Escolar Documentos

Profissional Documentos

Cultura Documentos

Handout One Accounting For Financial Statements

Enviado por

Kaith MendozaDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Handout One Accounting For Financial Statements

Enviado por

Kaith MendozaDireitos autorais:

Formatos disponíveis

PSBA - Manila

Financial Accounting and Reporting (Accounting 15)

FINANCIAL STATEMENTS

Statement of Financial Position

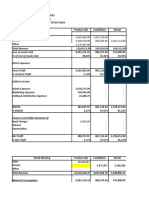

Problem 1. The following elements of Financial Statements are provided from the Trial Balance of Ford Inc. for the year

ended December 31,2011:

Preference Share at par P 100,000

Cash and cash equivalents (net of P200,000 overdraft) 1,000,000

Land Held for Sale 2,000,000

Bonds Payable due on December 31,2013 1,500,000

Deferred Tax Liability (P100,000 each to be realized in 2012, 2013, and 2014) 300,000

Revaluation Surplus 200,000

Salaries Payable 100,000

Cash surrender value of insurance 50,000

Note payable - payable in four installments semiannually on June 30 and December 31 400,000

Interest Payable 30,000

Inventory – (P200,000 will be realized in 15 months) 600,000

Investment Property 500,000

Biological Assets 200,000

Prepaid Asset and Office Supplies 300,000

Accounts Payable (net of P100,000 with debit balance) 400,000

Accounts Receivable – (P500,000 will be realized in 15 months) (net of P200,000 with Cr. Balance) 1,500,000

Contingent Asset 300,000

Contingent Liability 200,000

Provision for lawsuit (payable on December 31,2012) 500,000

Unamortized Premium on Bonds Payable 300,000

Investment in Trading Securities 3,000,000

Ordinary Share at par 500,000

Donated Capital 200,000

Deferred tax asset (P100,000 each to be realized in 2012, 2013 and 2014) 300,000

Income tax payable 100,000

Allowance for bad debts 200,000

Intangible Assets 2,000,000

Property, Plant and Equipment 5,000,000

Additional Paid In Capital in excess of par – Ordinary Shares 1,000,000

Investment in Available for Sale Securities 2,000,000

Unamortized Discount on Bonds Payable 100,000

Unamortized Discount on Bonds Receivable 400,000

Investment in Preference Shares of SM @ cost method 3,000,000

Investment in Ordinary Shares of BDO @ equity method 4,000,000

Share options 500,000

Treasury Shares 600,000

Accumulated Depreciation – PPE 800,000

Accumulated Amortization – Intangible Assets 200,000

Conversion Option 400,000

Cumulative translation debit – foreign operation 300,000

Subscribed Ordinary Share @ par 200,000

Retained Earnings appropriated for plant expansion – December 31,2011 5,000,000

Bond Sinking Fund for the Bonds Payable 1,500,000

Plant Expansion Fund – to be disbursed on January 30,2012 5,000,000

Cumulative unrealized gain on FAFVOCI debt instrument 200,000

Cumulative unrealized loss on FAFVOCI equity instrument (100,000)

Additional Paid in Capital in excess of par – Preference Shares 2,000,000

Utilities Payable 300,000

Share Dividends Payable @ par (large share dividend) 1,000,000

Cash Dividends Payable on January 10,2012 100,000

Cumulative Unrealized loss on derivative designated in cash flow hedge (effective portion) 300,000

Net remeasurement Loss – Defined Benefit Plan 400,000

Dividends Receivable from Investment in Associate 200,000

Interest Receivable from Notes Receivable 300,000

Investment in Joint Venture 2,000,000

Investment in Subsidiary 3,000,000

Notes Receivable – due on December 31,2012 2,000,000

Loan Receivable – realizable in in five equal annual installments every June 30 5,000,000

Investment in Bonds Receivable – Held to Maturity Securities due on December 31,2013 2,400,000

Cumulative unrealized gain on FLFVPL due to credit risk 100,000

Total Lease Liability (P200,000 principal will be due on September 31,2012) 1,200,000

Retained Earnings unappropriated – January 1,2011 2,000,000

Note: The only transactions that affect the retained earnings unappropriated for the year are the net income for 2011 and

dividends declared.

FAR – Accounting 15 Page 1

of 11

Required: Based on the result of your audit, determine the following as of December 31,2011:

____________1. Total Current Assets

____________2. Total Noncurrent Assets

____________3. Total Assets

____________4. Total Current Liabilities

____________5. Total Noncurrent Liabilities

____________6. Total Liabilities

____________7. Total Shareholder’s Equity

____________8. Total Retained Earnings – December 31,2011

____________9. Total Retained Earnings – Appropriated - December 31,2011

____________10. Total Retained Earnings – Unappropriated – December 31,2011

____________11. Profit or Loss for the year ended December 31,2011

ACCOUNTING EQUATION

Problem 2. DLSU Co. provided the following data regarding its financial position:

January 1,2013

Current Asset P2,000,000

Current Liability ?

Noncurrent Asset 5,000,000

Noncurrent Liability 3,000,000

The following additional data are provided:

1. The current ratio of DLSU Co. at the start of the year is 2:1.

2. The debt ratio at the end of the year is 40%.

3. Current Assets increased to P3,000,000 during the year.

4. Noncurrent assets increased by P2,000,000 during the year.

5. Noncurrent liability decreased to P1,000,000 during the year.

Required: Determine the following:

__________1. Current Liability on January 1,2013

__________2. Equity on January 1,2013

__________3. Current Liability on December 31,2013

__________4. Equity on December 31,2013

EVENTS AFTER REPORTING PERIOD: (Adjusting and Non-adjusting Events)

Problem 3. The financial statements of Benz Inc. are submitted to the external auditor on February 15,2012. The external

auditor issued the unqualified audit opinion on February 28,2012. The board of directors approved and authorized the

issuance of financial statements on March 15,2012. The stockholder’s ratified the issuance on March 31,2012. The

following events after reporting period of Benz Inc. are presented for the year ended December 31,2011:

a. On December 10,2011, Benz was charged by DENR of Environmental Regulation Violation. On December

31,2011, the defense counsel of Benz believed that it is probable that Benz will lose in the law suit and will be

liable in the range of P1,000,000 to P3,000,000. At that time, there is no best estimate of liability. On March

10,2012, the Supreme Court of the Philippines decided against the defendant Benz and award P2,500,000

amount of damages to DENR.

b. On December 15,2011, Benz was charged by the Benz Labor Union for Unfair Labor Practice in the Labor

Arbitrer. On December 31,2011, the defense counsel of Benz believed that it is reasonably possible that Benz will

lose in the labor dispute. The reasonable estimate of the liability is P1,000,000. On March 20,2012, the Supreme

Court decided in favor of the Benz Labor Union and awarded P1,500,000 amount of damages.

c. On January 10,2012, Benz was charged by Ford of Patent Infringement. On such date, the defense counsel of

Benz believed that it is probable that Benz will lose in the case. On March 12,2012, the Supreme Court ruled in

favor of Ford and awarded P500,000 of damages to the plaintiff.

d. On December 25,2011, Benz filed a civil case against Honda. The defense counsel of Benz believed that it is

probable that Benz will prevail in the civil case. The reasonable amount of damages is P3,000,000. The case was

decided by the Supreme Court on April 1,2012 and awarded P4,000,000 amount of damages to Benz.

e. On November 15,2011, Benz filed a civil case against Toyota. The defense counsel of Benz believed that it is

reasonably possible that Benz will prevail in the civil case. The reasonable amount of damages is P1,800,000.

