Escolar Documentos

Profissional Documentos

Cultura Documentos

Jawaban Debt Investments (Mindmap, E17-1 p17-1)

Enviado por

Rahmat DarmawanTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Jawaban Debt Investments (Mindmap, E17-1 p17-1)

Enviado por

Rahmat DarmawanDireitos autorais:

Formatos disponíveis

NAMA : RAHMAT DARMAWAN

MIND MAPPING NIM : K7718062

INVESTMENTS

DEBT

INVESTMENTS

CLASSIFICATION AND CATEGORIES OF

MEASUREMENT OF COMPANIES GROUP DEBT

FINANCIAL ASSETS INVESTMENTS

HOLD-FOR-COLLECTION

• AMORTIZED COST

WHAT IS THE COMPANY'S

BUSINESS MODEL FOR

MANAGING ITS FINANCIAL HOLD-FOR-COLLECION

ASSETS ?

AND SELLING

• FAIR VALUE

CASH FLOW

CHARACTERISTIC? TRADING

• FAIR VALUE

E17-1

A. 2 (Debt Investment at fair value)

B. 4 (Non- trading equity investments)

C. 2 (Debt Investment at fair value)

D. 1 (Debt Investment at amortized cost)

E. 1 (Debt Investment at amortized cost)

F. 4 (Non-trading equity invesments)

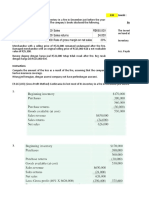

P17-1

(a) December 31, 2008 Debet Kredit

Debt Investments 108,660

Cash 108,660

(b) December 31, 2009

Cash 7,000

Debt Investments 1,567

Interest Revenue 5,433

(c) December 31, 2011

Cash 7,000

Debt Investments 1,728

Interest Revenue 5,272

(d) December 31, 2008

Debt Investments 108,660

Cash 108,660

(e) December 31, 2009

Cash 7,000

Debt Investments 1,567

Interest Revenue 5,433

Unrealized Holding Gain or 593

Loss— Income ($107,093 –

$106,500)

Securities Fair Value 593

Adjustment

(f) December 31, 2011

Cash 7,000

Debt Investments 1,728

Interest Revenue 5,272

Amortized Cost Fair Value Unrealized Gain

(Loss)

Spangler company, 7% 103,719 105,650 1,931

bonds previuos securitties

fair value

Securities fair value 2,053

adjusment, ( 107,500 –

105,447 )

(122)

Unrealized holding gain/loss-Income 122

Securities Fair Value Adjusments 122

Você também pode gostar

- 5 Series LLC Strategies EbookDocumento11 páginas5 Series LLC Strategies EbookjuniormintsAinda não há avaliações

- Walmart Inc. - Operating Model and Valuation - Cover Page and NavigationDocumento24 páginasWalmart Inc. - Operating Model and Valuation - Cover Page and Navigationmerag76668Ainda não há avaliações

- Financial Ratio Analysis AssignmentDocumento10 páginasFinancial Ratio Analysis Assignmentzain5435467% (3)

- Kieso IFRS4 TB ch17Documento68 páginasKieso IFRS4 TB ch17Scarlet WitchAinda não há avaliações

- Erika Christina - LD53 - Latihan KPDocumento14 páginasErika Christina - LD53 - Latihan KPNatasha HerlianaAinda não há avaliações

- Comprehensive Problems Solution Answer Key Mid TermDocumento5 páginasComprehensive Problems Solution Answer Key Mid TermGabriel Aaron DionneAinda não há avaliações

- UntitledDocumento10 páginasUntitledRima WahyuAinda não há avaliações

- Exercises: Ex. 9-143-Lower-Of-Cost-Or-Net Realizable ValueDocumento9 páginasExercises: Ex. 9-143-Lower-Of-Cost-Or-Net Realizable ValueManuel Magadatu100% (1)

- SBR BPP Textbook PDFDocumento905 páginasSBR BPP Textbook PDFHarith HathAinda não há avaliações

