Escolar Documentos

Profissional Documentos

Cultura Documentos

Local Market Trends: The Real Estate Report

Enviado por

susan5458Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Local Market Trends: The Real Estate Report

Enviado por

susan5458Direitos autorais:

Formatos disponíveis

FEBRUARY/MARCH 2011 Susan Strouse, B.S., M.A.

Inside This Issue Strouse Realty Group

American Dream Realty

> LOCAL MARKET TRENDS ..................... 1 5522 Scotts Valley Dr.

> MORTGAGE RATE OUTLOOK ............... 2 Scotts Valley, CA 95066

> HOME STATISTICS .............................. 2 (831) 338-6481

Susan@StrouseRealtyGroup.com

> FORECLOSURE STATS ........................ 3

http://www.StrouseRealtyGroup.com

> CONDO STATISTICS ............................ 3 DRE #01228878

> ANNUAL TABLES ................................. 4

The Real Estate Report

local market trends SANTA CRUZ COUNTY

Trends at a Glance

(Single-family Homes)

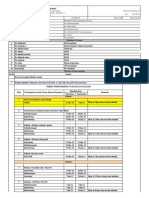

Jan 11 Dec 10 Jan 10

Median Price: $ 450,000 $ 522,500 $ 500,000

Av erage Price: $ 516,371 $ 591,497 $ 578,834

Units Sold: 91 132 90

Home Prices Start Year off Declining Inv entory : 570 573 470

Sale/List Price Ratio: 96.3% 96.6% 98.8%

The median price for single-family, re-sale homes Year-over-year, home inventory was up for the Day s on Market: 81 81 71

in Santa Cruz County was down 10% year-over- eighth month in a row: 21.3%. Day s of Inv entory 188 130 157

year, while the average price dropped 10.8%.

The sales price to list price ratio slipped again last

For complete information on a particular neighbor-

HOME SALES… month, down 0.3 of a point to 96.3%.

hood or property, call.

rose year-over-year, for the first since May. The 91 Pending sales were off for the sixth month in a row:

homes sold represent a 1.1% increase from last 6.6%.

January.

IN THE CONDO MARKET…

SALES MOMENTUM… the median price was up from December, but off

stabilized last month at –13%. 2.5% compared to last January. The average price

Our momentum stats are calculated using a 12- was also up from December, but off 1.7% year-

month moving average to eliminate seasonality. By over-year.

comparing this year’s 12-month moving average to Condos sales fell 50% from December, and were

last year’s, we get a percentage showing market down 4.% year-over-year. This is the third month in

momentum. a row condo sales have been lower than the year

PENDING MOMENTUM… before.

a harbinger of future sales, while still positive, has Pending sales were down for the fifth month in a

also been trending downward. Last month the num- row year-over-year: 26.2%.

ber was +6%, a decline from +8% the month be-

fore. Inventory, on the other hand, increased for the

eighth month in a row: up 30.6% year-over-year.

Remember, the real estate market is a matter of

MORE STATISTICS… neighborhoods and houses. No two are the same.

Santa Cruz County Homes: Sales Momentum

60.0%

40.0%

20.0%

0.0%

0 FMAMJ J ASOND0 FMAMJ J ASOND0 FMAMJ J ASOND0 FMAMJ J ASOND1 FMAMJ J ASOND1

-20.0%

6 7 8 9 0 1

-40.0%

-60.0%

Sales Pending Median © 2010 rereport.com

Susan Strouse, B.S., M.A. | Susan@StrouseRealtyGroup.com | (831) 338-6481

The Real Estate Report

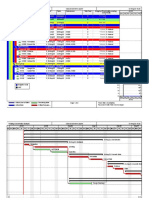

Mortgage Rate Outlook

30-Year Fixed Mortgage Rates Feb. 4 2011 -- HSH.com's overall mortgage tracker -- our sonal outlays increased by 0.7%, driving down the

weekly Fixed-Rate Mortgage Indicator (FRMI) -- savings rate a little to 5.3%. Over the past year, in-

10-10 found that the overall average rate for 30-year fixed- comes have risen by 3.8% while outgo climbed by

07-10 rate mortgages increased by another five basis 4.1%, all without most consumers taking on new

04-10 points, holding now at an average 5.17%. FHA- debt.

