Escolar Documentos

Profissional Documentos

Cultura Documentos

Forcible Entry

Enviado por

Nadine BediaDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Forcible Entry

Enviado por

Nadine BediaDireitos autorais:

Formatos disponíveis

G.R. No. 160914, March 25, 2015 MARCELA M. DELA CRUZ v. ANTONIO Q.

HERMANO AND HIS WIFE

REMEDIOS HERMANO

The burden of sufficiently alleging prior physical possession carries with it the concomitant burden of

establishing one’s case by a preponderance of evidence. To be able to do so, respondents herein must

rely on the strength of their own evidence, not on the weakness of that of petitioner. It is not enough that

the allegations of a complaint make out a case for forcible entry. The plaintiff must prove prior physical

possession. It is the basis of the security accorded by law to a prior occupant of a property until a person

with a better right acquires possession thereof.

The Court has scrutinized the parties’ submissions, but found no sufficient evidence to prove respondents’

allegation of prior physical possession.

To prove their claim of having a better right to possession, respondents submitted their title thereto and

the latest Tax Declaration prior to the initiation of the ejectment suit. As the CA correctly observed,

petitioner failed to controvert these documents with competent evidence. It erred, however, in

considering those documents sufficient to prove respondents’ prior physical possession.

Ownership certainly carries the right of possession, but the possession contemplated is not exactly the

same as that which is in issue in a forcible entry case. Possession in a forcible entry suit refers only to

possession de facto, or actual or material possession, and not one flowing out of ownership. These are

different legal concepts under which the law provides different remedies for recovery of possession. Thus,

in a forcible entry case, a party who can prove prior possession can recover the possession even against

the owner. Whatever may be the character of the possession, the present occupant of the property has

the security to remain on that property if the occupant has the advantage of precedence in time and until

a person with a better right lawfully causes eviction.

Similarly, tax declarations and realty tax payments are not conclusive proofs of possession. They are

merely good indicia of possession in the concept of owner based on the presumption that no one in one’s

right mind would be paying taxes for a property that is not in one’s actual or constructive possession.

Guided by the foregoing, the Court finds that the proofs submitted by respondents only established

possession flowing from ownership. Although respondents have claimed from the inception of the

controversy up to now that they are using the property as their vacation house, that claim is not

substantiated by any corroborative evidence. On the other hand, petitioner’s claim that she started

occupying the property in March 2001, and not in September of that year as Antonio alleged in his

Complaint, was corroborated by the Affidavit of petitioner’s caretaker. Respondents did not present any

evidence to controvert that affidavit.

Therefore, respondents failed to discharge their burden of proving the element of prior physical

possession. Their uncorroborated claim of that fact, even if made under oath, is self-serving. It does not

amount to preponderant evidence, which simply means that which is of greater weight or is more

convincing than evidence that is offered in opposition.

Você também pode gostar

- Marcela M. Dela Cruz, Petitioner, V. Antonio Q. HermanoDocumento1 páginaMarcela M. Dela Cruz, Petitioner, V. Antonio Q. HermanoDiane Dee YaneeAinda não há avaliações

- Cases PropertyDocumento6 páginasCases PropertyMia UnabiaAinda não há avaliações

- 55 Heirs of Ampil v. Sps ManahanDocumento2 páginas55 Heirs of Ampil v. Sps ManahanAlyanna ApacibleAinda não há avaliações

- Evidence - 48 Digest CasesDocumento51 páginasEvidence - 48 Digest CasesBebzky Bengdaen100% (1)

- Castillo - Civ - Sps Basa V LoyDocumento4 páginasCastillo - Civ - Sps Basa V LoyJona B. Reporial100% (1)

- Basa VS LoyDocumento4 páginasBasa VS LoyJansel Jayme BuencaloloyAinda não há avaliações

- Atienza vs. de CastroDocumento3 páginasAtienza vs. de CastroAlfred LacandulaAinda não há avaliações

- Forcible Entry and Unlawful DetainerDocumento14 páginasForcible Entry and Unlawful DetainerChristopher Dizon100% (1)

- Chittenden v. Brewster, 69 U.S. 191 (1865)Documento6 páginasChittenden v. Brewster, 69 U.S. 191 (1865)Scribd Government DocsAinda não há avaliações

- Villanueva v. CADocumento4 páginasVillanueva v. CACharisma AclanAinda não há avaliações

- Unlawful Detainer - Answer To ComplaintDocumento6 páginasUnlawful Detainer - Answer To ComplaintHaruAinda não há avaliações

- Carbonilla Vs AbieraDocumento2 páginasCarbonilla Vs AbieraRegine Yu100% (1)

