Escolar Documentos

Profissional Documentos

Cultura Documentos

Citigroup Open Bank Assistance Unredacted FDIC Minutes From 23 Nov 2008 (Lawsuit #2)

Enviado por

Vern McKinleyTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Citigroup Open Bank Assistance Unredacted FDIC Minutes From 23 Nov 2008 (Lawsuit #2)

Enviado por

Vern McKinleyDireitos autorais:

Formatos disponíveis

56617

Minutes

of

The Meet ing of the Board of Directors

of the

Federal Deposit Insurance Corporation

By Conference Call

Closed to Public Observation

November 23, 2008 - 10: 04 P.M.

At 10:04 p.m. on Sunday, November 23, 2008, the Chairman

called a special meeting of the Board of Directors of the

Federal Deposit Insurance Corporation which was held by means of

a telephone conference call.

Sheila C. Bair, Chairman of the Board of Directors;

Martin J. Gruenberg, Vice Chairman of the Board of Directors;

Thomas J. Curry, Director (Appointive); John C. Dugan, Director

(Comptroller of the Currency); John M. Reich, Director

(Director, Office of Thrift Supervision); John F. Bovenzi,

Deputy to the Chairman and Chief Operating Officer; Steven o.

App, Deputy to the Chairman and Chief Financial Officer;

Jason C. Cave, Acting Deputy to the Chairman; Jesse o.

Villarreal, Chief of Staff; Michael H. Krimminger, Special

Advisor for Policy, Office of the Chairman; Barbara A. Ryan,

Deputy to the Vice Chairman; Lisa K. Roy, Deputy to the Director

(Appointive); William A. Rowe, III, Deputy to the Director

(Comptroller of the Currency); Claude A. Rollin, Deputy to the

Director (Director, Office of Thrift Supervision); John V.

Thomas, Acting General Counsel; Sandra L. Thompson, Director,

Division of Supervision and Consumer Protection; Arthur J.

Murton, Director , Division of Insurance and Research;

Mitchell L. Glassman, Director, Division of Resolutions and

Receiverships; Eric J. Spitler, Director, Office of Legislative

Affairs; Andrew S. Gray, Director, Office of Public Affairs; and

Robert E. Feldman, Executive Secretary, participated in the

meeting.

Also participating in the meeting were: Christopher J.

Spoth, John M. Lane, Serena L. Owens, John H. Corston,

56618

Patricia A. Colohan, Pete D. Hirsch, Marc Steckel, and Christine

Grum, from the Division of Supervision and Consumer Protection;

Richard T. Aboussie, David N. Wall, and Mark G. Flanigan, from

the Legal Division; Diane L. Ellis, Miguel D. Browne,

Christopher J. Newbury, and Matthew Green, from the Division of

Insurance and Research; James R. Wigand and Herbert J. Held,

from the Division of Resolutions and Receiverships; Tiffany K.

Froman, from the Division of Information Technology; and

Alice C. Goodman, from the Office of Legislative Affairs.

Julie L. Williams, First Senior Deputy Comptroller and

Chief Counsel; and Douglas W. Roeder, Senior Deputy Comptroller,

Large Bank Supervision, Office of the Comptroller of the

Currency, also participated in the meeting.

Chairman Bair presided at the meeting; Mr. Feldman acted as

Secretary of the meet ing .

Chairman Bair called the meeting to order. Vice Chairman

Gruenberg then moved that the Board of Directors determine that

Corporation business required its consideration of the matters

which were to be the subj ect of the meeting on less than seven

days' notice to the public; that no earlier notice of the

meeting was practicable; that the public interest did not

require consideration of the matters which were to be the

subject of the meeting in a meeting open to public observation;

and that the matters could be considered in a meeting closed to

public observation by authority of subsections (c) (4), (c) (B) ,

(c) (9) (A) (ii), and (c) (9) (B) of the "Government in the Sunshine

Act" (5 U.S.C. 552b( (c) (4), (c) (B), (9) (A) (ii), and (c) (9) (B)) .

Chairman Bair seconded the motion and, with Director Reich,

Director Curry, and Director Dugan concurring, the motion was

carried.

James R. Wigand, Deputy Director, Franchise and Asset

Marketing Branch, Division of Resolutions and Receiverships

("DRR"), presented to the Board staff's recommendation that the

Board find that the failure of Citigroup Inc. ("Citigroup") and its

insured affiliate banks and thrifts would have serious adverse

effects on domestic and international economic conditions and

financial stability and that Citigroup's failure would seriously

and negatively affect already disrupted credit markets, including

short-term interbank lending, counterparty relationships in

Qualified Financial Contract markets, and bank senior and

subordinated debt markets, and would further disrupt the related

markets in deri vati ve products and other markets. Therefore,

stated Mr. Wigand, staff was further recommending that the Board

November 23, 200B (Closed)

56619

make a systemic risk determination and authorize staff to take

necessary steps to implement the provision of Corporation

assistance to Citigroup in the manner he would outline to the

Board. Mr. Wigand informed the Board that, based on preliminary

information, staff estimates no loss to the Deposit Insurance Fud

as a result of the recommended assistance.

