Escolar Documentos

Profissional Documentos

Cultura Documentos

Srei Infrastructure Finance LTD - NSSPL Research 08-10-10

Enviado por

Abhishek Burad JainDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Srei Infrastructure Finance LTD - NSSPL Research 08-10-10

Enviado por

Abhishek Burad JainDireitos autorais:

Formatos disponíveis

Friday 8th October 2010

Tuesday 27, May 2008

NSSPL RESEARCH

Srei Infrastructure Finance Ltd.

Reasonably valued financing

BUY

BSE code 532756 Srei Infra Finance Ltd standalone entity is primarily engaged in the business of project

financing and large ticket equipment financing. India has outlined large infrastructure

NSE code SREINFRA

projects for which the requirements of finance remain high. It also has a team for

Bloomberg code SREI:IN advisory on infrastructure projects generating a fee based income. It has a JV with BNP

Current price 101 Paribas 'Srei equipment finance Pvt Ltd(SEFPL)' it is financing equipment to SME

Target Price 191 across India. Srei is currently in the process of merging with a group company Quippo

Infrastructure Equipment Ltd (QIEL). QIEL is a holding company with stakes in various

MCap Rs bn 28.2 entities which include telecom towers, onshore rigs, power rentals, construction

MCap US$ mn 626.9 equipment and asset valuation and auction companies.

52 wk H/L 108/60.5

Face value 10 Hugh demand for infrastructure financing: India has recognized the acute shortage of

infrastructure and realizes if it has to maintain this growth momentum this problem

2 Wk Av vol ('000) 11060

would need to get addressed soon. In order to facilitate growth the government has

Financial Snapshot outlined large projects in all sectors of infrastructure, ranging from power, ports,

roads, mining, railways, telecom to urban infrastructure. Most of these projects are

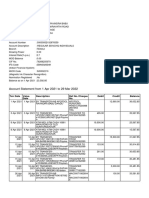

Rs Mn FY10 FY11E FY12E large in size and need major funding during the building and operational phase. This

NII 1,396.4 1,322.2 1,618.7 throws up a large opportunity for Srei who is predominantly engaged in this vertical.

% Ch 614.3 (5.3) 22.4

OPM 622.0 724.9 847.0 Growing loan book: Srei at the end of FY10 had an outstanding loan book of Rs40bn

PAT 1,114.9 1,189.3 1,364.0 this was a growth of 228%. This growth was also due to the lower base as in FY09 they

% Ch 121.4 6.7 14.7 did not disburse many loans due to the then ongoing financial crisis. However we

EPS* 9.6 4.3 4.9 believe it would be able to post growth in excess of 30% over the next few years. This

PER 9.9 22.3 19.5 would be in line with the industry where there would be huge demand for finance to

BV** 67.9 85.7 89.1 ensure projects progress smoothly.

P/BV 1.4 1.1 1.1

Adequately capitalized: Srei FY10 had a CAR of 20%, however post the merger with

*diluted EPS post merger pre bonus for FY11E

QIEL the CAR will rise to almost 38%. This would enable them to continue to disburse

**diluted BV post merger pre bonus for FY11E

loans without restrictions. In addition it has applied to the RBI to get a status of an

Share holding pattern Infrastructure finance company (IFC).

Share holding pattern Pre merger Subsidiaries and JV's expected to post strong growth: Srei Infra had spun of its

equipment finance business to a subsidiary in which BNP Paribas lease group had

Retail, 29.9 Promoters, 30.0

acquired a 50% stake. The new entity SEFPL has captured 30% of the domestic market

Bodies

share in equipment financing. The management has indicated they would maintain

Corporate, 13.3

their market share going forward ensuring strong growth for the JV going forward. The

FII's, 25.3 DII's, 1.5

ongoing merger with QIEL would also enable it to have good investments in various

rental business owned by QIEL. These businesses are expected to grow over the years

as the demand for them increases.

