Escolar Documentos

Profissional Documentos

Cultura Documentos

Revenues Set A New Record For The Second Year in A Row.: Economic Report

Enviado por

Jabnon NonjabDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Revenues Set A New Record For The Second Year in A Row.: Economic Report

Enviado por

Jabnon NonjabDireitos autorais:

Formatos disponíveis

Economic Report

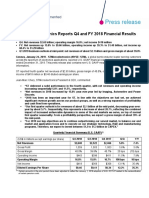

Revenues set a new record for the second year in a row.

For the year ended March 31, 2014, revenues of KUBOTA outside Japan. The ratio of overseas revenues to Revenues and overseas revenue ratio Operating income and operating Net income attributable to KUBOTA

Management

Corporation and its subsidiaries (hereinafter, the “Company”) consolidated revenues was 57.7%, 2.6 percentage points margin Corporation and net margin

increased ¥298.0 billion [24.6%], to ¥1,508.6 billion, from the higher than in the prior year.

(billion yen) (%) (billion yen) (%) (billion yen) (%)

prior year. Operating income increased ¥81.1 billion [66.8%] from 1,500 100 240 30 150 18

1,508.6

In the domestic market, revenues increased ¥95.3 billion the prior year, to ¥202.4 billion, due to increased domestic

131.7

[17.6%], to ¥638.3 billion, from the prior year. Domestic and overseas revenues and the effect of yen depreciation. 1,200 1,210.6 80

202.4

revenues in Farm & Industrial Machinery increased Income before income taxes and equity in net income of

1,021.6 160 20 100 12

substantially due to higher sales of farm equipment, affiliated companies, equivalent to operating income plus 900 57.7 60

55.1

construction machinery, and engines. Revenues in Water & other income of ¥8.9 billion, amounted to ¥211.3 billion, 50.7 121.4 78.1 8.7

13.4

Economic Report

Environment also increased steadily owing to sales growth which was ¥84.1 billion [66.1%] higher than in the prior year. 600 40

103.2 61.3

of products related to public works spending. Income taxes were ¥71.9 billion, and equity in net income of 80 10 50 6

6.4

In overseas markets, revenues increased ¥202.7 billion affiliated companies was ¥3.0 billion. Furthermore, after 300 20 10.1 10.0 6.0

[30.4%], to ¥870.2 billion, from the prior year. Overseas deduction of net income attributable to noncontrolling

revenues in Farm & Industrial Machinery rose in North interests of ¥10.8 billion, net income attributable to KUBOTA 0 0 0 0 0 0

America, Asia outside Japan, and Europe. Revenues in Corporation was ¥131.7 billion, ¥53.6 billion [68.7%] higher (FY) 2012 2013 2014 (FY) 2012 2013 2014 (FY) 2012 2013 2014

Water & Environment and Other expanded mainly in Asia than in the prior year.

Revenues Overseas revenue ratio Operating income Operating margin Net income attributable Net income ratio

to KUBOTA Corporation

Social Report

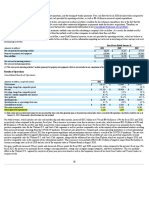

Financial Highlights

(billion yen)

(FY) 2012 2013 2014 Total assets Shareholders’ equity and ROA, ROE

shareholders’ equity to total assets

Year ended March 31:

Revenue ¥1,021.6 ¥1,210.6 ¥1,508.6 (billion yen) (billion yen) (%) (%)

2,500 1,000 100 18

Operating income 103.2 121.4 202.4 934.8

Income before income taxes 99.8 127.2 211.3 2,104.7 15.2

2,000 800 793.3 80

Net income attributable to KUBOTA Corp. 61.3 78.1 131.7 1,846.6

Environmental Report

674.4 12

Capital investments 34.1 50.5 51.2 1,500 1,550.7 600 60 10.7

Depreciation 24.0 29.9 35.3 43.5 44.4 10.6

42.9

1,000 400 40 9.3

R&D expenses 27.9 32.0 35.6 6 7.5

Net cash provided by operating activities 68.0 49.3 83.3 6.8

500 200 20

Free cash flow*1 38.3 0.1 30.2

As of March 31: 0 0 0 0

Total assets ¥1,550.7 ¥1,846.6 ¥2,104.7 (FY) 2012 2013 2014 (FY) 2012 2013 2014 (FY) 2012 2013 2014

Company Information

Shareholders’ equity 674.4 793.3 934.8 Shareholders’ equity Equity ratio ROA ROE

Interest-bearing debt 388.0 510.0 586.9

Per share data (Yen) :

Earnings per share (EPS)*2 ¥ 48.54 ¥ 62.15 ¥104.94

Book-value per share (BPS)*3 536.97 631.64 748.00 Revenues by reporting segment Revenues by region

(billion yen) (billion yen)

Principal financial data (%):

Operating margin 10.1 10.0 13.4 Other Other

41.6 51.9

Return on assets (ROA)*4 6.8 7.5 10.7 (2.8%) (3.4%)

Return on equity (ROE)*5 9.3 10.6 15.2 Farm &

Water & Industrial Asia outside

Shareholders’ equity to total assets 43.5 42.9 44.4 Environment Machinery Japan

Debt equity ratio (times)*6 0.58 0.64 0.63 313.9 1,153.1 284.0 Japan

(20.8%) (76.4%) (18.8%)

FY2014 FY2014 638.3

*1.Free cash flow = Net cash provided by operating activities – Purchases of fixed assets (42.3%)

*2.Earnings per share (EPS) = Net income attributable to KUBOTA Corp. ÷ Weighted average number of common shares outstanding

¥1,508.6 billion Europe ¥1,508.6 billion

*3.Book-value per share (BPS) = Shareholders’ equity ÷ Number of common shares outstanding as of each balance sheet date 177.5

*4.Return on assets (ROA) = Income before income taxes ÷ Total assets (average of beginning and end of fiscal year) (11.8%)

*5.Return on equity (ROE) = Net income attributable to KUBOTA Corp. ÷ Shareholders’ equity (average of beginning and end of fiscal year)

*6.Debt equity ratio = Interest-bearing debt ÷ Shareholders’ equity North America

The Company aligned the reporting periods of certain subsidiaries and affiliated companies with different financial statement closing dates to that of KUBOTA Corporation. To 356.9

reflect the impact of these changes, the Company retrospectively adjusted the consolidated financial statements for all periods presented.

