Escolar Documentos

Profissional Documentos

Cultura Documentos

Python Data Analysis Exercises

Enviado por

Google SpaceDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Python Data Analysis Exercises

Enviado por

Google SpaceDireitos autorais:

Formatos disponíveis

Python Data Analysis Exercises

1. Level 1: Get daily returns of Nifty 50 index and calculate cumulative abnormal

return of its individual stocks 7 days before, on the day and 7 days after FY

2018 Budget presentation. Divide the stock CARs into quintiles and back test

return on the spread between the daily returns of bottom quintile and top

quintile stocks over 90 trading days post budget presentation.

2. Level 1: Go to Capexdx database and get the data on stalled projects. They

have data on stalled/stopped/projects under implementation etc. under

different files. There are six or seven files that has different types of data. Some

of the columns are common across all the files. Create two or at most three

files by merging all data by a certain column/columns. Now go to ProwessDx

and download valuation and liquidity ratios of firms whose projects have

stopped yearwise. Merge the two data sets.

3. Level 2 (Requires static web scraping using BeautifulSoup): Go to NCLT

website IBBI orders which contains all court orders of firms dragged to

bankruptcy under IBC 2016. Download all pdf files into four different folders-

admitted, resolved, liquidation and others.

4. Level 3 (Requires interactive web scraping using Selenium): Get a list of BSE

500 firms and their auditors from 2010 to 2018. Auditor data is available on

Prowess. You would have to figure out the list of BSE 500 firms. Ignore index

rebalancing for the time being (although in actual research you would have to

keep that in consideration) and treat all BSE 500 firms at the end of FY 2018

to be the set from 2010-2018. Remove all firms that have more than one

auditor (Most banks, PSUs etc. would get removed from the set and you would

be left with perhaps 150-160 firms). The task is to analyse the returns of firms

around the days whenever an auditor is changed by the company.

A) Flag the auditor changes from the data from Prowess. The database gives

you the year of auditor change. You need the exact date of announcement

of auditor change.

B) Go to BSE website. It has a section on Corporate Announcements. Every

firm listed on BSE has some announcements (AGM, change of directors,

dividend payout, stock splits etc. along with their time stamp, date and

year of when the information was disseminated to exchange). Most auditor

change notifications are inside the AGM announcement document. Using

Selenium package in Python, extract the dates against these AGM pdfs and

put them against the Year of change from the file you cleaned from

Prowess.

C) Get data on daily BSE returns of the stocks in your sample (point B above)

7 days +/- the date of announcement of auditor change. Get the daily Index

returns of BSE 500 for these days (NSE 500 daily returns can be used as

a proxy) and find the CARs (like exercise 1) around the days of auditor

change announcement. (Remember that in exercise 1, the Budget

presentation was a single date. But in this auditor change, dates around

which CARs are to be calculated is different for different firms and is a

moving variable).

Você também pode gostar

- 21st Century Teachers' Tales PHONICS For BEGINNERS, Short Vowels Sound - Volume 1Documento48 páginas21st Century Teachers' Tales PHONICS For BEGINNERS, Short Vowels Sound - Volume 1Rose de Dios43% (7)

- CAPEX Planning Tutorial v2Documento10 páginasCAPEX Planning Tutorial v2PrashantRanjan2010Ainda não há avaliações

- Carl Schmitt and Donoso CortésDocumento11 páginasCarl Schmitt and Donoso CortésReginaldo NasserAinda não há avaliações

- General LedgerDocumento3 páginasGeneral LedgerAnshuman SharmaAinda não há avaliações

- SAP and Finance - Asset AccountingDocumento6 páginasSAP and Finance - Asset Accountingpawanjames7896Ainda não há avaliações

- Sap Fico Go Live DetailedCutover ActivitiesDocumento4 páginasSap Fico Go Live DetailedCutover Activitiesanand chawanAinda não há avaliações

- Fico PDFDocumento148 páginasFico PDFAniruddha ChakrabortyAinda não há avaliações

- Reform in Justice System of PakistanDocumento5 páginasReform in Justice System of PakistanInstitute of Policy Studies100% (1)

- Implementation - Real Time Type of Projects: ND RDDocumento14 páginasImplementation - Real Time Type of Projects: ND RDKrishaAinda não há avaliações

- ACCA F5 Tuition Mock June 2012 QUESTIONS Version 3 FINAL at 23rd April 2012Documento9 páginasACCA F5 Tuition Mock June 2012 QUESTIONS Version 3 FINAL at 23rd April 2012Hannah NazirAinda não há avaliações

