Escolar Documentos

Profissional Documentos

Cultura Documentos

ENTREPRENEURSHIP FINALS - 2018-19.docx Version 1

Enviado por

Gerby GodinezTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

ENTREPRENEURSHIP FINALS - 2018-19.docx Version 1

Enviado por

Gerby GodinezDireitos autorais:

Formatos disponíveis

SENIOR HIGH SCHOOL IN MALVAR

B A T A N G A S

FINAL EXAMINATION

ENTREPRENEURSHIP

Name Date

Section Score

I. Determine the MARKETING MIX that is being described on each item.

Choose from the following choices and write the LETTER of your choice on

the space provided.

XA. Product XC. Place XE. People XG. Positioning

XB. Price XD. Promotion XF. Packaging

_____ 1. The good or service that the customer buys __UCT

_____ 2. What to do to persuade/encourage the customers to buy

_____ 3. Those that contact with the customers in delivering the product PEOPLE

_____ 4. The amount the customer pays for the product

_____ 5. How the customers think of your product

_____ 6. How and where the product is distributed to customers PLACE

_____ 7. The outside appearance of the product PACKAGING

_____ 8. How the customers place your product in their minds and hearts POSIING

_____ 9. Considers how the salesperson dress and groom himself as he represents

the business

_____ 10. Must be the answer to the needs and wants of the consumers

II. SCRAMBLED WORDS

DIRECTIONS: Rearrange the letters from the word inside the table being

described below

11) MARWOPEN 16) TSSCO

12) SSSUIENB OLMDE 17) SGSRO OFRIPT

13) PERPOYTOT 18) ETN MECOIN

14) VENEREU 19) EAAMMGTNEN

15) GFNOASITCRE 20) IELGSN PPPETIRORROIHS

11. It is considered the most valuable resource of an organization

12. This refers to the enterprise plan

13. It is a miniature but exact replica of the product

14. The income generated from sale of goods or services, or any other use of capital or

assets, associated with the main operations of an organization before any costs or

expenses are deducted.

15. This refers to predicting future business performance.

16. This refers to expenditures incurred in generating revenues

17. It is the difference between revenues and the cost of goods sold.

18. It is the difference between revenues and the sum of the cost of goods sold and

selling and administrative expenses.

19. It promotes good governance within the organization, adheres to ethical standards,

and practices social responsibility.

20. A type of business organization owed by only one person

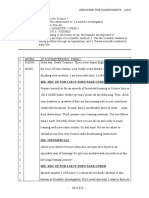

III. NET INCOME

DIRECTIONS:

A. Compute for the Capital Contribution and the unit sold, to get the Net Income,

where two have equal capital distribution.

QOUTE-TING-THING ENTERPRISES

PARTNERS’ CAPITAL CONTRIBUTION

% ON TOTAL

DESCRIPTION AMOUNT

CONTRIBUTION

Rosalina R. Pangilinan (21-25) 46,750.00

Wilma R. Malabanan 26.00% 221,000.00

Emmaline P. Obar (26-30) (31-35)

Randy R. Pangilinan 24.00% (36-40)

Veronica P. Obar (41-45) 157,250.00

TOTAL 100.00% 850,000.00

B. Compute for the unit/s sold, to get the Net Income based on Quote-Ting-

Thing Enterprises’ Total Project Cost per Month.

Total Project Cost - for One Month

Fixed Assets

Office and Store Equipment 150,000.00

Furniture & Fixture 68,000.00

Total - 218,000.00

Working Capital for a Month

Materials 320,000.00

Salaries & Wages 111,456.00

SSS Contribution – Workers 1,664.00

Philhealth Contribution – Workers 200.00 1,864.00

Administrative Expenses

Rent Expense – Office 10,000.00

Utilities Expense Office 8,000.00

Supplies – Office 2,500.00

Permit and Licenses 8,000.00

Advertising Expense 10,000.00

38,500.00 471,820.00

Total Project Cost 689,820.00

Cash on Hand 160,180.00

Capital Investment 850,000.00

Compute the SALES, COST OF SALES and GROSS PROFIT (based on Quote-

Ting-Thing Enterprises’ Total Project Cost per Month) and show the

OPERATING AND ADMINISTRATIVE EXPENSES of ₱ 1,605,840.00 (at the back

of their TEST PAPER/ANSWER SHEET if any) if the company has 12 employees

and working 6 times a week in 4 weeks.

