Escolar Documentos

Profissional Documentos

Cultura Documentos

Tax Quick Guide 2010

Enviado por

oberiniDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Tax Quick Guide 2010

Enviado por

oberiniDireitos autorais:

Formatos disponíveis

Quick Guide - amt edits_JOA 12/21/10 9:05 AM Page 3

Journal of Accountancy

Filing Season Quick Guide—Tax Year 2010

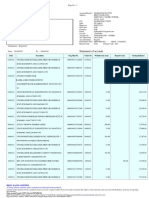

2010 Tax Rate Tables

Single Taxpayers Heads of Household

If Taxable Of the If Taxable Of the

Income Is But Not Amount Income Is But Not Amount

Over Over Tax Is Plus Over Over Over Tax Is Plus Over

$0 $8,375 10% $0 $0 $11,950 10% $0

$8,375 $34,000 $837.50 15% $8,375 $11,950 $45,550 $1,195 15% $11,950

$34,000 $82,400 $4,681.25 25% $34,000 $45,550 $117,650 $6,235 25% $45,550

$82,400 $171,850 $16,781.25 28% $82,400 $117,650 $190,550 $24,260 28% $117,650

$171,850 $373,650 $41,827.25 33% $171,850 $190,550 $373,650 $44,672 33% $190,550

$373,650 $108,421.25 35% $373,650 $373,650 $105,095 35% $373,650

Married Taxpayers Filing Joint Returns

and Surviving Spouses Trusts and Estates

If Taxable Of the If Taxable Of the

Income Is But Not Amount Income Is But Not Amount

Over Over Tax Is Plus Over Over Over Tax Is Plus Over

$0 $16,750 10% $0 $0 $2,300 15% $0

$16,750 $68,000 $1,675 15% $16,750 $2,300 $5,350 $345 25% $2,300

$68,000 $137,300 $9,362.50 25% $68,000 $5,350 $8,200 $1,107.50 28% $5,350

$137,300 $209,250 $26,687.50 28% $137,300 $8,200 $11,200 $1,905.50 33% $8,200

$209,250 $373,650 $46,833.50 33% $209,250 $11,200 $2,895.50 35% $11,200

$373,650 $101,085.50 35% $373,650

Capital Gains Rates

Married Taxpayers Filing Separate Returns ■ For taxpayers in 10% and 15% brackets, long-term capital gains tax rate

is zero.

If Taxable Of the ■ For all other brackets, long-term capital gains tax rate is 15%.

Income Is But Not Amount ■ Maximum unrecaptured section 1250 gain tax rate is 25%.

Over Over Tax Is Plus Over

■ Collectibles gain tax rate is 28%.

$0 $8,375 10% $0

$8,375 $34,000 $837.50 15% $8,375 Self-Employment Tax

■ Self-employment tax rate: 15.3% (12.4% OASDI tax and 2.9% Medicare

$34,000 $68,650 $4,681.25 25% $34,000 tax).

$68,650 $104,625 $13,343.75 28% $68,650 ■ Wage base: OASDI tax is computed on the first $106,800 of income. Max-

$104,625 $186,825 $23,416.75 33% $104,625 imum OASDI tax is $13,243.20.

■ Self-employed individuals who deduct the cost of health insurance for

$186,825 $50,542.75 35% $186,825 themselves and their spouses, dependents, and children under 27 years old

Quick Guide - amt edits_JOA 12/21/10 9:05 AM Page 4

JofA FILING SEASON QUICK GUIDE

as of the end of the tax year can take the deduction into account in calcu- expenses. Phases out between $50,000 and $60,000 AGI for single filers,

lating net earnings from self-employment for purposes of SECA taxes. $100,000 to $120,000 for married taxpayers filing jointly.

■ Section 25C nonbusiness energy property: 30% of sum of qualified en-

Kiddie Tax ergy efficiency improvements and residential energy property expenditures,

Parent’s highest rate applies to child’s unearned income over $1,900. up to $1,500 maximum aggregate credits for 2009 and 2010.

■ Section 25D residential energy-efficient property credit: 30% of amount

Personal Exemption paid for qualifying property (for qualified fuel cell property maximum cred-

■ $3,650

it of $500 for each 0.5 kilowatt of capacity).

■ Personal exemption phaseout rules no longer apply.

■ Small business health insurance credit: 35% of amount of nonelec-

Standard Deduction tive contributions eligible small business makes on behalf of employees for

■ Single taxpayers: $5,700 insurance premiums. Phased out for employers with between 10 and 25

■ Joint filers and surviving spouses: $11,400 employees and average annual wages of between $25,000 and $50,000.

