Escolar Documentos

Profissional Documentos

Cultura Documentos

PWC Client Advisory

Enviado por

FedsDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

PWC Client Advisory

Enviado por

FedsDireitos autorais:

Formatos disponíveis

ISSN 2094-1226/Year-end tax reminders for 2014

Amid yuletide celebrations, Philippine entities are busy closing their books of accounts for

2014. We take this opportunity to point out some key issues that are worthy to remember.

Client

advisory

letter

Isla Lipana & Co.

Income tax computation and

tax return preparation

No or under withholding penalized twice for failure to comply with the withholding

tax requirement. This is too steep a penalty especially if

of tax disallows the related you consider the fact that the income recipient is expected

to have reported the income and paid the corresponding

expense income tax. However, the imposition appears to have basis

in the Tax Code. Thus, it is the lookout of taxpayers to

Failure to remit the required withholding tax on time will properly comply with the requirement.

result to deficiency: (1) income tax and (2) withholding

tax assessments. On a related note on taking deductions, taxpayers must

properly distinguish valid expense “accruals” from mere

Expenses must be accrued/deducted and subjected to “provisions” or estimates. Accounting rules play an

withholding tax (if applicable) once the obligation is fixed important role on this matter. In fact, the Supreme Court

and the amount is knowable. provided clear guiding principles on when an expense

should be accrued and deducted for tax purposes. According

When claiming deductions for income tax purposes, to the High Court, a taxpayer must recognize an expense

taxpayers are obliged to withhold tax on those income when the obligation to pay is already fixed; the amount can

payments that are subject to withholding tax.1 The be determined with reasonable accuracy; and it is already

withholding tax should be withheld and remitted to the knowable, meaning the propriety of an accrual must be

BIR within the due dates provided under the Tax Code and judged not only by the facts that a taxpayer knew, but also

withholding tax regulations.2 those facts that the taxpayer could reasonably be expected

to have known.6

In terms of the timing, withholding agents are obligated to

withhold tax when the income is paid, becomes payable or Looking at it the other way, if the right to pay is uncertain in

when the expense/asset is accrued/recorded in the books, terms of timing and amount, the related expense should be

whichever comes first. In case the income is not yet paid considered a mere provision or estimate in the meantime.

or payable but has already been accrued or recorded as an As such, it cannot be claimed as a valid deduction for tax

expense or asset in the books of the taxpayer, the obligation purposes and thus no withholding obligation should apply.

to withhold tax arises in the last month of the quarter when

the deduction is claimed for income tax purposes.3

Expenses and input tax

In the past, the BIR had allowed deductions even if the

withholding taxes were paid only at the time of audit or

without compliant official

investigation.4 But now, despite payment of deficiency

withholding tax during audit or investigation, the related

receipts or invoices not valid

expense shall still be disallowed as deduction.5 As a result Alternative evidence to support expense deduction and

of this punitive measure, the withholding agent will be input tax credit is useless if not duly registered with BIR

1 Section 34(K), Tax Code. As a rule, when claiming a deduction, taxpayers are

2 Sections 58 and 81, Tax Code; Revenue Regulations (“RR”) required to substantiate such expense with sufficient

No. 2-98, as amended.

3 RR 12-2001.

4 RR 14-2002. 6 Commissioner of Internal Revenue vs. Isabela Cultural

5 RR 12-2013. Corporation, GR No. 172231 dated 12 February 2007.

2 Client advisory letter 2014

evidence, such as official receipts or other adequate records,

showing the amount of expense and its direct connection to

Noncompliant alphalist of

one’s trade or business.7 payees disallows expense

In this regard, an old Supreme Court case8 provides that deductions

not only must the taxpayer meet the business test, he must

substantially prove the deductions claimed by evidence or Under the Tax Code, failure to file correct or accurate

records; otherwise, such deductions will be disallowed. alphalist of payees gives rise to monetary penalty only but

The taxpayer must prove by substantial evidence that the according to the BIR it shall result to disallowance of the

expense being claimed has a proximate relation to his related expenses

business.

