Escolar Documentos

Profissional Documentos

Cultura Documentos

Factsheet

Enviado por

radityanationDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Factsheet

Enviado por

radityanationDireitos autorais:

Formatos disponíveis

HARLEY-DAVIDSON, INC.

NYSE: HOG Fact Sheet

Company Profile: Harley-Davidson® Motorcycle Shipments:

Throughout the world, Harley-Davidson unites people International motorcycle shipments have grown as a percentage of

total motorcycle shipments over the past five years.

deeply, passionately and authentically. With both

global significance and local relevance, it’s no surprise Domestic & International

that the Harley-Davidson brand is one of the strongest Harley-Davidson Motorcycle Shipments

in the world.

100%

Founded in 1903, Harley-Davidson has come to 80%

symbolize individuality, freedom and rebellion. The 60%

Company produces thirty-five Harley-Davidson® 40%

motorcycle models. The Harley-Davidson motorcycling 20%

experience is realized through authorized dealers in

more than 70 countries and the Harley Owners Group® 0%

2005 2006 2007 2008 2009

which has over one million members worldwide.

United States International

Harley-Davidson delivers the ultimate motorcycling

experience through a variety of products and services. Harley-Davidson® Motorcycle Retail Sales:

2009 Worldwide Retail Sales of

2009 Worldwide Revenue - $4.3 Billion Harley-Davidson Motorcycles

7%

18%

75%

United States

*Europe Region

Asia Pacific Region

Motorcycles - $3.2 Billion Canada

Latin America Region

Parts & Accessories - $767.3 Million

Data source for all 2009 retail sales figures shown above is sales warranty and registration information

provided by Harley-Davidson dealers and compiled by the Company. The Company must rely on

General Merchandise - $282.2 Million information that its dealers supply concerning retail sales, and this information is subject to revision.

* Data for Europe include Austria, Belgium, Denmark, Finland, France, Germany, Greece, Italy,

Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom.

2010 Sportster® 48™ 2010 FXDWG Dyna® Wide Glide®

SELECTED FINANCIAL DATA

2009 2008 2007

Income Statement Data:

Net Revenue $ 4,287,130 $ 5,578,414 $ 5,726,848

Cost of goods sold 2,900,934 3,647,270 3,612,748

Gross Profit 1,386,196 1,931,144 2,114,100

Operating income from HDMC 314,055 976,402 1,213,392

Operating income from HDFS (117,969) 82,765 212,169

Net income $ (55,116) $ 654,718 $ 933,843

Weighted-average common shares:

Diluted (in thousands)

233,573 234,477 249,882

Earnings per share: continuing ops. $ 0.30 $ 2.92 $ 3.74

Loss per share: discontinued ops. $ (0.54) $ (0.13) $ 0.00

Diluted (loss) earnings per share $ (0.24) $ 2.79 $ 3.74

Dividends paid $ 0.40 $ 1.29 $ 1.06

Additional Highlights:

• In 2009, Harley-Davidson’s share of the U.S. heavyweight (651+cc) market was approximately 53%, and approximately

12% in Europe.

• The Company paid dividends of $0.40 per share at a total cost of $93.8 million during 2009, compared to dividends of

$1.29 per share at a total cost of $302.3 million during 2008.

• Capital Expenditures were $116.7 million in 2009, and $1.0 billion in the last 5 years.

• $100 invested in Harley-Davidson at the end of 1986 would be worth approximately $9,000 at the end of 2009, vs. $782

if the same amount were invested in the S&P 500 Index, assuming that all dividends are reinvested for both.

• The Company incurred research and development expenses of $143.1 million, $163.5 million and $185.5 million during

2009, 2008 and 2007, respectively.

Contact Information:

Harley-Davidson, Inc. Toll-free: (877) HDSTOCK

Investor Relations Dept. Local: (414) 343-4782

3700 W. Juneau Ave. Fax: (414) 343-8106

Milwaukee, WI 53208 Web site: www.harley-davidson.com

E-mail: Investor.Relations@harley-davidson.com

Transfer Agent Information:

Computershare Investor Services Toll-free: (866) 360-5339

P.O. Box 43078 Local: (312) 360-5339

Providence, RI 02940-3078 Web site: http://www.computershare.com/hog

Forward-Looking Statements:

The Company intends that certain matters discussed in this document are “forward-looking statements” intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking

statements can generally be identified as such because the context of the statement will include words such as the Company “believes,” “anticipates,” “expects,” “plans,” or “estimates” or words of similar meaning. Similarly, statements that describe

future plans, objectives, outlooks, targets, guidance or goals are also forward-looking statements. Such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those anticipated

as of the date of this release. Certain of such risks and uncertainties are described below. Shareholders, potential investors, and other readers are urged to consider these factors in evaluating the forward-looking statements and cautioned not to

place undue reliance on such forward-looking statements. The forward-looking statements included in this release are only made as of the date of this release, and the Company disclaims any obligation to publicly update such forward-looking

statements to reflect subsequent events or circumstances. The Company’s ability to meet the targets and expectations noted depends upon, among other factors, the Company's ability to (i) execute its strategy and successfully exit certain product

lines and divest certain company assets, (ii) effectively execute the Company’s restructuring plans within expected costs and timing, (iii) successfully achieve with our labor unions flexible and cost-effective agreements to accomplish restructuring

goals and long-term competitiveness, (iv) manage the risks that our independent dealers may have difficulty obtaining capital, and adjusting to the recession and slowdown in consumer demand, (v) manage supply chain issues, (vi) anticipate the

level of consumer confidence in the economy, (vii) continue to have access to reliable sources of capital funding and adjust to fluctuations in the cost of capital, (viii) manage the credit quality, the loan servicing and collection activities, and the

recovery rates of HDFS’ loan portfolio, (ix) continue to realize production efficiencies at its production facilities and manage operating costs including materials, labor and overhead, (x) manage production capacity and production changes, (xi) provide

products, services and experiences that are successful in the marketplace, (xii) develop and implement sales and marketing plans that retain existing retail customers and attract new retail customers in an increasingly competitive marketplace, (xiii)

sell all of its motorcycles and related products and services to its independent dealers, (xiv) continue to develop the capabilities of its distributor and dealer network, (xv) manage changes and prepare for requirements in legislative and regulatory

environments for its products, services and operations, (xvi) adjust to fluctuations in foreign currency exchange rates, interest rates and commodity prices, (xvii) adjust to healthcare inflation, pension reform and tax changes, (xviii) retain and attract

talented employees, (xix) detect any issues with our motorcycles or manufacturing processes to avoid delays in new model launches, recall campaigns, increased warranty costs or litigation, and (xx) implement and manage enterprise-wide

information technology solutions and secure data contained in those systems. In addition, the Company could experience delays or disruptions in its operations as a result of work stoppages, strikes, natural causes, terrorism or other factors. Other

factors are described in risk factors that the Company has disclosed in documents previously filed with the Securities and Exchange Commission. Many of these risk factors are impacted by the current turbulent capital, credit and retail markets and

our ability to adjust to the recession. The Company’s ability to sell its motorcycles and related products and services and to meet its financial expectations also depends on the ability of the Company’s independent dealers to sell its motorcycles and

related products and services to retail customers. The Company depends on the capability and financial capacity of its independent dealers and distributors to develop and implement effective retail sales plans to create demand for the motorcycles

and related products and services they purchase from the Company. In addition, the Company’s independent dealers and distributors may experience difficulties in operating their businesses and selling Harley-Davidson motorcycles and related

products and services as a result of weather, economic conditions or other factors.

Você também pode gostar

- Iseki TM3200 3240 Parts ManualDocumento250 páginasIseki TM3200 3240 Parts ManualtzutzuAinda não há avaliações

- TTT - D9R - TEKQ0738 Cat Ultra Strength 40 Glass - SalesgramDocumento6 páginasTTT - D9R - TEKQ0738 Cat Ultra Strength 40 Glass - SalesgramAminadav100% (1)

- Tractor Principles: The Action, Mechanism, Handling, Care, Maintenance and Repair of the Gas Engine TractorNo EverandTractor Principles: The Action, Mechanism, Handling, Care, Maintenance and Repair of the Gas Engine TractorAinda não há avaliações

- Catalogo Aceites CaterpillarDocumento87 páginasCatalogo Aceites CaterpillarsergioAinda não há avaliações

- Cat TdtoDocumento2 páginasCat TdtoAhmed GhonimyAinda não há avaliações

- Cat Retroexcavadora 450fDocumento44 páginasCat Retroexcavadora 450fZayra PeñaAinda não há avaliações

- Service Manual - Mixer CDDocumento337 páginasService Manual - Mixer CDGabriel Castillo Muñoz100% (1)

- D8N Track-Type Tractor 9TC Filtros PDFDocumento3 páginasD8N Track-Type Tractor 9TC Filtros PDFandreina nuñez0% (1)