If Quote-Ting-Thing Enterprises sold 130 to 135 units per day with price range

per unit of ₱ 65-95.00, how much will be their daily sales and the cost of sales

per day? Compute the annual Net Income before tax.

Sales (# 46-50) ₱

Less: Cost of Sales (I# 51-55) ₱

Gross Profit (# 56-60) ₱

Less: Operating /Administrative Expenses ₱ 1,605,840.00

Net Income before Tax ₱ 675,120.00

Prepared by:

MARIA BUENASGRACIA O. NOBLETA

Teacher

Checked by:

APOLONIO A. VILLANUEVA, Ed.D.

Master Teacher II

NOTED:

JHOMAR C. SOR, Ed.D.

Principal II

TABLE OF SPECIFICATIONS

1. XA. Product 11. Manpower

2. XD. Promotion 12. Business Model

3. XE. People 13. Prototype

4. XB. Price 14. Revenue

5. XG. Positioning 15. Forecasting

6. XC. Place 16. Costs

7. XF. Packaging 17. Gross Profit

8. XG. Positioning 18. Net Income

9. XD. Promotion 19. Management

10. XA. Product 20. Single Proprietorship

DESCRIPTION % ON TOTAL AMOUNT

CONTRIBUTION

Rosalina R. Pangilinan 5.50% 46,750.00

Wilma R. Malabanan 26.00% 221,000.00

Emmaline P. Obar 26.00% 221,000.00

Randy R. Pangilinan 24.00% 204,000.00

Veronica P. Obar 18.50% 157,250.00

TOTAL 100.00% 850,000.00

**5.50% x 850,000 46,750.00

Table 5.0

Total Project Cost - for One Month

Fixed Assets

Office and Store Equipment 150,000.00

Furniture & Fixture 68,000.00

Total - 218,000.00

Working Capital for a Month

Materials 320,000.00

Salaries & Wages 111,456.00

SSS Contribution – Workers 1,664.00

Philhealth Contribution – Workers 200.00 1,864.00

Administrative Expenses

Rent Expense – Office 10,000.00

Utilities Expense Office 8,000.00

Supplies – Office 2,500.00

Permit and Licenses 8,000.00

Advertising Expense 10,000.00

Total Project Cost 433,320.00

Cash on Hand 416,680.00

Capital Investment 850,000.00

** 11,1456+1,864+10,000+8,000+2,500=133,820.00 (133,820x12) = 1,605,840

Sales ? 3,231,360.00

Less: Cost of Sales ? 950,400.00

Gross Profit ? 2,280,960.00

**Less: Operating /Administrative 1,605,840.00 1,605,840.00

Expenses

Net Income before Tax 670,000.00 675,120.00

132*85*24*12 = 3,231,360 132*25*24*12 = 950,400 3,231,360-950,400=1,605,840

Você também pode gostar

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsAinda não há avaliações

- Certificates For StudentsDocumento14 páginasCertificates For StudentsJean Vanessa SapurasAinda não há avaliações

- Thank You For Your Unending Support.: Arrival/Registration (Club Coordinators/Advisers)Documento2 páginasThank You For Your Unending Support.: Arrival/Registration (Club Coordinators/Advisers)Shiela Mae Mirasol Abay-abayAinda não há avaliações

- Sed 726 Curriculum Development in Science EducationDocumento114 páginasSed 726 Curriculum Development in Science EducationBolaji Samuel Olufemi100% (2)

- Design-Based Research in Science EducationDocumento15 páginasDesign-Based Research in Science Educationis03lcmAinda não há avaliações

- Anti-Bullying Narrative ReportDocumento1 páginaAnti-Bullying Narrative ReportRaymart DáøtAinda não há avaliações

- Action Plan TemplateDocumento8 páginasAction Plan TemplateciscolifeguardAinda não há avaliações

- Development and Validation of Modules Integrating Education For Sustainable DevelopmentDocumento21 páginasDevelopment and Validation of Modules Integrating Education For Sustainable DevelopmentAnne Besin-LaquianAinda não há avaliações