- 2019 LTD Case DigestsDocumento2 páginas2019 LTD Case DigestsCarleen BongatAinda não há avaliações

- Recit Evid Bago HolyweekDocumento2 páginasRecit Evid Bago HolyweekSam ManioAinda não há avaliações

- Manongsong V EstimoDocumento2 páginasManongsong V EstimoJoshua AbadAinda não há avaliações

- Petitioners Vs VS: First DivisionDocumento13 páginasPetitioners Vs VS: First DivisionkarlshemAinda não há avaliações

- VELEZ V LUMINARIASDocumento7 páginasVELEZ V LUMINARIASSohayle Boriongan MacaunaAinda não há avaliações

- MANZANO vs. PEREZ SRDocumento2 páginasMANZANO vs. PEREZ SRGeorge JerusalemAinda não há avaliações

- Dela Cruz Vs Hermano, 754 SCRA 231Documento19 páginasDela Cruz Vs Hermano, 754 SCRA 231Marc Gar-ciaAinda não há avaliações

- Almeda v. Heirs of Ponciano AlmedaDocumento1 páginaAlmeda v. Heirs of Ponciano AlmedaPam RamosAinda não há avaliações

- SPOUSES AURORA TOJONG SU AND AMADOR SU, v. EDA BONTILAO, PABLITA BONTILAO, AND MARICEL DAYANDAYAN,.G.R. No. 238892 DIGESTDocumento2 páginasSPOUSES AURORA TOJONG SU AND AMADOR SU, v. EDA BONTILAO, PABLITA BONTILAO, AND MARICEL DAYANDAYAN,.G.R. No. 238892 DIGESTMichael James Madrid MalinginAinda não há avaliações

- Sales 6 Santos To AcabalDocumento136 páginasSales 6 Santos To AcabalKim Muzika PerezAinda não há avaliações

- Implied and Express TrustDocumento7 páginasImplied and Express TrustmarkAinda não há avaliações

- Rule 133-134 (Edited)Documento20 páginasRule 133-134 (Edited)Matthew WittAinda não há avaliações

- Clado-Reyes V Limpe DigestDocumento2 páginasClado-Reyes V Limpe DigestPrincess Loyola Tapia100% (2)

- Mahinay Vs CADocumento4 páginasMahinay Vs CAmonica may ramosAinda não há avaliações

- Santos vs. Santos 366 SCRA 395, October 02, 2001Documento14 páginasSantos vs. Santos 366 SCRA 395, October 02, 2001Justin Jomel ConsultaAinda não há avaliações

- Art. 1456 Bueno v. ReyesDocumento4 páginasArt. 1456 Bueno v. ReyesPrecious Grace Flores BoloniasAinda não há avaliações

- Crisostomo Vs GarciaDocumento4 páginasCrisostomo Vs GarciaFloyd AmahitAinda não há avaliações

- Manongsong vs. EstimoDocumento15 páginasManongsong vs. EstimoRiena MaeAinda não há avaliações

- Crisostomo vs. GarciaDocumento6 páginasCrisostomo vs. GarciaElephantAinda não há avaliações

- Coca To C DigestDocumento15 páginasCoca To C DigestCharlene MiraAinda não há avaliações

- AnswerDocumento12 páginasAnswerJevi RuiizAinda não há avaliações

- Succession GDocumento35 páginasSuccession GBlessAinda não há avaliações

- Penalosa v. SantosDocumento16 páginasPenalosa v. SantosLucila MangrobangAinda não há avaliações

- 3 Dela Cruz Vs HermanoDocumento2 páginas3 Dela Cruz Vs HermanoSarah GantoAinda não há avaliações

- Amora vs. People Digested)Documento1 páginaAmora vs. People Digested)Beajee Lou AbianAinda não há avaliações

- 2 Penalosa V SantosDocumento14 páginas2 Penalosa V SantoscarafloresAinda não há avaliações

- Modesto Palali V Juliet AwisanDocumento1 páginaModesto Palali V Juliet AwisanDotsAinda não há avaliações

- FactumProbandum V FactumProbans Case DigestsDocumento4 páginasFactumProbandum V FactumProbans Case DigestsJessica WuAinda não há avaliações

- Glenny v. Langdon, 98 U.S. 20 (1878)Documento10 páginasGlenny v. Langdon, 98 U.S. 20 (1878)Scribd Government DocsAinda não há avaliações

- Spouses Miles v. Bonnie Lao, G.R. No. 209544, November 22, 2017Documento3 páginasSpouses Miles v. Bonnie Lao, G.R. No. 209544, November 22, 2017Nicasio Alvarez IIIAinda não há avaliações