Early 201410, the BIR requires all withholding agents,

Significantly, in 2013, the BIR mandated taxpayers to secure regardless of the number of employees and payees, whether

a new Authority to Print (ATP) covering all their principal the employees or payees are exempt or not, to submit an

and supplementary receipts or invoices.9 Non-compliance alphabetical list of employees and list of payees on income

with the ATP rule will be treated as if no receipts/invoices payments subject to creditable and final withholding taxes

were issued. Consequently, no deduction or input tax credits in the following manner:

shall be allowed if supported by non-compliant receipts/

invoices as they are not valid proof of substantiation. The • Attachment in the eFPS

Bureau’s objective is to increase compliance not just on the • Electronic Submission using the BIR’s website address at

purchasers, but more so, on the supplier side. esubmission@bir.gov.ph

• Electronic Mail (email) to dedicated BIR addresses

The BIR’s new rule restricts the amount that may be validly

claimed as a deduction as it disregards other adequate According to the BIR submissions of alphalist where income

records or evidence as proof of deduction, which many view payments and taxes withheld are lumped into one single

as contrary to what the Tax Code and jurisprudence allows. amount (e.g. various employees, various payees, PCD

In reviewing deductions to be taken, taxpayers should nominees, others) shall not be allowed. Non-conformity

assess the level of substantiation available, and decide with the prescribed format constitutes non-receipt of the

accordingly. submission and the income payment shall not qualify as a

deductible expense.

Note that the Tax Code11 imposes only administrative

7 Section 34(A)(b), Tax Code. penalties (PHP1,000 for every failure; PHP25,000

8 Atlas Consolidated Mining & Development Corporation vs. maximum for a calendar year) for failure to file certain

CIR, GR No. L-26911 dated 27 January 1981. information returns. Thus, the penalty of disallowing the

9 Revenue Memorandum Circular No. 52-2013. related expenses is too harsh and many taxpayers have

bravely opposed this regulation.

Glossary

10 Revenue Regulations No. 1-2014

BIR - Bureau of Internal Revenue

11 Section 250

eFPS - Electronic Filing and Payment System

PCD - Philippine Central Depository

2014 Client advisory letter 3

In fact several organizations went to the Supreme Court12 inclusive. The factors in determining whether the item of

and have been successful in securing temporarily restraining cost or expense should be part of direct costs are the direct

order (“TRO”) effective immediately and until further relation of such item to the PEZA-registered activities. 16

orders, stopping the BIR, the DoF and SEC from further

enforcing said regulations.

Option to carry-over excess

Intention to avail OSD must creditable withholding tax

appear in first taxable is lasting

quarter Decision to refund excess creditable withholding tax

(CWT) can be changed

Once the itemized deductions are used in the first quarter, Carry-over option is permanent

OSD is no longer allowed at year-end

According to BIR, having mixed income makes you The Tax Code17 provides that any excess of the sum of the

ineligible to use OSD quarterly tax payments over the total tax due on the entire

taxable income of that year shall either be:

Without any qualification, Philippine companies and

branches of foreign companies may opt to claim a 40% • carried over as excess credit; or

Optional Standard Deductions (OSD) in lieu of itemized • refunded.

deductions. They need only signify such election in the tax

return which shall be irrevocable for the taxable year.13 Taxpayer who indicated the option to cash refund or tax

credit certificate or who did not indicate any of the option

Under the BIR’s rules14, the taxpayer must signify his may still use the excess CWT as credit against its income tax

irrevocable intention to use either OSD or itemized due for the following years.

deductions in the first quarter return. Moreover, when the

BIR issued the use of New Tax Forms earlier this year15, it Once the option to carry-over has been elected, such option

also denied certain entities the right to avail of the OSD and shall be irrevocable. According to the Supreme Court,

mandated them to claim itemized deductions. These entities the irrevocability rule is not limited to the immediately

are those exempt under Section 30 and 27(C) of the Tax following taxable year but extends to the next succeeding

Code; those subject to special rates; and those with mixed taxable years. Such unused tax credits will remain in the

income. Many believe that the above is not in accord with taxpayer’s books in the succeeding taxable years until fully

the intention of the Tax Code. utilized.18 In short, the carry-over option is permanent.