- Marketing in Rural India: The Innovative Selling Mantra: Dr. Makarand UpadhyayaDocumento8 páginasMarketing in Rural India: The Innovative Selling Mantra: Dr. Makarand UpadhyayaEmy MathewAinda não há avaliações

- Measuremen: in ADGE - 104 (General Chemistry)Documento22 páginasMeasuremen: in ADGE - 104 (General Chemistry)Narag KrizzaAinda não há avaliações

- Temporary Progress Report Card For JHS: Old Cabalan Integrated SchoolDocumento4 páginasTemporary Progress Report Card For JHS: Old Cabalan Integrated SchoolSharmaine Deblois CincoAinda não há avaliações

- Science 7-Module On EclipsesDocumento20 páginasScience 7-Module On EclipsesireneAinda não há avaliações

- Output-for-LDM2 NROBLES FINALDocumento42 páginasOutput-for-LDM2 NROBLES FINALMontealegre Nhet100% (1)

- Sample ScriptDocumento5 páginasSample ScriptLawrence Mae Asong Pamotillo IIAinda não há avaliações

- Report On The Physical Count of Inventories CLASSROOM INVENTORY (Pricipal's Office)Documento29 páginasReport On The Physical Count of Inventories CLASSROOM INVENTORY (Pricipal's Office)Evelyn SarmientoAinda não há avaliações

- NEDA National Agenda Relationship To Science Education in The PhilippinesDocumento4 páginasNEDA National Agenda Relationship To Science Education in The PhilippinesCynlee SabanganAinda não há avaliações

- Homeroom PTA MeetingDocumento4 páginasHomeroom PTA Meetinggina mahinayAinda não há avaliações

- Alternative Learning Delivery Modalities (ALDM) of Secondary Social Studies Teachers: Addressing The New Normal Teaching PedagogiesDocumento10 páginasAlternative Learning Delivery Modalities (ALDM) of Secondary Social Studies Teachers: Addressing The New Normal Teaching PedagogiesAJHSSR JournalAinda não há avaliações

- Respsci HymnDocumento1 páginaRespsci HymnChen De Castro VillamilAinda não há avaliações

- Education For Innovation and Innovations in EducationDocumento60 páginasEducation For Innovation and Innovations in EducationORF_CASERAinda não há avaliações

- Structured Learning EpisodeDocumento2 páginasStructured Learning EpisodeRhomelyn AbellarAinda não há avaliações

- Demo Teaching Lesson PlanDocumento5 páginasDemo Teaching Lesson PlanMelba O. Cruz100% (1)

- Case StudyDocumento5 páginasCase StudyTirtharaj DhunganaAinda não há avaliações

- Thesis Proposal Chapter 1.3Documento19 páginasThesis Proposal Chapter 1.3ladeedeeAinda não há avaliações

- ACTION RESEARCH OUTLINE - La Union DivisionDocumento1 páginaACTION RESEARCH OUTLINE - La Union DivisionMARY JANE R. MACUTAYAinda não há avaliações

- Borderless Education With NotesDocumento24 páginasBorderless Education With Notesmonica.jagolinoAinda não há avaliações

- Final ProposalDocumento13 páginasFinal ProposalNim RaAinda não há avaliações

- IGP Templates and WorkshopDocumento15 páginasIGP Templates and WorkshopRay MundAinda não há avaliações

- School: Learning Continuity PlanDocumento41 páginasSchool: Learning Continuity PlanMa Victoria Dumapay TelebAinda não há avaliações

- Action Plan Proposal Culminating ProjectDocumento6 páginasAction Plan Proposal Culminating Projectapi-273393280Ainda não há avaliações

- University of Rizal SystemDocumento32 páginasUniversity of Rizal SystemFrancis Andres GumawaAinda não há avaliações

- Psychosocial Support PlanDocumento2 páginasPsychosocial Support PlanGwendolyn Lalamonan AnganaAinda não há avaliações

- Republic of The Philippines Matalino St. D.M. Government Center, Maimpis, City of San Fernando (P)Documento45 páginasRepublic of The Philippines Matalino St. D.M. Government Center, Maimpis, City of San Fernando (P)ShoeviceAinda não há avaliações

