Escolar Documentos

Profissional Documentos

Cultura Documentos

None - Form A-1 CUM Return

Enviado por

Prajakti KhadeDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

None - Form A-1 CUM Return

Enviado por

Prajakti KhadeDireitos autorais:

Formatos disponíveis

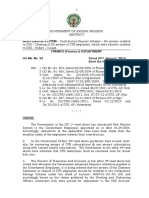

MAHARASHTRA LABOUR WELFARE BOARD

Form A-1 Cum Return

(Vide Rule 3-A)

For office use only

NOTE: 1) This form-cum-return is required to be submitted by every C

Employer along with the payment of Employees’ & Employer’s Six monthly

Contribution made by him in respect of all employees whose names stand on the register of his

establishment as on 30th June / 31st December as per the provisions of Section 6BB of the Bombay

Labour Welfare Fund Act, 1953.

2) Section 2(2) (b) of Bombay Labour Welfare Fund Act, 1953 “Supervisor” means who, being

employed in a supervisory capacity, draws wages exceeding Three Thousand Five Hundred rupees per

mensem or exercise, either by the nature of the duties attached to the office, or by reason of the powers

vested in him, functions mainly of a managerial nature.

3) EEC = Employees’ contribution, ERC = Employer’s contribution.

Establishment Code No

1. Name & Address of the Establishment :

2. Name of the Employer :

3. Class of the Establishment :

4. Total number of employees whose names stood on the No. Of E.E.C. E.R.C Penal TOTAL

establishment register as Employees Rs Rs Int.

on 30th June 20--

on 31st Decr.20--

a. Manager

b. Employees working in supervisory capacity

drawing wages exceeding 3,500- per month.

c. Employees drawing wages exceeding

Rs 3000/- per month June

EEC @ Rs 12.00 per employee &

ERC @ Rs 36.00 per employee Dec

d. Employees drawing wages up to & inclusive of

Rs 3000/- per month June

EEC @ Rs 6.00 per employee

ERC @ Rs 18.00 per employee Dec

5. Total Amount of contribution paid along

with this Form A-1-Cum-Return

Total of (a) to (d) above

6. Mode of Payment: - Cash/Cheque No ----------------------------Dated -----------------------

Drawn on --------------------------------

Certified that the information / particular

furnished above is / are true to the best of my knowledge and belief:

IMPORTANT

1. Cheque/DD should be drawn to each Estt, Code Number separately & in favor of Maharashtra Labour Welfare Fund

2. Cash payment will be accepted from 10.30 am to 3.00 pm.

3. Code No. of the Establishment allotted to you should be quoted at the appropriate place in this form\

4. DD should be payable at MUMBAI only

5. Please write Establishment code number on the back side of the Cheque/DD

Signature with name & designation of the authority

filling this form-cum-return

Você também pode gostar

- What You Must Know About Incorporate a Company in IndiaNo EverandWhat You Must Know About Incorporate a Company in IndiaAinda não há avaliações

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsNo Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsAinda não há avaliações

- Esi Form 5 WordDocumento3 páginasEsi Form 5 Wordpummy124Ainda não há avaliações

- PF Form No 12a, 10,5Documento6 páginasPF Form No 12a, 10,5Hareesh Kumar Reddy100% (1)

- Pay and AllowancesDocumento22 páginasPay and AllowancesSharon Elin Sunny0% (1)

- EPF JOINT REQUEST FOR 26 (6) OPTIONviSURESHDocumento2 páginasEPF JOINT REQUEST FOR 26 (6) OPTIONviSURESHSURESH KIDAMBIAinda não há avaliações

- EPF JOINT REQUEST FOR 26 (6) OPTIONviSURESHDocumento2 páginasEPF JOINT REQUEST FOR 26 (6) OPTIONviSURESHSURESH KIDAMBIAinda não há avaliações

- Higher Wager Form 26Documento2 páginasHigher Wager Form 26White knight 209 gamingAinda não há avaliações

- JD Form IDocumento2 páginasJD Form ISRINU KOLLIPARA MECH044Ainda não há avaliações

