Escolar Documentos

Profissional Documentos

Cultura Documentos

Re Remics

Enviado por

Feng WangDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Re Remics

Enviado por

Feng WangDireitos autorais:

Formatos disponíveis

Volume 4, Issue 30, July 28, 2008

Claire Mezzanotte

Managing Director, ABS/RMBS

A CLOSER LOOK AT RATING TRIPLE-A RE-REMICS

U.S. Structured Finance, In the June 16, 2008, U.S. Structured Finance Newsletter, DBRS introduced the concept of RMBS re-

+1 212 806 3272 securitization (Re-REMIC) as a restructuring tool. This newsletter addresses how such restructuring differs

cmezzanotte@dbrs.com

from a Collateralized Debt Obligation (CDO) and provides a closer look at DBRS’s approach in analyzing

Jan Buckler these transactions.

Senior Vice President,

Research and Modeling

Typically, a Re-REMIC is viewed as a pass-through of interest, principal and losses from one or more

U.S. Structured Finance

+1 212 806 3925 underlying certificates to a newly-created Re-REMIC trust. Recent Re-REMICs, frequently backed by

jbuckler@dbrs.com AAA-rated underlying certificates, often employ a simple A/B (or senior/subordination) structure, with

David Hartung Class B providing additional credit enhancement (CE) to Class A via subordination. The B class is designed

Senior Vice President, ABS to protect the A class if the underlying REMIC bond experiences write-downs that exceed its original AAA

U.S. Structured Finance

+1 212 806 3269

CE. The recent surge in re-securitization is driven by the desire to create securities with increased credit

dhartung@dbrs.com support to ensure rating stability and improved liquidity.

Quincy Tang Currently, a frequent topic of discussion among market participants is how rating a AAA Re-REMIC differs

Senior Vice President, RMBS

U.S. Structured Finance

from that of a CDO. Unlike a traditional RMBS CDO in which the ratings of the CDO classes were highly

+1 212 806 3256 dependent on the ratings of the pledged RMBS bonds (often lower-rated BBBs), DBRS gives no

qtang@dbrs.com consideration to the ratings of the underlying certificates in its Re-REMIC analysis. Instead, DBRS re-rates

Kathleen Tillwitz each underlying bond through a credit and cash flow analysis. As a result, each Re-REMIC class may only

Senior Vice President, be eligible for a AAA rating if the class does not suffer any principal write-downs and interest shortfalls

Operational Risk

U.S. Structured Finance after applying the expected losses and cash flow assumptions under DBRS’s AAA rating stresses.

+1 212 806 3265

ktillwitz@dbrs.com DBRS’s analysis indicates that a Re-REMIC generally creates less dollar-for-dollar AAA rating issuance as

a result of the re-tranching (see example in Graph 1 below). In other words, the resulting Class B often

carries a lower rating (generally from “A” to “BBB”) than the underlying REMIC certificate (originally

Toronto AAA-rated). Further, DBRS does not give any diversity benefit to Re-REMICs of more than one

DBRS Tower

181 University Avenue underlying class. On the contrary, DBRS may apply diversity penalties to Re-REMICs consisting of

Suite 700 multiple underlying bonds from a single originator or vintage.

Toronto, ON M5H 3M7

+1 416 593 5577

New York

140 Broadway, 35th Floor

New York, NY 10005

+1 212 806 3277

Chicago

101 North Wacker Drive

Suite 100

Chicago, IL 60606

+1 312 332 3429

DBRS has rated AAA Re-REMICs in both sequential and pro rata pay structures. The sizing of Class A is

highly dependent on the pay structure. In a sequential pay, Class B does not receive any principal until the

Class A is paid in full; this ensures increasing credit support for Class A. In a pro rata structure, Class B

pays down concurrently with Class A, which results in an erosion of support for Class A, and therefore

requires a much larger Class B size as credit enhancement. Graph 1 depicts the sizing difference for a

typical sequential and pro rata structure backed by the same underlying AAA certificate. In addition, DBRS

uses Intex to apply dynamic cash flow assumptions (i.e., fast/slow prepayment speeds, up/downward

interest rates stresses) to achieve the most conservative ratings for both Re-REMIC classes.

DBRS’s Re-REMIC approach is an extension of its standard rating methodology available at

www.dbrs.com, which includes a review of collateral quality through a default frequency and loss severity

analysis on each underlying deal, cash flow modeling, operational risk assessment and legal structure.

For more information on the process used by DBRS to analyze Re-REMICs, please contact Quincy Tang at

qtang@dbrs.com, Bernard Maas at bmaas@dbrs.com or Sagar Kongettira at skongettira@dbrs.com.

Please refer to www.dbrs.com for DBRS’s Privacy Policy, Disclaimers, Proprietary Rights, Terms and Conditions of Use.To stop receiving these mailings, please send

an e-mail to dbrs_sf-unsubscribe@news.dbrs.info with “unsubscribe” in the subject line.

