Escolar Documentos

Profissional Documentos

Cultura Documentos

American Home Product Corporation

Enviado por

Jinming XingDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

American Home Product Corporation

Enviado por

Jinming XingDireitos autorais:

Formatos disponíveis

American Home Product Corporation (AHP), a highly growing American

company, has four business lines: prescription drugs, packaged drugs, food

products, housewares and household products. For a quite long time, AHP has

applied a tight financial control and maintained an aggressive capital structure

policy. Its mission is to make money for its stockholders and to maximize profits

by minimizing costs. It has been able to finance internally its growth while paying

a very high portion of its earning to its shareholders (60%).

Currently, AHP seems to have no business risk but may face a certain risk in the

long run. Based on the ratios shown on the attached sheet, AHP should not worry

about business risk since its working capital is very healthy ($1472.8 million) and

cash excess $233 million. The high ROA, high profit margin, low current-to-asset

ration and 49.71 collection days show that AHP can generate cash quickly, thus it

can maintain current high growth rate. However, its decreasing annual sales

growth from 14.1% in 1978 to 8.8% in 1981 (exhibit 1) shows that it faces future

risk of losing market shares in all its business lines if it does not foresee

competition and continue to focus on increasing stockholders’ value.

AHP’s current financial performance is very good since it has high ROE (30.3),

high quick ratio (42.68), low debt-to-equity ratio (0.09) and low debt-to-asset

ratio (0.01). However, the pro forma of different debt ratios show that if AHP

increases debt ratio, it will face a financial risk of increased debt-to-equity and

debt-to-asset ratios. In other words, it will face solvency problems in long terms.

AHP also face liquidity problems since the quick ratios decrease when the debt

ratios increase.

In contrast, shareholders’ value increases when debt ratios increase. EPS

increases from $3.18 to $3.49. The dividend payout ratio also increases from

0.597 to 0.602. Similarly, the dividend yield from 0.063 to 0.070. It seems that

the company can increase shareholders’ value by increasing debt ratios.

Even though AHP has a very good current financial performance, it should

change the financial policy to increase debt ratio at a certain level. To meet the

goal of increasing shareholders’ value, AHP should not use its excess cash flow to

repurchase its stocks because this is only a temporary solution and may generate

serious financial problems in the long run. Instead, AHP should use this excess

cash to invest in profitable projects to improve its current products and launch

new products that meet current market demands. By doing so, AHP can

minimize the business risk, prepare itself for competition and increase sales

growth. On the other hands, AHP should increase debt ratio to a certain level that

is suitable for its business to increase shareholders’ value. This solution does not

bring financial risk to AHP but enable it to minimize business risk. If AHP only

concerns about how to increase shareholders’ value and ignores market threats, it

might lose its business to its competitors.

Você também pode gostar

- Hca FMDocumento40 páginasHca FMankit_shah_24100% (2)

- American Home ProductsDocumento6 páginasAmerican Home Productsabhinav_capoor0% (1)

- Is GMA 7 UnderleveragedDocumento7 páginasIs GMA 7 UnderleveragedRalph Julius VillanuevaAinda não há avaliações

- Alvio AnalysisDocumento5 páginasAlvio AnalysisPriyam AgarwalAinda não há avaliações

- Hospital Corporation CaseDocumento6 páginasHospital Corporation CaseRithika Baruah100% (3)

- American Home ProductsDocumento3 páginasAmerican Home ProductsRoy Anthony VenturaAinda não há avaliações

- 3 Dividend Plays With Sky-High Returns: Special ReportDocumento13 páginas3 Dividend Plays With Sky-High Returns: Special ReportRobert SloaneAinda não há avaliações

- Case Study On Hospital Corporation of AmericaDocumento40 páginasCase Study On Hospital Corporation of AmericaEduardo BautistaAinda não há avaliações

- M Lo Blanco Newsletter November 2019Documento5 páginasM Lo Blanco Newsletter November 2019carminatAinda não há avaliações

- Ratio InterpretationDocumento1 páginaRatio Interpretationjanuaryjanuary1203Ainda não há avaliações

