Escolar Documentos

Profissional Documentos

Cultura Documentos

Select Economic Indicators

Enviado por

pls20190 notas0% acharam este documento útil (0 voto)

15 visualizações1 páginarbi report

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentorbi report

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

15 visualizações1 páginaSelect Economic Indicators

Enviado por

pls2019rbi report

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 1

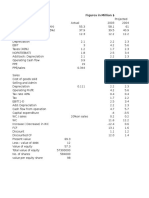

CURRENT STATISTICS

No. 1: Select Economic Indicators

Item 2011-12 2012-13 2013-14

2012-13

Q4 Q1 Q4 Q1

1 2 3 4 5

1 Real Sector (% Change)

1.1 GDP 5.0 5.1 5.4 4.8 4.4

1.1.1 Agriculture 1.9 2.0 2.9 1.4 2.7

1.1.2 Industry 1.2 1.0 -0.2 2.0 -0.9

1.1.3 Services 6.8 7.0 7.6 6.3 6.2

1.1a Final Consumption Expenditure 3.9 9.3 4.7 3.3 3.0

1.1b Gross Fixed Capital Formation 1.7 2.6 -2.2 3.4 -1.2

2012 2013

2012-13

Jun Jul Jun Jul

1 2 3 4 5

1.2 Index of Industrial Production 1.2 -2.0 -0.1 -2.2 ..

2 Money and Banking (% Change)

2.1 Scheduled Commercial Banks

2.1.1 Deposits 14.2 13.5 13.9 13.5 13.4

2.1.2 Credit 14.1 16.5 17.3 13.5 14.9

2.1.2.1 Non-food Credit 14.0 16.1 16.9 13.5 15.1

2.1.3 Investment in Govt. Securities 15.4 16.1 14.1 14.5 13.8

2.2 Money Stock Measures

2.2.1 Reserve Money (M0) 6.2 7.8 6.6 7.1 6.8

2.2.2 Broad Money (M3) 13.8 15.8 14.0 12.8 12.5

3 Ratios (%)

3.1 Cash Reserve Ratio 4.00 4.75 4.75 4.00 4.00

3.2 Statutory Liquidity Ratio 23.0 24.0 24.0 23.0 23.0

3.3 Cash-Deposit Ratio 4.8 5.9 5.8 5.3 5.0

3.4 Credit-Deposit Ratio 77.9 76.4 75.3 76.4 76.3

3.5 Incremental Credit-Deposit Ratio 77.1 46.7 27.4 44.8 43.0

3.6 Investment-Deposit Ratio 29.7 29.9 30.7 30.2 30.8

3.7 Incremental Investment-Deposit Ratio 31.9 39.0 53.4 39.8 52.8

4 Interest Rates (%)

4.1 Policy Repo Rate 7.50 8.00 8.00 7.25 7.25

4.2 Reverse Repo Rate 6.50 7.00 7.00 6.25 6.25

4.3 Marginal Standing Facility (MSF) Rate 8.50 9.00 9.00 8.25 10.25

4.4 Bank Rate 8.50 9.00 9.00 8.25 10.25

4.5 Base Rate 9.70/10.25 10.00/10.50 10.00/10.50 9.70/10.25 9.70/10.25

4.6 Term Deposit Rate >1 Year 7.50/9.00 8.00/9.25 8.00/9.25 7.50/9.00 7.50/9.00

4.7 Savings Deposit Rate 4.00 4.00 4.00 4.00 4.00

4.8 Call Money Rate (Weighted Average) 8.30 8.21 8.03 7.19 8.33

4.9 91-Day Treasury Bill (Primary) Yield 8.19 8.31 8.14 7.48 11.00

4.10 182-Day Treasury Bill (Primary) Yield 8.01 8.31 8.12 7.40 10.73

4.11 364-Day Treasury Bill (Primary) Yield 7.79 8.12 7.98 7.50 10.46

4.12 10-Year Government Securities Yield 7.95 8.15 - 7.39 8.17

5 RBI Reference Rate and Forward Premia

5.1 INR-US$ Spot Rate (Rs. ` Per Foreign Currency) 54.39 56.31 55.81 59.70 61.12

5.2 INR-Euro Spot Rate (Rs. ` Per Foreign Currency) 69.54 70.91 68.45 77.98 80.95

5.3 Forward Premia of US$ 1-month (%) 7.72 7.67 8.06 6.63 10.41

3-month (%) 7.57 7.17 7.17 6.23 9.69

6-month (%) 7.28 6.36 6.70 5.90 8.90

6 Inflation (%)

6.1 Wholesale Price Index 7.4 7.6 7.5 4.9 5.8

6.1.1 Primary Articles 9.8 9.8 10.5 8.1 9.0

6.1.2 Fuel and Power 10.6 12.1 8.4 7.1 11.3

