Escolar Documentos

Profissional Documentos

Cultura Documentos

Ifrs 14 From Ey

Enviado por

Obisike EmeziTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Ifrs 14 From Ey

Enviado por

Obisike EmeziDireitos autorais:

Formatos disponíveis

Applying IFRS

IFRS 14 Regulatory Deferral Accounts

Applying IFRS for

IFRS 14 Regulatory

Deferral Accounts

November 2014

Contents

In this issue:

1. Introduction................................................................................... 3

1.1 Key features of IFRS 14 ............................................................. 3

1.2 Looking ahead .......................................................................... 4

2. Scope of the interim standard ......................................................... 4

2.1 Entities that conduct rate-regulated activities ............................. 4

3. Recognition and measurement ........................................................ 6

3.1 Adoption of previous accounting policies applied prior to

adoption of IFRS ....................................................................... 6

3.2 Initial recognition and measurement ........................................... 8

3.3 Accounting in subsequent periods .............................................. 9

3.4 Service concession arrangements ............................................ 10

3.5 Income taxes .......................................................................... 10

4. Impairment considerations ............................................................ 11

4.1 Determination of the recoverable amount of the CGU ................ 11

4.2 Allocation of the impairment losses within the CGU .................... 11

5. Group considerations.................................................................... 12

5.1 Impact on associates, joint ventures and subsidiaries in the

consolidated financial statements............................................. 12

5.2 Business combinations and acquisitions .................................... 12

6. Presentation ................................................................................ 13

6.1 Earnings per share .................................................................. 13

6.2 Non-current assets held for sale and discontinued operations ..... 13

7. Disclosures .................................................................................. 14

8. Effective dates and transition ........................................................ 15

November 2014 Applying IFRS for IFRS 14 Regulatory Deferral Accounts 1

What you need to know

• IFRS 14 is an optional standard made available to first-time adopters

of IFRS only. The standard is intended to provide some relief from

derecognising rate-regulated assets and liabilities upon adoption of IFRS

while the IASB continues to deliberate the comprehensive rate-regulated

activities project.

• Existing IFRS preparers are prohibited from adopting this standard.

• The standard allows rate-regulated entities to continue recognising

regulatory deferral accounts in accordance with their previous generally

accepted accounting policies (GAAP), upon their first-time adoption of

IFRS.

• Entities that adopt IFRS 14 must present the regulatory deferral accounts

as separate line items on the statement of financial position and present

movements in these account balances as separate line items in the

statements of profit or loss and other comprehensive income.

• The standard requires disclosure of the nature of, and risks associated

with, the entity’s rate regulation and the effects of the rate regulation on

its financial statements.

• The standard is effective for annual periods beginning on or after

1 January 2016. Early application is permitted.

• The IASB is continuing its comprehensive rate-regulated activities project,

which could result in either a standard on rate regulation or a decision not

to develop specific requirements. By issuing IFRS 14, the IASB is not

anticipating the outcome of the comprehensive project.

2 November 2014 Applying IFRS for IFRS 14 Regulatory Deferral Accounts

1. Introduction

On 30 January 2014, the International Accounting Standards Board (IASB or

the Board) issued IFRS 14 Regulatory Deferral Accounts (the interim standard

or IFRS 14) to ease the adoption of International Financial Reporting Standards

(IFRS) for rate-regulated entities. The interim standard provides first-time

adopters of IFRS with some relief from derecognising rate-regulated assets and

liabilities until a comprehensive project on accounting for such assets and

liabilities has been completed by the IASB.

That said, there are differing views as to whether rate-regulated assets and

liabilities meet the current definitions of assets and liabilities set out in the

Conceptual Framework for Financial Reporting (conceptual framework) or the

definitions included in the discussion paper on the IASB’s project to revise the

conceptual framework. Therefore, it is important for rate-regulated entities

to stay tuned to the IASB’s progress on both the conceptual framework

and comprehensive project. A discussion paper on the comprehensive

rate-regulated activities project was issued on 17 September 2014, with

the comment period ending on 15 January 2015; re-deliberations on the

conceptual framework will continue during 2014.

In this publication, we take a closer look at the requirements of IFRS 14,

consider some of the potential benefits for reporting entities and explore some

of the practical challenges in implementing it. We believe the insights and

examples provided in this publication are particularly relevant for rate-regulated

entities that are considering adopting IFRS for the first time.

1.1 Key features of IFRS 14

Below are some of the key features of this interim standard:

IFRS 14 is intended

a) It allows (but does not require) an entity whose activities are subject to rate

to encourage regulation to continue applying most of its existing accounting policies for

rate-regulated entities regulatory deferral account balances upon first-time adoption of IFRS.

to adopt IFRS while the

b) Existing IFRS preparers are prohibited from applying this standard. Also,

IASB continues its work an entity whose current GAAP does not allow the recognition of

on the comprehensive rate-regulated assets and liabilities, or that has not adopted such policy

rate-regulated activities under its current GAAP, would not be allowed to recognise them on

project. first-time application of IFRS.

c) Entities that adopt this standard must present the regulatory deferral

accounts as separate line items in the statement of financial position and

present movements in these account balances as separate line items in the

statement of profit or loss and other comprehensive income (OCI).

d) The standard requires disclosures on the nature of, and risks associated

with, the entity’s rate regulation and the effects of that rate regulation on

its financial statements.

e) If the standard is applied, full retrospective application is required.

IFRS 14 is an optional standard that is intended to encourage rate-regulated

entities to adopt IFRS while bridging the gap with similar entities that already

apply IFRS, but which do not recognise regulatory deferral accounts. This would

be achieved by requiring separate presentation of the regulatory deferral

account balances (and movements in these balances) in the statement of

financial position and statements of profit or loss and other comprehensive

income.

November 2014 Applying IFRS for IFRS 14 Regulatory Deferral Accounts 3

1.2 Looking ahead

At the time of issuing IFRS 14, the IASB made it clear that the interim standard

is not intended to anticipate the outcome of the comprehensive project. This

means that the comprehensive project could result in either a standard on rate

regulation or a decision not to develop specific requirements. Therefore,

entities that elect to adopt IFRS 14 should be aware that the regulatory deferral

account balances may need to be derecognised from their financial statements

if the IASB decides not to issue a separate standard upon completion of the

comprehensive rate-regulated activities project, or to issue a standard

prohibiting recognition of (certain elements of) deferral account balances.

2. Scope of the interim standard

Only first-time adopters can avail themselves of IFRS 14. IFRS 14 must not be

adopted by entities that are currently preparing their financial statements

under IFRS. Therefore, IFRS 14 is applied exclusively in connection with

IFRS 1 First-time Adoption of International Financial Reporting Standards.

