Escolar Documentos

Profissional Documentos

Cultura Documentos

Lecture notes on the history of economic thought

Enviado por

Aurangzeb ChaudharyDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Lecture notes on the history of economic thought

Enviado por

Aurangzeb ChaudharyDireitos autorais:

Formatos disponíveis

lOMoARcPSD|1277595

Lecture notes, lecture 1-8 - Notes History of Economic

Thoughtrn

History of Economic Thought (Erasmus Universiteit Rotterdam)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

Notes History of Economic Thought

Lecture 1

Period Classical period Neoclassical period Modern economics

Main focus Wealth Allocation of scarce resources ‘Modeling’

Starting point 1776 1870 1940/50

Characteristi Wealth of Nations Marginal revolution

c

In the 19th century, the adequacy and importance of classical economics declined. The

alternatives were:

- Marx and socialism

- Historical economics

- Marginalism: mainstream of neoclassical period

- Institutionalism

- Keynesian economics

There are two types of explanation for the transition of economic ideas/schools.

- External factors: changes in societal circumstances.

- Internal factors: failure of consistency of theories; increasingly instruments and

techniques prove inadequate.

Change from classicism to marginalism: Industrial revolution, classical economics was not

appropriate for this.

Why did economics start as a science in 1776? What was so special about Adam Smith’s Wealth

of Nations?

The Wealth of Nations stated that the division of labor will make wealth grow. People are

constantly trying to improve their conditions. People advance together, yet primarily out of self-

interest. However, this self-interest does not mean that some people benefit while others are hurt.

Interdependence results in mutual adjustments in behavior, and such patterns channel passions in

socially desirable directions. Not all rules need to be imposed to reach an agreement and to

promote coordination. The main idea behind this is that people can’t live without social

interaction.

Smith: self-interest yields a better societal result than acting out of social interest. This is in

contradiction to the common opinion that wanted to suppress self-interest to promote the general

interest. Besides self-interest, appropriate institutions are required for advancement of

individuals:

- Directing behavior of individuals into a contribution to the general interest.

- Offer opportunities and limitations; not necessarily a positive outcome for everyone.

Goal: to improve one’s condition.

Means: wealth.

How to accumulate wealth: division of labor and thus trade/exchange.

We should all benefit: room for self-interest and institutions.

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

Smith’s ideas were in complete contrast with previous ideas.

Before 1776: Pre-classical period.

Early pre-classical period: Greek philosophers and scholastic writers. Economics from an

ethical/religious point of view.

Later pre-classical period: 1500-1776: Mercantilists and forerunners of classical school.

In the middle ages, importance of the market, wage labor, and growth of economic activity

became more important. As a result, society transformed. Economics became subordinated to

political objectives, to increase state power.

Who? Greek philosophers and Mercantilists Smith/classical

scholastic writers school

Focus Community State Market

Objectives Ethical/religious Political Economic

Mercantilism

Political objectives were to increase wealth and power. Mercantilists were no longer

philosophers, but government officials and merchants. Growth of wealth and trade in a time of

increasing trade, emerging cities, and state building. Economics was the management of the

national household.

1. Wealth. Money = power. Wealth = stock of gold and silver. Wealth was strongly linked

to political/state power.

2. Sources of wealth.

- Natural resources

- Stealing from others

- Foreign trade: E > M (Thomas Mun)

3. Zero-sum game. Total world amount of wealth is fixed. One country’s gain is another

country’s loss. Economic warfare.

4. Government. Necessity of regulation

- Individual interest conflicts with national interest

- Market induces conflicts

- Advancing political objectives.

An important point of mercantilism is the regulation of the economy. Strengthening the economy

by a positive balance of trade.

1. Facilitating production, transport, and export

2. Measures to keep products cheap in comparison to foreign products. Low wages = low

cost of production = competitive advantage in foreign trade. Low wages also encourage

labor supply. How: large population, regulation of food prices. ‘Utility of poverty’

doctrine.

3. Improve tax revenues

4. Trading companies and colonies

5. Military.

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

Mercantilism Classicism

Wealth Money Consumer goods

Sources Foreign trade Division of labor and

accumulation of capital

Economic game Zero-sum Positive-sum

Government and interests National interest and National interest is sum of

individual interests conflict individual interests

Why was mercantilism inadequate?

Transition feudal – commercial society.

- Shifts from services to goods

- Changes in level of aggregate demand

- Changes in patterns of production, distribution, and consumption

- Shift in power

- Profit as distinctive source of income.

Classical economics: Independence

1. Market as principle of organization

2. Economic process governed by laws of nature.

Forerunners classical economics

Charles Davenant: Wealth as money is an inadequate concept of wealth.

William Petty: Quantification of causal relationships between economic variables. Political

arithmetic. Importance of division of labor, effect on capital accumulation.

Dudley North: Trade as a positive-sum game. Plea for free trade.

David Hume: There is no need for jealousy of trade:

Price-specie flow mechanism: Trade surplus inflow of gold and silver (specie) prices

increase prices in export sector increase export decreases and import increases trade

surplus turns into a deficit outflow of gold and silver quantity of money decreases

prices decrease etc.

Richard Cantillon: role of entrepreneur, role of market. Abstraction as method. However: still a

large role for government.

Lecture 2

Analysis of Wealth of Nations

Paradox: In an advanced society, the worker and the landlord have to pay a large part of their

income to taxes. However, they’re better off in the advanced society compared to the primitive

society.

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

Explanation: Division of labor, specialization. Condition: extent of the market, and the use of

money. Division of labor implies exchange and thus the question of relative value of

commodities.

Value

- Use value

- Exchange value: the focus is on this.

1 How to measure exchange value? Disutility of labor (effort): index of wealth, to know whether

wealth has increased. Money is not an appropriate measure of value, because it fluctuates.

2 What determines exchange vale?

- Market price: depends on supply and demand. However, only in the short run,

temporary prices.

- Natural price: Long run price.

Distinction between primitive and advanced society. Primitive society: only 1 factor of

production: labor. Commodities exchange on the basis of the ratio of labor costs.

Advanced society: 3 factors of production: wage, rent, and profit. Wage + rent + profit = value of

good (costs of production) = sum of average rewards of factors of production = natural price,

stable in the long run.

- Demand > Supply Market price > natural price

- Demand < Supply Market price < natural price

- Demand = Supply Market price = natural price

As long as market price is not equal to the natural price, market adjustment process starts, driven

by self-interest of consumers/producers.

Suppose demand > supply

1. Price of good X increases

2. Higher reward for labor and capital

3. Profit opportunity arises, reallocation of resources

4. Supply of good X increases

5. Price of good X decreases

6. Lower reward for labor and capital

Results

- Equilibrium between market price and natural price is restored

- Natural rate of return on factors of production is equalized

- Supply = demand

- Efficient allocation of resources

- Price = real costs.

Driven by self-interest. Market power distorts market adjustments and accumulation of wealth.

Interplay of passions and institutions: trend of growth of liberty and wealth. Requires appropriate

institutions as interplay of interests and institutions may also have negative consequences.

Growth of wealth

- Division of labor labor productivity increases.

4

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

- Capital (accumulation): stock can be used in two ways

- As capital to make a profit

- For consumption purposes.