01-10 backed 30-year FRMs, a considerable and crucial

10-09 An improving economy is making investors more

part of the first-time homebuying market, moved up

07-09 interested in riskier investments with greater potential

by two more basis points (.02%) to finish the week at

04-09 (i.e. the stock market) at the expense of safe-haven

01-09 4.79%. Borrowers looking for an alternative to the

ones. As such, stock prices are rising and bond

10-08 benchmark 30-year FRM might consider a 5/1 Hybrid

yields are following, and mortgage rates follow bond

07-08 ARM, which is available at an relatively inexpensive

yields to a greater or lesser degree.

04-08 3.83% for the first five years, up three basis points

01-08 from last week. Market conditions make it unsurprising to see a de-

10-07 cline in construction spending. The 2.5% decline in

07-07 We have been seeing an accumulation of improving

outlays for December was across the board, driven

04-07 economic news, some of which suggests that the

01-07 down by a 4.1% decline in residential outlays, a 0.5%

economic gears are starting to become more fully

10-06 slip in commercial spending and a 2.8% did in public

engaged, with a more robust recovery set to bloom

07-06 works projects.

04-06

before too much more time has passed.

01-06 Mortgage rates are expected to move a little higher,

Personal incomes rose by 0.4% in December. Wages

10-05 probably a handful of basis points, perhaps as much

increased by 0.3%, while "transfer payments" in the

07-05 as ten.

04-05 form of government supports and such provided the

01-05 rest of the gain. With the change to Social Security

withholding putting a few more dollars in each pay-

3.0% 4.0% 5.0% 6.0% 7.0% 8.0%

check, some additional spending should occur, pro-

vided rising gasoline prices don't eat all of it up. Per-

The chart above shows the National

monthly average for 30-year fixed

rate mortgages as compiled by

HSH.com. The average includes mort-

gages of all sizes, including conforming, Santa Cruz County Homes - Prices & Sales

"expanded conforming," and jumbo. (3-month moving average—prices in $000's)

$1,000 200

Single-family Home Sales

Median & Average Prices

$900 180

$800 160

$700 140

120

$600

100

$500

80

$400 60

$300 40

$200 20

$100 0

0 FMAMJ J ASOND 0 FMAMJ J ASOND 0 FMAMJ J ASOND 1 FMAMJ J ASOND 1

7 8 9 0 1

Santa Cruz County - January 2011

Single-Family Homes % Change from Year Before

Prices Prices

Cities Median Average Sales Pend Inven DOI SP/LP Med Ave Sales Pend2 Inven

Susan Strouse, B.S., M.A. County $ 450,000 $ 516,371 91 240 570 188 96.3% -10.0% -10.8% 1.1% -6.6% 21.3%

Strouse Realty Group Aptos $ 560,000 $ 491,633 3 9 31 310 98.9% -5.5% -24.4% -50.0% 0.0% -11.4%

American Dream Realty Capitola $ 522,500 $ 522,500 2 3 24 360 97.4% -5.0% -5.3% -33.3% 0.0% 71.4%

5522 Scotts Valley Dr. Rio del Mar $ 689,685 $ 1,005,440 6 14 39 195 92.0% -7.4% 37.5% 20.0% -12.5% -17.0%

Scotts Valley, CA 95066 Seacliff $ 634,000 $ 634,000 1 2 15 450 97.6% -14.3% -44.1% -66.7% -75.0% -11.8%

(831) 338-6481 San Lorenzo Vly $ 307,900 $ 337,520 15 37 82 164 95.9% -5.3% 1.7% -21.1% -28.8% 36.7%

Susan@StrouseRealtyGroup.com Soquel $ 590,000 $ 546,600 5 12 28 168 96.9% -17.8% -23.8% 150.0% 9.1% -3.4%

http://www.StrouseRealtyGroup.com Scotts Valley $ 602,500 $ 651,182 11 26 58 158 95.2% -10.4% -28.6% 10.0% 36.8% 28.9%

DRE #01228878 Santa Cruz $ 542,633 $ 603,912 16 45 137 257 94.4% -12.1% -8.7% 0.0% -16.7% 59.3%

East County $ 335,500 $ 423,869 16 26 65 122 97.4% 8.2% -29.5% 60.0% -3.7% 18.2%

West County $ 718,500 $ 718,500 2 2 15 225 99.4% -20.7% -20.7% 100.0% -50.0% 15.4%

Page 2 Watsonv ille $ 289,000 $ 288,990 10 45 36 108 100.0% 4.1% -0.6% -16.7% 15.4% 100.0%

Susan Strouse, B.S., M.A.