An entity whose current GAAP does not allow the recognition of rate-regulated

assets and liabilities, or that has not adopted such policy under its current

GAAP, would not be allowed to recognise them through the adoption of

IFRS 14.

If an entity commences rate-regulated activities after adopting IFRS, the entity

would be considered an existing IFRS preparer and, as such, would be

prohibited from applying IFRS 14.

This restriction has caused some debate within jurisdictions that had previously

adopted IFRS, and were required to write-off their regulatory assets and

liabilities in their initial year of IFRS transition. As such, some respondents to

the exposure draft on IFRS 14 advocated widening the scope to include existing

IFRS reporters. However, the IASB considered the potential risks and costs

involved and decided not to permit existing IFRS reporters to adopt IFRS 14

since there is uncertainty that the comprehensive project will result in the same

accounting as is now permitted under IFRS 14.

2.1 Entities that conduct rate-regulated activities

The IASB defined the scope of IFRS 14 as follows: “an entity is permitted to

apply the requirements of this Standard in its first IFRS financial statements if

and only if it:

a) conducts rate-regulated activities; and

b) recognised amounts that qualify as regulatory deferral account balances in

its financial statements in accordance with its previous GAAP.”

The evaluation of whether an entity conducts rate-regulated activities is based

on whether an entity’s activities are subject to rate regulation, which is defined

in IFRS 14 as: ”A framework for establishing the prices that can be charged to

customers for goods or services and that framework is subject to oversight

and/or approval by a rate regulator.”

4 November 2014 Applying IFRS for IFRS 14 Regulatory Deferral Accounts

How we see it

Contrary to the Board’s proposal in the exposure draft Regulatory Deferral

Accounts (the ED), the price established by the regulator does not need to

be designed to recover the entity’s allowable cost of providing the regulated

goods or services.

The removal of the scope restriction that required that prices must recover

the entity’s allowable costs has resulted in a broader definition of rate

regulation which will allow more entities to consider the adoption of the

new standard.

Extract from IFRS 14: Appendix A Defined terms

Rate regulator

An authorised body that is empowered by statute or regulation to establish

the rate or a range of rates that bind an entity. The rate regulator may be a

third-party body or a related party of the entity, including the entity's own

governing board, if that body is required by statute or regulation to set rates

both in the interest of the customers and to ensure the overall financial

viability of the entity.

During re-deliberations, the Board agreed that the existence of an

external source of regulation is an important feature that distinguishes

rate-regulated activities from other commercial activities. As such,

paragraph BC22 of the Basis for Conclusions on IFRS 14 clarifies that an entity

that self-regulates the prices charged to the customers, without the

involvement of a formal rate regulator, is not allowed to apply the interim

standard to its self-regulated activities.

How we see it

In some instances, the rate regulator may also sit on the entity’s

board of directors. In such cases, entities adopting IFRS 14 will have to

assess whether they would still meet the definition of conducting

rate-regulated activities.

In our view, the definition of a rate regulator under IFRS 14 acknowledges

that the rate regulator may also be the entity’s own governing board. Hence,

even if it is the board of directors, so long as it is empowered by either

statute or regulation to set rates in the interest of both the customer and

the entity, it would be deemed a rate regulator within the scope of IFRS 14.

Therefore, the fact that the rate regulator is also a director of the entity

would not preclude the application of IFRS 14.

November 2014 Applying IFRS for IFRS 14 Regulatory Deferral Accounts 5

3. Recognition and measurement

IFRS 14 allows entities to recognise regulatory deferral account balances in the

statement of financial position at amounts that would otherwise be recognised in

the statement of profit or loss and other comprehensive income (OCI), if they do

not meet the criteria to be recognised as an asset under IFRS.

3.1 Adoption of previous accounting policies applied prior to

adoption of IFRS

IFRS 14 provides a temporary exemption from complying with other IFRS

standards and requirements as well as the definitions, recognition criteria and

measurement concepts for assets, liabilities, income and expenses in the

IFRS framework.

Under the exemption, entities electing to apply IFRS 14 must develop their

accounting policies under IAS 8 Accounting Policies, Changes in Accounting

Estimates and Errors. However, the standard goes on to say that entities must

continue applying their accounting policies for recognition, measurement,

impairment and derecognition of regulatory deferral account balances under

their previous GAAP.

IFRS 14 excludes those deferral account balances arising from rate-regulated

Entities will continue to activities that are assets and liabilities required to be recognised in accordance

apply their previous with other IFRS standards and the conceptual framework. Consequently, for

GAAP accounting policies regulatory deferral account balances that are recognised and measured

separately from other standards, the application of IFRS 14 would be rather

to the recognition,

straightforward. For example, for storm damage costs and volume or purchase

measurement, price variances that will be recovered in future rates are frequently recorded in

impairment and separate regulatory deferral accounts.

derecognition of the

However, where the regulatory balances are included within assets and liabilities

regulatory deferral that are scoped in other standards, additional data and greater effort will be

account balances. required to measure the regulatory deferral accounts, especially where,

historically, they have not been recorded or tracked separately. For example,

rate-regulated property, plant and equipment (PP&E) accounts recognised under

an entity’s previous GAAP will likely include activity that is unique to a

rate-regulated jurisdiction as well as activity that would be recognised under

IAS 16 Property, Plant and Equipment.

6 November 2014 Applying IFRS for IFRS 14 Regulatory Deferral Accounts

Illustration 3.1 — Implications for regulatory balances that are

combined within assets and liabilities from other IFRS standards

Consider a rate-regulated entity that intends to adopt IFRS in its 31 December

2016 year-end financial statements, with one year of comparatives (2015).

Therefore, the date of adoption would be 1 January 2015. The entity

currently prepares its financial statements under US GAAP for rate-regulated

companies and capitalises finance costs and costs of capital for the

construction of fixed assets (ASC 980-835-45-1).

Upon adoption of IFRS, the entity is allowed to avail itself of the deemed cost

exemption under paragraph D8B of IFRS 1 First-time Adoption of International

Financial Reporting Standards. Consequently, the property, plant and

equipment (PP&E) balances prior to the adoption of IFRS 14 will include an

allowance for funds used during construction (AFUDC) based on the respective

regulatory policies.

If the entity elects to adopt IFRS 14 as at 1 January 2015, any PP&E additions

subsequent to 1 January 2015 would include capitalised interest required

under IAS 23 Borrowing Costs. However, these amounts will differ from the

amounts calculated under the entity’s previous GAAP (i.e.,

ASC 980-835-45-1). The difference in the capitalised amounts will be

classified as a regulatory deferral account under IFRS 14.

Thus, on adoption of IFRS on 1 January 2015, the entity will likely need to

maintain two PP&E ledgers: one under IFRS for the PP&E balances from

1 January 2015 and another for the balances prior to 1 January 2015 under

the previous GAAP that are carried forward under the deemed cost exemption

available under IFRS 1.

