Escolar Documentos

Profissional Documentos

Cultura Documentos

Indonesia's Leading Department Store Guide

Enviado por

Dwi RiskaDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Indonesia's Leading Department Store Guide

Enviado por

Dwi RiskaDireitos autorais:

Formatos disponíveis

Indonesia Company Guide

Matahari Department Store

Version 5 | Bloomberg: LPPF IJ | Reuters: LPPF.JK Refer to important disclosures at the end of this report

DBS Group Research . Equity 9 Feb 2017

HOLD No ray of hope yet

Last Traded Price ( 8 Feb 2017): Rp15,325 (JCI : 5,361.10)

Price Target 12-mth: Rp16,200 (6% upside) (Prev Rp20,300) Cut TP to Rp16,200; HOLD call unchanged. LPPF’s share price

has de-rated sharply to near its record low PE since 2013 due to

the concerns of slower SSSG and rising capex after the company

Potential Catalyst: Strong pick-up in same-store sales growth

announced its plan to increase stakes in MatahariMall.com. It

Where we differ: Generally in line with consensus

now trades at 19x FY17F PE, -2.5SD below its historical mean PE

of 25x. Nevertheless, we see limited catalysts for the share price,

Analyst

Tiesha PUTRI +6221 30034931 tiesha.narandha@id.dbsvickers.com with household discretionary spending yet to show signs of

Andy SIM CFA +65 6682 3718 andysim@dbs.com bottoming.

Recovering SSSG to double-digit level would be a challenging

task. Excluding the impact of Lebaran seasonality shift in 1H16,

What’s New cumulative SSSG has consistently hovered at single-digit levels

• Lowering SSSG and earnings forecasts; maintain over the past one year. Management reiterated that the decline

HOLD with a lower TP of Rp16,200

in SSSG has nothing to do with competition, while the

• Share price has de-rated sharply; our DDM deterioration in 3Q16 was caused by the inventory assortment

valuation analysis suggests that it is fairly valued issue that management failed to address surrounding the

• Lack of catalysts, with discretionary spending yet Lebaran peak season. It is confident that this assortment issue

to show signs of bottoming has been addressed. However, we have yet to see a strong

recovery in discretionary spending. We expect LPPF’s SSSG to

only improve slightly to 7.1% in FY17F from 6.1% in FY16F.

Price Relative E-commerce foray – a long game. Following recent equity

raising for MatahariMall.com led by Mitsui & Co, LPPF is going

to inject Rp590bn cash into MatahariMall.com to avoid

ownership dilution. E-commerce in Indonesia only represents

c.2% of total retail sales but has grown at a spectacular pace.

The intensifying competition has caused customer acquisition

costs to remain elevated, hence funding is crucial to stay in the

game. A question remains on what step LPPF is going to take if

MatahariMall.com requires further equity injection in the future

to remain in the game. While management has announced the

Forecasts and Valuation plan to maintain its stakes in MatahariMall.com below 20%, the

FY Dec (Rp m) 2015A 2016F 2017F 2018F risk of LPPF having to inject more cash to avoid or limit

Revenue 9,007 9,949 11,033 12,304 ownership dilution still prevails should MatahariMall.com carry

EBITDA 2,564 2,906 3,286 3,682 out further capital raising in the future.

Pre-tax Profit 2,245 2,641 2,971 3,317

Net Profit 1,781 2,095 2,357 2,631 Valuation:

Net Pft (Pre Ex.) 1,781 2,095 2,357 2,631

Net Pft Gth (Pre-ex) (%) 25.5 17.6 12.5 11.6 We value LPPF at Rp16,200, based on 20x PE 17F (-2SD below

EPS (Rp) 610 718 808 902 its mean PE since 2013), on par with regional retailers.

EPS Pre Ex. (Rp) 610 718 808 902

EPS Gth Pre Ex (%) 25 18 13 12 Key Risks to Our View:

Diluted EPS (Rp) 610 718 808 902

Net DPS (Rp) 427 503 565 631

Slower-than-expected economic growth. LPPF’s target

BV Per Share (Rp) 379 670 975 1,311 segment makes up c.60% of the country’s population. A

PE (X) 25.1 21.3 19.0 17.0 further slowdown in the economy would impact this

PE Pre Ex. (X) 25.1 21.3 19.0 17.0 segment’s revenue growth, which would hurt its earnings.

P/Cash Flow (X) 20.6 18.7 16.2 14.4

EV/EBITDA (X) 17.1 14.9 13.1 11.4

Net Div Yield (%) 2.8 3.3 3.7 4.1 At A Glance

P/Book Value (X) 40.4 22.9 15.7 11.7 Issued Capital (m shrs) 2,918

Net Debt/Equity (X) CASH CASH CASH CASH Mkt. Cap (Rpbn/US$m) 44,717 / 3,353

ROAE (%) 161.0 107.2 82.9 68.8 Major Shareholders (%)

Earnings Rev (%): (2) (3) (6) Multipolar 20.5

Consensus EPS (Rp): 735 844 941 Asia Color 2.0

Other Broker Recs: B: 27 S: 2 H: 3 Free Float (%) 79.5

Source of all data on this page: Company, DBS Vickers, Bloomberg 3m Avg. Daily Val (US$m) 7.7

Finance L.P ICB Industry : Consumer Services / General Retailers

ASIAN INSIGHTS VICKERS SECURITIES

ed: CK / sa:MA, PY

Company Guide

Matahari Department Store

WHAT’S NEW

Fairly valued; lack of substantial positive catalysts ahead

SSSG had consistently hovered at single-digit levels, reflecting MatahariMall.com, possibly at a higher price. We note that in

the economic cycle. Following weaker-than-expected SSSG in 7M16, MatahariMall.com booked a significant loss of

3Q16, management has lowered its SSSG guidance for FY16 Rp490bn.

to 5%-6.5% vs. its initial guidance of 7%-7.5%.

PE multiple has de-rated sharply to 2.5SD below historical

Management claimed that the reason behind the weak 3Q16

mean. LPPF now trades at 19x PE 17F, -2.5SD below its

sales was the misstep in inventory assortment surrounding

historical mean since April 2013. The sharp de-rating in the

the Lebaran peak season, particularly for women’s apparels,

past month has brought down LPPF’s PE multiple to a level

rather than competition from online or specialty retailers. On

that is on par with regional peers despite having the highest

top of that, discretionary spending had remained muted in

ROE. We believe most of the negatives, including the increase

3Q16, which we believe also contributed to the decline in

of investment in MatahariMall.com, are already reflected in

SSSG.

the share price.

