Escolar Documentos

Profissional Documentos

Cultura Documentos

BOI MCLR 8.35 % W.E.F. 10.08.2019 & RBLR 8.25 % W.E.F. 01.09.2019 (All Charges Are Exclusive of GST)

Enviado por

AvunDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

BOI MCLR 8.35 % W.E.F. 10.08.2019 & RBLR 8.25 % W.E.F. 01.09.2019 (All Charges Are Exclusive of GST)

Enviado por

AvunDireitos autorais:

Formatos disponíveis

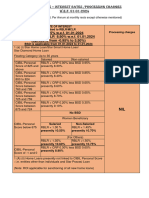

RETAIL LOANS – INTEREST RATES /PROCESSING CHARGES

(All loans at floating ROI, Per Annum at monthly rests except otherwise mentioned)

RATE OF INTEREST

PROCESSING CHARGES

All linked to Banks MCLR

BOI MCLR 8.35 % w.e.f. 10.08.2019

(All charges are Exclusive of GST)

& RBLR 8.25 % w.e.f. 01.09.2019

1.Star Home Loan/Star Smart Home Loan/ Star Home Loan/Star Smart Home Loan/Star

Star Pravasi Home Loan /Star Diamond Home Loan Pravasi Home Loan :

For Individuals –

Floating Category For all loans amounts:-

Up to 30 years ( CARD RATE) 0.25 % of loan amount

Min. Rs. 1,000/- Max. Rs. 20,000/-

For Women : 1 Year MCLR + 0.15 % For Partnership firms and Corporates:

For Others : 1 Year MCLR + 0.20 % Processing charges to be double that of applicable

to individuals.

2. Star Home Loan/Star Smart Home Loan/Star For Rural areas:-

Diamond Home Loan (Rs.30. lacs & above) Processing charges 75% of that applicable to

individuals in respect of loan availed by

RBLR + 0.10% borrowers from rural branches.

Star Diamond Home Loan :

One time processing charge of Rs.50, 000 or

BORROWER HAS CHOICE TO OPT BETWEEN

maximum as per Star Home Loan Scheme,

MCLR OR RBLR whichever is higher

*PLEASE NOTE RATE OF INTEREST FOR STAR PROCESSING CHARGES ARE WAIVED UPTO

HOME LOAN/STAR SMART HOME LOAN & 31.12.2019 FOR INDIVIDUALS ONLY (EXCEPT

STAR DIAMOND HOME LOAN WILL BE BASED PMAY & STAR PRAVASI LOANS )

ON CIBIL SCORE.

2. Star Top Up Loan

Rate of Interest applicable in respective Home Loan As per respective Home Loan schemes

account plus premium of 0.50% subject to minimum

1 year MCLR

3 Star Personal Loan Scheme

I. Fully Secured 1 Year MCLR +

4.50%

(MCLR-irrespective of any

amount) RBLR + 4.50%

(RBLR-Rs.1 lac and

above)

I. Clean/Unsecured 1 Year MCLR +

(MCLR-irrespective of any 5.50% One time 2.00% of loan amount

amount) Min. Rs.1,000/-

(RBLR-Rs.1 lac and RBLR + 5.50% Max. Rs.10,000/-

above)

II. Financing secured 1 Year MCLR +

under tie up 4.50%

arrangements

(MCLR-irrespective of any RBLR + 4.50%

amount)

(RBLR-Rs.1 lac and

above)

I. For Senior Citizen 1 Year MCLR + Senior Citizen (60 years & above)

aged 60 years & 3.50% No Processing Charges

above for Loans Upto

Rs.50,000/-

. Star Pensioner Loan Scheme

Fully 1 Year MCLR +2.50% Pensioners:

Secured/Clean/ One time 2.00% of loan amount

Unsecured Min. Rs. 500/- Max.Rs.2,000/-

(MCLR- RBLR + 2.50% No Processing Charges for senior citizens (60

( (fully Secured ) years & above)

irrespective of

any amount)

(RBLR-Rs.1 lac

and above)

5. Star Vehicle Loan

4 Wheelers / 2 Wheelers including Super Bikes: For New Four 0.25% of limit, minimum

New & 2nd Hand Vehicle – Wheeler Loan Rs.1000/- and

Max.Rs.5,000

1 Year MCLR + 0.60 % (irrespective of loan For New Two 1% of loan amount

amount) wheeler/2nd minimum Rs.500/- and

hand vehicles Max.Rs.10,000

(both 2/4

RBLR + 0.60% (loan amount of Rs.7.50 lacs and wheeler)

above) In case of Partnership firms and Corporate

borrowers, processing charges will be double

that applicable to individuals.

