Escolar Documentos

Profissional Documentos

Cultura Documentos

Departmental Exams Himachal Pradesh

Enviado por

madhaniasureshDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Departmental Exams Himachal Pradesh

Enviado por

madhaniasureshDireitos autorais:

Formatos disponíveis

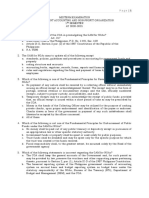

BOARD OF DEPARTMENTAL EXAMINATIONS, HIMACHAL PRADESH

DEPARTMENTAL EXAMINATIONS, JULY-AUG,2006

Paper No.9: Civil Service, Treasury and Financial Rules for IAS/HAS

Time Allowed: 3 Hours Maximum marks: 100

Notes: 1. Attempt any five questions.

2. All questions carry equal marks.

3. only Bare Acts/ Rules/ Approved reference books are allowed.

4. Attempt all parts of a question consecutively .

Q.No.1 Discuss the role of “budget” as an instrument of financial control based on the

Premise that “ Accountability is the cornerstone of all financial reporting in

Government”.

(20)

Q.No.2 Distinguish between the following:-

a) “Appropriation Account” and “Finance Account”

b) “Fiscal deficit” and “Revenue Deficit”

c) “Censure” and “ Warning”

d) “Dismissal” and :Removal” from service.

(20)

Q.No.3 Answer the following:

a) When does subscription to the GPF cease?

b) What is the effect of dismissal or removal from services on pension and

gratuity?

c) How is the Traveling Allowance to a Government servant under suspension,

who is required to perform journey to attend departmental enquiry, regulated?

d) What area the circumstances in which Death/ Retirement Gratuity lapses to

Government?

e) Can a Disciplinary Authority impose punishment on a Government servant of

reduction of his pay to the minimum of the time scale as a permanent

measures?

( 20)

Q.No.4 Comment on following:

(i) It was proposed by the office that recovery of an amount pertaining to the

period when a government servant was on deputation couldn’t be recovered

from the retirement gratuity.

(II) When suspension is regularized as leave, consequential recovery is

in escapable.

(III) Amount due on Court attachments should not be made form the

subsistence allowance Cont.P-2

IV) Disciplinary proceedings against a Govt. servant after his retirement was

Die- continued on a plea that there was no pecuniary loss to Government.

HIPA Sample Question Papers Downloaded from http://himachal.gov.in/hipa

(V) Family pension was denied to a son of a Government servant who retired

from service form 31.7.2005 on the ground that the son was born on

15.10.2005 i.e after the retirement of Govt. servant and was as such not a

family member at the time of his retirement.

(20)

Q.No.5 I) Indicate whether the following statements are True or false:

a) “Dies non” can be marked for late coming.

b) Cash balance of the Govt. is classified under “public Account”.

c) Appropriation account takes only expenditure side into its fold but does not

touch upon receipt side.

d) “Suspension” of a Govt. servant is not a penalty.

e) “Indentical pay scales” and “ same pay scale” are different connotations.

ii) Give two examples in respect of each of the following:-

a) “Non-tax revenue”. ©“In-direct taxes”.

b) “Public Account”. (d) “Capital receipts”.

(20)

Q.No.6 (a) To what extent can a Government commute his pension for a lump sum

Payment ?

( b) Under what circumstances is a Government servant/ pensioner not eligible

to commute his pension?

© From which date is commuted portion of pension of a Government Servant

to be restored?

(d) Whether commutation amount is taxable or not?

(20)

Q.No.7 What are the General Rules and Principles for entering into contracts or

Agreements involving expenditure from the State Revenue?

