under the policy

For related taxpayers, the following are

NOT deductible: MEMORIZE!

1. Losses from sales or exchanges of

property

2. Interest expense

3. Bad debts

For personal expenses:

1. Insurance paid on dwelling owned

and occupied by taxpayer

2. Premiums paid for life insurance

3. When a professional rents a

property for residential purposes

but receives clients in connection

with his work

Only part used as office is

deductible because it’s

considered a business

expense

4. Allowance given to children

5. Alimony or allowance paid via

separation agreement

For capital expenses:

1. New buildings, permanent

improvements, or any amount

spent in restoring property

2. Cost of defending or perfecting

title to property

3. Architect’s services

4. Expense for administration of

estate, court costs, attorney’s fees,

and executor’s commissions

5. Amount assessed and paid under

agreement between bondholders

and shareholders of a corporation,

to be used in corporation’s

reorganization

MFP - TAX I (Gruba/Ingles)

Você também pode gostar

- Module 4 - Value Added TaxDocumento16 páginasModule 4 - Value Added Taxanon_455551365Ainda não há avaliações

- TAX-Chap 2-3 Question and AnswerDocumento13 páginasTAX-Chap 2-3 Question and AnswerPoison Ivy100% (1)

- TAX SITUS-It Is The Place or Authority That Has The Right To Impose and Collect TaxesDocumento58 páginasTAX SITUS-It Is The Place or Authority That Has The Right To Impose and Collect TaxesTJ Julian BaltazarAinda não há avaliações

- Allowable Deductions From Gross Income - ReviewerDocumento4 páginasAllowable Deductions From Gross Income - RevieweryzaAinda não há avaliações

- Income Taxation NotesDocumento14 páginasIncome Taxation Notescristiepearl100% (2)

- Summary Notes - Property Relations & Estate Tax Credit and Distributable EstateDocumento3 páginasSummary Notes - Property Relations & Estate Tax Credit and Distributable EstateKiana FernandezAinda não há avaliações

- Topic 1 Preferential TaxationDocumento15 páginasTopic 1 Preferential TaxationRoMe LynAinda não há avaliações

- Chapter 6 - Introduction To The Value Added TaxDocumento8 páginasChapter 6 - Introduction To The Value Added TaxJamaica DavidAinda não há avaliações

- Tax Term Quiz TheoriesDocumento6 páginasTax Term Quiz TheoriesRena Jocelle NalzaroAinda não há avaliações

- OSD and NOLCODocumento2 páginasOSD and NOLCOAccounting FilesAinda não há avaliações

- H03 - Principles of Income TaxationDocumento10 páginasH03 - Principles of Income Taxationnona galidoAinda não há avaliações

- Acct Chapter 15BDocumento20 páginasAcct Chapter 15BEibra Allicra100% (1)

- Saludo vs. PNBDocumento8 páginasSaludo vs. PNBGLORILYN MONTEJOAinda não há avaliações

- Deductions From Gross IncomeDocumento5 páginasDeductions From Gross IncomeWenjunAinda não há avaliações

- CHAPTER 13 A - Regular Allowable Itemized DeductionsDocumento4 páginasCHAPTER 13 A - Regular Allowable Itemized DeductionsDeviane CalabriaAinda não há avaliações

- Tax On Corporation - NotesDocumento9 páginasTax On Corporation - NotesMervidelleAinda não há avaliações

- Gross Income Inclusion and ExclusionDocumento26 páginasGross Income Inclusion and ExclusionIvanna BasteAinda não há avaliações

- Donation ReviewerDocumento6 páginasDonation ReviewerronaldAinda não há avaliações

- Chapter 3 Concept of IncomeDocumento6 páginasChapter 3 Concept of IncomeChesca Marie Arenal Peñaranda100% (1)

- Estate Tax and Some Exempt TransfersDocumento3 páginasEstate Tax and Some Exempt TransfersfcnrrsAinda não há avaliações

