Escolar Documentos

Profissional Documentos

Cultura Documentos

A National Mortgage Modification Program Is My Solution

Enviado por

ValuEngine.com0 notas0% acharam este documento útil (0 voto)

55 visualizações4 páginasWith a fairly determined appraisal based on conditions at the local level, we can implement a mortgage modification/re-financing plan. My proposed National Mortgage Modification Program is designed to be applied to “traditional” mortgage structures--e.g. a one-year adjustable, a five-year adjustable, a fifteen-year fixed and a thirty-year fixed. Rates under the plan are tied to US Treasury rates as follows: 200 bps above the One-Year Bill, 150 bps above the 5-Year Note, 100 bps over the 7-Year Note and 100 bps over the 10-Year Note respectively.

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoWith a fairly determined appraisal based on conditions at the local level, we can implement a mortgage modification/re-financing plan. My proposed National Mortgage Modification Program is designed to be applied to “traditional” mortgage structures--e.g. a one-year adjustable, a five-year adjustable, a fifteen-year fixed and a thirty-year fixed. Rates under the plan are tied to US Treasury rates as follows: 200 bps above the One-Year Bill, 150 bps above the 5-Year Note, 100 bps over the 7-Year Note and 100 bps over the 10-Year Note respectively.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

55 visualizações4 páginasA National Mortgage Modification Program Is My Solution

Enviado por

ValuEngine.comWith a fairly determined appraisal based on conditions at the local level, we can implement a mortgage modification/re-financing plan. My proposed National Mortgage Modification Program is designed to be applied to “traditional” mortgage structures--e.g. a one-year adjustable, a five-year adjustable, a fifteen-year fixed and a thirty-year fixed. Rates under the plan are tied to US Treasury rates as follows: 200 bps above the One-Year Bill, 150 bps above the 5-Year Note, 100 bps over the 7-Year Note and 100 bps over the 10-Year Note respectively.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 4

Richard Suttmeier is the Chief Market Strategist at www.ValuEngine.com.

ValuEngine is a fundamentally-based quant research firm in Newtown, PA. ValuEngine

covers over 7,000 stocks every day.

A variety of newsletters and portfolios containing Suttmeier's detailed research, stock picks,

and commentary can be found at http://www.valuengine.com/nl/mainnl

December 23, 2010 – A National Mortgage Modification Program Is

My Solution

Housing Remains Weak as Mortgage Rates Rise

1. The Mortgage Bankers Association reported that its mortgage application index fell 18.6% last

week led by a decline of 24.6% for the refinance index. The sixth consecutive weekly drop has

happened as the 30-Year fixed rate mortgage rose to 4.85%.

2. Existing Home Sales increased 5.6% in November to an annual rate of 4.68 million units. Even

so, 2010 is shaping up to be the worst housing market since 1997.

3. Additional troubled homeowners have dropped out of the Obama foreclosure-relief program.

About 774,000 homeowners have left the program as of last month, which is 54% of the 1.4

million who applied for help.

4. Foreclosure filings may have fell 21% last month, but this decrease is expected to be

temporary, as lenders revise and resubmit paperwork in 2011.

According to the Federal Housing Finance Agency (FHFA) US house prices fell 1.6% in the third

quarter and are down 3.2% year over year.

The FHFA also reported a modest 0.7% rise in house prices in October versus September.

A National Mortgage Modification Program Is My Solution

Every county in the country has a Property Appraiser responsible for determining home values for tax

purposes and local government funding. Most counties base a home's appraised value on recent

sales in the community. Homes deemed to have changed hands at a too high or too low price are not

included in the calculation. Once the homes are set for the calculation, an average-price-per square-

foot is established. The value of every home in that neighborhood can then be calculated by

multiplying its square footage by the pre-determined average-price-per square-foot. This is typically set

in late August to establish the property taxes for the following calendar year. The appraised value

versus the mortgage balance—if any—on the home determines the homeowner’s equity-- which can

be positive or negative. Homeowners with negative equity are said to be “underwater.”

With a fairly determined appraisal based on conditions at the local level, we can implement a

mortgage modification/re-financing plan. My proposed National Mortgage Modification Program is

designed to be applied to “traditional” mortgage structures--e.g. a one-year adjustable, a five-year

adjustable, a fifteen-year fixed and a thirty-year fixed. Rates under the plan are tied to US Treasury

rates as follows: 200 bps above the One-Year Bill, 150 bps above the 5-Year Note, 100 bps over the

7-Year Note and 100 bps over the 10-Year Note respectively.

Underwater participants will have their mortgages divided into two components. One component

consists of the amount of negative equity in the home. This tail is financed as a zero percent

mortgage. To qualify for the program the underwater homeowner must put up 20% of the appraised

value--which I call the mortgage buffer. The remaining balance is financed at the rate stated above for

one of the four “traditional” mortgage products.