6.1.3 Manufactured Products 5.4 5.4 5.9 2.8 2.8

6.2 All India Consumer Price Index 10.21 9.9 9.9 9.9 9.6

6.3 Consumer Price Index for Industrial Workers 10.43 10.1 9.8 11.1 10.9

7 Foreign Trade (% Change)

7.1 Imports 0.4 -12.2 -1.2 0.1 -6.2

7.2 Exports -1.8 -6.1 -12.4 -5.3 11.6

RBI Monthly Bulletin September 2013 123

Você também pode gostar

- Government Publications: Key PapersNo EverandGovernment Publications: Key PapersBernard M. FryAinda não há avaliações

- Yardeni - Stategist Handbook - 2019Documento24 páginasYardeni - Stategist Handbook - 2019scribbugAinda não há avaliações

- Growth Rate and Composition of Real GDPDocumento27 páginasGrowth Rate and Composition of Real GDPpallavi jhanjiAinda não há avaliações

- gdp4q20 3rdDocumento21 páginasgdp4q20 3rd王建国Ainda não há avaliações

- EBRD On Ukraine DraftDocumento70 páginasEBRD On Ukraine Draftconsta7751Ainda não há avaliações

- 18 Statistics Key Economic IndicatorsDocumento17 páginas18 Statistics Key Economic Indicatorsjohnmarch146Ainda não há avaliações

- Key Economic IndicatorsDocumento30 páginasKey Economic IndicatorsJyotishree PandeyAinda não há avaliações

- Key Economic Indicators PDFDocumento30 páginasKey Economic Indicators PDFRitesh JhaAinda não há avaliações

- Fundamental Analysis Checklist, SUN PHARMA, CIPLA, GLENMARK (Final)Documento116 páginasFundamental Analysis Checklist, SUN PHARMA, CIPLA, GLENMARK (Final)sukeshAinda não há avaliações

- Equity Reserch Coal IndiaDocumento42 páginasEquity Reserch Coal IndiaPrajwal nayakAinda não há avaliações

- SPS Sample ReportsDocumento61 páginasSPS Sample Reportsphong.parkerdistributorAinda não há avaliações

- Us ModelDocumento1 páginaUs ModellgfinanceAinda não há avaliações

- Apr FileDocumento1 páginaApr FileAshwin GophanAinda não há avaliações

- New Public MAC DSA: Chart Package For Lower Scrutiny Countries Page 1 of 2Documento2 páginasNew Public MAC DSA: Chart Package For Lower Scrutiny Countries Page 1 of 2Liliya RepaAinda não há avaliações

- Hyundai Construction Equipment (IR 4Q20)Documento17 páginasHyundai Construction Equipment (IR 4Q20)girish_patkiAinda não há avaliações

- I. Economic Environment (1) O: The Dominican Republic WT/TPR/S/207/Rev.1Documento15 páginasI. Economic Environment (1) O: The Dominican Republic WT/TPR/S/207/Rev.1Office of Trade Negotiations (OTN), CARICOM SecretariatAinda não há avaliações

- Key Economic Indicators IndiaDocumento49 páginasKey Economic Indicators IndiavivekAinda não há avaliações

- Canadian Economic OutlookDocumento1 páginaCanadian Economic OutlookZain KhwajaAinda não há avaliações

- Office For National Statistics (ONS)Documento8 páginasOffice For National Statistics (ONS)Carmen PireddaAinda não há avaliações

- DL Ecb - Fsr201805.enDocumento12 páginasDL Ecb - Fsr201805.enIK CleeseAinda não há avaliações

- Financial RequirementsDocumento1 páginaFinancial Requirementstil telAinda não há avaliações

- AIN Conomic Ndicators: Ashemite Ingdom of OrdanDocumento16 páginasAIN Conomic Ndicators: Ashemite Ingdom of OrdanbamakuAinda não há avaliações