Santa Cruz County Homes: Year-Over-Year Median Price Change Strouse Realty Group

40.0% American Dream Realty

30.0% 5522 Scotts Valley Dr.

20.0% Scotts Valley, CA 95066

10.0% (831) 338-6481

0.0% Susan@StrouseRealtyGroup.com

-10.0% 0 F M A M J J A SON D 0 F M AM J J A S ON D 0 F M AM J J A SON D 1 F M A M J J A SON D 1 http://www.StrouseRealtyGroup.com

-20.0% 7 8 9 0 1 DRE #01228878

-30.0%

-40.0%

-50.0%

FORECLOSURE STATISTICS

Notices of default, the first step in the foreclosure proc- In December, cancellations outweighed the other alter-

ess, in Santa Cruz County declined 25.7% in December natives. There were 52 cancellations, an increase of

from the year before. The 107 notices filed in December 8.3% from last December. That’s a good sign.

were the lowest number filed in the past thirteen

Properties going back-to-bank declined 28%, another

months.

positive sign, while sales to third parties went from

Notices of sale, which set the date and time of an auc- eleven in November to eight in December, but were up

tion, and serve as the homeowner's final notice before from the sole sale in December 2009.

sale, rose 3.5% from November but were down 9.2%

The good news is that the total number of homes that

year-over-year,.

have had a notice of default filed declined by 18.5% in

After the filing of a Notice of Trustee Sale, there are December compared to December 2009.

only three possible outcomes. First, the sale can be

But, the total number of homes scheduled for sale in-

cancelled for reasons that include a successful loan

creased by 1%.

modification or short sale, a filing error, or a legal re-

quirement to re-file the notice after extended postpone- Unfortunately, the number of homes owned by the bank

ments. Alternatively, if the property is taken to sale, the rose 32.2%.

bank will place the opening bid. If a third party, typically

an investor, bids more than the bank's opening bid, the

property will be sold to the third party; if not, it will go

back to the bank and become part of that bank's REO

inventory.

Table Definitions

_______________

Santa Cruz County Condos- Prices & Sales Median Price

(3-month moving average—prices in $000's) The price at which 50% of prices

were higher and 50%were lower.

$700 45

Median & Average Prices

40

$600 Average Price

35

Add all prices and divide by the

Condo Sales

$500 30 number of sales.

25

$400

20 SP/LP

$300 15 Sales price to list price ratio or the

10 price paid for the property divided by

$200 the asking price.

5

$100 0

0 FMAMJ J ASOND 0 FMAMJ J ASOND 0 FMAMJ J ASOND 1 FMAMJ J ASOND 1 DOI

7 8 9 0 1 Days of Inventory, or how many

days it would take to sell all the

property for sale at the current rate

Santa Cruz County - January 2011 of sales.

Condos/Townhomes % Change from Year Before

Prices Prices Pend

Cities Median Average Sales Pend Inven DOI SP/LP Med Ave Sales Pend2 Inven Property under contract to sell that

County $ 304,250 $ 338,618 20 48 192 288 95.3% -2.5% -1.7% -4.8% -26.2% 30.6% hasn’t closed escrow.

Aptos $ 452,500 $ 452,500 2 4 5 75 97.6% 43.7% 43.7% 100.0% 100.0% 25.0%

Capitola $ 245,000 $ 245,000 1 3 18 540 100.0% -69.4% -69.4% 0.0% -70.0% 50.0% Inven

Rio del Mar $ - $ - 0 0 0 0 0.0% n/a n/a n/a n/a n/a Number of properties actively for

Scotts Valley $ 291,000 $ 302,500 4 4 8 60 97.1% n/a n/a n/a n/a n/a sale as of the last day of the month.

Santa Cruz $ 230,688 $ 233,246 3 17 52 520 92.3% -41.6% -40.7% -25.0% -19.0% 0.0%

Watsonv ille $ 194,000 $ 194,000 2 9 21 315 101.0% 7.8% 1.4% -71.4% -47.1% 40.0% Page 3

THE REAL ESTATE REPORT

Santa Cruz County

Susan Strouse, B.S., M.A.