- CH 14Documento71 páginasCH 14Febriana Nurul HidayahAinda não há avaliações

- 9 Basic DerivativesDocumento3 páginas9 Basic DerivativesBaron MirandaAinda não há avaliações

- Chapter 7 Supplemental QuestionsDocumento7 páginasChapter 7 Supplemental QuestionsDita Ens100% (1)

- Chapter 13 Akun Keuangan TugasDocumento2 páginasChapter 13 Akun Keuangan Tugassegeri kec0% (1)

- Depreciation AnswersDocumento22 páginasDepreciation AnswersGabrielle Joshebed Abarico100% (1)

- Problem Quizzes IntermediateDocumento7 páginasProblem Quizzes IntermediateEngel QuimsonAinda não há avaliações

- Ch. 17 Exercises and Answers - TaggedDocumento6 páginasCh. 17 Exercises and Answers - TaggedHaitham Ebrahim100% (1)

- Cost of CapitalDocumento26 páginasCost of CapitalRiti Nayyar100% (1)

- Kelompok 3 - Tugas 3 - Bab 'Persediaan'Documento3 páginasKelompok 3 - Tugas 3 - Bab 'Persediaan'Elsi NonnyAinda não há avaliações

- Uts - Akm3 - Suci Purnama Devi - F0318108 - E17.9 & P21.13 PDFDocumento4 páginasUts - Akm3 - Suci Purnama Devi - F0318108 - E17.9 & P21.13 PDFSuci Purnama Devi100% (1)

- TaufiqAlInsanSiahaan - Tugas Akuntansi Keuangan Menengah 1Documento6 páginasTaufiqAlInsanSiahaan - Tugas Akuntansi Keuangan Menengah 1taufiq al insanAinda não há avaliações

- Homework Week7Documento3 páginasHomework Week7Arista Yuliana SariAinda não há avaliações

- E22-6 (LO 2) Accounting Changes-DepreciationDocumento6 páginasE22-6 (LO 2) Accounting Changes-DepreciationRiana DeztianiAinda não há avaliações

- E21.4 (LO 2, 4) (Lessee Entries, Unguaranteed Residual Value) Assume That OnDocumento3 páginasE21.4 (LO 2, 4) (Lessee Entries, Unguaranteed Residual Value) Assume That OnWarmthxAinda não há avaliações

- Tugas Mandiri Lab. Ak. Meng 1 - PersediaanDocumento9 páginasTugas Mandiri Lab. Ak. Meng 1 - PersediaanZachra MeirizaAinda não há avaliações

- Tutorial Laporan Arus KasDocumento17 páginasTutorial Laporan Arus KasRatna DwiAinda não há avaliações

- Soal Latihan Minggu 4Documento9 páginasSoal Latihan Minggu 4Alifia AprizilaAinda não há avaliações

- E22 3Documento2 páginasE22 3bellaAinda não há avaliações

- Soal Ch. 15Documento6 páginasSoal Ch. 15Kyle KuroAinda não há avaliações

- ACY4001 Individual Assignment 2 SolutionsDocumento7 páginasACY4001 Individual Assignment 2 SolutionsMorris LoAinda não há avaliações

- Soal Chapter 17Documento6 páginasSoal Chapter 17Baiq Melaty Sepsa WindiAinda não há avaliações

- Forum 6Documento1 páginaForum 6cecillia lissawatiAinda não há avaliações

- Jawaban BE15 - AKMDocumento3 páginasJawaban BE15 - AKMMazz BadruezAinda não há avaliações

- Chapter 21 Latihan SoalDocumento10 páginasChapter 21 Latihan SoalJulyaniAinda não há avaliações

- Flynn Design AgencyDocumento4 páginasFlynn Design Agencycalsey azzahraAinda não há avaliações

- E14-3 (Entries For Bond Transactions) Presented Below Are Two Independent SituationsDocumento3 páginasE14-3 (Entries For Bond Transactions) Presented Below Are Two Independent SituationsAsuna SanAinda não há avaliações

- AKM - Kelompok 5Documento8 páginasAKM - Kelompok 5lailafitriyani100% (1)