- JD Form IiDocumento2 páginasJD Form Iiredminote7s098Ainda não há avaliações

- Option Form Epfo 95Documento10 páginasOption Form Epfo 95prakashAinda não há avaliações

- RD THDocumento2 páginasRD THRizwan PathanAinda não há avaliações

- EPF Form 19 10 C FormatDocumento6 páginasEPF Form 19 10 C FormatMohammed RafiqueAinda não há avaliações

- Epfo Higher Pension Option FormDocumento4 páginasEpfo Higher Pension Option Formvkwgl100% (1)

- PF Withdrawal Form: (Employee's Details)Documento7 páginasPF Withdrawal Form: (Employee's Details)Harish LohaniAinda não há avaliações

- Artifact 5 PF Withdrawal Form PDFDocumento1 páginaArtifact 5 PF Withdrawal Form PDFSuraj BaugAinda não há avaliações

- Legal Notice SiddhartDocumento6 páginasLegal Notice SiddhartADIL ABBASAinda não há avaliações

- Prof R BalakrishnanDocumento5 páginasProf R Balakrishnanabc defAinda não há avaliações

- ATC 7 Rrsuser119Documento22 páginasATC 7 Rrsuser119sourabhchoudhary9823Ainda não há avaliações

- ESI Form 5 - Half Yearly ReturnDocumento6 páginasESI Form 5 - Half Yearly ReturnAshim Agarwal100% (1)

- PRMB Insurance Renewal Period 05.04.2023 To 04.04.2024 Date 31.03.2023 DSCDocumento23 páginasPRMB Insurance Renewal Period 05.04.2023 To 04.04.2024 Date 31.03.2023 DSCSayan duttaAinda não há avaliações

- PF Withdrawal FormsDocumento7 páginasPF Withdrawal Formsxpus04Ainda não há avaliações

- DocumentDocumento2 páginasDocumentravikoriveda123Ainda não há avaliações

- Artifact 5 PF Withdrawal Application PDFDocumento1 páginaArtifact 5 PF Withdrawal Application PDFRamesh BabuAinda não há avaliações

- The Employees' Deposit Linked Insurance Scheme, 1976Documento6 páginasThe Employees' Deposit Linked Insurance Scheme, 1976jegathsn7707Ainda não há avaliações

- Gpf-Bill-Form 40a Nam Ta 49Documento2 páginasGpf-Bill-Form 40a Nam Ta 49robert100% (1)

- Wage Revision Clarification PDFDocumento4 páginasWage Revision Clarification PDFbraghavAinda não há avaliações

- Go.22 Da Arrears of CPS Account in CashDocumento4 páginasGo.22 Da Arrears of CPS Account in CashVenkatadurgaprasad GopamAinda não há avaliações

- Form t3Documento1 páginaForm t3Ninad PuranikAinda não há avaliações

- YDocumento4 páginasYBernadette RajAinda não há avaliações

- Form Ay EarlyDocumento1 páginaForm Ay Earlykeshav1980Ainda não há avaliações

- Application Form For Withdrawal of Accumulation From Provident FundDocumento2 páginasApplication Form For Withdrawal of Accumulation From Provident Fund$!v@Ainda não há avaliações

- PFguidlines &forms For Mphasis &finsource EmployeesDocumento10 páginasPFguidlines &forms For Mphasis &finsource EmployeesBinoy Xavier RajuAinda não há avaliações

- Andhra Pradesh Labour Welfare Fund Rules, 1988 PDFDocumento5 páginasAndhra Pradesh Labour Welfare Fund Rules, 1988 PDFneohorizonsAinda não há avaliações

- Circular No. 12 of 2023 Ex Gratia To DPS NWNPDocumento2 páginasCircular No. 12 of 2023 Ex Gratia To DPS NWNPpiyush jainAinda não há avaliações

- Indian Labour LawsDocumento4 páginasIndian Labour LawsiamgodrajeshAinda não há avaliações

- 2023 Onwards - Taxguru - inDocumento2 páginas2023 Onwards - Taxguru - inWahab KAinda não há avaliações

