Escolar Documentos

Profissional Documentos

Cultura Documentos

Gold Daily Sep 10

Enviado por

Arihant Pugaliya0 notas0% acharam este documento útil (0 voto)

11 visualizações1 páginaMarket able to hold above the middle bollinger is expected to see re-test of upper bollinger in near-term. BB-Trender provides short-term support at 1237.9. Market still holds above the short-term trend support as parabolic SAR, today at 1243.5.

Descrição original:

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoMarket able to hold above the middle bollinger is expected to see re-test of upper bollinger in near-term. BB-Trender provides short-term support at 1237.9. Market still holds above the short-term trend support as parabolic SAR, today at 1243.5.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

11 visualizações1 páginaGold Daily Sep 10

Enviado por

Arihant PugaliyaMarket able to hold above the middle bollinger is expected to see re-test of upper bollinger in near-term. BB-Trender provides short-term support at 1237.9. Market still holds above the short-term trend support as parabolic SAR, today at 1243.5.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 1

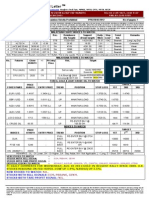

COMEX Gold – December’10 – Daily Briefing

Friday, September 10, 2010

Supports Resistances

1246.0 – 1246.4 1250.9

*1244.8* *1251.9*

1241.6 1254.6

1239.2 – 1239.5 1256.6

1235.4 *1259.3*

*1233.5* *1264.7*

1228.5 – 1228.7 1268.0

1225.9 1270.6

Open 1256.7

High 1260.5

Low 1243.5

Close 1250.9

Technical outlook for Dec’10 Contract

Market yesterday turned lower with relatively moderate volumes, following weakness from pullback the previous day,

and hit a low at the middle bollinger on the daily chart, closing above the week’s open, which suggests market today to

be in a mixed to positive setup and can expect test of levels upside today.

Bollinger bands today provide levels at 1264.3, 1245.6 and 1226.8. Market able to hold above the middle bollinger is

expected to see re-test of upper bollinger in near-term. Bands narrowing suggests market to see a sideways to positive

setup for near-term, held above the middle band. A close below middle band can expect weakness continue to test the

lower bollinger on daily chart.

Market still holds above the short-term trend support as parabolic SAR, today at 1243.5. A break of it on close can be

seen as indication for weakness near-term. BB-Trender provides short-term support at 1237.9.

Market downside yesterday was held by the key 14-Day EMA, which held downside earlier last week, and today is at

1244.8. 9-Day EMA is at 1249.4 and 20-Day EMA is at 1239.4 today.

Market profile suggests mixed to weaker setup for the market, with 1251.9 expected to play a pivot for today. Above it

sees levels to watch at 1255.9, with PoC yesterday at 1257.5 and value area yesterday at 1258.0 as key levels, followed

by 1261.4. Downside sees levels to watch at 1247.0, with key level at 1245.0, below which can expect weakness

continue for today, with levels to watch 1242.5 and 1238.5.

For today, market is seen in mixed to positive setup, with initial support at level 1246.4 and swing level at 1246.0, and

key support for today on move below it at the trend line at 1244.8, break of which can expect weakness for the market

towards 1239.5 and 1235.4, with support at level 1233.5 to be watched, further below which can expect downside

continue towards short-term retracement level 1224.4.

Upside today is expected to see initial resistance at the close yesterday at 1250.9. Market unable to hold above it can

expect weakness to test levels downside. Move above it can look for test of 5-Day EMA at 1251.9 today, further above

which can expect upside to test level 1256.6, with key level at 1259.3, further above which can expect upside to test the

week’s high 1264.7. Trend lien shows resistance today at 1268.0.

News and Fundamental view

Gold futures eased yesterday on pressure from position clearing as US economic data spurred risk appetite, hurting the

safe-haven. Data yesterday showed new U.S. claims for unemployment benefits fell more than expected last week to

their lowest level in two months, a hopeful sign for the troubled labor market. Also July U.S. trade deficit narrowed

more than expected, shrinking 14 percent, as imports retreated and exports shot to their highest since August 2008.