- MPS Jan 2024 CompendiumDocumento32 páginasMPS Jan 2024 Compendiummaryamshah63neduetAinda não há avaliações

- Economic IndicatorsDocumento6 páginasEconomic Indicatorsfusion2000Ainda não há avaliações

- Weekly Economic & Financial Commentary: EconomicsDocumento11 páginasWeekly Economic & Financial Commentary: EconomicsSharkyAinda não há avaliações

- Fiji's Economy: The Challenge of The FutureDocumento41 páginasFiji's Economy: The Challenge of The FutureFederico YouAinda não há avaliações

- Economic Growth, Savings and Investments: 2.1 OverviewDocumento22 páginasEconomic Growth, Savings and Investments: 2.1 OverviewZain Ul AbidinAinda não há avaliações

- September 2018 ECB Staff Macroeconomic Projections For The Euro AreaDocumento11 páginasSeptember 2018 ECB Staff Macroeconomic Projections For The Euro AreaIK CleeseAinda não há avaliações

- Economic And: at Constant FC) %Documento6 páginasEconomic And: at Constant FC) %Zeeshan WaqasAinda não há avaliações

- Quarterly Economic DataDocumento1 páginaQuarterly Economic Dataapi-25887578Ainda não há avaliações

- Chart PackDocumento83 páginasChart PackDksndAinda não há avaliações

- 8-Monetary Policy Information Compendium May 2017Documento32 páginas8-Monetary Policy Information Compendium May 2017Fareed ShahwaniAinda não há avaliações

- FY2018 (12m) FY2017 (12m) FY2016 (12m) FY2015 (12m) FY2014 (12m) FY2013 (12m) FY2012 (12m)Documento1 páginaFY2018 (12m) FY2017 (12m) FY2016 (12m) FY2015 (12m) FY2014 (12m) FY2013 (12m) FY2012 (12m)Divyank JyotiAinda não há avaliações

- Assessment Final)Documento1 páginaAssessment Final)Jal TaguibaoAinda não há avaliações

- Gross Domestic Product: September 2020 Quarter: List of TablesDocumento29 páginasGross Domestic Product: September 2020 Quarter: List of TablesIonuț AlexandrescuAinda não há avaliações

- Manufacturing and Mining: 3.1 FY2020: A Synoptic PresentationDocumento25 páginasManufacturing and Mining: 3.1 FY2020: A Synoptic Presentationanas ejazAinda não há avaliações

- Taxation Trends in The European Union - 2012 173Documento1 páginaTaxation Trends in The European Union - 2012 173d05registerAinda não há avaliações

- EBLSL Daily Market Update 5th August 2020Documento1 páginaEBLSL Daily Market Update 5th August 2020Moheuddin SehabAinda não há avaliações

- Summary of Economic Financial Data March 2021 1Documento14 páginasSummary of Economic Financial Data March 2021 1Fuaad DodooAinda não há avaliações

- U.S. Economy at A Glance Table: ProductionDocumento1 páginaU.S. Economy at A Glance Table: ProductionMaia ZambranoAinda não há avaliações

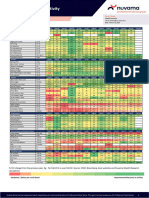

- Economic Spotlight - Nuvama ReportDocumento8 páginasEconomic Spotlight - Nuvama Reportsonika.arora1417Ainda não há avaliações

- Taxation Trends in The European Union - 2012 167Documento1 páginaTaxation Trends in The European Union - 2012 167d05registerAinda não há avaliações

- Economic IndicatorsDocumento6 páginasEconomic IndicatorsKhawaja BurhanAinda não há avaliações

- Economic And: at Constant FC) %Documento6 páginasEconomic And: at Constant FC) %Shadab AliAinda não há avaliações

- Investor Fact Sheet q3 Fy23Documento16 páginasInvestor Fact Sheet q3 Fy23Anshul SainiAinda não há avaliações

- 2015 Annual Results: Umut Zenar, CEO and Dr. Carsten Sauerland, CFODocumento55 páginas2015 Annual Results: Umut Zenar, CEO and Dr. Carsten Sauerland, CFOFrédéric GuillemetAinda não há avaliações