(20)

HIPA Sample Question Papers Downloaded from http://himachal.gov.in/hipa

Você também pode gostar

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Ainda não há avaliações

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)No EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Nota: 5 de 5 estrelas5/5 (1)

- 2018 Acconts Paper TheoryDocumento2 páginas2018 Acconts Paper TheoryHmingsangliana HauhnarAinda não há avaliações

- Midterm Exam Government Accounting and Npo Dfcamclp Ay 2020 2021 For Online StudentsDocumento12 páginasMidterm Exam Government Accounting and Npo Dfcamclp Ay 2020 2021 For Online StudentsLeny Joy Dupo33% (3)

- Quiz 1: Public Accounting and BudgetingDocumento6 páginasQuiz 1: Public Accounting and BudgetingjaleummeinAinda não há avaliações

- Government budget and the economyDocumento6 páginasGovernment budget and the economyRitikaAinda não há avaliações

- Midterm Exam Government Accounting and Npo Dfcamclp Ay 2020 2021 For Online StudentsDocumento12 páginasMidterm Exam Government Accounting and Npo Dfcamclp Ay 2020 2021 For Online StudentsNate Dela Cruz100% (1)

- ETS-02 (Ch-10 Macro)Documento2 páginasETS-02 (Ch-10 Macro)Kruti SitaparaAinda não há avaliações

- Test Bank For Core Concepts of Government and Not For Profit Accounting 2nd Edition GranofDocumento17 páginasTest Bank For Core Concepts of Government and Not For Profit Accounting 2nd Edition Granofhaeric0gas100% (20)

- Government Accounting Theory Cpar PDFDocumento4 páginasGovernment Accounting Theory Cpar PDFGeneGrace Zolina Tasic100% (1)

- College of Accountancy First Grading Examination ACCTG 156/8A InstructionsDocumento8 páginasCollege of Accountancy First Grading Examination ACCTG 156/8A Instructionserica insiong100% (1)

- Test Govt BudgetDocumento3 páginasTest Govt BudgetshobitgupAinda não há avaliações

- 2020 Dec. MIDTRM EXAM BSA 3A Accounting For Got. NPODocumento6 páginas2020 Dec. MIDTRM EXAM BSA 3A Accounting For Got. NPOVernn100% (1)

- Departmental Exams Himchal PradeshDocumento3 páginasDepartmental Exams Himchal PradeshmadhaniasureshAinda não há avaliações

- 3rd GovAcc 1SAY2324Documento9 páginas3rd GovAcc 1SAY2324Grand DuelistAinda não há avaliações

- ACCTG 6 Midterm ExaminationDocumento16 páginasACCTG 6 Midterm ExaminationJudy Anne RamirezAinda não há avaliações

- BQs Tax 2011 2012Documento44 páginasBQs Tax 2011 2012Dem SalazarAinda não há avaliações

- Worksheet - 1: Economics Class XIIDocumento6 páginasWorksheet - 1: Economics Class XIIManya MahawerAinda não há avaliações

- 12 Eco TP Govtbudgeteconomy 01Documento5 páginas12 Eco TP Govtbudgeteconomy 013468Shivansh AggarwalAinda não há avaliações

- RESA TAX PreWeek (B43)Documento23 páginasRESA TAX PreWeek (B43)MellaniAinda não há avaliações

- India Year Book Through MCQ Part 4Documento101 páginasIndia Year Book Through MCQ Part 4nik.adsinghAinda não há avaliações

- Midterm ExamDocumento12 páginasMidterm ExamGracias0% (2)

- Taxation Examination Taxation Examination: Accounting (Cagayan State University) Accounting (Cagayan State University)Documento47 páginasTaxation Examination Taxation Examination: Accounting (Cagayan State University) Accounting (Cagayan State University)Kc AguiluzAinda não há avaliações

- Module1 - Basic PrinciplesDocumento14 páginasModule1 - Basic PrinciplesChristian Mark AbarquezAinda não há avaliações

- Government Budget and The EconomyDocumento10 páginasGovernment Budget and The EconomyFathimaAinda não há avaliações

- 25494132Documento7 páginas25494132Janine LerumAinda não há avaliações

- Public Sector AccountingDocumento10 páginasPublic Sector AccountingbillAinda não há avaliações

- Government Accounting Quiz 1 Write The Letter Pertaining To Best AnswerDocumento4 páginasGovernment Accounting Quiz 1 Write The Letter Pertaining To Best AnswerWilliam DC RiveraAinda não há avaliações

- Model Question PapersDocumento14 páginasModel Question PaperscrpfdotnewsAinda não há avaliações