Mr. Wigand continued, stating that, in order to prevent the

foregoing systemic risks, staff was recommending that the Board

authorize the Corporation to enter into a transaction to provide

for shared loss coverage on a designated pool of assets

approximately $306 billion in size, along with the U. S. Department

of the Treasury's ("Treasury") Troubled Asset Relief Program

("TARP"), with the Corporation's potential loss protected by the

issuance of preferred stock by Citigroup. He added that the

Corporation and the TARP will provide guarantees on certain

residential assets for 10 years and certain other assets for a

period of 5 years. The Corporation, he said, will be exposed to

loss only after Citigroup absorbs the first $37 billion in losses

and the TARP absorbs the next $5 billion in losses. Mr. Wigand

stated that the Corporation's loss share will be capped at $10

billion and it will receive compensation in the form of $3 billion

in preferred stock. In addition, he said, the Board of Governors

of the Federal Reserve System ("Federal Reserve") will provide

certain financing secured, in part, by assets in a portfolio of

consumer and commercial loans designated by the Corporation,

Treasury, and the Federal Reserve (coli ect i vel y, the "Agenc ies" )

and Ci tigroup.

Mr. Wigand next stated that Citigroup and the Agencies will

share losses, with Citigroup having a 10 percent loss share on all

losses in excess of the $37 billion. He explained that the TARP

will take the second loss position up to $5 billion and the

Corporation will take the third loss position up to $10 billion,

with the loss share of the TARP and the Corporation capped as

explained above and the Federal Reserve taking remaining losses.

Mr. Wigand then informed the Board that Citigroup will manage the

assets, with instructions provided by the Agencies. Among the

instructions, he specified, will be those requiring use of loan

modification procedures comparable to those introduced by the

Corporation on August 20, 2008, at IndyMac Federal Bank, FSB,

Pasadena, California, of which the Corporation is conservator,

unless otherwise agreed. In addition, Mr. Wigand stated that

Citigroup will be subject to specific limitations on executive

compensation and dividends during the loss share period.

November 23, 2008 (Closed)

56620

Mr. Wigand then informed the Board that the Corporation,

the Office of the Comptroller of the Currency ("OCC"), and the

Office of Thrift Supervision ("OTS") have determined that the

insured affiliate banks and thrifts of Citigroup meet the

requirements under section 13 (c) (8) of the Federal Deposit

Insurance Act ("FDI Act") for receiving direct financial

assistance before the appointment of a receiver, and that

assistance will increase existing capital levels and improve

liquidity.

In exchange for the guarantees Mr. Wigand had described, he

explained that Citigroup has agreed to (1) seek the prior approval

of the Agencies before paying dividends for three years; (2)

develop an executive compensation program that rewards long-term

performance and profitability to be approved by the Agencies; and

(3) implement loan modification procedures conforming with the

Corporation's model used at IndyMac Federal Bank, FSB, for

mortgages in the asset pool, unless otherwise agreed.

Additionally, as Mr. Wigand had previously stated, the Corporation

and the TARP will receive preferred stock as reasonable

compensation for the guarantees provided.

Mr. Wigand then requested that John H. Corston, Associate

Director, Large Institutions and Analysis Branch, Complex

Financial Institutions, Division of Supervision and Consumer

Protection, provide the supervisory history and condition of

Citigroup and its insured bank and thrift affiliates. Mr.

Corston explained that Citibank, National Association, Las

Vegas, Nevada ("CBNA") is a nationally chartered bank founded in

1812 that is the lead bank within Citigroup, a financial holding

company regulated by the Federal Reserve; and that CBNA is the

third largest bank in the nation and is the predominant legal

entity representing 63 percent of consolidated holding company

assets. He then explained that the remaining insured legal

entities of Citigroup consist of an additional two national

banks, one federal savings bank, and one state non-member bank,

respectively, as follows: Citibank (South Dakota), N.A., Sioux

Falls, South Dakota; Department Stores National Bank, Sioux

Falls, South, Dakota; Citicorp Trust Bank, fsb, Wilmington,

Delaware; and ci tibank (Banamex USA), Century City, California.

He then continued, stating that Citigroup is the largest

consumer finance lender in the world, third largest mortgage

servicer, and the fourth largest student lender. It is also, he

said, the world's largest credit card lender and the third

largest in the United States as well as one of the world's

largest private banking and private wealth management

businesses.

November 23, 2008 (Closed)

56621

Mr. Corston added that Ci tigroup has three principal

nonbank subsidiaries: ci tigroup Global Markets Holdings, Inc., a

broker-dealer; Citigroup Funding, Inc., the primary funding

vehicle of Citigroup; and Associates First Capital Corporation,

the parent company of CitiFinancial, which provides consumer

finance. In addition, he said, there is one foreign banking

subsidiary-Grupo Financiero de Banamex SA de CV, a Mexican

banking organization.

Mr. Corston then stated that CBNA engages in extensive

foreign activities and has operations in over 100 countries,

operating approximately 1,000 retail branches in 13 states, the

District of Columbia, and Guam. He said that CBNA reported

foreign assets of $612 billion and foreign deposits of $554

billion held either in direct foreign branches of CBNA or in

other foreign entities that are mostly owned by the CBNA' sEdge

Act investment subsidiary, Citibank Overseas Investment Corp.

("COIC"). COIC, Mr. Corston explained, has over 20 foreign

banks that are headquartered and chartered in countries around

the world.

He then informed the Board that the risk profile of CBNA is

increasing rapidly due to the market's lack of confidence in the

company and a substantially weakened liquidity position. In

particular, Mr. Corston said that liquidity has reached crisis

proportions, such that the CBNA is projected to be unable to

meet its obligations. Most recently, he said this was

exemplified on Friday, November 21, 2008, when the United

Kingdom's Financial Services Agency imposed a $6.4 billion cash

lockup requirement to protect the interests of the United

Kingdom broker-dealer.