BORROWER HAS CHOICE TO OPT No processing charges for Senior Citizen, Retired

BETWEEN MCLR OR RBLR Employees of the Bank and Pensioners drawing

Pension from the Bank.

**PLEASE NOTE RATE OF INTEREST WILL For Rural areas:

Processing charges will be 75% of that

BE BASED ON CIBIL SCORE.

applicable to individual borrowers provided loan

is availed by borrowers from rural areas/ from

rural branches.

PROCESSING CHARGES ARE WAIVED UPTO

31.12.2019 FOR INDIVIDUALS ONLY.

6. i. Star Education Loans:-

Limit upto Rs.7.50 1 Year MCLR No processing charges.

lacs to covered +1.70%

under Credit a) No Processing charges – for study in India.

Guarantee Fund b) For study abroad : Processing charges Rs.5,000/-

Scheme (Processing charge excluding Service Tax to be refunded

Above Rs.7.50 lacs 1 Year MCLR + once actual loan is availed. Applicant/s to be suitably

2.50%

Concessions*: advised about this condition at the time of submission of

a) for Girl Students: 0.50 % application and consent letter to be obtained from the

b) All students pursuing applicant/s to avoid dispute at later stage)

professional courses (Like

Engineering /Medical Student applicant may be required to pay fee/charges, if any,

/Management etc.) are eligible levied by third party service providers who operate common

for 0.50 % interest concession. portal for lodging loan applications set up.

Maximum concession under (a)

& (b) is 1 % p.a. subject to, One time charges for any Deviations from the Scheme norms

minimum one year MCLR including approval of courses outside scheme –

Up to Rs.4.00 lacs Rs. 500/-*

HIGHER AMOUNTS ABOVE Rs.20.00 Over Rs.4.00 lacs up to Rs.7.50 lacs Rs.1,500/-*

LACS ARE ALSO SANCTIONED ON Over Rs.7.50 lacs up to Rs.20.00 lacs Rs.3,000/-*

CASE TO CASE BASIS. *Per Deviation

ii. Star Vidya Loan: Same as Star Education Loan scheme

For studies in India in Premier

Institutes

Max. Rs. 30.00 lacs

1 year MCLR

iii.Pradhan Mantri Kaushal Rin Yojana NIL

1 Year MCLR + 1.50%

1 % interest concession may be provided for

loanees, if the interest is serviced during the study

period when repayment holiday is specified for

interest/repayment under the scheme. No

concession will be available after commencement

of repayment.

7. Star Loan against Property –

For Loan (Repayable by installments)

One time @ 1% of sanctioned loan amount Min.

Rs.5,000/- and Max. Rs.50,000/-.

(i) Loan/ Overdraft Reducible For Mortgage OD (Reducible)

1 Year

(Monthly Reducible Limit) 0.50% of the Sanctioned limit min.Rs.5,000/- and

MCLR Max. Rs.30,000/- for 1st year at the time of original

+2.00% sanction.

0.25% of the Reviewed limit min.Rs.2,500/- and

Max. Rs.15,000/- for subsequent years.

(ii) Overdraft (Non-Reducible) For Mortgage OD (Not reducible )

1 Year 0.50% of the Sanctioned/Reviewed limit

MCLR + min.Rs.5,000/- and

2.50% Max. Rs.30,000/- on annual basis.

For Rural areas:

Processing charges will be 75% of those normal

applicable charges in respect of loans availed by

borrowers from rural areas from rural branches.