■ Married taxpayers filing separately: $5,700 ($0 if one spouse itemizes

deductions) Saver’s Credit Applicable Percentages

■ Heads of household: $8,400 Applicable

u Additional standard deduction for 65+ and blind taxpayers: Filing Status AGI Percentage

■ Single taxpayers: $1,400 Married filing jointly $0 to $33,500 50%

■ Married filers and surviving spouses: $1,100

$33,500 to $36,000 20%

■ Heads of household: $1,400

u The former $500 standard deduction for state and local real property taxes $36,000 to $55,500 10%

is not available for 2010. Head of household $0 to $25,125 50%

u Standard deduction for individuals who can be claimed as dependents $25,125 to $27,000 20%

cannot exceed greater of $950 or $300 plus individual’s earned income. $27,000 to $41,625 10%

All other filers $0 to $16,750 50%

Itemized Deductions

$16,750 to $18,000 20%

The former Pease limitation on itemized deductions no longer applies; tax-

payers can deduct the full amount of their itemized deductions in 2010. $18,000 to $27,750 10%

Standard Mileage Rate Section 179 and Bonus Depreciation

■ Business standard mileage rate: 50¢ per mile ■ Section 179 expense deduction: $500,000, with $2 million threshold limit

■ Medical transportation standard mileage rate: 16.5¢ ■ Section 168(k) bonus depreciation: Additional 50% first-year deprecia-

■ Charitable standard mileage rate: 14¢ tion for qualifying property

■ For business autos for which the optional business standard mileage rate

is used, depreciation is considered to have been allowed at 23¢ per mile. Retirement Plan Limits

■ Maximum 401(k) plan elective deferral: $16,500

Tax Credits ■ Additional catch-up contributions for age 50+: $5,500

■ Earned income: 45% (percentage for families with three or more qual-

■ Defined benefit plan maximum benefit: $195,000 (may be reduced based

ifying children).

on participant’s age, average compensation or length of plan participation)

■ First-time homebuyer: $8,000 ($4,000 for married taxpayers filing joint-

■ Defined contribution plan contribution limit: $49,000 or 100% of com-

ly); $6,500 for homeowners who have lived in current residence five con-

pensation, whichever is less

secutive years in the past eight. Extended to Sept. 30, 2010 (for binding

contracts in place before May 1, 2010). Phases out for AGI between ■ IRA contribution limit: $5,000 (plus $1,000 catch-up for age 50+)

$125,000 and $145,000 ($225,000 and $245,000 AGI for joint filers). ■ IRA phaseout: AGI from $89,000 to $109,000 (married taxpayers filing

■ Child: $1,000 per qualifying child under 17. Refundable to the extent jointly); $56,000 to $66,000 (single taxpayers, heads of household); $0 to

of 15% of the taxpayer’s earned income in excess of $3,000; qualifying $10,000 (married taxpayers filing separately); $167,000 to $177,000 (non-

child must be the taxpayer’s dependent. Phases out starting with modified active participant whose spouse is an active plan participant)

AGI above $75,000 ($110,000 for joint filers, $55,000 for married filing ■ Roth IRA contribution limit: $5,000 (plus $1,000 catch-up for age 50+)

separately). ■ Roth IRA phaseout: $167,000 to $177,000 (married taxpayers filing joint-

■ Making work pay: Lesser of 6.2% of individual’s earned income or $400 ly); $105,000 to $120,000 (single taxpayers, heads of household); $0 to

($800 for married taxpayers filing jointly). Phased out at a 2% rate for in- $10,000 (married taxpayers filing separately).

dividuals whose modified adjusted gross income exceeds $75,000 ■ SEP minimum required compensation: $550

($150,000 for married taxpayers filing jointly). Reduced by the one-time eco- ■ SEP discriminatory contribution test amount: $245,000

nomic recovery payments of $250 provided by the Veterans Administra- ■ Rollovers allowed from elective deferral plans to Roth-designated ac-

tion, Railroad Retirement Board, and Social Security Administration. counts, effective for distributions made after Sept. 27, 2010.

■ Adoption expense: $13,170 maximum.

■ Child and dependent care: 35% of employment-related expenses (up Gift Tax Exclusions

to $3,000 in expenses for one qualifying individual or $6,000 for two or more ■ Per-donee gift tax exclusion: $13,000

qualifying individuals); credit decreases by 1% for each $2,000 of AGI over ■ Exclusion for transfers to noncitizen spouse: $134,000

$15,000, down to 20%. ■ Gift tax exemption: $1 million

■ American opportunity: $2,500 per year (100% of the first $2,000 of qual-

ifying expenses and 25% of the next $2,000), with 40% of the credit re- AMT Exemption

fundable. Phases out for taxpayers with AGIs between $80,000 and $90,000 ■ $72,450 for married taxpayers filing jointly

($160,000 and $180,000 for married taxpayers filing jointly). ■ $47,450 for single taxpayers and heads of household

■ Lifetime learning: 20% of up to $10,000 of qualified tuition and related ■ $36,225 for married taxpayers filing separately

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Articles of Incorporation SampleDocumento3 páginasArticles of Incorporation SamplePiel Marie AguilarAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Atty. Aileen R. Maglana v. Atty. Jose Vicente R. Opinion, B.B No. 2713Documento16 páginasAtty. Aileen R. Maglana v. Atty. Jose Vicente R. Opinion, B.B No. 2713Ramon Carlo GuicoAinda não há avaliações