Valuations: Given the various businesses Srei is engaged in we prefer valuing it as a

Sum Of The Parts (SOTP). The standalone entity post the merger with QIEL would have

a book value of Rs86/share. The joint venture with BNP Paribas would derive a value of

Rs13.4/share post a 25% holding company discount to its books. The total BV of the

financing business would be Rs99.4. Given the growth expected over the years we

Sameer Dalal believe a P/BV multiple of 1.5X a 50% discount to IDFC would be more than justified at

91-22-4213-4444 that we arrive at a price of Rs150. To this we add a value of Rs42 for its other

sameer@natverlal.com investments. Based on this we arrive at a target price of Rs191 rating the stock a BUY

with an upside of 89%.

NATVERLAL & SONS

Regd. Off.: Fairy Manor, 5th Floor, 13 Rustom Sidhwa Marg, Fort, Mumbai - 400 001.

Tel. Board: 91-22-4213 4444 Dealing Rm: 91-22-4213 4400, 2265 1121 Fax : 91-22-4213 4440 Email : research@natverlal.com

NSSPL RESEARCH Srei Infrastructure Finance Ltd

Investment Rationale

Demand for finance for infrastructure soaring

The Indian GDP has been growing at a strong pace over the past few years. While the

global markets declined due to the financial crisis the Indian economy grew at close to

6%. To maintain this growth rate the government has identified that the Indian

infrastructure would need to be improved. The government has planned large

projects in the various infrastructure spaces to ensure that there is no strangle hold on

the growth. It is now very well documented that the Indian government had planned

th

investments of Rs20,542bn of investments in the XI five year plan and it is estimated

th

that the investment would be in excess of Rs40,000bn in the XII 5 year plan.

6600 Planned Infrastructure Investments

7000

R 6000

s 5000

4000 3440

2920 2800

3000 2480

2000

B 2000 1440 1200 1040 1120 1280

n 1000 400

160 80360 80 4080

0

Xth plan XIth plan

Source: Infrastructure.gov.in, Srei, NSSPL

Project finance loan book growing

Srei as a standalone entity gets over 80% of its revenues from project financing and

this division is expected to be the prime focus going forward. The loan book

outstanding as of FY10 grew by a whopping 228% to Rs38.5bn. This included a bridge

loan of Rs1.2bn towards Quippo telecom this has now been repaid to it. Following this

at the end of Q1 FY11 the loan book of Srei stands at Rs31bn, the management has

indicated they would look to finish the current year with a loan book in excess of

Rs45bn, at that rate the growth on a year ending basis would be modest at 12.5%, but

post the repayment of the bridge loan would be 66%. We believe this target would be

achievable following the large demand funds required for the various ongoing

projects. In addition to this Srei has approved loans of Rs8.5bn which would be

disbursed over the current year.

The remaining income that Srei generates is from a fee based income. The bulk of it

coming from the project advisory business. This is expected to continue to grow as

more projects would be announced going forward. It is expected that almost 12-14%

of the overall revenues would continue to be generated from these activities.

Marginal decline in NIM's and interest spreads

Srei had an NIM of 5.7% in FY10, however this would not be sustainable going forward.

The higher interest spread and NIM was due to the loans given to Quippo telecom in

the form of a bridge loan. The management has indicated that these would move

down towards industry standards over the next few years. This would affect the

profitability of Srei, however given the loan book is expected to grow this would

ensure profitability would be able to continue to grow going forward.

NATVERLAL & SONS

2

NATSONS

NSSPL RESEARCH

RESEARCH Srei Infrastructure Finance Ltd

Srei too is participating in a very competitive market, even though there is a very large

potential. Given this we have factored the NIM’s to gradually move back to industry

levels

Adequately capitalized to ensure growth momentum remains strong

The RBI has stipulated that NBFC maintain a CAR in excess of 20% Srei at the end of

FY10E had a CAR of 22%, this would have implied to grow they would need to raise

capital in the near future. However since then it has announced a merger with its

group company of the promoters QIEL, post this merger the capital of the organization

will increase, this will take the merged entities CAR to in excess of 55%. This would

ensure they would be able to increase their loan books without having to raise any

further capital. In addition to this Srei has written to the RBI to get approved as an

Infrastructure Finance Company (IFC), If this status gets approved this would reduce

their CAR to 15% enabling them to continue to grow for a longer period without

having to raise capital.