8. BOI STAR DOCTOR PLUS (RETAIL) SCHEME

i) Personal Loan

Fully Secured 1 Year MCLR + 2.00% +

BSS (0.30%)

Clean/Unsecured 1 Year MCLR + 3.00% +

BSS (0.30%)

ii) Vehicle Loan 50% concession in charges as applicable to

members of public. for Personal Loan and Vehicle

4 Wheelers:

loan

a. New Vehicle 1 Year MCLR +0.40% +

BSS (0.30%)

b. Second hand vehicles 1 Year MCLR + 0.40% +

BSS (0.30%)

9. STAR REVERSE MORTGAGE LOAN SCHEME

2.30% + BSS 0.30% above 1 year MCLR p.a. (fixed) Loan Amount Processing Charges

at monthly rests for the loan tenure subject to reset Upto Rs.5 lacs Rs.1250 + GST

clause at the end of every 5 years period (present BSS Upto Rs.10 lacs Rs.2500 + GST

0.30% above 1 year MCLR) Upto Rs.20 lacs Rs.5000 + GST

Upto Rs.25 lacs Rs.6250 + GST

Valuation report fees and Advocates fees to be borne by

the borrower.

Annual Service Charge @ 0.25% on the loan amount

outstanding/recoverable at the time of annual review.

10. Access to own credit report – charges per report max. Rs.50/-

11. CERSAI registration Fees: As per Annexure.

Annexure-I

Fee Chargeable as specified in the Table under rule 7

All the charges are excluding GST

Serial Nature of transaction to be Rule Form Amount of fee payable

No Register .

1. Particulars of creation or Sub-rule (2) Form Rs.100 for creation and for any

modification of security interest by of rule 4. I subsequent modification of security

way of mortgage by deposit of title interest for a loan above Rs.5 lakh.

deeds. For a loan upto Rs.5 lakh, the fee would

be Rs.50 for both creation and

modification of security interest.

2. Particulars of creation or Sub-rule (2A) Form NIL

modification of security interest by of rule 4. I

way of mortgage of immovable

property other than by deposit of title

deeds

3. Particulars of creation or Sub-rule (2B) Form Rs.100 for creation and for any

modification of security interest in of rule 4. I subsequent modification of security

hypothecation of plant and interest for a loan above Rs.5 lakh.

machinery, stocks, debt including For a loan upto Rs.5 lakh, the fee would

book debt or receivables, whether be Rs.50 for both creation and

existing or future. modification of security interest.

4. Particulars of creation or Sub-rule (2C) Form Rs.100 for creation and for any

modification of security interest in of rule 4. I subsequent modification of security

intangible assets, being know-how, interest for a loan above Rs.5 lakh.

patent, copyright, trade mark,

licence, franchise or any other For a loan upto Rs.5 lakh, the fee would

business or commercial right of be Rs.50 for both creation and

similar nature modification of security interest.

5. Particulars of creation or Sub-rule (2D) Form Rs.100 for creation and for any

modification of security interest in of rule 4. I subsequent modification of security

any under construction residential or interest for a loan above Rs.5 lakh.

commercial building or a part thereof For a loan upto Rs.5 lakh, the fee would

by an agreement or instrument other be Rs.50 for both creation and

than by mortgage. modification of security interest.

6. Particulars of satisfaction of charge Sub-rule Form NIL

for security interest filed under sub- (2),(2A), (2B), II

rule (2) and (2A) to (2D) of rule 4 (2C), (2D) of

rule 4.

7. Particulars of securitization or - Form Rs.500/-

reconstruction of financial assets III

8. Particulars of satisfaction of - Form Rs.50/-

securitization or reconstruction IV

transactions

9. Any application for information - - Rs.10/-

recorded/maintained in the Register

by any person

10. Any application for condonation of Sub-rule (2) - Not exceeding 10 times of the basic fee,

delay up to 30 days of rule 5. as applicable

ADDITIONAL FEE APPLICABLE FOR DELAY IN FILING OF RECORDS WEF 22.1.2016

Sr. No. Number of days of delay Additional fee to Illustration

in filing of chargeable charged

transaction

1 From 31 to 40 days Twice the amount of If the applicable fee is Rs.100/- then additional

applicable fee fee applicable will be Rs.200/-

2 From 41 days to 50 days Five times the amount of If the applicable fee is Rs.100/- then additional

applicable fee fee applicable will be Rs.500/-

3 From 51 days to 60 days Ten times the amount of If the applicable fee is Rs.100/- then additional

applicable fee fee applicable will be Rs.1000/-

All the above charges are excluding GST

Provided that where particulars of transaction of creation or modification of more than one

security interest are filed by a person, the fee payable by such person shall be the one that is the

highest among the fee prescribed for security interest for which particulars of creation or

modification are filed by such persons.