- Explanatory Memorandum On Federal ReceiptsDocumento101 páginasExplanatory Memorandum On Federal ReceiptsM Sikander HaiderAinda não há avaliações

- Lecture PPT - 51-60Documento29 páginasLecture PPT - 51-600arvinderAinda não há avaliações

- Accounts Paper QuestionsDocumento3 páginasAccounts Paper QuestionsNisar ShahAinda não há avaliações

- TAX Summary Lecture (15 May 2021)Documento30 páginasTAX Summary Lecture (15 May 2021)rav danoAinda não há avaliações

- PC-16 TEST PAPER II: 75 QUESTIONS ON CIVIL ACCOUNTSDocumento19 páginasPC-16 TEST PAPER II: 75 QUESTIONS ON CIVIL ACCOUNTSManoj SainiAinda não há avaliações

- Governmental Accounting Test QuestionsDocumento10 páginasGovernmental Accounting Test Questionsbluegatica100% (1)

- CE Government Accounting PDFDocumento9 páginasCE Government Accounting PDFjtAinda não há avaliações

- AGNPO Midterms ReviewerDocumento79 páginasAGNPO Midterms ReviewerKurt Morin Cantor100% (2)

- Basic Principles of TaxationDocumento46 páginasBasic Principles of TaxationMelvin PernezAinda não há avaliações

- Namma Kalvi 12th Economics Unit 9 Surya Economics Guide em PDFDocumento43 páginasNamma Kalvi 12th Economics Unit 9 Surya Economics Guide em PDFAakaash C.K.Ainda não há avaliações

- Basic Principles of TaxationDocumento31 páginasBasic Principles of TaxationPAGLINGAYEN, MA. ANGELICAAinda não há avaliações

- Holidays Homework - Economics Class XII Sections A-DDocumento3 páginasHolidays Homework - Economics Class XII Sections A-DAkshita ChauhanAinda não há avaliações

- PRELIM EXAM KEYDocumento10 páginasPRELIM EXAM KEYShane Torrie100% (1)

- Basic Tax Principles ExplainedDocumento46 páginasBasic Tax Principles Explained在于在Ainda não há avaliações

- Acct 033Documento9 páginasAcct 033erraAinda não há avaliações

- Govt Budget Q Sheet 1Documento9 páginasGovt Budget Q Sheet 1AvcelAinda não há avaliações

- CH 10. Govt. Budget AK LatestDocumento12 páginasCH 10. Govt. Budget AK LatestAdrian D'souzaAinda não há avaliações

- 11-2-24...4110-inter rev both...int-2008...law...ansDocumento7 páginas11-2-24...4110-inter rev both...int-2008...law...ansnikulgauswami9033Ainda não há avaliações

- Test Bank For Government and Not For Profit Accounting 8th by GranofDocumento20 páginasTest Bank For Government and Not For Profit Accounting 8th by GranofHorace Renfroe100% (40)

- Delhi Public School, Durg: 1 Hour 30 MiDocumento4 páginasDelhi Public School, Durg: 1 Hour 30 MiYuvraj ChoudharyAinda não há avaliações

- ACC117-CON09 Module 1 ExamDocumento10 páginasACC117-CON09 Module 1 ExamMarlon LadesmaAinda não há avaliações

- Govt Budget Part 3Documento18 páginasGovt Budget Part 3Devarsh :DAinda não há avaliações

- Basic Principles of TaxationDocumento11 páginasBasic Principles of Taxation在于在Ainda não há avaliações

- Summative Assessment 01Documento5 páginasSummative Assessment 01cpabirreplyAinda não há avaliações

- Gov Acctg Solman MillanDocumento69 páginasGov Acctg Solman MillanMichael Brian Torres100% (2)

- Non Gov Book QuestionsDocumento11 páginasNon Gov Book QuestionsRojille Rye RotorAinda não há avaliações

- ACC 111 Quiz 1 ReviewDocumento5 páginasACC 111 Quiz 1 ReviewRiezel PepitoAinda não há avaliações

- PS Accounting App SUBDocumento3 páginasPS Accounting App SUBMuhammad MustafaAinda não há avaliações