Moreover, a regulator might specify the useful lives and method used in

determining depreciation expense for rate-making purposes, which may differ

from the requirements of IAS 16. Under IFRS 14, a regulatory deferral debit or

credit balance would be recorded for the difference between the carrying

amount of PP&E recognised under IAS 16, and as calculated under the

applicable regulatory requirements. In this case, the difference between the

depreciation charges would be shown on a separate line on the statement of

profit or loss.

What does it mean for you?

The two scenarios in illustration 3.1 above essentially highlight that entities

would potentially have to maintain additional sets of records and ledgers

upon the adoption of IFRS 14. In addition to the existing regulatory and,

possibly, tax ledgers, an entity may need to implement a separate ledger to

track the differences related to the IFRS 14 regulatory deferral account

balances. This is in addition to the separate ledger that an entity needs to

maintain under IFRS even without adopting IFRS 14.

We encourage entities to assess how the cost of developing and maintaining

additional ledgers might impact their decision to adopt the interim standard.

November 2014 Applying IFRS for IFRS 14 Regulatory Deferral Accounts 7

3.2 Initial recognition and measurement

As the regulatory deferral account balances to be recognised are restricted to

the incremental amounts from what would otherwise be recognised as assets

and liabilities under IFRS and the conceptual framework, the measurement of

these balances effectively entails a two-step process:

• An entity would first determine the carrying amount of its assets and

liabilities under IFRS, excluding IFRS 14.

• These amounts would then be compared with the assets and liabilities

determined under the entity’s previous GAAP presentation (i.e., its

rate-regulated balances).

The differences would represent the regulatory deferral debit or credit account

balances to be recognised by the entity.

The example below illustrates a simple scenario in which the regulatory

deferral account balances are recognised and measured separately from other

standards.

Illustration 3.2 — Determining the regulatory deferral account

balances to be recognised on initial application of IFRS

Assume Entity A is a gas company in Country X that reports under US GAAP

and has a December year end. In order to reduce volatility in rates charged to

customers, the regulator in Country X requires Entity A to recover the

differences between actual and estimated costs over time.

Under US GAAP, the deferred gas costs meet the asset recognition criteria and

are presented as “Other assets and deferred costs” on Entity A’s balance

sheet as at 31 December 20X1. There are no other assets included in this line

item on the balance sheet aside from these deferred costs.

The rate regulator permitted Entity A to recover its gas supply costs on the

basis of a one-for-one pass through to customers. Under the rate-setting

mechanism, it also requires the entity to amortise any net over or

under-recovery of gas costs on a straight-line basis over three years.

Entity A decides to adopt IFRS in its 20X3 financial statements.

On the date of IFRS adoption (1 January 20X2), Entity A has a carrying

amount of CU117,000 presented as Other assets and deferred costs on its US

GAAP balance sheet, which relates to the net under-recovery of gas costs to

be deferred over the next three years.

Entity A has assessed that these deferred costs do not meet the requirements

to be recognised as assets under IFRS.

Consequently, the regulatory deferral account balances to be recognised

under IFRS 14 amount to CU117,000, which is the difference between the

deferred costs capitalised and recognised under US GAAP and what would

have been recognised under IFRS without the adoption of IFRS 14 (i.e., CUNil).

Amortisation expense of CU39,000 (CU117,000/3 years) will be recognised

annually during the three year recovery period.

The standard is clear that if an entity had not recognised regulatory deferral

account balances under its previous GAAP, it is not allowed to change its

accounting policies in order to start recognising regulatory deferral account

balances upon initial adoption of IFRS.

8 November 2014 Applying IFRS for IFRS 14 Regulatory Deferral Accounts

3.3 Accounting in subsequent periods

An entity that elects to adopt IFRS 14 must continue to apply its previous GAAP

accounting policies for the recognition, measurement, impairment and

derecognition of regulatory deferral account balances. The accounting policies

need to be applied consistently in subsequent periods.

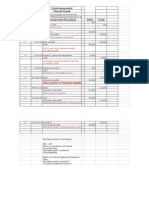

Illustration 3.3 — Calculating the regulatory deferral account

balances in subsequent periods

Following from Illustration 3.2 above, the table below presents the effects of

variations in the cost of gas on Entity A’s rate-regulated activities over a

three-year period, as at 31 December:

(CU’000) 20x1 20x2 20x3

Amount charged to customers based on regulated rates 917 1,124 1,079

Part of rate that recovers deficit/surplus in prior years — (39) (24)

Net amount charged to customers in respect of

917 1,085 1,055

current year

Actual gas supply costs of current year 1,034 1,040 980

Net amount of (under)/over recovery of costs (i.e.,

(117) 45 75

regulatory deferral account (debit)/credit balance)

As discussed in Illustration 3.2, due to the under-recovery of gas costs, a debit

regulatory deferral balance of CU117,000 was recognised as at 1 January

20x2 on application of IFRS 14. This regulatory deferral account debit balance

will be amortised over three years, with an annual charge of CU39,000. In

year 20x2, the over-recovery of gas costs of CU(45,000) results in a

regulatory deferral credit balance which will also be amortised over three

years, with an annual credit of CU(15,000). The table below shows the

movements in the net regulatory deferral account balances over the

three-year period, as at 31 December:

Regulatory deferral account balances, net (CU’000) 20x1 20x2 20x3

Beginning balance — 117 33

Net under-recovery of gas costs during the year 117 — —

Net over-recovery of gas costs during the year — (45) (75)

Amortisation of:

• Under-recovery of gas costs incurred in Year 20x1 — (39) (39)

• Over-recovery of gas costs incurred in Year 20x2 — — 15

Net movement 117 (84) (99)

Ending balance 117 33 (66)

Under IFRS 14, the net movement in the debit and credit balances will flow to

the statement of profit or loss and OCI.

A similar process would be applied when accounting for the activity in the

regulatory deferral account balances for the subsequent years.

November 2014 Applying IFRS for IFRS 14 Regulatory Deferral Accounts 9

An entity may also need to use estimates and assumptions in the recognition and

measurement of its regulatory deferral account balances. Therefore, for events

that occur between the end of the reporting period and the date when the

financial statements are authorised for issue, IAS 10 Events after Reporting

Period needs to be applied to identify whether those estimates and assumptions

should be adjusted for in the balances at the end of the reporting period to

reflect those events.

3.4 Service concession arrangements

Many governments have utilised contractual service concession arrangements

for the development, maintenance and operation of various infrastructure

initiatives. Given the similarities that may exist between some service

concession arrangements and rate-regulated schemes (e.g., the use of variance

accounts due to price regulation) and the potential overlap in the scope of

IFRIC 12 Service Concession Arrangements and IFRS 14, there may be some

implementation issues for entities to consider when a service concession

arrangement exists (i.e., how the two standards would interact with

each other).