Você também pode gostar

- John Lewis Marketing Report MBA 2017Documento20 páginasJohn Lewis Marketing Report MBA 2017adamAinda não há avaliações

- Labor 2018 Bar Question and AnswerDocumento14 páginasLabor 2018 Bar Question and AnswerTap cruz89% (18)

- RetailServiceCharges Adv EnglishDocumento4 páginasRetailServiceCharges Adv EnglishYogesh PangareAinda não há avaliações

- RBI Format ROI PCDocumento6 páginasRBI Format ROI PCSandesh ManeAinda não há avaliações

- RBI Format ROI PCDocumento8 páginasRBI Format ROI PCom vermaAinda não há avaliações

- Msme Loan - Upto 2lakhs: NF-546 NF-998 NF-588 NF-855 NF-803 NF-482 NF-373 NF-368Documento4 páginasMsme Loan - Upto 2lakhs: NF-546 NF-998 NF-588 NF-855 NF-803 NF-482 NF-373 NF-368Santosh KumarAinda não há avaliações

- Advances Related Service Charges W.E.F. 01.04.2019 A PDFDocumento11 páginasAdvances Related Service Charges W.E.F. 01.04.2019 A PDFSudhakar BataAinda não há avaliações

- 03.01.2024 Consolidated Ser. ChargesDocumento63 páginas03.01.2024 Consolidated Ser. ChargesNadeem KhanAinda não há avaliações

- RBI Format ROI PDocumento8 páginasRBI Format ROI PSrikanth ReddyAinda não há avaliações

- RetailServiceCharges Adv EnglishDocumento4 páginasRetailServiceCharges Adv EnglishMohit KumarAinda não há avaliações

- RBI Format ROI PC PDFDocumento9 páginasRBI Format ROI PC PDFmohana sundaram pAinda não há avaliações

- Processing Fees / Charges - SME ProductsDocumento17 páginasProcessing Fees / Charges - SME ProductsSanjay KumarAinda não há avaliações

- Housing Loan DetailsDocumento9 páginasHousing Loan DetailsPandurangbaligaAinda não há avaliações

- Educative Series Gold LoanDocumento2 páginasEducative Series Gold LoanRohith RaoAinda não há avaliações

- Interest Rate Linked To MCLR 0Documento5 páginasInterest Rate Linked To MCLR 0Satya JitAinda não há avaliações

- RBI - ROI FormatDocumento9 páginasRBI - ROI Formatranajoy biswasAinda não há avaliações

- Rbi Format Roi PCDocumento10 páginasRbi Format Roi PCsriramAinda não há avaliações

- Service Charges Final - 03.06.2017for Circular IssuingDocumento39 páginasService Charges Final - 03.06.2017for Circular IssuingshivaAinda não há avaliações

- Wa0004 PDFDocumento8 páginasWa0004 PDFDrChandan IngoleAinda não há avaliações

- Bank of IndiaDocumento57 páginasBank of IndiaPramila PalAinda não há avaliações

- IOB9540Foot Service Charges 01.07.2017 PDFDocumento39 páginasIOB9540Foot Service Charges 01.07.2017 PDFHarishPratabhccAinda não há avaliações

- Banking OadsdDocumento85 páginasBanking Oadsdkalis vijayAinda não há avaliações

- RBI ROI FormatDocumento11 páginasRBI ROI FormatSandeep SandyAinda não há avaliações

- RETAIL - Interest For Retail Loans - MCLR - Service Charges - From Web On 25082018Documento12 páginasRETAIL - Interest For Retail Loans - MCLR - Service Charges - From Web On 25082018Harish YadavAinda não há avaliações

- XYZHL Application Form - Editable - FinalDocumento5 páginasXYZHL Application Form - Editable - FinalamiteshnegiAinda não há avaliações

- Personal Loan: Why Avail A Personal Loan From HDFC Bank?Documento6 páginasPersonal Loan: Why Avail A Personal Loan From HDFC Bank?Ramana GAinda não há avaliações

- Canara Bank ChargesDocumento8 páginasCanara Bank Chargesaca_trader100% (1)

- Bank ComparisionDocumento66 páginasBank ComparisionEkansh DanielAinda não há avaliações

- Educative Series LAPDocumento2 páginasEducative Series LAPRohith RaoAinda não há avaliações