The subsequent chart shows that LPPF’s SSSG has broadly

The company generates more than enough operating cash

moved in line with nominal household consumption growth.

flow to cover its capex annually and even if we are to assume

We expect the demand recovery momentum to continue in

an increase in inventory days by 10 days in 2017 and 2018

2017 but only at a gradual pace. While demand for

due to a persistently weak demand environment or

necessities had generally improved in 3Q16, discretionary

management’s push toward direct purchase sales, our

household spending growth has yet to show signs of

calculation shows that LPPF can still generate Rp2.4tr/Rp2.6tr

bottoming as it further eased to 4.3% y-o-y in 4Q16, still

operating cash flow in 2017F/2018F. If the company

lagging behind non-discretionary household spending. We do

maintains a dividend payout ratio of 70% in the same period

not see a strong reason to expect a surge in nominal

and double its capex budget to Rp1tr per year, it can still fund

household consumption growth in the near future, which in

the expansion using internal cash.

the past year hovered between 7% and 8%. For this reason,

restoring SSSG to double-digit levels would be a challenging Our DDM valuation analysis suggests limited downside to

task for LPPF, in our view. We now project LPPF’s same-store current share price. We ran a three-stage DDM valuation

sales to grow by 6.1% in 2016F and 7.1% in 2017F (from analysis to estimate the level of reduction in potential future

7.6%/8.4% for FY16F/FY17F initially). We therefore lower our dividends that the current share price has priced in. Currently,

net profit forecasts by 2%/3% for FY16F/FY17F. We expect LPPF maintains a dividend payout ratio of 70% despite its

LPPF net profit to grow by 18% in FY16F and 13% in FY17F. ability to raise it to 100%. Our DDM model assumes LPPF will

grow its dividend at 13% CAGR over the next 10 years on

A change in strategy? LPPF has committed Rp590bn cash to

the back of: 1) 11% net profit and dividend CAGR in the first

be injected in stages into Lippo Group’s e-commerce arm

five years, 2) 7% net profit CAGR in the subsequent five years

MatahariMall.com from the end of 2016 to 3Q17. The

and a linear increase in dividend payout ratio (DPR) from 70%

additional investment is made to avoid LPPF’s ownership

in year-5 to 100% in year-10, and 3) stable growth rate of

dilution in MatahariMall.com, which recently raised equity of

6% from year-11 onwards. We assume SSSG of 6%-7% in

USD100m – led by Japan’s Mitsui & Co. Prior to this, LPPF

our model

owned a minority stake of 9.47% in MatahariMall.com.

Based on our calculation, LPPF’s current share price range of

There appears to be a change in management’s strategy with

Rp14,800-Rp15,700 implies a scenario of 32%-37% of

regard to LPPF’s investment in MatahariMall.com as it

annual operating cash flow or roughly Rp1.2tr-Rp1.5tr being

previously guided for no further investment in

retained to fund capex or working capital needs over the next

MatahariMall.com. Looking ahead, the company aims to

10 years. As a comparison, LPPF only allocates Rp450bn

maintain its stake in MatahariMall.com below 20%.

capex budget for FY16 (excluding investment in

In a statement release to the public, management stated that MatahariMall.com). This affirms our view that the current

it had not planned to participate in any further funding valuation has largely priced in a slowing SSSG and more

initiatives by MatahariMall.com, but the question remains on importantly the risk of significant rise in capex or investment

how far LPPF would let its stake in MatahariMall.com being as the company works to achieve its goal to become an

diluted should MatahariMall.com require further equity omnichannel retailer. Our key assumptions and sensitivity

raising after 3Q17. Not letting its stakes being diluted would analysis on the DDM valuation are presented on the

mean that LPPF has to top up its investment in subsequent page.

ASIAN INSIGHTS VICKERS SECURITIES

Page 2

Company Guide

Matahari Department Store

We see limited positive catalysts, especially since the demand Competition against online fashion retailers should not be

environment (particularly for discretionary spending) has yet overlooked. We visited some major online retailers’ websites

to show signs of an encouraging pick-up. What can surprise to get the on-the-ground perspective on how intense the

on the upside would be if LPPF manages to improve its competition is among the players. We focus our observation

profitability, be it from further opex efficiency or on key players in fashion retailing, an area where we see that

improvement in sales mix (toward more direct purchase), and LPPF has an edge over the competitors given its long

if there is further increase in its dividend payout ratio from experience in the field. We limit our observation to

the current level of 70%. blouse/shirt and t-shirt categories for both women and men.

We also visited LPPF’s first Nevada Store in Jakarta to compare

The company has continued to roll out initiatives to increase

the price offerings against online fashion retailers.

profitability, among which is to improve its sales mix. The

company recently opens its first specialty store in Jakarta, The highlights from our observation are:

called Nevada Store, to test the market. Nevada Store sells

i. Key players are crowding into middle-class apparel

LPPF’s private label apparels and shoes i.e. Nevada,

market. The Alibaba-backed Lazada, Zalora and

Connexion, Details, and Cole, which command higher

BerryBenka on average have 90% of SKU with final

margins compared to consigned merchandise. In 9M16, the

price (after discount) ranging between Rp100,000-

higher-margin direct purchase (DP) accounted for 36.7% of

300,000 (USD8-22). As a comparison, the average

LPPF’s gross sales (vs. 35.3% in 9M15). There is also room to

basket size of LPPF’s offline stores is c.USD20.

improve its sales mix if LPPF can increase sales of women’s

Increasing competition against online retailers

apparels, which command higher margins and currently only

should not be overlooked, especially since LPPF

contribute 8%-9% of total sales.

caters to the middle-class segment, which could

Indonesia’s Internet retailing landscape in brief. Indonesia’s turn increasingly price sensitive when the economy

retail landscape is still dominated by brick-and-mortar shops slows.

while Internet retailing only makes up a small fragment with a

ii. For LPPF’s private label items, discount on online

share of less than 2% of total retail sales. It nonetheless has

store nearly doubled that given on onffline stores.

grown at a spectacular pace with a CAGR of 45% in 2011-

Discounts given on MatahariMall.com are generally

2016, driven by the strong penetration of smart phones.

higher than those in Nevada Store (offline). We

Apparel and footware Internet retailing is the fastest growing

observed that a 20% promotional discount is given

category with a CAGR of 152% in 2011-2016. It represented

on apparels sold in Nevada Store. The similar items

24% of total Internet retailing revenue.

are sold at a 36% discount on MatahariMall.com. It

Indonesia’s Internet retailing is still in the early stages, which is worth noting that any promotional discount given

means gaining market share remains the main objective of for purchases made through MatahariMall.com is

the key players for the time being rather than turning the borne by LPPF. The impact of heavy online

business into a profitable venture. This keeps customer promotion is not significant for now as online sales

acquisition costs elevated given the tight competition among contribution is still small, at less than 1% of LPPF’s

existing and new players to attract traffic. Two key challenges total sales.

faced by online retailers in Indonesia are high unbanked

population (over 70% of population does not have a bank

account) and poor infrastructure.

LPPF’s SSSG vs. private consumption expenditure growth Cash flow and FCFF trend and forecasts

30.0 Rp bn

1H16 SSSG was

expectionally high due 3,500

25.0 to a shift in Lebaran 3,000

peak season.

2,500

20.0 2,000

1,500

15.0

1,000

500

10.0

0

5.0 (500) 2014A 2015A 2016F 2017F 2018F

(1,000)

(1,500)

SSSG, % (LHS) Private consumption GDP (current price), % Operating cash flow Cash flow from investing act. FCFF

Source: Company, DBS Vickers, Bloomberg Finance L.P Source: DBS Vickers

ASIAN INSIGHTS VICKERS SECURITIES

Page 3

Company Guide

Matahari Department Store

LPPF’s investment in MatahariMall.com

LPPF's

LPPF stakes in

Date investment in

GEI

GEI (Rp bn)

Feb-15 LPPF signed agreement to buy share purchase option of GEI

Aug-15 LPPF exercised option to buy 2.5% stakes 2.5% 32

Sep-15 LPPF's stakes in GEI was diluted after IDV purchased GEI's new shares 2.3% 32

Dec-15 LPPF's stakes in GEI was diluted after IDV purchased GEI's new shares 2.0% 32