- 5 Herramientas de Tren de FuerzaDocumento255 páginas5 Herramientas de Tren de Fuerzacaptain_commander100% (1)

- Oil CoolersDocumento2 páginasOil Coolerskarol1177Ainda não há avaliações

- Catalogo de Partes Hidraulicas B125Documento4 páginasCatalogo de Partes Hidraulicas B125gustavo caicedo100% (1)

- B08 3 A6t PDFDocumento2 páginasB08 3 A6t PDFRakESaN SoundwangS100% (1)

- Grasa Multiproposito CatDocumento2 páginasGrasa Multiproposito Catrolex21Ainda não há avaliações

- C4.4 Acert PDFDocumento2 páginasC4.4 Acert PDFsandroyanezAinda não há avaliações

- R1600H Underground Loader Remote Control System: Global Service TrainingDocumento19 páginasR1600H Underground Loader Remote Control System: Global Service TrainingJORGE QUIQUIJANAAinda não há avaliações

- VOLVO EC330C LD EC330CLD EXCAVATOR Service Repair Manual PDFDocumento23 páginasVOLVO EC330C LD EC330CLD EXCAVATOR Service Repair Manual PDFfjjsjekdmmeAinda não há avaliações

- Emissions System: 777G Off-Highway TruckDocumento18 páginasEmissions System: 777G Off-Highway TruckFrancisco FerrerAinda não há avaliações

- 992g DIRECCION-FRENOSDocumento49 páginas992g DIRECCION-FRENOSJose Cruz RiosAinda não há avaliações

- PEHJ0069 - Cat Hydraulic and Power Train FiltersDocumento4 páginasPEHJ0069 - Cat Hydraulic and Power Train FiltersJuan Galarza AiteAinda não há avaliações

- Pruebas y Ajustes 416bDocumento30 páginasPruebas y Ajustes 416bVictor NunezAinda não há avaliações

- 1 - Y6 Plus Operation ManualDocumento50 páginas1 - Y6 Plus Operation ManualLeo CarrizoAinda não há avaliações

- Armado 793c InglésDocumento215 páginasArmado 793c InglésFelipeNicolasSilvaAinda não há avaliações

- Dictionary of Pictograph Symbols: Excerpted From Operation & Maintenance Manual (SEBD0400-03-01)Documento82 páginasDictionary of Pictograph Symbols: Excerpted From Operation & Maintenance Manual (SEBD0400-03-01)Franciscley CardosoAinda não há avaliações

- OutputDocumento39 páginasOutputRuben Condori Canaviri100% (2)

- Plano HidráulicoDocumento12 páginasPlano HidráulicoJuan Portilla Amasifuen100% (1)

- EX2500-6 Specs PDFDocumento14 páginasEX2500-6 Specs PDFIlham Agung WicaksonoAinda não há avaliações

- 2.tipos de Tren de FuerzaDocumento43 páginas2.tipos de Tren de FuerzaJames Edward Alarcon Ramos100% (1)

- To l2l'5" Lift: kW/95 Wt. Kell+gtl ToaderDocumento18 páginasTo l2l'5" Lift: kW/95 Wt. Kell+gtl ToaderRoberto GuillenAinda não há avaliações

- Operation Manual x45Documento116 páginasOperation Manual x45acalderon4596100% (1)

- D8R Series II Track-Type Tractor Electrical System: Electrical Schematic Symbols and DefinitionsDocumento2 páginasD8R Series II Track-Type Tractor Electrical System: Electrical Schematic Symbols and DefinitionsDarío Ache EmeAinda não há avaliações

- Husaberg 1999 Repair ManualDocumento48 páginasHusaberg 1999 Repair ManualAndré Duestad100% (1)

- FT-11.05 - 01 - CASAPPA - Bomba de Engranajes - PLP30Documento12 páginasFT-11.05 - 01 - CASAPPA - Bomba de Engranajes - PLP30Carlos Augusto Navarro BurgosAinda não há avaliações

- Plano Hidraulico 785CDocumento13 páginasPlano Hidraulico 785CGilmer PatricioAinda não há avaliações

- Failure Modes of TurbochargersDocumento12 páginasFailure Modes of Turbochargersbetoven8437Ainda não há avaliações

- Manual Bomba DESMI DK-9400Documento8 páginasManual Bomba DESMI DK-9400Schneider ParadaAinda não há avaliações

- Curso de 834hDocumento21 páginasCurso de 834hAnonymous Yt1axNOSG6100% (1)