- Summary Ross Chapter 4Documento5 páginasSummary Ross Chapter 4Akun 19 LKSAinda não há avaliações

- BBBY Case ExerciseDocumento7 páginasBBBY Case ExerciseSue McGinnisAinda não há avaliações

- Corporate Financial Mastering: Simple Methods and Strategies to Financial Analysis MasteringNo EverandCorporate Financial Mastering: Simple Methods and Strategies to Financial Analysis MasteringAinda não há avaliações

- The Shareholder Value Triple PlayDocumento12 páginasThe Shareholder Value Triple PlayJohn evansAinda não há avaliações

- Americanhomeproductscorporation Copy 120509004239 Phpapp02Documento6 páginasAmericanhomeproductscorporation Copy 120509004239 Phpapp02Tanmay Mehta100% (1)

- PDFDocumento8 páginasPDFSamantha Marie ArevaloAinda não há avaliações

- 1determine A FirmDocumento50 páginas1determine A FirmCHATURIKA priyadarshaniAinda não há avaliações

- A Complete Supplement Store Business Plan: A Key Part Of How To Start A Supplement & Health StoreNo EverandA Complete Supplement Store Business Plan: A Key Part Of How To Start A Supplement & Health StoreAinda não há avaliações

- Corporate Finance - Hill Country Snack FoodDocumento11 páginasCorporate Finance - Hill Country Snack FoodNell MizunoAinda não há avaliações

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)Ainda não há avaliações

- Hill Country Snack Foods Case AnalysisDocumento5 páginasHill Country Snack Foods Case Analysisdivakar62Ainda não há avaliações

- Analiza Premierfoods - Dec11Documento3 páginasAnaliza Premierfoods - Dec11Tudor OprisorAinda não há avaliações

- Hutchison Whampoa Case ReportDocumento6 páginasHutchison Whampoa Case ReporttsjakabAinda não há avaliações

- Avon Products Inc - 2009Documento22 páginasAvon Products Inc - 2009Charisse L. SarateAinda não há avaliações

- The Hutchinson Whampoa Case - CLASS 18, BINDING BONDS Marco PattiDocumento5 páginasThe Hutchinson Whampoa Case - CLASS 18, BINDING BONDS Marco PattiMarco PattiAinda não há avaliações

- 9 Acciones de Rápido Crecimiento - AP 16-02-11Documento13 páginas9 Acciones de Rápido Crecimiento - AP 16-02-11Mauricio ZvikAinda não há avaliações

- Diageo CaseDocumento5 páginasDiageo CaseMeena67% (9)

- A) Johnson Baby Johnson: EquityDocumento14 páginasA) Johnson Baby Johnson: EquityRnD Team BAinda não há avaliações

- Diageo Case Write UpDocumento10 páginasDiageo Case Write UpAmandeep AroraAinda não há avaliações

- Case: Debt Policy at UST Inc. - Protagonist: Vincent GiererDocumento2 páginasCase: Debt Policy at UST Inc. - Protagonist: Vincent GiererSu_NeilAinda não há avaliações

- Submitted by Ramesh Babu Sadda (2895538) : Word Count: 2800Documento18 páginasSubmitted by Ramesh Babu Sadda (2895538) : Word Count: 2800Ramesh BabuAinda não há avaliações

- Case Study #2: Growing PainsDocumento13 páginasCase Study #2: Growing PainsTricia Ann Jungco Maquirang100% (1)

- A Complete Pest Control Business Plan: To Start with Little to No MoneyNo EverandA Complete Pest Control Business Plan: To Start with Little to No MoneyAinda não há avaliações

- ABC Healthcare Corporation 2Documento7 páginasABC Healthcare Corporation 2NAUGHTYAinda não há avaliações

- Rosario Acero S.A Case Study SolutionDocumento3 páginasRosario Acero S.A Case Study SolutionMrittika SahaAinda não há avaliações

- Hill Country CaseDocumento5 páginasHill Country CaseDeepansh Kakkar100% (1)