Direct cost of PEZA- Next-day payment before

registered entities not noontime cut-off is late

exclusive Previously, taxpayers are allowed to file tax returns and

pay tax the following day before noontime cut-off without

Despite BIR regulations and rulings to the contrary, for penalties.19 However, starting 2012, the BIR no longer

purposes of computing the 5% gross income tax of entities considers this as a valid reason to abate penalties.20

registered with the Philippine Economic Zone Authority Thus, taxpayers should ensure that returns are filed and

(PEZA), the Court of Tax Appeals (CTA) has confirmed corresponding taxes are paid within the deadlines to avoid

that the list of direct costs under RR No. 11-2005 is not all- incurring penalties.

12 PSE, BAP, PASBDI, FMAP, TOAPMHI vs. Secretary of

Finance, CIR and Chairperson of SEC, G.R. No. 213860 dated

9 September 2014

16 East Asia Utilities Corporation vs. CIR, Court of Tax Appeals

13 Section 34(L), Tax Code.

Case No. 8179 dated 21 May 2014.

14 Revenue Memorandum Circular No. 16-2010.

17 Section 76, Tax Code.

15 Revenue Regulations No. 2-2014.

18 Asiaworld Properties Philippine Corporation vs. CIR, GR. No.

171766 dated 29 July 2010.

19 Revenue Regulations No. 13-2001.

20 Revenue Regulations No. 4-2012.

4 Client advisory letter 2014

Employee stock options

are taxed depending on Tax compliance

position

Stock options are subject to fringe benefit tax if the

matters

employee is supervisor or manager while it will be

subject to withholding tax on compensation if given to

rank and file employees

BIR treats stock options as shares of stock and imposes

BIR orders taxpayers to

DST, CGT and/or donor’s tax on every transfer thereof preserve their records for

Recently, the BIR issued a more comprehensive circular21 ten years

on stock options, discussing the specific tax treatment of

the income/gain arising from the various stages of the The law says taxpayers must keep their books for three

stock option cycle, i.e., grant, exercise and sale. years unless there is a finding of fraud

The RMC declares that stock options are “shares of stock” The BIR says ten years without distinction

and shall be taxable as such. When a stock option is

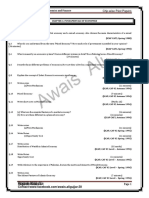

granted by the employer without any consideration, the The Tax Code requires taxpayers to preserve their books of

employer cannot claim any expense deductions. In case accounts, including subsidiary books and other accounting

the option is granted for a price, the entire consideration records, for a period from the last entry in each book until

shall be subject to capital gains tax of 10% (5% for the last day within which the Commissioner is authorized

the first PHP100,000 net gain) on the net capital gain. to make an assessment.1 The Commissioner is authorized

In either case, the issuance of the option is subject to to examine the books and make an assessment within three

documentary stamp tax (DST). (3) years from the due date of filing the tax return or actual

date of filing the return, whichever is later.2 In case of fraud,

Any transfer of stock options shall be treated as sale or the Commissioner can make an assessment within ten (10)

exchange of unlisted shares subject also to capital gains years from discovery of such fraudulent acts.3

tax and DST. If the transfer is without consideration,

however, it will instead be subject to 30% donor’s tax Starting 2013, however, taxpayers are required by the BIR

based on the fair market value (FMV) of the option. to retain hardcopies of their books and accounting records

for ten years instead of three years.4 In 2014, the BIR further

Upon exercise, the excess of the FMV over the exercise modified the rule, requiring taxpayers to keep hardcopies