Productive labor (stock increases) vs. unproductive labor (stock decreases).

Growth of stock by productive labor: the larger the part of stock used as capital, the more labor

can be used productively, and the more the stock can be increased.

Labor production increases surplus increases capital accumulation ratio of

productive/unproductive labor increases.

Growth: increasing rent/wage/profit income + falling prices. If wealth increases population

increases extent of market enlarges division of labor increases labor productivity

increases.

Appropriate laws and institutions are needed as to make efforts pay off. However, it is possible

that some groups do not gain from the growth of wealth.

3 classes in society

1. Capitalists: profit-income. Clever constructions at the expense of others, class interest

≠ interest of society.

2. Landowners: rent-income. Foolish and conservative, class interest = interest of society.

3. Laborers: wage-income. No power or notion, active and frugal, class interest =

interest of society.

Obstruction and inequalities

- Merchants with privileged position, backed by government

- Market hindrances

- Processes of adjustment in markets not optimal

- Inefficient allocation

- No incentive for innovation

- All detrimental to growth.

Wealth of nations: optimism on long-run trend of growth of productivity, which would improve

the position of laborers.

However, in the 19th century, a more negative view developed. Due to population growth, profits

declined, capital accumulation declined, growth declined. Labor supply increased, wages

decreased. Demand for food increased, prices increased, which would lead to poverty. The only

class to benefit from population growth were the land-owners.

Population factor: key factor in the development of societies: ratio between population size and

means of subsistence.

Thomas Malthus (1766-1834)

Malthus’ population theory

1. Size of population is always determined by the available means of subsistence.

2. Growth rate of population always outruns the growth rate of production.

Claim: if population growth is larger than growth means of subsistence, checks become active.

Checks

Population grows geometrically, food production arithmetically.

5

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

Checks to balance these unequal forces.

1. Positive checks: food shortages, famines, epidemics, and wars.

2. Preventive checks: Vice, moral restraint.

The time it was published was the end of an era. The Industrial Revolution provided a new type

of economy: innovations, rising productivity, development of non-agrarian, industrial production,

and reallocation of resources.

Irish famine: seemed like evidence for Malthusian theory. However, this led to half-hearted

reactions, because they thought of it as something natural, inevitable.

Poor laws increased population size, which decreased wages, although food prices were rising,

leading to more poverty. According to Malthus, poor laws should be abolished.

David Ricardo (1772-1823)

His rent theory followed from the debate on Corn Laws, which were designed to regulate imports

in times of shortages.

The Corn Laws failed after 1790, because of Napoleonic wars, and population growth. However,

the debate started again in 1815.

Ricardo’s rent theory

1. Population growth: necessity for increase in food production.

2. More land exploitation / imports.

3. With further growth: there was a need to use less fertile land / more labor and capital =

diminishing returns.

4. Cost advantage on fertile land.

5. Competition among farmers for cost advantage.

6. Because of this competition, cost advantage or surplus was claimed by the landowners in

the form of rent.

7. Cost advantage = price – cost of production

8. Price = cost of production in last unit of corn on the least fertile land in exploitation (P =

MC).

9. On marginal (least fertile land in use) land: price – cost of production = 0.

10. On fertile land: price – costs of production = cost advantage/surplus = rent > 0.

11. If price of corn increases, the cost advantage increases and thus also rent increases.

Rent

- Originates in difference in cost of production as a consequence of differences in

fertility of land.

- It is not a reward for the use of a scarce resource.

- Is price-determined, not price-determining.

- If corn prices increase, rent increases.

- The Corn Laws created an artificial scarcity to the advantage of landowners.

Tutorial 1 – Physiocracy

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

According to physiocrats, agriculture is the only source of wealth.

- Surplus is originated during production

- Laissez-faire, government intervention distorts the economy, agents should be able to

pursue their own interests.

- Wealth = production

- Natural order of economy (Tableau Economique – p. 41 Brue & Grant).

The emphasis was on agriculture, the only source of surplus. Landowners should be taxed,

because rents are the surplus the landowners get. All taxes imposed on others would be passed on

to the landowner anyway.

The physiocratic school was wrong to consider industry and trade as sterile, this led also to the

false belief that only landowners should be taxed because only land could yield a surplus.

However, by studying society as a whole and circulation of goods and wealth, they founded

economics as a social science. Quesnay’s tableau economique is a precursor to later economic

flow diagrams and national income accounting. The law of diminishing returns was stated first by

Turgot. Furthermore, they also originated the analysis of tax shifting and incidence. Finally, the

physiocrats turned the attention of economists to the question of the proper role of government in

the economy.

Physiocrats on low wages

Due to low wages, poor farmers had a low income, therefore they had no means for investments,

or only for very small investments. Consequently, the production in agriculture didn’t grow at a

high rate. According to the physiocrats, agriculture was the sole source of wealth. Low wages

imply low investments, which implies low productivity growth in agriculture. Therefore low

wages had a negative effect on the growth of wealth.

Wealth Sources

Mercantilism Gold and silver Foreign trade

Physiocracy Consumption goods Agriculture (land)

Classicism Stock of (consumption) goods Labor, capital and land (total production)

Lecture 3

According to Ricardo, the aim of political economy is to determine the laws which regulate the

distribution of income.

Societal development Distribution of income Growth and distribution of wealth

Rent, wages, profit

Due to population growth and rising food prices, rent incomes increased. On marginal land: price

= cost of production = costs of labor + costs of capital = wages + profits, no rent is paid on

marginal land. Profit is a residue, the difference between the value of output of the last unit of

labor and the costs of that last unit of labor (costs of subsistence). Because of diminishing

marginal returns, the marginal output tends to fall to the level of subsistence, less and less room

for profits. Marginal output marginal costs.

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

Tendency of declining rate of profit

Population ↑ food prices ↑ (diminishing returns) costs ↑ price of subsistence ↑

wages ↑, rents ↑ profits ↓

Savings and investments ↓ rate of accumulation of capital ↓ economic growth ↓

stationary state of economy. In the long run there is a declining rate of profit due to population

growth.

Ricardo was against the Corn Laws for two reasons:

1. Income (in this case of landowners) should not be regulated by law. Prohibiting cheap

imports accumulates the stationary state.

2. Restrictions on foreign trade are always at the cost of the wealth of all trading partners

(comparative advantage).

General Glut controversy (Malthus)

There is a possibility of depression in effective demand is too low. Labor receives part of the

product of labor. Capitalists save, which leads to overproduction (deflation and depression as

consequence). Unproductive demand is very important, to prevent overproduction.

The economy needs a class that spends a lot to keep the economy going, the size of the effective

demand should be maintained. This is the task of landowners, rent incomes are thus important,

therefore the Corn Laws are a good thing to ensure the rent income for landowners, whose

unproductive demand keeps an economy going.

This theory was rejected after Say’s Law.

Say’s Law

- General overproduction is impossible

- Production creates income

- Production factors receive a reward and the sum of rewards = value of production

output

- Purchasing power = value of output

- ‘Supply creates its own demand’. Overproduction is no problem: rejection of Malthus’

theory.

However, Say’s Law does not account for savings.

