Escolar Documentos

Profissional Documentos

Cultura Documentos

Daftar Pustaka PDF

Enviado por

LALA0 notas0% acharam este documento útil (0 voto)

15 visualizações6 páginasTítulo original

DAFTAR PUSTAKA.pdf

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

15 visualizações6 páginasDaftar Pustaka PDF

Enviado por

LALADireitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 6

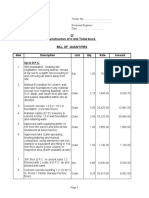

DAFTAR KEPUSTAKAAN

Ajzen, I. (1991). The theory of planned behaviour. Organizational behavior and

human decision processes. 50, 179-211.

Andrew, Vincentius dan Linawati, Nanik. (2014). Hubungan faktor demografi dan

pengetahuan keuangan dengan perilaku keuangan karyawan swasta di

Surabaya. FINESTA, 02 : 35-39.

Arifin, Agus Zainul. (2017). The Influence of Financial Knowledge, Control and

Income on Individual Financial Behavior. European Research Studies Journal

, XX (3A).

Arikunto, Suharsimi. (2006). Prosedur Penelitian: Suatu Pendekatan Praktik.

Jakarta: PT Rineka Cipta.

Aro, K. S., & Nurmi, J. (2007). Self-esteem during university studies predictics

career charectiristics 10 years later. Journal of Vocational Behavior, 70, 463-

477

Atinkson, A. and Messy, F.A. (2011). Assesing Financial Literacy In 12

Countries: An OECD/INFE International Pilot Exercise. Journal of Pension

Economics and Finance, 10(4) : 657 – 665.

Baron, R. A., Branscombe, N. R., & Bryne, D. 2008. Social Psychology, (12th

edition). USA: Perason Education, Inc.

Baumeister, R., F., Campbell, J. D., Krueger, J. I., & Vohs, K. E. (2003). Does High

Selfesteem Cause Better Performance, Interpersonal Success, Happiness, or

Healthier Lifestyles?. Psychological Science in the Public Interest, 4: 1-44.

Bodie, Z., Kane, A., & Marcus, A. J. (2008). Investments (7th Edition ed.). New

York: McGraw-Hill.

Brown, S., Taylor, K., & Price, S. W. (2005). Debt and distress: Evaluating the

psychological cost of credit. Journal of Economic Psychology, 26, (1), 642–

663.

Bulut, S., Gürkan, A. & Sevil, Ü. (2008). Adölesan gebelikler. Aile ve Toplum

Dergisi, 4 (13), 37-44.

Buss. 1973. Psychology, Man in Perspective. New York: John Wiley & Sons, Inc.

Cummins, M.M. Haskell, J.H, Jenkins S.J. (2009). Financial Attitudes and

Spending Habits of University Freshmen. Journal of Economics and

Economic Education Research 10, 1

Desmita. (2010). Psikologi Perkembangan. Bandung: PT Remaja Rosdakarya.

Dew, Jeffery dan Xiao Jing Jian. (2011). The Financial Management Behavior

Scale: Development and Vation.Journal of Financial Counseling and

Planning Volume 22: 43-59.

Ghozali, Imam. (2006). Aplikasi Analisis Multivarite dengan SPSS. Cetakan

Keempat. Badan Penerbit Universitas Diponegoro: Semarang.

Ghozali, Imam. 2012. Aplikasi Analisis Multivariate dengan Program IBM SPSS.

Yogyakarta: Universitas Diponegoro

Gilmore, J.V. (1974). The productive personality, San fransisco: albion publishing.

Gitman, Lawrence. (2002). Principle of Managerial Finance (10th ed). Prentice Hall:

New Jersey.

Hadjali, Hamid Reza., Meysam Salimi, Masoumeh Sadat A. (2012). Exploring

Main Factors Affecting On Impulse Buying Behaviors. Journal Of American

Sains, 8 (1), pp. 245-251

Hair, J.F., W.C. Black, B.J. Babin, R.E. Anderson, R.L.Tatham, (2010).

Multivariate Data Analysis, 7 Ed. New Jersey : Prentice Hall

Halim, Yopie Kurnia Erista dan Astuti, Dewi. (2015). Financial Stressors, Financial

Behavior, Risk Tolerance, Financial Solvency, Financial Knowledge, dan

Kepuasan Finansial. FINESTA, Vol. 3, 19-23.