'SEFPL' JV a market leader in equipment financing

Srei only a few years ago was focused on the equipment financing business. In 2008

that division was spun off into a 100% subsidiary in which BNP Paribas leasing group, a

100% subsidiary of the BNP group, took a 50% stake. This subsidiary became a joint

venture and was rechristened Srei Equipment Finance Pvt Ltd. In this transaction BNP

paid a sum of Rs7.75bn of this Rs3.75bn was paid to Srei while the rest was kept by the

newly formed JV. To ensure that there is no conflict between the parent Srei and SEFPL

a structure has been put in place, SEFPL will only look at funding loans where

equipment costs are below Rs150mn. Equipment above this price would not fall into

their category and Srei the parent entity would look to fund these purchases.

SEFPL is the market leader in the equipment finance business having a market share of

30%. The management has indicated they would be keen to maintain their market

share going forward. Given this space is expected to have a growth in excess of 30% to

maintain their market share it would have to grow its loans at the same rate. Given its

strong position in the industry we are of the view they would be able to maintain their

market share. At the end of Q1 FY11 the new worth of SEFPL stood at Rs9.95bn while

the total AUM was Rs92.9bn of which Rs82bn was interest bearing. The NIM during

the period was strong at 5.5%, however we believe there would be some pressure to

this as competition in the space increases.

Given its large loan book of individual loans below Rs150mn they have managed to

keep their net NPA's low at 1.18%. This too we don't see as much of a concern as the

assets purchased against the loans are pledged ensuring repayment on sale of assets.

Merger with Quippo Infrastructure Equipment Ltd

In FY10 Srei decided to merge a promoter group company QIEL with itself. The merger

was done with a price of Rs102 for Srei, in the deal for every 2 shares held in QIEL 3

shares of Srei would be given. Post this merger the share capital of Srei will rise to

Rs2.79bn an increase of 140%. With this the net worth of the company too would rise

by almost 200%. Once the merger is complete the subsidiaries and investments of

QIEL would come onto the books of Srei. The four major holding of that would come

into the Srei fold are

NATVERLAL & SONS

3

NSSPL RESEARCH Srei Infrastructure Finance Ltd

Quippo Telecom Infrastructure limited: QTIL was incorporated with an objective of

providing “shared passive telecom infrastructure”. Since then it has come a long way

to become one of the largest business in the space. Along the way QTIL bought out the

telecom towers of Spice and just recently acquired the telecom towers of Tata

Teleservices. QTIL has now been rechristened Viom, where Srei would have a stake of

11%. Viom presently has 38000 towers spread across India and enjoy an occupancy

rate of 2.2 per tower. The management has indicated they would be looking to add

another 20000 towers over the next few years. Funding of these expansions is

expected to be a mix of internal accruals. Debt and further equity dilution. This time

however the equity dilution is expected to be in the form of an IPO, this would help

determine the value of investment of Srei.

Quippo Construction Equipment Ltd: QCEL offers a range of equipment for the real

estate, Infrastructure, industrial construction and mining space. It offers a unique

opportunity of renting of equipment instead of purchasing this equipment. This is a

unique business model at a very nascent stage, but given the growth in infrastructure

activity this business has the possibility of generating strong earning going forward.

The biggest issues concerning this business are logistics for moving the equipment to

different sites and having equipment at times when required.

Quippo Energy Pvt ltd: QEPL is another innovative business model that was initiated

by QIEL. QEPL has 60MW of portable power generation, these generation sets run on

gas. The capacity can be made to the required amount and then sent to a customer to

fill the gap faced by organizations.

Quippo Oil & Gas Infrastructure Ltd: QOGIL currently owns 5 onshore rigs which are

leased out to E&P companies. Currently 2 of the 5 rigs have already been contracted

while the negotiations are ongoing for the other 3 rigs. The management has

indicated they too would soon be contracted.

Treasury stock creation:

Srei prior to the merger with QIEL owned 17% stake in QIEL. Post the merger Srei for

the stake held in QIEL would be given shares in Srei. As per Indian guidelines a

company cannot own stock in itself. To adjust for these shares a trust would be created

which in turn would hold the stock for Srei. This stock would be classified as treasury

stock. When fund requirements would be there for Srei we could see this being sold to

large investors ensuring funding without dilution of fresh equity.

Bonus Issue

Srei board had approved a bonus issue post the merger with QIEL. The bonus ration

was set to 4 additional shares for every 5 shares held of the company. Since this would

be done post the merger the owners of QIEL would be eligible for this bonus as well.