Dec-15 LPPF exercised option to buy 4,404,700 shares in GEI 5.2% 85

Jan-16 LPPF exercised option to buy 7,864,075 stakes in GEI 9.5% 180

LPPF announced a plan to increase stakes to a max of 20% in GEI by

Nov-16

injecting Rp590bn in stages

LPPF issue public disclosure on its plan to acquire 7,326,495 shares in

Dec-16 GEI for Rp165bn (part of the investment plan announced in Nov-16)

before end of Jan-17

*GEI is the parent company of MatahariMall.com

Source: Company, DBS Vickers

Key assumptions for DDM valuation analysis Sensitivity matrix for DDM valuation

A ( ba s e ) B Risk-free rate

Cost of equity Avg. DPR in 7.5% 8.0% 8.5% 9.0%

High growth period (17F-22F) 14.5% 14.5% transition 85% 15,800 15,200 14,800 14,300

Transition period (23F-27F) 11.0% 11.0% period 100% 16,800 16,200 15,700 15,200

Stable growth period (28F onward) 6.0% 6.0%

NPV of dividends in high growth period (Rp bn) 8,235 8,235 Risk-free rate*

CAGR 11% 11% 7.5% 8.0% 8.5% 9.0%

Terminal growth*

DPR 70% 70% 4.0% 12,400 12,100 11,700 11,400

NPV of dividend in transition period (Rp bn) 7,456 8,773 4.5% 13,100 12,700 12,300 11,900

CAGR 15% 16% 5.0% 13,800 13,400 13,000 12,600

Avg. DPR 85% 100% 5.5% 14,700 14,200 13,800 13,400

NPV of dividends in stable growth period (Rp bn) 27,353 28,792 6.0% 15,800 15,200 14,800 14,300

DPR 100% 100% 6.5% 17,000 16,500 15,900 15,400

NPV ( Rp bn) 43, 044 45, 799

*Based on the assumption of 85% avg. DPR in transition period

NPV/s ha re ( Rp) 14, 800 15, 700

Source: DBS Vickers

Source: DBS Vickers

LPPF launched its first Nevada Store in Jakarta to test the market

Source: DBS Vickers

ASIAN INSIGHTS VICKERS SECURITIES

Page 4

Company Guide

Matahari Department Store

Quarterly SSSG Trend

CRITICAL DATA POINTS TO WATCH

50%

40%

Earnings Drivers:

Stable SSSG and new store openings. We assume 6.1%/7.1% 30%

SSSG, and the opening of 8/7 new stores in FY16F/17F. LPPF 20%

saw weaker SSSG in FY15 (i.e. 6.8%) because of generally 10%

weaker consumer spending and slower economy, especially in 0%

ex-Java islands such as Kalimantan where incomes have been

1Q12

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

1Q15

2Q15

3Q15

4Q15

1Q16

2Q16

3Q16

-10%

affected by low commodity prices and several closures of

-20%

commodity-related businesses. Kalimantan’s economy is

dependent on the commodity industry, such as coal-mining -30%

and oil palm cultivation. SSSG Same-store sales volume growth

Direct Purchase vs. Consignment Sales

LPPF opened 10-11 new stores annually in the past two years.

100% 37%

For 2017, we assume that LPPF will open 7seven new stores,

in line with management’s guidance. 80%

32% 34% 36% 37% 38% 39%

36%

60%

Recovery of consumer sentiment. LPPF’s target market is mid-

35%

low/middle income consumers, which make up about 60% of

40%

the country’s population. A pick-up in the consumer 68% 66% 64% 63% 62% 61%

34%

sentiment, represented by the Consumer Confidence Index, 20%

would help lift sales growth.

0% 33%

2013 2014 2015A 2016F 2017F 2018F

Larger share of retail sales to lift margins. LPPF operates two Consignment sales Retail sales (direct purchase)

main business segments: consignment sales and retail sales. Service fees Gross margin (RHS)

Gross margins from retail sales (or direct purchase) are higher

New Stores

than from consignment sales, at c.44% vs. c.31%. Going

forward, we expect retail sales to outpace consignment sales,

which would expand margins as the revenue mix shifts.

Expect net profit to grow at 12% CAGR (FY16F-18F). Our

earnings projection is premised on: (1) margin expansion

arising from a shift in revenue mix (we expect the higher-

margin retail sales to contribute 39% to LPPF’s gross revenue

in FY18 vs. 36% in FY15), (2) new stores openings, and (3) an

uptick in same-store sales growth as the economy recovers,

supported by a debt-free balance sheet and strong cash flow Same-Store Sales Growth (%)

generation.

Low exposure to USD/IDR volatility. More than 80% of LPPF’s

products are sourced locally, so margins are virtually

unaffected by the volatile rupiah. Currently, the rupiah is

hovering around Rp13,300 to the US dollar. Our in-house

forecast for the rupiah is Rp13,876 by the end of 2017,

implying 4% depreciation, assuming four 25bps fed rate hikes

in 2017. We like LPPF for its minimal exposure to the USD and

relatively stable earnings throughout our forecast period.

Source: Company, DBS Vickers

ASIAN INSIGHTS VICKERS SECURITIES

Page 5

Company Guide

Matahari Department Store

Leverage & Asset Turnover (x)

Balance Sheet:

An asset-light, debt-free company. At the end of 2015, LPPF

has paid off its outstanding debt, in line with its objective in

being debt-free by end of last year. The other positive aspect is

the company’s asset-light business model. We like that 100%

of LPPF’s stores are leased – 70% on 10-year fixed rent

contracts and 30% on revenue sharing contracts with the

space operator.

LPPF also does not rely heavily on distribution centres as its

effective supply chain allows for just-in-time inventory system;

Capital Expenditure

its goods are shipped to its stores nationwide within 48 hours

of arriving at the distribution centre. This business model has

allowed the company to improve its operating efficiency, and

its store and marketing initiatives have expanded net margins

over the past few years.

Share Price Drivers:

Better-than-expected same store growth. A recovery in the

domestic economy and a pick-up in consumer spending will

be reflected in better-than-expected SSSG for LPPF. In FY15,

LPPF stores recorded 6.8% SSSG, which was weak but ROE (%)

relatively better than peers’ amid the slow economy.

Key Risks:

Slower demand because of higher price of subsidised fuel

Increase in fuel price could reduce middle-low/middle income

consumers’ disposable income, subsequently reducing

discretionary spending.

Limited available space for expansion

LPPF’s store expansion could be slowed down if space

becomes more limited. This could lead to a slower-than- Forward PE Band (x)

expected revenue growth for the firm. 33

31

+2sd

29

Company Background +1sd

27

PT Matahari Department Store Tbk engages in the retail Avg.