price shall be taxed depending on the position of the of their books for the first five (5) years, while electronic

grantee. For rank and file grantees, the excess shall be copies may be retained for the next five (5) years using

subject income tax and withholding tax on compensation; an Electronic Storage System (ESS) that meets the BIR’s

for supervisors and managers, the excess shall be subject control requirements to ensure the integrity, accuracy and

to fringe benefit tax. reliability.5

In case the grantee is a supplier, the stock options shall While it may be more practical to store documents

be treated as payment for the supply of goods/services, electronically, as opposed to maintaining voluminous hard

hence subject to the relevant withholding tax and other copies, which can fade away or be accidentally destroyed,

applicable taxes. certainly, having a compliant ESS entails additional costs

(which can be relatively substantial) of doing business

The BIR also imposed reportorial requirements during

each stage of the stock option transaction.

1 Section 235, Tax Code.

2 Section 203, Tax Code.

3 Section 222, Tax Code.

4 Revenue Regulations No. 17-2013.

21 Revenue Memorandum Circular No. 79-2014. 5 Revenue Regulation No. 5-2014.

2014 Client advisory letter 5

for taxpayers. The issue remains whether a ten-year

retention period is in keeping with what the Tax Code

requires. Yuletide greetings

Documenting transfer

pricing arrangement must

not be an afterthought

Transactions with related parties must be at arm’s We wish you and your families a m

length and must be supported with simultaneous

documentations amazing new year!

The BIR’s transfer pricing rules became effective in

February 2013.6 One of the crucial requirements

in the guidelines is for taxpayers to have transfer

pricing documentation to demonstrate compliance

with the arm’s length principle as regards related

party transactions. The documentation must be

“contemporaneous” i.e., must be in existence at the time

the taxpayer develops or implements any intercompany

arrangement, or reviews these arrangements when

preparing tax returns. While the BIR does not require

transfer pricing documents to be submitted when the

tax returns are filed, such documents should be retained

by the taxpayers and submitted to BIR upon request.

We hope that the above pointers will help ease your

year-end review process as another year comes to

a close and help you manage your tax position for

2014.

6 Revenue Regulations No. 2-2013.

6 Client advisory letter 2014

s Talk to us

For further discussion on the contents of this issue of

the Client Advisory Letter, please contact any of our

partners.

meaningful Christmas and an

Alexander B. Cabrera Malou P. Lim

Chairman & Senior Partner, Tax Managing Partner

concurrent Tax Partner T: +63 (2) 459 2016

T: +63 (2) 459 2002 malou.p.lim@

alex.cabrera@ph.pwc.com ph.pwc.com

Lawrence C. Biscocho Carlos T. Carado II

T: +63 (2) 459 2007 T: +63 (2) 459 2020

lawrence.biscocho@ carlos.carado@

ph.pwc.com ph.pwc.com

Fedna B. Parallag

T: +63 (2) 459 3109

fedna.parallag@

ph.pwc.com

Request for copies of text

You may ask for the full text of the Client Advisory Letter

by writing our Tax Department, Isla Lipana & Co.,

29th Floor, Philamlife Tower, 8767 Paseo de Roxas, 1226

Makati City, Philippines. T: +63 (2) 845 2728.

F: +63 (2) 845 2806. Email lyn.golez@ph.pwc.com.

2014 Client advisory letter 7

www.pwc.com/ph

© 2014 Isla Lipana & Co. All rights reserved.

PwC refers to the Philippine member firm, and may sometimes refer to the PwC network.

Each member firm is a separate legal entity.

Please see www.pwc.com/structure for further details.

Isla Lipana & Co. helps organizations and individuals create the value they’re looking

for. We’re a network of firms in 157 countries with more than 195,000 people who are

committed to delivering quality in assurance, tax and advisory services. Find out more by

visiting us at pwc.com/ph.