- DebtswapschemeDocumento7 páginasDebtswapschemeANBUAinda não há avaliações

- Loan Policy of Uco Bank For Retail SectorDocumento22 páginasLoan Policy of Uco Bank For Retail SectorAnurag BohraAinda não há avaliações

- RBI ROI FormatDocumento11 páginasRBI ROI FormatDevender RajuAinda não há avaliações

- Loanagainstproperty PDFDocumento4 páginasLoanagainstproperty PDFsameer ahmadAinda não há avaliações

- Commercial Banking AssignmentDocumento9 páginasCommercial Banking AssignmentDinesh KumarAinda não há avaliações

- RATE OF INTEREST FOR AGRICULTURE LOANS2422EnglishDocumento3 páginasRATE OF INTEREST FOR AGRICULTURE LOANS2422EnglishmanojAinda não há avaliações

- Chapter3 Bank OperationsDocumento16 páginasChapter3 Bank OperationsRiya AgarwalAinda não há avaliações

- Baroda Salary Classic AccountDocumento3 páginasBaroda Salary Classic AccountSajid NavyAinda não há avaliações

- Sbi ProjectDocumento7 páginasSbi ProjectSumeet KambleAinda não há avaliações

- ServicechargesCADDocumento8 páginasServicechargesCADdixeshAinda não há avaliações

- Cgtmse (Credit Guarantee Fund Trust For Micro & Small Enterprises)Documento16 páginasCgtmse (Credit Guarantee Fund Trust For Micro & Small Enterprises)Abinash MandilwarAinda não há avaliações

- UCO Kisan Tatkal SchemeDocumento2 páginasUCO Kisan Tatkal SchemeSuvasish DasguptaAinda não há avaliações

- Sbi Home LoanDocumento20 páginasSbi Home LoanbijjubhaiAinda não há avaliações

- Annexure 2Documento77 páginasAnnexure 2Maheshkumar AmulaAinda não há avaliações

- Documentation Needed To Apply For An Corporation Bank Home LoanDocumento4 páginasDocumentation Needed To Apply For An Corporation Bank Home LoanKeerthana PadmakumarAinda não há avaliações

- Is On Retail LoansDocumento5 páginasIs On Retail LoansDipti NagarAinda não há avaliações

- Retail Credit SchemesDocumento18 páginasRetail Credit SchemesAman MujeebAinda não há avaliações

- Revision of Service Charges Wef 01042023Documento53 páginasRevision of Service Charges Wef 01042023kkrandy01Ainda não há avaliações

- Housing Loan - Marketing KitDocumento15 páginasHousing Loan - Marketing Kitsanty86Ainda não há avaliações

- Dena Niwas Housing Loan: (To Be Reset at The End of Every 3 Years)Documento24 páginasDena Niwas Housing Loan: (To Be Reset at The End of Every 3 Years)asdAinda não há avaliações

- Kishore MDocumento8 páginasKishore MRajesh YsAinda não há avaliações

- Personal Loan Most Important Terms and Conditions 060623Documento2 páginasPersonal Loan Most Important Terms and Conditions 060623saigurudevaliveAinda não há avaliações

- Interest Concession of Available On The Above Card Rates Upto 31.10.2011 For All Types of New Home LoansDocumento19 páginasInterest Concession of Available On The Above Card Rates Upto 31.10.2011 For All Types of New Home LoansapsagarAinda não há avaliações

- BOI MSME Loan ProductsDocumento95 páginasBOI MSME Loan ProductsganpatigajanandganeshAinda não há avaliações

- RBI ROI FormatDocumento8 páginasRBI ROI Formatsrinivas.rmbaAinda não há avaliações

- CGTMSE SchemesDocumento20 páginasCGTMSE SchemesarulbankofindiaAinda não há avaliações

- Home Improvement Loans: FeaturesDocumento6 páginasHome Improvement Loans: Featuresshailabanumh256Ainda não há avaliações

- IOB-Commission ChartDocumento5 páginasIOB-Commission ChartSubham Pnb RoyAinda não há avaliações

- LoanDocumento1 páginaLoanPrateek SoniAinda não há avaliações

- Credit Guarantee Fund Scheme For Micro and Small Enterprises (Cgmse)Documento2 páginasCredit Guarantee Fund Scheme For Micro and Small Enterprises (Cgmse)Santhosh santhuAinda não há avaliações

- MSME SchemesDocumento53 páginasMSME SchemesKalyani BorkarAinda não há avaliações