- Board of Commissioners V Dela RosaDocumento4 páginasBoard of Commissioners V Dela RosaAnonymous AUdGvY100% (2)

- Ralph Winterowd Interviews Jean Keating, December 12, 2023Documento35 páginasRalph Winterowd Interviews Jean Keating, December 12, 2023eric schmidt100% (2)

- Chapter 7 Intangible AssetsDocumento34 páginasChapter 7 Intangible AssetsHammad Ahmad100% (5)

- PACIFIC ACE FINANCE LTD. (PAFIN) v. EIJI YANAGISAWADocumento17 páginasPACIFIC ACE FINANCE LTD. (PAFIN) v. EIJI YANAGISAWAAnne ObnamiaAinda não há avaliações

- Despiece Upgrade PDFDocumento5 páginasDespiece Upgrade PDFjonbilbaoAinda não há avaliações

- DRRM School Memo and Letter of InvitationDocumento7 páginasDRRM School Memo and Letter of InvitationRames Ely GJAinda não há avaliações

- People v. Calma (Opinion)Documento3 páginasPeople v. Calma (Opinion)Peter Joshua OrtegaAinda não há avaliações

- Tab 82Documento1 páginaTab 82Harshal GavaliAinda não há avaliações

- University of Karachi: (Asoka's Dhamma)Documento6 páginasUniversity of Karachi: (Asoka's Dhamma)Syed Mohsin Mehdi TaqviAinda não há avaliações

- Solvency PPTDocumento1 páginaSolvency PPTRITU SINHA MBA 2019-21 (Kolkata)Ainda não há avaliações

- Vikrant SinghDocumento3 páginasVikrant SinghUtkarshAinda não há avaliações

- Appointment Letter FORMATDocumento3 páginasAppointment Letter FORMATVishal YadavAinda não há avaliações

- Capital InsuranceDocumento8 páginasCapital InsuranceLyn AvestruzAinda não há avaliações

- 135 Enlisted Political Parties With BioDocumento12 páginas135 Enlisted Political Parties With BioRabab RazaAinda não há avaliações

- Gentlemen of The JungleDocumento2 páginasGentlemen of The JungleClydelle Garbino PorrasAinda não há avaliações

- Renter Information Rental Information Charge Information: Biswadeep Das Time ChargesDocumento1 páginaRenter Information Rental Information Charge Information: Biswadeep Das Time ChargesBiswadeep DasAinda não há avaliações

- IT Security Threats Vulnerabilities and CountermeasuresDocumento35 páginasIT Security Threats Vulnerabilities and Countermeasureschristian may noqueraAinda não há avaliações

- Facebook Expose Part 1 of WitnessesDocumento5 páginasFacebook Expose Part 1 of WitnessesByronHubbardAinda não há avaliações

- Juz AmmaDocumento214 páginasJuz AmmaIli Liyana Khairunnisa KamardinAinda não há avaliações

- 1788-10 Series 310 Negative Pressure Glove Box ManualDocumento10 páginas1788-10 Series 310 Negative Pressure Glove Box Manualzivkovic brankoAinda não há avaliações

- What Is A Citizen CharterDocumento6 páginasWhat Is A Citizen CharterGanesh ShindeAinda não há avaliações

- Babylone Convent Bye Laws Chapter 1Documento5 páginasBabylone Convent Bye Laws Chapter 1Karan RajveerAinda não há avaliações

- 101, Shubham Residency, Padmanagar PH ., Hyderabad GSTIN:36AAFCV7646D1Z5 GSTIN/UIN: 36AAFCV7646D1Z5 State Name:, Code: Contact: 9502691234,9930135041Documento8 páginas101, Shubham Residency, Padmanagar PH ., Hyderabad GSTIN:36AAFCV7646D1Z5 GSTIN/UIN: 36AAFCV7646D1Z5 State Name:, Code: Contact: 9502691234,9930135041mrcopy xeroxAinda não há avaliações

- Complaint-Affidavit THE UNDERSIGNED COMPLAINANT Respectfully Alleges: I, MR. NAGOYA, of Legal Age, Filipino, Single, and A Resident of Baguio CityDocumento2 páginasComplaint-Affidavit THE UNDERSIGNED COMPLAINANT Respectfully Alleges: I, MR. NAGOYA, of Legal Age, Filipino, Single, and A Resident of Baguio CityNarz SabangAinda não há avaliações

- Henna Residence BriefDocumento56 páginasHenna Residence BrieffendeysanAinda não há avaliações

- The Industrial Revolution and Its Impact On SocietyDocumento18 páginasThe Industrial Revolution and Its Impact On Societypeteatkinson@gmail.comAinda não há avaliações

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento3 páginasStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceHiten AhirAinda não há avaliações

- Republic of The Philippines Province of Capiz Municipality of DumaraoDocumento2 páginasRepublic of The Philippines Province of Capiz Municipality of DumaraoCHEENY TAMAYO100% (1)