Escolar Documentos

Profissional Documentos

Cultura Documentos

Case - 1: Click of Calculator WWW - Taxguru.in

Enviado por

Billa RockTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Case - 1: Click of Calculator WWW - Taxguru.in

Enviado por

Billa RockDireitos autorais:

Formatos disponíveis

Leave Salary Calculator

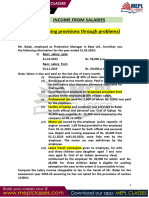

CASE - 1

In case of an employee of the central government or a state government, any amount received as cash equivalent of leave

salary in respect of the period of earned leave at this credit at the time of retirement/superannuation is exempt from tax.

[Sec 10(10AA)(i)].

CASE - 2

In the case of a non-Government employee leave salary is exempt from under section 10(10AA)(ii) to the extent of the

least of the followings:

a. cash equivalent of the leave salary in respect of the periof of earned leave to the credit of an employee only

at the time of retirement whether on superannuation or otherwise {eg. voluntary retirement} (earned leave

entitlements cannot exceed 30 days for every year of actual service rendered for the employer from whose

service he has retired);or

b.10 months average salary; or

Average salary is to be calculated on the basis of average salary drawn during the period of 10

months immediately preceding the retirement/superannuation. [SALARY

= Baisc + D.A + COMMISSION - other allowance & perquisite]

c.Rs.300000 (Maximum limit as specified by government after 2 APRIL 1998)

d. leave encashment actually received at the time of retirement

Click of Calculator

Download Source - www.taxguru.in

Download Source - www.taxguru.in

Provide inputs below

Name of the employee: Mr. X

Duration of Service: 24 Years

Leave entitlement for every year of service: 1.5 Months

Leave availed while in Service: 0 Months

Leave at the credit of employee at retirement: 36 Months

Leave Salary Reveived by employee: 795600

Average Salary received during the 10 months

immediately preceeding the retirement /

superannuation 22100

Leave entitlement as per Income Tax Act i.e one month's leave

for every year of service Err:502 Months

Leave Availed 0 Months

Leave to the credir of employee at the time of retirement Err:502 Months

a.

}

Cash Equivalent of Leave to the credit of Employee

at the time of retirement Err:502

b. 10 months' average salary 221000 Find the Lower Amount

c. Maximum Limit 300000 (if the figure is negetive

d. Leave Salary Received 795600 consider it Zero)

ENTER LOWER AMOUNT 221000

Download Source - www.taxguru.in

Tax Treatment of Leave Salary Received by Mr. X

LEAVE SALARY RECEIVED 795600

Exemption u/s 10(10AA) 221000

TAXABLE LEAVE SALARY 574600

Você também pode gostar

- Employment Agreement Contract TDWDocumento3 páginasEmployment Agreement Contract TDWshahirah_alkaff33% (3)

- Group AssignmentDocumento9 páginasGroup AssignmentXiao Han WongAinda não há avaliações

- Kinazo - Labor Finals Case Digests PDFDocumento89 páginasKinazo - Labor Finals Case Digests PDFMaria Recheille Banac KinazoAinda não há avaliações

- Per ManualDocumento421 páginasPer Manualsuresh babuAinda não há avaliações

- HCM Extracts Dbi List Rel7Documento1.141 páginasHCM Extracts Dbi List Rel7P Rajendra100% (1)

- Compensation Management NoteDocumento57 páginasCompensation Management NoteAishwaryaSantoshAinda não há avaliações

- Salary Increase and Teachers Benefits Written ReportDocumento9 páginasSalary Increase and Teachers Benefits Written Reportrhodalyn baluarteAinda não há avaliações

- SCORG Offer - Vignesh S SamrajDocumento4 páginasSCORG Offer - Vignesh S SamrajRanjith KumarAinda não há avaliações

- Appointmnet Letter PDFDocumento11 páginasAppointmnet Letter PDFvikashAinda não há avaliações

- 10 HR Metrics Every Company Should TrackDocumento44 páginas10 HR Metrics Every Company Should TrackProtap RoyAinda não há avaliações

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsNo Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsAinda não há avaliações

- Richard Lobo EVP and Head Human Resources - Infosys LimitedDocumento28 páginasRichard Lobo EVP and Head Human Resources - Infosys LimitedAnkit Kumar ChoudharyAinda não há avaliações

- Income Tax Salary NotesDocumento48 páginasIncome Tax Salary NotesTanya AntilAinda não há avaliações

- SCDL - PGDBA - Finance - Sem 4 - TaxationDocumento23 páginasSCDL - PGDBA - Finance - Sem 4 - Taxationapi-3762419100% (2)

- Head Salary PDFDocumento48 páginasHead Salary PDFRvi MahayAinda não há avaliações

- Income From SalaryDocumento60 páginasIncome From SalaryroopamAinda não há avaliações

- Income Tax 05Documento17 páginasIncome Tax 05AMJAD ULLA RAinda não há avaliações

- Incone From Salary Ppts - pdf348Documento48 páginasIncone From Salary Ppts - pdf348saloniagarwalagarwal3Ainda não há avaliações