- Guidelines On The Grant of Rice AllowanceDocumento5 páginasGuidelines On The Grant of Rice AllowancePauline Caceres AbayaAinda não há avaliações

- Format PF 5.10.12Documento6 páginasFormat PF 5.10.12hdpanchal86Ainda não há avaliações

- Sholarship Form 2023-2024Documento9 páginasSholarship Form 2023-2024Mohd ImranAinda não há avaliações

- Performa For Joint Request Under Paragraph 26 (Final)Documento2 páginasPerforma For Joint Request Under Paragraph 26 (Final)Nihar Ranjan TripathyAinda não há avaliações

- Retirement BenefitsDocumento14 páginasRetirement BenefitsAnupAinda não há avaliações

- PCT FormsDocumento4 páginasPCT Formsvivekgoenka10% (1)

- PF GuidelineDocumento2 páginasPF GuidelineRohan DobriyalAinda não há avaliações

- Income Tax Declaration Form 2022-2023Documento2 páginasIncome Tax Declaration Form 2022-2023ARUN CHAUHANAinda não há avaliações

- PF Pension Settlement Form-TCSDocumento4 páginasPF Pension Settlement Form-TCSSridhara Krishna BodavulaAinda não há avaliações

- By Order and in The Name of The Governor of MaharashtraDocumento9 páginasBy Order and in The Name of The Governor of MaharashtraravinderAinda não há avaliações

- First Nca NotificationDocumento4 páginasFirst Nca NotificationmathaiAinda não há avaliações

- Retirement Settelement BenefitsDocumento15 páginasRetirement Settelement BenefitssantoshkumarAinda não há avaliações

- Form 10c Form 19 Word Format Doc Form 10cDocumento6 páginasForm 10c Form 19 Word Format Doc Form 10cshaikali1980Ainda não há avaliações

- 2016fin MS193Documento2 páginas2016fin MS193Venkataraju Badanapuri0% (1)

- PF Forms FormatsDocumento10 páginasPF Forms FormatsSnehal ChauhanAinda não há avaliações

- 5254 - Tax Regime - 2024 - 240408 - 212256Documento3 páginas5254 - Tax Regime - 2024 - 240408 - 212256sunil78Ainda não há avaliações

- Indian Labour Laws 136Documento4 páginasIndian Labour Laws 136kritz57Ainda não há avaliações

- REPLYDocumento94 páginasREPLYabhiGT40100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionAinda não há avaliações

- SCV Manpower RYG StatusDocumento1 páginaSCV Manpower RYG StatusPrajakti KhadeAinda não há avaliações

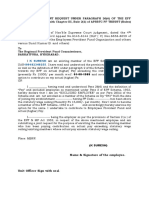

- Absence Warning Letter-2Documento1 páginaAbsence Warning Letter-2Prajakti Khade0% (1)

- Absence Warning Letter-2Documento1 páginaAbsence Warning Letter-2Prajakti KhadeAinda não há avaliações

- Case Studies - Human Resources and EthicsDocumento6 páginasCase Studies - Human Resources and EthicsPrajakti KhadeAinda não há avaliações

- Professional Email Example 08Documento1 páginaProfessional Email Example 08Prajakti KhadeAinda não há avaliações

- CSR Activities (Overvier)Documento13 páginasCSR Activities (Overvier)Prajakti KhadeAinda não há avaliações

- Questionnaire On Disciplinary Action at KGEPLDocumento3 páginasQuestionnaire On Disciplinary Action at KGEPLPrajakti KhadeAinda não há avaliações

- Pastor's Meeting With Sam LangfordDocumento7 páginasPastor's Meeting With Sam LangfordthatdoodAinda não há avaliações

- 06 AbbreviationDocumento3 páginas06 AbbreviationAkash VermaAinda não há avaliações

- Visayan SuretyDocumento2 páginasVisayan SuretyTanya PimentelAinda não há avaliações

- REPUBLIC FLOUR MILLS INC Vs Commissioner of Customs TarrayoDocumento1 páginaREPUBLIC FLOUR MILLS INC Vs Commissioner of Customs TarrayoMae Clare D. BendoAinda não há avaliações