25

business for several types of products such as clothes,

23

accessories, bags, shoes, cosmetics, and household -1sd

appliances. 21

-2sd

19

17

Apr-13 Apr-14 Apr-15 Apr-16 Apr-17

EV/EBITDA Band (x)

22.0

21.0

+2sd

20.0

19.0 +1sd

18.0

17.0 Avg.

16.0

-1sd

15.0

14.0 -2sd

13.0

12.0

Apr-13 Apr-14 Apr-15 Apr-16

Source: Company, DBS Vickers

ASIAN INSIGHTS VICKERS SECURITIES

Page 6

Company Guide

Matahari Department Store

Key Assumptions

FY Dec 2014A 2015A 2016F 2017F 2018F

New Stores 6.00 11.0 8.00 7.00 8.00

Same-Store Sales Growth 10.7 6.80 6.10 7.10 7.60

Segmental Breakdown

FY Dec 2014A 2015A 2016F 2017F 2018F

Gross Revenues (Rpbn)

Consignment sales 9,552 10,354 11,109 11,966 12,961

Retail sales (direct 4,899 5,729 6,420 7,219 8,159

Service fees 45.4 50.2 54.7 59.9 65.9

Total 14,496 16,133 17,584 19,246 21,185

Gross Profit (Rpbn) We forecast 9% growth

Consignment sales 2,981 3,228 3,474 3,754 4,079 in gross revenue in

Retail sales (direct 2,038 2,412 2,735 3,111 3,516 FY17F

Service fees 28.7 31.8 35.6 38.9 42.9

Total 5,048 5,671 6,245 6,905 7,638

Gross Profit Margins (%)

Consignment sales 31.2 31.2 31.3 31.4 31.5

Retail sales (direct 41.6 42.1 42.6 43.1 43.1

Service fees 63.3 63.4 65.0 65.0 65.0

Total 34.8 35.2 35.5 35.9 36.1

Income Statement (Rpbn)

FY Dec 2014A 2015A 2016F 2017F 2018F

Revenue 7,926 9,007 9,949 11,033 12,304

Cost of Goods Sold (2,878) (3,336) (3,704) (4,129) (4,666)

Gross Profit 5,048 5,671 6,245 6,905 7,638

Other Opng (Exp)/Inc (2,937) (3,342) (3,636) (3,977) (4,374)

Operating Profit 2,111 2,330 2,609 2,928 3,264

Other Non Opg (Exp)/Inc (27.1) 8.10 8.10 8.10 8.10

Associates & JV Inc 0.0 0.0 0.0 0.0 0.0

Net Interest (Exp)/Inc (233) (92.8) 23.7 34.8 44.9

Exceptional Gain/(Loss) 0.0 0.0 0.0 0.0 0.0

Pre-tax Profit 1,851 2,245 2,641 2,971 3,317

Tax (431) (464) (546) (614) (686)

Minority Interest 0.0 0.0 0.0 0.0 0.0

Preference Dividend 0.0 0.0 0.0 0.0 0.0

Net Profit 1,419 1,781 2,095 2,357 2,631

Net Profit before Except. 1,419 1,781 2,095 2,357 2,631

EBITDA 2,318 2,564 2,906 3,286 3,682

Growth

Revenue Gth (%) 17.3 13.6 10.5 10.9 11.5

EBITDA Gth (%) 17.2 10.6 13.3 13.1 12.1

Opg Profit Gth (%) 18.5 10.3 12.0 12.2 11.5

Net Profit Gth (Pre-ex) (%) 23.4 25.5 17.6 12.5 11.6

Margins & Ratio

Gross Margins (%) 34.8 35.2 35.5 35.9 36.1

Opg Profit Margin (%) 14.6 14.4 14.8 15.2 15.4

Net Profit Margin (%) 9.8 11.0 11.9 12.2 12.4

ROAE (%) 891.1 161.0 107.2 82.9 68.8

ROA (%) 41.6 45.8 43.4 39.9 36.9

ROCE (%) 122.9 118.4 85.9 70.4 60.5

Div Payout Ratio (%) 60.0 70.0 70.0 70.0 70.0

Net Interest Cover (x) 9.0 25.1 NM NM NM

Source: Company, DBS Vickers

ASIAN INSIGHTS VICKERS SECURITIES

Page 7

Company Guide

Matahari Department Store

Quarterly / Interim Income Statement (Rpbn)

FY Dec 3Q2015 4Q2015 1Q2016 2Q2016 3Q2016

Revenue 2,892 2,194 1,862 3,318 2,343

Cost of Goods Sold (1,080) (816) (700) (1,196) (874)

Gross Profit 1,812 1,378 1,162 2,122 1,468

Other Oper. (Exp)/Inc (887) (832) (856) (967) (909)

Operating Profit 925 547 307 1,155 560

Other Non Opg (Exp)/Inc 2.50 5.60 1.70 (3.7) 0.40

Associates & JV Inc 0.0 0.0 0.0 0.0 0.0

Net Interest (Exp)/Inc (13.3) (48.5) 0.60 (2.4) 4.40

Exceptional Gain/(Loss) 0.0 0.0 0.0 0.0 0.0

Pre-tax Profit 914 504 309 1,149 565

Tax (178) (107) (65.2) (235) (112)

Minority Interest 0.0 0.0 0.0 0.0 0.0

Net Profit 736 397 244 913 453

Net profit bef Except. 736 397 244 913 453

EBITDA 988 615 367 1,219 627

Growth

Revenue Gth (%) 25.6 (24.1) (15.1) 78.2 (29.4)

EBITDA Gth (%) 49.7 (37.8) (40.3) 232.1 (48.5)

Opg Profit Gth (%) 53.6 (40.9) (43.9) 276.6 (51.5)

Net Profit Gth (Pre-ex) (%) 59.1 (46.1) (38.6) 274.7 (50.4)

Margins

Gross Margins (%) 34.4 35.3 35.3 36.6 35.0

Opg Profit Margins (%) 17.6 14.0 9.3 19.9 13.3 Margins based on

Net Profit Margins (%) 14.0 10.2 7.4 15.8 10.8 gross revenue

Balance Sheet (Rpbn)

FY Dec 2014A 2015A 2016F 2017F 2018F

Net Fixed Assets 726 877 1,030 1,122 1,150

Invts in Associates & JVs 0.0 0.0 0.0 0.0 0.0

Other LT Assets 570 740 982 1,425 1,425

Cash & ST Invts 786 947 1,393 1,794 2,807

Inventory 955 1,008 1,100 1,238 1,411

Debtors 45.1 39.3 46.6 51.7 57.6

Other Current Assets 331 279 279 279 279

Total Assets 3,413 3,889 4,831 5,909 7,129

ST Debt 423 110 110 110 110

Creditor 1,411 1,552 1,645 1,833 2,072

Other Current Liab 685 777 777 777 777

LT Debt 410 0.0 0.0 0.0 0.0

Other LT Liabilities 325 344 344 344 344

Shareholder’s Equity 159 1,106 1,954 2,844 3,826

Minority Interests 0.0 0.0 0.0 0.0 0.0

Total Cap. & Liab. 3,413 3,889 4,831 5,909 7,129

Non-Cash Wkg. Capital (764) (1,002) (996) (1,042) (1,101)

Net Cash/(Debt) (46.8) 836 1,283 1,684 2,696

Debtors Turn (avg days) 2.1 1.6 1.7 1.7 1.7

Creditors Turn (avg days) 192.8 182.6 176.2 177.5 178.0

Inventory Turn (avg days) 130.5 118.6 117.9 119.8 121.3

Asset Turnover (x) 2.3 2.3 2.1 1.9 1.7

Current Ratio (x) 0.8 0.9 1.1 1.2 1.5

Quick Ratio (x) 0.3 0.4 0.6 0.7 1.0

Net Debt/Equity (X) 0.3 CASH CASH CASH CASH

Net Debt/Equity ex MI (X) 0.3 CASH CASH CASH CASH

Capex to Debt (%) 32.5 343.0 407.8 407.8 404.0

Z-Score (X) 12.0 13.7 13.2 12.7 12.2

Source: Company, DBS Vickers

ASIAN INSIGHTS VICKERS SECURITIES

Page 8

Company Guide

Matahari Department Store

Cash Flow Statement (Rpbn)