American Dream Realty

5522 Scotts Valley Dr.

Scotts Valley, CA 95066

(831) 338-6481

Susan@StrouseRealtyGroup.com

http://www.StrouseRealtyGroup.com

Go online to see the full report

with the city by city breakdown:

http://www.StrouseRealtyGroup.com

Santa Cruz County Homes: Sales Price/Listing Price Ratio

101%

100%

99%

98%

97%

96%

95%

0 FMAMJ J A SOND 0 FMAMJ J A SOND 0 FMAMJ J A SOND 1 FMAMJ J A SOND 1

7 8 9 0 1

© 2010 rereport.com

Santa Cruz County Homes - Sales, Pending & Days of Inventory

(3-month moving average)

400 500

Peak of buyers Market

350 450

Days of Inventory

400

Sales & Pending

300

350

250 300

200 250

150 200

150

100

100

50 50

0 0

0 FMAMJ J ASOND 0 FMAMJ J ASOND 0 FMAMJ J ASOND 1 FMAMJ J ASOND 1

7 8 9 0 1

This Real Estate Report is published and copyrighted by http://rereport.com.

Information contained herein is deemed accurate and correct, but no warranty is implied or given.

Você também pode gostar

- Allodial TiTle and Land PatentsDocumento7 páginasAllodial TiTle and Land PatentsMike Brown67% (6)

- Bed Bugs - Sample LetterDocumento1 páginaBed Bugs - Sample LetterMegAinda não há avaliações

- Cestui Que Vie 1540Documento2 páginasCestui Que Vie 1540Chemtrails Equals Treason83% (6)

- Tenant electricity bill responsibilitiesDocumento14 páginasTenant electricity bill responsibilitiesNas AyuniAinda não há avaliações

- Curtain Wall Stick SystemDocumento15 páginasCurtain Wall Stick SystemAnonymous PWdOlxY100% (2)

- DEED OF DONATION-Brigada EskwelaDocumento1 páginaDEED OF DONATION-Brigada EskwelaALDRIN OBIAS86% (7)

- Deed of Absolute Sale2Documento34 páginasDeed of Absolute Sale2jimmy_andangAinda não há avaliações

- DBP Vs CADocumento2 páginasDBP Vs CAPaolo BrillantesAinda não há avaliações

- Local Market Trends: The Real Estate ReportDocumento4 páginasLocal Market Trends: The Real Estate ReportSusan StrouseAinda não há avaliações

- Local Market Trends: The Real Estate ReportDocumento4 páginasLocal Market Trends: The Real Estate Reportsusan6276Ainda não há avaliações

- San Mateo County Real Esetate Market Update - Feburary 2011Documento4 páginasSan Mateo County Real Esetate Market Update - Feburary 2011Gwen WangAinda não há avaliações

- Local Market Trends: The Real Estate ReportDocumento4 páginasLocal Market Trends: The Real Estate ReportSusan StrouseAinda não há avaliações

- Local Market Trends: The Real Estate ReportDocumento4 páginasLocal Market Trends: The Real Estate Reportsusan5458Ainda não há avaliações

- Local Market Trends: The Real Estate ReportDocumento4 páginasLocal Market Trends: The Real Estate ReportSusan StrouseAinda não há avaliações

- Yuli Lyman San Mateo County Real Estate Market ReportDocumento4 páginasYuli Lyman San Mateo County Real Estate Market ReportylymanAinda não há avaliações

- Local Market Trends: The Real Estate ReportDocumento4 páginasLocal Market Trends: The Real Estate ReportSusan StrouseAinda não há avaliações

- Santa Clara County Market Update - October 2011Documento4 páginasSanta Clara County Market Update - October 2011Gwen WangAinda não há avaliações

- Monthly New Residential Sales, February 2019Documento5 páginasMonthly New Residential Sales, February 2019Valter SilveiraAinda não há avaliações

- Pacific Grove Real Estate Sales Market Action Report For December 2016Documento4 páginasPacific Grove Real Estate Sales Market Action Report For December 2016Nicole TruszkowskiAinda não há avaliações

- Carmel Highlands Market Action Report For January 2016Documento4 páginasCarmel Highlands Market Action Report For January 2016Nicole TruszkowskiAinda não há avaliações