- LtboDocumento64 páginasLtboCongressman Zach NunnAinda não há avaliações

- Appendix-3: Bangladesh: Some Selected StatisticsDocumento28 páginasAppendix-3: Bangladesh: Some Selected StatisticsSHafayat RAfeeAinda não há avaliações

- Piper Jaffray On BAGL 8.14Documento4 páginasPiper Jaffray On BAGL 8.14lehighsolutionsAinda não há avaliações

- IIFL - MF - Factsheet - February 2023Documento12 páginasIIFL - MF - Factsheet - February 2023Diksha DuttaAinda não há avaliações

- Cash - Cost - EBITDA 2017-2022 FVDocumento7 páginasCash - Cost - EBITDA 2017-2022 FVJulian Brescia2Ainda não há avaliações

- Indonesia: The Delta Variant and Lagging Vaccination Have Set Back The RecoveryDocumento4 páginasIndonesia: The Delta Variant and Lagging Vaccination Have Set Back The RecoveryTopan ArdiansyahAinda não há avaliações

- Macro Economics Aspects of BudgetDocumento44 páginasMacro Economics Aspects of Budget6882535Ainda não há avaliações

- INDIA@2030 Presentation - M.D. PaiDocumento33 páginasINDIA@2030 Presentation - M.D. Paimannugupta123Ainda não há avaliações

- Ghana's Debt Hits GHS142bnDocumento12 páginasGhana's Debt Hits GHS142bnGhanaWeb EditorialAinda não há avaliações

- Industry: Website: Http://indiabudget - Nic.inDocumento20 páginasIndustry: Website: Http://indiabudget - Nic.inAbhijeetBhiseAinda não há avaliações

- Industry: Website: Http://indiabudget - Nic.inDocumento20 páginasIndustry: Website: Http://indiabudget - Nic.insanj123@rediffmail.comAinda não há avaliações

- Monmouth Inc Figures in Million $Documento3 páginasMonmouth Inc Figures in Million $amanAinda não há avaliações

- EBLSL Daily Market Update 6th August 2020Documento1 páginaEBLSL Daily Market Update 6th August 2020Moheuddin SehabAinda não há avaliações

- The India Consumption Story: July 19, 2018 - ShivDocumento19 páginasThe India Consumption Story: July 19, 2018 - ShivSinghania AbhishekAinda não há avaliações

- CIC ReportDocumento24 páginasCIC Reportpls2019Ainda não há avaliações

- Monetary Policy Statement April 2020Documento92 páginasMonetary Policy Statement April 2020pls2019Ainda não há avaliações

- Expert Committee On Micro, Small and Medium PDFDocumento142 páginasExpert Committee On Micro, Small and Medium PDFpls2019Ainda não há avaliações

- Msme Report PDFDocumento142 páginasMsme Report PDFpls2019Ainda não há avaliações

- Payment Gateways and Payment AggregatorsDocumento1 páginaPayment Gateways and Payment Aggregatorspls2019Ainda não há avaliações

- State Budgets StudyDocumento2 páginasState Budgets Studypls2019Ainda não há avaliações

- Digital PaymentsDocumento2 páginasDigital Paymentspls2019Ainda não há avaliações

- Monetary Policy ReportDocumento75 páginasMonetary Policy Reportpls2019Ainda não há avaliações

- Rbi ReportDocumento83 páginasRbi Reportpls2019Ainda não há avaliações

- Monthly Bulletin PDFDocumento1 páginaMonthly Bulletin PDFpls2019Ainda não há avaliações

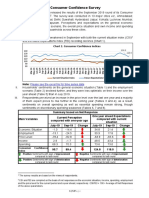

- Consumer Confidence SurveyDocumento4 páginasConsumer Confidence Surveypls2019Ainda não há avaliações

- Petition For Issuance of Letter of AdministrationDocumento4 páginasPetition For Issuance of Letter of AdministrationMa. Danice Angela Balde-BarcomaAinda não há avaliações

- TVM Stocks and BondsDocumento40 páginasTVM Stocks and Bondseshkhan100% (1)

- Euro Currency Market (Unit 1)Documento27 páginasEuro Currency Market (Unit 1)Manoj Bansiwal100% (1)

- Sample Employment ContractDocumento2 páginasSample Employment Contracttimmy_zamora100% (1)