Mr. Corston then reported that, on Friday, November 21,

2008, market acceptance of CBNA's liabilities diminished, as the

company's stock plunged to a 16-year low; credit default swap

spreads widened by 75 basis points to 512.5 basis points; and

counterparties advised that they would require greater

collateralization on any transactions with CBNA.

Mr. Corston next informed the Board that, without

substantial government intervention that results in a positive

market perception on the morning of Monday, November 24, 2008,

OCC and Citigroup project that CBNA will be unable to pay

obligations or meet expected deposit outflows the following

week. Citigroup's contractual cash flow projections, he said,

November 23, 2008 (Closed)

56622

show that a total of 7.2 percent deposit run off will result in

no cash surplus.

Mr. Corston continued his presentation, stating that current

requests by Citigroup to the Federal Reserve to expand the

Commercial Paper Funding Facility ("CPFF") (created by the

Federal Reserve on October 7,2008, to help provide liquidity to

term funding markets) and to expand collateral and entities

eligible for posting to the Primary Dealer Credit Facility

("PDCF") and the Term Securities Lending Facility ("TSLF") would

provide short - term funding reI ief . However, according to Mr.

Corston, the additional funding provided by CPFF, PDCF, and TSLF

would not be sufficient to withstand an extensive deposit

runoff.

Mr. Corston then turned to the matter of systemic risk,

explaining that it appears likely that any transaction

implemented by the Corporation under a least-cost framework

would have significant adverse effects on economic conditions

and the financial markets based on Citigroup's size and the

markets in which it operates. Given Citigroup's significant

international presence, he said, the effects on money market

liquidi ty could be expected on a global basis. In addition, he

stated that term funding markets remain under considerable

stress. Mr. Corston said that these pressures have increased

over the past week with a loss of investor confidence in

financial institutions' performance, as evidenced by a

significant drop in bank equity values and another round of

increases in banks' credit default swap spreads. Citigroup has

been particularly vulnerable, Mr. Corston said, with its

exposure to credit and market losses coupled with its dependence

on international operations for funding. He observed that the

Corporation is prohibited from taking action that could expose

the Deposit Insurance Fund in a manner that could benefit debt

or equity holders of a company without invocation of the

systemic risk exception available under the FDI Act.

Mr. Corston then emphasized that not providing open bank

assistance to Citigroup would likely have major systemic

effects. He said that both financial stability and overall

economic conditions would be adversely affected for the reasons

he had already discussed, and that staff believes the

consequences could extend to the broader economy. Recent

disruptions to global money and credit markets since September

and other developments, he said, point to a clear nexus between

financial market turmoil and impaired economic performance that

could be expected to worsen further if Citigroup and its insured

November 23, 2008 (Closed)

56623

subsidiaries should be allowed to fail. Mr. Corston said that

such an event would significantly undermine business and

household confidence. In addition, Mr. Corston stated, with the

liquidity of banking organizations further reduced and their

funding costs increased, banking organizations would become even

less willing to lend to businesses and households, thereby

contributing to weaker economic performance, further damage to

financial markets, and other material negative effects.

In creating the systemic risk exception, Mr. Corston stated

that Congress clearly envisioned that circumstances could arise

in which the exception should be used. He concluded his

presentation by stating that, in view of the current intense

financial strains, as well as the likely consequences to the

general economy and financial system of a failure to provide

open bank assistance to the third-largest commercial bank in the

United States, staff believed that circumstances such as

Congress envisioned are clearly present and that invocation of

the systemic risk exception is justified.

John V. Thomas, Acting General Counsel, then clarified

that, despite Mr. Corston's reference to a least-cost framework

resolution of Citigroup having significant adverse effects on

economic conditions and the financial markets, the actual

problem is not that staff's recommendation is a least-cost

resolution, inasmuch as the expected cost to the Corporation is

zero. Rather, Mr. Thomas said, the problem, i. e., the need for

the Board to make a systemic risk determination to implement

staff's recommended resolution exists because it amounts to the

provision of open bank assistance. Chairman Bair acknowledged

Mr. Thomas's point and thanked him for the clarification.

Vice Chairman Gruenberg then stated his support for the

case and expressed his view that the finding of systemic risk is

clear and justified. He noted the exceptional cooperation that

had occurred among the Federal bank regulatory agencies and

Treasury to do what is necessary to maintain financial stability

in an extraordinary set of market conditions. He added that

conditions imposed on Citigroup relating to dividends and

executive compensation, as well as the loan modification

protocol, are essential components of the case.

Director Curry agreed with Vice Chairman Gruenberg's

comments and added that staff has amply made the case that the

systemic risk determination standard has been met. He indicated

further that he hoped that the open bank assistance contemplated

November 23, 2008 (Closed)

56624

by the recommendation is sufficient and that he was prepared to

vote in favor of the recommendat ion.

Director Dugan stated that he strongly supported the

recommendation, agreeing, as Vice Chairman Gruenberg and

Director Curry had said, that the facts presented amply

justified the recommendation. He added that the proposal was

not simply about Citigroup and its insured bank and thrift

affiliates but about confidence in other banks he well. As a

result, he said, it was absolutely critical that the Board act

decisively to take measures to address the circumstances

described. Director Dugan, too, hoped that the assistance to be

granted was adequate to accomplish the Agencies' goals and said,

that with the combination of the Agencies' resources, he thought

it would be.