- Local Market Trends: The Real Estate ReportDocumento4 páginasLocal Market Trends: The Real Estate Reportsusan5458Ainda não há avaliações

- Big Sur Real Estate Sales Market Action Report November 2016Documento4 páginasBig Sur Real Estate Sales Market Action Report November 2016Nicole TruszkowskiAinda não há avaliações

- NHS 23Documento5 páginasNHS 23Dinheirama.comAinda não há avaliações

- Big Sur Real Estate Sales Market Action Report December 2016Documento4 páginasBig Sur Real Estate Sales Market Action Report December 2016Nicole TruszkowskiAinda não há avaliações

- Monthly New Residential Sales, June 2021Documento5 páginasMonthly New Residential Sales, June 2021Abdullah TheAinda não há avaliações

- Big Sur Real Estate Sales Market Action Report For August 2016Documento4 páginasBig Sur Real Estate Sales Market Action Report For August 2016Nicole TruszkowskiAinda não há avaliações

- Carmel Highlands Real Estate Sales Market Action Report For December 2016Documento4 páginasCarmel Highlands Real Estate Sales Market Action Report For December 2016Nicole TruszkowskiAinda não há avaliações

- 78163, TX Real Estate Market Report (May, 2023) PDFDocumento3 páginas78163, TX Real Estate Market Report (May, 2023) PDFDon WrightAinda não há avaliações

- EAL State: Falling Leaves and Falling P#cesDocumento4 páginasEAL State: Falling Leaves and Falling P#cesChad LariscyAinda não há avaliações

- Big Sur Coast Real Estate Sales Market Report For October 2016Documento4 páginasBig Sur Coast Real Estate Sales Market Report For October 2016Nicole TruszkowskiAinda não há avaliações

- Pacific Grove Real Estate Sales Market Report For June 2016Documento4 páginasPacific Grove Real Estate Sales Market Report For June 2016Nicole TruszkowskiAinda não há avaliações

- Monthly New Residential Sales, February 2021Documento5 páginasMonthly New Residential Sales, February 2021Şimal KöseoğluAinda não há avaliações

- Carmel Valley Real Estate Sales Market Action Report November 2016Documento4 páginasCarmel Valley Real Estate Sales Market Action Report November 2016Nicole TruszkowskiAinda não há avaliações

- 2018 01 15 News Release RLDocumento26 páginas2018 01 15 News Release RLapi-125614979Ainda não há avaliações

- Santa Clara County Market Update - November 2011Documento4 páginasSanta Clara County Market Update - November 2011Gwen WangAinda não há avaliações

- Big Sur Real Estate Sales Market Action Report For January 2016Documento4 páginasBig Sur Real Estate Sales Market Action Report For January 2016Nicole TruszkowskiAinda não há avaliações

- Pebble Beach Real Estate Sales Market Action Report For January 2016Documento4 páginasPebble Beach Real Estate Sales Market Action Report For January 2016Nicole TruszkowskiAinda não há avaliações

- Monthly New Residential Sales, February 2023Documento5 páginasMonthly New Residential Sales, February 2023SJ WealthAinda não há avaliações

- Pebble Beach Real Estate Sales Market Report For October 2016Documento4 páginasPebble Beach Real Estate Sales Market Report For October 2016Nicole TruszkowskiAinda não há avaliações

- San Mateo County Market Update - Septemebr 2011Documento4 páginasSan Mateo County Market Update - Septemebr 2011Gwen WangAinda não há avaliações

- Monterey Real Estate Sales Market Action Report For September 2016Documento4 páginasMonterey Real Estate Sales Market Action Report For September 2016Nicole TruszkowskiAinda não há avaliações

- Pebble Beach Real Estate Sales Market Report For November 2016Documento4 páginasPebble Beach Real Estate Sales Market Report For November 2016Nicole TruszkowskiAinda não há avaliações

- Carmel Highlands Real Estate Sales Market Action Report For November 2016Documento4 páginasCarmel Highlands Real Estate Sales Market Action Report For November 2016Nicole TruszkowskiAinda não há avaliações

- Wakefield Reutlinger and Company/Realtors Newsletter November 2010Documento2 páginasWakefield Reutlinger and Company/Realtors Newsletter November 2010Wakefield Reutlinger RealtorsAinda não há avaliações