After Ricardo

1. Ricardians: McCulloch, John Stuart Mill.

2. Anti-Ricardo: theoretical objections: value theory; objections regarding methods.

3. Ricardian socialists: distribution.

Development and refinement of classic system:

1. Utilitarianism

2. Value theory

3. Methodology

4. Distribution.

1 Utilitarianism

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

Jeremy Bentham (1748-1832). Utilitarianism: ethical arithmetics. Consequentialism: the

consequences of an action determine whether an action was good or bad. Utilitarianism had an

egalitarian doctrine: everyone’s interests are equally important.

- Human action is motivated by the desire to obtain pleasure and to avoid pain.

- Principle of utility: tendency to promote happiness.

- Science of human happiness.

Bentham’s utilitarianism:

1. An action is not in itself good or bad

2. Consequences: how it affects happiness

3. Positive and negative consequences: pleasures and pains

4. Maximization of surplus: the principle of utility.

The focus is on social utility, it is the greatest happiness for the greatest number that is the

measure of right and wrong (example with saving 1 or 6 people from getting killed by a tram).

There is also diminishing marginal utility of money: redistribution from the rich to the poor

would increases social utility. However, in redistribution, the principle of security (being rich and

feeling secured by possessions) should come before equity, because there should be an incentive

to exert effort for everyone.

2 Value theory

Bentham anticipated marginalism.

Likewise John Stuart Mill: revision of Ricardo’s value theory. Importance of both utility and

costs in determining exchange value. Factors of supply and demand (elasticity).

3 Method

William Nassau Senior: in political economy there is a distinction between science and art. The

science of political economy should be purely positive, not normative.

John Stuart Mill: Economics is a separate science. Abstraction and empirical research should be

used as method.

4 Distribution

Mill was no advocate of equality of property of income, but that ‘all start fair’.

Task of government is to promote equality of opportunity.

Distribution ≠ law of nature.

The distinction between production and distribution is also important. Production is characterized

by laws and absolute character. Distribution depends on laws and customs and can thus be

changed. There are no economic requirements or absolute rules regarding the distribution of

wealth. However, there are conditions, equality must be compatible with growth and incentives.

Process of growth promotes equality and softens competition, therefore reform of society is not

necessary.

After 1850, the classical school declined. The alternative that arose were marginalism, the

historical school, and socialism: utopian writers and Marx.

Historical School

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

- Approach to economics which rejects the abstract-deductive method of the classical

economists

- Emphasis on context of economic phenomena, changes in economy and structure are

always explained by societal factors, therefore not every economic law is applicable to

every country.

Three objections against classical approach:

Isolation of economic phenomena Economic phenomena inseparable from social phenomena

Universal validity of conclusions Abstraction does not produce conclusion with universal

validity

Laissez-faire policy Laissez-faire policy also depends on the societal structure,

it is not applicable to every country.

In the historical school, there were conflicting opinions on the methods of political economy.

Schmoller

1. Economic relationships can only be understood in their socio-historical context.

2. Economics is an empirical (and not an abstract) science.

3. Inductive method: facts as starting-point for discovery of interrelations.

Menger

1. Economics is an abstract science.

2. Builds from assumptions and essences to deduce conclusions.

3. Deductive method.

Socialism

Socialism has had several meanings:

- Capitalism has grave moral flaws (excesses, inequality of wealth, income, power) → need

for socio-economic reforms to remedy these flaws.

- Socialism as economic system: state property of means of production, directive control of

investments, more equality.

- Socialism as stage in the development of society.

In general:

- Free operation of the market not beneficent to society.

- Conflicting interests of individuals and society.

- Regulating function of government to protect interests of society.

- Crises and depressions

- View of man and society: a man’s character is formed by his environment (society).

Utopian socialist: Robert Owen

- Environment molds human nature

- Improving life/work circumstances improves character

10

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

- New Lanark Mills:

- No child labor (until the age of 10)

- Free schooling

- Food, clothes, fuel sold at cost

- Shorter workdays, wages relatively high

- Payment during sickness, old age insurance,

- Recreational facilities

Even with this measures, which don’t seem profit-maximizing, he still made positive profits,

although his companions were not always satisfied with him.

Lecture 4

Karl Marx

Materialist theory of history: Forces of production determine relations of production. Relations of

production determine economic structure. Economic structure determines political, ideological,

and legal structure (superstructure).

Legal, social, political structures

Relations of production } ↑

Propertied class ← ↑ → non-propertied class } ↑

↑ } ↑

Forces of production → needs } ↑

- Labor } → Economic structure

- Capital }

- Land }

- Technology }

- Production techniques }

- Resources }

Forces of production constantly change due to changes in population, technology, education,

division of labor, and innovations. These forces of productions also influence relations of

productions, although these are less flexible to change.

Hegel: In society there is a thesis and an antithesis. The conflict between these two builds up until

it ‘explodes’ and a new ‘equilibrium’ develops. This new equilibrium is the synthesis.

Thesis: Forces of production } Synthesis: new superstructure

Antithesis: Relations of production }

In capitalism there is a conflict between capitalists and workers. Capitalists appropriate the fruits

of cooperation at the expense of workers, which have a weaker position. This conflict develops,

and as a result, there will be a new synthesis: socialist society.

Marx aimed to identify laws of motion (characteristics) of capitalism that lead to an ‘explosion of

the conflict’, which would lead to socialism and communism.

Influence of classicism:

- Labor theory of value

11

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

- Law of declining rate of profit

Features of capitalism

1. Money-making

2. Labor is a commodity

1 Money-making

Natural exchange: commodity money commodity

Capitalism: money commodity new money new money > money

Production is the creation of exchange value for profit.

Exchange value = no intrinsic exchange value, value only exists in the comparison between

goods.

Exchange value = quantitative relationship between two different things which save something in

common of the same magnitude.

Common element in goods: labor (labor theory of value). Labor is what creates value, capital and

land are unproductive. This theory is somewhat similar to physiocracy, which also saw only one

factor which creates value. However, physiocrats thought it was land, Marx thought it was labor.

2 Labor as a commodity

- Labor is a marketable commodity.

- Capitalism is a perverted system, because it purchases labor to make money.

- Labor is abstract labor = average, homogeneous, simple labor = labor which only varies in

quantity, labor time.

- Value of a commodity is determined by labor time needed to produce a commodity under

normal conditions (socially necessary labor time).

Surplus value

Labor is the only commodity that creates value over own and above its own value (exchange

value = labor costs, use value = value of output of labor).

Surplus S = use value – exchange value = value of output of labor – wage costs

Workers work longer than necessary to produce value equal to wage costs, because the capitalists

appropriates surplus, it exploits labor.

Production depends on capital and labor

1. Constant capital C: resources, land, machines

2. Variable capital V: labor costs

Surplus value rate = S/V

Organic composition of capital = C/V

Increasing S:

- Hours worked ↑ (is limited, market-determined)

- Productivity of labor per hour ↑

Investments in C: machines, technologies, economies of scale, substitution of labor.

Organic composition of capital C/V ↑. Internal inconsistency of capitalism falling rate of profit.

Profit = S/(C + V) = (S/V)/(C/V + 1) = surplus value rate / organic composition of capital.

C/V ↑ Profits ↓

12

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

Capitalists’ intention to increase S leads to a decrease in profits. Decreasing labor: decreasing

source of value. Why do capitalists do this? Marx: they have no choice, it’s a ‘law of motion’:

capital accumulation forces down rate of profit.