- Petitioners - versus-BONNIE BAUTISTA LAO, Respondent. G.R. NoDocumento3 páginasPetitioners - versus-BONNIE BAUTISTA LAO, Respondent. G.R. Nobb yattyAinda não há avaliações

- Mahinay Vs Gako Case DigestDocumento3 páginasMahinay Vs Gako Case DigestLou100% (1)

- HILARIO VsDocumento10 páginasHILARIO VsHazel Joy Galamay - Garduque100% (2)

- Pascual v. Spouses Coronel and in Spouses Barias v. Heirs of Bartolome Boneo, Et Al.Documento9 páginasPascual v. Spouses Coronel and in Spouses Barias v. Heirs of Bartolome Boneo, Et Al.Edz ZVAinda não há avaliações

- Coverage FinalDocumento19 páginasCoverage FinalKean Fernand BocaboAinda não há avaliações

- Tumlos Vs Fernandez DigestDocumento2 páginasTumlos Vs Fernandez Digestproject_ziAinda não há avaliações

- AYSON, JR. V FELIXDocumento2 páginasAYSON, JR. V FELIXChilzia RojasAinda não há avaliações

- 7 GR 441Documento3 páginas7 GR 441Alvin GULOYAinda não há avaliações

- LegformDocumento13 páginasLegformLovely Zyrenjc100% (1)

- Rule 130 Sec 39Documento17 páginasRule 130 Sec 39Therese JavierAinda não há avaliações

- Motion To Vacate Judgement and Motion To Reverse or Cancel SaleDocumento5 páginasMotion To Vacate Judgement and Motion To Reverse or Cancel Salepelliott123100% (4)

- Digests AgainDocumento5 páginasDigests AgainGieldan BulalacaoAinda não há avaliações

- Rule 62 DigestsDocumento12 páginasRule 62 DigestsCel DelabahanAinda não há avaliações

- CAÑEZO vs. ROJASDocumento2 páginasCAÑEZO vs. ROJASpotbatangkalawakanAinda não há avaliações

- Canezo vs. RoxasDocumento9 páginasCanezo vs. RoxasMarites regaliaAinda não há avaliações

- Case Digest LTD FinalsDocumento3 páginasCase Digest LTD FinalsRewel Jr.Ainda não há avaliações

- Motions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsNo EverandMotions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsNota: 4.5 de 5 estrelas4.5/5 (14)

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)No EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)Ainda não há avaliações

- A Simple Guide To Hurdling The Bar ExamsDocumento34 páginasA Simple Guide To Hurdling The Bar ExamsNadine Bedia100% (1)

- Tax Set 2Documento30 páginasTax Set 2Nadine BediaAinda não há avaliações

- The Sacrament of ConfirmationDocumento11 páginasThe Sacrament of ConfirmationNadine BediaAinda não há avaliações

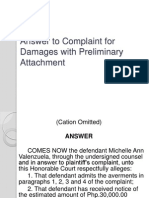

- Answer To Complaint For Damages With Preliminary AttachmentDocumento8 páginasAnswer To Complaint For Damages With Preliminary AttachmentNadine BediaAinda não há avaliações

- Election Law DigestsDocumento21 páginasElection Law DigestsNadine BediaAinda não há avaliações

- Puppy LoveDocumento2 páginasPuppy LoveNadine Bedia100% (1)

- Syntax - English Sentence StructureDocumento14 páginasSyntax - English Sentence StructureNadine BediaAinda não há avaliações

- Petition For Notarial CommissionDocumento13 páginasPetition For Notarial CommissionNadine BediaAinda não há avaliações

- Certificate of Membership in The Philippine BarDocumento0 páginaCertificate of Membership in The Philippine BarNadine BediaAinda não há avaliações

- Nominal and Temperate DamagesDocumento16 páginasNominal and Temperate DamagesNadine BediaAinda não há avaliações

- Election Law DigestDocumento55 páginasElection Law DigestNadine Bedia100% (1)

- Pajuyo v. CA, G.R. No. 146364, June 3, 2004Documento15 páginasPajuyo v. CA, G.R. No. 146364, June 3, 2004Nadine BediaAinda não há avaliações

- Pajuyo v. CA, G.R. No. 146364, June 3, 2004Documento15 páginasPajuyo v. CA, G.R. No. 146364, June 3, 2004Nadine BediaAinda não há avaliações

- Election Law DigestDocumento13 páginasElection Law DigestNadine BediaAinda não há avaliações

- 2011 Justice BrionDocumento489 páginas2011 Justice BrionNadine BediaAinda não há avaliações