- 2 General Principles of Income TaxationDocumento9 páginas2 General Principles of Income TaxationDenise ZurbanoAinda não há avaliações

- Tax Reviewer All About TaxationDocumento8 páginasTax Reviewer All About TaxationJoanne MayAinda não há avaliações

- Taxation Sia/Tabag TAX.2807-Income Tax On Corporations MAY 2020Documento12 páginasTaxation Sia/Tabag TAX.2807-Income Tax On Corporations MAY 2020Ramainne Ronquillo100% (1)

- Art 1795 - 1799Documento5 páginasArt 1795 - 1799Mhico Mateo100% (1)

- Taxation On Estates and Trusts - REVISED 2022Documento16 páginasTaxation On Estates and Trusts - REVISED 2022rav danoAinda não há avaliações

- Chapter 13C Optional Standard DeductionsDocumento3 páginasChapter 13C Optional Standard DeductionsJason Mables100% (1)

- Tax Reviewer 3 TRANSFER TAXDocumento6 páginasTax Reviewer 3 TRANSFER TAXAlliahDataAinda não há avaliações

- Regular Income Tax - Itemized DeductionsDocumento12 páginasRegular Income Tax - Itemized DeductionsJaneAinda não há avaliações

- TAX REMEDIES NotesDocumento6 páginasTAX REMEDIES NotesLemuel Angelo M. Eleccion100% (2)

- Transfer TaxesDocumento3 páginasTransfer TaxesbeverlyrtanAinda não há avaliações

- 5 Sales ReadyDocumento27 páginas5 Sales ReadyBrian DuelaAinda não há avaliações

- INTAX Chapter 8Documento15 páginasINTAX Chapter 8Levy PanganAinda não há avaliações

- Income Taxation - 6Documento21 páginasIncome Taxation - 6Maria Maganda MalditaAinda não há avaliações

- Powers of The BIRDocumento11 páginasPowers of The BIRmartina lopez100% (1)

- Guide Notes On Donor'S Tax Donor'S TaxDocumento10 páginasGuide Notes On Donor'S Tax Donor'S TaxNori LolaAinda não há avaliações

- Sale Report - Articles 1489-1518Documento10 páginasSale Report - Articles 1489-1518Mark Joseph DelimaAinda não há avaliações

- Article 1493: Title Vi Sales Effects of The Contract When The Thing Sold Has Been LostDocumento5 páginasArticle 1493: Title Vi Sales Effects of The Contract When The Thing Sold Has Been LostMaricon AsidoAinda não há avaliações

- Week 2 G. Contract of Commodatum Essentially GratuitousDocumento15 páginasWeek 2 G. Contract of Commodatum Essentially GratuitousDANICA FLORES100% (1)

- xP04 Value Added Tax Booklet PDFDocumento70 páginasxP04 Value Added Tax Booklet PDFmae KuanAinda não há avaliações

- TRUE OR FALSE (p.179,180)Documento2 páginasTRUE OR FALSE (p.179,180)Aberin GalenzogaAinda não há avaliações

- Chapter 1: Nature and Form of The Contract: 1459, However, Does Not Require That The Vendor Must Have TheDocumento10 páginasChapter 1: Nature and Form of The Contract: 1459, However, Does Not Require That The Vendor Must Have TheMarlon Amiel SungaAinda não há avaliações

- Reviewer Law On PartnershipDocumento26 páginasReviewer Law On Partnershipkat perezAinda não há avaliações

- SALES REPORT 1489-1491 v2Documento22 páginasSALES REPORT 1489-1491 v2MAry Jovan PanganAinda não há avaliações

- Corporation Law Midterms Quick NotesDocumento15 páginasCorporation Law Midterms Quick NotesMarieAinda não há avaliações

- Chapter 8 Regular Income Tax - Exclusion From Gross IncomeDocumento2 páginasChapter 8 Regular Income Tax - Exclusion From Gross IncomeJason MablesAinda não há avaliações

- Handouts Gross EstateDocumento2 páginasHandouts Gross Estateonlineonrandomdays100% (1)