These mortgages must be kept on the books of the bank participating in this plan as an investment. In

addition the bank collects a 50 basis point fee, and the balance of the spread above the US Treasury

goes to the FDIC’s Deposit Insurance Fund (DIF). The 20% mortgage buffer is placed in the escrow

account of the homeowner. This buffer can come from the homeowner's IRA or 401 K without penalty

and without tax consequence.

Every year, program participants have their mortgages reviewed given the new property appraisal. If

the appraised value declines, the mortgage decreases again taking funds from the mortgage buffer. If

the appraised value goes up, the mortgage balance increases by that much--, which reduces the zero

percent mortgage tail.

This plan will stabilize the housing market and put money in the pockets of homeowners.

What happens if you sell your home? If you sell at the appraised value set at the beginning of the

program, you get your 20% back. If you sell below appraised value, you get only that portion of the

20% above the mortgage amount. If you sell below the mortgage amount, you split the loss with the

bank. You do not participate in any other home price appreciation unless the sale price exceeds the

original total mortgage: the initial appraised value plus the zero mortgage tail. That windfall is shared

by the homeowner and the lending bank.

The National Mortgage Modification Program puts the borrower and lender in partnership in the

mortgage market, gives consumers more money in their pockets in an effort to spur consumption and

the economy, and gives community and regional banks a mortgage product line where profits are

generated by earning the interest spread between rate paid on consumer deposits and the interest

rate on the mortgages.

Tracking the US Capital Markets – US stocks are overvalued fundamentally and overbought

technically on both daily and weekly charts. The major equity averages straddle weekly pivots and

risky levels at 11,496 Dow, 1250.3 SPX, 2670 NASDAQ, 5136 Dow Transports and 787.37 Russell

2000. Fifteen of sixteen sectors are overvalued according to ValuEngine with only 37.5% of all stocks

undervalued. At 35% the stock market tends to find a top. Only 17.5% of all stocks are undervalued by

20% or more.

The Yield on the 10-Year Note (3.348) – This week’s pivot at 3.358 has been a magnet. My

semiannual value level at 3.479 was violated at last week’s high yield of 3.568.

Comex Gold ($1387.4) – The 50-day simple moving average is $1371.8 with this week’s risky level at

$1426.1.

Nymex Crude Oil ($90.48) – Has been influenced by my weekly pivot at $89.61. My semiannual value

level is $83.94 with my annual risky level at $97.29.

The Euro (1.3100) – My weekly pivot is 1.3079 with quarterly pivot at 1.3318. The 200-day simple

moving average is 1.3091.

The Dow Industrial Average (11,559) – I will not have new monthly, quarterly, semiannual and annual

value levels, pivots and risky levels until January 3, 2011, but this week’s pivot is 11,496 and today’s

risky level is 11,586.

That’s today’s Four in Four. Have a great day.

Richard Suttmeier

Chief Market Strategist

ValuEngine.com, (800) 381-5576

Send your comments and questions to Rsuttmeier@Gmail.com. For more information on our products and services visit

www.ValuEngine.com

As Chief Market Strategist at ValuEngine Inc, my research is published regularly on the website www.ValuEngine.com. I have daily, weekly, monthly, and

quarterly newsletters available that track a variety of equity and other data parameters as well as my most up-to-date analysis of world markets. My

newest products include a weekly ETF newsletter as well as the ValuTrader Model Portfolio newsletter. You can go HERE to review sample issues and

find out more about my research.

“I Hold No Positions in the Stocks I Cover.”

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Preface: Anil Dhirubhai AmbaniDocumento47 páginasPreface: Anil Dhirubhai AmbaniAnshUpadhyayAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- A Primer On Us Bankruptcy - StroockDocumento247 páginasA Primer On Us Bankruptcy - Stroock83jjmack100% (1)

- Prac 1 - First Preboard - P2 65th NewDocumento12 páginasPrac 1 - First Preboard - P2 65th NewArianne Llorente100% (1)

- International Bank For Reconstruction and DevelopmentDocumento7 páginasInternational Bank For Reconstruction and DevelopmentbeyyAinda não há avaliações

- Glosar Juridic RO enDocumento64 páginasGlosar Juridic RO envaalentina_albu67% (3)

- Stock Verifications Part 2Documento26 páginasStock Verifications Part 2Anand DubeyAinda não há avaliações

- Cacayorin v. AfpmbaDocumento2 páginasCacayorin v. AfpmbaWorstWitch TalaAinda não há avaliações

- Principles of Working Capital Management-1Documento29 páginasPrinciples of Working Capital Management-1margetAinda não há avaliações