The case was decided by the Supreme Court on April 10,2012 and awarded P2,500,000 amount of damages to

Benz.

f. On September 30,2011, an employee of Benz filed a civil case against Benz. The defense counsel of Benz

believed that it is remote that Benz will lose the case and the reliable estimate of liability is P200,000. The case

was decided by Supreme Court on March 30,2012 and awarded P300,000 amount of damages to the employee

of Benz.

g. On December 31,2011, Benz has an outstanding receivable from Way Inc. in the amount of P5,000,000. On

March 14,2012, Way Inc. declared bankruptcy and the Court placed the company under receivership. On such

date, the receiver declared that only 40% of the payable of Way will be liquidated.

h. On March 10,2012, the Investment Property of Benz Inc. was razed by fire. The carrying value of such property

on December 31,2011 is P10,000,000.

i. On March 16,2012, the warehouse containing the inventory of Benz Inc. was destroyed by earthquake. The total

from such calamity is P25,000,000.

FAR – Accounting 15 Page 2

of 11

j. On January 20,2012, Benz Inc. acquired 100% interest of Ferrari Inc. for P100,000,000.

Required: Based on the result of your audit, provide the treatment of the preceding events after reporting period:

________________________1. Event A

________________________2. Event B

________________________3. Event C

________________________4. Event D

________________________5. Event E

________________________6. Event F

________________________7. Event G

________________________8. Event H

________________________9. Event I

________________________10. Event J

Statement of Comprehensive Income

Problem 4. The income tax rate for the year is 30%. The following income and expense accounts are obtained from the

Trial Balance of Ferrari Inc., which is a diversified company, for the year ended December 31,2011:

Deferred Tax Expense P1,200,000

Impairment loss on Non-current Asset Held for Sale, before tax 300,000

Gain on sale of Non-current Asset Held for sale, before tax 400,000

Sales 40,000,000

Purchases of Raw Materials 10,000,000

Bad debts expense 100,000

Impairment loss on Loans Receivable 200,000

Gain on factoring of Accounts Receivable 400,000

Loss on Notes Receivable Discounting 100,000

Purchase discount and allowance on Raw Materials 300,000

Sales discount and allowance 400,000

Purchase return on Raw Materials 500,000

Sales return 200,000

Freight In on Raw Materials 300,000

Direct Labor 1,000,000

Factory Overhead – 50% of Direct Labor ?

Raw Materials, January 1 2,000,000

Raw Materials, December 31 3,000,000

WIP, January 1 1,500,000

WIP, December 31 2,500,000

Finished Goods, January 1 5,000,000

Finished Goods, December 31 3,000,000

Gain on changes in Fair Value less cost to sell of Biological Assets 1,000,000

Share dividend received from Investment in SMC @ cost method(fair value of OS) 500,000

Cash and property dividend received from Investment in SMC @ cost method 300,000

Cash and property dividend received from Investment in BDO @ equity method 200,000

Share in net loss from Investment in BDO @ equity method 500,000

Interest received from Investment in Held to Maturity Securities 300,000

Amortization of Premium on Held to Maturity Securities 20,000

Realized loss on sale of Investment in Held to Maturity Securities 400,000

Loss on changes in far value of Investment Property 500,000

Realized gain on sale of Investment Property 100,000

Realized deferred income from government grant 400,000

Depreciation on Property, Plant and Equipment 3,000,000

Depletion of Wasting Asset 2,000,000

Loss on sale of an item of Property, Plant and Equipment 1,000,000

Impairment loss of Property, Plant and Equipment 500,000

Amortization of Intangible Asset 400,000

Pre-organization cost 200,000

Research and development cost 300,000

Stock issuance cost of Ordinary Shares 200,000

Warranty Expense 500,000

Premium Expense 200,000

Current Tax Expense 2,000,000

Interest Paid on Bonds Payable 200,000

Amortization of Discount on Bonds Payable 50,000

Amortization of Bonds Payable Issue cost 50,000

Gain on debt restructuring – asset swap 200,000

Gain on debt restructuring – equity swap 300,000

Gain on debt restructuring – modification of terms (5% of original liability) 100,000

Interest Expense on Finance Lease 200,000

Gain on sale and leaseback – operating lease 300,000

Loss on sale and leaseback – finance lease 400,000

FAR – Accounting 15 Page 3

of 11

Compensation Expense – Share Options 100,000

Compensation Expense – Share appreciation rights 200,000

Revenue from discontinued operation, before tax 1,000,000

Expenses from discontinued operation, before tax 500,000

Impairment loss of assets of discontinued operation, before tax 300,000

Realized gain on sale of assets of discontinued operation, before tax 400,000

Expense from Law Suit 500,000

Freight Out 200,000

Sales Commission 100,000

Salary of Marketing Department’s employees 100,000

Advertising Expense 500,000

Salary of legal counsel 500,000

Salary of directors and executives 900,000

Salary of accounting department 200,000

Office Supplies used 100,000

Rental Expense on Main building 1,000,000

Utilities Expense 100,000

Extraordinary loss from calamity 300,000

Unrealized holding loss from FLFVPL – due to credit risk 400,000

Realized loss from FLFVPL – due to credit risk 100,000

Unrealized holding loss from FLFVPL – not due to credit risk 200,000

Unrealized holding gain on derivatives designated as fair value hedge 100,000

Unrealized holding loss on derivates designated as cash flow hedge (effective) 300,000

Realized loss on derivatives designated as cash flow hedge (effective) 100,000

Unrealized holding gain on derivatives designated as cash flow hedge (ineffective) 200,000