FY Dec 2014A 2015A 2016F 2017F 2018F

Pre-Tax Profit 1,851 2,245 2,641 2,971 3,317

Dep. & Amort. 207 234 297 358 418

Tax Paid (431) (464) (546) (614) (686)

Assoc. & JV Inc/(loss) 0.0 0.0 0.0 0.0 0.0

Chg in Wkg.Cap. (87.0) 240 (6.3) 46.0 58.7

Other Operating CF 167 (79.5) 0.0 0.0 0.0

Net Operating CF 1,705 2,175 2,386 2,761 3,108

Capital Exp.(net) (271) (379) (450) (450) (446)

Other Invts.(net) 0.0 0.0 0.0 0.0 0.0

Invts in Assoc. & JV 0.0 0.0 0.0 0.0 0.0

Div from Assoc & JV 0.0 0.0 0.0 0.0 0.0

Other Investing CF 1.70 (84.6) (242) (443) 0.0

We have factored in

Net Investing CF (269) (463) (692) (893) (446) Rp590bn investment in

Div Paid (460) (851) (1,247) (1,467) (1,650) MatahariMall.com with

Chg in Gross Debt (988) (700) 0.0 0.0 0.0 25% of total

Capital Issues 0.0 0.0 0.0 0.0 0.0 investment being

Other Financing CF 0.0 0.0 0.0 0.0 0.0 disbursed in FY16F.

Net Financing CF (1,448) (1,551) (1,247) (1,467) (1,650)

Currency Adjustments 25.6 0.0 0.0 0.0 0.0

Chg in Cash 13.7 161 446 402 1,012

Opg CFPS (Rp) 614 663 820 930 1,045

Free CFPS (Rp) 492 616 663 792 912

Source: Company, DBS Vickers

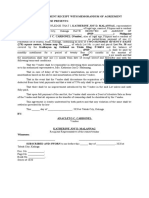

Target Price & Ratings History

Source: DBS Vickers

Analyst: Tiesha PUTRI

Andy SIM CFA

ASIAN INSIGHTS VICKERS SECURITIES

Page 9

Company Guide

Matahari Department Store

DBS Vickers recommendations are based an Absolute Total Return* Rating system, defined as follows:

STRONG BUY (>20% total return over the next 3 months, with identifiable share price catalysts within this time frame)

BUY (>15% total return over the next 12 months for small caps, >10% for large caps)

HOLD (-10% to +15% total return over the next 12 months for small caps, -10% to +10% for large caps)

FULLY VALUED (negative total return i.e. > -10% over the next 12 months)

SELL (negative total return of > -20% over the next 3 months, with identifiable catalysts within this time frame)

Share price appreciation + dividends

Completed Date: 9 Feb 2017 07:55:21 (WIB)

Dissemination Date: 9 Feb 2017 14:49:43 (WIB)

GENERAL DISCLOSURE/DISCLAIMER

This report is prepared by PT DBS Vickers Sekuritas Indonesia. This report is solely intended for the clients of DBS Bank Ltd, DBS Vickers Securities

(Singapore) Pte Ltd, its respective connected and associated corporations and affiliates only and no part of this document may be (i) copied,

photocopied or duplicated in any form or by any means or (ii) redistributed without the prior written consent of PT DBS Vickers Sekuritas

Indonesia.

The research set out in this report is based on information obtained from sources believed to be reliable, but we (which collectively refers to DBS

Bank Ltd, its respective connected and associated corporations, affiliates and their respective directors, officers, employees and agents (collectively,

the “DBS Group”)) do not make any representation or warranty as to its accuracy, completeness or correctness. Opinions expressed are subject to

change without notice. This document is prepared for general circulation. Any recommendation contained in this document does not have regard

to the specific investment objectives, financial situation and the particular needs of any specific addressee. This document is for the information of

addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate independent legal

or financial advice. The DBS Group accepts no liability whatsoever for any direct, indirect and/or consequential loss (including any claims for loss of

profit) arising from any use of and/or reliance upon this document and/or further communication given in relation to this document. This

document is not to be construed as an offer or a solicitation of an offer to buy or sell any securities. The DBS Group, along with its affiliates and/or

persons associated with any of them may from time to time have interests in the securities mentioned in this document. The DBS Group may have

positions in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and

other banking services for these companies.

Any valuations, opinions, estimates, forecasts, ratings or risk assessments herein constitutes a judgment as of the date of this report, and there can

be no assurance that future results or events will be consistent with any such valuations, opinions, estimates, forecasts, ratings or risk assessments.

The information in this document is subject to change without notice, its accuracy is not guaranteed, it may be incomplete or condensed and it

may not contain all material information concerning the company (or companies) referred to in this report and the DBS Group is under no

obligation to update the information in this report.

This publication has not been reviewed or authorized by any regulatory authority in Singapore, Hong Kong or elsewhere. There is no planned

schedule or frequency for updating research publication relating to any issuer.

The valuations, opinions, estimates, forecasts, ratings or risk assessments described in this report were based upon a number of estimates and

assumptions and are inherently subject to significant uncertainties and contingencies. It can be expected that one or more of the estimates on

which the valuations, opinions, estimates, forecasts, ratings or risk assessments were based will not materialize or will vary significantly from actual

results. Therefore, the inclusion of the valuations, opinions, estimates, forecasts, ratings or risk assessments described herein IS NOT TO BE RELIED

UPON as a representation and/or warranty by the DBS Group (and/or any persons associated with the aforesaid entities), that:

(a) such valuations, opinions, estimates, forecasts, ratings or risk assessments or their underlying assumptions will be achieved, and

(b) there is any assurance that future results or events will be consistent with any such valuations, opinions, estimates, forecasts, ratings or risk

assessments stated therein.

Please contact the primary analyst for valuation methodologies and assumptions associated with the covered companies or price targets.

Any assumptions made in this report that refers to commodities, are for the purposes of making forecasts for the company (or companies)

mentioned herein. They are not to be construed as recommendations to trade in the physical commodity or in the futures contract relating to the

commodity referred to in this report.

DBS Vickers Securities (USA) Inc ("DBSVUSA")"), a U.S.-registered broker-dealer, does not have its own investment banking or research

department, has not participated in any public offering of securities as a manager or co-manager or in any other investment banking transaction

in the past twelve months and does not engage in market-making.

ASIAN INSIGHTS VICKERS SECURITIES

Page 10

Company Guide

Matahari Department Store

ANALYST CERTIFICATION

The research analyst(s) primarily responsible for the content of this research report, in part or in whole, certifies that the views about the

companies and their securities expressed in this report accurately reflect his/her personal views. The analyst(s) also certifies that no part of his/her

compensation was, is, or will be, directly, or indirectly, related to specific recommendations or views expressed in the report. The DBS Group has

procedures in place to eliminate, avoid and manage any potential conflicts of interests that may arise in connection with the production of

research reports. As of 9 Feb 2017, the analyst(s) and his/her spouse and/or relatives who are financially dependent on the analyst(s), do not hold

interests in the securities recommended in this report (“interest” includes direct or indirect ownership of securities). The research analyst(s)

responsible for this report operates as part of a separate and independent team to the investment banking function of the DBS Group and

procedures are in place to ensure that confidential information held by either the research or investment banking function is handled

appropriately.

COMPANY-SPECIFIC / REGULATORY DISCLOSURES

1. PT DBS Vickers Sekuritas Indonesia (''DBSVI'') have a proprietary position in Matahari Department Store recommended in this report as of 8

Feb 2017.