For example, when adopting IFRS, an entity would apply the requirements of

IFRIC 12 prior to the application of IFRS 14. For infrastructure assets under

service concession arrangements, the entity (i.e., the operator) would not

recognise PP&E since the grantor is considered to be the party controlling the

asset. Instead, the entity recognises the consideration received or receivable as

either a financial asset or an intangible asset for the construction or upgrade

services that it provides. In some instances, it may be necessary to divide the

operator's right to cash flows into a financial asset (where there is an

unconditional contractual right to cash or other financial assets) and an

intangible asset (where there is only a licence and a right to charge users). This

is also known as a ‘hybrid model’.

Therefore, when adopting IFRS 14 in the case of a hybrid model, both the

financial asset and intangible asset need to be combined and compared against

the carrying amount under the previous GAAP, in order to determine the

amount of regulatory deferral account balance under IFRS 14. This approach is

aligned with the principle in paragraph 7 of IFRS 14, which explicitly states that

any amounts recognised as assets or liabilities in accordance with other IFRSs

should be excluded from the regulatory deferral account balances.

3.5 Income taxes

IFRS 14 states that the deferred tax asset or liability arising on recognition of a

regulatory deferral account balance is included within the separate line item

presented for the regulatory deferral account balance or movements within the

balance. This differs from the general IAS 12 Income Taxes requirements of

combining all deferred tax assets or liability balances.

10 November 2014 Applying IFRS for IFRS 14 Regulatory Deferral Accounts

Entities should also consider how they would determine deferred income taxes

allocated to a regulatory deferral account. This would likely involve significant

judgements and estimates in determining the split between the regulatory

deferral account balances and other IFRS assets and liabilities.

On an ongoing basis, there may also be process implications to consider.

For example, this may require separate tax ledgers to be maintained for

the IFRS balances and the regulatory deferral accounts so as to track and

monitor these balances separately for any utilisation, derecognition and

impairment assessments.

4. Impairment considerations

IFRS 14 allows an entity to continue to apply its previous GAAP accounting

policies for the identification, recognition, measurement and reversal of any

impairment of its recognised regulatory deferral account balances.

Consequently, the requirements under IAS 36 Impairment of Assets do not

apply to the separate regulatory deferral account balances recognised.

Having said that, IAS 36 might require an entity to perform an impairment test

on a cash-generating unit (CGU) that includes regulatory deferral account

balances. The impairment test may be required because the CGU contains

goodwill, or because one or more of the impairment indicators described in

IAS 36 have been identified as relating to the CGU. Below are some

considerations to keep in mind in such situations.

4.1 Determination of the recoverable amount of the CGU

IAS 36 requires an entity to assess whether there is any indication that an asset

or CGU may be impaired at the end of each reporting period. Certain events

that occur subsequent to the balance sheet date, but prior to the issuance of

the financial statements, may also need to be considered.

If any impairment indication exists at the end of any interim or annual reporting

period, the entity would have to estimate the recoverable amount of the asset

or CGU. Paragraph B16 of IFRS 14 provides that an entity must apply the

requirements under paragraphs 74-79 of IAS 36 to establish whether any of the

regulatory deferral account balances recognised should be included in

determing the carrying and recoverable amount of the CGU for the purpose of

the impairment test. Therefore, if the regulatory deferral account balances are

included in the carrying amount of a CGU, they must also be included in the

recoverable amount of the CGU.1

The inclusion or exclusion of regulatory deferral account balances for purposes

of the impairment assessment of the CGU needs to be consistently applied

period to period, unless a change is justified.

4.2 Allocation of the impairment losses within the CGU

Paragraph B16 of IFRS 14 provides that the remaining requirements of IAS 36

must be applied to any impairment loss that is recognised as a result of the

impairment test. Therefore, the requirements in paragraphs 104-105 of IAS 36

would be relevant in recognising and allocating the impairment loss for a CGU

where regulatory deferral account balances are recognised.

In allocating the impairment losses for a CGU, the impairment losses are first

applied to reduce the goodwill and then to the other assets of the unit, including

any regulatory deferral account debit balances, on a pro-rata basis, of the

carrying amount of each asset in the CGU in accordance with IAS 36.104(b).

1 IAS 36.75

November 2014 Applying IFRS for IFRS 14 Regulatory Deferral Accounts 11

However, it is important to note that any impairment losses that are allocated

to the regulatory deferral account debit balances should not reduce their

carrying amount to below the amount of costs that are recoverable under the

rate regulation mechanisms.2

5. Group considerations

In a group situation, there could be complex scenarios that arise as a result of

the regulatory regimes and historical accounting policies of an entity’s

subsidiaries. Paragraph 8 of IFRS 14 requires that an entity that is within its

scope, and elects to apply it, must apply all of its requirements to all regulatory

deferral account balances arising from all of the entity's rate-regulated

activities. Therefore, careful assessment of the costs versus benefits should be

evaluated when deciding whether to adopt IFRS 14.

5.1 Impact on associates, joint ventures and subsidiaries in the

consolidated financial statements

IFRS 10 Consolidated Financial Statements and IAS 28 Investments in

Associates and Joint Ventures require the use of uniform accounting policies for

like transactions and other events in similar circumstances, by the parent and

the subsidiaries, associates and joint ventures.

Consequently, if a parent recognises regulatory deferral account balances in its

consolidated financial statements, in accordance with IFRS 14, it must apply the

same accounting policies to the regulatory deferral account balances arising in

all of its subsidiaries. This applies irrespective of whether the subsidiaries

recognise those balances in their own financial statements.

Conversely, if the parent does not recognise regulatory deferral account

balances in its consolidated financial statements, any such balances in the

subsidiary’s separate financial statements would also have to be derecognised

upon consolidation, even if the subsidiary meets the criteria to apply IFRS 14.

Similar to subsidiaries, adjustments may be required to make the associate's or

joint venture's accounting policies for the recognition, measurement,

impairment and derecognition of regulatory deferral account balances conform

to those of the investing entity in applying the equity method.

5.2 Business combinations and acquisitions

When an entity that has adopted IFRS 14 acquires a business, its accounting

policies must be applied to the acquiree’s regulatory deferral account balances

as of the date of acquisition.

However, an entity that is an existing IFRS preparer is not allowed to apply

IFRS 14 in its consolidated financial statements. Therefore, even if the entity

acquires a business and the acquiree is a first-time adopter who chooses to

implement IFRS 14, the entity should not reflect the acquiree’s regulatory

deferral account balances, as of the date of acquisition, in the consolidated

financial statements.