- Oracle Fixed AssetsDocumento8 páginasOracle Fixed AssetsRakesh NatarajAinda não há avaliações

- Erp Fusion Reporting WPDocumento10 páginasErp Fusion Reporting WPS.Nantha KumarAinda não há avaliações

- How To Set Up Matrix Consolidation With BPC 7.5 NWDocumento16 páginasHow To Set Up Matrix Consolidation With BPC 7.5 NWhmarkillieAinda não há avaliações

- (Complaint Affidavit For Filing of BP 22 Case) Complaint-AffidavitDocumento2 páginas(Complaint Affidavit For Filing of BP 22 Case) Complaint-AffidavitRonnie JimenezAinda não há avaliações

- DILG Resources 2011216 85e96b8954Documento402 páginasDILG Resources 2011216 85e96b8954jennifertong82Ainda não há avaliações

- Asset Management SrsDocumento42 páginasAsset Management SrsDonz MallawarachchiAinda não há avaliações

- Sap Fico Project Book MaterialDocumento100 páginasSap Fico Project Book Materialabhilash eshwarappaAinda não há avaliações

- BSBFIM601 Hints For Task 2Documento32 páginasBSBFIM601 Hints For Task 2Mohammed MGAinda não há avaliações

- Reporting Data in Alternate Unit of Measure in BI 7.0Documento10 páginasReporting Data in Alternate Unit of Measure in BI 7.0shine_vallickavuAinda não há avaliações

- Prepare Budgets: Performance ObjectiveDocumento25 páginasPrepare Budgets: Performance ObjectiveTanushree JawariyaAinda não há avaliações

- BSBFIM601 Hints For Task 2Documento32 páginasBSBFIM601 Hints For Task 2Marwan Issa71% (7)

- Project Guidelines - MBADocumento2 páginasProject Guidelines - MBATofa PatraAinda não há avaliações

- Monika Narang: Mobile No: +91-9945154240 EmailDocumento6 páginasMonika Narang: Mobile No: +91-9945154240 EmailRicky DasAinda não há avaliações

- Start From HereDocumento18 páginasStart From Herekonda83Ainda não há avaliações

- Revisions-October 13-2023-1Documento2 páginasRevisions-October 13-2023-1Usman RaiAinda não há avaliações

- InstructionsforProject BSBFIM6Documento7 páginasInstructionsforProject BSBFIM6AYUSHI KULTHIAAinda não há avaliações

- Cell Based Reporting For Effective Custom Reports and AnalyticsDocumento6 páginasCell Based Reporting For Effective Custom Reports and Analyticskalicharan13Ainda não há avaliações

- Fin 611course Project Part 2Documento3 páginasFin 611course Project Part 2peter muliAinda não há avaliações

- Dominic Robinson CV 042013Documento6 páginasDominic Robinson CV 042013dominicrobinsonAinda não há avaliações

- 130: What Are The Key Flexfields That Are Only Used in Oracle Applications by The Accounting Flexfield and No Other Flexfield?Documento5 páginas130: What Are The Key Flexfields That Are Only Used in Oracle Applications by The Accounting Flexfield and No Other Flexfield?Vidhi SethiAinda não há avaliações

- MastekDocumento77 páginasMastekmanish121Ainda não há avaliações

- GL & AP EntriesDocumento3 páginasGL & AP EntriesObilesu RekatlaAinda não há avaliações

- Financial Reporting: R12 Oracle General Ledger Management FundamentalsDocumento62 páginasFinancial Reporting: R12 Oracle General Ledger Management FundamentalsAdil Akbar JanjuaAinda não há avaliações

- SAP BI/BW Interview Questions Asked in Face To Face (F2F) Interviews and Phone InterviewsDocumento19 páginasSAP BI/BW Interview Questions Asked in Face To Face (F2F) Interviews and Phone InterviewsPrabhakar PrabhuAinda não há avaliações

- Project Guidelines FS 2022Documento3 páginasProject Guidelines FS 2022Rahul UoAinda não há avaliações

- Project For ACG 3301 Summe 1Documento1 páginaProject For ACG 3301 Summe 1Napoleon LedezmaAinda não há avaliações

- Advanced Financial Statements Analysis by Investopedia PDFDocumento74 páginasAdvanced Financial Statements Analysis by Investopedia PDFbijueAinda não há avaliações