Compensation for investment banking services:

2. DBSVUSA does not have its own investment banking or research department, nor has it participated in any public offering of securities as a

manager or co-manager or in any other investment banking transaction in the past twelve months. Any US persons wishing to obtain further

information, including any clarification on disclosures in this disclaimer, or to effect a transaction in any security discussed in this document

should contact DBSVUSA exclusively.

Disclosure of previous investment recommendation produced:

3. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd (''DBSVS''), their subsidiaries and/or other affiliates may have published other

investment recommendations in respect of the same securities / instruments recommended in this research report during the preceding 12

months. Please contact the primary analyst listed in the first page of this report to view previous investment recommendations published by

DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd (''DBSVS''), their subsidiaries and/or other affiliates in the preceding 12 months.

RESTRICTIONS ON DISTRIBUTION

General This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or

located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be

contrary to law or regulation.

Australia This report is being distributed in Australia by DBS Bank Ltd. (“DBS”) or DBS Vickers Securities (Singapore) Pte Ltd (“DBSVS”),

both of which are exempted from the requirement to hold an Australian Financial Services Licence under the Corporation Act

2001 (“CA”) in respect of financial services provided to the recipients. Both DBS and DBSVS are regulated by the Monetary

Authority of Singapore under the laws of Singapore, which differ from Australian laws. Distribution of this report is intended

only for “wholesale investors” within the meaning of the CA.

Hong Kong This report is being distributed in Hong Kong by or on behalf of, and is attributable to DBS Vickers (Hong Kong) Limited

which is licensed and regulated by the Hong Kong Securities and Futures Commission and/or by DBS Bank (Hong Kong)

Limited which is regulated by the Hong Kong Monetary Authority and the Securities and Futures Commission. Where this

publication relates to a research report, unless otherwise stated in the research report(s), DBS Bank (Hong Kong) Limited is not

the issuer of the research report(s). This publication including any research report(s) is/are distributed on the express

understanding that, whilst the information contained within is believed to be reliable, the information has not been

independently verified by DBS Bank (Hong Kong) Limited. This report is intended for distribution in Hong Kong only to

professional investors (as defined in the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong) and any

rules promulgated thereunder.)

For any query regarding the materials herein, please contact Paul Yong (CE. No. ASE988) at equityresearch@dbs.com.

Indonesia This report is being distributed in Indonesia by PT DBS Vickers Securities Indonesia.

Malaysia This report is distributed in Malaysia by AllianceDBS Research Sdn Bhd ("ADBSR"). Recipients of this report, received from

ADBSR are to contact the undersigned at 603-2604 3333 in respect of any matters arising from or in connection with this

report. In addition to the General Disclosure/Disclaimer found at the preceding page, recipients of this report are advised that

ADBSR (the preparer of this report), its holding company Alliance Investment Bank Berhad, their respective connected and

associated corporations, affiliates, their directors, officers, employees, agents and parties related or associated with any of

them may have positions in, and may effect transactions in the securities mentioned herein and may also perform or seek to

perform broking, investment banking/corporate advisory and other services for the subject companies. They may also have

received compensation and/or seek to obtain compensation for broking, investment banking/corporate advisory and other

services from the subject companies.

Wong Ming Tek, Executive Director, ADBSR

ASIAN INSIGHTS VICKERS SECURITIES

Page 11

Company Guide

Matahari Department Store

Singapore This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) or DBSVS (Company Regn No.

198600294G), both of which are Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the

Monetary Authority of Singapore. DBS Bank Ltd and/or DBSVS, may distribute reports produced by its respective foreign

entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial

Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert

Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons

only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 6327 2288 for matters arising from,

or in connection with the report.

Thailand This report is being distributed in Thailand by DBS Vickers Securities (Thailand) Co Ltd. Research reports distributed are only

intended for institutional clients only and no other person may act upon it.

United Kingdom This report is produced by PT DBS Vickers Sekuritas Indonesia which is regulated by the Otoritas Jasa Keuangan (OJK).

This report is disseminated in the United Kingdom by DBS Vickers Securities (UK) Ltd, ("DBSVUK"). DBSVUK is authorised and

regulated by the Financial Conduct Authority in the United Kingdom.

In respect of the United Kingdom, this report is solely intended for the clients of DBSVUK, its respective connected and

associated corporations and affiliates only and no part of this document may be (i) copied, photocopied or duplicated in any

form or by any means or (ii) redistributed without the prior written consent of DBSVUK. This communication is directed at

persons having professional experience in matters relating to investments. Any investment activity following from this

communication will only be engaged in with such persons. Persons who do not have professional experience in matters

relating to investments should not rely on this communication.

Dubai This research report is being distributed in The Dubai International Financial Centre (“DIFC”) by DBS Bank Ltd., (DIFC Branch)

having its office at PO Box 506538, 3rd Floor, Building 3, East Wing, Gate Precinct, Dubai International Financial Centre (DIFC),

Dubai, United Arab Emirates. DBS Bank Ltd., (DIFC Branch) is regulated by The Dubai Financial Services Authority. This

research report is intended only for professional clients (as defined in the DFSA rulebook) and no other person may act upon

it.

United States This report was prepared by PT DBS Vickers Sekuritas Indonesia. DBSVUSA did not participate in its preparation. The research

analyst(s) named on this report are not registered as research analysts with FINRA and are not associated persons of

DBSVUSA. The research analyst(s) are not subject to FINRA Rule 2241 restrictions on analyst compensation, communications

with a subject company, public appearances and trading securities held by a research analyst. This report is being distributed

in the United States by DBSVUSA, which accepts responsibility for its contents. This report may only be distributed to Major

U.S. Institutional Investors (as defined in SEC Rule 15a-6) and to such other institutional investors and qualified persons as

DBSVUSA may authorize. Any U.S. person receiving this report who wishes to effect transactions in any securities referred to

herein should contact DBSVUSA directly and not its affiliate.

Other jurisdictions In any other jurisdictions, except if otherwise restricted by laws or regulations, this report is intended only for qualified,

professional, institutional or sophisticated investors as defined in the laws and regulations of such jurisdictions.

PT DBS Vickers Sekuritas Indonesia

DBS Bank Tower, Ciputra World 1, 32/F

Jl. Prof. Dr. Satrio Kav. 3-5, Jakarta 12940, Indonesia

Tel. 6221-3003 4900, Fax: 6221-3003 4943

Otoritas Jasa Keuangan (OJK)

ASIAN INSIGHTS VICKERS SECURITIES

Page 12

Você também pode gostar

- Debt Deception: How Debt Buyers Abuse The Legal System To Prey On Lower-Income New Yorkers (2010)Documento36 páginasDebt Deception: How Debt Buyers Abuse The Legal System To Prey On Lower-Income New Yorkers (2010)Jillian Sheridan100% (1)

- Hire Purchase PPT 1Documento17 páginasHire Purchase PPT 1Sourabh ChatterjeeAinda não há avaliações

- Company Law - Floatation Charges, Sem 5, Pintu Babu, Roll 110Documento17 páginasCompany Law - Floatation Charges, Sem 5, Pintu Babu, Roll 110Devendra DhruwAinda não há avaliações

- World Transfer Pricing 2016Documento285 páginasWorld Transfer Pricing 2016Hutapea_apynAinda não há avaliações

- Forex Trading Using Intermarket Analysis-Louis Mendelsohn-By-bdforexproDocumento20 páginasForex Trading Using Intermarket Analysis-Louis Mendelsohn-By-bdforexproMd Sakir HasanAinda não há avaliações