- Decline LetterDocumento2 páginasDecline LetterKhatim al AbroriAinda não há avaliações

- Case Digest No. 3Documento3 páginasCase Digest No. 3Faye Allen MatasAinda não há avaliações

- Another." Ambrose Bierce : Quotation, N: The Act of Repeating Erroneously The Words ofDocumento23 páginasAnother." Ambrose Bierce : Quotation, N: The Act of Repeating Erroneously The Words ofSybok100% (3)

- Quincy Standage Revised ResumeDocumento4 páginasQuincy Standage Revised Resumeapi-406925870Ainda não há avaliações

- Eastern Shipping Lines v. POEA, G.R. No. 76633Documento5 páginasEastern Shipping Lines v. POEA, G.R. No. 76633Daryl CruzAinda não há avaliações

- PhptoDocumento13 páginasPhptoAshley Jovel De GuzmanAinda não há avaliações

- On August 31 2015 The Rijo Equipment Repair Corp S Post ClosingDocumento1 páginaOn August 31 2015 The Rijo Equipment Repair Corp S Post ClosingMiroslav GegoskiAinda não há avaliações

- Gender and Human Rights-5Documento18 páginasGender and Human Rights-5Fahad AmeerAinda não há avaliações

- 01 ONG-CHIA-vs-REPUBLICDocumento3 páginas01 ONG-CHIA-vs-REPUBLICMaria Victoria Dela TorreAinda não há avaliações

- Emergency Binder ChecklistDocumento2 páginasEmergency Binder ChecklistAgustin Peralta100% (1)

- Home Improvement Business Exam GuideDocumento10 páginasHome Improvement Business Exam GuideAl PenaAinda não há avaliações

- 007.MTL-NSS-AB-2023-007 - Quotation For SS Fabrication & Coating - MR-SS-0145Documento1 página007.MTL-NSS-AB-2023-007 - Quotation For SS Fabrication & Coating - MR-SS-0145abasithamAinda não há avaliações

- Circular No. 38 /2016-Customs: - (1) Notwithstanding Anything Contained in This Act ButDocumento18 páginasCircular No. 38 /2016-Customs: - (1) Notwithstanding Anything Contained in This Act ButAnshAinda não há avaliações

- Business law-Module+No.2Documento34 páginasBusiness law-Module+No.2Utkarsh SrivastavaAinda não há avaliações

- Audcise NotesDocumento3 páginasAudcise NotesdfsdAinda não há avaliações

- Scratch Your BrainDocumento22 páginasScratch Your BrainTrancemissionAinda não há avaliações

- Limbauan Vs AcostaDocumento6 páginasLimbauan Vs AcostaJENNY BUTACANAinda não há avaliações

- Choose A Plan - ScribdDocumento1 páginaChoose A Plan - ScribdUltraJohn95Ainda não há avaliações

- 2020 Contract Negotiations - Official ATU Proposal 6-25-21Documento5 páginas2020 Contract Negotiations - Official ATU Proposal 6-25-21Chicago Transit Justice CoalitionAinda não há avaliações

- Executive Department by Atty. Anselmo S. Rodiel IVDocumento39 páginasExecutive Department by Atty. Anselmo S. Rodiel IVAnselmo Rodiel IVAinda não há avaliações

- Womens Sermon - pptx1!Documento22 páginasWomens Sermon - pptx1!Welyn SabornidoAinda não há avaliações

- Bid Opening and EvaluationDocumento64 páginasBid Opening and EvaluationDavid Sabai100% (3)

- 8e Daft Chapter 06Documento24 páginas8e Daft Chapter 06krutikdoshiAinda não há avaliações

- Ifrs25122 PDFDocumento548 páginasIfrs25122 PDFAmit Kemani100% (1)

- 2014 Texas Staar Test - End of Course - English IDocumento69 páginas2014 Texas Staar Test - End of Course - English IManeet MathurAinda não há avaliações

- Case Study and Mind Map Health Psychology - 2Documento4 páginasCase Study and Mind Map Health Psychology - 2api-340420872Ainda não há avaliações

- MRP Project ReportDocumento82 páginasMRP Project ReportRaneel IslamAinda não há avaliações

- Manual Multisim 2001 (Ingles)Documento72 páginasManual Multisim 2001 (Ingles)Anonymous W1QQcbA4sWAinda não há avaliações

- A Liberal Upheaval - Dror ZeigermanDocumento65 páginasA Liberal Upheaval - Dror ZeigermanfnfjerusalemAinda não há avaliações

- 9.tajanglangit V Southern MotorsDocumento3 páginas9.tajanglangit V Southern MotorsAngela AquinoAinda não há avaliações