- 2013032121504538Documento24 páginas2013032121504538zanella88Ainda não há avaliações

- 321d Esquema Hidraulico Excavadora CatDocumento2 páginas321d Esquema Hidraulico Excavadora CatWilson CamachitoAinda não há avaliações

- Catalog-F7-05-47 Elevated Monitor PDFDocumento3 páginasCatalog-F7-05-47 Elevated Monitor PDFAhmed Hassan100% (1)

- 194-210 CSG649Documento107 páginas194-210 CSG649IV FVAinda não há avaliações

- Aux Valve Brakes ST710Documento16 páginasAux Valve Brakes ST710Jose VegaAinda não há avaliações

- Hydrostatic Steering Unit Ospb, Ospc and Ospf: ServiceDocumento32 páginasHydrostatic Steering Unit Ospb, Ospc and Ospf: ServiceFelipe100% (1)

- Instalacion Bombas de Presion CatDocumento2 páginasInstalacion Bombas de Presion CatTito Zenon100% (1)

- Senr3193 Hydrostatic TransmissionDocumento48 páginasSenr3193 Hydrostatic TransmissionMoicano P SánchezAinda não há avaliações

- Correas - Medidas CaterpillarDocumento3 páginasCorreas - Medidas CaterpillarOscar olivoAinda não há avaliações

- Ajuste de Válvulas e PonteDocumento4 páginasAjuste de Válvulas e Pontewagner_guimarães_1Ainda não há avaliações

- Manual de Propietario Del Ford Edge 2012 (Inglés)Documento396 páginasManual de Propietario Del Ford Edge 2012 (Inglés)Luis Alberto GarciaAinda não há avaliações

- 2013catalog WEBDocumento114 páginas2013catalog WEBEver RiveraAinda não há avaliações

- Cat PM620 PM622Documento24 páginasCat PM620 PM622quyenAinda não há avaliações

- Manual de Operacio Cargador 992gDocumento24 páginasManual de Operacio Cargador 992gHugoRamosMamaniAinda não há avaliações

- Interactive Schematic: This Document Is Best Viewed at A Screen Resolution of 1024 X 768Documento13 páginasInteractive Schematic: This Document Is Best Viewed at A Screen Resolution of 1024 X 768Carlos Andres Campos TorresAinda não há avaliações

- 7785 A5Documento13 páginas7785 A5hmltdt9221100% (1)

- 789C Prueba de Calado ConvertidorDocumento5 páginas789C Prueba de Calado ConvertidorSergio Velarde Romay100% (1)

- Rineer Hydraulics Inc, Specifications PDFDocumento2 páginasRineer Hydraulics Inc, Specifications PDFTulio Andres CoyAinda não há avaliações

- Glosario de Terminos CAT en Ingles PDFDocumento92 páginasGlosario de Terminos CAT en Ingles PDFRicardo AndradeAinda não há avaliações

- Coca ColaDocumento17 páginasCoca Colavinu810Ainda não há avaliações

- Steinberg Alexandra 4536 A3Documento136 páginasSteinberg Alexandra 4536 A3Yong RenAinda não há avaliações

- Harley-Davidson Motor Co.: Enterprise Software SelectionDocumento4 páginasHarley-Davidson Motor Co.: Enterprise Software Selectionjuan guerreroAinda não há avaliações

- Harley Davidson, Inc.Documento9 páginasHarley Davidson, Inc.Rich ChuaAinda não há avaliações

- Fats & Oils Refining & Blending World Summary: Market Values & Financials by CountryNo EverandFats & Oils Refining & Blending World Summary: Market Values & Financials by CountryAinda não há avaliações

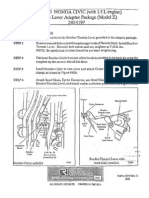

- 1988 - 1990 Honda Civic Throttle Lever Adaptor PackageDocumento2 páginas1988 - 1990 Honda Civic Throttle Lever Adaptor PackageradityanationAinda não há avaliações

- Air Locker Application ChartDocumento16 páginasAir Locker Application ChartradityanationAinda não há avaliações

- 1967 Mustang SpecsDocumento12 páginas1967 Mustang Specsradityanation100% (1)

- Air Locker Application ChartDocumento16 páginasAir Locker Application ChartradityanationAinda não há avaliações

- MP 31Documento5 páginasMP 31Bang JayAinda não há avaliações

- HarleyDavidson-CarburetorsTuning InstructionsDocumento17 páginasHarleyDavidson-CarburetorsTuning Instructionsradityanation100% (1)