- Ambit - CDSL - Initiation - Best Play On Equitisation - 05sept2023Documento54 páginasAmbit - CDSL - Initiation - Best Play On Equitisation - 05sept2023Naushil Shah100% (1)

- Insights Demand To Remain SluggishDocumento93 páginasInsights Demand To Remain SluggishmrfakhriAinda não há avaliações

- Acknowledgement Receipt With Memorandum of Agreement (Anacleto C. Carbonel)Documento1 páginaAcknowledgement Receipt With Memorandum of Agreement (Anacleto C. Carbonel)Christina Pic-it BaguiwanAinda não há avaliações

- Final Base Module Guide PDFDocumento362 páginasFinal Base Module Guide PDFmohansusiAinda não há avaliações

- LPPF Mansek 01112016Documento6 páginasLPPF Mansek 01112016nirwana.construction01Ainda não há avaliações

- Shinsegae (004170 KS - Buy)Documento7 páginasShinsegae (004170 KS - Buy)PEAinda não há avaliações

- Mitra Adiperkasa: Indonesia Company GuideDocumento14 páginasMitra Adiperkasa: Indonesia Company GuideAshokAinda não há avaliações

- Indonesian Property Leader Bumi Serpong Damai GuideDocumento10 páginasIndonesian Property Leader Bumi Serpong Damai GuidetimphamAinda não há avaliações

- London Sumatra Indonesia TBK: Still Positive But Below ExpectationDocumento7 páginasLondon Sumatra Indonesia TBK: Still Positive But Below ExpectationHamba AllahAinda não há avaliações

- Ganesha Ecosphere 3QFY20 Result Update - 200211 PDFDocumento4 páginasGanesha Ecosphere 3QFY20 Result Update - 200211 PDFdarshanmadeAinda não há avaliações

- LIC Housing Finance Q1FY19 earnings rise 5.3% on lower provisionsDocumento9 páginasLIC Housing Finance Q1FY19 earnings rise 5.3% on lower provisionsdarshanmaldeAinda não há avaliações

- Glenmark - MacquarieDocumento11 páginasGlenmark - MacquarieSomendraAinda não há avaliações

- Havells India LTD (HAVL) PDFDocumento5 páginasHavells India LTD (HAVL) PDFViju K GAinda não há avaliações

- FOCUS - Indofood Sukses Makmur: Saved by The GreenDocumento10 páginasFOCUS - Indofood Sukses Makmur: Saved by The GreenriskaAinda não há avaliações

- ICICI - Piramal PharmaDocumento4 páginasICICI - Piramal PharmasehgalgauravAinda não há avaliações

- SobhaDocumento21 páginasSobhadigthreeAinda não há avaliações

- Jasa Marga Upgrade Jul28 v2Documento6 páginasJasa Marga Upgrade Jul28 v2superrich92Ainda não há avaliações

- Indiabulls Housing Finance: CMP: INR949 TP: INR1,150 (+21%)Documento12 páginasIndiabulls Housing Finance: CMP: INR949 TP: INR1,150 (+21%)Veronika AkheevaAinda não há avaliações

- RIL 4QFY20 Results Update | Sector: Oil & GasDocumento34 páginasRIL 4QFY20 Results Update | Sector: Oil & GasQUALITY12Ainda não há avaliações

- ACESDocumento4 páginasACESokky siahaanAinda não há avaliações

- Summarecon Agung: Indonesia Company GuideDocumento10 páginasSummarecon Agung: Indonesia Company GuideGoro ZhouAinda não há avaliações

- Teamlease Services (Team In) : Q4Fy19 Result UpdateDocumento8 páginasTeamlease Services (Team In) : Q4Fy19 Result Updatesaran21Ainda não há avaliações

- Mphasis HSBCDocumento9 páginasMphasis HSBCmittleAinda não há avaliações

- Muthoot Finance: Steady QuarterDocumento7 páginasMuthoot Finance: Steady QuarterMukeshChauhanAinda não há avaliações

- RBL Bank - 4QFY19 - HDFC Sec-201904191845245959765Documento12 páginasRBL Bank - 4QFY19 - HDFC Sec-201904191845245959765SachinAinda não há avaliações

- Telekomunikasi Indonesia (TLKM) : Target Price: RP 75.000Documento6 páginasTelekomunikasi Indonesia (TLKM) : Target Price: RP 75.000Hamba AllahAinda não há avaliações

- Hero Motocorp: Play On Rural RecoveryDocumento10 páginasHero Motocorp: Play On Rural RecoveryjaimaaganAinda não há avaliações

- Research - Note - 2017 12 27 - 10 48 05 000000 PDFDocumento14 páginasResearch - Note - 2017 12 27 - 10 48 05 000000 PDFMOHAMEDAinda não há avaliações

- Panca Mitra Multiperdana: Tailwinds AheadDocumento6 páginasPanca Mitra Multiperdana: Tailwinds AheadSatria BimaAinda não há avaliações

- Bahana Sekuritas SMGR - Underperforming Sales Volume May Lead To Weak 1H19 ResultsDocumento7 páginasBahana Sekuritas SMGR - Underperforming Sales Volume May Lead To Weak 1H19 ResultsKPH BaliAinda não há avaliações

- BANK JAGO EXECUTIONDocumento5 páginasBANK JAGO EXECUTIONTasya AngelineAinda não há avaliações

- BLS International - 2QFY18 - HDFC Sec-201711112030262626379Documento11 páginasBLS International - 2QFY18 - HDFC Sec-201711112030262626379Anonymous y3hYf50mTAinda não há avaliações

- Nazara Technologies - Prabhu - 14022022140222Documento8 páginasNazara Technologies - Prabhu - 14022022140222saurabht11293Ainda não há avaliações

- Trent - Update - Oct23 - HSIE-202310090927441183889Documento8 páginasTrent - Update - Oct23 - HSIE-202310090927441183889sankalp111Ainda não há avaliações

- Indofood CBP: Navigating WellDocumento11 páginasIndofood CBP: Navigating WellAbimanyu LearingAinda não há avaliações

- Avenue - Super Dolat 211020 PDFDocumento10 páginasAvenue - Super Dolat 211020 PDFnani reddyAinda não há avaliações

- GRUH-Finance-Limited 204 QuarterUpdateDocumento10 páginasGRUH-Finance-Limited 204 QuarterUpdatevikasaggarwal01Ainda não há avaliações

- SMGR Ugrade - 4M17 Sales FinalDocumento4 páginasSMGR Ugrade - 4M17 Sales FinalInna Rahmania d'RstAinda não há avaliações

- CDSL TP: 750: in Its Own LeagueDocumento10 páginasCDSL TP: 750: in Its Own LeagueSumangalAinda não há avaliações

- Asia Securities Sampath Bank Initiation 12 Oct 2016Documento34 páginasAsia Securities Sampath Bank Initiation 12 Oct 2016Anonymous 3z9kKcGOAinda não há avaliações

- Results in Line, Sales Momentum Continues: PL Mid-Cap DayDocumento5 páginasResults in Line, Sales Momentum Continues: PL Mid-Cap DaymaheshhaseAinda não há avaliações

- Trimegah Company Focus 3Q23 JSMR 14 Dec 2023 Maintain Buy HigherDocumento10 páginasTrimegah Company Focus 3Q23 JSMR 14 Dec 2023 Maintain Buy HigheredwardlowisworkAinda não há avaliações