Why?

Competition between capitalists:

1. Labor market: drives up wages at expense of profits substitution

2. Commodity markets: competition forces capitalists to reduce costs to sell at lower prices

more efficient production techniques organic composition of capital increases.

Capitalists have to follow (2), otherwise they lose market share. This in an internal contradiction

of capitalism.

However, this is not inevitable, falling wages: S/V ↑. This was acknowledged by Marx, but he

just assumed a falling rate of profit.

Laws of motion in capitalism

- Law of declining rate of profit

- Theory of business crises

- Concentration of capital

- Rise of the reserve army of the unemployed

- Law of increasing misery.

Smith: Marx:

Capital accumulation } Labor- Growth

Division of labor } productivity ↑ labor-

Innovation } productivity

↑

Limits +

Ricardo: Diminishing returns

due to the exhaustion Wages at

of resources and land subsistence

as population increases level

with wages at subsistence-level

Business crises and reserve army of the unemployed

Value theory

Aristotle: distinction between exchange value and use value.

Scholastic writers

1. Demand factors: indigentia, need, utility in relation to scarcity

2. Supply factor: costs of production (‘labor and expenses’)

Marginalism focusses on demand factors. Neoclassicism combined classicism (supply) and

marginalism (demand).

Classic value theory: value paradox

- Water is most useful but a free good, diamonds are pretty useless but expensive.

- Value cannot be a matter of usefulness

- Value is determined by relative scarcity. What determines relative scarcity?

13

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

- Demand in relation to supply; ratio between quantities → price

- Underneath price there is a natural value, long run-price determined by costs of

production. Classicism was interested in this ‘real’ long-run price.

Smith

1. Focus on exchange value

2. Distinction between a primitive (labor) and an advanced economy (rewards for the use of

the factor of production)

3. Two questions mixed up:

- How does value arise (production, costs, distinction market and natural prices)

- How to measure value? (Labor).

Ricardo

1. Distinction primitive/advanced artificial

2. Use value condition for exchange value

3. Exchange value determined by scarcity and labor:

- Non reproducible commodities: scarcity

- Reproducible commodities: labor

4. Labor theory of value: the value of a commodity is determined by the amount of labor

time necessary to produce that commodity

Ricardo was more aware of importance of use value, use value is necessary for exchange value to

exist: scarcity or labor.

Problems labor theory of value:

1. How to take into account that industries differ in the ratio between labor and capital?

- Influence of the rate of profit on relative prices relatively small

2. What about rent and profit?

- Rent is price determined

- Capital is stored-up labor

3. Heterogeneity of labor:

- Translation of differences in productivity to differences in labor time.

J.S. Mill had more a Smithian view on value: cost approach, focus on utility.

Classic value theory

- Value is created in production

- Wealth defined in terms of commodities

- Commodities embody value because production required effort/disutility/costs (objective

measure)

- Focus on the long-run; growth/distribution of wealth

One-sided supply approach.

Marginalism

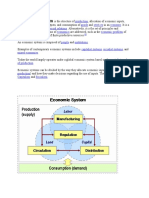

Consumption exchange distribution and production.

Focus on utility, satisfying wants. Utility or want is no condition for exchange value, utility is the

source of value. Utility, demand and price can be related, if a distinction is made between total

utility and marginal utility: X↑ → MUX↓ → P↓

Marginalism tried to model economics after natural sciences, to make it more scientific.

14

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

Shortcoming of classic value theory: different value theories for different types of commodities,

no distinction between total and marginal utility, and prices are not determined by historical

costs.

Law of diminishing marginal utility: Gossen’s first law: X↑ → MUX (dTU/dX) ↓

Equimarginal rule (Jevons): Gossen’s second law: MUA/PA = MUB/PB = … = MUN/PN

Marginal revolution

1. Modeling of economics after the natural sciences

2. Consumers Producers

Demand → Prices → Supply → Allocation of means

↑

Wants/Income

3. In a way equally one-sided. Only second generation applies marginal analysis to supply-

side.

Tutorial 2

Age of Ricardo

1815-1848 Restoration period

- Aristocracy tried to restore traditional order against developments set in motion by the

Industrial Revolution.

- 18-15-1830: Age of Ricardo: conflict between landowners and industrialists + workers,

latter won, shared profits with landowners.

- Debate revolved around distribution of wealth; profit for capitalists vs. rent for

landowners.

Consequences of rent development

1. Ricardo argues that food production needs to be increased to feed the growing population.

Given the need to take land of inferior quality into cultivation, costs of production

increase and consequently food prices rise. As a consequence, the relative shares of

wages, profits, and rents in national income change, affecting further growth.

2. Rising costs and food prices push up both the relative share of rents and wages in the long

run (nominal wage at subsistence-level must rise in order to compensate for rising food

prices).

3. These relative shares of rents and wages increase at the expense of the share of profits,

which is squeezed between the two other shares. No profits, no capital accumulation, no

further growth.

Classical School Marginalist School

1 Aim/problem Economic growth & Allocation of means to maximize

15

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

development utility

2 Level & time horizon Macro, long run Individual consumer/firm, micro

3 Focus, approach Policy issues, supply side Abstract/theoretical, demand side

4 Pricing theory Value = matter of production Value = utility through competition

Lecture 5

Marginal productivity theory

Marginal productivity theory (MPT) applies the marginal utility theory to the supply side.

Applying more units of a factor of production will lead to a decrease in marginal product. If the

marginal product of a production factor decreases, the price of the production factor will also

decrease.

According to the MPT, choice decisions regarding factors of production depend on their marginal

products. John Bates Clark asked: how many units of the variable input factor should be used?

- As long as MPL*P0 > PL: add more units of labor.

- As soon as MPL*P0 < PL: reduce number of units of labor.

- Equilibrium: MPL*P0 = PL

The MPL-curve is the demand curve for labor.

Edgeworth’s table displayed the diminishing returns and the distinction between average and

marginal product.

According to Clark, the MPT is also a distribution theory.

Total wage bill: ABCD

Total product: AEBD

Reward for capital: CEB

Debate following the MPT

1. The MPT is not a residual theory, since it doesn’t matter which factor is held constant of

variable. If in the graph labor was fixed, and capital was variable, it would still yield the

same distribution of income.

2. Adding-up problem (product exhaustion). TP = MPL*L + MPK*K?

16

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

Wicksteed: sum of rewards of the production factors on the basis of their marginal

products = value of total product, under conditions of perfect competition and constant

returns to scale.

3. Profit-problem: reward for capital is interest. If profit ≠ reward for production factor, then

how is it explained? MPT: In perfectly competitive markets and long-run equilibrium: TR

= TC, there are no profits in the long run.

4. Ethical implication. Clark: ‘if under perfect competition each production factor gets paid

according to their value of marginal product, the distribution of income is fair’.

Objections: claims on fairness cannot be derived from a theory which explains relations

between variables.

Supply became equally important as demand. There was a need to review old theories.

Léon Walras

Had a different approach than Jevons and Menger. Walras emphasized the economy as a system

of interdependence of variables. Supply and demand are interdependent. This approach led to his

general equilibrium model.