2 IAS 36.105

12 November 2014 Applying IFRS for IFRS 14 Regulatory Deferral Accounts

6. Presentation

One of the key aspects of IFRS 14 is the presentation changes introduced for

Regulatory deferral both the statement of financial position and statement or profit or loss and OCI.

account balances, and The interim standard requires regulatory deferral account balances to be

the net movements in presented as separate line items on the statement of financial position. In

the account balances, addition, the total of all regulatory deferral debit balances must be separated

are presented on from the total of all regulatory deferral credit balances. The net movements in

separate line items in the the account balances must be presented, net of the applicable deferred income

statement of financial taxes, as a separate line item on the statement of profit or loss. The net

position and statement movements in regulatory deferral account balances that relate directly to OCI

are also presented separately.

of profit or loss and OCI.

The IASB believes that presenting the regulatory deferral accounts separately

on the statement of financial position and the statement of profit or loss and

OCI would enhance comparability with entities that already apply IFRS and,

thus, do not recognise regulatory deferral accounts.

6.1 Earnings per share

Entities are also required to present additional earnings per share (EPS)

amounts. Although entities would continue presenting basic and diluted EPS in

accordance with IAS 33 Earnings per Share, they are also required to present

basic and diluted EPS, excluding the net movement in the regulatory deferral

account balances with equal prominence.

6.2 Non-current assets held for sale and discontinued

operations

Other presentation requirements include the exclusion of regulatory deferral

accounts, and the related net movements, from discontinued operations or

disposal group amounts presented in accordance with IFRS 5 Non-current

Assets Held for Sale and Discontinued Operations.

Instead, the entity must present the total of the regulatory deferral account

debit balances and credit balances that are part of the disposal group either

within the line items that are presented for the regulatory deferral account

debit balances and credit balances or as separate line items alongside the other

regulatory deferral account debit balances and credit balances.

November 2014 Applying IFRS for IFRS 14 Regulatory Deferral Accounts 13

7. Disclosures

Extract from IFRS 14

27 An entity that elects to apply this Standard shall disclose information

that enables users to assess:

(a) the nature of, and the risks associated with, the rate regulation that

establishes the price(s) that the entity can charge customers for the

goods or services it provides; and

(b) the effects of that rate regulation on its financial position, financial

performance and cash flows.

Some of the key disclosure requirements include:

• A description of the rate-regulated activities and regulatory rate-

setting process

• An explanation of how the future recovery or reversal of each class of

regulatory deferral account balance is affected by risks and uncertainties,

such as demand and regulatory risks

• The basis on which regulatory deferral account balances are recognised and

measured initially and subsequently

• A reconciliation of the carrying amount of each class of regulatory deferral

account balance as of the beginning and end of the reporting period

In addition, the description of the rate-regulated activities and explanation

of the future recovery or reversal of regulatory deferral account balances

may be provided in the financial statements or incorporated by cross-reference

to information that is readily available to users of the financial statements

(e.g., management commentary or risk report).

For consolidated financial statements, it is important to note that disclosures

under IFRS 12 Disclosure of Interests in Other Entities must also include

separate disclosure of the regulatory deferral accounts and the related net

movement for the interests disclosed.

14 November 2014 Applying IFRS for IFRS 14 Regulatory Deferral Accounts

8. Effective dates and transition

IFRS 14 is effective for annual periods beginning on or after 1 January 2016

and earlier application is permitted. If adopted, IFRS 14 needs to be applied on a

full retrospective basis.

Since IFRS 14 is only made available to first-time adopters of IFRS,

entities should also consider when implementing the interim standard,

how it would interact with the exemptions contained within IFRS 1. One of

the common considerations would be the deemed cost exemption

(paragraphs D5 to D8B of IFRS 1), which is further explored in the

illustrative example below.

Illustration 8.1 — Application of the deemed cost exemption under

IFRS 1 and the adoption of IFRS 14

Assume that an entity reporting under US GAAP has a PP&E balance of CU100

as at 31 December 20x1, which includes capitalised costs allowed under

ASC 980-360. With effect from 1 January 20x2, the entity adopted IFRS and

the PP&E balance determined under IFRS is CU80.

Question:

Upon adoption of IFRS 14, should the entity record a regulatory deferral

account debit balance of CU20 or CUNil?

Answer:

The deemed cost exemption in IFRS 1 is meant to provide some relief for the

practical difficulties that entities may face in determining the historical PP&E

balances under other IFRSs as at the date of adopting IFRS.

Paragraph D8B of IFRS 1 specifically allows entities to elect to use the

previous GAAP carrying amount of PP&E at the date of transition to IFRS as

the deemed cost if these assets were previously used in operations subject to

rate regulation.

Therefore, upon adoption of IFRS 14, the deemed cost of the PP&E balance is

CU100 and the regulatory deferral account debit balance is CUNil as at

1 January 20x2.

November 2014 Applying IFRS for IFRS 14 Regulatory Deferral Accounts 15

EY | Assurance | Tax | Transactions | Advisory

About EY

EY is a global leader in assurance, tax, transaction and advisory services.

The insights and quality services we deliver help build trust and confidence

in the capital markets and in economies the world over. We develop

outstanding leaders who team to deliver on our promises to all of our

stakeholders. In so doing, we play a critical role in building a better working

world for our people, for our clients and for our communities.

EY refers to the global organization, and may refer to one or more, of the

member firms of Ernst & Young Global Limited, each of which is a separate

legal entity. Ernst & Young Global Limited, a UK company limited by

guarantee, does not provide services to clients. For more information about

our organization, please visit ey.com.

About EY’s International Financial Reporting Standards Group

A global set of accounting standards provides the global economy with

one measure to assess and compare the performance of companies. For

companies applying or transitioning to International Financial Reporting

Standards (IFRS), authoritative and timely guidance is essential as the

standards continue to change. The impact stretches beyond accounting

and reporting, to key business decisions you make. We have developed

extensive global resources — people and knowledge — to support our clients

applying IFRS and to help our client teams. Because we understand that

you need a tailored service as much as consistent methodologies, we work

to give you the benefit of our deep subject matter knowledge, our broad

sector experience and the latest insights from our work worldwide.

© 2014 EYGM Limited.

All Rights Reserved.