Chairman Bair asked Director Dugan whether OCC had a

supervisory strategy for helping to get CBNA and the two other

national bank affiliates of Citigroup (collectively,

"Citigroup's national banks") under control again. Director

Dugan responded that the situation was about confidence as

opposed to capital in those institutions or their reserve

levels. He indicated that OCC will be closely monitoring the

situation and dealing with issues related to supervision, but

that the issue at hand was that of a potential world-wide bank

run needing to be brought under control. Chairman Bair agreed

regarding the need to re-instill confidence about banks, but she

added that the Corporation will look forward to working with acc

regarding the appropriate supervisory strategy for Citigroup's

national banks. She expressed her understanding that all of the

Federal depository institution regulators are committed to

making sure that Citigroup pursues selling itself or certain

parts of itself, but noted that this is not the first time that

Citigroup has become challenged.

Chairman Bair then set out her understanding that Ci tigroup

has a significant off-balance-sheet exposure that could be

having to be come on book at the end of 2009, which could

further complicate the situation. She noted that the

Corporation has already provided $77 billion in guarantees of

Ci tigroup' s unsecured senior debt under the debt guarantee

program component of the Temporary Liquidity Guarantee Program

initiated by the Corporation on October 13, 2008, to mitigate

the serious adverse effects on economic conditions or financial

stability that would otherwise create systemic risk to the

credit markets. Chairman Bair further noted that the

Corporation could ultimately wind up guaranteeing even more of

November 23, 2008 (Closed)

56625

Citigroup's debt unsecured senior debt if Citigroup were to

apply for an exception to its debt guarantee limit. She

observed how deeply those guarantees place the U. S. government

"on the hook." In addition, approving staff's recommendation

from the instant proposal, which she said is something the

Board's need to do, would involve the Corporation's providing

additional reinsurance on the losses of Citigroup's loan

portfolio. Chairman Bair cautioned, however, that the

Corporation's and the TARP's financial assistance to Citigroup

is not sufficient to right Citigroup as it has significant

problems requiring a very aggressive supervisory strategy.

Without the latter, Chairman Bair stated, the Corporation will

find itself needing to infuse additional assistance into

Citigroup.

Director Reich then indicated his support for staff's

recommendation and recognized that systemic risk was involved.

In response to a question from Director Reich on Citigroup's

current liquidity situation, Douglas W. Roeder, Senior Deputy

Comptroller, Large Bank Supervision, acc, stated that the

liquidity component of CBNA's CALS rating was not less than a

"3", given the support CBNA was about to receive from the

transaction on the table at this meeting. Chairmn Bair then

asked how the latter could be so when the acc was on the verge of

having to close the Citigroup's national banks because CBNA was

not going to be able to meet its liquidity needs the morning of

Monday, November 24, 2008. She added that CBNA has $500 billion

in foreign deposits that cannot be guaranteed by anyone and

repeated that she could not understand how the acc could rate

CBNA's as high as a "3" given the latter circumstances. Director

Dugan responded that the "3" rating for liquidity essentially

anticipates what the rating will be once the transaction before

the Board is approved. Chairman Bair responded, in turn, that the

Corporation does not use that just-described approach as a

criterion in its liquidity ratings and that it is certainly not

the criterion used for the liquidity ratings of other banks. She

indicated that it is not a good approach to say that an

institution can receive a "3" rating for liquidity if it could

only be demonstrated that government assistance would enable

adequate liquidity. Then, Director Dugan said that he thought the

ability to contemplate government assistance enabling an

institution to achieve adequate liquidity had been the standard.

He stated that the fact that CBNA has already received a certain

amount of government assistance and the fact that the instant

proposal would provide more are factors in evaluating its current

liquidity rating. Further, he said, OCC will adjust and evaluate

November 23, 2008 (Closed)

56626

CBNA's liquidity after it examines what happens once the proposal

is actually consummated.

Chairmn Bair said that the just-completed discussion on

CBNA's liquidity rating raises again her question as to what acc's

supervisory strategy is for CBNA. She added that she was of the

view that the current proposal would not resolve Citigroup's

problems and that, unless acc found a way to stabilize the

situation at CBNA, the Corporation would find itself again being

asked to infuse additional assistance. Chairman Bair stated that

she wanted the latter statement on the record of the Board's

consideration of this matter, and she said that the Corporation

desires to work constructively with the acc about realistically

recognizing Citigroup's underlying problems as being deeper than

merely being reflective of general market conditions. She

emphasized that Citigroup has certain problems very specific to

itself and that all of the depository institution regulators need

to work together on a means of fixing them.

Director Dugan stated that ace would continue to work very

hard to address Citigroup's problems without committing to a

particular strategy at this point. He added that the acc will be

looking at numerous options and will keep the Board informed of

those options.

Staff then responded to questions from Director Reich

regarding the "ring-fencing"-specific identification of assets in

an asset pool-of the previously referenced $306 billion asset pool

that was the subj ect of the loss share coverage and regarding the

Corporation's standard loss sharing protocol. Also in response to

a question from Director Reich, Mr. Thomas indicated that the

dividend restrictions under which eitigroup must seek the

Agencies' consent to pay in excess of $.01 per share per quarter

for three years are contractual in nature versus the separate

supervisory basis the acc has under which it, too, can restrict

the payment of dividends with respect to Citigroup's national

banks.

Director Reich then asked if any changes in management are

expected or required as the result of the proposal. Chairman

Bair, terming that a good question, asked Director Dugan to

respond. Director Dugan responded that the agreement requires no

changes in management. Chairman Bair then asked whether acc was

evaluating the quality of management as a component of its

supervisory strategy. Director Dugan responded that acc is always

evaluating the quality of management, and he added that acc simply

cannot dismiss management unless there are available other people

November 23, 2008 (Closed)

56627

who are willing and capable to take over. Director Reich then

stated his symathy for the situation Director Dugan, as

Comptroller of the Currency, is facing, stating that there is no

doubt in his mind that this is a systemic risk situation.