- Foreign Tax CreditDocumento2 páginasForeign Tax CreditSophiaFrancescaEspinosaAinda não há avaliações

- Cpa Review - CGTDocumento10 páginasCpa Review - CGTKenneth Bryan Tegerero TegioAinda não há avaliações

- Income Tax - Corporations Sample Problems: SolutionsDocumento12 páginasIncome Tax - Corporations Sample Problems: SolutionsYellow BelleAinda não há avaliações

- Quiz 3 - Classification of Taxpayers and Source of IncomeDocumento2 páginasQuiz 3 - Classification of Taxpayers and Source of IncomeJimbo ManalastasAinda não há avaliações

- Allowable Deductions From Gross IncomeDocumento5 páginasAllowable Deductions From Gross IncomeTet VergaraAinda não há avaliações

- Deductions From Gross IncomeDocumento2 páginasDeductions From Gross Incomericamae saladagaAinda não há avaliações

- DEDUCTIONSDocumento9 páginasDEDUCTIONSAisaia Jay ToralAinda não há avaliações

- Deductions From Gross IncomeDocumento3 páginasDeductions From Gross IncomeKezAinda não há avaliações

- GROSS INCOME DEDUCTIONS Advance NotesDocumento13 páginasGROSS INCOME DEDUCTIONS Advance NotesMary Angeline SalvaneraAinda não há avaliações

- Allowable DeductionsDocumento16 páginasAllowable DeductionsChyna Bee SasingAinda não há avaliações

- Allowable DeductionsDocumento15 páginasAllowable DeductionsEloisa Venice TinsayAinda não há avaliações

- Allowable Deductions (Taxation Review)Documento82 páginasAllowable Deductions (Taxation Review)Prie DitucalanAinda não há avaliações

- 6 - Deductions From Gross IncomeDocumento9 páginas6 - Deductions From Gross IncomeSamantha Nicole Hoy100% (2)

- TAX 1 - Gross ProfitDocumento3 páginasTAX 1 - Gross ProfitPacaña, Vincent Michael M.Ainda não há avaliações

- Bayer Phils. Versus Agana, G.R. No. L38701 April 8, 1975: FactsDocumento51 páginasBayer Phils. Versus Agana, G.R. No. L38701 April 8, 1975: FactsMikaela PamatmatAinda não há avaliações

- Group 4 - Solo Parents ActDocumento2 páginasGroup 4 - Solo Parents ActMikaela PamatmatAinda não há avaliações

- Group 4 - Solo Parents ActDocumento2 páginasGroup 4 - Solo Parents ActMikaela PamatmatAinda não há avaliações

- Pinga V. Heirs of Santiago GR No. 170354 Facts:: Ex ParteDocumento11 páginasPinga V. Heirs of Santiago GR No. 170354 Facts:: Ex ParteMikaela PamatmatAinda não há avaliações

- C Pleadings and Manner of AllegationsDocumento26 páginasC Pleadings and Manner of AllegationsMikaela PamatmatAinda não há avaliações

- G Other CasesDocumento86 páginasG Other CasesMikaela PamatmatAinda não há avaliações

- SCA CasesDocumento33 páginasSCA CasesMikaela PamatmatAinda não há avaliações

- Rex Castillon For Petitioners. Fortunato A. Padilla For RespondentsDocumento8 páginasRex Castillon For Petitioners. Fortunato A. Padilla For RespondentsMikaela PamatmatAinda não há avaliações

- Sps Tan V China BankDocumento2 páginasSps Tan V China BankRobert RosalesAinda não há avaliações

- Appeal Etc. CasesDocumento14 páginasAppeal Etc. CasesMikaela PamatmatAinda não há avaliações

- Document. - Whenever An Action or DefenseDocumento8 páginasDocument. - Whenever An Action or DefenseMikaela PamatmatAinda não há avaliações

- Sps. Huang v. LBPDocumento18 páginasSps. Huang v. LBPMikaela PamatmatAinda não há avaliações