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Passage of HJR 192 PDFDocumento3 páginasThe Passage of HJR 192 PDFKeith Muhammad: BeyAinda não há avaliações

- Bond Spreads - Leading Indicator For CurrenciesDocumento6 páginasBond Spreads - Leading Indicator For CurrenciesanandAinda não há avaliações

- Private Placement & Venture CapitalDocumento18 páginasPrivate Placement & Venture Capitalshraddha mehtaAinda não há avaliações

- Dossier Marketfinal-2Documento30 páginasDossier Marketfinal-2Tiri WuAinda não há avaliações

- Rolling IndustriesDocumento11 páginasRolling IndustriesPoen, Chris ChouAinda não há avaliações

- Company Final Accounts - ProblemsDocumento5 páginasCompany Final Accounts - ProblemsDhinesh0% (1)

- A Study On HDFC Mutual FundDocumento88 páginasA Study On HDFC Mutual FundSagar Paul'gAinda não há avaliações

- Singapore-Listed DMX Technologies Attracts S$183.1m Capital Investment by Tokyo-Listed KDDI CorporationDocumento3 páginasSingapore-Listed DMX Technologies Attracts S$183.1m Capital Investment by Tokyo-Listed KDDI CorporationWeR1 Consultants Pte LtdAinda não há avaliações

- York, 15 Justice Frankfurter, After Referring To It As An 1, Unfortunate Remark Characterized It As "ADocumento20 páginasYork, 15 Justice Frankfurter, After Referring To It As An 1, Unfortunate Remark Characterized It As "AShaiAinda não há avaliações

- Standalone Balance Sheet (Tata Motors) : AssetsDocumento43 páginasStandalone Balance Sheet (Tata Motors) : AssetsAniketAinda não há avaliações

- PPL Cup DifficultDocumento8 páginasPPL Cup DifficultRukia Kuchiki100% (1)

- Problems and QuestionsDocumento5 páginasProblems and Questionsmashta04Ainda não há avaliações

- Mini Case - Chapter 14Documento8 páginasMini Case - Chapter 14Jennifer Johnson100% (1)

- Gems and JewelsDocumento2 páginasGems and JewelskritinigamAinda não há avaliações

- Sanmit Ahuja Expert Member Cganga - Centre For Ganga River Basin Management & StudiesDocumento24 páginasSanmit Ahuja Expert Member Cganga - Centre For Ganga River Basin Management & StudiesSid KaulAinda não há avaliações

- Relationship Between GDP, Inflation and MonopolyDocumento3 páginasRelationship Between GDP, Inflation and MonopolyDeepti VermaAinda não há avaliações

- Cadbury Poland CaseDocumento2 páginasCadbury Poland CaseWint Wah Hlaing0% (1)

- The Relationship Between Brand Image and Purchase Intention Evidence From Award Winning Mutual FundsDocumento15 páginasThe Relationship Between Brand Image and Purchase Intention Evidence From Award Winning Mutual FundsjoannakamAinda não há avaliações

- Lesson 4 - Statement of Cash Flows Ch23Documento65 páginasLesson 4 - Statement of Cash Flows Ch23zhart1921Ainda não há avaliações

- Rit2 - RTD - Rit RTD DocumentationDocumento5 páginasRit2 - RTD - Rit RTD DocumentationhiyogiyoAinda não há avaliações

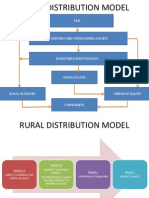

- Hul Distribution ModelDocumento5 páginasHul Distribution ModelBhavik LodhaAinda não há avaliações

- Transitional Living Program For Young AdultsDocumento5 páginasTransitional Living Program For Young AdultsBrian HaraAinda não há avaliações

- Financial Management Notebook 1Documento14 páginasFinancial Management Notebook 1ngocmytrieuAinda não há avaliações

- Industry Profile: Automobile Industry at Global LevelDocumento21 páginasIndustry Profile: Automobile Industry at Global LevelTanzim VankaniAinda não há avaliações

- WiproDocumento11 páginasWiproUnknown XyzAinda não há avaliações

- Westminsterresearch: Eva and Shareholder Value Creation: An Empirical Study Wajeeh ElaliDocumento195 páginasWestminsterresearch: Eva and Shareholder Value Creation: An Empirical Study Wajeeh Elalijafar11Ainda não há avaliações

- Lecture 1 - Introduction To BankingDocumento23 páginasLecture 1 - Introduction To BankingLeyli MelikovaAinda não há avaliações

- A STUDY ON RATIO ANALYSIS OF SundaramDocumento64 páginasA STUDY ON RATIO ANALYSIS OF SundaramDivyansh VermaAinda não há avaliações

- Weekly UAS Manacc TUTORKU (Answered)Documento8 páginasWeekly UAS Manacc TUTORKU (Answered)Della BianchiAinda não há avaliações

- Chartered Financial Analyst: Us Cfa®Documento14 páginasChartered Financial Analyst: Us Cfa®Amit ManyalAinda não há avaliações