- Associated Bank V TanDocumento17 páginasAssociated Bank V Tancmv mendozaAinda não há avaliações

- ValuEngine Weekly: Basic Materials Stocks, Raytheon, Valuation Watch, and MoreDocumento6 páginasValuEngine Weekly: Basic Materials Stocks, Raytheon, Valuation Watch, and MoreValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Finance Stocks, Twitter, Valuation Watch, and MoreDocumento5 páginasValuEngine Weekly: Finance Stocks, Twitter, Valuation Watch, and MoreValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Tech Stocks, General Motors, and MoreDocumento5 páginasValuEngine Weekly: Tech Stocks, General Motors, and MoreValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Construction Stocks, JPMorgan Chase, Valuation Watch, and MoreDocumento6 páginasValuEngine Weekly: Construction Stocks, JPMorgan Chase, Valuation Watch, and MoreValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Consumer Staples, Volkswagen, and ValuEngine CapitalDocumento6 páginasValuEngine Weekly: Consumer Staples, Volkswagen, and ValuEngine CapitalValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Aerospace Stocks, JCPenney, and ValuEngine CapitalDocumento7 páginasValuEngine Weekly: Aerospace Stocks, JCPenney, and ValuEngine CapitalValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Consumer Staples, Volkswagen, and ValuEngine CapitalDocumento6 páginasValuEngine Weekly: Consumer Staples, Volkswagen, and ValuEngine CapitalValuEngine.comAinda não há avaliações

- Ve Weekly NewsDocumento7 páginasVe Weekly NewsValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Construction Stocks, Mylan, Market Valuation Study, and ValuEngine CapitalDocumento10 páginasValuEngine Weekly: Construction Stocks, Mylan, Market Valuation Study, and ValuEngine CapitalValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Basic Materials Sector, General Electric, Valuation Study, and MoreDocumento10 páginasValuEngine Weekly: Basic Materials Sector, General Electric, Valuation Study, and MoreValuEngine.comAinda não há avaliações

- December 2, 2016: Market OverviewDocumento7 páginasDecember 2, 2016: Market OverviewValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Medical Stocks, Toyota Motor, Valuation Warning, and ValuEngine CapitalDocumento7 páginasValuEngine Weekly: Medical Stocks, Toyota Motor, Valuation Warning, and ValuEngine CapitalValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Industrial Products, Macy's, and ValuEngine CapitalDocumento7 páginasValuEngine Weekly: Industrial Products, Macy's, and ValuEngine CapitalValuEngine.comAinda não há avaliações

- December 2, 2016: Market OverviewDocumento7 páginasDecember 2, 2016: Market OverviewValuEngine.comAinda não há avaliações

- December 2, 2016: Market OverviewDocumento7 páginasDecember 2, 2016: Market OverviewValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Basic Materials Stocks, Twitter, Market Valuations, Benzinga Show, and ValuEngine CapitalDocumento11 páginasValuEngine Weekly: Basic Materials Stocks, Twitter, Market Valuations, Benzinga Show, and ValuEngine CapitalValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Finance Stocks, Horizon Pharma, and ValuEngine CapitalDocumento7 páginasValuEngine Weekly: Finance Stocks, Horizon Pharma, and ValuEngine CapitalValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Autos/Tires/Trucks, Volkswagen, and ValuEngine CapitalDocumento7 páginasValuEngine Weekly: Autos/Tires/Trucks, Volkswagen, and ValuEngine CapitalValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Oils/Energy Stocks, Deutsche Bank, Benzinga Pre-Market Prep, and ValuEngine CapitalDocumento8 páginasValuEngine Weekly: Oils/Energy Stocks, Deutsche Bank, Benzinga Pre-Market Prep, and ValuEngine CapitalValuEngine.comAinda não há avaliações

- Ve Weekly NewsDocumento8 páginasVe Weekly NewsValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Tech Stocks, Apple, and ValuEngine CapitalDocumento8 páginasValuEngine Weekly: Tech Stocks, Apple, and ValuEngine CapitalValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Retail/Wholesale Stocks, Softbank, and ValuEngine CapitalDocumento7 páginasValuEngine Weekly: Retail/Wholesale Stocks, Softbank, and ValuEngine CapitalValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Consumer Staples Stocks, Cooper Standard, New Market Highs, and ValuEngine CapitalDocumento8 páginasValuEngine Weekly: Consumer Staples Stocks, Cooper Standard, New Market Highs, and ValuEngine CapitalValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Transport Stocks, Boeing, Brexit, and ValuEngine CapitalDocumento8 páginasValuEngine Weekly: Transport Stocks, Boeing, Brexit, and ValuEngine CapitalValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Industrial Product Stocks, Apple, Valuations, and ValuEngine CapitalDocumento11 páginasValuEngine Weekly: Industrial Product Stocks, Apple, Valuations, and ValuEngine CapitalValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Finance Stocks, FOX, Valuations, and ValuEngine CapitalDocumento10 páginasValuEngine Weekly: Finance Stocks, FOX, Valuations, and ValuEngine CapitalValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Basic Materials Stocks, UPS, ValuEngine View Results, and ValuEngine CapitalDocumento8 páginasValuEngine Weekly: Basic Materials Stocks, UPS, ValuEngine View Results, and ValuEngine CapitalValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Health Care Stocks, Tesla, and ValuEngine CapitalDocumento7 páginasValuEngine Weekly: Health Care Stocks, Tesla, and ValuEngine CapitalValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Construction Stocks, Hewlett Packard, and ValuEngine CapitalDocumento7 páginasValuEngine Weekly: Construction Stocks, Hewlett Packard, and ValuEngine CapitalValuEngine.comAinda não há avaliações