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeNo EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeAinda não há avaliações

- An Analysis On The Role of Lending Companies in The Philippines Financial SystemDocumento11 páginasAn Analysis On The Role of Lending Companies in The Philippines Financial SystemMaria Cristina MorfiAinda não há avaliações

- Ito Na Talaga SBADocumento6 páginasIto Na Talaga SBAjoyce nacuteAinda não há avaliações

- Surname Q2-ADocumento33 páginasSurname Q2-ALovely Anne Dela CruzAinda não há avaliações

- DB ISIN DE000DB7XHP3 and ISIN XS1071551474Documento76 páginasDB ISIN DE000DB7XHP3 and ISIN XS1071551474omidreza tabrizianAinda não há avaliações

- RL LT : Cloze Such, Pasl, HadDocumento16 páginasRL LT : Cloze Such, Pasl, HadKiều TrinhAinda não há avaliações

- Obu Rap ThesisDocumento7 páginasObu Rap Thesisbk3q07k5Ainda não há avaliações

- Discounted Cash FlowDocumento36 páginasDiscounted Cash Flowapi-3838939100% (12)

- Corpo Case Digest 5Documento21 páginasCorpo Case Digest 5ianmaranon2Ainda não há avaliações

- CIR v. Mistubishi Metal Corp.Documento7 páginasCIR v. Mistubishi Metal Corp.Togz MapeAinda não há avaliações

- Financial Institutions and Markets NotesDocumento49 páginasFinancial Institutions and Markets Notespatrick vandiAinda não há avaliações

- Module 3 - Food Product DevelopmentDocumento15 páginasModule 3 - Food Product Developmentrbtlch1nAinda não há avaliações

- MONEY Demand and Supply of MoneyDocumento63 páginasMONEY Demand and Supply of MoneySwagat MohantyAinda não há avaliações

- Report On " Analyzing Financial Status of Three Pharmaceutical Companies"Documento26 páginasReport On " Analyzing Financial Status of Three Pharmaceutical Companies"Rahi MunAinda não há avaliações

- Bengal Chemicals & Pharmaceuticals LTD - 11920231113659Documento16 páginasBengal Chemicals & Pharmaceuticals LTD - 11920231113659shafaquesameen2001Ainda não há avaliações

- Basic Accounting-PartnerDocumento13 páginasBasic Accounting-PartnerSala SahariAinda não há avaliações

- Rani Channamma University Belagavi: Course Structure and SyllabusDocumento417 páginasRani Channamma University Belagavi: Course Structure and SyllabusSimran KagziAinda não há avaliações

- MOF Homework 1Documento1 páginaMOF Homework 1Adjanni Arbon DoceAinda não há avaliações

- FinMgt Module 1 Fundamental Financial Management ConceptsDocumento8 páginasFinMgt Module 1 Fundamental Financial Management ConceptsLa Casa de Calma FurnitureAinda não há avaliações

- An Introduction To Callable Debt SecuritiesDocumento37 páginasAn Introduction To Callable Debt SecuritiesrpcampbellAinda não há avaliações

- Trans CredtransDocumento32 páginasTrans CredtransAnonymous L8uRK2eAinda não há avaliações

- Evolution of Financial Service Sector in IndiaDocumento47 páginasEvolution of Financial Service Sector in IndiaGauravSingh0% (1)

- Research 2Documento2 páginasResearch 2Not Tiffany HwangAinda não há avaliações

- Statement of AccountDocumento3 páginasStatement of AccountPrithiv825Ainda não há avaliações

- FDIC FIL 16 2004 Accounting)Documento9 páginasFDIC FIL 16 2004 Accounting)Michael LeeAinda não há avaliações

- Case Studies AssignmentDocumento4 páginasCase Studies Assignment9xy42xfqgcAinda não há avaliações

- Simple Interest, Simple Discount Notes, Promissory NotesDocumento22 páginasSimple Interest, Simple Discount Notes, Promissory NotesKatrina LisingAinda não há avaliações

- NoidaDocumento23 páginasNoidaAmmar Tambawala100% (1)

- An Example of A Fixed-Income Security Would Be A 5% Fixed-Rate Government Bond Where ADocumento8 páginasAn Example of A Fixed-Income Security Would Be A 5% Fixed-Rate Government Bond Where AOumer ShaffiAinda não há avaliações