(23.7%)

15 KUBOTA REPORT 2014 KUBOTA REPORT 2014 16

14kubota_web_e_0917PDF用.indd 15-16 2014/09/17 18:59

Economic Report

Farm & Industrial Machinery Topics

Establishing a production center for an upland farming tractor in France and starting mass production in April 2015

KUBOTA has announced plans to establish a company in France to manufacture new upload

Management

farming tractors of 130 to 170 horsepower with mass production slated to commence in April

2015. We aim to produce 3,000 tractors per year from 2017. Compared with rice cultivation, a

core market for KUBOTA, the area of arable land for upland crops, such as wheat, corn and Dunkerque

soybeans, is roughly four times larger, and large-scale farmland has been expanding in mainly E U R O P E

Europe and North America. KUBOTA decided to build a new plant because France is a

central area of demand in Europe and Dunkerque is in close proximity to a port for convenient France

exports to North America and elsewhere. First, KUBOTA aims to expand the large-scale dry-

field agricultural equipment business in Europe and North America alongside Kverneland

ASA, a Norwegian tractor implement manufacturer the Company acquired in May 2013.

Through this initiative, we aim to become an all-round agricultural machinery manufacturer

Economic Report

with a strong global presence in both the rice cultivation market and the upland crop market.

Increasing production capacity of the diesel engine plant in the Republic of Indonesia

KUBOTA doubled the production capacity for compact diesel engines under 14 horsepower

at its plant in Indonesia from 60,000 to 120,000 units annually and commenced production

in July 2014. Compact diesel engines are used in walk-behind power tillers and irrigation

Social Report

pumps, for example, and are positioned as a product for the initial stages of agricultural

mechanization. With strong grass-roots demand in Southeast Asia, KUBOTA decided to

invest in expanding production capacity to meet growing demand in tandem with a move to

an industrial district at the request of Semarang City. KUBOTA aims to enhance its brand

image as an agricultural machinery manufacturer while contributing to advances in

agricultural mechanization by increasing sales of these engines in Southeast Asia. Artist’s rendition of the plant

Review of operations

Establishing new companies for strengthening agricultural machinery sales in Cambodia and Laos

Environmental Report

Revenues in this segment increased 29.3% from the prior launching a new line of products and other factors. Sales

year, to ¥1,153.1 billion, and accounted for 76.4% of of construction machinery expanded along with the

SIAM KUBOTA Corporation Co., Ltd. (SKC), a joint-venture company formed with the Siam

consolidated revenues. recovery of housing starts, while sales of engines showed

Cement Group, a company affiliated with Thailand’s royal family, established wholly owned

Domestic revenues increased 24.9%, to ¥332.6 billion. only a slight increase. Revenues in Europe rose subsidiaries in Cambodia and Laos in January 2014. Both Cambodia and Laos are

Sales of farm equipment marked a record increase due to significantly because of increased sales of tractors and agricultural countries that produce mostly rice. In recent years, the increase in wages in

front-loaded demand before the consumption tax hike and construction machinery and steady sales of engines owing Thailand has led to an upswing in the number of people moving to work in Thailand from

execution of the agricultural-related supplemental budget. to the bottoming out of the economy. Revenues in Asia Cambodia and Laos. This has in turn resulted in labor shortages in the agricultural areas of

Sales of construction machinery expanded sharply due to outside Japan increased sharply owing to higher sales of the two countries and a rapid expansion in demand for agricultural machinery. To date,

the increase in public works spending and other factors. farm equipment and recovery in sales of construction KUBOTA has sold tractors, combine harvesters, compact diesel engines and power tillers to

Company Information

dealers in Cambodia and Laos through SKC. With the establishment of new companies in

Sales of engines also rose. machinery in China.

both countries, which are expected to enjoy growing demand for machinery, efforts are

Overseas revenues increased 31.1%, to ¥820.5 billion. Operating income in this segment increased 69.2%, to being directed toward further expanding the Group’s network of dealers thereby expanding

In North America, as economic recovery trends continued, ¥196.9 billion due to increased revenues in Japan and the agricultural machinery business.

sales of tractors increased favorably due to the effects of overseas and the effects of yen depreciation.

Revenues and overseas revenue ratio Segment profit and segment profit margin Launch of agricultural machinery compatible with newly developed agricultural support system with ICT for farmers in Japan

(billion yen) (%) (billion yen) (%)

In Japan, farmers are working to enlarge agricultural operations, bolster cost

1,600 80 240 45

competitiveness, and create high-value-added agricultural products while striving to

70.1 71.2

67.0 196.9 efficiently produce the safe, worry-free, and delicious agricultural products demanded by

1,200

1,153.1 60 consumers. KUBOTA has developed the KUBOTA Smart Agri System (KSAS) as a new

160 30

system that uses information communications technology (ICT) to assist with farming and

892.0

800 40 116.4 related services. We began offering this service in June 2014. At the same time, we

727.5

95.4 17.1 introduced agricultural machinery compatible with KSAS and will help farmers improve

80 15

agricultural operations and management using data accumulated from this machinery.

400 20

13.1 13.0 KUBOTA launched for the first time tractors able to transmit data about land cultivation work

records and machinery operating performance, combine harvesters able to measure harvest

0 0 0 0

yields for each farm and flavor variations, and rice transplanters able to electronically adjust

(FY) 2012 2013 2014 (FY) 2012 2013 2014

the amount of fertilizer applied. Data gathered by KSAS can be used to formulate agricultural

Revenues Overseas revenue ratio Segment profit Segment profit margin

work plans to find optimal harvest yields and rice crop flavors.