- 2020NMBE Taxation With AnswersDocumento21 páginas2020NMBE Taxation With AnswersWilsonAinda não há avaliações

- 8 Explanatory Memorandum of Federal Receipts 2021 22Documento101 páginas8 Explanatory Memorandum of Federal Receipts 2021 22Azhar AliAinda não há avaliações

- Budget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018No EverandBudget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018Ainda não há avaliações

- Transfer GuidelinesDocumento7 páginasTransfer GuidelinesmadhaniasureshAinda não há avaliações

- Rules For Pay FixationDocumento6 páginasRules For Pay FixationmadhaniasureshAinda não há avaliações

- SAS Sample PapersDocumento20 páginasSAS Sample PapersmadhaniasureshAinda não há avaliações

- Departmental Exams Himchal PradeshDocumento3 páginasDepartmental Exams Himchal PradeshmadhaniasureshAinda não há avaliações

- Sample Papers SASDocumento2 páginasSample Papers SASmadhaniasureshAinda não há avaliações

- Departmantal Exams Himachal PradeshDocumento2 páginasDepartmantal Exams Himachal PradeshmadhaniasureshAinda não há avaliações

- Departmental Exams Himachal PradeshDocumento3 páginasDepartmental Exams Himachal PradeshmadhaniasureshAinda não há avaliações

- Departmental Exams Himachal PradeshDocumento2 páginasDepartmental Exams Himachal PradeshmadhaniasureshAinda não há avaliações

- Departmantal Exams Himachal PradeshDocumento2 páginasDepartmantal Exams Himachal PradeshmadhaniasureshAinda não há avaliações

- GFR 2005Documento279 páginasGFR 2005chunayAinda não há avaliações

- SAS Sample PapersDocumento6 páginasSAS Sample Papersmadhaniasuresh50% (2)

- Notice of Decertification Petition by Members of SEIU Local 221 in San Diego, California 11-21-12Documento5 páginasNotice of Decertification Petition by Members of SEIU Local 221 in San Diego, California 11-21-12Anonymous iC9QziKAinda não há avaliações

- Territorial JurisdictionDocumento264 páginasTerritorial JurisdictionshraddhaAinda não há avaliações

- Gamogamo vs. PNOC Shipping and Transport Corp., 381 SCRA 742 (2002Documento16 páginasGamogamo vs. PNOC Shipping and Transport Corp., 381 SCRA 742 (2002Mei SuyatAinda não há avaliações

- Salient Features of RA 7610Documento28 páginasSalient Features of RA 7610Pevi Mae Jalipa83% (12)

- 17 - Universal Adult Franchise and The Methods of Representation (188 KB)Documento9 páginas17 - Universal Adult Franchise and The Methods of Representation (188 KB)Tabish BeighAinda não há avaliações

- IBPS - CWE - SPL - V Recruitment of Specialist OfficerDocumento2 páginasIBPS - CWE - SPL - V Recruitment of Specialist OfficerKutty AravindAinda não há avaliações

- 1601 CDocumento6 páginas1601 CJose Venturina Villacorta100% (1)

- General (Plenary) Legislative PowerDocumento162 páginasGeneral (Plenary) Legislative PowerBrenda de la GenteAinda não há avaliações

- Indian Penal CodeDocumento3 páginasIndian Penal CodeSHRUTI SINGHAinda não há avaliações

- Overview of The BSPDocumento27 páginasOverview of The BSPSherra ElizagaAinda não há avaliações

- Certified List of Candidates For Congressional and Provincial Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocumento3 páginasCertified List of Candidates For Congressional and Provincial Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsAinda não há avaliações

- Financial Services Act 2007Documento114 páginasFinancial Services Act 2007Farheen BegumAinda não há avaliações

- Bhutto & Zardari's Corruption Highlighted in Raymond Baker's Book On Dirty Money - Teeth MaestroDocumento6 páginasBhutto & Zardari's Corruption Highlighted in Raymond Baker's Book On Dirty Money - Teeth Maestroسید ہارون حیدر گیلانیAinda não há avaliações