EYG No. AU2640

ED None

This material has been prepared for general informational purposes only and is not intended to

be relied upon as accounting, tax, or other professional advice. Please refer to your advisors for

specific advice.

ey.com

Você também pode gostar

- IFRS 14 Regulatory Deferral AccountsDocumento24 páginasIFRS 14 Regulatory Deferral AccountsMarc Eric RedondoAinda não há avaliações

- Interim Standard Comprehensive Project 25 April 2013: Accounts Published Accounts IssuedDocumento4 páginasInterim Standard Comprehensive Project 25 April 2013: Accounts Published Accounts IssuedJuan TañamorAinda não há avaliações

- Audit and Accounting Guide: Entities With Oil and Gas Producing Activities, 2018No EverandAudit and Accounting Guide: Entities With Oil and Gas Producing Activities, 2018Ainda não há avaliações

- Ifrs at A Glance Ifrs 1 First Time Adoption of Ifrss: WWW - Bdo.GlobalDocumento4 páginasIfrs at A Glance Ifrs 1 First Time Adoption of Ifrss: WWW - Bdo.GlobalAhmed AshrafAinda não há avaliações

- Accounting Policy Options in IFRSDocumento11 páginasAccounting Policy Options in IFRSSaiful Iksan PratamaAinda não há avaliações

- Audit and Accounting Guide - Depository and Lending Institutions: Banks and Savings Institutions, Credit Unions, Finance Companies, and Mortgage CompaniesNo EverandAudit and Accounting Guide - Depository and Lending Institutions: Banks and Savings Institutions, Credit Unions, Finance Companies, and Mortgage CompaniesAinda não há avaliações

- JP GAAP Vs IFRSDocumento181 páginasJP GAAP Vs IFRSCharlie Magne G. SantiaguelAinda não há avaliações

- IFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsNo EverandIFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsNota: 4 de 5 estrelas4/5 (11)

- 2018 Interim Disclosure ChecklistDocumento24 páginas2018 Interim Disclosure ChecklistWedi TassewAinda não há avaliações

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23Ainda não há avaliações

- IFRS 1 First-time Adoption SummaryDocumento2 páginasIFRS 1 First-time Adoption SummarypiyalhassanAinda não há avaliações

- Financial Steering: Valuation, KPI Management and the Interaction with IFRSNo EverandFinancial Steering: Valuation, KPI Management and the Interaction with IFRSAinda não há avaliações

- Ifrs 1 First Time Adoption of Ifrss: BackgroundDocumento3 páginasIfrs 1 First Time Adoption of Ifrss: Backgroundmusic niAinda não há avaliações

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsAinda não há avaliações

- IFRS 1 Technical SummaryDocumento2 páginasIFRS 1 Technical SummaryShashank GuptaAinda não há avaliações

- IFRS 14 - Regulatory Deferral AccountsDocumento3 páginasIFRS 14 - Regulatory Deferral AccountsMarc Eric Redondo100% (1)

- SABS - Impending IFRS Convergence - Vinayak PaiDocumento7 páginasSABS - Impending IFRS Convergence - Vinayak PaiBasappaSarkarAinda não há avaliações

- IFRS 1 Technical SummaryDocumento2 páginasIFRS 1 Technical SummaryBheki Tshimedzi0% (1)

- Regulatory Deferral Accounts: IFRS Standard 14Documento24 páginasRegulatory Deferral Accounts: IFRS Standard 14Teja JurakAinda não há avaliações

- Note 4 - 1FRS 1 - FIRST TIME ADOPTION OF IFRSDocumento6 páginasNote 4 - 1FRS 1 - FIRST TIME ADOPTION OF IFRSdemolaojaomoAinda não há avaliações

- C C C CC CCCCC CC CCCCCCCCC CCC C ËDocumento8 páginasC C C CC CCCCC CC CCCCCCCCC CCC C ËAshu AshwiniAinda não há avaliações

- Applying Rev RHC Mar 2015Documento33 páginasApplying Rev RHC Mar 2015Danik AstutikAinda não há avaliações

- 14-Regulatory Deferral AccountsDocumento20 páginas14-Regulatory Deferral AccountsChelsea Anne VidalloAinda não há avaliações

- 56 Ifrs e yDocumento40 páginas56 Ifrs e ybhupathiAinda não há avaliações

- Chapter 23Documento40 páginasChapter 23rameelamirAinda não há avaliações

- EY PBGuide April 2014Documento26 páginasEY PBGuide April 2014Pankaj GourAinda não há avaliações

- Microsoft PowerPoint Presentation IFRSDocumento27 páginasMicrosoft PowerPoint Presentation IFRSSwati SharmaAinda não há avaliações

- IFRS1Documento2 páginasIFRS1Jkjiwani AccaAinda não há avaliações

- ch6 IFRSDocumento56 páginasch6 IFRSAnonymous 6aW7sZWdILAinda não há avaliações

- Regulatory Deferral Accounts: Ifrs 14Documento22 páginasRegulatory Deferral Accounts: Ifrs 14Saad Abu AlhaijaAinda não há avaliações

- SECTIONAL INDEX OF TECHNICAL RELEASESDocumento37 páginasSECTIONAL INDEX OF TECHNICAL RELEASESHamza ShahidAinda não há avaliações

- International Financial Reporting Standards (IFRS) : An OverviewDocumento10 páginasInternational Financial Reporting Standards (IFRS) : An Overviewsanjay guptaAinda não há avaliações

- IFRS1Documento1 páginaIFRS1Md TurjoyAinda não há avaliações

- 25 Notes of Financial StatementsDocumento35 páginas25 Notes of Financial StatementsDustin ThompsonAinda não há avaliações

- ICAP TRsDocumento45 páginasICAP TRsSyed Azhar Abbas0% (1)

- Preface To IFRS StandardsDocumento4 páginasPreface To IFRS StandardsMARIABEVIELEN SUAVERDEZAinda não há avaliações

- 2021 IFRS 1 First-Time Adoption of International Financial Reporting Standards - FinalDocumento48 páginas2021 IFRS 1 First-Time Adoption of International Financial Reporting Standards - FinalLuisa LuiAinda não há avaliações

- IFRS GAAP ComparisonDocumento196 páginasIFRS GAAP ComparisonDiah Kartika Retna AAinda não há avaliações

- Ifrs 14: Regulatory Deferral AccountDocumento4 páginasIfrs 14: Regulatory Deferral AccountAira Nhaira MecateAinda não há avaliações

- Applying IFRS 15 - P&DDocumento73 páginasApplying IFRS 15 - P&DMuhammad Zaid Sahak100% (1)

- Ifrs 1 AagDocumento5 páginasIfrs 1 AagMoses TAinda não há avaliações

- IFRS Convergence in India ProjectDocumento32 páginasIFRS Convergence in India ProjectVimal GogriAinda não há avaliações

- Ifrs Bdo 2020Documento104 páginasIfrs Bdo 2020SyedAinda não há avaliações

- Technical Summary: IFRS 1 First-Time Adoption of InternationalDocumento1 páginaTechnical Summary: IFRS 1 First-Time Adoption of InternationalNadiani NanaAinda não há avaliações