Disclaimer

The contents of this advisory letter are summaries, in general terms, of selected issuances

from various government agencies. They do not necessarily reflect the official position of

Isla Lipana & Co. They are intended for guidance only and as such should not be regarded

as a substitute for professional advice.

Você também pode gostar

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeNo Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeNota: 1 de 5 estrelas1/5 (1)

- 1040 Exam Prep: Module II - Basic Tax ConceptsNo Everand1040 Exam Prep: Module II - Basic Tax ConceptsNota: 1.5 de 5 estrelas1.5/5 (2)

- Costing SheetDocumento2 páginasCosting SheetazadAinda não há avaliações

- Rich Dad, Poor DadDocumento10 páginasRich Dad, Poor DadEngrZaptrescunoPauAinda não há avaliações

- Deferred Tax and Business Combinations: IFRS 3/IAS 12Documento15 páginasDeferred Tax and Business Combinations: IFRS 3/IAS 12direhitAinda não há avaliações

- 1 Syllabus - NIRC Remedies (1st Sem 18-19)Documento13 páginas1 Syllabus - NIRC Remedies (1st Sem 18-19)Zyki Zamora Lacdao100% (3)

- Tax RemediesDocumento16 páginasTax RemediesJoshua Catalla Mabilin100% (1)

- LEGAL REMEDIES TAX REVIEW FinalDocumento266 páginasLEGAL REMEDIES TAX REVIEW FinalAlgen S. Gomez100% (1)

- Tax DigestDocumento7 páginasTax DigestLeo Angelo LuyonAinda não há avaliações

- Cir Vs Fitness by DesignDocumento2 páginasCir Vs Fitness by DesignAnonymous 5MiN6I78I0Ainda não há avaliações

- Pbcom V CirDocumento9 páginasPbcom V CirAbby ParwaniAinda não há avaliações

- TAXATION II REMEDIES CasesDocumento26 páginasTAXATION II REMEDIES CasesJayzel LaureanoAinda não há avaliações

- CIR v. Isabela Cultural CorporationDocumento14 páginasCIR v. Isabela Cultural CorporationkimAinda não há avaliações

- Remedies of The TaxpayerDocumento4 páginasRemedies of The TaxpayerAngelyn Sanjorjo50% (2)

- 02-IAS 12 Income TaxesDocumento42 páginas02-IAS 12 Income TaxesHaseeb Ullah KhanAinda não há avaliações

- Final Tax and Creditable Withholding TaxesDocumento3 páginasFinal Tax and Creditable Withholding Taxesarrianemartinez100% (4)

- CIR vs. ISABELA CULTURAL CORPDocumento2 páginasCIR vs. ISABELA CULTURAL CORPRenmarc JuangcoAinda não há avaliações

- 8 Pointers For Expanded Withholding Taxes in The PhilippinesDocumento3 páginas8 Pointers For Expanded Withholding Taxes in The Philippinesjan daveAinda não há avaliações

- Cir Vs Isabel Cultural Corp. GR No. 172231 Feb 12, 2007Documento9 páginasCir Vs Isabel Cultural Corp. GR No. 172231 Feb 12, 2007Godfrey Saint-OmerAinda não há avaliações

- Green Valley Marketing Corp. v. Commissioner of Internal Revenue, C.T.A. Case No. 8988, (November 3, 2017) PDFDocumento42 páginasGreen Valley Marketing Corp. v. Commissioner of Internal Revenue, C.T.A. Case No. 8988, (November 3, 2017) PDFKriszan ManiponAinda não há avaliações

- Re: Accrual BasisDocumento7 páginasRe: Accrual BasisEmmanuel Emigdio DumlaoAinda não há avaliações

- CIR Vs Isabela Cultural Corporation (ICC)Documento11 páginasCIR Vs Isabela Cultural Corporation (ICC)Victor LimAinda não há avaliações

- Departmental Interpretation and Practice Notes No. 12 (Revised)Documento6 páginasDepartmental Interpretation and Practice Notes No. 12 (Revised)Difanny KooAinda não há avaliações