Director Reich then suggested that, in hindsight, there may have

been some systemic situations prior to the current one that were

not classified as such as the failure of IndyMac Bank, F. S. B. ,

Pasadena, California, on July 11, 2008, which pointed to the next

weakest institution, Washington Mutual Bank, Seattle, Washington,

which failed on September 2S, 2008, which, in turn, pointed to the

insured bank and thrift affiliates of Wachovia Corporation,

Charlotte, North Carolina, which generated the Corporation's

first systemic risk finding on September 29, 2008, and which

finally pointed to the Citigroup situation. Director Reich

wondered which notable institution would be next. He expressed

his hope that the Federal bank regulators and Treasury would

look at future such situations in a balanced manner and avoid

"selective creativity" in determining what constitutes systemic

risk and what does not and what is possible for the government

to do and what is not. He stated that there has been a high

degree of pressure exerted in certain situations and not in

others, making him concerned about parity.

Vice Chairman Gruenberg then thanked the Corporation's

staff, many of whom had been at work the entire weekend in

connection with this matter as well as the staff of other

agencies for their extraordinary efforts. Chairman Bair

concurred with Vice Chairman Gruenberg's statement and noted

that many staff still had a long night before them working on

executing the necessary agreements and making announcements to

the media.

Then, in accordance with the recommendation of staff and on

motion of Vice Chairman Gruenberg, seconded by Director Curry,

concurred in by Director Dugan, Director Reich, and Chairman

Bair, the Board adopted the following resolution:

(1) finding that the instability of the insured bank and

thrift affiliates of Citigroup ("Banks") would have

serious adverse effects on economic conditions or

financial stability and would create systemic risk to

the credit markets;

(2) finding that severe financial conditions exist which

threaten the stability of a significant number of

insured depository institutions or of insured

depository institutions possessing significant

November 23, 2008 (Closed)

56628

financial resources and the Banks are insured

depository institutions under such threat of

instability and that the Board takes this action in

order to mitigate the serious adverse effects, which

will lessen the risk to the insurance fund, and

systemic risks, posed by the Banks, and that the

proposal will be the least costly of all available

methods;

(3) finding that the proposal which involves the provision

of assistance under section 13 (c) (2) of the FDI Act,

12 U.S.C. § 1823 (C) (2), in the form of guarantees

against loss to, or contributions to, the Banks, will

mitigate the serious adverse effects on economic

conditions or financial instability that would be

caused by the Banks' continued seriously weakened

condition;

(4) finding that the conditions for receiving direct

financial assistance before the appointment of a

receiver under section 13 (c) (8) (A) (i) and (ii) of the

FDI Act have been satisfied;

(5) authorizing the Chairman of the Board, or her

designee, to provide the written recommendation to the

Secretary of the Treasury specified under section

13 (C) (4) (G) (i) of the FDI Act, 12 U.S.C. §

1823 (C) (4) (G) (i); and

(6) authorizing the Director, Division of Resolutions and

Receiverships, or his designee, and all other

Corporation staff to take all appropriate action to

implement the provision of assistance authorized

hereunder, including but not limited to: credit

support in the form of loan guarantees, and loss

sharing, and to take any other action necessary and

appropriate in connection with this matter:

WHEREAS, staff has presented information to the

Board of Directors ("Board") of the Federal Deposit

Insurance Corporation ("FDIC" or "Corporation")

indicating that the recent unprecedented disruption in

credit markets and the resultant effects on the

abilities of banks to fund themselves and to

intermediate credit place the United States in danger

of suffering adverse economic conditions and financial

instability; and

November 23, 2008 (Closed)

56629

WHEREAS, these conditions threaten the stability

of a significant number of insured depository

institutions, thereby increasing the potential for

losses to the Deposit Insurance Fund in the

resolutions of such insured depository institutions;

and

WHERES, staff has advised the Board of the FDIC

that Citibank, National Association, Las Vegas,

Nevada, Citibank (South Dakota), N.A., Sioux Falls,

South Dakota, Citicorp Trust Bank, fsb, Wilmington,

Delaware, Citibank (Banamex USA), Century City,

California, Department Stores National Bank, Sioux

Falls, South Dakota ("Banks"), and their affiliates

are in seriously weakened condition; and

WHEREAS, staff has advised that severe financial

conditions exist which threaten the stability of the

Banks which are insured depository institutions

possessing significant financial resources; and

WHEREAS, a proposal for the stabilization of the

Banks and their affiliates without the appointment of

the FDIC as receiver has been developed in

consultation with the Board of Governors of the

Federal Reserve System ("Federal Reserve Board") and

the Secretary of the Treasury (collectively the

"Agencies"), which involves the Agencies provision of

guarantees against loss on certain residential assets

for 10 years and certain other assets for a period of

5 years; and

WHEREAS, Citigroup Inc. ("Citigroup") will take a

first loss position equal to $37 billion; and

WHEREAS, for losses above $37 billion, there is a

loss sharing agreement where losses are shared 10

percent by Citigroup and 90 percent by the Agencies

with Treasury taking a second loss position up to $5

billion, the Corporation taking the third loss

position up to $10 billion, and the Federal Reserve

Board having agreed to take the remaining risk based

on nonrecourse lending on the pool of assets

("Proposal"); and

November 23, 2008 (Closed)