Handi, A. K. & Mahastanti, L. A. (2012). Perilaku Penggunaan Uang: Apakah

Berbeda Untuk Jenis Kelamin Dan Kesulitan Keuangan.

Hasibuan, Malayu S.P. (2010). Manajemen Sumber Daya Manusia. Jakarta: PT

Bumi Aksara.

Hayhoe, C.R., Leach, L., & Turner, P. R. (1999). Discrimining the Number of

Credit Cards Held by College Students Using Credit Card and Money

Attitudes. Journal of Economic Psychology, 20: 643-656

Henry Faizal Noor. (2009). Investasi, Pengelolaan Keuangan Bisnis,dan

Pengembangan Ekonomi Masyarakat. Jakarta: Indeks.

Herdjiono, Irine dan Damanik , Lady Angela. (2016). Pengaruh Financial

Attitude,Financial Knowledge, Parental Income Terhadap Financial

Management Behavior. Jurnal Manajemen Teori dan Terapan No. 3.

Hilgert, M. A., Hogarth, J. M., & Beverly, S. G. (2003). Household financial

management: The connection between knowledge and behavior. Federal

Reserve Bulletin, 309-322

Huddleston, P. & Minahan, S. 2011. Consumer behavior:Women and shopping

.New York: cumBusiness Expert Press.

Ida dan Dwinta, Cinthia Yohana. (2010). Pengaruh Locus of Control, Financial

Knowledge, Income Terhadap Financial Management Behavior. Jurnal

Bisnis Dan Akuntansi, Vol. 12, No. 3, 131 -144.

Javed, M. K., Degong, Ma & Qadeer, T. (2017). Importance of Financial

Knowledge And Self-Esteem In Determining Individuals’ Financial

Behavior. Proceedings of Academics World 76th International Conference:

56-59. Malaysia, 3rd August 2017.

Joo, S., & Grable, J. E. (2004). An Exploratory Framework of The Determinants

of Financial Satisfaction. Journal of Family and Economic Issues, 25, 25-50.

Juen, Teo Tze, et al. (2013). The Influence of Financial Knowledge, Financial

Practices and Self Esteem On Money Management Skills of Young Adults.

Malaysian Journal of Youth Studies, 23-37.

Kholilah, Naila Al dan Iramani Rr .(2013). Studi Financial Management Behavior

Pada Masyarakat Surabaya. Journal of Business and Banking, Vol 3, No. 1,

69 – 80.

Kiyosaki, Robert T. (2009). The Cash Flow Quadrant. Gramedia, Jakarta..

Klontz, Brad et al. (2011). Money Beliefs and Financial Behaviors: Development

of the Klontz Money Script Inventory. The Journal of Financial Therapy, Vol

2(1), 1-22.

Krishna, A., R. Rofaida dan M. Sari. 2010. Analisis Tingkat Literasi Keuangan di

Kalangan Mahasiswa dan Faktor-faktor yang Mempengaruhinya (Survey

pada Mahasiswa Universitas Pendidikan Indonesia). Proceedings of The 4th

International Conference on Teacher Education.

Lee, Jinkook and Hogarth, Jeanne M. (1999). The Price of Money: Consumer

Understandingof APRs and Contract Interest Rates. Journal of Public Policy

and Marketing, 18 (Spring), hlm. 66–76.

Marsh, Brant A. (2006). Examining The Personal Finance Attitudes, Behaviors,

And Knowledge Levels Of First-Year And Senior Students At

BaptistUniversities In The State Of Texas. Disertasi.

Mien, Nguyen T. N. dan Thao, T. P. (2015). Factor affecting personal financial

management behaviours: Evidence from Vietnam. Proceedings of the Second

Asia-Pasific Conference on Global Business, Economics, Finance and Social

Science.

Muhson, Ali. (2013). Teknik Analisis Data. Metodologi Penelitian Pendidikan.

Nandanan, Padma & Fernandez, S. P. (2017). A study on the gender differences in

the spending attitude and behavior of IT profesionals in Urban Bangalore.