↓ ← ← Supply of final goods ← ← ←

↓ → → Demand for final goods → ↓ ↑

↓ ↑ ↓ ↑

Households Firms

↓ ↑ ↓ ↑

↓ ↑ ← Demand for factors ← ← ← ↑

→ → → Supply of factors → → → ↑

Prices are simultaneously determined by supply and demand.

Alfred Marshal (1842-1924)

Marshall’s emphasis was on the interdependence of demand (wants) and supply (activities).

Marshall is considered to be the father of neoclassical economics.

Bridging differences:

- Abstract theory vs. empirics/induction

- Static vs. dynamic analysis

- Focus on money/wealth as an instrument.

Attempt at synthesis, in showing the complementarity of utility (marginalist) and cost (classical)

approaches.

According to Marshall, poverty is an obstacle in growth and development. Economics was an

instrument to improve well-being and character of individuals, and thus of society.

Demand

- People aim to satisfy their wants.

- Law of diminishing marginal utility.

17

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

- Individuals take decisions at the margin: not whether he wants any but whether he wants a

bit more, comparing marginal utility with the price of an additional unit.

- Hence downward-sloping demand curve, since people insist on paying less for something

that yields less satisfaction (marginal utility). How much less people wanted to pay,

depends on the price elasticity of demand.

Consumer surplus

1. Downward-sloping demand curve, each next unit yields less marginal utility than the

previous unit.

2. If MUX decreases Price of good X also decreases.

3. This leads to the market price P.

4. Consumers were willing to pay more for the first units of consumption. They were willing

to pay above market price P.

5. The sum of these advantages of consumers = consumer surplus.

Maximization

Substitution at the margin. The assumption of rationality is important: resources are allocated

between commodities such that ratios of marginal utilities to prices of commodities are equal for

each commodity Equimarginal rule or Gossen’s second law.

Theory of demand

Time period is sufficiently short to allow for ceteris paribus assumption. This involves the

problem of aggregation. Again, the assumption of rationality is important. Preferences, person’s

wealth, purchasing power of money, and prices of substitutes are all constant.

Supply

- Supply curves slope upwards to the right: additional efforts or costs to increase production

requires extra incentives.

- Supply curve = marginal cost curve with nature of costs subjective: real costs. Marshall

spoke in terms of “real costs” when considering costs of production. By “real” he meant

ultimately the disutility of both the labor and the waiting involved in producing and

bringing a commodity to market. However, Marshall just assumed equality of real costs

and money costs.

- Supply price: sum of money to be paid for these extra efforts.

- Supply schedule: a locus of points linking in each case supply price to exertions necessary

for producing a given amount of a commodity.

- Distinction between prime (variable) and supplementary (fixed) costs.

- Time is the chief problem in economics: market period (very short run), short run, and

long run. The time periods are differentiated on the basis of the price elasticity of supply.

Market period: Price elasticity of supply = 0. Value is demand-driven, costs of production are

irrelevant.

Short run: Upward-sloping supply curve, supply can be adjusted, decisions depend on variable

costs.

18

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

Long run: Supply is perfectly elastic and all costs are variable. Supply price depends exclusively

of costs of production.

Distribution

- Four inputs: land, labor, capital and organization.

- One unified theory of inputs/outputs.

- Decisions are taken at the margin: comparing the marginal product of an input to its costs,

adding units of inputs until marginal costs equal marginal product.

- Prices of factors of production are determined at the margin, entrepreneurs compare the

relative efficiency of factors of production, substituting to produce at lowest costs.

- Next to these pecuniary motives:

- Customs (wage rigidities).

- Duty (moral imperatives).

- Environment (influence of climate, race, geographical location and national

character on motives/desires).

- Approbation (people not only do things for money but also for esteem and

admiration).

What did Marshall know and have we forgotten?

Dynamics of time

- Time key problem

- Consequences of decisions and actions become only apparent in the course of time.

- Method of isolation useful but also of limited use.

- Need for dynamic analysis

Consumption and progress

- Importance of growth of wealth but also of the composition of output.

- Rather than satisfaction of material wants: progress in terms of behavior and character.

Three classes of needs

- Biological needs: food, clothes, shelter.

- Wants which afford strength and increases efficiency.

- Artificial/superficial wants.

The point is to use increased opportunities for consumption productively.

Distinction between standards:

- Standard of comfort

- Standard of life.

Increasing consumer expenditures Standard of life ↑ Health, physical and mental strength,

and moral ↑ Efficiency of labor ↑ Production ↑ Income ↑ Increasing consumer

expenditures etc.

Lecture 6

According to Marshall, economics was an instrument for social progress.

Welfare economics

19

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

Welfare economics arose out of concern for the persistence of poverty, how to increase and better

distribute wealth? What is welfare optimality/condition? What factors impede achievement of

maximal welfare? Role of government and how to determine the welfare effects of a policy?

English version of welfare economics/Pigou

Economics is about collecting knowledge to bring about social progress. Self-interest does not

necessarily result in maximal welfare. Pigou followed in the footsteps of Marshall. Economics

needs practical usefulness, it should be ‘fruit bearing rather than light bringing’. Pigou was in

some aspects utilitarian, concerned with the greatest happiness of the greatest number. Pigou had

a normative perspective, in contrast to Pareto, who focused more on theoretical, positive

economics.

Wealth and welfare (1912)

- Welfare cannot be defined.

- Economics is confined to economic welfare, the part of social welfare which can be

measured in terms of money. Economic welfare itself is not complete in explaining social

welfare, but it is reasonable to assume that it’s a good measure. Numbers may differ, but

economic and social welfare move in the same direction.

- Changes in economic welfare through national product.

- Society is to ensure that:

- Size of national product is maximized.

- More equal distribution of national product is realized.

- Fluctuations in size of the national product is tempered.

- Pigou made the distinction between private and social product. Maximal private product ≠

maximal social product.

- This leads to a justification of government intervention. Self-interest creates conditions

for which the invisible hand leads to maximal social welfare, but this is different in

practice. Self-interest only benefits the social interest if there is an agreement between

private and social ends, otherwise government intervention is necessary.

- Pigou was looking for disharmonies between private and social interests. There are three

types:

- Production or size of national product (monopolies, external effects).

- Distribution: desirability of redistribution.

- Fluctuations: uncertainty and irregularity. This diminishes social welfare and

increases poverty public production progress, social security, welfare state.

- There should be no government intervention in economic incentives and property rights,

the value of security weighs more than value of equity (Bentham).

Continental variant/Pareto

Pareto follows Walras’ general equilibrium model.

Conditions for maximizing welfare (Pareto-optimum):

- Optimal allocation of resources

- Optimal level of output

- Optimal distribution of goods.

This is seen as proof that perfectly competitive markets will bring about Pareto optimal

allocation, leading to maximal social welfare. This is proof of Adam Smith’s theory of free

market and invisible hand.

20

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

Pareto followed a theoretical approach to economics: theoretical abstraction, without much

practical value.

Austrian economics

Austrian economics was close to neoclassical economics, but became more distant later on.

First generation: Menger, Von Böhm-Bawerk, Wieser.

Second generation: Ludwig von Mises, Friedrich Hayek, Joseph Schumpeter.

Austrian school rejected formalism, use of mathematics in economics.

Austrian approach

- Model of explanation is based on individual plans and motives in which disequilibria in

the economy are emphasized.