Unrealized holding gain on derivatives designated as hedge of net investment in

Foreign operation (effective) 500,000

Realized gain on derivatives designated as hedge of net investment in

Foreign operation (effective) 300,000

Translation adjustment debit – Foreign Operation 2,000,000

Transaction gain from foreign exchange transaction 500,000

Unrealized holding gain on Trading Securities 2,000,000

Realized loss on sale of Trading Securities 500,000

Unrealized holding loss on FAFVOCI equity instrument 3,000,000

Realized holding loss on FAFVOCI equity instrument 1,000,000

Unrealized holding gain on FAFVOCI Debt Instruments 2,000,000

Realized gain on sale of FAFVOCI Debt Instruments 1,500,000

Net Remeasurement Gain or Actuarial Gain under Defined Benefit Plan 100,000

Employee Benefit Expense 200,000

Increase in Revaluation Surplus during 2011 2,000,000

Realized Revaluation Surplus during 2011 200,000

Additional notes during 2011 are also provided as follows:

1. The depreciation of Property, Plant and Equipment is 60% administrative and 40% selling.

2. The depletion of Wasting Asset is considered part of Other Expenses.

3. The employee benefit expense is 80% administrative and 20% selling.

4. The compensation expense from share option is for administrative department employees while that from share

appreciation rights is for selling department employees.

5. The rental, utilities and office supplies expense is equally divided between administrative and selling departments.

6. Finance cost is separated from other expenses.

7. Ferrari uses the functional or cost of sale format in preparing its Statement of Comprehensive Income.

Required: Based on the result of your audit, determine the following for the year ended December 31,2011:

____________1. Cost of Sales

____________2. Gross Profit

____________3. Total Other Income

____________4. Administrative Expense

____________5. Selling Expense

____________6. Total Other Expense

____________7. Total Income Tax Expense

____________8. Income from Continued Operation

____________9. Income or (loss) from discontinued operation

____________10. Profit or Loss

____________11. Net Other Comprehensive Income with Reclassification Adjustment

____________12. Net Other Comprehensive Income without Reclassification Adjustment

____________13. Net Other Comprehensive Income

____________14. Total Comprehensive Income

FAR – Accounting 15 Page 4

of 11

CAPITAL MAINTENANCE APPROACH

Problem 5. On January 1, 2013, the total assets of LLB Inc. is P2,000,000 while its total liabilities is P1,200,000. During

the year, the corporation issued 20,000 ordinary shares with par value of P10 for P20/share. The corporation also

declared and paid cash dividends in the amount of P100,000 and distributed property dividends with book value of

P100,000 and fair value of P500,000.

During 2013, the total assets increased to P5,000,000 while the total liabilities increased by P1,800,000. Nothing

affects the total stockholder’s equity accounts except the transactions provided and profit or loss. What is the profit/

(loss) of LLB Inc. for the year ended December 31,2013?

NON-CURRENT ASSET HELD FOR SALE

Problem 6. On January 1, 2013, JD Inc. constructed a building classified as owner-occupied property for a total cost of

P2,200,000 with useful life of 10 years and residual value of P200,000. It is the company’s policy to use the cost method

of valuation for property, plant and equipment. On December 31, 2013, the company determined that the carrying amount

of the building will be recovered principally through a sale transaction rather than through continuing use. The following

amounts are provided by a qualified appraiser:

12/31/2013 12/31/2014 12/31/2015

Value in Use P2,500,000 P2,300,000 P2,000,000

Fair Value less Cost to Sell 1,500,000 1,400,000 1,300,000

On December 31, 2015, JD Inc. decided not to sell the building and it no longer met the criteria for being classified

as held for sale.

Required: Based on the result of your audit, determine the following:

____________1. Carrying amount of building on 12/31/2013

____________2. Impairment loss of building for the year ended 12/31/2013

____________3. Carrying amount of building on 12/31/2014

____________4. Impairment loss of building for the year ended 12/31/2014

____________5. Depreciation expense of building for the year ended 12/31/2014

____________6. Carrying amount of building on 12/31/2015

____________7. Reversal of impairment loss for the year ended 12/31/2015

DISCONTINUED OPERATION

Problem 7. On January 1,2013, ABS-CBN, a communication entity, has decided to dispose one of its radio operations

known as DZMM SAIS TRENTA. During 2013, the total revenues from the operation of DZMM is P50,000,000 while its

total operating expenses is P40,000,000. During 2013, the post-tax impairment loss of the assets of DZMM amounts to

P5,000,000. On December 31,2013, DZMM sold one of its satellites with a cost of P5,000,000 and accumulated

depreciation of P2,000,000. The selling price of the satellite is P6,000,000 and its fair value is P4,000,000. During 2013,

DZMM also incurred pre-tax termination costs of P1,000,000 as a result of the discontinuance. The normal corporate

income tax for year 2013 is 30%. What is the single amount to be presented in the line item-discontinued operation

of the 2013 Statement of Comprehensive Income of ABS-CBN?

Change in Accounting Estimate

Problem 8. On January 1,2013, Wayne Inc. acquired a machine for P530,000 with useful life of 5 years and residual

value of P30,000. It is the company’s policy to use SYD method for depreciation of its property, plant and equipment. On

January 1, 2015, due to new information, Wayne Inc. changed its depreciation method from SYD to Straight Line Method.

Aside from that, the revised useful life is 7 years from the date of acquisition. There is no change in the residual value.

Required: Based on your audit, determine the following:

____________1. Depreciation expense for the year ended December 31,2015

____________2. Carrying value of the machine as of December 31,2015

Problem 9. On January 1,2013, Queen Inc. purchased an equipment for P120,000 with useful life of 4 years and residual

value of P20,000.It is the company’s policy to use 200% Double Declining Balance Method for depreciation of its property,

plant and equipment. On January 1,2014, due to new information, Queen changed its depreciation method from Double

Declining Balance Method to SYD Method. The remaining useful life as of January 1,2014 is 2 years. The residual value is

also revised to P15,000. What is the cumulative effect of these accounting changes in the January 1,2014 Retained

Earnings to be presented in the 2014 Statement of Changes in Equity assuming the tax rate is 30%?

Change in Accounting Policy

Problem 10. On January 1,2013, Arrow Inc. started its operation. It is the company’s policy to provide bad debts expense

based on 5% of its ending receivables. The following data are also provided on December 31,2013:

Accounts Receivable P1,000,000

Allowance for Bad Debts 50,000

Credit Sales 3,000,000

Written off Receivables 30,000

On January 1,2014, the company changed its accounting policy for providing bad debts expense from 5% of

ending receivables to 10% of credit sales. During 2014, the following data are also provided:

Accounts Receivable 12/31/2014 P2,000,000

Credit Sales 5,000,000

Recovery of previously written off AR 20,000

Written off Receivables 40,000

What is the cumulative effect of this accounting change in the January 1,2014 Retained Earnings to be presented

in 2014 Statement of Changes in Equity assuming the tax rate is 30%?