- Revenue Memorandum Order No. 42-03: October 23, 2003Documento11 páginasRevenue Memorandum Order No. 42-03: October 23, 2003nathalie velasquezAinda não há avaliações

- TAX 2 Group 1 Handout PDFDocumento6 páginasTAX 2 Group 1 Handout PDFMi-young SunAinda não há avaliações

- And Prescribed by The National Office." (Italics and Emphasis Supplied)Documento2 páginasAnd Prescribed by The National Office." (Italics and Emphasis Supplied)Ckey ArAinda não há avaliações

- CWT RulesDocumento2 páginasCWT RulesCherry Amor Venzon OngsonAinda não há avaliações

- CIR v. Isabela CulturalDocumento4 páginasCIR v. Isabela CulturalDiwata de LeonAinda não há avaliações

- Tax 3 - Unit 3 Chapter 10 Tax Remedies of TaxpayersDocumento7 páginasTax 3 - Unit 3 Chapter 10 Tax Remedies of TaxpayersJeni ManobanAinda não há avaliações

- Tax AssessmentsDocumento3 páginasTax AssessmentsKing AlduezaAinda não há avaliações

- Deloitte Africa Tax and LegalDocumento2 páginasDeloitte Africa Tax and LegalCalvin kamothoAinda não há avaliações

- Deductions DigestDocumento5 páginasDeductions DigestJesse Myl MarciaAinda não há avaliações

- GR 172231 - CIR Vs Isabela Cultural CorpDocumento4 páginasGR 172231 - CIR Vs Isabela Cultural CorpJane MarianAinda não há avaliações

- Acct Case 1 - 211123 - 122050Documento4 páginasAcct Case 1 - 211123 - 122050HADTUGIAinda não há avaliações

- Webinar On How To Deal With Open Cases in The BirDocumento25 páginasWebinar On How To Deal With Open Cases in The BirkirkoAinda não há avaliações

- XDocumento2 páginasXSophiaFrancescaEspinosaAinda não há avaliações

- Taxation Case Digests Part IIDocumento35 páginasTaxation Case Digests Part IIAdNU College of Law LibraryAinda não há avaliações

- Fate of "Unjust Enrichment" Principle Under GSTDocumento2 páginasFate of "Unjust Enrichment" Principle Under GSTRajula Gurva ReddyAinda não há avaliações

- Tax Digests 2018 CompilationDocumento32 páginasTax Digests 2018 CompilationMarhen ST CastroAinda não há avaliações

- CIR v. Isabela Cultural Corporation, G.R. No. 172231, 2007Documento5 páginasCIR v. Isabela Cultural Corporation, G.R. No. 172231, 2007JMae MagatAinda não há avaliações

- Cases FinalsDocumento10 páginasCases FinalsNīc CādīgālAinda não há avaliações

- Facts:: in Its November 9, 2010 Decision CTA Special First DivisionDocumento3 páginasFacts:: in Its November 9, 2010 Decision CTA Special First DivisionWilliam BilarAinda não há avaliações

- 3 CIR Vs FILINVESTDocumento40 páginas3 CIR Vs FILINVESTLouise Nicole AlcobaAinda não há avaliações

- RMC No. 42-03 - Rules On Assessment of National INternal Revenue Taxes Covered by A LN Under The Relief System PDFDocumento12 páginasRMC No. 42-03 - Rules On Assessment of National INternal Revenue Taxes Covered by A LN Under The Relief System PDFCkey ArAinda não há avaliações

- W3 Module 3 - Tax Administration Part IIDocumento14 páginasW3 Module 3 - Tax Administration Part IIElmeerajh JudavarAinda não há avaliações

- 1maple v. CIRDocumento26 páginas1maple v. CIRaudreydql5Ainda não há avaliações

- Sbu Tax MT Samaniego Emil (4S)Documento5 páginasSbu Tax MT Samaniego Emil (4S)Naked PolitixxxAinda não há avaliações