- Objections against description of market process in terms of a static equilibrium model.

The economy is dynamic.

- Against the mathematical formalization of economic phenomena.

- Economic behavior takes place in a world of imperfect knowledge and uncertainty:

disequilibrium is the rule.

- And yet market works better than regulation.

The socialist debate was on the question if economic efficiency is achievable in an stated planned

system.

Mises: Common property of capital (goods) means no (factor) market, no pricing mechanism, no

efficient allocation of means.

Oscar Lange: Prices are indeed essential, but why would a central planning board be unable to

set prices and assume the role of the market? Lange used Walras’ general equilibrium model with

an auctioneer who sets the price.

Socialists seem to win the debate after this strong argument by Oscar Lange. However…

Friedrich Hayek

1. Central planning board is unable to solve the problem of information. Prices also convey

information, it is a mechanism of translating information into prices. The social planning

board is unable to perform this task, which is performed by the market.

2. Socialism is incompatible with liberty. Social planning begins with economic choices,

distorts individual choices and wants, and will eventually control the entire society, it will

turn into a totalitarian state.

Joseph Schumpeter

Agreed with Marx that capitalism will collapse and will be replaced with socialism. In his book

Capitalism, Socialism, and Democracy he describes three factors that will contribute to the fall of

capitalism.

1. Entrepreneurial function grows obsolete. Entrepreneur will be replaced by a manager,

who wants to consolidate the business, there will be less innovation.

2. Destruction of the political strata.

3. Destruction of the institutional framework of capitalism.

Society moves to socialism, Schumpeter described long-run economic developments.

21

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

Institutionalism

Institutionalism originated in the United States around 1900. It arose in times with robber

capitalism and labor conflicts. There was a challenge to laissez-faire policy in the face of

monopolies, depression, and poverty. This contributed to the debate on the reorganization of

society (socialism) and reforms.

Institutionalism built from the ideas of the Historical school. It criticized (neo)classical thought

for the explanation of economic phenomena:

- From abstracting individual choices.

- With given objections and preferences.

- With given institutions.

This method abstracts from what really matters in the economy.

Individual choices are not fully rational, but are influenced by character, environment, society,

and institutions.

1. Preferences, behavior etc. are determined by social or institutional context.

2. Institutions as starting-point of economic analysis.

3. Rejection of the notion of equilibrium.

The economy is a process of continuous structural adjustments to changing societal and

technological circumstances.

Thorstein Veblen

Veblen started the economic analysis from institutions.

Institutions: patterns of behavior which we unconsciously adopt as we are socialized as

members of our society.

Criticism on (neo)classicism

1. Simplistic view of man: choice behavior ≠ utility maximizing. But social process:

institutions determine how people act and choose.

2. Outdated concept of change is assuming some end-state.

3. Assumption of harmony of interests and equilibrium.

4. Notion that capitalists produce socially desirable results.

Economics is the study of the evolving institutional structure → individual behavior

Structure = complex of habits of thought and behavioral patterns or instincts:

1. The parental instinct (caring) }

2. Workmanship (pride) } social orientation

3. Idle curiosity (ideas for innovation }

4. Acquisitiveness selfish instinct

There is a tension between these instincts. The self-regarding instinct gets the upper hand. There

is a drive to gain at the expense of others. This drive tends to reduce social welfare.

Industrial or technological activities and institutions

↑ ↑ ↓

Socially-oriented instincts

↑ ↕ ↓

Self-regarding instincts

↑ ↓ ↓

22

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

Ceremonial activities and institutions

Theory of the leisure class

Rejection of the view of consumption as a means to happiness; cultural theory. Important purpose

of consumption is to impress others. Spending money has not to do with utility but with keeping

up and outdoing others.

Theory of the business enterprise

Business activities: capitalist, marking profits, predator, does not produces (social) welfare.

Machines process: engineer (making goods), technological procedures to produce goods,

productivity, serviceability, and efficiency.

Formalist revolution

1. Growing use of mathematical techniques and tools.

2. Emphasis on theory and development of theory.

3. Institutional context disappears.

4. Interest in Walras’ general equilibrium model and condition and stability of equilibrium.

The contrast between neoclassicism and the Austrian school became more pronounced due to this

formalization of economics.

Developments in microeconomics

- Shift from Marshallian (partial equilibrium) economics to Walrasian (general equilibrium)

economics.

- Less attention for historical and institutional factors and policy issues.

- Mathematical formalization.

- Market process in terms of equilibrium.

Tutorial 3

Neoclassicism

- Static system of general equilibrium

- Individual interests culminate in harmonious outcome. Positive approach to interest, there

is no need for government intervention.

- Laissez-faire, free markets, limited government intervention. Although Pigou was in favor

of government intervention in some cases.

- Alfred Marshall (his view is more radical), Milton Friedman.

Institutionalism

- Dynamic, evolutionary perspective.

- Society is characterized by conflicts of interest and power structures. Negative approach

to interests.

- Thorstein Veblen.

- Sum of individual interests ≠ social interest.

Disequilibrium Equilibrium

Market Austrian School Neoclassicism

Government Institutionalism Keynesianism

23

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

Marshall combined a formalist/deductive approach with a historical institutional approach.

Adoption of positivism: claim the need for a strict distinction between facts and values.

Formalism: mathematical approach to economics, optimal use of resources, mathematical

modelling, quantifiable methods.

Austrian School

Uncertainty, subjectivity (no perfect foresight, personal opinions play a role), evolutionary

approach. Coordination problem: economic science is too complex. Government should not want

to think that it can replace the economic system, government intervention is undesirable.

Knowledge can be incomplete and imperfect, this leads to a disequilibrium.

Keynesianism

Focus is on the demand-side of the economy.

Animal spirits: urge to consume pushes economic activities forward: effective demand is the

most important determinant of national income, output, and unemployment.

Instability: producers and consumers are either too optimistic or too pessimistic about

consumption, savings, and investments Business cycle. This instability is an argument for

government intervention.

Government intervention: government needs to smoothen/stabilize erratic expectations and

sentiments through active fiscal and monetary policies.

Chicago school

- Originates from neoclassical, Marshallian economics, with its emphasis on

microeconomics, equilibrium approach, rational choice, and optimizing behavior.

- Belief in the efficiency of free markets, to allocate resources and distribute income.

- Skepticism about government intervention.

Monetarism

Keynes: fight depression by fiscal and monetary policy, pumping money into the economy.

Friedman: quantity of money is the key factor in producing inflation.

Monetarism (Friedman)

1. Change in money supply is the only systematic factor influencing overall level of

spending and economic activity

2. Only action required to ensure prosperity and price stability is for the central bank to stick

to the golden rule: rate of growth of money supply = real state of economic growth.

Monetarism was motivated by a dislike of Keynesian economics and its interventionist

policies. In general, stabilization policies either don’t work or make things worse.

Lecture 7

In the first decades of the 20th century, Marshallian economics was dominant. It became even

more dominant when American institutionalism lost support. This dominance of Marshallian

economics led to a formalization of economics, and an increasing use of mathematics. The focus

was on equilibrium, especially on the Walrasian general equilibrium model. However, business

24

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

cycles also gained interest from the academic community. This interest firstly was of empirical

nature (Mitchell), but later on it was also of theoretical interest (Austrian School, which focused

on uncertainty and disequilibrium). Keynes combined the business cycle with neoclassical

economics.