- PAS 1 With Notes - Pres of FS PDFDocumento75 páginasPAS 1 With Notes - Pres of FS PDFFatima Ann GuevarraAinda não há avaliações

- FASB-IASB standards comparisonDocumento2 páginasFASB-IASB standards comparisonKomal RehmanAinda não há avaliações

- Ifrs - An Overview: International Financial Reporting StandardsDocumento19 páginasIfrs - An Overview: International Financial Reporting Standardskitta880% (2)

- Ipsas 14 Events AfterDocumento17 páginasIpsas 14 Events AfterPhebieon MukwenhaAinda não há avaliações

- IFRS IAS SummaryDocumento94 páginasIFRS IAS SummaryLin AungAinda não há avaliações

- IFRS 1 - First Time AdopterDocumento9 páginasIFRS 1 - First Time AdopterAkinwumi AyodejiAinda não há avaliações

- Ifrs 01Documento1 páginaIfrs 01marmah_hadiAinda não há avaliações

- PFRS 14: Regulatory Deferral AccountsDocumento23 páginasPFRS 14: Regulatory Deferral AccountsMeiAinda não há avaliações

- GenesisDocumento55 páginasGenesismuskan kundra100% (1)

- IFRS 14 & 15: International Financial Reporting StandardDocumento19 páginasIFRS 14 & 15: International Financial Reporting StandardAromalAinda não há avaliações

- IFRSDocumento14 páginasIFRSNishchay Dhingra100% (1)

- IFRS Conceptual Framework GuideDocumento10 páginasIFRS Conceptual Framework GuideRobbie CruzAinda não há avaliações

- Financial Statements and Notes for Attock Refinery LimitedDocumento36 páginasFinancial Statements and Notes for Attock Refinery LimitedHasnain KharAinda não há avaliações

- Summary of Financial Statements For Fiscal 2019Documento24 páginasSummary of Financial Statements For Fiscal 2019Obisike EmeziAinda não há avaliações

- CITATION Jar15 /L 1033Documento2 páginasCITATION Jar15 /L 1033Obisike EmeziAinda não há avaliações

- E Commerce in USDocumento7 páginasE Commerce in USObisike EmeziAinda não há avaliações

- Models For Measuring and Predicting Shareholder VaDocumento25 páginasModels For Measuring and Predicting Shareholder VaObisike EmeziAinda não há avaliações

- Impact of CovidDocumento5 páginasImpact of CovidObisike EmeziAinda não há avaliações

- How To Account For Climate in Financial Reporting Part 2Documento16 páginasHow To Account For Climate in Financial Reporting Part 2Obisike EmeziAinda não há avaliações

- Assessing Biodiversity Impacts of Trade A Review of Challenges in The Agriculture SectorDocumento12 páginasAssessing Biodiversity Impacts of Trade A Review of Challenges in The Agriculture SectorObisike EmeziAinda não há avaliações

- Faith's Country Primitives: An Excel Project in Flexible Budgeting and Standard Cost AnalysisDocumento14 páginasFaith's Country Primitives: An Excel Project in Flexible Budgeting and Standard Cost AnalysisObisike EmeziAinda não há avaliações

- Market Segmentation ChapterDocumento17 páginasMarket Segmentation Chapterjaspal singhAinda não há avaliações

- Analyzing The Amazon Success Strategies: January 2018Documento7 páginasAnalyzing The Amazon Success Strategies: January 2018Ирина ГонтаренкоAinda não há avaliações

- Marketing Strategy of AmazonDocumento51 páginasMarketing Strategy of AmazonObisike Emezi100% (1)

- IATA Industry Accounting Working Group Guidance IFRS 16, LeasesDocumento44 páginasIATA Industry Accounting Working Group Guidance IFRS 16, LeasesObisike EmeziAinda não há avaliações

- IFRS 9 - Expected Credit Loss: Consideration For Accounts Receivable and Contract AssetsDocumento14 páginasIFRS 9 - Expected Credit Loss: Consideration For Accounts Receivable and Contract AssetsObisike EmeziAinda não há avaliações

- Choosing IFRS 16 Transition Options and Practical ExpedientsDocumento4 páginasChoosing IFRS 16 Transition Options and Practical ExpedientsObisike EmeziAinda não há avaliações

- IFRS 16 Impact Asseement Extracts From BT and Gudance NotesDocumento3 páginasIFRS 16 Impact Asseement Extracts From BT and Gudance NotesObisike EmeziAinda não há avaliações

- Model Proposal MSC Finance ThesisDocumento2 páginasModel Proposal MSC Finance ThesisObisike EmeziAinda não há avaliações

- EY's Spotlight On Telecommunications Accounting: Holger ForstDocumento8 páginasEY's Spotlight On Telecommunications Accounting: Holger ForstObisike EmeziAinda não há avaliações

- Impact of Capital Structure on Financial Performance of Nigerian FirmsDocumento2 páginasImpact of Capital Structure on Financial Performance of Nigerian FirmsObisike EmeziAinda não há avaliações

- Literature Review For Research ProposalDocumento11 páginasLiterature Review For Research ProposalObisike EmeziAinda não há avaliações

- Research Proposal AssignmentDocumento12 páginasResearch Proposal AssignmentObisike EmeziAinda não há avaliações

- Writing An M SC Research ThesisDocumento6 páginasWriting An M SC Research ThesisObisike EmeziAinda não há avaliações

- Icaew Diploma in Ifrss Assignment 1 Paper 17 Oct 2011Documento13 páginasIcaew Diploma in Ifrss Assignment 1 Paper 17 Oct 2011Obisike EmeziAinda não há avaliações

- Harvard Referencing PDFDocumento28 páginasHarvard Referencing PDFObisike EmeziAinda não há avaliações

- CFA Level 1 Study Guide: Corporate FinanceDocumento343 páginasCFA Level 1 Study Guide: Corporate Financed-fbuser-32825803100% (12)

- IFRS 16 Leases and asset sales accountingDocumento4 páginasIFRS 16 Leases and asset sales accountingObisike EmeziAinda não há avaliações

- Augustine & Akinwumi (2018), Usefullness of Accounting Theory N Practices...Documento17 páginasAugustine & Akinwumi (2018), Usefullness of Accounting Theory N Practices...Rifaldi AhmadAinda não há avaliações

- Carbon Exposure and Shareholder Value: Thesis DescriptionDocumento11 páginasCarbon Exposure and Shareholder Value: Thesis DescriptiontariqAinda não há avaliações

- d16 Dipifr QP CleanDocumento8 páginasd16 Dipifr QP CleanbasukaustubhAinda não há avaliações

- Dipifr 2019 Dec QDocumento7 páginasDipifr 2019 Dec QObisike EmeziAinda não há avaliações