FAR – Accounting 15 Page 5

of 11

Problem 11. On January 1,2014, IRON Inc. decided to change its accounting policy for costing of its inventory from FIFO

to Weighted Average. The following data are provided:

FIFO WEIGHTED AVERAGE

12/31/2012 P1,000,000 P1,500,000

12/31/2013 2,000,000 1,000,000

12/31/2014 3,000,000 5,000,000

What is the cumulative effect of this accounting change in the January 1,2014 Retained Earnings to be presented

in 2014 Statement of Changes in Equity assuming the tax rate is 30%?

Problem 12. On January 1,2013, THOR Inc. acquired a building to be held as investment property in the amount of

P3,300,000. The building has a residual value of P300,000 and has a useful life of 6 years. It is the company’s policy to

use cost method for the valuation of its investment property. On January 1,2015, THOR Inc. decided to change its

accounting treatment of its investment property from cost method to fair value method. The following fair values are also

provided:

December 31,2013 P3,500,000

December 31,2014 3,000,000

December 31,2015 3,200,000

What is the cumulative effect of this accounting change in the January 1,2015 Retained Earnings to be presented

in 2015 Statement of Changes in Equity assuming the tax rate is 30%?

Classification of Operating, Investing and Financing Activities. Indicate the proper classification of the following cash

flows by using O for Operating, I for Investing and F for financing.

___Cash paid for the acquisition of merchandise inventory

___Cash received from the sale of available for sale securities

___Cash received from the sale of trading securities

___Cash paid for the acquisition of treasury shares

___Cash paid for salaries of employees and officers

___Cash paid to stockholders as distribution of earnings

___Cash received from investment in associate

___Cash paid for interest on loans payable

___Cash received for interest on notes receivable

___Cash paid for acquisition of call option

___Cash received from the sale of investment property

___Cash paid for acquisition of land to be classified as property, plant and equipment

___Cash received from bank loan

___Cash paid for advances to subsidiary

___Cash received from customers

___Cash paid for utilities

___Cash paid for taxes

___Cash received from investment of stockholders

___Cash paid for acquisition of held to maturity securities

___Cash paid for acquisition of patent

___Cash paid for the disposal of trademark

___Cash paid for acquisition of prepaid insurance

___Cash received from the sale of factory equipment

Direct Method.

A. Collection from Customers.

Problem 13. The following data are provided by James Inc. for the year ended December 31,2013:

Total Sales P20,000,000

Cash received from cash customers 5,000,000

Factored accounts receivable 1,000,000

Dishonored notes receivable 3,000,000

Interest on dishonored notes receivable 500,000

Recovery of previously written off accounts receivable 300,000

Written off accounts receivable during the year 200,000

Sales discount availed by customers during the year 100,000

Credit memo issued by James Inc. during the year 400,000

Bad debt expense during the year 800,000

The following balances are provided:

Accounts Receivable, January 1,2013 P10,000,000

Net realizable value of AR, January 1,2013 9,500,000

Net realizable value of AR, December 31,2013 12,000,000

What is the total collection from customers for the year ended December 31, 2013?

FAR – Accounting 15 Page 6

of 11

Problem 14. The following data are provided by Lebron Inc. for the year ended December 31,2013:

12/31/2012 12/31/2013

Trade AR P1,000,000 P2,000,000

Trade NR 3,000,000 3,500,000

Unearned Revenue 5,000,000 2,000,000

The total revenue reported by Lebron Inc. on its Income Statement for the year ended December 31,2013 is P10,000,000.

What is the total cash collected from customers for the year ended December 31, 2013?

B. Cash Paid to Suppliers

Problem 15. The following data are provided by Dwayne Inc. for the year ended December 31,2013:

12/31/2012 12/31/2013

Merchandise Inventory P2,000,000 P2,500,000

Accounts payable 3,000,000 4,000,000

Purchase discount 500,000

Credit memo issued by suppliers 300,000

Note payable issued for some accounts payable 200,000

Cost of goods sold for year 2013 9,000,000

What is the total cash paid to suppliers for the year ended December 31, 2013?

C. Cash Paid for Operating Expense

Problem 16. The following data are provided by Wade Inc. for the year ended December 31,2013:

12/31/2012 12/31/2013

Prepaid salary P1,000,000 P1,500,000

Accrued salary 2,500,000 5,000,000

Salary expense for year 2013 7,000,000

What is the total cash paid for salaries for the year ended December 31, 2013?

Problem 17. The following information are provided concerning the operating expenses of TY Inc.:

12/31/2010 12/31/2011

Prepaid Expenses 1,000,000 3,000,000

Accrued Expenses 2,000,000 2,500,000

Total Operating Expenses 10,000,000

Acc. Depreciation 3,000,000 4,000,000

Acc. Amortization 2,000,000 2,500,000

The following notes are also provided:

a. Non-cash expenses such as amortization expense and depreciation expense are included in the total operating

expenses.

b. During the year, TY sold equipment with a cost of P2,000,000. The net proceeds from the sale of equipment is

P2,100,000 and the gain on disposal is P500,000.

c. During the year, TY sold patent with a cost of P1,000,000. The net proceeds from the sale of patent is P600,000

and the loss on disposal is P200,000.

What is the cash basis operating expenses for the year ended December 31, 2011?

Problem 18. The following information are provided by LA Inc. concerning its interest expense:

12/31/2010 12/31/2011

Prepaid Interest 100,000 150,000

Accrued Interest Payable 250,000 100,000

Discount on Bonds Payable 300,000 150,000

Premium on Bonds Payable 250,000 50,000

The following data are also provided:

a. During 2011, LA extinguished some Bonds Payable originally issued at a discount with a face value of P1,000,000

through asset swap. The book value of the land given up is P1,100,000 and the fair value is P1,200,000. The

extinguishment of Bonds Payable resulted to a loss of P150,000.

b. During 2011, LA extinguished some Bonds Payable originally issued at a premium with a face value of

P2,000,000 by payment of P2,000,000. The extinguishment resulted to a gain of P100,000.

c. The total interest expense for the year is P2,000,000.

What is the cash paid for interest for the year ended December 31, 2011?

D. Cash Paid for Taxes

Problem 19. The following data are provided by Chris Inc. for the year ended December 31,2013:

12/31/2012 12/31/2013

Prepaid taxes P1,500,000 P1,000,000

Income tax payable 2,000,000 3,000,000

Deferred tax asset 2,000,000 4,000,000

FAR – Accounting 15 Page 7

of 11

Deferred tax liability 3,000,000 2,000,000

Current Tax Expense for year 2013 5,000,000

Deferred Tax Expense for year 2013 6,000,000

What is the total cash paid for taxes for the year ended December 31, 2013?