17 KUBOTA REPORT 2014 KUBOTA REPORT 2014 18

14kubota_web_e_0917PDF用.indd 17-18 2014/09/17 18:59

Economic Report

Water & Environment Topics

Received an order for Water supply system and Water Purification Plant (WPP) and Sewerage Treatment Plant (STP) in

Myanmar’s special economic zone

KUBOTA received an order for a water supply system as well as water purification and sewerage

Management

treatment plants to be installed and constructed within the Thilawa Special Economic Zone

(SEZ). The Thilawa SEZ occupies a wide area of approximately 2,400 hectares and is expected

to attract not only Japanese companies but also companies from all over the world. For the first

stage of development in the roughly 400-hectare Phase 1 Development Area, KUBOTA used

ductile iron pipes for water intake and supply systems as well as its own proprietary treatment

methods, which deliver low running costs, for water purification and sewage treatment. In

addition to water- and environment-related products, KUBTOA plans to provide the Thilawa SEZ

with a wide range of water, effluent and exhaust gas treatment equipment provided by KUBOTA

KASUI Corporation. In this manner, the Group is looking to contribute to the economic

development of Myanmar.

Economic Report

Constructing palm oil mill effluent treatment facilities in Indonesia—KUBOTA contributes to environmental improvement and

the use of renewable energy development by the anaerobic membrane

KUBOTA received an order for five plants to recover biogas from palm oil mill effluent (POME) in

Sumatra in the Republic of Indonesia. This is the first order received in Indonesia and the second

order received in the region, following an order in Sarawak, Malaysia in October 2012. Palm oil is

a major export for Indonesia and Malaysia. The POME that is discharged as a result of the

production of palm oil is polluting both water and air. This in turn has become a major problem

Social Report

with the heightened awareness of global warming. By providing and promoting the Company’s

anaerobic membrane bioreactor (MBR) system, which has dramatically increased biogas yield

(20% or higher than other systems), KUBOTA hopes to make a contribution to environmental

conservation and the promotion of renewable energy use at palm oil mills in Indonesia and

Malaysia, which produce 85% of the palm oil consumed globally.

Plant in Malaysia

Received order for MBR system to be used in the City of Canton, Ohio, USA, the largest MBR facility in the North America

Environmental Report

KUBOTA Membrane U.S.A. Corporation received an order for a water recycling treatment facility in

Review of operations Canton City, Ohio, USA in collaboration with its US partner. The facility will be the largest wastewater

treatment facility to use MBR technology in North America with a capacity to serve a population of

Water & Environment is comprised of pipe-related products Revenues in pipe-related products rose mainly due to 150,000 people. The Company began technical development of MBRs and launched the Kubota

(ductile iron pipes, plastic pipes, pumps, valves, and other higher sales of plastic pipes. In addition, revenues in submerged membrane unit (SMU) in 1991. The Company first set up a local subsidiary in London,

products), environment-related products (environmental environment-related products and social infrastructure- UK in 2001. In the ensuing period, subsidiaries have been established in Washington, USA and

Shanghai, China. KUBOTA SMUs are attracting worldwide acclaim. Having considerable previous

control plants and other products), and social infrastructure- related products also increased. Overseas revenues

success in small and medium-sized facilities with a capacity to serve a population of 25,000 people,

related products (industrial castings, spiral-welded steel expanded 17.6%, to ¥45.0 billion owing to increased sales

the Company developed a product for large treatment facilities. This particular project order is a

pipes, vending machines, precision equipment, air- of pumps and industrial castings. measure of the Company’s success and the result of vigorous sales and marketing activities. The

Company Information

conditioning equipment, and other products). Operating income in this segment increased 6.5%, to Company will accelerate the business development for large treatment facilities in Europe and the

Revenues in this segment increased 10.6% to ¥313.9 ¥24.9 billion, as the increase in revenues offset an Middle East.

billion from the prior year, and accounted for 20.8% of increase in material costs.

consolidated revenues.

Domestic revenues increased 9.5% to ¥268.9 billion.

Other

Revenues and overseas revenue ratio Segment profit and segment profit margin

Review of operations

Other is comprised of construction, services, and other businesses.

(billion yen) (%) (billion yen) (%)

Revenues in this segment increased 20.1% to ¥41.6 billion from the prior year, and accounted for 2.8% of consolidated revenues. Revenue

400 20 30 15

generated from construction and other business also rose.

24.9 Operating income in this segment increased 57.7% to ¥3.8 billion.

300 313.9 15

23.4

283.9

263.3 20 10

14.3 17.4 7.9

13.5

200 10 Launch of imported Japanese rice milling and marketing operations in Singapore

11.6 8.2

10 6.6 5

100 5 As its second Japanese rice export receiving base after Kubota Rice Industry (H.K.) Co., Ltd.,

which was established in 2011, KUBOTA established the subsidiary Kubota Rice Industry

(Singapore) Co., Ltd. to import, mill, and sell Japanese rice in Singapore. Operations began in

0 0 0 0

January 2014 after the construction of a rice milling plant in Singapore. We aim to expand

(FY) 2012 2013 2014 (FY) 2012 2013 2014

Japanese rice import and polishing businesses overseas as a way to help troubled Japanese

Revenues Overseas revenue ratio Segment profit Segment profit margin Selling rice produced in Kumamoto

rice producers export their crops. Prefecture for the first time

(Source: Kumamoto Prefecture)

19 KUBOTA REPORT 2014 KUBOTA REPORT 2014 20

14kubota_web_e_0917PDF用.indd 19-20 2014/09/17 18:59

Economic Report

Consolidated Balance Sheets Consolidated Statements of Income

Assets (In millions of yen) (In millions of yen)

March 31, 2014 March 31, 2013 Change Year ended March 31, 2014 Year ended March 31, 2013 Change

Amount % Amount % Amount Amount % Amount % Amount %

Current assets Cash and cash equivalents 87,022 99,789 (12,767) Revenues 1,508,590 100.0 1,210,566 100.0 298,024 24.6

Notes and accounts receivable: Cost of revenues 1,057,003 70.1 880,891 72.8 176,112 20.0

Trade notes 69,974 73,895 (3,921) Selling, general and administrative expenses 247,865 16.4 208,605 17.2 39,260 18.8

Management

Trade accounts 534,921 436,642 98,279 Other operating expenses (income)-net 1,291 0.1 (289) (0.0) 1,580 –

Less: Allowance for doubtful notes and Operating income 202,431 13.4 121,359 10.0 81,072 66.8