- User's Manual CapitalineonlineDocumento74 páginasUser's Manual CapitalineonlineGurjeevAnandAinda não há avaliações

- Stage: Initiation Project Proposal 2006/7 Upgrade of ERI SUN Accounting SystemDocumento6 páginasStage: Initiation Project Proposal 2006/7 Upgrade of ERI SUN Accounting SystemKevin Ruel Manuto OlivesAinda não há avaliações

- Microsoft - PL 300.VJan 2024.by .HuynDair.127qDocumento101 páginasMicrosoft - PL 300.VJan 2024.by .HuynDair.127qSibasish RoyAinda não há avaliações

- Developing IFRS Footnotes: Change RequestDocumento7 páginasDeveloping IFRS Footnotes: Change RequestCMA RAMESHWARAM RAMAinda não há avaliações

- Periodic Review Procedure v1Documento8 páginasPeriodic Review Procedure v1migueAinda não há avaliações

- SAP Real Time 001Documento10 páginasSAP Real Time 001Abhijeet SinghAinda não há avaliações

- Unit 7 Project Management 7Documento31 páginasUnit 7 Project Management 7chuchuAinda não há avaliações

- Final Project PEP, KODocumento3 páginasFinal Project PEP, KOCharudatta MundeAinda não há avaliações

- Dom 9Documento2 páginasDom 9narayana saAinda não há avaliações

- WWW - Sec.gov: A. What Is An Annual Report? B. Name The Federal Government Agency That Requires A Publicly HeldDocumento5 páginasWWW - Sec.gov: A. What Is An Annual Report? B. Name The Federal Government Agency That Requires A Publicly HeldNur AlahiAinda não há avaliações

- Strathclyde University Finance & Financial Management Group-Based AssignmentDocumento4 páginasStrathclyde University Finance & Financial Management Group-Based AssignmentJuan SanguinetiAinda não há avaliações

- TyiepdkDocumento2 páginasTyiepdkKranti KumarAinda não há avaliações

- Sap s4 Hana Fico DocumentDocumento101 páginasSap s4 Hana Fico DocumentMohammed R SiddiquiAinda não há avaliações

- 1.) Research Paper (220 Points) (Course Final Assessment)Documento5 páginas1.) Research Paper (220 Points) (Course Final Assessment)ladycontesaAinda não há avaliações

- Requirement Analysis DocumentDocumento11 páginasRequirement Analysis DocumentAnkur ChauhanAinda não há avaliações

- IBM® Tivoli® Software: Document Version 4Documento50 páginasIBM® Tivoli® Software: Document Version 4RajMohenAinda não há avaliações

- Case Study CiscoDocumento7 páginasCase Study Ciscoapi-241493839Ainda não há avaliações

- Oracle DBI For Financials: Daily Business Intelligence - Automating Operational ReportingDocumento16 páginasOracle DBI For Financials: Daily Business Intelligence - Automating Operational Reportingmaanee.8Ainda não há avaliações

- Project Real - Obiee FaqsDocumento4 páginasProject Real - Obiee FaqsSuman EtikalaAinda não há avaliações

- XI. Oracle FSG & Standard Reports: A. OverviewDocumento6 páginasXI. Oracle FSG & Standard Reports: A. OverviewMtvchip MtvAinda não há avaliações

- Poured Concrete Structure Contractors World Summary: Market Values & Financials by CountryNo EverandPoured Concrete Structure Contractors World Summary: Market Values & Financials by CountryAinda não há avaliações

- Industrial Building Construction World Summary: Market Values & Financials by CountryNo EverandIndustrial Building Construction World Summary: Market Values & Financials by CountryAinda não há avaliações

- Water Well Drilling Contractors World Summary: Market Values & Financials by CountryNo EverandWater Well Drilling Contractors World Summary: Market Values & Financials by CountryAinda não há avaliações

- Pre-fabricated & Mobile Buildings World Summary: Market Sector Values & Financials by CountryNo EverandPre-fabricated & Mobile Buildings World Summary: Market Sector Values & Financials by CountryAinda não há avaliações

- Motor Homes Built on Purchased Chassis World Summary: Market Sector Values & Financials by CountryNo EverandMotor Homes Built on Purchased Chassis World Summary: Market Sector Values & Financials by CountryAinda não há avaliações

- Modifications + Conversions & Overhaul of Aircraft World Summary: Market Sector Values & Financials by CountryNo EverandModifications + Conversions & Overhaul of Aircraft World Summary: Market Sector Values & Financials by CountryAinda não há avaliações