- BB Strategies For GrowthDocumento8 páginasBB Strategies For GrowthGustavo MicheliniAinda não há avaliações

- DR Lal Pathlabs LTD - Samplestudy - ElearnMarketDocumento33 páginasDR Lal Pathlabs LTD - Samplestudy - ElearnMarketNarendraDugarAinda não há avaliações

- Fa FinalDocumento2 páginasFa FinalMohammad Sameed ZaheerAinda não há avaliações

- Final Project Strategic Management and PolicyDocumento10 páginasFinal Project Strategic Management and PolicyBushra ImranAinda não há avaliações

- The Case of The Unidentified Industries 1995Documento5 páginasThe Case of The Unidentified Industries 1995Hassan MohiuddinAinda não há avaliações

- 6 Financial Planning and ForecastingDocumento68 páginas6 Financial Planning and ForecastingKieth GomezAinda não há avaliações

- Pacific Grove Spice Company Case Write UpDocumento3 páginasPacific Grove Spice Company Case Write UpVaishnavi Gnanasekaran100% (4)

- 9th JanDocumento6 páginas9th JanmiaAinda não há avaliações

- Computerisation of A Police Department in Aswi Case Study AnalysisDocumento8 páginasComputerisation of A Police Department in Aswi Case Study AnalysisSyed Huzayfah Faisal0% (1)

- Ratio Analysis of P GDocumento8 páginasRatio Analysis of P GSelebriti Takaful PerakAinda não há avaliações

- RiskDocumento15 páginasRiskNiraj Arun ThakkarAinda não há avaliações

- Liberty Medical Group Detailed Ratio Analysis - Two-Year ComparisonDocumento10 páginasLiberty Medical Group Detailed Ratio Analysis - Two-Year ComparisonthrowawayyyAinda não há avaliações

- 8.scrutiniztion of The Auditors Report, Notes To Account, Significant Accounting Policies &various Schedules & AnnexuresDocumento28 páginas8.scrutiniztion of The Auditors Report, Notes To Account, Significant Accounting Policies &various Schedules & AnnexuresNeeraj BhartiAinda não há avaliações

- Soapbox Whirlpool VFINALDocumento15 páginasSoapbox Whirlpool VFINALAnonymous Ecd8rCAinda não há avaliações

- FM Cia 3Documento6 páginasFM Cia 3Priyanshu ChhabariaAinda não há avaliações

- Johnson Turnaround (Case Study)Documento10 páginasJohnson Turnaround (Case Study)angelAinda não há avaliações

- Burget Paints Financial Report Summary and InsightsDocumento5 páginasBurget Paints Financial Report Summary and InsightscoolAinda não há avaliações

- Capital Structure and Leverage Quiz # 3Documento4 páginasCapital Structure and Leverage Quiz # 3Maurice Hanellete EspirituAinda não há avaliações

- The Importance of Book ValueDocumento4 páginasThe Importance of Book ValuelowbankAinda não há avaliações

- Accounting Control Research TaskDocumento12 páginasAccounting Control Research TaskAgamdeep SinghAinda não há avaliações

- ACC - ACF1200 Topic 6 SOLUTIONS To Questions For Self-StudyDocumento3 páginasACC - ACF1200 Topic 6 SOLUTIONS To Questions For Self-StudyChuangjia MaAinda não há avaliações

- SA Case StudyDocumento6 páginasSA Case StudyKanika MaheshwariAinda não há avaliações

- ThaneDocumento2 páginasThaneAkansha KhaitanAinda não há avaliações

- Fire Technical Examples DIFT No 30Documento27 páginasFire Technical Examples DIFT No 30Daniela HanekováAinda não há avaliações

- Activity Evaluation Form: "Where Children Come First"Documento1 páginaActivity Evaluation Form: "Where Children Come First"TuTitAinda não há avaliações

- Chem Resist ChartDocumento13 páginasChem Resist ChartRC LandaAinda não há avaliações

- Object-Oriented Design Patterns in The Kernel, Part 2 (LWN - Net)Documento15 páginasObject-Oriented Design Patterns in The Kernel, Part 2 (LWN - Net)Rishabh MalikAinda não há avaliações