International Journal of Business and Management Invention, 6(7):55-59.

Neymotin, F. (2010). Linking self-esteem with the tendency to engage in financial

planning. Journal of Economic Psychology, 31:996-1007.

Ningsih, R. O. & Rita, M. R. (2010) “Financial Attitude dan Komunikasi Keluarga

Pengeluaran Uang Saku: Ditinjau Dari Perbedaan Gender”. JMK, 8(2).

Ningsih, Retno Utami dan Rita, Maria Rio. (2010). Financial Attitudes dan

Komunikasi Keluarga Tentang Pengeluaran Uang Saku : Ditinjau dari

Perbedaan Gender. JMK, 8(2).

Orton, L. 2007. Financial Literacy: Lesson From International Experience. CPRN

Research Report, September 2007, pp. 1-63.

Panigoro, Attalarik Syah. (2011). Analisa Kepribadian dan Gender Terhadap

Perencanaan Keuangan Pribadi pada Mahasiswa Fakultas Ekonomi UPN

“veteran” Jawa timur, Skripsi Program S1 Fakultas Ekonomi Universitas

Pembangunan Nasional “Veteran” Jawa Timur.

Parrota, J. L. & Johnson, P. J. 1998. The Impact Of Financial Attitudes And

Knowledge On Financial Management And Satisfaction Of Recently Married

Individuals. Association for Financial Counseling and Planning Education.

Perry, V.G. & Morris, M.D. (2015). Who Is In Control? The Role of Self-

Perception, Knowledge, and Income In Explaining Consumer Financial

Behavior. The Journal of Consumer Affairs, 39 (2)

Potter, Jeff et al. (2002). Global self esteem across the life span. Journal Psychology

and Aging, 17: 423-434.

Putra , Rizky Eka. (2015). Pengertian Behavior Finance.

http://firtsbloger.blogspot.co.id/2015/04/pengertian-behavior-finance.html

(diakses tanggal 28 februari 2017)

Refera, Matewos Kebede, and Kolech, Aby Getahun. (2015). Personal

Financial Management Capability Among Employees In Jimma Town,

Southwest Ethiopia : A Pilot Study. European Journal of Contemporary

Economics and Management, 2(2) : 29 – 53.

Republika. (22 April 2014). Walhi Nilai Pengurangan Perilaku Konsumtif Dapat

Selamatkan Bumi.

http://www.republika.co.id/berita/nasional/umum/14/04/22/n4fcxs-walhi-

nil%20ai-pengurangan-perilaku-konsumtif-dapat-selamatkan-bumi

Ricciardi V. And Simon, H, K. (2000). What is Behavior in Finance? Business, Education,

and Technology Journal, Fall: 1 – 9

Rosenberg, M., Schooler, C., Schoenbach, C., & Rosernberg F. (1995). Global Self-

esteem and Specific Self-Esteem Different Concepts, Different Outcomes.

American Sociological Review, 60 (1): 141-156.

Sabri, Mohamad Fazli et al. (2008). Financial behavior and Problems among

College Students in Malaysia: Research and Education Implication.

Consumer Interests Annual. Vol 54.

Saputra, Yulius Eka Agung. (2014). Manajemen dan Perilaku Organisasi.

Yogyakarta: Graha Ilmu.

Sekaran, Uma. (2006). Metodologi Penelitian Untuk Bisnis: Edisi

Keempat.Jakarta: Salemba Empat.

Sekaran, Uma. 2011. Research Methods fr Business. Buku 2. Jakarta: Salemba

Empat.

Semuel, Hatane. 2007. Pengaruh Stimulus Media Iklan, Uang Saku, Usia Dan

Gender Terhadap Kecenderungan Perilaku Pembelian Impulsif (Studi Kasus

Produk Pariwisata). Jurnal Manajemen Pemasaran, 2(1), hal: 31-42.

Septiani, Nina & Rita, M.R. (2013). Melek Finansial Dan Spending Habits

Berdasarkan Jenis Kelamin (Studi Empiris Pada Mahasiswa/I Di FEB Uksw).

Fakultas Ekonomi dan Bisnis Universitas Kristen Satya Wacana.