IMF sold 10 metric tonnes of gold to the central bank of Bangladesh on Sept. 7, using Tuesday's market prices for the

transaction. IMF said the sale raised $403 million, adding that it was part of 403.3 tonnes approved for sale by its

executive board in September 2009.

According to data from sources, ETFs holdings worldwide eased by 0.1% yesterday, with SPDR, the largest, easing

0.1%, ETF Securities, the second largest, easing -0.7%, while iShares added 0.6% to its holdings.

Japanese government today said Japan's economy isn't quite as weak as first thought, but it still needs help, as it

unveiled details of a new $11 billion stimulus package. Revised figures showed that GDP expanded at an annualized

rate of 1.5% in the April-June period, an improvement on the meager 0.4% reported in last month's preliminary report.

Você também pode gostar

- Sample of Acceptance Letter of The Nominee and Alternate Nominee of The One Person Corporation DateDocumento9 páginasSample of Acceptance Letter of The Nominee and Alternate Nominee of The One Person Corporation DateIlyn RamirezAinda não há avaliações

- Prelims GoodGov AnsDocumento11 páginasPrelims GoodGov Ansluciaalfeche100% (1)

- Gold Sep 02Documento1 páginaGold Sep 02gitmlifeAinda não há avaliações

- Using Binaries For Short Term Directional TradingDocumento9 páginasUsing Binaries For Short Term Directional TradingconnytheconAinda não há avaliações

- Alan Farley NewsletterDocumento12 páginasAlan Farley NewsletterRamos LewisAinda não há avaliações

- End of Week 05 June 2015 Global ViewDocumento2 páginasEnd of Week 05 June 2015 Global ViewAjith Chand BhandaariAinda não há avaliações

- Derivatives ProjectDocumento4 páginasDerivatives ProjectShubhashish SinhaAinda não há avaliações

- Commodity Market Newsletter 13-DecemberDocumento9 páginasCommodity Market Newsletter 13-Decembertheequicom1Ainda não há avaliações

- Teknikal - 13 04 16e PDFDocumento1 páginaTeknikal - 13 04 16e PDFAnonymous yH9XlnAinda não há avaliações

- Daily Market Commentary Sept 5Documento6 páginasDaily Market Commentary Sept 5almakzomyAinda não há avaliações

- Fred Tam News LetterDocumento7 páginasFred Tam News LetterTan Lip SeongAinda não há avaliações

- Gold Futures: 120 Mins Chart - Dec'11 ContractDocumento2 páginasGold Futures: 120 Mins Chart - Dec'11 ContractGaurav JaiswalAinda não há avaliações

- Volume 9 Highlights: InsideDocumento20 páginasVolume 9 Highlights: InsidedpbasicAinda não há avaliações

- The Nasdaq Is Below 3759 With Its 50-Day SMA at 3693.Documento2 páginasThe Nasdaq Is Below 3759 With Its 50-Day SMA at 3693.Richard SuttmeierAinda não há avaliações

- Gold Report: Analyst: Hareesh VDocumento2 páginasGold Report: Analyst: Hareesh Vhitesh315Ainda não há avaliações

- Free Commodity Market TipsDocumento9 páginasFree Commodity Market TipsRahul SolankiAinda não há avaliações

- Commerz Weekly Technical CommoditiesDocumento21 páginasCommerz Weekly Technical CommoditiesBlackHat InvestmentsAinda não há avaliações

- 6fde2d1da482a6a077134b94 1 PDFDocumento25 páginas6fde2d1da482a6a077134b94 1 PDFТеодор АнтоновAinda não há avaliações

- The Nasdaq Sets Another New All Time Multi-Year High at 3824.44.Documento2 páginasThe Nasdaq Sets Another New All Time Multi-Year High at 3824.44.Richard SuttmeierAinda não há avaliações