- En 50124 1 2001Documento62 páginasEn 50124 1 2001Vivek Kumar BhandariAinda não há avaliações

- Villamaria JR Vs CADocumento2 páginasVillamaria JR Vs CAClarissa SawaliAinda não há avaliações

- Vedic Maths Edited 2Documento9 páginasVedic Maths Edited 2sriram AAinda não há avaliações

- Dialog+ SW9xx - SM - Chapter 7 - 2-2013 - EN - Rinsing Bridge Version 5Documento1 páginaDialog+ SW9xx - SM - Chapter 7 - 2-2013 - EN - Rinsing Bridge Version 5Al ImranAinda não há avaliações

- Business CombinationsDocumento18 páginasBusiness Combinationszubair afzalAinda não há avaliações

- Chap9 PDFDocumento144 páginasChap9 PDFSwe Zin Zaw MyintAinda não há avaliações

- Taylor Et Al v. Acxiom Corporation Et Al - Document No. 91Documento40 páginasTaylor Et Al v. Acxiom Corporation Et Al - Document No. 91Justia.comAinda não há avaliações

- War at Sea Clarifications Aug 10Documento4 páginasWar at Sea Clarifications Aug 10jdageeAinda não há avaliações

- Chapter Three: Tools For Exploring The World: Physical, Perceptual, and Motor DevelopmentDocumento43 páginasChapter Three: Tools For Exploring The World: Physical, Perceptual, and Motor DevelopmentHsieh Yun JuAinda não há avaliações

- Manual Samsung Galaxy S Duos GT-S7562Documento151 páginasManual Samsung Galaxy S Duos GT-S7562montesjjAinda não há avaliações

- Estate TaxDocumento10 páginasEstate TaxCharrie Grace PabloAinda não há avaliações

- Distribution BoardDocumento7 páginasDistribution BoardmuralichandrasekarAinda não há avaliações

- BECIL Registration Portal: How To ApplyDocumento2 páginasBECIL Registration Portal: How To ApplySoul BeatsAinda não há avaliações

- Nuclear Power Engineering (MEE 2027) : Fall Semester (2020-2021)Documento13 páginasNuclear Power Engineering (MEE 2027) : Fall Semester (2020-2021)AllAinda não há avaliações

- Practical Cs Xii Mysql 2022-23 FinalDocumento9 páginasPractical Cs Xii Mysql 2022-23 FinalHimanshu GuptaAinda não há avaliações

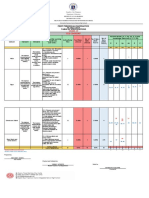

- Revised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10Documento6 páginasRevised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10May Ann GuintoAinda não há avaliações

- TMPRO CASABE 1318 Ecopetrol Full ReportDocumento55 páginasTMPRO CASABE 1318 Ecopetrol Full ReportDiego CastilloAinda não há avaliações

- Ac221 and Ac211 CourseoutlineDocumento10 páginasAc221 and Ac211 CourseoutlineLouis Maps MapangaAinda não há avaliações

- Meriam Mfc4150 ManDocumento40 páginasMeriam Mfc4150 Manwajahatrafiq6607Ainda não há avaliações

- Mitsubishi FanDocumento2 páginasMitsubishi FanKyaw ZawAinda não há avaliações

- Planning EngineerDocumento1 páginaPlanning EngineerChijioke ObiAinda não há avaliações

- Discovery and Integration Content Guide - General ReferenceDocumento37 páginasDiscovery and Integration Content Guide - General ReferencerhocuttAinda não há avaliações

- IIM L: 111iiiiiiiDocumento54 páginasIIM L: 111iiiiiiiJavier GonzalezAinda não há avaliações

- Lateritic NickelDocumento27 páginasLateritic NickelRAVI1972100% (2)

- Information Technology Project Management: by Jack T. MarchewkaDocumento44 páginasInformation Technology Project Management: by Jack T. Marchewkadeeps0705Ainda não há avaliações