There has been no date set for the bonus shares as this would be done post the

merger.

NATVERLAL & SONS

4

NSSPL RESEARCH Srei Infrastructure Finance Ltd

Valuations:

On a standalone basis prior to the merger with QIEL, Srei is trading at a P/BV of 1.4X

and a P/E of 9.9X for FY10. Post the merger with QIEL Srei is trading at a P/BV of 1.1X for

and a P/E of 20.4X for FY11E.

Since Srei has various businesses they operate in through JV’s and subsidiaries we

prefer to value it on the Sum Of The Parts(SOTP) basis. The main operation of the

standalone Srei will be project financing. For this business we would prefer to use a

P/BV. At present we would prefer to take a conservative P/B of 1.5X over a 50%

discount to IDFC. This discount though large we believe is justifiable as the EPS would

decline in FY11E post the merger with QIEL. QIEL being an holding company with

investments in various rental businesses does not generate much profitability.

The tie up with BNP for its equipment finance business is a large entity. Srei has a 50%

stake in this business which has a total net worth of Rs9.95bn at the end of Q1FY11.

This too is a financing organization for small and medium enterprises and we value this

on a P/BV basis as well. Since Srei is a holding company of this business we are going to

take a 25% discount to the value of the net worth owned by Srei. Even though it is a

market leader in this space we maintain a conservative P/BV of 1.5X for this business

and arrive a t a price of Rs19.5.

Srei has investments in various different business of this the largest is Viom Networks.

Post the merger of Srei and QIEL the passive telecom infrastructure arm came into the

investment fold of Srei with a 11% stake in it. Recently SBI-Macquire invested Rs14bn

into Viom for a 11% stake. This values the overall entity at Rs127bn. To value this we

are taking a conservative approach of a 25% discount to the price as a listed entity with

similar number of towers is trading at a lower valuation. However Viom does

command a higher valuation due to the higher occupancy per tower. Based on the

25% discount we arrive at a price of Rs37/share. For the other business which are

smaller in size and yet growing we take a total value of Rs5 per share.

Adding the value of the various businesses we arrive at a price target of Rs191/share.

We are initiating coverage on Srei with a BUY recommendation with a this is an upside

of 90% from the current levels.

Sum Of The Parts Valuation

Total BV/share Srei owned BV Discount % Discounted BV Target P/BV Target price

Srei Standalone FY11E 86.1 86.1 0.0 0.0 1.5 129.1

Srei BNP FY10 34.6 17.3 25.0 13.0 1.5 19.5

Value @ recent

No of towers placement Srei Stake % Srei value Discount%

Viom Networks 37,300 127,272 11.0 13,999.9 25.0 37.6

Other Business 5.0

Target 191.1

NATVERLAL & SONS

5

NSSPL RESEARCH Srei Infrastructure Finance Ltd

Risks

Increasing competition in the financing space

With larger projects being implemented with certain backing by the government we

see more funds looking to lend to the infrastructure sector. There is also a lot of keen

interest being shown by overseas investors. With this the competition in the space is

increasing. However given the size of these projects it is usually a consortium of banks

and NBFC that look at these individual projects. We expect this to remain a trend going

forward. This ensures enough room for the new and old players in the industry

without having a very significant impact on the interest spreads.

Raising funds at reasonable rates

Interest rates have been on the rise over the past quarters in line with the central bank

raising the repo and reverse repo rate. The rising rates coupled with banks lending

directly to projects could pose some problems for Srei in raising money at reasonable

rates. It will be key to see how Srei is able to manage raising funds and remain

competitive. Most of the loans given out by Srei are on a floating terms, they would be

able to pass on any increase in interest cost to them. This would ensure some stability

to the interest spread going forward.

Delay in large projects

We have seen over time large infrastructure projects in India keep getting delayed.

There could be various reasons, environmental clearance, land acquisition or changes

to the project. These delays in projects could affect them either with postponement of

loan disbursement or if loans are dispersed delay in receipts of income. Fortunately no

single project is financed by a single institution and with them diversifying into various

projects it does reduce the risk. However this is a concern not only to Srei but to the

overall industry.