- Science 7 WK 1Documento6 páginasScience 7 WK 1LAIRA JOY VIERNESAinda não há avaliações

- Project Proposal (Bell)Documento2 páginasProject Proposal (Bell)Jojirose Anne Bernardo MondingAinda não há avaliações

- The Effects of Self-Learning Kit in The Academic Performance of The Grade 9 Learners in Quantum Mechanical Model of AtomDocumento23 páginasThe Effects of Self-Learning Kit in The Academic Performance of The Grade 9 Learners in Quantum Mechanical Model of AtomKennedy Fieldad VagayAinda não há avaliações

- Banzon 2. Mijeno 3. Gomez 4. Villaruz 5. Zara: Department of EducationDocumento2 páginasBanzon 2. Mijeno 3. Gomez 4. Villaruz 5. Zara: Department of EducationJocet GeneralaoAinda não há avaliações

- Sbar AttendanceDocumento49 páginasSbar AttendanceRonniel LabioAinda não há avaliações

- Science Q4week 4scriptDocumento13 páginasScience Q4week 4scriptFia Jean Nadonza PascuaAinda não há avaliações

- Background of The StudyDocumento2 páginasBackground of The StudySKyTakes LsAinda não há avaliações

- Influence of Study Habits and Coping Mechanism To Course Enhancement PerformanceDocumento41 páginasInfluence of Study Habits and Coping Mechanism To Course Enhancement PerformanceChoji HeiwajimaAinda não há avaliações

- Application LDocumento8 páginasApplication LRoldan OrmillaAinda não há avaliações

- ICT Training Design and MatrixDocumento4 páginasICT Training Design and MatrixShen De AsisAinda não há avaliações

- Activity 1A MicroscopeDocumento4 páginasActivity 1A MicroscopeClarito ManaayAinda não há avaliações

- EDAL Concept and Relevance of AssessmentDocumento5 páginasEDAL Concept and Relevance of AssessmentChristle EdianonAinda não há avaliações

- FS2 Classroom ManagementDocumento5 páginasFS2 Classroom ManagementArgie CagunotAinda não há avaliações

- Personal Data Sheet 2020 UpdatedDocumento14 páginasPersonal Data Sheet 2020 UpdatedJanneth Sanchez-EstebesAinda não há avaliações

- Effectiveness of Multimedia-Assisted Instruction in Teaching Technology and Livelihood Education For Grade 8 Students of Lagundi-CCL National High SchoolDocumento8 páginasEffectiveness of Multimedia-Assisted Instruction in Teaching Technology and Livelihood Education For Grade 8 Students of Lagundi-CCL National High SchoolPsychology and Education: A Multidisciplinary JournalAinda não há avaliações

- Pres3 - SBM and K To 12Documento36 páginasPres3 - SBM and K To 12Ian Khay CastroAinda não há avaliações

- Factors That Influence Students' Academic Performances in Advance ChemistryDocumento35 páginasFactors That Influence Students' Academic Performances in Advance ChemistryJanica Rheanne JapsayAinda não há avaliações

- Portfolio Reflection Point 1 DraftDocumento2 páginasPortfolio Reflection Point 1 Draftapi-253986464Ainda não há avaliações

- Localized Module in Promoting Philippine-Hilot in Teaching Wellness Massage and The Student's Performance in Tle 10: Input To New Delivery Modes of InstructionDocumento12 páginasLocalized Module in Promoting Philippine-Hilot in Teaching Wellness Massage and The Student's Performance in Tle 10: Input To New Delivery Modes of InstructionIOER International Multidisciplinary Research Journal ( IIMRJ)Ainda não há avaliações

- Theory of BiogenesisDocumento6 páginasTheory of BiogenesisScarlet OrigenesAinda não há avaliações

- Action-Research-Oral-Language-Skills-for-Grade Three-PupilsDocumento43 páginasAction-Research-Oral-Language-Skills-for-Grade Three-PupilsEr MaAinda não há avaliações

- Project MARTDocumento9 páginasProject MARTRUZZEL MART MANLIGUISAinda não há avaliações

- PDEV2111 Lesson 6 Coping With Stress in Middle and Late AdolescenceDocumento4 páginasPDEV2111 Lesson 6 Coping With Stress in Middle and Late AdolescenceJohn RoasaAinda não há avaliações