Shohin, Muhammad. (2015). Sikap terhadap uang dan perilaku berhutang. Jurnal

Psikologi Terapan, 03 (01)

Sina, Peter Garlans. (2014). Motivasi Sebagai Penentu Perencanaan Keuangan

(Suatu Studi Pustaka). Jurnal Ilmiah Akuntansi dan Bisnis, Vol. 9(1)

Sina, Peter Garlans. 2013. Money Belief Penentu Financial behavior. Universitas

Kristen Satya Wacana, 92-101.

Stuart and Sundeen. (1991).Principles and Practice of Psychiatric Nursing ed

4.Stlouis : The CV Mosby year book.

Sudrajad, Akhmad. (2009). “Konsep Harga Diri” .

https://akhmadsudrajat.wordpress.com/2009/05/16/harga-diri/ (diakses

tanggal 1 maret 2017)

Sugiyono. (2008). Metode Penelitian Bisnis. Bandung: Alfabeta.

Sugiyono. (2011). Metode Penelitian Pendidikan (Pendekatan Kuantitatif,

Kualitatif dan R&D). Bandung: Alfabeta.

Sugiyono. (2013). Metode Penelitian Kuantitatif, Kualitatif dan R&D. Bandung:

Alfabeta.

Taneja, R. Machanda. (2012). Money attitude: An Abridgement. Journal OF Arts,

Science and Commerce, 3(3):94-98

Tang, Ning, Baker, Andrew. (2016). Self –Esteem, Financial Knowledge and

Financial behavior. Journal of Economic Psychology, 1-40.

Tang, Ning. (2016). Like Father Like Son: How Does Parents’ Financial behavior

Affect Their Children’s Financial behavior?. The Journal of Consumer

Affairs, 1-28.

Tempo.co. (7 Desember 2016). Survei : Pria Lebih Banyak Belanja Online

Dibanding Wanita. https://bisnis.tempo.co/read/825954/survei-pria-lebih-

banyak-belanja-online-dibanding-wanita

Teng, Fei, dkk.(2016). Money and Relationship: When and Why Thinking about

Money Leads People to Approach Other. Organizatonal Behaviour and

Human Decision Processes, 137 (2016): 58-70.

Tjandrasa, Benny Budiawan. (2014). Perkembangan Behavioral Finance di

Indonesia dan Mancanegara. Forum Manajemen Indonesia, 1-10.

Verplanken, B. and Herabadi, A., 2001. Individual differences in impulse buying

tendency:feeling and no thinking. European Journal of Personality, 15 (S1),

S71-S83.

Wittasari, A. D. (2008). Wanita Pekerja Rentan Gila Belanja. Jakarta: Kartini.

Yulianti, Norma dan Silvy, Meliza. 2013. Sikap Pengelola Keuangan dan Perilaku

Perencanaan Investasi Keluarga Di Surabaya. Journal of Business and

Banking, 3 (1).

Yunisha, Fransisca . (24 Juni 2015). Wanita Vs Prilaku Konsumtif. Kompasiana.

http://www.kompasiana.com/miracle_sisca/wanita-vs-prilaku-

konsumtif_55109b9ca33311303cba8581

Zahroh, Fatimatus. 2014. Menguji Tingkat Pengetahuan keuangan, Sikap

Keuangan Pribadi, dan Perilaku Keuangan Pribadi Mahasiswa Jurusan

Manajemen Fakultas Ekonomika dan Bisnis Semester 3 dan Semester 7.

Skripsi. FEB Undip.

Zakaria, R. H, Jaafar, N. I. M. & Marican, S. (2012) “Financial Behavior And

Financial Position: A Structural Equaling Modelling Approach”. Middle-East

Journal of Scientific Research,11(5), 602-609.