Change in regulations

The Indian government is central to the infrastructure development of India. Indian

politics ensure many problems to this development and these political concerns will

linger. In addition we may see some changes in the guidelines from the central bank on

CAR requirements. However given the strong CAR that Srei has presently this would

not be a serious cause of concern.

NATVERLAL & SONS

6

NSSPL RESEARCH Srei Infrastructure Finance Ltd

Company background

Srei Infrastructure was initially engaged in equipment financing, following

spinning that off into a subsidiary it now focuses on project financing. It has

recently announced a merger with a unlisted promoter group company though

this it will get have large investments in various rental business.

Srei was promoted the calcutta based Kanoria Family. Mr. Hemant Kanoria is

currently the CMD and has had over 27 years of experience in the field. He is

assisted by Mr. Sunil Kanoria, the Vice Chairman of the board with over 17

years of experience. Both of the promoters do participate in the overall growth

and strategy of the organization. Srei has multiple divisions and for each of

these there is a professional with good experience looking after the day to day

needs.

Business structure

SREI Quippo

Merged

JV's subsidaries

Viom Quippo Oil Quippo Quippo

Go Industries Mumbai

SREI BNP Networks Quippo Valuers Futuristic

and Gas Construciton Energy and Auctioner Economic zone

Ltd

Share holding pattern Pre merger Share holding pattern post merger

Bodies

corporate, 3.5

Retail, 9.6

Retail, 29.9 Promoters, 30.0

FII's, 14.5 Promoters, 46.2

Bodies

Corporate, 13.3 DII's, 16.5

FII's, 25.3 Treasury

DII's, 1.5

stock, 9.7

NATVERLAL & SONS

7

NSSPL RESEARCH Srei Infrastructure Finance Ltd

Financials

Profit & Loss Balance Sheet

In Rs million FY09 FY10 FY11E FY12E In Rs million FY09 FY10 FY11E FY12E

Interest Income 2,134.8 3,884.2 5,524.5 7,033.1 Equity capital 1,162.9 1,162.9 2,792.9 2,792.9

YoY (%) (50.5) 81.9 42.2 27.3 Reserves 5,785.7 6,738.1 21,242.5 22,347.3

Interest Expense 1,939.3 2,487.8 3,945.7 5,126.5 Net worth 6,948.6 7,901.0 24,035.4 25,140.2

YoY (%) (35.8) 28.3 58.6 29.9 Total borrowings 13,426.1 35,432.7 44,003.8 57,746.3

Net Interest income 195.5 1,396.4 1,578.8 1,906.6 Deferred tax 0.0 344.0 386.7 435.9

YoY (%) (84.8) 614.3 13.1 20.8 Total liabilities 20,374.7 43,677.7 68,425.9 83,322.3

Total expenses 735.6 622.0 736.0 858.8 Net block 803.5 831.1 922.8 1,003.8

YoY (%) 28.0 (15.4) 18.3 16.7 Investments 4,805.1 7,073.3 24,468.2 24,468.2

PBDT (540.1) 774.4 842.8 1,047.8

Other income 1,129.5 817.1 1,004.8 1,077.9 Current assets 15,161.5 36,543.7 44,002.7 58,979.8

Depreciation 76.9 101.4 108.3 119.0 Inventories 10.7 9.5 11.4 13.7

PBT before provision 512.5 1,490.1 1,739.3 2,006.7 Debtors 72.2 36.5 40.0 40.0

Provisions 8.8 8.8 13.6 18.3 Cash 2,970.8 525.5 468.9 450.7

PBT 503.7 1,481.3 1,725.6 1,988.3 Loans and advances 12,107.8 35,972.2 43,482.4 58,475.4

(-) Tax 0.1 366.4 426.8 491.8

PAT 503.6 1,114.9 1,298.8 1,496.5 liabilities & provisions 395.4 770.4 967.8 1,129.4

Extra-ordinary expenses 0.0 0.0 0.0 0.0 Net current assets 14,766.1 35,773.3 43,034.9 57,850.4