(3,186) (2,712) (474)

accounts receivable Other income (expenses):

Total notes and accounts receivable, net 601,709 507,825 93,884 Interest and dividend income 4,446 3,799 647

Short-term finance receivables-net 162,983 141,157 21,826 Interest expense (1,500) (1,330) (170)

Inventories 299,765 263,217 36,548 Gain on sales of securities-net 4,700 154 4,546

Other current assets 82,482 68,476 14,006 Valuation loss on other investments (6) (360) 354

Total current assets 1,233,961 58.6 1,080,464 58.5 153,497 Foreign exchange gain (loss)-net (4,150) 8,753 (12,903)

Investments and long-term Investments in and loan receivables from

22,631 19,535 3,096 Other, net 5,372 (5,197) 10,569

finance receivables affiliated companies

Other investments 137,641 126,715 10,926 Other income (expenses), net 8,862 5,819 3,043

Economic Report

Long-term finance receivables-net 334,112 275,815 58,297 Income before income taxes and equity in net income of

affiliated companies 211,293 14.0 127,178 10.5 84,115 66.1

Total investments and long-term finance

494,384 23.5 422,065 22.9 Income taxes:

receivables 72,319

Property, plant and Land 93,308 91,367 1,941 Current 74,024 41,376 32,648

equipment Buildings 255,657 243,327 12,330 Deferred (2,108) 284 (2,392)

Machinery and equipment 424,478 397,213 27,265 Total income taxes 71,916 41,660 30,256

Construction in progress 11,300 12,844 (1,544) Equity in net income of affiliated companies 3,034 1,606 1,428

Total 784,743 744,751 39,992 Net income 142,411 9.4 87,124 7.2 55,287 63.5

Accumulated depreciation (502,042) (480,968) (21,074) Less: Net income attributable to the noncontrolling

interests 10,750 9,070 1,680

Net property, plant and equipment 282,701 13.4 263,783 14.3 18,918

Net income attributable to KUBOTA Corporation 131,661 8.7 78,054 6.4 53,607 68.7

Social Report

Other assets Goodwill and intangible assets-net 34,628 30,475 4,153

Long-term trade accounts receivable 35,737 32,010 3,727

Other 23,824 18,461 5,363

Consolidated Statements of Comprehensive Income

(In millions of yen)

Less: Allowance for doubtful receivables (578) (656) 78 Change

Year ended March 31, 2014 Year ended March 31, 2013

Total other assets 93,611 4.5 80,290 4.3 13,321 Net income 142,411 87,124 55,287

Total 2,104,657 100.0 1,846,602 100.0 258,055 Other comprehensive income (loss), net of tax:

Foreign currency translation adjustments 32,522 48,766 (16,244)

Unrealized gains on securities 10,065 16,205 (6,140)

Unrealized gains on derivatives 55 135 (80)

Liabilities and equity (In millions of yen)

Pension liability adjustments 3,285 5,848 (2,563)

March 31, 2014 March 31, 2013 Change

Environmental Report

Total other comprehensive income 45,927 70,954 (25,027)

Amount % Amount % Amount Comprehensive income 188,338 158,078 30,260

Current liabilities Short-term borrowings 181,573 140,324 41,249 Less: Comprehensive income attributable to the 12,643 17,071 (4,428)

noncontrolling interests

Trade notes payable 40,561 19,655 20,906

Comprehensive income attributable to Kubota Corporation 175,695 141,007 34,688

Trade accounts payable 200,145 228,178 (28,033)

Advances received from customers

Notes and accounts payable for capital

7,873 10,122 (2,249)

Consolidated Statements of Changes in Equity

expenditures 15,262 15,871 (609) (In millions of yen)

Shareholders’ Equity

Accrued payroll costs 36,829 32,846 3,983 Shares of

Accumulated

common stock Noncontrolling

Accrued expenses 48,939 39,725 9,214 Retained other Total

outstanding Common stock Capital surplus Legal reserve Treasury stock interests

(thousands) earnings comprehensive

Income taxes payable 36,349 18,097 18,252 loss

Company Information

Other current liabilities 61,626 51,580 10,046 Balance, at March 31, 2012 1,255,941 84,070 88,869 19,539 567,161 (65,894) (19,345) 57,963 732,363

Current portion of long-term debt 89,766 78,589 11,177 Net income 78,054 9,070 87,124

Total current liabilities 718,923 34.2 634,987 34.4 83,936 Other comprehensive income 62,953 8,001 70,954

Long-term liabilities Long-term debt 315,598 291,085 24,513 Cash dividends paid to Kubota Corporation

shareholders, ¥16 per common share (20,102) (20,102)

Accrued retirement and pension costs 13,026 29,050 (16,024)

Cash dividends paid to noncontrolling

Other long-term liabilities 56,497 39,515 16,982 (420) (420)

interests

Total long-term liabilities 385,121 18.3 359,650 19.5 25,471 Purchases and sales of treasury stock 10 (10) (10)

Equity KUBOTA Corporation shareholders’ equity: Retirement of treasury stock (1) (19,151) 19,152 –

Common stock 84,070 84,070 – Increase in noncontrolling interests 175 175

Capital surplus 88,753 88,919 related to contribution

(166)

Changes in ownership interests in

Legal reserve 19,539 19,539 – 51 (2,035) (16,135) (18,119)

subsidiaries

Retained earnings 703,740 605,962 97,778 Balance, at March 31, 2013 1,255,951 84,070 88,919 19,539 605,962 (4,976) (203) 58,654 851,965

Accumulated other comprehensive Net income 131,661 10,750 142,411

income (loss) 38,996 (4,976) 43,972

Other comprehensive income 44,034 1,893 45,927

Treasury stock, at cost (287) (203) (84)

Cash dividends paid to Kubota Corporation

Total KUBOTA Corporation shareholders’ shareholders, ¥19 per common share (23,870) (23,870)

equity 934,811 44.4 793,311 42.9 141,500 Cash dividends paid to noncontrolling

Noncontrolling interests 65,802 3.1 58,654 3.2 (970) (970)

7,148 interests

Total equity 1,000,613 47.5 851,965 46.1 148,648 Purchases and sales of treasury stock (6,205) (10,097) (10,097)