- P5 4Documento3 páginasP5 4Monica HutagaolAinda não há avaliações

- KIeso Chapter 18 Part 1Documento8 páginasKIeso Chapter 18 Part 1Pelangi DiamondAinda não há avaliações

- Be16 P16 2aDocumento7 páginasBe16 P16 2aLisa Hammerle ClarkAinda não há avaliações

- KasdanPiutang 4B Kelompok1Documento11 páginasKasdanPiutang 4B Kelompok1Estin TasyaAinda não há avaliações

- 2-31 Total Costs and Unit Costs, Service Setting. The Big Event (TBE) Recently Started A Business OrganizingDocumento3 páginas2-31 Total Costs and Unit Costs, Service Setting. The Big Event (TBE) Recently Started A Business OrganizingTiffany Shane GantuangcoAinda não há avaliações

- Tugas AKM II Minggu 9Documento2 páginasTugas AKM II Minggu 9Clarissa NastaniaAinda não há avaliações

- Working 4Documento8 páginasWorking 4Hà Lê DuyAinda não há avaliações

- Belinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To TheDocumento1 páginaBelinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To ThebelindaAinda não há avaliações

- The Statement of Financial Position of Stancia Sa at DecemberDocumento1 páginaThe Statement of Financial Position of Stancia Sa at DecemberCharlotte100% (1)

- E16-10 Prepare Adjusting Entry To Record Fair Value, and Indicate Statement PresentationDocumento2 páginasE16-10 Prepare Adjusting Entry To Record Fair Value, and Indicate Statement PresentationRisky FernandoAinda não há avaliações

- Nur Haliza Daeng Besse - Inventory Dan Aktiva TetapDocumento28 páginasNur Haliza Daeng Besse - Inventory Dan Aktiva TetapNurhaliza DaengAinda não há avaliações

- Zulfitri Handayani - A031191125 (Akkeu P15-3)Documento6 páginasZulfitri Handayani - A031191125 (Akkeu P15-3)RismayantiAinda não há avaliações

- InstructionsDocumento2 páginasInstructionsGabriel SAinda não há avaliações

- Jawaban LKS Nasional 2017 PDFDocumento13 páginasJawaban LKS Nasional 2017 PDFadebsb100% (2)

- Jawaban TugasDocumento7 páginasJawaban TugasRani AdhirasariAinda não há avaliações

- P2 41 2 42 SolutionsDocumento3 páginasP2 41 2 42 SolutionsMarjorie PalmaAinda não há avaliações

- Exercise 21Documento3 páginasExercise 21Ruth UtamiAinda não há avaliações

- Syukur Tugas Akl IiDocumento3 páginasSyukur Tugas Akl IiMuhammad SyukurAinda não há avaliações

- Test 2 HomeworkDocumento12 páginasTest 2 HomeworkMiguel CortezAinda não há avaliações

- Akuntansi Manajemen 8-24Documento8 páginasAkuntansi Manajemen 8-24Chika Slalubahagia SlamanyaAinda não há avaliações

- Arini Alfahani - Tugas AKM IDocumento2 páginasArini Alfahani - Tugas AKM Iarini alfahaniAinda não há avaliações

- 11.3 Break Even in Units ($75,000/15,000 Units) - Fixed Cost Is $37,500Documento14 páginas11.3 Break Even in Units ($75,000/15,000 Units) - Fixed Cost Is $37,500Rizzah Nianiah100% (1)

- Tugas CH 8 Dan 9Documento13 páginasTugas CH 8 Dan 9muhammad alfariziAinda não há avaliações

- DDDocumento4 páginasDDAmelia Salini100% (1)

- Latihan Accounts ReceivableDocumento2 páginasLatihan Accounts ReceivableAlghifary RamadhanAinda não há avaliações

- CHAPTER 17 INVESTMENTS ExercisesDocumento14 páginasCHAPTER 17 INVESTMENTS ExercisesAila Marie MovillaAinda não há avaliações