- Bourne Ultimatum The Ilovepdf Compressed PDFDocumento105 páginasBourne Ultimatum The Ilovepdf Compressed PDFMark Joseph ValenciaAinda não há avaliações

- What Year Is It? BSADocumento8 páginasWhat Year Is It? BSAJeremy McCulloughAinda não há avaliações

- Product ProfitabilityDocumento16 páginasProduct Profitabilitybrigadier786239190% (10)

- Sales Round2Documento63 páginasSales Round2cmv mendoza100% (2)

- CHAPTER 1 UneditedDocumento6 páginasCHAPTER 1 UneditedNieva Marie EstenzoAinda não há avaliações

- Marketing Case PavadermDocumento4 páginasMarketing Case PavadermPlacebogsu0% (1)

- Law 504 - Assignment 3Documento4 páginasLaw 504 - Assignment 3fatanahaishahAinda não há avaliações

- Competitor AnalysisDocumento3 páginasCompetitor AnalysiskalahoneyAinda não há avaliações

- Segmentation of Shoppers Using Their Behaviour: A Research Report ONDocumento68 páginasSegmentation of Shoppers Using Their Behaviour: A Research Report ONpankaj_20082002Ainda não há avaliações

- XLS092-XLS-EnG Tire City - RaghuDocumento49 páginasXLS092-XLS-EnG Tire City - RaghuSohini Mo BanerjeeAinda não há avaliações

- Depreciation Practice in BangladeshDocumento17 páginasDepreciation Practice in BangladesharafatAinda não há avaliações

- Math ProblemsDocumento12 páginasMath ProblemsForhad Ahmad100% (1)

- PO Terms and ConditionsDocumento3 páginasPO Terms and ConditionsSurya BijuAinda não há avaliações

- Case Study#1: Seven-Eleven Japan CoDocumento5 páginasCase Study#1: Seven-Eleven Japan Cokhurram95103Ainda não há avaliações

- Market ResearchDocumento54 páginasMarket ResearchAli SaifyAinda não há avaliações

- Trian GE StakeDocumento3 páginasTrian GE StakeBenzingaProAinda não há avaliações

- Distribution Channel Example in IndiaDocumento18 páginasDistribution Channel Example in IndiaNirbhay Pandey100% (3)

- Rosen Hedonics JPE 1974Documento22 páginasRosen Hedonics JPE 1974Saurav DuttAinda não há avaliações

- RESA at 1505 Final PreboardDocumento12 páginasRESA at 1505 Final PreboardLlyod Francis LaylayAinda não há avaliações

- Presention of EnterpreneurshipDocumento5 páginasPresention of EnterpreneurshipAbbiya RanaAinda não há avaliações

- New Product Design ProcessDocumento4 páginasNew Product Design Processsonam katiyarAinda não há avaliações

- Newsletter 33 February 2015 PDFDocumento16 páginasNewsletter 33 February 2015 PDFClerk To The CouncilAinda não há avaliações

- Heineken: Brewing A Better World: Anmol Mirpuri 212265963 INTL 4400Documento10 páginasHeineken: Brewing A Better World: Anmol Mirpuri 212265963 INTL 4400Anmol MirpuriAinda não há avaliações

- Chapter 18 Revenue RecognitionDocumento15 páginasChapter 18 Revenue RecognitionjingyanAinda não há avaliações

- Introduction of GSTDocumento27 páginasIntroduction of GSTaksh40% (5)

- Bsbinm601 Copy 2Documento12 páginasBsbinm601 Copy 2sayan goswamiAinda não há avaliações

- Strategic Management Report - National FoodsDocumento24 páginasStrategic Management Report - National Foodssana100% (4)

- Krispy Kreme Doughtnuts (KKD)Documento60 páginasKrispy Kreme Doughtnuts (KKD)Wajahat AliAinda não há avaliações

- Trademarks NotesDocumento55 páginasTrademarks NotesYin Huang / 黄寅100% (2)

- Supply Chain Analyst Planning in Orlando FL Resume Juileth Gironza-RojasDocumento1 páginaSupply Chain Analyst Planning in Orlando FL Resume Juileth Gironza-RojasJuliethGironzaRojasAinda não há avaliações

- Channel Incentive Policy 20-21Documento5 páginasChannel Incentive Policy 20-21kushrohitAinda não há avaliações

- TSG - The Premier Wholesaler of Distressed PropertiesDocumento18 páginasTSG - The Premier Wholesaler of Distressed PropertiesRaul Sanchez De VaronaAinda não há avaliações