E. Cash Collected from Interest

Problem 20. The following data are provided by Bosh Inc. for the year ended December 31,2013:

12/31/2012 12/31/2013

Interest receivable P3,000,000 P2,000,000

Unearned interest 2,000,000 2,500,000

Interest revenue for year 2013 12,000,000

What is the total collected interest for the year ended December 31, 2013?

Problem 21. The following information are provided concerning the interest income of AT Inc. for 2011:

12/31/2010 12/31/2011

Unearned Interest Income 200,000 100,000

Accrued Interest Income 400,000 500,000

Discount on Bonds Rec. 500,000 300,000

Premium on Bonds Rec. 400,000 100,000

The following data are also provided:

a. During 2011, AT sold the Bonds Rec. with a face value of P1,000,000 and which was originally purchased at a

discount. The net proceeds of the sale was P950,000. Gain on derecognition of Bonds Receivable was P100,000.

b. During 2011, AT sold the Bonds Rec. with a face value of P1,000,000 and which was originally purchased at a

premium. The net proceeds of the sale was P1,100,000. Loss on derecognition of Bonds Receivable was

P50,000.

c. The total interest revenue for the year was P3,000,000.

What is the total cash collected from interest for the year ended December 31, 2011?

F. Cash Paid for Dividends

Problem 22. The following information are provided regarding the Retained Earnings of AIM Inc.:

12/31/2010 12/31/2011

Retained Earnings 2,500,000 2,000,000

Cash Dividends Payable 3,500,000 1,000,000

The following notes are also provided:

1. On January 1,2011, AIM changed its inventory costing method from FIFO to Weighted Average. The FIFO cost on

January 1, 2011 is P1,000,000 while the Weighted Average Cost is P2,000,000. The tax rate is 30%.

2. On June 1,2011, AIM reissued treasury shares with a total cost of P1,000,000 in the amount of P500,000. There

was no share premium arising from treasury shares transaction at the time of re-issuance of treasury shares.

3. On December 31,2011, AIM declared cash dividends and property dividends. The book value of property

dividends at that date is P400,000 while the fair value is P600,000.

4. The adjusted net income for 2011 was P1,500,000.

What is the amount of dividends paid in cash for 2011?

G. Investing Activity

Problem 23. The following information are provided affecting JT’s Land:

12/31/2010 12/31/2011

Land 2,000,000 1,000,000

The following notes are also provided:

1. On January 1,2011, JT purchased land by paying P100,000 in cash.

2. On February 1,2011, JT received a land from government with a book value P200,000 and fair value of P300,000.

3. On March 1,2011, JT issued 10,000 ordinary shares in exchange of a land with a fair value of P400,000. The fair

value of ordinary shares is P30 per share and the par value is P10.

4. On April 1, 2011, JT sold land to another company. In exchange to the lan, JT received a promissory note of

P500,000.

5. On May 1,2011, JT sold land to the government for cash. JT realized P200,000 gain on disposal of land.

What is the net cash inflow (outflow) from investing activitiy for 2011?

FAR – Accounting 15 Page 8

of 11

Problem 24. The following information are provided affecting DV’s Noncurrent Asset:

12/31/2010 12/31/2011

Machinery & Equip. 3,500,000 1,500,000

Patent 3,000,000 1,000,000

Accumulated Dep. 500,000 300,000

Accumulated Amort. 600,000 200,000

The following notes are also provided:

1. On January 1,2011, DV purchased machinery by paying P500,000 in cash.

2. On February 1,2011, DV purchased patent by paying P300,000 in cash.

3. On March 1,2011, DV received equipment as dividend from an investee company with a book value of P300,000

and fair value of P400,000.

4. On April 1,2011, DV purchased a patent in the amount of P600,000. DV issued a promissory note in that amount.

5. On May 1,2011, DV issued 5,000 Preference Shares with a fair value of P20 per share and par value of P10 in

exchange for a machinery. The fair value of the machinery is P300,000.

6. On June 1,2011, DV sold a patent for cash. The total amortization expense for the year was P400,000. The loss

on disposal of patent was P600,000.

7. On July 1,2011, DV sold an equipment for cash. The total depreciation expense for the year was P800,000. The

gain on disposal was P500,000.

What is the net cash inflow (outflow) from investing activity for 2011?

Problem 25. The following information are provided affecting JD’s Investment in Associate with a 20% ownership:

12/31/2010 12/31/2011

Investment in Associate 2,000,000 1,000,000

The following notes are also provided:

1. The investee company reported a net income of P1,000,000 and total other comprehensive income with a debit

balance of P500,000 as of December 31,2011.

2. The investment was acquired in the beginning of 2009 and the total fair value of consideration given up is higher

than book value of net assets acquired. The differences are attributed to the following:

Book Value Fair value

Land 1,000,000 1,100,000

Building 1,200,000 1,700,000

Equipment 1,200,000 1,100,000

Inventory 1,200,000 1,400,000

All beginning inventories of Investee in 2009 were sold in that year. The building has a useful life of 10 years

from January 1,2009 while the equipment has 4 years useful life.

3. JD Inc. received a property dividend and cash dividend for the year. The book value of the property dividend is

P200,000 while the fair value is P300,000.

Assuming the company presents dividend received as part of Operating Activity, What is the amount of cash

received from Investment in Associate?

Indirect Method

Problem 26. The following summarized data are provided from the Statement of Financial Position and Income Statement

of Miami Heat Inc. STATEMENT OF FINANCIAL POSITION

Current Asset Section Current Liability Section

12/31/2012 12/31/2013 12/31/2012 12/31/2013

Cash and CE P1,000,000 P2,000,000 Accounts Payable P2,000,000 P3,000,000

Trading Securities 300,000 200,000 Accrued Expenses 1,000,000 500,000

AR, net 500,000 300,000 Income tax payable 500,000 600,000

Inventory 1,500,000 2,500,000 Interest payable 300,000 100,000

INCOME STATEMENT

Net Sales P10,200,000

Less: Cost of Goods Sold (5,000,000)

Gross Profit P 5,200,000

Less: Operating Expenses (including P200,000 depreciation

and bad debt expense of P100,000) ( 2,000,000)

Net Operating Income P 3,200,000

Add: Gain on sale of investment property 700,000

Holding gain on trading securities 200,000

Less: Amortization of patent (300,000)

Realized loss on sale of trading securities (100,000)

FAR – Accounting 15 Page 9

of 11

Loss on sale of factory equipment (400,000)

Income before interest and tax P 3,300,000

Less: Loss on interest expense (100,000)

Net income before tax P 3,200,000

Less income tax expense 960,000

Net Income P 2,240,000

What is the net cash flow from operating activities for the year ended December 31, 2013?