- Reflection PaperDocumento7 páginasReflection PaperAzmr Hadjirul AbduhailAinda não há avaliações

- Narrative ReportDocumento7 páginasNarrative ReportPaola Marie AdisazAinda não há avaliações

- The Effects of Online Class in Face To Face Classes: Department of Education Schools Division Office - Quezon CityDocumento10 páginasThe Effects of Online Class in Face To Face Classes: Department of Education Schools Division Office - Quezon CityJewel Valencia100% (1)

- Akmen CH 12 KelarDocumento19 páginasAkmen CH 12 KelarFadhliyaFAinda não há avaliações

- March 6Documento2 páginasMarch 6Gerby GodinezAinda não há avaliações

- Statistics and Probability FinalDocumento3 páginasStatistics and Probability FinalGerby Godinez100% (2)

- Tos For Entrep Finals 2ND Sem 2019-2020Documento3 páginasTos For Entrep Finals 2ND Sem 2019-2020Gerby GodinezAinda não há avaliações

- TOS GRADE 11 STAT & PROB (Finals) 2019 - 2020Documento2 páginasTOS GRADE 11 STAT & PROB (Finals) 2019 - 2020Gerby Godinez100% (1)

- Individual Daily Log and Accomplishment Report: Leyte National High School Leyte, LeyteDocumento5 páginasIndividual Daily Log and Accomplishment Report: Leyte National High School Leyte, LeyteGerby GodinezAinda não há avaliações

- OBSERVATION 2nd QuarterDocumento4 páginasOBSERVATION 2nd QuarterGerby GodinezAinda não há avaliações

- FINAL Exam in Entrep 11 2019-2020 FinalDocumento4 páginasFINAL Exam in Entrep 11 2019-2020 FinalGerby Godinez100% (1)

- Learner Enrollment and Survey Form: Grade Level and School InformationDocumento2 páginasLearner Enrollment and Survey Form: Grade Level and School InformationThe Great Papyrus90% (73)

- User Guide For LESF Facility - School Adviser PDFDocumento10 páginasUser Guide For LESF Facility - School Adviser PDFClaudine Manuel LibunaoAinda não há avaliações

- Department of Education: Republic of The PhilippinesDocumento16 páginasDepartment of Education: Republic of The PhilippinesGodofredo CualterosAinda não há avaliações

- June 1 To 5Documento1 páginaJune 1 To 5Gerby GodinezAinda não há avaliações

- Solving Exponential Equations: Contextualized Teacher Resource in General Mathematics 11Documento13 páginasSolving Exponential Equations: Contextualized Teacher Resource in General Mathematics 11Gerby GodinezAinda não há avaliações

- Solving Exponential Equations: Contextualized Learner Resource in General Mathematics 11Documento14 páginasSolving Exponential Equations: Contextualized Learner Resource in General Mathematics 11Gerby Godinez100% (1)

- LEARNING ACTIVITY SHEET in Oral CommDocumento4 páginasLEARNING ACTIVITY SHEET in Oral CommGerby GodinezAinda não há avaliações

- Work From Home Individual Accomplishment Report - RRRDocumento1 páginaWork From Home Individual Accomplishment Report - RRRJerick VelascoAinda não há avaliações

- MELC SHS Applied Subjects PDFDocumento37 páginasMELC SHS Applied Subjects PDFjames paul belmoro0% (1)

- 1/2log2 7 Nlogxm Logamo Logah/J Alogbx Log MNDocumento4 páginas1/2log2 7 Nlogxm Logamo Logah/J Alogbx Log MNGerby GodinezAinda não há avaliações

- Empowerment2ND - Docx Version 1Documento4 páginasEmpowerment2ND - Docx Version 1Gerby GodinezAinda não há avaliações

- Sieve of EratosthenesDocumento2 páginasSieve of EratosthenesGerby GodinezAinda não há avaliações

- Assignment 4Documento10 páginasAssignment 4Ieyrah Rah ElisyaAinda não há avaliações