- Master Trader Plan For Week 9-17-18Documento12 páginasMaster Trader Plan For Week 9-17-18tummalaajaybabuAinda não há avaliações

- New Highs Yet Again But Not For Dow Industrials!Documento3 páginasNew Highs Yet Again But Not For Dow Industrials!Richard SuttmeierAinda não há avaliações

- Dailyfx: Latest Trading VideoDocumento10 páginasDailyfx: Latest Trading VideoTitan1000Ainda não há avaliações

- General Market Update - July 2019Documento7 páginasGeneral Market Update - July 2019Anonymous kOLTDa6Ainda não há avaliações

- Daily Metals and Energy Report September 16 2013Documento6 páginasDaily Metals and Energy Report September 16 2013Angel BrokingAinda não há avaliações

- Commodities Weekly Outlook, 08.07.13 To 12.07.13Documento6 páginasCommodities Weekly Outlook, 08.07.13 To 12.07.13Angel BrokingAinda não há avaliações

- International Commodities Evening Update July 17 2013Documento3 páginasInternational Commodities Evening Update July 17 2013Angel BrokingAinda não há avaliações

- Daily Metals and Energy Report, May 10 2013Documento6 páginasDaily Metals and Energy Report, May 10 2013Angel BrokingAinda não há avaliações

- Cycle Highs Remain Unconfirmed With The Nasdaq Above 3759.Documento2 páginasCycle Highs Remain Unconfirmed With The Nasdaq Above 3759.Richard SuttmeierAinda não há avaliações

- The Technical Take - September 16, 2013Documento20 páginasThe Technical Take - September 16, 2013dpbasicAinda não há avaliações

- Daily Metals Newsletter - 01-12-16Documento1 páginaDaily Metals Newsletter - 01-12-16Jaeson Rian ParsonsAinda não há avaliações

- 6JULY201510JULY2015GLOBALMARKETSDocumento1 página6JULY201510JULY2015GLOBALMARKETSAjith Chand BhandaariAinda não há avaliações

- Risk Aversion Continues As Four More Banks FailDocumento5 páginasRisk Aversion Continues As Four More Banks FailValuEngine.comAinda não há avaliações

- Daily Metals and Energy Report November 14Documento6 páginasDaily Metals and Energy Report November 14Angel BrokingAinda não há avaliações

- Daily MCX NewsletterDocumento9 páginasDaily MCX Newsletterapi-230785654Ainda não há avaliações

- Daily Metals and Energy Report September 10 2013Documento6 páginasDaily Metals and Energy Report September 10 2013Angel BrokingAinda não há avaliações

- New Multi-Year High at 3840.47 and New All Time High at 1092.20 Russell.Documento2 páginasNew Multi-Year High at 3840.47 and New All Time High at 1092.20 Russell.Richard SuttmeierAinda não há avaliações

- The Dollar Gets A PulseDocumento4 páginasThe Dollar Gets A PulseValuEngine.comAinda não há avaliações

- 301, 3 Floor, Mangal City, Vijay Nagar, Indore Toll Free: 9009010900Documento8 páginas301, 3 Floor, Mangal City, Vijay Nagar, Indore Toll Free: 9009010900Aashika JainAinda não há avaliações

- International Commodities Evening Update December 11 2013Documento3 páginasInternational Commodities Evening Update December 11 2013angelbrokingAinda não há avaliações

- Daily Metals and Energy Report September 12 2013Documento6 páginasDaily Metals and Energy Report September 12 2013Angel BrokingAinda não há avaliações

- The S&P 500, Nasdaq & Transports Set New Highs On Thursday.Documento2 páginasThe S&P 500, Nasdaq & Transports Set New Highs On Thursday.Richard SuttmeierAinda não há avaliações

- Teknikal - 05 09 16eDocumento1 páginaTeknikal - 05 09 16eAnonymous yH9XlnAinda não há avaliações