- MONTHLY NEW RESIDENTIAL SALES/ U.S. Census BureauDocumento5 páginasMONTHLY NEW RESIDENTIAL SALES/ U.S. Census BureauVerónica SilveriAinda não há avaliações

- Pebble Beach Market Action Report For May 2016Documento4 páginasPebble Beach Market Action Report For May 2016Nicole TruszkowskiAinda não há avaliações

- Monterey Market Action Report For January 2016Documento4 páginasMonterey Market Action Report For January 2016Nicole TruszkowskiAinda não há avaliações

- Carmel Highlands Real Estate Sales Market Action Report For March 2016Documento4 páginasCarmel Highlands Real Estate Sales Market Action Report For March 2016Nicole TruszkowskiAinda não há avaliações

- January 2011 Portland Oregon Market Statistics Courtesy of Liste2Sold Andrew BeachDocumento7 páginasJanuary 2011 Portland Oregon Market Statistics Courtesy of Liste2Sold Andrew BeachAndrewBeachAinda não há avaliações

- Carmel Highlands Homes Market Action Report Real Estate Sales For November 2013Documento4 páginasCarmel Highlands Homes Market Action Report Real Estate Sales For November 2013Nicole TruszkowskiAinda não há avaliações

- Carmel Real Estate Sales Market Report For May 2016Documento4 páginasCarmel Real Estate Sales Market Report For May 2016Nicole TruszkowskiAinda não há avaliações

- Residential Review:: A Publication of RMLS, The Source For Real Estate Statistics in Your CommunityDocumento20 páginasResidential Review:: A Publication of RMLS, The Source For Real Estate Statistics in Your Communitywrite4uAinda não há avaliações

- Carmel Highlands Homes Market Action Report Real Estate Sales For December 2013Documento4 páginasCarmel Highlands Homes Market Action Report Real Estate Sales For December 2013Nicole TruszkowskiAinda não há avaliações

- View Market Statistics For Sussex County, Delaware: Text: GALLO To: 87778Documento4 páginasView Market Statistics For Sussex County, Delaware: Text: GALLO To: 87778info3440Ainda não há avaliações

- January 2010 RMLS Market Action Statistics For Portland Oregon Real Estate Presented by Listed Sold Team at Prudential NW PropertiesDocumento7 páginasJanuary 2010 RMLS Market Action Statistics For Portland Oregon Real Estate Presented by Listed Sold Team at Prudential NW PropertiesAndrewBeachAinda não há avaliações

- Carmel Real Estate Sales Market Action Report November 2016Documento4 páginasCarmel Real Estate Sales Market Action Report November 2016Nicole TruszkowskiAinda não há avaliações

- Monterey Real Estate Sales Market Report For June 2016Documento4 páginasMonterey Real Estate Sales Market Report For June 2016Nicole TruszkowskiAinda não há avaliações

- Market History Bucks SingleFamilyDocumento10 páginasMarket History Bucks SingleFamilyDavid SlaughterAinda não há avaliações

- Big Sur Real Estate Sales Market Action Report For March 2016Documento4 páginasBig Sur Real Estate Sales Market Action Report For March 2016Nicole TruszkowskiAinda não há avaliações

- Market Stats For Bethel December 2011Documento4 páginasMarket Stats For Bethel December 2011Donna KuehnAinda não há avaliações

- Carmel Real Estate Sales Market Action Report For December 2016Documento4 páginasCarmel Real Estate Sales Market Action Report For December 2016Nicole TruszkowskiAinda não há avaliações

- Carmel Real Estate Sales Market Action Report For August 2016Documento4 páginasCarmel Real Estate Sales Market Action Report For August 2016Nicole TruszkowskiAinda não há avaliações

- Big Sur Coast Real Estate Sales Market Report For June 2015Documento4 páginasBig Sur Coast Real Estate Sales Market Report For June 2015Nicole TruszkowskiAinda não há avaliações

- Pacific Grove Real Estate Sales Market Action Report For August 2016Documento4 páginasPacific Grove Real Estate Sales Market Action Report For August 2016Nicole TruszkowskiAinda não há avaliações

- Monterey Real Estate Sales Market Report For October 2016Documento4 páginasMonterey Real Estate Sales Market Report For October 2016Nicole TruszkowskiAinda não há avaliações