- Explanatory Note To The Revision of FIATA Model Rules For Freight Forwarding ServicesDocumento16 páginasExplanatory Note To The Revision of FIATA Model Rules For Freight Forwarding ServicesFTU.CS2 Tô Hải YếnAinda não há avaliações

- Energy Investor's Guidebook 2013 (Philippines)Documento149 páginasEnergy Investor's Guidebook 2013 (Philippines)idoru_m015Ainda não há avaliações

- Chapter 1Documento25 páginasChapter 1Annie Basing-at AngiwotAinda não há avaliações

- Finance Guidelines Manual For Local Departments of Social Services - VA DSS - Oct 2009Documento426 páginasFinance Guidelines Manual For Local Departments of Social Services - VA DSS - Oct 2009Rick ThomaAinda não há avaliações

- CHALLANDocumento1 páginaCHALLANDaniyal ArifAinda não há avaliações

- Kenneth A. Dockins v. Benchmark Communications, 176 F.3d 745, 4th Cir. (1999)Documento12 páginasKenneth A. Dockins v. Benchmark Communications, 176 F.3d 745, 4th Cir. (1999)Scribd Government DocsAinda não há avaliações

- Tri-City Times: New Manager Ready To Embrace ChallengesDocumento20 páginasTri-City Times: New Manager Ready To Embrace ChallengesWoodsAinda não há avaliações

- SAP PST Keys ReferenceDocumento8 páginasSAP PST Keys ReferenceMilliana0% (1)

- Main ProjectDocumento67 páginasMain ProjectJesus RamyaAinda não há avaliações

- Midnights Children LitChartDocumento104 páginasMidnights Children LitChartnimishaAinda não há avaliações

- Write A Letter To Your Friend Describing Your Sister's Birthday Party Which You Had Organized. You May Us The Following Ideas To Help YouDocumento2 páginasWrite A Letter To Your Friend Describing Your Sister's Birthday Party Which You Had Organized. You May Us The Following Ideas To Help YouQhairunisa HinsanAinda não há avaliações

- Ultra 3000 Drive (2098-In003 - En-P)Documento180 páginasUltra 3000 Drive (2098-In003 - En-P)Robert BarnetteAinda não há avaliações

- Company Law-I Types of Company, (PPT No-8) PDFDocumento8 páginasCompany Law-I Types of Company, (PPT No-8) PDFAbid CoolAinda não há avaliações

- Fraud Detection and Deterrence in Workers' CompensationDocumento46 páginasFraud Detection and Deterrence in Workers' CompensationTanya ChaudharyAinda não há avaliações

- Menasco HSE Training-Role of HSE ProfessionalDocumento10 páginasMenasco HSE Training-Role of HSE ProfessionalHardesinah Habdulwaheed HoluwasegunAinda não há avaliações

- Basic Laws On The Professionalization of Teaching PD 1006 Edited Oct 11 2019Documento6 páginasBasic Laws On The Professionalization of Teaching PD 1006 Edited Oct 11 2019Renjie Azumi Lexus MillanAinda não há avaliações

- Position PAperDocumento11 páginasPosition PAperDan CuestaAinda não há avaliações

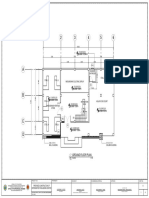

- Ground Floor Plan: Office of The Provincial EngineerDocumento1 páginaGround Floor Plan: Office of The Provincial EngineerAbubakar SalikAinda não há avaliações

- Research - Procedure - Law of The Case DoctrineDocumento11 páginasResearch - Procedure - Law of The Case DoctrineJunnieson BonielAinda não há avaliações

- Music Scrap BookDocumento38 páginasMusic Scrap BookKaanthi PendemAinda não há avaliações

- EssayDocumento3 páginasEssayapi-358785865100% (3)

- Kashmir Problem and SolutionssDocumento7 páginasKashmir Problem and SolutionssmubeenAinda não há avaliações

- Soon Singh Bikar v. Perkim Kedah & AnorDocumento18 páginasSoon Singh Bikar v. Perkim Kedah & AnorIeyza AzmiAinda não há avaliações

- Aeris Product Sheet ConnectionLockDocumento2 páginasAeris Product Sheet ConnectionLockGadakAinda não há avaliações

- KB4-Business Assurance Ethics and Audit December 2018 - EnglishDocumento10 páginasKB4-Business Assurance Ethics and Audit December 2018 - EnglishMashi RetrieverAinda não há avaliações