- Motilal Oswal - 2QFY20 - HDFC Sec-201910251913301814908Documento15 páginasMotilal Oswal - 2QFY20 - HDFC Sec-201910251913301814908Ajay SinghAinda não há avaliações

- DCB Bank Limited: Investing For Growth BUYDocumento4 páginasDCB Bank Limited: Investing For Growth BUYdarshanmadeAinda não há avaliações

- Malindo Feedmill: 3Q21F Earnings Preview: Anticipating Weak 3Q Outlook Focus On 4QDocumento6 páginasMalindo Feedmill: 3Q21F Earnings Preview: Anticipating Weak 3Q Outlook Focus On 4QdkdehackerAinda não há avaliações

- Ashok Leyland Q3FY19 Result UpdateDocumento4 páginasAshok Leyland Q3FY19 Result Updatekapil bahetiAinda não há avaliações

- Supreme Industries LTD Hold: Retail Equity ResearchDocumento5 páginasSupreme Industries LTD Hold: Retail Equity ResearchanjugaduAinda não há avaliações

- Iiww 161210Documento4 páginasIiww 161210rinku23patilAinda não há avaliações

- Kotak Mahindra Bank (KMB IN) : Q2FY20 Result UpdateDocumento10 páginasKotak Mahindra Bank (KMB IN) : Q2FY20 Result UpdateHitesh JainAinda não há avaliações

- Stock Report On JSW Steel in India PDFDocumento8 páginasStock Report On JSW Steel in India PDFPranavPillaiAinda não há avaliações

- Kalpataru Power TransmissionDocumento3 páginasKalpataru Power TransmissionvaibhavacharyaAinda não há avaliações

- EEI 3Q17 earnings miss forecasts on weak domestic and foreign operationsDocumento8 páginasEEI 3Q17 earnings miss forecasts on weak domestic and foreign operationsKurt YuAinda não há avaliações

- Stock Report On Baja Auto in India Ma 23 2020Documento12 páginasStock Report On Baja Auto in India Ma 23 2020PranavPillaiAinda não há avaliações

- Dalmia Bharat - 2QFY20 - HDFC Sec-201910222145294572701Documento11 páginasDalmia Bharat - 2QFY20 - HDFC Sec-201910222145294572701praveensingh77Ainda não há avaliações

- L&T Tech Services | HOLD - An imbalanced equationDocumento9 páginasL&T Tech Services | HOLD - An imbalanced equationdarshanmadeAinda não há avaliações

- Astra Agro Lestari TBK: Soaring Financial Performance in 3Q20Documento6 páginasAstra Agro Lestari TBK: Soaring Financial Performance in 3Q20Hamba AllahAinda não há avaliações

- BIMB Holdings: Malaysia Company GuideDocumento11 páginasBIMB Holdings: Malaysia Company GuideEugene TeoAinda não há avaliações

- Tata Motors: Weakness Persists But Faith IntactDocumento13 páginasTata Motors: Weakness Persists But Faith IntactDinesh ChoudharyAinda não há avaliações

- @LJ LNT Fin Prabhudas 040518Documento9 páginas@LJ LNT Fin Prabhudas 040518Amey TiwariAinda não há avaliações

- Trent Feb07 - 2020 202002102024105183431 PDFDocumento5 páginasTrent Feb07 - 2020 202002102024105183431 PDFdarshanmadeAinda não há avaliações

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNo EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsAinda não há avaliações

- Brazilian banks adopt asset-liability management to mitigate risksDocumento13 páginasBrazilian banks adopt asset-liability management to mitigate risksJohn MichaelAinda não há avaliações

- Authority Letter & NOC (Faizan Pharmacy) SamundriDocumento2 páginasAuthority Letter & NOC (Faizan Pharmacy) Samundrifaizanhafeez786Ainda não há avaliações

- 01 Us v. DrescherDocumento6 páginas01 Us v. DrescherAminor VillaroelAinda não há avaliações

- Alfa Dyestuff Industries Ltd. 20-21Documento14 páginasAlfa Dyestuff Industries Ltd. 20-21Naheyan Jahid PabonAinda não há avaliações

- Mechanics of Currency Dealing and Exchange Rate QuotationsDocumento6 páginasMechanics of Currency Dealing and Exchange Rate Quotationsvijayadarshini vAinda não há avaliações

- Global Financial Crisis and Its Impact On Bangladesh's EconomyDocumento55 páginasGlobal Financial Crisis and Its Impact On Bangladesh's EconomyImroz Mahmud0% (1)

- Ifms Sanction Contingent FVCDocumento3 páginasIfms Sanction Contingent FVCkedarAinda não há avaliações

- APAC 50 by ITCDocumento38 páginasAPAC 50 by ITCyash guptaAinda não há avaliações

- Câu Hỏi Ôn Tập - PolicyDocumento13 páginasCâu Hỏi Ôn Tập - Policythịnh huỳnhAinda não há avaliações

- 1962 - Malkiel - Expectations, Bond Prices, and The Term Structure of Interest RatesDocumento23 páginas1962 - Malkiel - Expectations, Bond Prices, and The Term Structure of Interest Ratesjoydiv4Ainda não há avaliações

- Entrep PPT Week16 Module4 2NDQTRDocumento22 páginasEntrep PPT Week16 Module4 2NDQTRjeselyAinda não há avaliações

- A.investment A Pays $250 at The Beginning of Every Year For The Next 10 Years (A Total of 10 Payments)Documento4 páginasA.investment A Pays $250 at The Beginning of Every Year For The Next 10 Years (A Total of 10 Payments)EjkAinda não há avaliações

- Comparative Analysis of Indian and Global Stock MarketsDocumento35 páginasComparative Analysis of Indian and Global Stock MarketsAmol Dahiphale0% (1)

- Analyze Financial Ratios of a CompanyDocumento9 páginasAnalyze Financial Ratios of a Companyshameeee67% (3)

- Hurun India Future Unicorn 2021 Fina Press ReleaselDocumento14 páginasHurun India Future Unicorn 2021 Fina Press ReleaselnikunjbubnaAinda não há avaliações

- Transcorp International Gets In-Principle RBI Authorisation For Semi Closed Pre-Paid Payment Instrument (PPI) Service (Company Update)Documento3 páginasTranscorp International Gets In-Principle RBI Authorisation For Semi Closed Pre-Paid Payment Instrument (PPI) Service (Company Update)Shyam SunderAinda não há avaliações

- As 2, Valuation of Inventories: Excluded Inventories (Not Dealt With Byas2)Documento2 páginasAs 2, Valuation of Inventories: Excluded Inventories (Not Dealt With Byas2)manvinderAinda não há avaliações

- NSSF Amm 2019 FiguresDocumento25 páginasNSSF Amm 2019 Figuresjadwongscribd100% (1)

- Illustrative Example PDFDocumento16 páginasIllustrative Example PDFTanvir AhmedAinda não há avaliações

- RTO Programme Pitchbook 20191213Documento7 páginasRTO Programme Pitchbook 20191213Kung FooAinda não há avaliações

- 2012 - Tpa ProjectDocumento14 páginas2012 - Tpa ProjectIshika kanyalAinda não há avaliações

- Intermediate Accounting 2 Topic: Unearned RevenuesDocumento5 páginasIntermediate Accounting 2 Topic: Unearned RevenuesJhazreel BiasuraAinda não há avaliações

- Credit Card ETB Customer - Mar29 - 06 04Documento4 páginasCredit Card ETB Customer - Mar29 - 06 04tanvir019Ainda não há avaliações