- 2012 01 09 Migbank Daily Technical Analysis ReportDocumento15 páginas2012 01 09 Migbank Daily Technical Analysis ReportmigbankAinda não há avaliações

- Suttmeier Weekly Market BriefingDocumento3 páginasSuttmeier Weekly Market BriefingRichard SuttmeierAinda não há avaliações

- 10yrtnotes 30thaugDocumento1 página10yrtnotes 30thaugdeepalish88Ainda não há avaliações

- Technically Speaking - October 21, 2015Documento12 páginasTechnically Speaking - October 21, 2015dpbasicAinda não há avaliações

- Daily Metals and Energy Report, July 5 2013Documento6 páginasDaily Metals and Energy Report, July 5 2013Angel BrokingAinda não há avaliações

- AKD Commodities Research5Documento4 páginasAKD Commodities Research5jibranqqAinda não há avaliações

- Trade Fib SampleDocumento12 páginasTrade Fib SamplekhobiAinda não há avaliações

- International Commodities Evening Update November 19Documento3 páginasInternational Commodities Evening Update November 19Angel BrokingAinda não há avaliações

- International Commodities Evening Update, July 15 2013Documento3 páginasInternational Commodities Evening Update, July 15 2013Angel BrokingAinda não há avaliações

- Technically Speaking - September 22, 2015Documento11 páginasTechnically Speaking - September 22, 2015dpbasicAinda não há avaliações

- A Spaghetti of Tight Value / Risky Levels and Pivots Spell Choppy Trading.Documento2 páginasA Spaghetti of Tight Value / Risky Levels and Pivots Spell Choppy Trading.Richard SuttmeierAinda não há avaliações

- Market Analytics November 23rd 2022Documento7 páginasMarket Analytics November 23rd 2022Abubakar AminAinda não há avaliações

- Dynamic Trader Daily Report: Special NoteDocumento2 páginasDynamic Trader Daily Report: Special NoteBudi MulyonoAinda não há avaliações

- Market Overview (Economy) : Commodity Last CHG % CHGDocumento3 páginasMarket Overview (Economy) : Commodity Last CHG % CHGAk ChowdaryAinda não há avaliações

- Commodities Weekly Tracker - 6th August 2012Documento20 páginasCommodities Weekly Tracker - 6th August 2012Angel BrokingAinda não há avaliações

- 301, 3 Floor, Mangal City, Vijay Nagar, Indore Toll Free: 9009010900Documento8 páginas301, 3 Floor, Mangal City, Vijay Nagar, Indore Toll Free: 9009010900Aashika JainAinda não há avaliações

- Dailyfx: Dollar Consolidation Should Lead To Additional GainsDocumento11 páginasDailyfx: Dollar Consolidation Should Lead To Additional GainsTitan1000Ainda não há avaliações

- May 2, 2010Documento10 páginasMay 2, 2010Stanky LeeAinda não há avaliações

- The Power of Japanese Candlestick Charts: Advanced Filtering Techniques for Trading Stocks, Futures, and ForexNo EverandThe Power of Japanese Candlestick Charts: Advanced Filtering Techniques for Trading Stocks, Futures, and ForexNota: 4.5 de 5 estrelas4.5/5 (2)

- Kase on Technical Analysis Workbook: Trading and ForecastingNo EverandKase on Technical Analysis Workbook: Trading and ForecastingAinda não há avaliações

- Financial Leverage and Performance of Nepalese Commercial BanksDocumento23 páginasFinancial Leverage and Performance of Nepalese Commercial BanksPushpa Shree PandeyAinda não há avaliações

- CHAPTER 1 FMDocumento26 páginasCHAPTER 1 FMZati TyAinda não há avaliações

- FIIDocumento73 páginasFIIArun PrakashAinda não há avaliações

- The Useof Financial Ratiosin Predicting Corporate Failurein Sri LankaDocumento8 páginasThe Useof Financial Ratiosin Predicting Corporate Failurein Sri LankaChamunorwa MunemoAinda não há avaliações