Total 2,104,657 100.0 1,846,602 100.0 258,055 Retirement of treasury stock (10,013) 10,013 –

Increase in noncontrolling interests 207 207

related to contribution

Changes in ownership interests in (166) (62) (4,732) (4,960)

subsidiaries

Balance, at March 31, 2014 1,249,746 84,070 88,753 19,539 703,740 38,996 (287) 65,802 1,000,613

21 KUBOTA REPORT 2014 KUBOTA REPORT 2014 22

14kubota_web_e_0917PDF用.indd 21-22 2014/09/17 18:59

Economic Report

Consolidated Statements of Cash Flows Consolidated Segment Information

(In millions of yen)

Year ended March 31, 2014 Year ended March 31, 2013 Change

Reporting segments

Year ended March 31, 2014 (In millions of yen)

Operating activities:

Farm & Industrial

Net income 142,411 87,124 Water & Environment Other Adjustments Consolidated

Machinery

Depreciation and amortization 35,344 29,942

Revenues:

Gain on sales of securities-net (4,700) (154)

Management

External customers 1,153,088 313,931 41,571 – 1,508,590

Valuation loss on other investments 6 360

Intersegment 76 6,147 23,676 (29,899) –

Loss from disposal of fixed assets-net 737 851

Total 1,153,164 320,078 65,247 (29,899) 1,508,590

Impairment loss on long-lived assets 885 296

Operating income 196,891 24,878 3,791 (23,129) 202,431

Equity in net income of affiliated companies (3,034) (1,606 )

Identifiable assets at March 31, 2014 1,584,062 269,272 92,703 158,620 2,104,657

Deferred income taxes (2,108) 284

Depreciation and amortization 25,272 6,995 749 2,328 35,344

Increase in notes and accounts receivable (82,602) (61,445)

Capital expenditures 36,541 10,038 748 3,902 51,229

Increase in inventories (16,932) (19,651)

Increase in other current assets (178) (2,853)

Economic Report

Year ended March 31, 2013 (In millions of yen)

Increase (decrease) in trade notes and accounts payable (13,013) 15,824

Farm & Industrial

Increase (decrease) in income taxes payable 17,570 (2,267) Water & Environment Other Adjustments Consolidated

Machinery

Increase in other current liabilities 13,075 8,347 Revenues:

Decrease in accrued retirement and pension costs (10,302 ) (4,533 ) External customers 892,018 283,921 34,627 – 1,210,566

Other 6,163 (1,196 ) Intersegment 59 5,497 22,075 (27,631) –

Net cash provided by operating activities 83,322 49,323 33,999 Total 892,077 289,418 56,702 (27,631) 1,210,566

Investing activities: Operating income 116,387 23,352 2,404 (20,784) 121,359

Social Report

Purchases of fixed assets (53,157) (49,175) Identifiable assets at March 31, 2013 1,344,365 260,258 83,582 158,397 1,846,602

Purchase of investment securities (2,125) (234 ) Depreciation and amortization 20,811 6,213 741 2,177 29,942

Proceeds from sales of property, plant and equipment 1,050 1,228 Capital expenditures 38,587 8,024 742 3,102 50,455

Proceeds from sales and redemption of investments 11,563 412

Acquisition of business, net of cash acquired – 642

Increase in finance receivables (258,945) (200,614)

Revenues from external customers by Geographic information

Collection of finance receivables 198,923 167,992

product groups Information for revenues from external customers by destination

Net (increase) decrease in short-term loan receivables from affiliated (In millions of yen) (In millions of yen)

companies (360) 1,680

Environmental Report

Year ended Year ended Year ended Year ended

Net (increase) decrease in time deposit (1,075) 31 March 31, 2014 March 31, 2013 March 31, 2014 March 31, 2013

Other (83) (1,023) Farm Equipment and Japan 638,346 543,027

Engines 1,002,913 781,911 North America 356,890 278,976

Net cash used in investing activities (104,209) (79,061) (25,148)

Construction Machinery 150,175 110,107 Europe 177,466 118,305

Financing activities:

Farm & Industrial Machinery 1,153,088 892,018 Asia outside Japan 283,971 226,367

Proceeds from issuance of long-term debt 140,068 148,685

Pipe-related Products 167,741 151,032 Other Areas 51,917 43,891

Repayments of long-term debt (121,334) (114,218)

Environment-related Total 1,508,590 1,210,566

Net increase in short-term borrowings 24,170 32,830

Products 73,180 64,917

Payments of cash dividends (23,870) (20,102)

Company Information

Social Infrastructure- Information for property, plant and equipment based on physical location

Purchases of treasury stock (10,097) (10) related Products 73,010 67,972 (In millions of yen)

Purchases of noncontrolling interests (4,753) (18,048) Water & Environment 313,931 283,921 March 31, 2014 March 31, 2013

Other (970) (243) Other 41,571 34,627 Japan 180,735 178,672

Net cash provided by financing activities 3,214 28,894 (25,680) Total 1,508,590 1,210,566 North America 29,859 25,566

Effect of exchange rate changes on cash and cash equivalents 4,906 7,243 (2,337) Europe 19,661 14,274

Net increase (decrease) in cash and cash equivalents (12,767) 6,399 Asia outside Japan 47,941 41,101

Cash and cash equivalents, beginning of year 99,789 93,390 Other Areas 4,505 4,170

Cash and cash equivalents, end of year 87,022 99,789 (12,767) Total 282,701 263,783

Notes

(In millions of yen)

Cash paid during the year for:

Interest 11,493 8,483 3,010

Income taxes net of refunds 56,510 43,517 12,993

Please refer to Annual Securities Report for the detailed financial information. http://www.kubota-global.net/ir/financial/yuho/index.html

23 KUBOTA REPORT 2014 KUBOTA REPORT 2014 24

14kubota_web_e_0917PDF用.indd 23-24 2014/09/17 18:59

Você também pode gostar

- Rastriya Banijya Bank Limited: Interim Financial StatementsDocumento30 páginasRastriya Banijya Bank Limited: Interim Financial Statementstekbahadurkarki2057Ainda não há avaliações