- Yes Bank Annual Report 2011-12Documento204 páginasYes Bank Annual Report 2011-12shah1703Ainda não há avaliações

- KCNXBPW /O/Bpw) Ns ) BPW: (") Lem /J) Lem Apm' F LN N Iytbmsv Is MSV)Documento24 páginasKCNXBPW /O/Bpw) Ns ) BPW: (") Lem /J) Lem Apm' F LN N Iytbmsv Is MSV)Avani Raju Baai0% (1)

- CPM Guidant Corporation Shaping Culture Through Systems ChristoperDocumento19 páginasCPM Guidant Corporation Shaping Culture Through Systems ChristoperfreteerAinda não há avaliações

- PFR - 5 MW Solar of Milisaty Vinimay Pvt. LTDDocumento11 páginasPFR - 5 MW Solar of Milisaty Vinimay Pvt. LTDpvpavanAinda não há avaliações

- RTD Pension DocumentsDocumento53 páginasRTD Pension Documentsangel_aaahAinda não há avaliações

- Bond Capital Mezzanine FinanceDocumento9 páginasBond Capital Mezzanine FinanceVisakan Kandaswamy100% (1)

- Additional Income and Adjustments To IncomeDocumento1 páginaAdditional Income and Adjustments To IncomeSz. RolandAinda não há avaliações

- Henry Sy and John Gokongwei I. SynopsisDocumento7 páginasHenry Sy and John Gokongwei I. SynopsisRyuu Castillo-GuarinAinda não há avaliações

- Accounting 2 Week 1 4 LPDocumento33 páginasAccounting 2 Week 1 4 LPMewifell100% (1)

- Environmental, Social and Governance KPIDocumento14 páginasEnvironmental, Social and Governance KPISuta Vijaya100% (1)

- Lincoln Park Retiree LawsuitDocumento64 páginasLincoln Park Retiree LawsuitJessica StrachanAinda não há avaliações

- Contracts Undercredit Transaction S - Lecture NotesDocumento85 páginasContracts Undercredit Transaction S - Lecture NotesJanetGraceDalisayFabreroAinda não há avaliações

- Real Estate Principles Legal Equitable "Exclusive Equity"Documento92 páginasReal Estate Principles Legal Equitable "Exclusive Equity"Ven Geancia100% (1)

- Fundamentals of Trade FinanceDocumento9 páginasFundamentals of Trade FinanceMohammed SuhaleAinda não há avaliações

- Midterm Quiz 1 (Basic Concepts and Principles On Extinguishment of Obligations) SubmissionsDocumento3 páginasMidterm Quiz 1 (Basic Concepts and Principles On Extinguishment of Obligations) SubmissionsJinky ValdezAinda não há avaliações

- PTR MOSES CARLOS B. AGAWA - RESUME / CV - Updated December 2010Documento12 páginasPTR MOSES CARLOS B. AGAWA - RESUME / CV - Updated December 2010Ptr MosesAinda não há avaliações

- Question Bank (Repaired)Documento7 páginasQuestion Bank (Repaired)jayeshAinda não há avaliações

- MAINDocumento80 páginasMAINNagireddy KalluriAinda não há avaliações

- Time Table Term 2 - PGDM 12-14Documento6 páginasTime Table Term 2 - PGDM 12-14Gagan KarwarAinda não há avaliações

- Coworking Space: Shared Workspaces in Metro ManilaDocumento23 páginasCoworking Space: Shared Workspaces in Metro ManilaKenneth VirtudesAinda não há avaliações

- Wyckoff Methode With Supply and - Alex RayanDocumento49 páginasWyckoff Methode With Supply and - Alex RayanmansoodAinda não há avaliações

- Investment Chapter 7Documento3 páginasInvestment Chapter 7Bakpao CoklatAinda não há avaliações

- Questions Time Value of MoneyDocumento3 páginasQuestions Time Value of Moneyarma nadeemAinda não há avaliações

- Cfap 2 CLW PKDocumento128 páginasCfap 2 CLW PKTeacher HaqqiAinda não há avaliações

- CSD PlanDocumento12 páginasCSD PlanNargis FatimaAinda não há avaliações

- Future-Wealth-Gain Bajaj BrochureDocumento24 páginasFuture-Wealth-Gain Bajaj BrochureVivek SinghalAinda não há avaliações