Zimbardo. (2000). Psychology and Life. United State of America: Scott, Foresman.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (120)

- A Varactor Tuned Indoor Loop AntennaDocumento12 páginasA Varactor Tuned Indoor Loop Antennabayman66Ainda não há avaliações

- List of Light Commercial LED CodesDocumento8 páginasList of Light Commercial LED CodesRenan GonzalezAinda não há avaliações

- 1 075 Syn4e PDFDocumento2 páginas1 075 Syn4e PDFSalvador FayssalAinda não há avaliações

- Moparm Action - December 2014 USADocumento100 páginasMoparm Action - December 2014 USAenricoioAinda não há avaliações

- Consultancy Services For The Feasibility Study of A Second Runway at SSR International AirportDocumento6 páginasConsultancy Services For The Feasibility Study of A Second Runway at SSR International AirportNitish RamdaworAinda não há avaliações

- Sappi Mccoy 75 Selections From The AIGA ArchivesDocumento105 páginasSappi Mccoy 75 Selections From The AIGA ArchivesSappiETCAinda não há avaliações

- MSDS Bisoprolol Fumarate Tablets (Greenstone LLC) (EN)Documento10 páginasMSDS Bisoprolol Fumarate Tablets (Greenstone LLC) (EN)ANNaAinda não há avaliações

- Vocabulary Practice Unit 8Documento4 páginasVocabulary Practice Unit 8José PizarroAinda não há avaliações

- MML3 Journal To CapcomDocumento103 páginasMML3 Journal To CapcomFer BarcenaAinda não há avaliações

- For Exam ReviewerDocumento5 páginasFor Exam ReviewerGelyn Cruz67% (3)

- Electric Arc Furnace STEEL MAKINGDocumento28 páginasElectric Arc Furnace STEEL MAKINGAMMASI A SHARAN100% (3)

- Brand Guidelines Oracle PDFDocumento39 páginasBrand Guidelines Oracle PDFMarco CanoAinda não há avaliações

- Type BOQ For Construction of 4 Units Toilet Drawing No.04Documento6 páginasType BOQ For Construction of 4 Units Toilet Drawing No.04Yashika Bhathiya JayasingheAinda não há avaliações

- Cencon Atm Security Lock Installation InstructionsDocumento24 páginasCencon Atm Security Lock Installation InstructionsbiggusxAinda não há avaliações

- Optimization of Crude Oil DistillationDocumento8 páginasOptimization of Crude Oil DistillationJar RSAinda não há avaliações

- Incoterms 2010 PresentationDocumento47 páginasIncoterms 2010 PresentationBiswajit DuttaAinda não há avaliações

- Well Stimulation TechniquesDocumento165 páginasWell Stimulation TechniquesRafael MorenoAinda não há avaliações

- Cara Membuat Motivation LetterDocumento5 páginasCara Membuat Motivation LetterBayu Ade Krisna0% (1)

- Bs en 1991-1-5 2003 + 2009 Thermal Actions (Unsecured)Documento52 páginasBs en 1991-1-5 2003 + 2009 Thermal Actions (Unsecured)Tan Gui SongAinda não há avaliações

- Completed NGC3 ReportDocumento4 páginasCompleted NGC3 ReportTiCu Constantin100% (1)

- Stainless Steel 1.4404 316lDocumento3 páginasStainless Steel 1.4404 316lDilipSinghAinda não há avaliações

- Permit To Work Audit Checklist OctoberDocumento3 páginasPermit To Work Audit Checklist OctoberefeAinda não há avaliações

- Bondoc Vs PinedaDocumento3 páginasBondoc Vs PinedaMa Gabriellen Quijada-TabuñagAinda não há avaliações

- Mix Cases UploadDocumento4 páginasMix Cases UploadLu CasAinda não há avaliações

- Fin 3 - Exam1Documento12 páginasFin 3 - Exam1DONNA MAE FUENTESAinda não há avaliações

- Coca-Cola Summer Intern ReportDocumento70 páginasCoca-Cola Summer Intern ReportSourabh NagpalAinda não há avaliações

- Nguyen Dang Bao Tran - s3801633 - Assignment 1 Business Report - BAFI3184 Business FinanceDocumento14 páginasNguyen Dang Bao Tran - s3801633 - Assignment 1 Business Report - BAFI3184 Business FinanceNgọc MaiAinda não há avaliações

- Shares and Share CapitalDocumento50 páginasShares and Share CapitalSteve Nteful100% (1)

- BBCVDocumento6 páginasBBCVSanthosh PgAinda não há avaliações

- Lps - Config Doc of Fm-BcsDocumento37 páginasLps - Config Doc of Fm-Bcsraj01072007Ainda não há avaliações