56630

WHEREAS, the Corporation is receiving $3 billion

in preferred stock as compensation for its taking the

$10 billion third loss position; and

WHEREAS, the Proposal is subject to prudential

regulatory oversight and executive compensation

restrictions, with the guarantees having a limited

duration, and staff believes that the Proposal will

avoid or mitigate the serious adverse effects on

economic conditions or financial stability in the most

cost effective method; and

WHERES, the FDIC, the Office of the Comptroller

of the Currency, and the Office of Thrift Supervision

have determined that the Banks meet the conditions

under section 13 (c) (8) (A) (i) and (ii) of the Federal

Deposit Insurance Act ("FDI Act") for receiving direct

financial assistance before the appointment of a

receiver; and

WHEREAS, staff has recommended that the FDIC

Board make a systemic risk recommendation supporting

action by the FDIC; and

WHEREAS, the Corporation has been advised that

the Federal Reserve Board is expected to make a

similar recommendation and that the Secretary of the

Treasury, after consultation with the President, is

expected to make the systemic risk determination in

this situation.

NOW, THEREFORE, BE IT RESOLVED, that the Board

finds that the instability of the Banks would have

serious adverse effects on economic conditions or

financial stability and would create systemic risk to

the credit markets.

BE IT FURTHER RESOLVED, that severe financial

conditions exist which threaten the stability of a

significant number of insured depository institutions

or of insured depository institutions possessing

significant financial resources and the Banks are

insured depository institutions under such threat of

instability and that the Board takes this action in

order to mitigate the serious adverse effects, which

will lessen the risk to the insurance fund, and

systemic risks, posed by the Banks, and that the

November 23, 2008 (Closed)

56631

proposal will be the least costly of all available

methods.

BE IT FURTHER RESOLVED, that the Board finds that

the Proposal which involves the provision of

assistance under section 13 (c) (2) of the FDI Act, 12

U. S. C. § 1823 (C) (2), in the form of guarantees against

loss to, or contributions to, the Banks, will mitigate

the serious adverse effects on economic conditions or

financial instability that would be caused by the

Banks' continued seriously weakened condition.

BE IT FURTHER RESOLVED, that the Board finds that

the conditions for receiving direct financial

assistance before the appointment of a receiver under

section 13 (c) (8) (A) (i) and (ii) of the FDI Act have

been satisfied.

BE IT FURTHER RESOLVED, that the Board hereby

authorizes the Chairman of the Board, or her designee,

to provide the written recommendation to the Secretary

of the Treasury specified under section 13 (C) (4) (G) (i)

of the FDI Act, 12 U.S.C. § 1823 (C) (4) (G) (i).

BE IT FURTHER RESOLVED, that the Board hereby

authorizes the Director , Division of Resolutions and

Receiverships, or his designee, and all other FDIC

staff to take all appropriate action to implement the

provision of assistance authorized hereunder,

including but not limited to: credit support in the

form of loan guarantees, and loss sharing, and to take

any other action necessary and appropriate in

connection with this matter.

(EXECUTIVE SECRETARY'S NOTE: On Sunday, November 23, 2008, the

United States government entered into an agreement with

Citigroup Inc., to provide a package of guarantees, liquidity

access, and capital, whereby, as part of the agreement, the

Department of the Treasury and the Corporation will provide

protection against the possibility of unusually large losses on

an asset pool of approximately $306 billion of loans and

securities backed by residential and commercial real estate and

other such assets, which will remain on Citigroup's balance

sheet. As a fee for that arrangement, Citigroup will issue

preferred shares to the Treasury and the Corporation. In

addition, Citigroup will comply with enhanced executive

November 23, 2008 (Closed)

56632

compensation restrictions and implement the Corporation's

mortgage modification program.)

Documents and materials relevant to the Board's

consideration of the foregoing are marked an exhibit for

identification, are filed in the jacket of this meeting, and, by

reference, are made a part of these minutes and the permanent

files of the Board of Directors.

There being no further business, the meeting was adj ourned.

¿d .Executive Secretary

November 23, 2008 (Closed)

Você também pode gostar

- Testimony BarofskyDocumento14 páginasTestimony BarofskyZerohedgeAinda não há avaliações

- Statement - Bernanke032409Documento7 páginasStatement - Bernanke032409ROLLINGSTONEAinda não há avaliações

- Memo To Oversight Committee Members and Various DocumentsDocumento86 páginasMemo To Oversight Committee Members and Various DocumentsDealBookAinda não há avaliações

- Feoeral Reserve System: Board of GovernorsDocumento5 páginasFeoeral Reserve System: Board of GovernorsZerohedgeAinda não há avaliações

- AIG Scandal 2005Documento10 páginasAIG Scandal 2005Rahmatullah100% (1)

- United States Court of Appeals, Eleventh CircuitDocumento19 páginasUnited States Court of Appeals, Eleventh CircuitScribd Government DocsAinda não há avaliações

- Citigroup OSIG PDFDocumento77 páginasCitigroup OSIG PDFsuksesAinda não há avaliações

- Case: 1: 1o-Cv-01277 Assigned To: Huvelle, Ellen S. Assign. Date: Description: GeneralDocumento25 páginasCase: 1: 1o-Cv-01277 Assigned To: Huvelle, Ellen S. Assign. Date: Description: GeneralfraudblawgAinda não há avaliações

- Iaqf Competition PaperDocumento10 páginasIaqf Competition Paperapi-262753233Ainda não há avaliações

- AIG Accounting ScandalDocumento7 páginasAIG Accounting ScandalStelliz Dinh71% (14)

- General Re's Agreed Statement of FactsDocumento14 páginasGeneral Re's Agreed Statement of FactsDealBookAinda não há avaliações