- Esteves v. SarmientoDocumento34 páginasEsteves v. SarmientoMikaela PamatmatAinda não há avaliações

- Gorg 2 DigestDocumento8 páginasGorg 2 DigestMikaela PamatmatAinda não há avaliações

- Group 4 - Peaceful Concerted ActivitiesDocumento15 páginasGroup 4 - Peaceful Concerted ActivitiesMikaela Pamatmat100% (2)

- (G.R. NO. 160855: April 16, 2008) CONCEPCION CHUA GAW, Petitioner, v. SUY BEN CHUA and FELISA CHUA, Respondents. Decision Nachura, J.Documento8 páginas(G.R. NO. 160855: April 16, 2008) CONCEPCION CHUA GAW, Petitioner, v. SUY BEN CHUA and FELISA CHUA, Respondents. Decision Nachura, J.Mikaela PamatmatAinda não há avaliações

- Digest Titan V DavidDocumento3 páginasDigest Titan V DavidMikaela PamatmatAinda não há avaliações

- Week-10 - PartnershipDocumento22 páginasWeek-10 - PartnershipMikaela PamatmatAinda não há avaliações

- Week-10 - PartnershipDocumento22 páginasWeek-10 - PartnershipMikaela PamatmatAinda não há avaliações

- Vat Syllabi Train Jun 2020 2Documento13 páginasVat Syllabi Train Jun 2020 2Susannie AcainAinda não há avaliações

- Labor Reviewer - WagesDocumento22 páginasLabor Reviewer - WagesMikaela Pamatmat100% (1)

- Land Bank of The Philippines Vs Atlanta Industries (Servando)Documento3 páginasLand Bank of The Philippines Vs Atlanta Industries (Servando)Mikaela PamatmatAinda não há avaliações

- Page No.: Class No.: Name: School: Ateneo Section: 4E SignatureDocumento1 páginaPage No.: Class No.: Name: School: Ateneo Section: 4E SignatureMikaela PamatmatAinda não há avaliações

- QUIZ NIGHT QsDocumento8 páginasQUIZ NIGHT QsMikaela PamatmatAinda não há avaliações

- 136 Phil Coconut V Republic (Sy)Documento7 páginas136 Phil Coconut V Republic (Sy)Mikaela Pamatmat100% (1)

- Arigo v. Swift (Pamatmat)Documento3 páginasArigo v. Swift (Pamatmat)Mikaela PamatmatAinda não há avaliações

- Wedding Singer ContractDocumento4 páginasWedding Singer ContractMikaela PamatmatAinda não há avaliações

- Sustainability 11 05819 v2Documento23 páginasSustainability 11 05819 v2Mikaela PamatmatAinda não há avaliações

- Digests FinalDocumento12 páginasDigests FinalMikaela PamatmatAinda não há avaliações

- 103 Abbas V SET (Sy)Documento2 páginas103 Abbas V SET (Sy)Mikaela PamatmatAinda não há avaliações

- 48 - 1997 SummerDocumento42 páginas48 - 1997 SummerLinda ZwaneAinda não há avaliações

- Final ReportDocumento6 páginasFinal ReportBrian Rey L. AbingAinda não há avaliações

- Consultant Agreement PDFDocumento6 páginasConsultant Agreement PDFRathore&Co Chartered AccountantAinda não há avaliações

- Leyson vs. OmbudsmanDocumento12 páginasLeyson vs. OmbudsmanDNAAAinda não há avaliações

- imageRUNNER+ADVANCE+C5051-5045-5035-5030 Parts CatalogDocumento268 páginasimageRUNNER+ADVANCE+C5051-5045-5035-5030 Parts CatalogDragos Burlacu100% (1)

- Software Requirement SpecificationDocumento10 páginasSoftware Requirement SpecificationSushil SarrafAinda não há avaliações

- FZCODocumento30 páginasFZCOawfAinda não há avaliações

- Rachel Mitchell Task 1Documento1.003 páginasRachel Mitchell Task 1nazmul HasanAinda não há avaliações