- Let's Talk About SexDocumento31 páginasLet's Talk About SexSimdikaAinda não há avaliações

- Loner by NillaDocumento865 páginasLoner by NillaAddie100% (1)

- Catalog 2012 RossiDocumento19 páginasCatalog 2012 Rossitublin601Ainda não há avaliações

- Phillip Serrano. OIS ReportDocumento5 páginasPhillip Serrano. OIS ReportReno Gazette JournalAinda não há avaliações

- Petitioner Vs Vs Respondent: Second DivisionDocumento12 páginasPetitioner Vs Vs Respondent: Second DivisionSeonoAinda não há avaliações

- Preventing Ri DoDocumento57 páginasPreventing Ri DoVictoriano OrdonioAinda não há avaliações

- Survey QuestionnaireDocumento1 páginaSurvey QuestionnaireLester John Alejo Estolonio50% (2)

- Affidavit of Loss - St. Peter (FLORES)Documento1 páginaAffidavit of Loss - St. Peter (FLORES)Richard BarnuevoAinda não há avaliações

- ContactsDocumento1 páginaContactsWBKOAinda não há avaliações

- Marriage in Heaven: Ileana. Soon Afterwards Comes The Question If The Woman Is Still Alive, But Knowing HowDocumento2 páginasMarriage in Heaven: Ileana. Soon Afterwards Comes The Question If The Woman Is Still Alive, But Knowing HowStefania NituAinda não há avaliações

- Topic 1 - Basics of Bureaucracy (NOTES)Documento7 páginasTopic 1 - Basics of Bureaucracy (NOTES)Jennie SevillaAinda não há avaliações

- Reviewer Psoac RevisedDocumento56 páginasReviewer Psoac RevisedKrissie Guevara100% (2)

- Revelation Timeline ChartDocumento3 páginasRevelation Timeline Chartjoel marshallAinda não há avaliações

- Lesson2 - DeliverancePrayers 220719 211600Documento5 páginasLesson2 - DeliverancePrayers 220719 211600Jean Pierre NdagijimanaAinda não há avaliações

- Ebook PDF Twentieth Century World An International History PDFDocumento41 páginasEbook PDF Twentieth Century World An International History PDFalicia.mclaughlin973100% (33)

- Sources For Battle of ThermopylaeDocumento6 páginasSources For Battle of ThermopylaeAidan Earnest100% (1)

- The Virtues of FastingDocumento2 páginasThe Virtues of FastingnorfaezahAinda não há avaliações

- Christian Privilege ChecklistDocumento4 páginasChristian Privilege ChecklistTyler HallAinda não há avaliações

- Handling Complaints Grievances Process Chart-HR-WW-POL-02chartDocumento1 páginaHandling Complaints Grievances Process Chart-HR-WW-POL-02chartPardeep SinghAinda não há avaliações

- 20 Cadiente vs. SantosDocumento3 páginas20 Cadiente vs. Santoschristopher d. balubayanAinda não há avaliações

- Fighting Serbs, Mihailovich and Yugoslavia Ruth MitchellDocumento34 páginasFighting Serbs, Mihailovich and Yugoslavia Ruth MitchellAleksandar Stosich50% (2)

- 2 Dayag Vs CanizaresDocumento1 página2 Dayag Vs CanizaresBluebells33Ainda não há avaliações

- Kleiman Lawsuit - Exhibit 29Documento7 páginasKleiman Lawsuit - Exhibit 29Peter McCormackAinda não há avaliações

- Contempt of CourtDocumento18 páginasContempt of CourtAman Kumar100% (1)

- Johnson Vs McIntoshDocumento2 páginasJohnson Vs McIntoshPilyang SweetAinda não há avaliações

- Erik Von Kuehnelt-Leddihn: The Intelligent American's Guide To Europe - Study GuideDocumento85 páginasErik Von Kuehnelt-Leddihn: The Intelligent American's Guide To Europe - Study GuideAlex Markov100% (2)