Explanations of fluctuations

1. Overinvestment theories: fluctuations in investments, a disequilibrium between the

production of capital goods and the production of consumer goods. There are two types of

arguments explaining why these fluctuations arise.

- Monetary factors (Mises, Hayek): interest rates.

- Discoveries and innovations (Schumpeter).

2. Underconsumption (Keynes): insufficiency of consumer expenditures/demand (which is

to some extent in line with Malthus’ theory). Keynes combined the underconsumption

with

3. Psychological explanation: emphasizing changes in expectations.

Böhm-Bawerk’s interest theory

Problem of interest: if only land and labor are original factors of production, the reward for

capital = rewards for land and labor to produce capital. How to explain interest, the additional

reward for the use of factors of production?

Capital is a derived factor, it needs to be produced by land and labor. In the long-run equilibrium:

all revenues of the sale of consumer goods = sum of rewards for factors of production, therefore

reward for capital = reward for land and labor.

Existence of interest: higher values of present goods as compared to future goods. A ‘premium’

for not delaying consumption.

- Increase of flow of income in the future → marginal utility of present goods is higher,

therefore they have a higher value.

- Positive time preference: future is uncertain, therefore people want to consume as soon as

possible.

- Roundabout production: use of capital in production, money is ‘locked up’ in the process.

The producer is compensated for not using his money by interest.

Interest is the reward for postponing consumption.

Consumers make a decision what to do with their income, determined by the interest rate:

1. Present consumption?

2. Or postpone consumption and save?

Producers make a decision what to do with their investments, determined by the interest rate.

1. Production processes which yield a direct return?

2. Or production processes which are more productive, but yield a (higher) return later?

Knut Wicksell

Wicksell used Böhm-Bawerk’s theory of interest to show the influence of changes in the rate of

interest on the real economy.

Natural interest rate: the interest rate at which savings = investments.

Market interest rate: the interest rate at which the banking system lends/creates credit.

25

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

Natural interest rate ≠ market interest rate.

Situation I: natural rate > market rate

→ Process of expansion: rising demand for investment goods; factors of production withdrawn

from consumer industry → scarcity ↑ and prices consumer goods ↑ → profits ↑ →

expansion/investments → process of expansion, rising investments and prices.

The expected return on investments > costs of investments (market rate). Investments are

attractive, this leads to more investments, which leads to an expansion of the economy, resulting

in a rising demand for investment goods.

Situation II: natural rate < market rate

→ No investments → production and employment ↓ → consumer expenditures ↓ → prices fall

→ profits ↓ → cumulative process of declining prices and depression.

The expected return on investments < cost of investments (market rate). Investments are not

attractive, which leads to a contraction of output and employment, resulting in a depression.

The bank should ensure that market rate = natural rate.

Whether the economy is in situation I, II, or in equilibrium, is observable by changes in the price

level.

Inflation: natural rate > market rate.

Deflation: natural rate < market rate.

Equilibrium: natural rate = market rate.

Mises combined these two theories of interest.

1 Wicksell’s two movements of the economy

Natural rate ↔ market rate

↓ ↓

Expansion Depression

Inflation Deflation

2 Böhm-Bawerk’s changes in the structure of capital.

Mises’ theory of interest

- Natural rate > market rate → producers are induced to choose longer/more capital

intensive processes of production → relative scarcity consumer goods/prices ↑ → extra

production capital goods.

- When expansion of credit breaks down → banks increase market rate → longer processes

of production no longer profitable.

- Dumping capital goods/turning away from longer processes of production → loss of

output/employment.

Start of expansion: when banks expand credit above level of savings, which leads to a lower

market interest rate. Consequently, investments become more attractive, which increases the

demand for investment goods.

Prices of consumer goods ↑ → market interest rate ↑ → reallocation of resources → eventually a

depression.

Friedrich Hayek

26

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

The London School of Economics challenged Cambridge (Keynes) with Hayek as front man,

however, LSE (Hayek) lost the battle. Later on, he became a professor in Chicago, one of the

main figures of the Chicago School. He was in favor of free markets, because of the complexity

of the economy, which could not be replaced by government intervention. He believed in the

market as a self-correcting mechanism.

Friedrich Hayek explained how an artificially low interest rate induces malinvestments.

Time profile of decisions:

- Households: preferred distribution between present and future consumption.

- Producers: planning of distribution of production for present and future consumption.

Credit expansion → supply of capital ↑ → market interest rate ↓ → investments become more

attractive → investments in higher stages of production → shifting output of consumer goods

towards a more distant future (longer time profile). However, future demand is not present, due to

the shorter time profile of households.

Given low interest rate, consumers tend to shorten time profile.

Result: investment profile ≠ public planned savings, creating a crisis.

With consumption and investments both increasing, an expansion starts, creating competition for

resources between longer/shorter production processes. A crisis develops as soon as investments

cannot be profitably completed and terminated.

This is a monetary explanation of fluctuations. Hayek was close to neoclassicism, in the sense

that he assumed a normal process of restoring the equilibrium. Keynes objected to this

assumption.

John Maynard Keynes

Frame of mind: Keynes considered capitalism to be a (useful) stage in society, it allowed for the

growth from poverty to abundance. However, it was based on the ‘love of money’, an illness, as

Keynes described it. Capitalists value the money itself higher than the products they buy with it.

Once capitalism has brought prosperity, the love of money should be restricted. Money became

an end in itself, contradicting the ‘good life’. Markets tend to feed the love of money, therefore

they shouldn’t be left free.

Central role for animal spirits: psychological condition of decisions taken by economic agents,

this leads to instability. Government should stability these animal spirits.

Rejection of Say’s law: urge to consume (demand) drives economy, not supply. Aggregate

demand is crucial for Keynesian economics.

Consumption: determined by subjective (psychological) and objective (interest, distribution,

expectations) factors. Propensity to consume is determined by subjective factors.

Investments: decision based on expected return (unstable and erratic) and costs (interest rate).

This is all about expectations, which often depend on irrational sentiments, which leads to

fluctuations.

General Theory (1936)

Treatise on Money (1930): process of growth and decline caused by discrepancies between

savings (households) and investments (producers).

Repair mechanism: savings and investments are interconnected through the interest rate.

27

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

This mechanism failed because it is simply untrue that during a depression there is an unused pile

of savings ready for investments. On the contrary: income declines, low savings. With low levels

of output and employment, there may be a stable equilibrium in which S = I holds. However, this

would be low levels of savings and investments. Savings don’t have an effect on the interest rate,

due to their low level, there is no correcting mechanism. This stable equilibrium may go on for a

long time.

Economics: logic of choice in conditions of uncertainty, not scarcity. Difference between

probability (can be calculated) and fundamental uncertainty (dominant). This brings about

instability.

Aggregated demand may fall short relative to supply → supply (Y) adjusts downwards to bring

back equilibrium at a level below full employment.

Keynes also criticized the classical labor model of supply and demand, where unemployment can

be reduced by lowering the real wage until supply equals demand. This aggravates the entire

situation.

Expectations in a world of uncertainty and instability.