- SPOUSES DAVID B. CARPO & and RECHILDA S. CARPO V. ELEANOR CHUA and ELMA DY NGDocumento3 páginasSPOUSES DAVID B. CARPO & and RECHILDA S. CARPO V. ELEANOR CHUA and ELMA DY NGRengie GaloAinda não há avaliações

- The Green Wall - Story and Photos by Stephen James Independent Investigative Journalism & Photography - VC Reporter - Ventura County Weekly - California Department of Corrections whistleblower D.J. Vodicka and his litigation against the CDC.Documento8 páginasThe Green Wall - Story and Photos by Stephen James Independent Investigative Journalism & Photography - VC Reporter - Ventura County Weekly - California Department of Corrections whistleblower D.J. Vodicka and his litigation against the CDC.Stephen James - Independent Investigative Journalism & PhotographyAinda não há avaliações

- 5th Year PES Mrs - Hamdoud Research Methodology 2Documento3 páginas5th Year PES Mrs - Hamdoud Research Methodology 2Rami DouakAinda não há avaliações

- 3471A Renault EspaceDocumento116 páginas3471A Renault EspaceThe TrollAinda não há avaliações

- Sfa 5.22 PDFDocumento36 páginasSfa 5.22 PDFLuis Evangelista Moura PachecoAinda não há avaliações

- Legal DraftingDocumento28 páginasLegal Draftingwadzievj100% (1)

- Partial Discharge Diagnostic Testing and Monitoring Solutions For High Voltage CablesDocumento55 páginasPartial Discharge Diagnostic Testing and Monitoring Solutions For High Voltage CablesElsan BalucanAinda não há avaliações

- Magnetic Properties of MaterialsDocumento10 páginasMagnetic Properties of MaterialsNoviAinda não há avaliações

- Accredited Architecture QualificationsDocumento3 páginasAccredited Architecture QualificationsAnamika BhandariAinda não há avaliações

- 03 Marine Multispecies Hatchery Complex Plumbing Detailed BOQ - 23.10.2019Documento52 páginas03 Marine Multispecies Hatchery Complex Plumbing Detailed BOQ - 23.10.2019samir bendreAinda não há avaliações

- Among Us Hack Mod Menu Mod AlwaysDocumento4 páginasAmong Us Hack Mod Menu Mod AlwaysC JAinda não há avaliações

- Renderoc LA55Documento2 páginasRenderoc LA55Mansoor AliAinda não há avaliações

- NV 2Documento2 páginasNV 2Joshua ApongolAinda não há avaliações

- BIR Form 2307Documento20 páginasBIR Form 2307Lean Isidro0% (1)

- Arslan 20 Bba 11Documento11 páginasArslan 20 Bba 11Arslan Ahmed SoomroAinda não há avaliações

- Openness and The Market Friendly ApproachDocumento27 páginasOpenness and The Market Friendly Approachmirzatouseefahmed100% (2)

- Fuel Supply Agreement - First DraftDocumento104 páginasFuel Supply Agreement - First DraftMuhammad Asif ShabbirAinda não há avaliações

- C# Program To Print Even NumbersDocumento11 páginasC# Program To Print Even NumbersNadikattu RavikishoreAinda não há avaliações

- Io TDocumento2 páginasIo TPrasanth VarasalaAinda não há avaliações

- BA5411 ProjectGuidelines - 2020 PDFDocumento46 páginasBA5411 ProjectGuidelines - 2020 PDFMonisha ReddyAinda não há avaliações

- PCB Design PCB Design: Dr. P. C. PandeyDocumento13 páginasPCB Design PCB Design: Dr. P. C. PandeyengshimaaAinda não há avaliações

- Today Mass Coloration in The Lndustri-Al Environment: Lenzinger BerichteDocumento5 páginasToday Mass Coloration in The Lndustri-Al Environment: Lenzinger BerichteAditya ShrivastavaAinda não há avaliações