Escolar Documentos

Profissional Documentos

Cultura Documentos

Economy in 2020

Enviado por

Abdul Malik SoomroDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Economy in 2020

Enviado por

Abdul Malik SoomroDireitos autorais:

Formatos disponíveis

Economy in 2020

EditorialDecember 31, 2019

THE incoming year will be a decisive one for the economy. The stabilisation that

saw a tortured start in 2019 is set to continue, but optimists in the market are

anticipating an end to the chokehold of high interest rates and the aggressive

taxation drive sometime in the early months of 2020. The growth rate has

plummeted while forecasts say the economy should register a growth rate of

between 2.5pc to 3.5pc by the end of the fiscal year. Manufacturing has hit one of

its lowest ebbs ever, except perhaps for the years immediately following the great

crash of 2008, while private investment and business confidence have also been

lacklustre. Even as the economy chokes under the stabilisation measures adopted

out of necessity by the government in 2019, the incoming year presents some

promise of change.

The prime minister has already begun promising a shift in the focus of economic

management away from stabilisation towards growth. In multiple forums over the past

few weeks, he has declared the economy stable and the time to move towards growth

to now be imminent. These words are partially responsible for fuelling a sense of

optimism among certain sections of the business community about the new year. If

interest rates are to be reduced and the level of government spending, especially on

development projects with strong linkages across various sectors of the economy,

picks up, a return to growth and reinflation of aggregate demand can spur economic

activities quickly. Interestingly however, the prime minister’s finance adviser is a

little more circumspect when talking about transitioning to growth, but even he is

promising greater dedication of fiscal resources to encourage export-oriented sectors.

Still, a lot depends on how the fiscal numbers turn out and how stable the reserve

accumulation that has taken place thus far remains. Business groups are asking when

growth will return, whereas the government must ask itself whether we are in a

position to afford growth at the moment. The fiscal numbers seem to be improving,

even if largely on the back of excruciating expenditure cuts, and reserves had only in

recent months reversed a long trend of continuous declines. But if there’s a sudden

move to apply the accelerator at this point and reignite domestic demand, the deflation

of which is the core aspect of the ongoing stabilisation programme, the same deficits

could reappear again. Instead of keeping the focus on growth, the government should

present 2020 as the year of reform and outline in detail its plans for the state-owned

enterprises, the power sector and the future of administered pricing regimes as well as

the overhaul of the regulators to ensure a competitive playing field going forward.

More than raw growth, let 2020 be the year the country arrests and reverses the steady

erosion of its productivity. That would make for a very happy new year indeed.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Decline in TerrorismDocumento2 páginasDecline in TerrorismAbdul Malik SoomroAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Mass Transit Woes - EpaperDocumento4 páginasMass Transit Woes - EpaperAbdul Malik SoomroAinda não há avaliações

- Decline in TerrorismDocumento2 páginasDecline in TerrorismAbdul Malik SoomroAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Decline in TerrorismDocumento2 páginasDecline in TerrorismAbdul Malik SoomroAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Economy in 2020Documento1 páginaEconomy in 2020Abdul Malik SoomroAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Importance of Agriculture Towards The Development of Nigeria EconomyDocumento1 páginaThe Importance of Agriculture Towards The Development of Nigeria EconomyAKINYEMI ADISA KAMORUAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Major Heads - Railways AccounbtsDocumento3 páginasMajor Heads - Railways AccounbtsSri Nagesh KumarAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Trade of The Century: When George Soros Broke The British PoundDocumento15 páginasThe Trade of The Century: When George Soros Broke The British PoundStellaAinda não há avaliações

- GST Definition, Objective, Framework, Action Plan, GST ScopeDocumento8 páginasGST Definition, Objective, Framework, Action Plan, GST ScopeKATAinda não há avaliações

- Tyre Industry in IndiaDocumento11 páginasTyre Industry in IndiaAlok ChowdhuryAinda não há avaliações

- PPTDocumento34 páginasPPTsaranyadevi_m_2012_mbaAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Hyderabad Electric Supply Company - Electricity Consumer Bill (Mdi)Documento2 páginasHyderabad Electric Supply Company - Electricity Consumer Bill (Mdi)aurang zaibAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- International Finance DEC 2023Documento3 páginasInternational Finance DEC 2023Sneha DograAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Presentation by Bikramjeet Singh ON Study On Working Capital Management On Iffco-Phulpur UnitDocumento14 páginasPresentation by Bikramjeet Singh ON Study On Working Capital Management On Iffco-Phulpur UnitPreetaman SinghAinda não há avaliações