Net Profit 503.6 1,114.9 1,298.8 1,496.5 Misc expenses 0.0 0.0 0.0 0.0

YoY (%) (53.4) 121.4 16.5 15.2 Total assets 20,374.7 43,677.7 68,425.9 83,322.3

Key Ratios Valuations

FY09 FY10 FY11E FY12E FY06 FY10 FY11E FY12E

EPS (Rs) 4.3 9.6 4.7 5.4 PE (x) 23.3 10.5 21.7 18.8

CEPS (Rs) 5.0 13.4 5.2 6.0 Cash PE (x) 20.2 7.5 19.5 16.9

Book value (Rs) 59.8 67.9 86.1 90.0 Price/book value (x) 1.7 1.5 1.2 1.1

DPS (Rs) 1.0 1.2 1.2 1.2

NIM 1.7 5.7 4.0 3.7

Interest spread 0.1 7.6 5.1 4.5

CAR 57.4 20.0 38.0 32.0

ROE 7.4 15.0 8.1 6.1

Disclaimer

The information provided in the document is from publicly available data and other sources, which we believe are reliable. It also includes analysis and views

expressed by our research team.

The report is purely for information purposes and does not construe to be investment recommendation/advice. Investors should not solely rely on the

information contained in this document and must make investment decisions based on their own investment objectives, risk profile and financial position.

Efforts are made to try and ensure accuracy of data however, Natverlal & Sons Stockbrokers Pvt Ltd. And / or any of its affiliates and / or employees shall not

be liable for loss or damage that may arise from any error in this document. Natverlal & Sons Stockbrokers Pvt Ltd and / or any of its affiliates and / or

employees may or may not hold positions in any of the securities mentioned in the document.

This document is not for public distribution and should not be reproduced or redistributed without prior permission.

Natverlal & Sons Stockbrokers Pvt Ltd. Fairy Manor, 13 Rustom Sidhwa Marg Fort Mumbai 400001 Tel 91-22-22658737 Email research@natverlal.com

NATVERLAL & SONS

8

Você também pode gostar

- Fortis CRISIL ReportDocumento4 páginasFortis CRISIL ReportAbhishek Burad JainAinda não há avaliações

- UN Population Data - India 2011Documento8 páginasUN Population Data - India 2011Abhishek Burad JainAinda não há avaliações

- Mini Paper PlantDocumento12 páginasMini Paper PlantAbhishek Burad JainAinda não há avaliações

- ACE Curriculam 6 To 8Documento148 páginasACE Curriculam 6 To 8Abhishek Burad JainAinda não há avaliações

- Million Plus UAs Cities 2011Documento2 páginasMillion Plus UAs Cities 2011Ujjwal GargAinda não há avaliações

- Mother & ChildcareDocumento156 páginasMother & ChildcareAbhishek Burad JainAinda não há avaliações

- Excellence in Diagnostic CareDocumento20 páginasExcellence in Diagnostic CareDominic LiangAinda não há avaliações

- Private Valuation Company - PVT (English) PDFDocumento55 páginasPrivate Valuation Company - PVT (English) PDFDesire Paul Gueye-massaAinda não há avaliações

- Notes: Awakening Africa's Sleeping GiantDocumento4 páginasNotes: Awakening Africa's Sleeping GiantAbhishek Burad JainAinda não há avaliações

- ValuationsDocumento27 páginasValuationsblabitan100% (1)

- Sintex Industries Natsons Research 26-07-2010Documento8 páginasSintex Industries Natsons Research 26-07-2010Abhishek Burad JainAinda não há avaliações

- Uflex Limited - Natsons Research 28-05-2010Documento8 páginasUflex Limited - Natsons Research 28-05-2010Abhishek Burad JainAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- GDC RCP Office Case v3Documento7 páginasGDC RCP Office Case v3api-251521127Ainda não há avaliações

- Lec 1 After Mid TermDocumento9 páginasLec 1 After Mid TermsherygafaarAinda não há avaliações

- Debt Crisis and Debt Cycle: Prof. Andrey Zahariev, PHDDocumento9 páginasDebt Crisis and Debt Cycle: Prof. Andrey Zahariev, PHDloveisdAinda não há avaliações

- Blackbook Topics TybbiDocumento2 páginasBlackbook Topics Tybbiankit chauhan100% (1)

- Case 4 - Wellfleet Bank (Patacsil)Documento6 páginasCase 4 - Wellfleet Bank (Patacsil)Davy PatsAinda não há avaliações