- Fractional ProgrammingDocumento53 páginasFractional Programmingjc224Ainda não há avaliações

- Growth of Mutual Fund IndustryDocumento3 páginasGrowth of Mutual Fund Industryarpanad20104513Ainda não há avaliações

- Fin Man Case Study On Fs AnalysisDocumento6 páginasFin Man Case Study On Fs AnalysisRechelleAinda não há avaliações

- DMX - Technologiies 3Q2009 - Profit Rises 18.01% To US$2.8M 091109Documento3 páginasDMX - Technologiies 3Q2009 - Profit Rises 18.01% To US$2.8M 091109WeR1 Consultants Pte LtdAinda não há avaliações

- Bata & AB BankDocumento8 páginasBata & AB BankSaqeef RayhanAinda não há avaliações

- Monopoly & Imperfect CompetitionDocumento22 páginasMonopoly & Imperfect CompetitionLovely Salazar100% (1)

- EdelweissDocumento6 páginasEdelweissZerohedge100% (1)

- Oil and Gas Reservoirs Management PrinciplesDocumento13 páginasOil and Gas Reservoirs Management PrinciplesTim ClarkeAinda não há avaliações

- Jarvis Balanced Fund Desember 2020Documento2 páginasJarvis Balanced Fund Desember 2020rinasiahaanAinda não há avaliações

- Financial Analysis - Planning NotesDocumento49 páginasFinancial Analysis - Planning NotesMadhan Kumar BobbalaAinda não há avaliações

- Abrasive Peeling of PotatoesDocumento12 páginasAbrasive Peeling of PotatoesJoseph LouiseAinda não há avaliações

- Ramon Magsaysay Technological University Graduate School DepartmentDocumento4 páginasRamon Magsaysay Technological University Graduate School DepartmentJerson AgsiAinda não há avaliações

- Ratio Analysis: Interpretation of Financial Statements: 1) Profitability RatiosDocumento4 páginasRatio Analysis: Interpretation of Financial Statements: 1) Profitability RatiosCollen MahamboAinda não há avaliações

- Bacos, Romelito D. 201111820 Engr. Roslyn Peňa, Ce 20 January 2014Documento6 páginasBacos, Romelito D. 201111820 Engr. Roslyn Peňa, Ce 20 January 2014Rommell BacosAinda não há avaliações

- Project Finance-Merger and AcquisitionDocumento57 páginasProject Finance-Merger and Acquisitionsandeepfox100% (1)

- Financial Reporting Paper 2.1 Dec 2023Documento28 páginasFinancial Reporting Paper 2.1 Dec 2023Oni SegunAinda não há avaliações

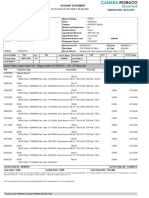

- Canara Robeco Equity Hybrid Fund - Regular Monthly IDCW (GBDP) - ISIN: INF760K01068Documento2 páginasCanara Robeco Equity Hybrid Fund - Regular Monthly IDCW (GBDP) - ISIN: INF760K01068brotoAinda não há avaliações

- London Gold Pool Aftermath From Its CollapseDocumento18 páginasLondon Gold Pool Aftermath From Its CollapseLarryDavid1001Ainda não há avaliações

- Problems 7Documento4 páginasProblems 7jojAinda não há avaliações

- Investment Banking - Course OutlineDocumento4 páginasInvestment Banking - Course OutlineVrinda GargAinda não há avaliações

- 1st Quarter - Fundamentals of Accounting 2 - ANSWER KEYDocumento7 páginas1st Quarter - Fundamentals of Accounting 2 - ANSWER KEYDin Rose Gonzales50% (2)

- Takeover Ukraine Agricultural LandDocumento33 páginasTakeover Ukraine Agricultural LanddulescuxAinda não há avaliações

- Assign 1 SolutionDocumento18 páginasAssign 1 Solutionnybabo1100% (3)

- SustainabilityDocumento19 páginasSustainabilitySenthil KumarAinda não há avaliações