- NYU Press Chapter Examines AIG's Reckless CDS Bets and DownfallDocumento23 páginasNYU Press Chapter Examines AIG's Reckless CDS Bets and DownfallRaymond Behnke [STUDENT]Ainda não há avaliações

- Basel 2.5, Basel III. Their Tasks Are To Identify Risks To The Financial Stability of TheDocumento5 páginasBasel 2.5, Basel III. Their Tasks Are To Identify Risks To The Financial Stability of TheSahoo SKAinda não há avaliações

- PCGG challenges Ombudsman dismissal of behest loan caseDocumento14 páginasPCGG challenges Ombudsman dismissal of behest loan casemeriiAinda não há avaliações

- International Insurance Co., A Corporation v. Alfred M. Johns, James W. McFadden Thomas v. Ogletree, Richard W. Sherman, and G. Paul Whorton, 874 F.2d 1447, 11th Cir. (1989)Documento35 páginasInternational Insurance Co., A Corporation v. Alfred M. Johns, James W. McFadden Thomas v. Ogletree, Richard W. Sherman, and G. Paul Whorton, 874 F.2d 1447, 11th Cir. (1989)Scribd Government DocsAinda não há avaliações

- Dodd-Frank Wall Street Reform and Consumer Protection Act, Pub. L. 111-203, 12 U.S.C. 5301 Et Seq. (2010)Documento20 páginasDodd-Frank Wall Street Reform and Consumer Protection Act, Pub. L. 111-203, 12 U.S.C. 5301 Et Seq. (2010)MarketsWikiAinda não há avaliações

- Corporate Governance: BankruptcyDocumento37 páginasCorporate Governance: Bankruptcybhadoria9Ainda não há avaliações

- General Banking LawDocumento62 páginasGeneral Banking LawMarc Gar-cia100% (1)

- Presidential Adhoc Fact-Finding Vs DesiertoDocumento13 páginasPresidential Adhoc Fact-Finding Vs DesiertojazrethAinda não há avaliações

- United States Court of Appeals, Third CircuitDocumento19 páginasUnited States Court of Appeals, Third CircuitScribd Government DocsAinda não há avaliações

- American International GroupDocumento16 páginasAmerican International Groupsanyasam100% (1)

- United States Court of Appeals, Fourth CircuitDocumento17 páginasUnited States Court of Appeals, Fourth CircuitScribd Government DocsAinda não há avaliações

- Resolution Plans Required For Insured Depository Institutions With $50 Bilion or More inDocumento55 páginasResolution Plans Required For Insured Depository Institutions With $50 Bilion or More inForeclosure FraudAinda não há avaliações

- Financial Derivatives: A Perceived ValueDocumento20 páginasFinancial Derivatives: A Perceived ValueIvan MendesAinda não há avaliações

- Harbeck Responds To Letter From Cong. GarrettDocumento28 páginasHarbeck Responds To Letter From Cong. GarrettIlene KentAinda não há avaliações

- Ethics - AIG Case StudyDocumento13 páginasEthics - AIG Case StudyTrish Bustamante100% (1)

- Trends Winter 2013Documento16 páginasTrends Winter 2013caitlynharveyAinda não há avaliações

- Dodd-Frank ACT: 1. Oversees Wall StreetDocumento12 páginasDodd-Frank ACT: 1. Oversees Wall StreetTanishaq bindalAinda não há avaliações

- Press ReleaseNo Customer of 53 Defunct Fund Managers Will Be Left Out of Government Bailout - SECDocumento4 páginasPress ReleaseNo Customer of 53 Defunct Fund Managers Will Be Left Out of Government Bailout - SECKweku ZurekAinda não há avaliações

- AIG: Meltdown: How The Web of The Entire Financial System UnraveledDocumento29 páginasAIG: Meltdown: How The Web of The Entire Financial System UnraveledJs WilyAinda não há avaliações

- Commissioner of Internal Revenue v. Union Mutual Insurance Company of Providence, 386 F.2d 974, 1st Cir. (1967)Documento7 páginasCommissioner of Internal Revenue v. Union Mutual Insurance Company of Providence, 386 F.2d 974, 1st Cir. (1967)Scribd Government DocsAinda não há avaliações

- Poli Meeting 2Documento811 páginasPoli Meeting 2Ariel Joseph NicolasAinda não há avaliações

- GAO D11616highDocumento1 páginaGAO D11616highDinSFLAAinda não há avaliações

- Falling Giant - A Case Study of AIG - InvestopediaDocumento4 páginasFalling Giant - A Case Study of AIG - InvestopediatanmriAinda não há avaliações

- Valueclick & I-DealDocumento6 páginasValueclick & I-Dealchstrcheeto4prezAinda não há avaliações

- AIG FraudDocumento14 páginasAIG FraudakashnagarAinda não há avaliações

- Actuarial Accouning - A Cautionary ReportDocumento69 páginasActuarial Accouning - A Cautionary ReportroymalpicarAinda não há avaliações

- SBI Life InsuranceDocumento41 páginasSBI Life InsuranceSandeep Mauriya0% (1)

- Petitioner Vs VS: Third DivisionDocumento9 páginasPetitioner Vs VS: Third DivisionLDCAinda não há avaliações

- MBIA v. Credit Suisse, DLJ & SPSDocumento36 páginasMBIA v. Credit Suisse, DLJ & SPS83jjmackAinda não há avaliações

- Corporate Governance at SIC Company LimitedDocumento19 páginasCorporate Governance at SIC Company LimitedFaizan UllahAinda não há avaliações