- GR No. 172231 CIR V Isabela Cultural CorporationDocumento9 páginasGR No. 172231 CIR V Isabela Cultural CorporationRene ValentosAinda não há avaliações

- Practical Issues in TDSDocumento21 páginasPractical Issues in TDShrushikesh0501Ainda não há avaliações

- Cir VS IccDocumento9 páginasCir VS IccDel Rosario MarianAinda não há avaliações

- AS22Documento7 páginasAS22Selvi balanAinda não há avaliações

- TX102 Topic 1 Module 3Documento21 páginasTX102 Topic 1 Module 3Richard Rhamil Carganillo Garcia Jr.Ainda não há avaliações

- National TaxationDocumento18 páginasNational TaxationShiela Joy CorpuzAinda não há avaliações

- 11 Income-Tax Lecture-NotesDocumento6 páginas11 Income-Tax Lecture-NotesandreamrieAinda não há avaliações

- Historical Perspective: 23 Subsequently BecameDocumento10 páginasHistorical Perspective: 23 Subsequently BecameSella DestikaAinda não há avaliações

- REMEDIES by J. DimaampaoDocumento2 páginasREMEDIES by J. DimaampaoJeninah Arriola CalimlimAinda não há avaliações

- Advanced Taxation & Fiscal Policy Nov 2011Documento7 páginasAdvanced Taxation & Fiscal Policy Nov 2011Samuel DwumfourAinda não há avaliações

- Presumptions in Tax AssessmentsDocumento2 páginasPresumptions in Tax AssessmentsDennis VelasquezAinda não há avaliações

- Revenue Regulations No. 05-99: Requirements For Deductibility of Bad Debts From Gross IncomeDocumento5 páginasRevenue Regulations No. 05-99: Requirements For Deductibility of Bad Debts From Gross IncomeelmersgluethebombAinda não há avaliações

- CIR V. Isabela Cultural Corp.: GR NO 172231 February 12, 2007Documento2 páginasCIR V. Isabela Cultural Corp.: GR NO 172231 February 12, 2007Mary AnneAinda não há avaliações

- Taxation Law Pre-Bar Notes 2017-SupplementalDocumento7 páginasTaxation Law Pre-Bar Notes 2017-SupplementalPnix HortinelaAinda não há avaliações

- Tax Remedies Under The Nirc Assessment of Internal Revenue TaxesDocumento15 páginasTax Remedies Under The Nirc Assessment of Internal Revenue TaxesmarizenocAinda não há avaliações

- BiddingDocumento75 páginasBiddingFedsAinda não há avaliações

- 1604e 2018Documento2 páginas1604e 2018FedsAinda não há avaliações

- 2316Documento1 página2316FedsAinda não há avaliações

- 1604E Jan 2018 ENCS Final Annex BDocumento2 páginas1604E Jan 2018 ENCS Final Annex BFeds100% (1)

- Preservation of Books of Accounts and Accounting Records in Philippines - Tax and Accounting Center, IncDocumento7 páginasPreservation of Books of Accounts and Accounting Records in Philippines - Tax and Accounting Center, IncFedsAinda não há avaliações

- CTA CaseDocumento9 páginasCTA CaseFedsAinda não há avaliações

- 1604E Jan 2018 ENCS Final Annex BDocumento2 páginas1604E Jan 2018 ENCS Final Annex BFeds100% (1)

- Revenue Memorandum Circular No. 55-2016: For ExampleDocumento2 páginasRevenue Memorandum Circular No. 55-2016: For ExampleFedsAinda não há avaliações

- 1604-C Guidelines Jan 2018 FinalDocumento1 página1604-C Guidelines Jan 2018 FinalFedsAinda não há avaliações

- Deciding On The Donee: Step3Documento4 páginasDeciding On The Donee: Step3FedsAinda não há avaliações

- Robinson CGEDocumento16 páginasRobinson CGEErmita YusidaAinda não há avaliações