- Carmel Real Estate Sales Market Report For September 2016Documento4 páginasCarmel Real Estate Sales Market Report For September 2016Nicole TruszkowskiAinda não há avaliações

- Economic & Budget Forecast Workbook: Economic workbook with worksheetNo EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetAinda não há avaliações

- Local Market Trends: The Real Estate ReportDocumento4 páginasLocal Market Trends: The Real Estate Reportsusan5458Ainda não há avaliações

- Local Market Trends: The Real Estate ReportDocumento4 páginasLocal Market Trends: The Real Estate Reportsusan5458Ainda não há avaliações

- Local Market Trends: Phantom Inventory ReduxDocumento4 páginasLocal Market Trends: Phantom Inventory Reduxsusan5458Ainda não há avaliações

- Local Market Trends: The Real Estate ReportDocumento4 páginasLocal Market Trends: The Real Estate Reportsusan5458Ainda não há avaliações

- Local Market Trends: Phantom Inventory ReduxDocumento4 páginasLocal Market Trends: Phantom Inventory Reduxsusan5458Ainda não há avaliações

- RFI Pengiriman CAM (220723)Documento1 páginaRFI Pengiriman CAM (220723)Nafilul HudaahmadAinda não há avaliações

- List by CategoryDocumento81 páginasList by CategoryJhomar Urim RennipskradAinda não há avaliações

- Updated Training Calendar 2021-22Documento1 páginaUpdated Training Calendar 2021-22supriya kumariAinda não há avaliações

- Rent AgreementDocumento2 páginasRent AgreementAnurag JainAinda não há avaliações

- AuthorizationDocumento3 páginasAuthorizationJune Delfino DeluteAinda não há avaliações

- Maintenance Free Exposed and Finished Surfaces RevisedDocumento9 páginasMaintenance Free Exposed and Finished Surfaces RevisedThameez HarishAinda não há avaliações

- Slabs ComputationDocumento13 páginasSlabs ComputationGintokiAinda não há avaliações

- MUGI HOUSE B2 Lease AgreementDocumento6 páginasMUGI HOUSE B2 Lease AgreementstacyAinda não há avaliações

- A Review On Modular Construction For High-Rise Buildings: Building Structures-Arc 652Documento6 páginasA Review On Modular Construction For High-Rise Buildings: Building Structures-Arc 652SUBHIKSHA D 1861738Ainda não há avaliações

- KPDA Directory of Members in Good Standing, 27th October 2021Documento3 páginasKPDA Directory of Members in Good Standing, 27th October 2021BobAinda não há avaliações

- Deed of Absolute Sale of Portion of The LandDocumento5 páginasDeed of Absolute Sale of Portion of The LandgongsilogAinda não há avaliações

- PCAB List of Licensed Contractors For CFY 2017-2018Documento650 páginasPCAB List of Licensed Contractors For CFY 2017-2018Crystal DAinda não há avaliações

- Euclidean ZoningDocumento1 páginaEuclidean Zoningneda1388Ainda não há avaliações

- Co-Owners Deed Of Sale For Undivided PropertyDocumento2 páginasCo-Owners Deed Of Sale For Undivided PropertyruelAinda não há avaliações

- Gordy WelchDocumento1 páginaGordy WelchsiegelgallagherAinda não há avaliações

- "Rohan Square ": Members PresentDocumento26 páginas"Rohan Square ": Members PresentPon Malai KrishAinda não há avaliações

- 2012 PM Summit Jamie Woodwell MBA Multifamily Market DynamicsDocumento36 páginas2012 PM Summit Jamie Woodwell MBA Multifamily Market DynamicsRahul PatelAinda não há avaliações

- Master Spec - Reference 1Documento37 páginasMaster Spec - Reference 1Jayson100% (1)

- ScheduleDocumento2 páginasScheduleMukul BhattaraiAinda não há avaliações

- Land Law Tutorial 3 - Land Law Tutorial 3Documento25 páginasLand Law Tutorial 3 - Land Law Tutorial 3YASMIN HUMAIRA BINTI ASZAHAM UnknownAinda não há avaliações

- Absolute Sale Deed 130sqm PropertyDocumento5 páginasAbsolute Sale Deed 130sqm PropertyAJ FHAinda não há avaliações

- Glossary DL - IfADocumento23 páginasGlossary DL - IfAJerry SerapionAinda não há avaliações