- ValuEngine Weekly: Tech Stocks, Cigna, Chinese Reports, and ValuEngine CapitalDocumento8 páginasValuEngine Weekly: Tech Stocks, Cigna, Chinese Reports, and ValuEngine CapitalValuEngine.comAinda não há avaliações

- Myanmar Accounting Standard 7: Statement of Cash FlowsDocumento18 páginasMyanmar Accounting Standard 7: Statement of Cash FlowsKyaw Htin WinAinda não há avaliações

- Bank of The Philippine Islands About BPIDocumento14 páginasBank of The Philippine Islands About BPIEizzel SamsonAinda não há avaliações

- SME Financing PPT DTDocumento28 páginasSME Financing PPT DTdeepaktandon86% (7)

- Sample Budget Worksheet: HousingDocumento4 páginasSample Budget Worksheet: Housingramkumardotg_5807772Ainda não há avaliações

- Falaknaz PresidencyDocumento12 páginasFalaknaz PresidencyAdnan AfzalAinda não há avaliações

- Rishabh Itt PPT On Financial MangmentDocumento21 páginasRishabh Itt PPT On Financial MangmentRishabh AgrwalAinda não há avaliações

- SOA Format ManilaDocumento1 páginaSOA Format ManilaDaianne ZipaganAinda não há avaliações

- Pension Cir 8 DT 16 08Documento12 páginasPension Cir 8 DT 16 08himadri_bhattacharjeAinda não há avaliações

- EBL FinalDocumento31 páginasEBL FinalAbdul KaderAinda não há avaliações

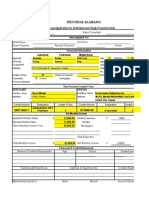

- Hyundai Alabang: Auto Loan Application For Individual and Single ProprietorshipDocumento4 páginasHyundai Alabang: Auto Loan Application For Individual and Single ProprietorshipXierylleAngelicaAinda não há avaliações

- Project Name: 5 The Pavement, Clapham Common, London SW4 0HZDocumento2 páginasProject Name: 5 The Pavement, Clapham Common, London SW4 0HZjordenAinda não há avaliações

- G.R. No. 97753 August 10, 1992 CALTEX (PHILIPPINES), INC., Petitioner, Court of Appeals and Security Bank and Trust Company, RespondentsDocumento17 páginasG.R. No. 97753 August 10, 1992 CALTEX (PHILIPPINES), INC., Petitioner, Court of Appeals and Security Bank and Trust Company, RespondentsJucca Noreen SalesAinda não há avaliações

- Farmers SuicideDocumento16 páginasFarmers SuicideSANJIVAN CHAKRABORTYAinda não há avaliações

- The Dublin Builder 1859fbcmaDocumento15 páginasThe Dublin Builder 1859fbcmamilkheight2Ainda não há avaliações

- Leveraged Buyout Bankrupties, The Problem of HindsightDocumento104 páginasLeveraged Buyout Bankrupties, The Problem of Hindsight83jjmackAinda não há avaliações

- Discretionary Lending Power Updated Sep 2012Documento28 páginasDiscretionary Lending Power Updated Sep 2012akranjan888Ainda não há avaliações

- Sychographic Segmentation of Indian Urban ConsumersDocumento24 páginasSychographic Segmentation of Indian Urban ConsumersLinesh BabariyaAinda não há avaliações

- Mark XDocumento10 páginasMark XJennifer Ayers0% (2)

- Item Analysis (Business Math)Documento1 páginaItem Analysis (Business Math)Edna Grace Abrera TerragoAinda não há avaliações

- Mistake As Ground For Vitiated ConsentDocumento3 páginasMistake As Ground For Vitiated ConsentkdescallarAinda não há avaliações

- C 03Documento52 páginasC 03Lạc LốiAinda não há avaliações