- Pdfanddoc 33163Documento74 páginasPdfanddoc 33163Unison Homoeo LaboratoriesAinda não há avaliações

- Fact-Sheet SyngeneDocumento4 páginasFact-Sheet SyngeneRahul SharmaAinda não há avaliações

- CAF 02 CHP Wise Past PaperDocumento45 páginasCAF 02 CHP Wise Past PaperaliAinda não há avaliações

- Defined Contribution Plan Summary DescriptionDocumento20 páginasDefined Contribution Plan Summary DescriptionJorge Monroy VillapuduaAinda não há avaliações

- RMO No. 8-2017Documento5 páginasRMO No. 8-2017attyGezAinda não há avaliações

- 1588756021-1693-Allegis Servicses Final PrintDocumento9 páginas1588756021-1693-Allegis Servicses Final PrintDehradun MootAinda não há avaliações

- BMR Case StudyDocumento92 páginasBMR Case StudychamatkaribabaAinda não há avaliações

- Jawaban Praktikum AkdDocumento5 páginasJawaban Praktikum AkdNurhasanahAinda não há avaliações

- London Examinations GCE: Accounting (Modular Syllabus) Advanced Subsidiary/Advanced LevelDocumento16 páginasLondon Examinations GCE: Accounting (Modular Syllabus) Advanced Subsidiary/Advanced LevelSadman DibboAinda não há avaliações

- Turbocharged - Assuming Coverage With Outperform - 23set19 - BBIDocumento17 páginasTurbocharged - Assuming Coverage With Outperform - 23set19 - BBIbenjah2Ainda não há avaliações

- Working Capital and The Financing Decision: Discussion QuestionsDocumento35 páginasWorking Capital and The Financing Decision: Discussion QuestionsBlack UnicornAinda não há avaliações

- Basic AccountingDocumento16 páginasBasic AccountingronnelAinda não há avaliações

- Strategy of McDonalsDocumento38 páginasStrategy of McDonalsSufianAinda não há avaliações

- Tamil Nadu Revenue Recovery Act, 1864 PDFDocumento37 páginasTamil Nadu Revenue Recovery Act, 1864 PDFLatest Laws TeamAinda não há avaliações

- IHRM Module 6Documento53 páginasIHRM Module 6Dr. Veena Santhosh RaiAinda não há avaliações

- Partnership Deed FormatDocumento5 páginasPartnership Deed FormatAnkit RaiAinda não há avaliações

- Joint Stock CompanyDocumento58 páginasJoint Stock CompanyZunaira TauqeerAinda não há avaliações

- Orissa Apartment Ownership Act 1982Documento21 páginasOrissa Apartment Ownership Act 1982Pathadarshini ParijaAinda não há avaliações

- Stock Valuation Practice QuestionsDocumento6 páginasStock Valuation Practice QuestionsmushtaqAinda não há avaliações

- Chapt 8 Deduct From Gross IncomeDocumento10 páginasChapt 8 Deduct From Gross IncomeKeysi02Ainda não há avaliações

- F&A Best - SAPOSTDocumento23 páginasF&A Best - SAPOSTsheikh arif khan100% (2)

- Books of AccountsDocumento31 páginasBooks of AccountsFerly Mae ZamoraAinda não há avaliações

- Human Capital FormationDocumento9 páginasHuman Capital Formationtannu singh67% (6)

- Valuing SynergiesDocumento4 páginasValuing SynergiesAnonymous hPo9UwAinda não há avaliações

- YCAB Annual Report 2014Documento102 páginasYCAB Annual Report 2014windaAinda não há avaliações

- 3 Nights: HFVD5723Documento3 páginas3 Nights: HFVD5723SPIDERMAN - IN EXILEAinda não há avaliações

- Future of Outbound Travel in Asia PacificDocumento44 páginasFuture of Outbound Travel in Asia PacificAnonymous P1dMzVxAinda não há avaliações