- Convenience Store OperationsDocumento14 páginasConvenience Store OperationsKshitij AnandAinda não há avaliações

- Almacenes Éxito S.A.: Consolidated Financial Results 1Q21Documento37 páginasAlmacenes Éxito S.A.: Consolidated Financial Results 1Q21Manuela PinzónAinda não há avaliações

- April 27, 2018 Honda Motor Co., Ltd. Reports Consolidated Financial Results For The Fiscal Fourth Quarter and The Fiscal Year Ended March 31, 2018Documento22 páginasApril 27, 2018 Honda Motor Co., Ltd. Reports Consolidated Financial Results For The Fiscal Fourth Quarter and The Fiscal Year Ended March 31, 2018Le NovoAinda não há avaliações

- Ge Announces First Quarter 2018 ResultsDocumento14 páginasGe Announces First Quarter 2018 ResultsTodd SullivanAinda não há avaliações

- 1.1 Sunpharma and Pfizer 1 2 3 4Documento7 páginas1.1 Sunpharma and Pfizer 1 2 3 4AnanthkrishnanAinda não há avaliações

- Cholamandalam Investment and Finance Company - Q1FY20 Result Update - QuantumDocumento4 páginasCholamandalam Investment and Finance Company - Q1FY20 Result Update - QuantumdarshanmadeAinda não há avaliações

- 2018 Schindler Annual Report GR eDocumento76 páginas2018 Schindler Annual Report GR eTri NhanAinda não há avaliações

- Financial Report Ajinomoto 2021Documento93 páginasFinancial Report Ajinomoto 2021Joachim VIALLONAinda não há avaliações

- Vinati Organics: Newer Businesses To Drive Growth AheadDocumento6 páginasVinati Organics: Newer Businesses To Drive Growth AheadtamilAinda não há avaliações

- Major Gains Were Seen in Our Core Business, The Business Technologies BusinessDocumento16 páginasMajor Gains Were Seen in Our Core Business, The Business Technologies BusinessGAinda não há avaliações

- Carrefour 2022 Half-Year Financial ReportDocumento71 páginasCarrefour 2022 Half-Year Financial Reportgarcia.heberAinda não há avaliações

- Gea Annual Report 2018 Tcm11 52655Documento256 páginasGea Annual Report 2018 Tcm11 52655geniusMAHIAinda não há avaliações

- MM Fin HighlightsDocumento1 páginaMM Fin HighlightsAbhinavHarshalAinda não há avaliações

- AR2018 EngDocumento83 páginasAR2018 Engomkar kadamAinda não há avaliações

- Stmicro - Q4-Fy2018 PR - FinalDocumento12 páginasStmicro - Q4-Fy2018 PR - Finalakshay kumarAinda não há avaliações

- Jain Irrigation Systems LTD: AccumulateDocumento6 páginasJain Irrigation Systems LTD: Accumulatesaran21Ainda não há avaliações

- Alibaba Dec Q2020Documento15 páginasAlibaba Dec Q2020free meAinda não há avaliações

- Financial Summary: Toyota Motor CorporationDocumento29 páginasFinancial Summary: Toyota Motor CorporationHassan PansariAinda não há avaliações

- RIL 2Q FY21 Analyst Presentation 30oct20Documento60 páginasRIL 2Q FY21 Analyst Presentation 30oct20ABHISHEK GUPTAAinda não há avaliações

- TeslaQ2 2022Documento30 páginasTeslaQ2 2022Massimiliano ZocchiAinda não há avaliações

- Nse: Itc PRICE: INR 203.10Documento7 páginasNse: Itc PRICE: INR 203.10Shresth GuptaAinda não há avaliações

- Bajaj Auto LTD 2Documento8 páginasBajaj Auto LTD 2niravAinda não há avaliações

- AIA Engineering Feb 19Documento6 páginasAIA Engineering Feb 19darshanmaldeAinda não há avaliações

- Investment: IdeasDocumento4 páginasInvestment: IdeasArkiAinda não há avaliações

- Pidilite Industries (PIDIND) : High Raw Material Prices Hit MarginDocumento10 páginasPidilite Industries (PIDIND) : High Raw Material Prices Hit MarginSiddhant SinghAinda não há avaliações

- IDirect SKFIndia Q2FY20Documento10 páginasIDirect SKFIndia Q2FY20praveensingh77Ainda não há avaliações

- Tanzania AziziDocumento5 páginasTanzania Aziziazizin1994Ainda não há avaliações

- Titan Company (TITIND) : Multiple Levers in Place To Drive Sales GrowthDocumento5 páginasTitan Company (TITIND) : Multiple Levers in Place To Drive Sales Growthaachen_24Ainda não há avaliações

- Nocil LTD.: Margins Have Bottomed Out, Import Substitution in PlayDocumento8 páginasNocil LTD.: Margins Have Bottomed Out, Import Substitution in PlaySadiq SadiqAinda não há avaliações

- IS Danamon 2021Documento1 páginaIS Danamon 2021kaiser bowmanAinda não há avaliações

- Maybank-Integrated AR 2022 - Corporate-Part 2Documento96 páginasMaybank-Integrated AR 2022 - Corporate-Part 2yennielimclAinda não há avaliações

- Aarti Industries - 3QFY20 Result - RsecDocumento7 páginasAarti Industries - 3QFY20 Result - RsecdarshanmaldeAinda não há avaliações

- Statutory Accounts For The Full Year Ended 30 June 2020Documento118 páginasStatutory Accounts For The Full Year Ended 30 June 2020TimBarrowsAinda não há avaliações

- Alliance Aviation 2020Documento80 páginasAlliance Aviation 2020Hoàng Minh ChuAinda não há avaliações

- 1391-Monthly Fiscal Bulletin 8Documento16 páginas1391-Monthly Fiscal Bulletin 8Macro Fiscal PerformanceAinda não há avaliações

- Volume 5 - March 2022: Descriptions FY2021 FY2020 %Documento5 páginasVolume 5 - March 2022: Descriptions FY2021 FY2020 %fielimkarelAinda não há avaliações

- Financial Summary: Toyota Motor CorporationDocumento33 páginasFinancial Summary: Toyota Motor CorporationHassan PansariAinda não há avaliações