- Chapter 4Documento65 páginasChapter 4임재영Ainda não há avaliações

- Advanced Financial Accounting 6th Edition Beechy Test Bank Full Chapter PDFDocumento63 páginasAdvanced Financial Accounting 6th Edition Beechy Test Bank Full Chapter PDFSandraMurraykean100% (13)

- Ave 4Documento3 páginasAve 4Jessa0% (1)

- Tugas Manajemen Keuangan (Working Capital)Documento7 páginasTugas Manajemen Keuangan (Working Capital)anaAinda não há avaliações

- Pharma Case Excel File For StudentsDocumento53 páginasPharma Case Excel File For StudentsJerodAinda não há avaliações

- SCALP Handout 040Documento2 páginasSCALP Handout 040Eren CuestaAinda não há avaliações

- Managerial Accounting Principles Applied in Apple Inc.Documento7 páginasManagerial Accounting Principles Applied in Apple Inc.Vruhali Soni100% (4)

- Financial Statement Analysis of Maruti SuzukiDocumento6 páginasFinancial Statement Analysis of Maruti SuzukiAshish AimaAinda não há avaliações

- Entrepreneur Week 11-20Documento25 páginasEntrepreneur Week 11-20Andrea Kristne Mojares Dimatatac80% (5)

- The Hubbart FormulaDocumento1 páginaThe Hubbart FormulaCealpahu100% (2)

- QuesadillasDocumento23 páginasQuesadillasrichard rhamilAinda não há avaliações

- EREGL DCF ModelDocumento10 páginasEREGL DCF ModelKevser BozoğluAinda não há avaliações

- Chapter12 AnalysisDocumento25 páginasChapter12 AnalysisJan ryanAinda não há avaliações

- Biotransplant Inc.Documento15 páginasBiotransplant Inc.Juan Manuel GonzalezAinda não há avaliações

- Class Notes: Class: XI Topic: Financial StatementDocumento3 páginasClass Notes: Class: XI Topic: Financial StatementRajeev ShuklaAinda não há avaliações

- FSA M.com IVDocumento5 páginasFSA M.com IVAli HaiderAinda não há avaliações

- Fs FinalDocumento39 páginasFs FinalJahara Obedencio CalaycaAinda não há avaliações

- The Statement of Profit or Loss and Other Comprehensive Income Textbook Pages: 115 - 136Documento29 páginasThe Statement of Profit or Loss and Other Comprehensive Income Textbook Pages: 115 - 136Cheuk Ying NicoleAinda não há avaliações

- Financial PlanDocumento30 páginasFinancial PlanFatin HazwaniAinda não há avaliações

- Fin 1 - Ats 1Documento11 páginasFin 1 - Ats 1Joy ConsigeneAinda não há avaliações

- ACC 309 FinalDocumento42 páginasACC 309 FinalSalman Khalid77% (22)

- Annual Report 2015-2016 PDFDocumento82 páginasAnnual Report 2015-2016 PDFfahim zamanAinda não há avaliações

- CH 4 Solutionsdocx PDF FreeDocumento129 páginasCH 4 Solutionsdocx PDF FreeYang LeksAinda não há avaliações

- Dynacor Gold Mines Inc.: Management Discussion and Analysis For The Six-Month Period Ended June 30, 2021Documento26 páginasDynacor Gold Mines Inc.: Management Discussion and Analysis For The Six-Month Period Ended June 30, 2021JIMI MARCOS ALTAMIRANO HUAMANIAinda não há avaliações

- Excel Pinakafinal Na Balance HihiDocumento14 páginasExcel Pinakafinal Na Balance HihiBrex Malaluan GaladoAinda não há avaliações

- WWW - Eichermotors Com: Eicher Motors Limited Registered OfficeDocumento416 páginasWWW - Eichermotors Com: Eicher Motors Limited Registered OfficeAishwarya RathoreAinda não há avaliações

- Cost and Management Accounting 2 CHAPTER 1Documento44 páginasCost and Management Accounting 2 CHAPTER 1chuchuAinda não há avaliações

- PGBPDocumento14 páginasPGBPSaurav MedhiAinda não há avaliações

- Intercompany Profit Transactions - Inventories: Answers To Questions 1Documento22 páginasIntercompany Profit Transactions - Inventories: Answers To Questions 1NisrinaPArisantyAinda não há avaliações