- Solutions Ch04Documento4 páginasSolutions Ch04jessicalaurent1999Ainda não há avaliações

- MBAC 6450 Syllabus - Summer 2018 - Session 1Documento25 páginasMBAC 6450 Syllabus - Summer 2018 - Session 1Hoang Kim NghiaAinda não há avaliações

- Certificate of Final Tax Withheld at Source: Kawanihan NG Rentas InternasDocumento5 páginasCertificate of Final Tax Withheld at Source: Kawanihan NG Rentas InternasBrianSantiagoAinda não há avaliações

- ABM11 - Business Mathematics - Q1 - W8 - (8) FINALDocumento5 páginasABM11 - Business Mathematics - Q1 - W8 - (8) FINALEmmanuel Villeja LaysonAinda não há avaliações

- Chyna's Dreamland Chase SeptDocumento5 páginasChyna's Dreamland Chase SeptJonathan Seagull Livingston100% (1)

- The Evolution of Money From Barter System To Cryptocurrency: When Money First IntroducedDocumento3 páginasThe Evolution of Money From Barter System To Cryptocurrency: When Money First IntroducedMohd AqdasAinda não há avaliações

- AramcoGoldCoins FOFOA032210Documento15 páginasAramcoGoldCoins FOFOA032210Christien PetrieAinda não há avaliações

- S Ep JFX 3 Wa El Al GS2Documento8 páginasS Ep JFX 3 Wa El Al GS2Danda RavindraAinda não há avaliações

- FM 1 CH 4 (Lti) My MLC ExtDocumento19 páginasFM 1 CH 4 (Lti) My MLC ExtMELAT ROBELAinda não há avaliações

- Tugas 1 TMK Adbi4201 Bahasa Inggris NiagaDocumento3 páginasTugas 1 TMK Adbi4201 Bahasa Inggris NiagaSakazukiAinda não há avaliações

- Chap 011Documento14 páginasChap 011dbjnAinda não há avaliações

- The Following Data Pertain To Lincoln Corporation On December 31Documento8 páginasThe Following Data Pertain To Lincoln Corporation On December 31Jhianne Mae Albag100% (1)

- Introduction To Finance Markets Investments and Financial Management 15th Edition Melicher Norton Solution ManualDocumento19 páginasIntroduction To Finance Markets Investments and Financial Management 15th Edition Melicher Norton Solution ManualberthaAinda não há avaliações

- Stock Exchange Listing and Firm Performance in GhanaDocumento20 páginasStock Exchange Listing and Firm Performance in GhanaSaint Hilary Doe-Tamakloe100% (3)

- Literature Review Capital BudgetingDocumento4 páginasLiterature Review Capital Budgetingc5p9zbep100% (1)

- ch13 Fin303Documento31 páginasch13 Fin303Bui Thi Thu Hang (K13HN)Ainda não há avaliações

- Audit Walkthrough QuestionnaireDocumento3 páginasAudit Walkthrough QuestionnaireRey Sabado100% (1)

- Chapter 9 Private Equity and VentureDocumento53 páginasChapter 9 Private Equity and VenturestephaniAinda não há avaliações

- A Project Report On Fundamental Analysis of Mahindra Amp Mahindra CompanyDocumento114 páginasA Project Report On Fundamental Analysis of Mahindra Amp Mahindra CompanyamritabhosleAinda não há avaliações

- Technical MemorandumDocumento2 páginasTechnical MemorandumChrispy ChickenAinda não há avaliações

- MOCK P4 DecDocumento5 páginasMOCK P4 DecHunainAinda não há avaliações

- Loan Contract OrnopiaDocumento5 páginasLoan Contract OrnopiaaizhelarcipeAinda não há avaliações

- BAB 13 InggrisDocumento33 páginasBAB 13 InggrisPindy Widiya PamungkasAinda não há avaliações

- Prepared by:-CA Priyanka SatarkarDocumento31 páginasPrepared by:-CA Priyanka Satarkarnick1425Ainda não há avaliações

- A Assume That Carbondale Co Expects To Receive S 500 000 inDocumento1 páginaA Assume That Carbondale Co Expects To Receive S 500 000 inAmit PandeyAinda não há avaliações