- Tugas Ifrs Chapter 7.2Documento4 páginasTugas Ifrs Chapter 7.2Nabilla salsaAinda não há avaliações

- Acct 201 3nd AssingnmentDocumento2 páginasAcct 201 3nd Assingnmentapi-280585803Ainda não há avaliações

- Chapter 6 - Accounting and The Time Value of MoneyDocumento96 páginasChapter 6 - Accounting and The Time Value of MoneyTyas Widyanti100% (2)

- Practice 5 InvestmentDocumento12 páginasPractice 5 InvestmentParal Fabio MikhaAinda não há avaliações

- Hade PDFDocumento2 páginasHade PDFMaradewiAinda não há avaliações

- Ratio Analysis of WiproDocumento7 páginasRatio Analysis of Wiprosandeepl4720% (2)

- Seminar ON Major Project 2022-2023Documento14 páginasSeminar ON Major Project 2022-2023Yaswanth ChowdaryAinda não há avaliações

- Felix Capability OverviewDocumento12 páginasFelix Capability OverviewGagan GahlotAinda não há avaliações

- Module 5. Student CH 5-20 Build A Model: Dividend $2.50 $3.25 $4.23 $4.52Documento5 páginasModule 5. Student CH 5-20 Build A Model: Dividend $2.50 $3.25 $4.23 $4.52seth litchfieldAinda não há avaliações

- Fina ManDocumento20 páginasFina ManhurtlangAinda não há avaliações

- Mid Term Examination Far 1st Sem 22 23Documento11 páginasMid Term Examination Far 1st Sem 22 23Rechelle Anne Naris ObilloAinda não há avaliações

- LSIP - Bilingual - 30 - Sep - 2022 RELEASE PDFDocumento121 páginasLSIP - Bilingual - 30 - Sep - 2022 RELEASE PDFandry4jcAinda não há avaliações

- Tutorial 3 For FM-IDocumento5 páginasTutorial 3 For FM-IarishthegreatAinda não há avaliações

- Power Point For Dividend PolicyDocumento51 páginasPower Point For Dividend PolicyAnonymous DStKlFbQ1B100% (1)

- Financial Management MCQ, SDocumento22 páginasFinancial Management MCQ, SDiqra Laziz100% (1)

- Financial Metrics ExampleDocumento2 páginasFinancial Metrics ExampleSourav shabuAinda não há avaliações

- 7 Relative Valuation Notes AllDocumento49 páginas7 Relative Valuation Notes AllFaisal HossainAinda não há avaliações

- Fees Hit Private-EquityCos - Dechert StudyDocumento3 páginasFees Hit Private-EquityCos - Dechert StudyputigersAinda não há avaliações

- Alm HDFC Bank LimitedDocumento8 páginasAlm HDFC Bank LimitedMohmmedKhayyumAinda não há avaliações

- QuizDocumento2 páginasQuizCassandra Dianne Ferolino MacadoAinda não há avaliações

- Project On Working Capital (OPTCL)Documento66 páginasProject On Working Capital (OPTCL)Prateek Anand33% (3)

- Restated Earnings Largely Driven by Non-Cash Expenses: 2GO Group, IncDocumento4 páginasRestated Earnings Largely Driven by Non-Cash Expenses: 2GO Group, IncJAinda não há avaliações

- Review Materials For DeptlDocumento4 páginasReview Materials For DeptlSteffAinda não há avaliações

- Soal Tambahan Chap 8Documento3 páginasSoal Tambahan Chap 8Tarisya PermatasariAinda não há avaliações

- Fin ZC415Documento11 páginasFin ZC415vigneshAinda não há avaliações

- FM W10a 1902Documento9 páginasFM W10a 1902jonathanchristiandri2258Ainda não há avaliações

- Cost Accountancy: Bba - Ii Semester - IiiDocumento19 páginasCost Accountancy: Bba - Ii Semester - IiiNishikant RayanadeAinda não há avaliações

- Intermediate Accounting 2008 SolutionDocumento6 páginasIntermediate Accounting 2008 Solutionchin leaAinda não há avaliações