Problem 27. ASUS Corporation has recently decided to go public and has hired you as an independent CPA. One

statement that the entity is anxious to have prepared is a statement of cash flows. Financial statements of ASUS for

2010 and 2009 are provided below.

Statement of Financial Position

12/31/2010 12/31/2009

Cash 153,000 72,000

Accounts Receivable 135,000 81,000

Merchandise Inventory 144,000 180,000

PPE (net of Acc. Dep. of P120,000 and P114,000 as

of 12/31/2010 and 12/31/2009, respectively) 108,000 246,000

540,000 579,000

Accounts payable 66,000 36,000

Income taxes payable 132,000 147,000

Bonds payable 135,000 225,000

Share capital 81,000 81,000

Retained earnings 126,000 90,000

540,000 579,000

Income Statement

For the Year Ended December 31,2010

Sales 3,150,000

Cost of sales 2,682,000

Gross profit 468,000

Selling expenses 225,000

Administrative expenses 72,000 297,000

Income from operations 171,000

Interest expense 27,000

Profit before taxes 144,000

Income taxes 36,000

Profit or loss 108,000

The following additional data were provided:

1. Dividends for the year 2010 were P72,000.

2. During the year, equipment was sold for P90,000. This equipment cost P132,000 originally and had a book

value of P108,000 at the time of sale. The loss on sale was incorrectly charged to cost of sales.

3. All depreciation expense is in the selling expense category.

1. What is the net cash provided by operating activities?

a. 153,000 c. 108,000

b. 90,000 d. 75,000

2. Assuming the same data provided in number 59, what is the net cash provided (used) by investing

activities?

a. (132,000) c. 18,000

b. 90,000 d. (108,000)

3. Assuming the same data provided in number 59, what is the net cash provided (used) by financing

activities?

a. (90,000) c. 18,000

b. (162,000) d. 72,000

FAR – Accounting 15 Page

10 of 11

Interim Reporting

Problem 28. NYY Inc. prepares quarterly interim financial reports. On February 14, 2013, the company incurred a

calamity loss resulting from an earthquake in the amount of P200,000. The calamity loss was paid by the company on

November 1,2013. How much calamity loss shall be recognized in the interim income statements for the 1 st

quarter, 2nd quarter, 3rd quarter and 4th quarter, respectively?

Problem 29. NYM Inc. prepares quarterly interim financial reports. On the March 31,2013, the following data for inventory

are provided:

Cost P2,000,000

Estimated selling price 2,500,000

Gross profit rate based on sale 20%

Estimated cost to complete 300,000

Estimated cost to sell 400,000

On June 30,2013, the following data for inventory are also provided:

Cost P2,000,000

Estimated selling price 3,000,000

Gross profit rate based on sale 20%

Estimated cost to complete 200,000

Estimated cost to sell 400,000

How much loss on inventory writedown shall be recognized in the interim income statements for the 1 st

quarter, 2nd quarter, 3rd quarter and 4th quarter, respectively? How much gain on reversal of loss on inventory

writedown shall be recognized in the interim income statements for the 1 st quarter, 2nd quarter, 3rd quarter and 4th

quarter, respectively?

Problem 30. BYN Inc. prepares quarterly interim financial reports. On January 1, 2013, the company paid P200,000 for

advertisement which will benefit the whole year 2013. On April 1,2013, the company incurred repairs and maintenance in

the amount of P300,000 and paid it on December 15,2013. The repairs and maintenance will only benefit the remainder of

the year. How much advertising expense shall be recognized in the interim income statements for the 1 st quarter,

2nd quarter, 3rd quarter and 4th quarter, respectively? How much repairs and maintenance expense shall be

recognized in the interim income statements for the 1 st quarter, 2nd quarter, 3rd quarter and 4th quarter,

respectively?

Problem 31. LAA Inc. prepares quarterly interim financial reports. The company provides bad debt expense 10% based

on credit sales for the quarter. The company estimated that the total bad debt expense for year 2013 is P200,000. The

company recognized bad debt expense for the 1 st, 2nd, and 3rd quarter in the amount of P30,000, P50,000 and P80,000

respectively. During the 4th quarter, the total credit sales is P600,000 and the company wrote off P50,000 accounts

receivables. How much bad debt expense shall be recognized in the 4 th quarter income statement?

Operating Segment

Problem 32. LAD Inc. has several operating segments. The following data are provided concerning its segments:

Segment Total Assets Total External Revenue Total Internal Revenue Profit/(Loss)

A P2,000,000 P 50,000 P 550,000 P 50,000

B 100,000 200,000 100,000 20,000

C 200,000 30,000 270,000 (100,000)

D 3,000,000 20,000 180,000 30,000

E 700,000 100,000 1,900,000 (200,000)

Required: Determine the following amounts:

__________1. Quantitative threshold in assets to be considered as reportable segment

__________2. Quantitative threshold in revenues to be considered as reportable segment

__________3. Quantitative threshold in profit or loss to be considered as reportable segment

__________4. 75% Quantitative threshold for reportable segments

__________5. How many reportable segments should LAD Inc. disclose?

Problem 33. TBR Inc. is considering providing disclosures for its major customers. The following data are provided

concerning its operating segments:

Segment T Total External Revenue Total Internal Revenue

A P 500,000 P 100,000

B 200,000 50,000

C 300,000 150,000

D 100,000 180,000

E 400,000 20,000

FAR – Accounting 15 Page

11 of 11

What is the minimum revenue to be provided by a customer to be considered a major customer which will

require disclosures from TBR Inc.?