- Camposol Holding PLC: Fourth Quarter and Preliminary Full Year 2018 ReportDocumento24 páginasCamposol Holding PLC: Fourth Quarter and Preliminary Full Year 2018 Reportkaren ramosAinda não há avaliações

- Jubilant Q1FY21 ResultsDocumento9 páginasJubilant Q1FY21 ResultsDeepak SharmaAinda não há avaliações

- Hiscox Interim Statement 2009Documento14 páginasHiscox Interim Statement 2009saxobobAinda não há avaliações

- Restated Earnings Largely Driven by Non-Cash Expenses: 2GO Group, IncDocumento4 páginasRestated Earnings Largely Driven by Non-Cash Expenses: 2GO Group, IncJAinda não há avaliações

- July 31, 2018 Honda Motor Co., Ltd. Reports Consolidated Financial Results For The Fiscal First Quarter ENDED JUNE 30, 2018Documento17 páginasJuly 31, 2018 Honda Motor Co., Ltd. Reports Consolidated Financial Results For The Fiscal First Quarter ENDED JUNE 30, 2018Black Star11Ainda não há avaliações

- 107 25 Walmart 10 K ExcerptsDocumento6 páginas107 25 Walmart 10 K Excerptsi wayan suputraAinda não há avaliações

- KHD Konzern H1 2018 EnglischDocumento42 páginasKHD Konzern H1 2018 EnglischVarun VermaAinda não há avaliações

- Aveva Group Full Year Results 25may2021 PresentationDocumento36 páginasAveva Group Full Year Results 25may2021 PresentationGNR DESIGNAinda não há avaliações

- Tanla Solutions (TANSOL) : Rebound in Core Business SegmentsDocumento5 páginasTanla Solutions (TANSOL) : Rebound in Core Business SegmentsashishkrishAinda não há avaliações

- AAP Q4 2022 Earnings - FinalDocumento10 páginasAAP Q4 2022 Earnings - FinalDaniel KwanAinda não há avaliações

- FinolexDocumento171 páginasFinolexAkash Nil ChatterjeeAinda não há avaliações

- Financial Results Briefing Material For FY2019: April 1, 2018 To March 31, 2019Documento30 páginasFinancial Results Briefing Material For FY2019: April 1, 2018 To March 31, 2019choiand1Ainda não há avaliações

- 2021 Business PerformanceDocumento22 páginas2021 Business PerformanceSebastian SinclairAinda não há avaliações

- CH 15Documento56 páginasCH 15Quỳnh Anh Bùi ThịAinda não há avaliações

- Nyse Cas 2008Documento97 páginasNyse Cas 2008gaja babaAinda não há avaliações

- Dolat Capital Market - Vinati Organics - Q2FY20 Result Update - 1Documento6 páginasDolat Capital Market - Vinati Organics - Q2FY20 Result Update - 1Bhaveek OstwalAinda não há avaliações

- Phiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001.: BSE Limited National Stock Exchange of India LimitedDocumento6 páginasPhiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001.: BSE Limited National Stock Exchange of India LimitedJITHIN KRISHNAN MAinda não há avaliações

- Intrep 2Documento46 páginasIntrep 2mailimailiAinda não há avaliações

- Telecommunication Services - Etihad Etisalat - 7020Documento2 páginasTelecommunication Services - Etihad Etisalat - 7020AliAinda não há avaliações

- Japfa Comfeed Indonesia: Equity ResearchDocumento7 páginasJapfa Comfeed Indonesia: Equity Researchroy95121Ainda não há avaliações

- 2022Q1 PR EN FinalDocumento13 páginas2022Q1 PR EN FinalMATHU MOHANAinda não há avaliações

- BS en Iso 17892-2-2014 PDFDocumento26 páginasBS en Iso 17892-2-2014 PDFIvan Arapov100% (3)

- GCC Standardization Organization (Gso)Documento10 páginasGCC Standardization Organization (Gso)Jabnon NonjabAinda não há avaliações

- Api-598-En-12266-1 Seat LeakDocumento2 páginasApi-598-En-12266-1 Seat Leakelumalai24100% (10)

- Researching & Writing A Literature Review: NCSU LibrariesDocumento30 páginasResearching & Writing A Literature Review: NCSU LibrariesJabnon NonjabAinda não há avaliações

- OIML R 49-1: Nternational EcommendationDocumento34 páginasOIML R 49-1: Nternational EcommendationYussef Abujalid FernándezAinda não há avaliações

- 135 FR en HydrusDocumento7 páginas135 FR en HydrusJabnon NonjabAinda não há avaliações

- Soil TestDocumento7 páginasSoil TestJabnon NonjabAinda não há avaliações

- Investigation Into Failure Phenomena of Water Meter in The Kingdom of BahrainDocumento118 páginasInvestigation Into Failure Phenomena of Water Meter in The Kingdom of BahrainJabnon NonjabAinda não há avaliações

- Calculating Beta ExcelDocumento17 páginasCalculating Beta ExcelJohan BothaAinda não há avaliações

- Butterfly ValvesDocumento24 páginasButterfly ValvesJabnon NonjabAinda não há avaliações

- EM Master Thesis - Water Meter Faliures - V1Documento2 páginasEM Master Thesis - Water Meter Faliures - V1Jabnon NonjabAinda não há avaliações

- Degree of LeverageDocumento4 páginasDegree of LeverageVarinder AnandAinda não há avaliações

- Performance of FirmsDocumento15 páginasPerformance of FirmsJabnon NonjabAinda não há avaliações

- GCC Standardization Organization (Gso)Documento10 páginasGCC Standardization Organization (Gso)Jabnon NonjabAinda não há avaliações

- BS en 1010-2-2006+a1-2010 - (2019-02-14 - 07-24-50 Am)Documento66 páginasBS en 1010-2-2006+a1-2010 - (2019-02-14 - 07-24-50 Am)Jabnon NonjabAinda não há avaliações

- BS 750Documento30 páginasBS 750Jabnon Nonjab100% (1)

- Guidelines For Drinking Water Quality 4th EditionDocumento631 páginasGuidelines For Drinking Water Quality 4th EditionAlejandro VeraAinda não há avaliações