- Current Liab Trade and Other PayablesDocumento6 páginasCurrent Liab Trade and Other PayablesRamainne Chalsea RonquilloAinda não há avaliações

- 4AC0 - 01 - Mark Scheme Accounting JanDocumento14 páginas4AC0 - 01 - Mark Scheme Accounting JanFahad FarhanAinda não há avaliações

- Walmart MoneyCard February StatementDocumento3 páginasWalmart MoneyCard February Statementdavid chenAinda não há avaliações

- Debt Recovery Management of SBIDocumento12 páginasDebt Recovery Management of SBIDipanjan DasAinda não há avaliações

- 3-1int 2003 Dec QDocumento6 páginas3-1int 2003 Dec Qjalan1989Ainda não há avaliações

- 1) Simple and Flexible: Features of TallyDocumento9 páginas1) Simple and Flexible: Features of TallyPoojitha ReddyAinda não há avaliações

- Assignmenth. Hhvbjyu. GGDocumento2 páginasAssignmenth. Hhvbjyu. GGchetanphalak.instagramAinda não há avaliações

- Peachtree Training Manual - FinalDocumento72 páginasPeachtree Training Manual - FinalBona IbrahimAinda não há avaliações

- ToA - Quizzer 9 Inty PPE & BiologicalDocumento15 páginasToA - Quizzer 9 Inty PPE & BiologicalRachel Leachon100% (1)

- Free Dump: Pass For Sure With Free Exam Dumps, PDF Demo Is Available For EveryoneDocumento5 páginasFree Dump: Pass For Sure With Free Exam Dumps, PDF Demo Is Available For EveryoneMyank100% (1)

- P2 01Documento10 páginasP2 01Herald GangcuangcoAinda não há avaliações

- StatementsDocumento2 páginasStatementsFIRST FIRSAinda não há avaliações

- Martel Law OfficeDocumento6 páginasMartel Law Officechrisguamos69% (16)

- 18bco23c U3Documento17 páginas18bco23c U3Prasad IyengarAinda não há avaliações

- Name and Address of Branch/ Office in Which The Deposit Is HeldDocumento7 páginasName and Address of Branch/ Office in Which The Deposit Is Heldvvnrao123Ainda não há avaliações

- Non Integrated AccountingDocumento4 páginasNon Integrated AccountingbinuAinda não há avaliações

- SIKLUS PERUSAHAANDocumento15 páginasSIKLUS PERUSAHAANRiska GintingAinda não há avaliações

- Set 3Documento14 páginasSet 3Prakshi KansalAinda não há avaliações

- Lizzie Inc General Journal EntriesDocumento10 páginasLizzie Inc General Journal EntriesshaankkAinda não há avaliações

- 4AC1Documento19 páginas4AC1AcUK AyeshaAinda não há avaliações

- Unit-6 Subsidiary Books PDFDocumento52 páginasUnit-6 Subsidiary Books PDFShiva AggarwalAinda não há avaliações

- Special Procurement Sap MMDocumento7 páginasSpecial Procurement Sap MMAjith KumarAinda não há avaliações

- Eft, Ecs, Core Banking SolutionsDocumento28 páginasEft, Ecs, Core Banking SolutionsRamya KarthiAinda não há avaliações

- CA Foundation Accounts Test - 1Documento8 páginasCA Foundation Accounts Test - 1Vasanta ParateAinda não há avaliações

- Bus 704 - Homework 3 Assignment: Due February 22 at 5:30 PMDocumento3 páginasBus 704 - Homework 3 Assignment: Due February 22 at 5:30 PMtanishkaAinda não há avaliações

- Complete Financial Statements With SCF Direcdt MethodDocumento23 páginasComplete Financial Statements With SCF Direcdt MethodJuja FlorentinoAinda não há avaliações

- FAQs Real Estate SectorDocumento16 páginasFAQs Real Estate SectorAnonymous 2CsXfDV780% (5)

- Lotus savings bank account statement from Feb 2022 to Aug 2022Documento13 páginasLotus savings bank account statement from Feb 2022 to Aug 2022Sunkara ThanmayeesaisowmyaAinda não há avaliações

- Umme Zainab Accounting AssighnmentDocumento2 páginasUmme Zainab Accounting Assighnmentzm65012Ainda não há avaliações

- Loan statement summaryDocumento2 páginasLoan statement summaryShantesh AroraAinda não há avaliações

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideNo Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideNota: 2.5 de 5 estrelas2.5/5 (2)

- Business Process Mapping: Improving Customer SatisfactionNo EverandBusiness Process Mapping: Improving Customer SatisfactionNota: 5 de 5 estrelas5/5 (1)

- Financial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksNo EverandFinancial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksNota: 4 de 5 estrelas4/5 (1)

- GDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekNo EverandGDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekAinda não há avaliações

- Electronic Health Records: An Audit and Internal Control GuideNo EverandElectronic Health Records: An Audit and Internal Control GuideAinda não há avaliações

- The Layman's Guide GDPR Compliance for Small Medium BusinessNo EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessNota: 5 de 5 estrelas5/5 (1)

- Musings on Internal Quality Audits: Having a Greater ImpactNo EverandMusings on Internal Quality Audits: Having a Greater ImpactAinda não há avaliações

- Mistakes in Quality Statistics: and How to Fix ThemNo EverandMistakes in Quality Statistics: and How to Fix ThemAinda não há avaliações

- Internet Fraud Casebook: The World Wide Web of DeceitNo EverandInternet Fraud Casebook: The World Wide Web of DeceitAinda não há avaliações

- Executive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceNo EverandExecutive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceNota: 4 de 5 estrelas4/5 (1)

- Strategic Consulting Frameworks: Consulting PreparationNo EverandStrategic Consulting Frameworks: Consulting PreparationAinda não há avaliações

- GDPR for DevOp(Sec) - The laws, Controls and solutionsNo EverandGDPR for DevOp(Sec) - The laws, Controls and solutionsNota: 5 de 5 estrelas5/5 (1)

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersNo EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersNota: 4.5 de 5 estrelas4.5/5 (11)

- Guidelines for Organization of Working Papers on Operational AuditsNo EverandGuidelines for Organization of Working Papers on Operational AuditsAinda não há avaliações

- Scrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsNo EverandScrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsAinda não há avaliações

- Audit and Assurance Essentials: For Professional Accountancy ExamsNo EverandAudit and Assurance Essentials: For Professional Accountancy ExamsAinda não há avaliações

- Mastering Internal Audit Fundamentals A Step-by-Step ApproachNo EverandMastering Internal Audit Fundamentals A Step-by-Step ApproachNota: 4 de 5 estrelas4/5 (1)

- Guide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyNo EverandGuide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyAinda não há avaliações