If animal spirits are low, there is no spontaneous recovery of full employment by the economy.

The government should intervene by investments and/or fiscal/monetary policy → creating a

‘multiplied’ effect on output, income, and employment.

After the General Theory:

- Debate on what Keynes precisely meant.

- Mathematical explorations.

- Hicks/Hansen: development of a model in which neoclassicism and Keynesian

perspectives are combined: IS-LM: neoclassical synthesis.

Milton Friedman (1912-2006)

Influenced by:

- Mitchell: importance of empirical research. Need for testing economic theory but by the

correspondence between predictions and facts.

- Marshall: theory as an engine of analysis for addressing real problems.

- Knight: suspicious of state intervention.

Free market ideology and focus on optimizing behavior, mathematical orientation → Chicago

School.

Importance of money and monetary policy

- Quantity Theory of Money: MV = PT

- V is relatively stable → money supply affects the level of economic activity (T) only in

the short run.

- In the long run, money supply only affects prices, there are no real effects.

- Therefore pumping money into the economy only leads to inflation. Government

shouldn’t intervene.

- Rejection of the Phillips curve: natural rate of unemployment.

28

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

1. Government cannot control unemployment and interventions only create inflation.

2. To prevent inflation, golden rule is to ensure that growth of money supply = growth rate

of the real economy.

Overview

Eras

Industrial Revolution (1760 – 1830)

The Industrial Revolution is one of the most significant changes in recent human history. The

transition included people moving from countryside to larger cities, going from hand production

to the use of machines, increased use of steam power and going from wood and other bio-fuels to

the use of coal. For the first time in recent history the living standard of the masses of ordinary

people began experienced a sustainable growth. The classical school was largely influenced by

the industrial revolution and thus influenced economics.

The Marginal Revolution (1865 – 1880)

There are four main reasons for this period being called the Marginal Revolution. First, during

the late nineteenth century much of the focus in economics turned from the classical long-term

development, which is the theory of population, welfare and growth, towards shorter terms. The

use of capital and labor in production, the choices of the consumer and utility became important

subjects. As hinted by the phrasing «the Marginal Revolution», the theory of decisions made at

the margin was much studied and strongly influenced future economics. This goes especially for

the theory of marginal utility. Second, the use of mathematics became more and more common,

though Jevons did not particularly contribute to this development. Walras was the major

contributor on this field. As mentioned earlier, von Thünen, Cournot and some others began this

way of looking at economics some years before Jevons’ time, but the majority did not. However,

in the 1870’s, largely due to the major advances in natural science, the general view in economics

took a more mathematical approach. More than the pioneers mentioned earlier, Jevons, Menger

and Walras incorporated these new theories into a system. And perhaps more importantly, more

than earlier these thoughts gained acceptance among the scientific environment. Although both

Walras and Menger wrote important works in the field of marginal utility and the use

mathematics in economics, Jevons developed his theories rather individually. Finally, the

generation of economist including Jevons was, as mentioned earlier, among the first to have a

formal education in economics. Thus the scientific field gradually turned towards being a

profession, which is rather different from earlier economists.

The Great Depression (10/29/1929 – 1940)

The Great Depression was a severe worldwide economic depression in the decade preceding

World War II. The timing of the Great Depression varied across nations, but in most countries it

started in 1930 and lasted until the late 1930s or middle 1940s. It was the longest, most

widespread, and deepest depression of the 20th century. The depression originated in the U.S.,

after the fall in stock prices that began around September 4, 1929, and became worldwide news

with the stock market crash of October 29, 1929 (known as Black Tuesday). The Great

Depression had devastating effects in countries rich and poor. Personal income, tax revenue,

profits and prices dropped, while international trade plunged by more than 50%. Unemployment

in the U.S. rose to 25%, and in some countries rose as high as 33%.

29

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

Schools

Physiocrats (1710 – 1765)

Physiocracy is an economic theory developed by the Physiocrats, a group of economists who

believed that the wealth of nations was derived solely from the value of “land agriculture” or

“land development.” Their theories originated in France and were most popular during the second

half of the 18th century. Physiocracy is perhaps the first well-developed theory of economics.

- Quesnay

- Cantillon

- Tourgot.

Classicism (1735 – 1860)

Classical economics is widely regarded as the first modern school of economic thought. Its major

developers include Adam Smith, Jean-Baptiste Say, David Ricardo, Thomas Malthus and John

Stuart Mill. Classical economists claimed that free markets regulate themselves, when free of any

intervention. Adam Smith referred to a so-called invisible hand, which will move markets

towards their natural equilibrium, without requiring any outside intervention. Pre-runner:

- Adam Smith

- Ricardo

- Malthus

- Mill, James

- Mill, John Stuart

- Say.

Pre-Marginalists (1800 – 1850)

The pre-marginalist did, as the marginalists, focus upon maximization and individual behavior,

either on the production or the demand side of the economy. However, contrary to the

marginalist, they did not achieve much publication and fame in the scientific environment.

- Von Thünen

- Dupuit

- Cournot.

Marginalism (1850 – 1900)

The marginalists includes Jevons, Menger and Walras, who were the most important contributors

to the Marginal Revolution. They worked on the decisions made by individuals in the economy

and developed the demand and supply curves. The three began the process of making economics

a profession.

- Jevons

- Walras

- Menger.

Neoclassicism (1850 – 1970)

Irving Fisher introduced the term neoclassical economy in 1900, but it was later used to include

the works of also earlier writers. The term is an umbrella term for several different schools

including marginalism. However, excluding institutional economics and Marxism. As expressed

by E. Roy Weintraub, neoclassical economics rests on three assumptions, although certain

branches of neoclassical theory may have different approaches:

30

Downloaded by Aurangzeb Chaudhary (zebch_61@hotmail.com)

lOMoARcPSD|1277595

- People have rational preferences among outcomes that can be identified and associated

with a value.

- Individuals maximize utility and firms maximize profits.

- People act independently on the basis of full and relevant information.

- Jevons

- Menger

- Walras

- Von Weiser

- Von Böhm-Bawerk

- Marshall

- Wicksell

- Fisher

- Slutsky

- Pareto

- Hicks

Austrian School (1865 – 1920)

The Austrian School of economics is a school of economic thought which bases its study of

economic phenomena on the interpretation and analysis of the purposeful actions of individuals.

It derives its name from its origin in late-19th and early-20th century Vienna with the work of

Carl Menger, Eugen von Böhm-Bawerk, Friedrich von Wieser, and others.

- Menger

- Von Böhm-Bawerk

- Von Wieser

American Institutionalism (1918 – 1950)

The ‘institutional approach’ to economics goes back to a conference paper in 1918 by Walton

Hamilton titled ‘The Institutional Approach to Economic Theory’. The paper was a call for the

profession at large to adopt the ‘institutional approach’ and a conception of economic theory that

was:

(i) Capable of giving unity to economic investigations of many different areas.

(ii) Relevant to the problem of social control.

(iii) Relate to institutions as both the ‘changeable elements of economic life and the

agencies through which they are to be directed’.

(iv) Concerned with ‘processes’ in the form of institutional change and development.

(v) Based on an acceptable theory of human behavior, in harmony with the ‘conclusions

of modern social psychology’.

At its inception, then, institutionalism could be seen as a very promising program – modern,