- Income From Salaries: CA Final Paper7 Direct Tax Laws Chapter 4 CA - Rachana KumarDocumento65 páginasIncome From Salaries: CA Final Paper7 Direct Tax Laws Chapter 4 CA - Rachana KumarRupaliAinda não há avaliações

- Sunday, April 5, 2009: Income Under The Head Salary (Section 15 - 17)Documento14 páginasSunday, April 5, 2009: Income Under The Head Salary (Section 15 - 17)Prashant singhAinda não há avaliações

- Direct Taxation: Gyanamayee PanigrahiDocumento11 páginasDirect Taxation: Gyanamayee PanigrahiAJ WalkerAinda não há avaliações

- Tax On Salary IncomeDocumento15 páginasTax On Salary Incomeapi-19778412Ainda não há avaliações

- Q1 (A) Discuss Provisions Relating To Taxability of Salary According To Charging Section 15 of The Income Tax ActDocumento40 páginasQ1 (A) Discuss Provisions Relating To Taxability of Salary According To Charging Section 15 of The Income Tax ActDhiraj YAdavAinda não há avaliações

- Salary IncomeDocumento83 páginasSalary IncomechitkarashellyAinda não há avaliações

- Taxation of SalaryDocumento27 páginasTaxation of SalaryAshish RanjanAinda não há avaliações

- Income Under The Head Salaries: (Section 15 - 17)Documento55 páginasIncome Under The Head Salaries: (Section 15 - 17)leela naga janaki rajitha attiliAinda não há avaliações

- Module 2 - Income From SalariesDocumento22 páginasModule 2 - Income From SalariesAishwarya NAinda não há avaliações

- Whichever Is Lower: A) DeductionsDocumento3 páginasWhichever Is Lower: A) Deductions8151 KATALE PRIYANKAAinda não há avaliações

- Retirement BenefitsDocumento14 páginasRetirement BenefitsAnupAinda não há avaliações

- Lecture 11 Income From Salary - Till Leave SalaryDocumento19 páginasLecture 11 Income From Salary - Till Leave Salarynileshshengule12Ainda não há avaliações

- Theory Questions: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocumento10 páginasTheory Questions: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherAinda não há avaliações

- Final Indirect Tax ProjectDocumento39 páginasFinal Indirect Tax Projectssg1015Ainda não há avaliações

- Income From Salary QUESTIONSDocumento20 páginasIncome From Salary QUESTIONSSiva SankariAinda não há avaliações

- Notes On Income From SalaryDocumento5 páginasNotes On Income From SalaryNarendra KelkarAinda não há avaliações

- Income Tax: Topic: Gratuity Provident Fund Presented By, Prof - MadhumathiDocumento12 páginasIncome Tax: Topic: Gratuity Provident Fund Presented By, Prof - MadhumathimadhumathiAinda não há avaliações

- 77taxability of Retirement Benefits 231122 092942Documento9 páginas77taxability of Retirement Benefits 231122 092942jasontamang565Ainda não há avaliações

- Taxation - Direct and Indirect - Chapter 4 PPT MkJy53msNBDocumento32 páginasTaxation - Direct and Indirect - Chapter 4 PPT MkJy53msNBRupal DalalAinda não há avaliações

- Salary Income-Pg DTDocumento11 páginasSalary Income-Pg DTOnkar BandichhodeAinda não há avaliações

- About The Charts: CA Pooja Kamdar DateDocumento8 páginasAbout The Charts: CA Pooja Kamdar DatekbalakarthikaAinda não há avaliações

- Salary IllustrationDocumento10 páginasSalary IllustrationSarvar Pathan100% (1)

- Retirement BenefitsDocumento10 páginasRetirement BenefitsRs AbhishekAinda não há avaliações

- Income Tax Law and PracticesDocumento26 páginasIncome Tax Law and Practicesremruata rascalralteAinda não há avaliações

- Income From SalariesDocumento6 páginasIncome From Salariesmayankking404Ainda não há avaliações

- Problems On Income From Salaries: Tax SupplementDocumento20 páginasProblems On Income From Salaries: Tax SupplementJkAinda não há avaliações

- ACC202 Employment Income NotesDocumento11 páginasACC202 Employment Income NotesPhebieon MukwenhaAinda não há avaliações

- MPFX Howto 2017 q3 enDocumento2 páginasMPFX Howto 2017 q3 enlindaAinda não há avaliações

- Income From SalaryDocumento35 páginasIncome From SalaryNistha RayAinda não há avaliações

- Meaning of Salary': Condition For Charging Income U/H "Salaries"Documento21 páginasMeaning of Salary': Condition For Charging Income U/H "Salaries"kiranshingoteAinda não há avaliações

- Salaries NotesDocumento48 páginasSalaries Notesbhatiasanjay89Ainda não há avaliações

- HhytyDocumento51 páginasHhytyNitin gAinda não há avaliações

- Chapter 4a PDFDocumento14 páginasChapter 4a PDFBrinda RAinda não há avaliações

- Leave Encashment - Tax Free FormDocumento1 páginaLeave Encashment - Tax Free FormPaymaster Services100% (1)