- BS 750Documento30 páginasBS 750Jabnon Nonjab100% (1)

- Life Cycle Cost Study For PipeDocumento11 páginasLife Cycle Cost Study For PipedwianantoraharjoAinda não há avaliações

- NEMA, UL, and IP Rating CodesDocumento12 páginasNEMA, UL, and IP Rating CodesDasuki FahmiAinda não há avaliações

- BS EN 1074 - 6:2008 Fire HydrantDocumento24 páginasBS EN 1074 - 6:2008 Fire HydrantJabnon NonjabAinda não há avaliações

- Transportation MethodsDocumento39 páginasTransportation MethodsJabnon NonjabAinda não há avaliações

- BS en 1010-2-2006+a1-2010 - (2019-02-14 - 07-24-50 Am)Documento66 páginasBS en 1010-2-2006+a1-2010 - (2019-02-14 - 07-24-50 Am)Jabnon NonjabAinda não há avaliações

- Water Supply Systems Volume IIDocumento187 páginasWater Supply Systems Volume IIErnest Christian NanolaAinda não há avaliações

- EM Master Thesis - Water Meter Faliures - V1Documento2 páginasEM Master Thesis - Water Meter Faliures - V1Jabnon NonjabAinda não há avaliações

- EM Master Thesis - Water Meter Faliures - V1 PDFDocumento117 páginasEM Master Thesis - Water Meter Faliures - V1 PDFJabnon NonjabAinda não há avaliações

- Thesis PPT (04-11-2018) - RDocumento34 páginasThesis PPT (04-11-2018) - RJabnon NonjabAinda não há avaliações

- Ien512 S SolDocumento8 páginasIen512 S SolJabnon NonjabAinda não há avaliações

- EM Master Thesis - Water Meter Faliures - V1 PDFDocumento117 páginasEM Master Thesis - Water Meter Faliures - V1 PDFJabnon NonjabAinda não há avaliações

- Capital Structure and Financial Performance Evidence From Listed Firms in The Oil and Gas Sector in NigeriaDocumento8 páginasCapital Structure and Financial Performance Evidence From Listed Firms in The Oil and Gas Sector in NigeriaInternational Journal of Innovative Science and Research TechnologyAinda não há avaliações

- Ashenafi BeyeneDocumento77 páginasAshenafi BeyeneYonas Begashaw Jr.Ainda não há avaliações

- Three Kinds of FS Analysis TechniquesDocumento4 páginasThree Kinds of FS Analysis TechniquesHazel Denisse GragasinAinda não há avaliações

- Financial Performance Analysis On: Uttara Bank LimitedDocumento6 páginasFinancial Performance Analysis On: Uttara Bank LimitedAshik RahmanAinda não há avaliações

- Test BankDocumento33 páginasTest BankThelma T. DancelAinda não há avaliações

- Top Glove PDFDocumento39 páginasTop Glove PDFWan Khaidir71% (7)

- Xyz Company: Profit and Loss Account For The Year EndedDocumento19 páginasXyz Company: Profit and Loss Account For The Year EndedYaswanth MaripiAinda não há avaliações

- Ratio AnalysisDocumento4 páginasRatio AnalysisKana jillaAinda não há avaliações

- Tax Planning Strategies and Financial Performance of Listed Deposit Money Banks in NigeriaDocumento13 páginasTax Planning Strategies and Financial Performance of Listed Deposit Money Banks in NigeriaEditor IJTSRDAinda não há avaliações

- Profitability RatiosDocumento24 páginasProfitability RatiosEjaz Ahmed100% (1)

- Research Paper - Behavioral FinanceDocumento10 páginasResearch Paper - Behavioral FinanceYasir MehmoodAinda não há avaliações

- Fs Analysis MC ProblemsDocumento7 páginasFs Analysis MC ProblemsarkishaAinda não há avaliações

- Chapter IIDocumento17 páginasChapter II21MCO004 Ajay Kumar K SAinda não há avaliações

- Final ProjectDocumento64 páginasFinal ProjectShiju ShajiAinda não há avaliações

- MM Proposition MCQDocumento3 páginasMM Proposition MCQMM Fakhrul IslamAinda não há avaliações

- 5ffb Ims03Documento32 páginas5ffb Ims03Azadeh AkbariAinda não há avaliações

- Ionut TintaruDocumento6 páginasIonut TintaruBalent AndreeaAinda não há avaliações

- Workout Gym Business PlanDocumento25 páginasWorkout Gym Business PlanZUZANI MATHIYAAinda não há avaliações

- Financial Accounting, 7e by Pfeiffer, Hanlon, Magee 2023, Test BankDocumento32 páginasFinancial Accounting, 7e by Pfeiffer, Hanlon, Magee 2023, Test BankTest bank World0% (1)

- Assessing Financial Health (Part-A)Documento17 páginasAssessing Financial Health (Part-A)kohacAinda não há avaliações

- FS Analysis III (Quizzer)Documento6 páginasFS Analysis III (Quizzer)Jn Fancuvilla LeañoAinda não há avaliações

- Chapter 4 - Analysis of Financial StatementsDocumento50 páginasChapter 4 - Analysis of Financial Statementsnoor_maalik100% (1)

- Tata ChemicalsDocumento19 páginasTata ChemicalsPraveen R V100% (1)

- Dutch Bangla Bank 10720015Documento11 páginasDutch Bangla Bank 10720015ABIDUZ ZAMANAinda não há avaliações

- Financial Analysis of Tata MotorsDocumento45 páginasFinancial Analysis of Tata MotorsSourish DuttaAinda não há avaliações

- JP Morgan Delayed Alibaba Group Holding Limited 1Documento10 páginasJP Morgan Delayed Alibaba Group Holding Limited 1Man Ho LiAinda não há avaliações

- Ratio Analysis - BBA ClassDocumento27 páginasRatio Analysis - BBA ClassSophiya PrabinAinda não há avaliações

- Harley Davidson Strategic Management Changed NewDocumento33 páginasHarley Davidson Strategic Management Changed NewDevina GuptaAinda não há avaliações

- Tata Motors ReportDocumento5 páginasTata Motors ReportrastehertaAinda não há avaliações