Escolar Documentos

Profissional Documentos

Cultura Documentos

Foreign Exchange

Enviado por

Kevin Vaz0 notas0% acharam este documento útil (0 voto)

19 visualizações8 páginasUsing Indian Rupee as vehicle currency, work out the Bid and the Ask rates for: a)EURO / US$ b)CHF / SGD c)GBP / Swedish Korner. Using CANADIAN$ 10,000, KOREAN WON 25,000, SWEDISH KRONER 15,000. If the same rates are to be quoted in a foreign country, what Bid and Ask rates would be offered for the following Currencies: Korean Won,

Descrição original:

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoUsing Indian Rupee as vehicle currency, work out the Bid and the Ask rates for: a)EURO / US$ b)CHF / SGD c)GBP / Swedish Korner. Using CANADIAN$ 10,000, KOREAN WON 25,000, SWEDISH KRONER 15,000. If the same rates are to be quoted in a foreign country, what Bid and Ask rates would be offered for the following Currencies: Korean Won,

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

19 visualizações8 páginasForeign Exchange

Enviado por

Kevin VazUsing Indian Rupee as vehicle currency, work out the Bid and the Ask rates for: a)EURO / US$ b)CHF / SGD c)GBP / Swedish Korner. Using CANADIAN$ 10,000, KOREAN WON 25,000, SWEDISH KRONER 15,000. If the same rates are to be quoted in a foreign country, what Bid and Ask rates would be offered for the following Currencies: Korean Won,

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 8

c

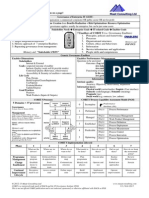

FOREIGN EXCHANGE - ARITHMETICS

RUPEES PER UNIT OF FOREIGN

CURRENCY BID ASK

USD 39.8500 39.8700

EURO 63.0700 63.1000

GBP 79.7000 79.7200

JPY 38.4000 38.4300

CHF 39.1700 39.2000

SGD 29.4500 29.4700

YUAN 5.6900 5.7000

KOREAN WON 4.0200 4.0300

AFRICAN RAND 5.1300 5.1500

AUSTRALIAN DOLLAR 37.3800 37.4000

SWEDISH KRONER' 6.7100 6.7500

DANISH KRONER 8.4500 8.4800

CANADIAN DOLLAR 36.6900 36.7300

THAI BHATT 126.4700 126.4900

Q.1. How much money would be realized by the Indian Exporters for?

US$ 1000, Yuan 20,000, SG$ 25000, JPY 10, 00,000.

Q.2 How much money would be payable for:

EURO10, 000, GBP 20,000, AUS$ 20,000

Q.3 You are travelling abroad on a world tour and you need the following currencies:

CANADIAN$ 10,000, KOREAN WON 25,000, SWEDISH KRONER 15,000.

Q.4 In India, the Foreign Currency Rates quoted are Direct. If the same rates are to be

quoted in a Foreign Country, what Bid and Ask rates would be offered for the

following Currencies: Korean Won, Swiss Franc, British Po und, and African Rand.

Similarly the other rates can be worked out.........................

Q.5 Using Indian Rupee as Vehicle Currency, work out the Bid and the Ask rates for:

a)EURO/US$ b) CHF/SGD c)GBP/Swedish Korner.

Q.6 In a Foreign Exchange Market, one of the dealers in Foreign Exchange has quoted

following spot and 6 months Forward Rate in respect of four currencies:

RS. PER UNIT OF FOREIGN CURRENCY

CURRENCY SPOT 6 MONTH FORWARD

BID ASK BID ASK

USD 40.1200 40.1600 39.3200 39.3800

EURO 63.0600 63.1000 65.0800 65.1400

CHF 37.8600 37.9000 37.5400 37.6000

GBP 79.7000 79.7400 80.2000 80.2600

a) c Find the annualized premium/discount for each currency with respect to

rupee?

b) c Based on answer in a) what forward rate do you expect for 12 Months

forward for each currency?

Q.7 Following Rates in the Foreign Exchange Markets of different countries are being

quoted at the same point of time: (Assuming all the countries follow the

convention of quoting direct rates)

A)c New York Market (USD) BID ASK

EURO 1.5912 1.5935

POUND 1.9817 1.9842

B) c LONDON (GBP) BID ASK

USD 0.5016 0.5025

EURO 0.8025 0.8050

C) c PARIS (EURO) BID ASK

USD 0.6284 0.6300

GBP 1.2454 1.2475

Do you think that there exists an arbitrage in the Foreign Exchange market?

If the scope for arbitrage exists how can it be exploited?

Q.8 A Bank is quoting :-

SD/GBP spot 0.6835/0.6850 Ȃ Spot

1 Month Forward - 20/15

3 Months Forward - 30/40

SD/ERO spot 0.9280/0. 9290 Ȃ Spot

1 Month Forward - 30/25

3 Months Forward - 40/60

Find out a quote for GBP/Euro for 65 Days.