- CRM2020-346 Decision and DocumentsDocumento71 páginasCRM2020-346 Decision and DocumentspaulfarrellAinda não há avaliações

- Code of Ethics and Guidelines Iaap: I. Analyst-Patient RelationshipsDocumento4 páginasCode of Ethics and Guidelines Iaap: I. Analyst-Patient RelationshipsChiriac Andrei TudorAinda não há avaliações

- 06-Coca-Cola Bottlers Phil., Inc. v. City of Manila GR No 156252Documento7 páginas06-Coca-Cola Bottlers Phil., Inc. v. City of Manila GR No 156252ryanmeinAinda não há avaliações

- PRC-Hospital Blood Services AgreementDocumento4 páginasPRC-Hospital Blood Services Agreementagelesswap100% (2)

- In The Matter Of: Re U (Child) (1999)Documento7 páginasIn The Matter Of: Re U (Child) (1999)Fuzzy_Wood_PersonAinda não há avaliações

- Answering Brief of Defendants-Appellees: Ronald Pierce et al vs. Chief Justice Tani Cantil-Sakauye Judicial Council Chair and Steven Jahr Judicial Council Administrative Director - Federal Class Action Lawsuit for Alleged Illegal Use of California Vexatious Litigant Law by Family Court Judges in Child Custody Disputes - Ventura County - Tulare County - Sacramento County - San Mateo County - Santa Clara County - Riverside County - San Francisco County - US District Court for the Northern District of California Judge Jeffrey S. White - US Courts for the Ninth Circuit - 9th Circuit Court of Appeal Class Action for Injunctive and Declaratory ReliefDocumento171 páginasAnswering Brief of Defendants-Appellees: Ronald Pierce et al vs. Chief Justice Tani Cantil-Sakauye Judicial Council Chair and Steven Jahr Judicial Council Administrative Director - Federal Class Action Lawsuit for Alleged Illegal Use of California Vexatious Litigant Law by Family Court Judges in Child Custody Disputes - Ventura County - Tulare County - Sacramento County - San Mateo County - Santa Clara County - Riverside County - San Francisco County - US District Court for the Northern District of California Judge Jeffrey S. White - US Courts for the Ninth Circuit - 9th Circuit Court of Appeal Class Action for Injunctive and Declaratory ReliefCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story Ideas100% (1)

- Property Case DigestsDocumento10 páginasProperty Case DigestsMonica Cajucom100% (6)

- Comparative Study Analysis - An Argumentative PaperDocumento3 páginasComparative Study Analysis - An Argumentative PaperChloie Marie RosalejosAinda não há avaliações

- Commissioner of Internal Revenue v. Dash Engineering Philippines, Inc.Documento3 páginasCommissioner of Internal Revenue v. Dash Engineering Philippines, Inc.Rap PatajoAinda não há avaliações

- 19 People V Madrigal-GonzalesDocumento14 páginas19 People V Madrigal-GonzalesFrench TemplonuevoAinda não há avaliações

- Right To Life and Personal Liberty Under The Constitution of India: A Strive For JusticeDocumento12 páginasRight To Life and Personal Liberty Under The Constitution of India: A Strive For JusticeDIPESH RANJAN DASAinda não há avaliações

- Lim v. People, GR No. 211977, October 12, 2016Documento13 páginasLim v. People, GR No. 211977, October 12, 2016Charmila SiplonAinda não há avaliações

- Rappler, editor guilty cyberlibel businessman articleDocumento3 páginasRappler, editor guilty cyberlibel businessman articletaehyung trash100% (2)

- Culpable Homicide (Section 299 of The Indian Penal Code, 1860)Documento3 páginasCulpable Homicide (Section 299 of The Indian Penal Code, 1860)nikhil pathakAinda não há avaliações

- United States v. Hosea Hampton, 4th Cir. (2011)Documento2 páginasUnited States v. Hosea Hampton, 4th Cir. (2011)Scribd Government DocsAinda não há avaliações

- People Vs VelosDocumento2 páginasPeople Vs VelosCyril FriasAinda não há avaliações

- Visit RelativesDocumento5 páginasVisit RelativesYahring AbdullohAinda não há avaliações