- Fixed Income Market Report - 28.02.2022Documento1 páginaFixed Income Market Report - 28.02.2022Fuaad DodooAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Instruction Sheet - GIC-19100468Documento5 páginasInstruction Sheet - GIC-19100468Ashraf ShaikhAinda não há avaliações

- Summary of Accounts Held Under Customer Id: Xxxxx1382 As On October 31, 2021 I. Operative Account in INRDocumento1 páginaSummary of Accounts Held Under Customer Id: Xxxxx1382 As On October 31, 2021 I. Operative Account in INRabhishek ranaAinda não há avaliações

- s9 PresentationDocumento10 páginass9 Presentationmohammed shabeerAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Chapter - 4 Industrial Development: Merits of PrivatizationDocumento2 páginasChapter - 4 Industrial Development: Merits of PrivatizationGhalib HussainAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Analisis Transfer Princing D Spute Atas Transaksi Antar Perusahaan Afiliasi (Studi Kasus Pada PT "X" Di Jakarta)Documento196 páginasAnalisis Transfer Princing D Spute Atas Transaksi Antar Perusahaan Afiliasi (Studi Kasus Pada PT "X" Di Jakarta)Nanda RizkiAinda não há avaliações

- Assignment 2: Topic: Dumping and Its Impact On India With Reference To ChinaDocumento16 páginasAssignment 2: Topic: Dumping and Its Impact On India With Reference To Chinarashi bakshAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Pak Studies ProjectDocumento10 páginasPak Studies ProjectZaini Pehlwan GAinda não há avaliações

- Statement of Account Central Bank of India: Vasna Branch, Ahmedabad Branch Code: 281463Documento2 páginasStatement of Account Central Bank of India: Vasna Branch, Ahmedabad Branch Code: 281463jainam100% (2)

- BE-Way Bill SystemDocumento2 páginasBE-Way Bill SystemKrishna Computer DakorAinda não há avaliações

- Industries (Sme) of Bangladesh SDGS, 2030Documento4 páginasIndustries (Sme) of Bangladesh SDGS, 2030Sharfin RahmanAinda não há avaliações

- World Machine Tool Survey: ResearchDocumento12 páginasWorld Machine Tool Survey: Researchפּואַ פּוגאַAinda não há avaliações

- The Perishable Agricultural Commodities ActDocumento1 páginaThe Perishable Agricultural Commodities ActRdspiegelAinda não há avaliações

- World: Plantains - Market Report. Analysis and Forecast To 2020Documento7 páginasWorld: Plantains - Market Report. Analysis and Forecast To 2020IndexBox MarketingAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Asia International Auctioneers, Inc. v. CIRDocumento1 páginaAsia International Auctioneers, Inc. v. CIRJulie Ann Edquila Padua100% (1)

- Socio-Economic IndicatorsDocumento2 páginasSocio-Economic IndicatorsKassaf ChowdhuryAinda não há avaliações

- Solar Power Plant - World's Largest Floating Solar Power Plant To Be Built On Narmada's Omkareshwar Dam in MP - The Economic TimesDocumento1 páginaSolar Power Plant - World's Largest Floating Solar Power Plant To Be Built On Narmada's Omkareshwar Dam in MP - The Economic TimescreateAinda não há avaliações

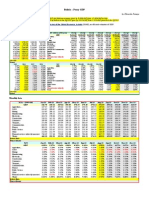

- Bolivia - Proxy GDPDocumento1 páginaBolivia - Proxy GDPEduardo PetazzeAinda não há avaliações

- China Statistical Yearbook 2012Documento2 páginasChina Statistical Yearbook 2012ssshantha99740% (1)

- Business Structure: Multiple-Choice QuestionsDocumento3 páginasBusiness Structure: Multiple-Choice Questionsno dont look at meAinda não há avaliações

- Taxation Law QuestionsDocumento3 páginasTaxation Law QuestionsgeorgeAinda não há avaliações