- Problems On Business/Profession Income: SEM It AssignmentDocumento9 páginasProblems On Business/Profession Income: SEM It AssignmentNikhilAinda não há avaliações

- Chapter 3 Payroll Accounting SystemDocumento17 páginasChapter 3 Payroll Accounting SystemNasiibuAinda não há avaliações

- Salary Income NotesDocumento14 páginasSalary Income NotesHani ShehzadiAinda não há avaliações

- Retirement Benefits: Taxable Limits and ExemptionsDocumento38 páginasRetirement Benefits: Taxable Limits and ExemptionsVineet GargAinda não há avaliações

- SalaryDocumento66 páginasSalaryFurqan AhmedAinda não há avaliações

- Appointment - ER Consulting BangaloreDocumento4 páginasAppointment - ER Consulting BangaloreRanganath hsAinda não há avaliações

- Rules For Statutory Deductions Exemptions Perquisites-PayrollDocumento4 páginasRules For Statutory Deductions Exemptions Perquisites-PayrollSiba MishraAinda não há avaliações

- Welcome!: Income Under Head - SalariesDocumento66 páginasWelcome!: Income Under Head - SalariesKalpana ChoudharyAinda não há avaliações

- Retirement BenefitsDocumento17 páginasRetirement BenefitsadityaAinda não há avaliações

- Fundamentals of Acc II CH 3 & 4Documento13 páginasFundamentals of Acc II CH 3 & 4Sisay Belong To Jesus100% (2)

- Chapter 4Documento11 páginasChapter 4yosef mechalAinda não há avaliações

- Incomes On RetirementDocumento11 páginasIncomes On RetirementShabnam HabeebAinda não há avaliações

- Taxation of Leave SalaryDocumento1 páginaTaxation of Leave SalaryJPAinda não há avaliações

- SalariesDocumento35 páginasSalariesSamyak Jirawala100% (1)

- Current Liabilities (Payroll)Documento13 páginasCurrent Liabilities (Payroll)Bona MisbaAinda não há avaliações

- Enhancement in Gratuity Limit Under Payment of Gratuity ActDocumento4 páginasEnhancement in Gratuity Limit Under Payment of Gratuity ActPaymaster ServicesAinda não há avaliações

- Appointment LetterDocumento4 páginasAppointment LetterUpendra NeravatiAinda não há avaliações

- The Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsNo EverandThe Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsAinda não há avaliações

- Case Studies in OB - ALL - 2020-2021Documento29 páginasCase Studies in OB - ALL - 2020-2021Sitota KebedeAinda não há avaliações

- Revision Annotated BibliographyDocumento2 páginasRevision Annotated Bibliographyapi-325211358Ainda não há avaliações

- Why Do You Want To Study This SubjectDocumento9 páginasWhy Do You Want To Study This SubjectTariq KhanAinda não há avaliações

- Ammbuja Report2Documento76 páginasAmmbuja Report2Mr. AnikAinda não há avaliações

- 2018 Payroll Guide: WWW - Payworks.caDocumento15 páginas2018 Payroll Guide: WWW - Payworks.caPrameela KondaveetiAinda não há avaliações

- Pension Mathematics With Numerical Illustrations: Second EditionDocumento13 páginasPension Mathematics With Numerical Illustrations: Second EditionG.k. FlorentAinda não há avaliações

- Org B Asgmt No. 2 (CHP 5) More Than A PaycheckDocumento1 páginaOrg B Asgmt No. 2 (CHP 5) More Than A PaycheckAnnaM0% (1)

- Gsis V NLRCDocumento2 páginasGsis V NLRCJoeyBoyCruzAinda não há avaliações

- Uob One Account Salary CreditDocumento1 páginaUob One Account Salary Creditvincent8295547Ainda não há avaliações

- Canete ResearchDocumento2 páginasCanete ResearchJeoffrey Agnes Sedanza PusayAinda não há avaliações

- Upload 2Documento27 páginasUpload 2NAGESH PORWALAinda não há avaliações

- Labor Law-OmanDocumento9 páginasLabor Law-OmanAisha FayazAinda não há avaliações

- Jafza Rules 6th Edition 2016Documento58 páginasJafza Rules 6th Edition 2016Binoy PsAinda não há avaliações

- Session 10 - Payroll (PAYE, NIS HS) PDFDocumento7 páginasSession 10 - Payroll (PAYE, NIS HS) PDFDarrel SamueldAinda não há avaliações

- I. Arnold & Q Bar (15pts)Documento18 páginasI. Arnold & Q Bar (15pts)Shane SagumAinda não há avaliações

- Field Application Engineer Salary (India)Documento5 páginasField Application Engineer Salary (India)Mehul PatelAinda não há avaliações

- GOCC Governance Act of 2011Documento21 páginasGOCC Governance Act of 2011John AlmedaAinda não há avaliações

- IHRM Case StudyDocumento6 páginasIHRM Case StudyTanzila1702Ainda não há avaliações

- Evolution of BusinessDocumento26 páginasEvolution of BusinessSamiksha SainiAinda não há avaliações

- User Manual For CISBDocumento7 páginasUser Manual For CISBLayHunGraceAinda não há avaliações