Q.9 Three different traders are quoting as follows:

TRADER -A : 1GBP = 1.9860 USD/1.9870 USD

TRADER-B : 1GBP = 2.8370 SGD/2.8370 SGD

TRADER-C : 1 USD= 1.4315 SGD/ 1.4325 SGD

Identify and Calculate the Triangular Arbitrage on 1 Million $.

Ans. Arbitrage gain is 2100$ on 1 Million.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Steelpipe Sales Catalogue 4th Edition May 12Documento61 páginasSteelpipe Sales Catalogue 4th Edition May 12jerome42nAinda não há avaliações

- 21PGDM177 - I&E AssignmentDocumento6 páginas21PGDM177 - I&E AssignmentShreya GuptaAinda não há avaliações

- GPETRO Scope TenderDocumento202 páginasGPETRO Scope Tendersudipta_kolAinda não há avaliações

- India's sustainable economic growth scenarioDocumento44 páginasIndia's sustainable economic growth scenariojatt ManderAinda não há avaliações

- COBIT 5 Foundation Exam Revision On A PageDocumento1 páginaCOBIT 5 Foundation Exam Revision On A PageSergiö Montoya100% (1)

- Lemon MaltDocumento33 páginasLemon MaltUmar AsifAinda não há avaliações

- TAXATION LAW TITLEDocumento6 páginasTAXATION LAW TITLEJose Maria Jude DuremdesAinda não há avaliações

- ARCHITECTURAL INTERNSHIP ReportDocumento41 páginasARCHITECTURAL INTERNSHIP ReportsinafikebekeleAinda não há avaliações

- Banglalink (Final)Documento42 páginasBanglalink (Final)Zaki Ahmad100% (1)

- Managing Human Resources at NWPGCLDocumento2 páginasManaging Human Resources at NWPGCLMahadi HasanAinda não há avaliações

- My Project Report On Reliance FreshDocumento67 páginasMy Project Report On Reliance FreshRajkumar Sababathy0% (1)

- 3m Fence DUPADocumento4 páginas3m Fence DUPAxipotAinda não há avaliações

- Gestion de La Calidad HoqDocumento8 páginasGestion de La Calidad HoqLuisa AngelAinda não há avaliações

- Kasut You DistributionDocumento9 páginasKasut You DistributionNo Buddy100% (1)

- APSS1B17 - Contemporary Chinese Society and Popcult - L2 (Week 3)Documento28 páginasAPSS1B17 - Contemporary Chinese Society and Popcult - L2 (Week 3)Arvic LauAinda não há avaliações

- 1 MDL299356Documento4 páginas1 MDL299356Humayun NawazAinda não há avaliações

- Internship PresentationDocumento3 páginasInternship Presentationapi-242871239Ainda não há avaliações

- BudgetingS15 FinalExam 150304 2Documento9 páginasBudgetingS15 FinalExam 150304 2FrOzen HeArtAinda não há avaliações

- Pest Analysis of Soccer Football Manufacturing CompanyDocumento6 páginasPest Analysis of Soccer Football Manufacturing CompanyHusnainShahid100% (1)

- PRMG 6007 - Procurement Logistics and Contracting Uwi Exam Past Paper 2012Documento3 páginasPRMG 6007 - Procurement Logistics and Contracting Uwi Exam Past Paper 2012tilshilohAinda não há avaliações

- Analisis Cost Volume Profit Sebagai Alat Perencanaan Laba (Studi Kasus Pada Umkm Dendeng Sapi Di Banda Aceh)Documento25 páginasAnalisis Cost Volume Profit Sebagai Alat Perencanaan Laba (Studi Kasus Pada Umkm Dendeng Sapi Di Banda Aceh)Fauzan C LahAinda não há avaliações

- Resume of Nikol - Kueneman - 2010Documento2 páginasResume of Nikol - Kueneman - 2010api-23862654Ainda não há avaliações

- Client Reacceptance Checklist - DR - FagihDocumento1 páginaClient Reacceptance Checklist - DR - FagihAlizer AbidAinda não há avaliações

- Swift MessageDocumento29 páginasSwift MessageAbinath Stuart0% (1)

- Employee Suggestion Programs Save MoneyDocumento3 páginasEmployee Suggestion Programs Save Moneyimran27pk100% (1)

- Analyzing Transactions and Double Entry LectureDocumento40 páginasAnalyzing Transactions and Double Entry LectureSuba ChaluAinda não há avaliações

- JDA Demand - Focus 2012Documento43 páginasJDA Demand - Focus 2012Abbas Ali Shirazi100% (1)

- InventoryDocumento53 páginasInventoryVinoth KumarAinda não há avaliações

- AWS Compete: Microsoft's Response to AWSDocumento6 páginasAWS Compete: Microsoft's Response to AWSSalman AslamAinda não há avaliações

- Pandit Automotive Tax Recovery ProcessDocumento6 páginasPandit Automotive Tax Recovery ProcessJudicialAinda não há avaliações