FAR – Accounting 15 Page

12 of 11

Você também pode gostar

- Final Examination in Auditing Principles and Application 1Documento8 páginasFinal Examination in Auditing Principles and Application 1Anie Martinez0% (1)

- Sales Chapter 13 Part II REPORTDocumento50 páginasSales Chapter 13 Part II REPORTJeane Mae BooAinda não há avaliações

- Lesson 4 Expenditure Cycle PDFDocumento19 páginasLesson 4 Expenditure Cycle PDFJoshua JunsayAinda não há avaliações

- Ourladyoffatimauniversity: The Problem and ItDocumento19 páginasOurladyoffatimauniversity: The Problem and ItOwen PacenioAinda não há avaliações

- Colegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityDocumento5 páginasColegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityJhomel Domingo GalvezAinda não há avaliações

- CCE ReceivablesDocumento5 páginasCCE ReceivablesJane TuazonAinda não há avaliações

- 2016 4083 4th Evaluation ExamDocumento8 páginas2016 4083 4th Evaluation ExamPatrick ArazoAinda não há avaliações

- Notes in Fi4Documento1 páginaNotes in Fi4Gray JavierAinda não há avaliações

- ACCO 30043 Assignment No.6 RevisedDocumento11 páginasACCO 30043 Assignment No.6 RevisedRoseanneAinda não há avaliações

- Premium-Liability Bafacr4x OnlineglimpsenujpiaDocumento8 páginasPremium-Liability Bafacr4x OnlineglimpsenujpiaAga Mathew MayugaAinda não há avaliações

- Kuis AklDocumento6 páginasKuis AklArista Yuliana SariAinda não há avaliações

- This Study Resource Was: Consignment SalesDocumento3 páginasThis Study Resource Was: Consignment SalesKez MaxAinda não há avaliações

- ACCO 3026 Final ExamDocumento11 páginasACCO 3026 Final ExamClarisseAinda não há avaliações

- Weston Corporation Has An Internal Audit Department Operating OuDocumento2 páginasWeston Corporation Has An Internal Audit Department Operating OuAmit PandeyAinda não há avaliações

- Chapter 11Documento3 páginasChapter 11Kamran AhmedAinda não há avaliações

- ACCO 30043 Assignment No.3Documento8 páginasACCO 30043 Assignment No.3RoseanneAinda não há avaliações

- ACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREDocumento12 páginasACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREKabalaAinda não há avaliações

- T 2Documento3 páginasT 2Corazon Lim LeeAinda não há avaliações

- Question Text: Retained Earnings Retained Earnings Retained Earnings Retained EarningsDocumento32 páginasQuestion Text: Retained Earnings Retained Earnings Retained Earnings Retained EarningsYou're WelcomeAinda não há avaliações

- Decentralized and Segment ReportingDocumento44 páginasDecentralized and Segment ReportingShaina Santiago AlejoAinda não há avaliações

- Finals Exercise 2 - WC Management InventoryDocumento3 páginasFinals Exercise 2 - WC Management Inventorywin win0% (1)

- PUP Review Handout 1 OfficialDocumento3 páginasPUP Review Handout 1 OfficialDonalyn CalipusAinda não há avaliações

- Intacc2 - Assignment 4Documento3 páginasIntacc2 - Assignment 4Gray JavierAinda não há avaliações

- Not For Profit Organization and Government Accounting HandoutDocumento6 páginasNot For Profit Organization and Government Accounting HandoutNicoleAinda não há avaliações

- R3 - ARC - AP and ATDocumento10 páginasR3 - ARC - AP and ATOliver SalamidaAinda não há avaliações

- Intacc 3 HWDocumento7 páginasIntacc 3 HWMelissa Kayla ManiulitAinda não há avaliações

- 10 Responsibility Accounting Live DiscussionDocumento4 páginas10 Responsibility Accounting Live DiscussionLee SuarezAinda não há avaliações

- ROMERO BSMA1E Standard Costing ExerciseDocumento4 páginasROMERO BSMA1E Standard Costing ExerciseAliah Romero100% (1)

- CHAPTER 11 Without AnswerDocumento3 páginasCHAPTER 11 Without Answerlenaka0% (1)

- (169472718) MODAUD1 UNIT 1 - Analysis and Correction of ErrorsDocumento5 páginas(169472718) MODAUD1 UNIT 1 - Analysis and Correction of ErrorsJervin LabroAinda não há avaliações

- C18 - Defined Benefit Plan PDFDocumento23 páginasC18 - Defined Benefit Plan PDFKristine Diane CABAnASAinda não há avaliações

- PENFinalExam1415 1lAdvancedFinancialAccountingandReportingPart1 COCDocumento20 páginasPENFinalExam1415 1lAdvancedFinancialAccountingandReportingPart1 COCRhedeline LugodAinda não há avaliações

- TaxationDocumento7 páginasTaxationDorothy ApolinarioAinda não há avaliações

- She QuizDocumento4 páginasShe QuizJomar Villena100% (1)

- CE On Agriculture T1 AY2020-2021Documento2 páginasCE On Agriculture T1 AY2020-2021Luna MeowAinda não há avaliações

- Lyceum of The Philippines University Manila College of Business AdministrationDocumento166 páginasLyceum of The Philippines University Manila College of Business AdministrationVanessa SisonAinda não há avaliações

- POST-TEST 1 - Auditing and The Audit Process - AUDITING AND ASSURANCE PRINCIPLES - CONCEPTS AND APPLICATIONSDocumento6 páginasPOST-TEST 1 - Auditing and The Audit Process - AUDITING AND ASSURANCE PRINCIPLES - CONCEPTS AND APPLICATIONSDonise Ronadel SantosAinda não há avaliações

- SAMCIS AE 322 COURSE GUIDE v2Documento6 páginasSAMCIS AE 322 COURSE GUIDE v2Fernando III PerezAinda não há avaliações

- Problem 17-1, ContinuedDocumento6 páginasProblem 17-1, ContinuedJohn Carlo D MedallaAinda não há avaliações

- PRACTICAL ACCOUNTING 1 Part 2Documento9 páginasPRACTICAL ACCOUNTING 1 Part 2Sophia Christina BalagAinda não há avaliações

- Chapter OneDocumento5 páginasChapter OneHazraphine LinsoAinda não há avaliações

- CasesDocumento3 páginasCasesHL100% (1)

- 08 - Activity Based Costing and Balance ScorecardDocumento4 páginas08 - Activity Based Costing and Balance ScorecardMarielle CastañedaAinda não há avaliações

- MQ1Documento8 páginasMQ1alellieAinda não há avaliações

- Discussion 2 - Production Cycle - ACCT 2Documento1 páginaDiscussion 2 - Production Cycle - ACCT 2Giselle MartinezAinda não há avaliações

- Persuasiveness of EvidenceDocumento2 páginasPersuasiveness of Evidencesamuel debebeAinda não há avaliações

- Management Advisory Services - FinalDocumento8 páginasManagement Advisory Services - FinalFrancis MateosAinda não há avaliações

- 0405 MAS Preweek Quizzer PDFDocumento22 páginas0405 MAS Preweek Quizzer PDFTokkiAinda não há avaliações

- Self-Test Partnership and Corporate LiquidationDocumento6 páginasSelf-Test Partnership and Corporate Liquidationxara mizpahAinda não há avaliações

- Reviewer AdvacDocumento4 páginasReviewer AdvacMarjorie AmpongAinda não há avaliações

- Actrev 3Documento3 páginasActrev 3Kenneth Bryan Tegerero Tegio0% (1)

- Toa Quizzer 1: Multiple ChoiceDocumento18 páginasToa Quizzer 1: Multiple ChoiceRukia KuchikiAinda não há avaliações

- Ms 03 - CVP AnalysisDocumento10 páginasMs 03 - CVP AnalysisDin Rose GonzalesAinda não há avaliações

- Introduction To Business Combinations: Summary of Items by TopicDocumento30 páginasIntroduction To Business Combinations: Summary of Items by TopicKyla Ramos DiamsayAinda não há avaliações

- Cuartero - Unit 3 - Accounting Changes and Error CorrectionDocumento10 páginasCuartero - Unit 3 - Accounting Changes and Error CorrectionAim RubiaAinda não há avaliações

- Straight ProblemsDocumento1 páginaStraight ProblemsMaybelle100% (1)

- Audit of Financial StatementsDocumento8 páginasAudit of Financial Statementsd.pagkatoytoyAinda não há avaliações

- SFP - ExerciseDocumento2 páginasSFP - ExerciseJustine SorizoAinda não há avaliações

- Ford Inc Statement of Financial PositionDocumento3 páginasFord Inc Statement of Financial PositionTina PascualAinda não há avaliações

- A. The Following Account Balances Were Presented On December 31, 2017Documento3 páginasA. The Following Account Balances Were Presented On December 31, 2017Shiela Mae Pon AnAinda não há avaliações

- Assessing The Financial Position of An Aquaculture BusinessDocumento4 páginasAssessing The Financial Position of An Aquaculture Businessjoao pedro FonsecaAinda não há avaliações

- Income Statement FormatDocumento2 páginasIncome Statement FormatShruti MohanAinda não há avaliações

- Instructor Manual For Financial Managerial Accounting 16th Sixteenth Edition by Jan R Williams Sue F Haka Mark S Bettner Joseph V CarcelloDocumento14 páginasInstructor Manual For Financial Managerial Accounting 16th Sixteenth Edition by Jan R Williams Sue F Haka Mark S Bettner Joseph V CarcelloMarkCallahanxgyfq100% (37)

- Applied Auditing Review Course Pre-Board - FinalDocumento13 páginasApplied Auditing Review Course Pre-Board - FinalROMAR A. PIGAAinda não há avaliações

- MCQ of Financial Statement AnalysisDocumento8 páginasMCQ of Financial Statement AnalysisRahul Ghosale100% (11)

- Case Study - ACI and Marico BDDocumento9 páginasCase Study - ACI and Marico BDsadekjakeAinda não há avaliações

- Balance Sheet: (Tata Motors LTD.)Documento13 páginasBalance Sheet: (Tata Motors LTD.)Ameya PatilAinda não há avaliações

- BSMM 8110 Midterm 7Documento31 páginasBSMM 8110 Midterm 7jemilart4realAinda não há avaliações

- GO AIRLINES (INDIA) LTDDocumento14 páginasGO AIRLINES (INDIA) LTDPrachi GargAinda não há avaliações

- ch05 - Lap Posisi Keuangan Plus PSAK 1Documento73 páginasch05 - Lap Posisi Keuangan Plus PSAK 1Nabilah FarahAinda não há avaliações

- Afar - First Preboard QuestionnaireDocumento15 páginasAfar - First Preboard QuestionnairewithyouidkAinda não há avaliações

- Quali - ReviewDocumento32 páginasQuali - ReviewLA M AEAinda não há avaliações

- Anzelika Cintana - Tugas Minggu Ke-9 - AM-S1 ManajemenDocumento9 páginasAnzelika Cintana - Tugas Minggu Ke-9 - AM-S1 ManajemenApes Together Strongs ATSAinda não há avaliações

- Session 11Documento88 páginasSession 11Tram AnhhAinda não há avaliações

- Tutorial 6 Consolidated Statement of Financial Position (Csofp) - Part 2 - Question 1 (Q10.11)Documento8 páginasTutorial 6 Consolidated Statement of Financial Position (Csofp) - Part 2 - Question 1 (Q10.11)cynthiama7777Ainda não há avaliações

- Case Financial Performance - PT TimahDocumento14 páginasCase Financial Performance - PT TimahIto PuruhitoAinda não há avaliações

- UntitledDocumento23 páginasUntitledaaaAinda não há avaliações

- Itisthe2 Steps in The Accounting Cycle. It Is Also Called As The Book of Final Entries?Documento11 páginasItisthe2 Steps in The Accounting Cycle. It Is Also Called As The Book of Final Entries?Noel BuctotAinda não há avaliações

- Fsa Lectures (Notes) : Introduction To Financial Statement AnalysisDocumento13 páginasFsa Lectures (Notes) : Introduction To Financial Statement AnalysisDaniyal ZafarAinda não há avaliações

- Ratio Analysis: Ratio Analysis Is The Process of Establishing and Interpreting Various RatiosDocumento26 páginasRatio Analysis: Ratio Analysis Is The Process of Establishing and Interpreting Various RatiosTarpan Mannan100% (2)

- Chapter09 - Answer PDFDocumento21 páginasChapter09 - Answer PDFAvon Jade RamosAinda não há avaliações

- Material Complementario - Cafes Monte BiancoDocumento20 páginasMaterial Complementario - Cafes Monte BiancoGlenda ChiquilloAinda não há avaliações

- 10.13, Dr. G. MalyadriDocumento25 páginas10.13, Dr. G. MalyadriPaulo HunterAinda não há avaliações

- Acct 3211 #1Documento17 páginasAcct 3211 #1yahye ahmedAinda não há avaliações

- ACC 226 Week 4 To 5 SIMDocumento33 páginasACC 226 Week 4 To 5 SIMMireya YueAinda não há avaliações

- Powerol - Monthly MIS FormatDocumento34 páginasPowerol - Monthly MIS Formatdharmender singhAinda não há avaliações

- REYNOSO MBBA507 Final AssessmentDocumento7 páginasREYNOSO MBBA507 Final AssessmentGianne Denise ReynosoAinda não há avaliações

- Lesley Dela Cruz Clearners Worksheet Sept 30, 2020 Trial Balance Adjustments Debit Credit DebitDocumento7 páginasLesley Dela Cruz Clearners Worksheet Sept 30, 2020 Trial Balance Adjustments Debit Credit DebitJasmine ActaAinda não há avaliações

- Kertas Kerja Siklus AkuntansiDocumento13 páginasKertas Kerja Siklus AkuntansiNando Dista SaputraAinda não há avaliações

- Key Quiz 2 2022 2023Documento4 páginasKey Quiz 2 2022 2023Leslie Mae Vargas ZafeAinda não há avaliações