- Periodic Report: Update On Outstanding Lending Facilities Authorized by The Board Under Section 13 (3) of The Federal Reserve Act October 7, 2020Documento8 páginasPeriodic Report: Update On Outstanding Lending Facilities Authorized by The Board Under Section 13 (3) of The Federal Reserve Act October 7, 2020Evariste GaloisAinda não há avaliações

- Pre-Packaged Insolvency Framework - A Boon or Bane For IndiaDocumento8 páginasPre-Packaged Insolvency Framework - A Boon or Bane For IndiaBhai Ki Vines (Shivansh Gupta)Ainda não há avaliações

- The AIG Bailout: William K. Sjostrom, JRDocumento49 páginasThe AIG Bailout: William K. Sjostrom, JRmetilla2010Ainda não há avaliações

- Response To SGX Queries and Letter To The Editor of Business TimesDocumento5 páginasResponse To SGX Queries and Letter To The Editor of Business TimesWeR1 Consultants Pte LtdAinda não há avaliações

- Teamsters GE LawsuitDocumento31 páginasTeamsters GE LawsuitDan ShepardAinda não há avaliações

- The Causes and Effects of The Aig Bailout: Hearing Committee On Oversight and Government Reform House of RepresentativesDocumento171 páginasThe Causes and Effects of The Aig Bailout: Hearing Committee On Oversight and Government Reform House of RepresentativesScribd Government DocsAinda não há avaliações

- Ziff Davis Bankruptcy Filing 2Documento75 páginasZiff Davis Bankruptcy Filing 2Rafat AliAinda não há avaliações

- Madoff Trustee's First Interim ReportDocumento47 páginasMadoff Trustee's First Interim ReportDealBookAinda não há avaliações

- SEC Charges Bank of America $150M for Merrill Lynch Merger DisclosuresDocumento3 páginasSEC Charges Bank of America $150M for Merrill Lynch Merger Disclosuresa2b7127Ainda não há avaliações

- City Council Special Meeting Packet 11-15-12 OCR DocumentDocumento144 páginasCity Council Special Meeting Packet 11-15-12 OCR DocumentL. A. PatersonAinda não há avaliações

- Bank FailuresDocumento17 páginasBank FailuresLamar GarrenAinda não há avaliações

- A Bill: 112 Congress 1 SDocumento10 páginasA Bill: 112 Congress 1 SDinSFLAAinda não há avaliações

- AIG's Missing Securities Lending Piece and the Role it Played in the BailoutDocumento70 páginasAIG's Missing Securities Lending Piece and the Role it Played in the Bailouttruongvinhlan19895148Ainda não há avaliações

- Pipefitters Local Annuity Plumbers LocalDocumento6 páginasPipefitters Local Annuity Plumbers LocalAlbany Times UnionAinda não há avaliações

- United States Court of Appeals, Third CircuitDocumento6 páginasUnited States Court of Appeals, Third CircuitScribd Government DocsAinda não há avaliações

- The Enabling Environment for Disaster Risk Financing in Fiji: Country Diagnostics AssessmentNo EverandThe Enabling Environment for Disaster Risk Financing in Fiji: Country Diagnostics AssessmentAinda não há avaliações

- The Independent Filmmaker's Law and Business Guide: Financing, Shooting, and Distributing Independent Films and SeriesNo EverandThe Independent Filmmaker's Law and Business Guide: Financing, Shooting, and Distributing Independent Films and SeriesAinda não há avaliações

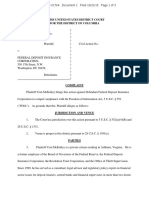

- Stamped Complaint McKinley V FDICDocumento3 páginasStamped Complaint McKinley V FDICVern McKinleyAinda não há avaliações

- McKinley V FHFA US CT Appeals DC Circuit Judge Garland Opinion 10 Jan 2014Documento10 páginasMcKinley V FHFA US CT Appeals DC Circuit Judge Garland Opinion 10 Jan 2014Vern McKinleyAinda não há avaliações

- McKinley V FHFA, DC Circuit Court of Appeals, Oral Argument Order (Lawsuit #4)Documento1 páginaMcKinley V FHFA, DC Circuit Court of Appeals, Oral Argument Order (Lawsuit #4)Vern McKinleyAinda não há avaliações

- McKinley V Board of Governors AIG Production 4 January 2013 Heavily Redacted (Lawsuit #3a)Documento908 páginasMcKinley V Board of Governors AIG Production 4 January 2013 Heavily Redacted (Lawsuit #3a)Vern McKinleyAinda não há avaliações

- McKinley V Board of Governors Stipulation of Dismissal (Lawsuit #3a)Documento1 páginaMcKinley V Board of Governors Stipulation of Dismissal (Lawsuit #3a)Vern McKinleyAinda não há avaliações

- McKinley V CFTC SEC Stipulation of Dismissal (Lawsuit #5)Documento1 páginaMcKinley V CFTC SEC Stipulation of Dismissal (Lawsuit #5)Vern McKinleyAinda não há avaliações

- McKinley V Board of Governors Stipulation of Dismissal (Lawsuit #3a)Documento1 páginaMcKinley V Board of Governors Stipulation of Dismissal (Lawsuit #3a)Vern McKinleyAinda não há avaliações

- OCC Emails On JPMC FSOC Meeting May 2012Documento37 páginasOCC Emails On JPMC FSOC Meeting May 2012Vern McKinleyAinda não há avaliações

- McKinley V Board of Governors Defendant Motion For Summary Judgment (Lawsuit #3a)Documento64 páginasMcKinley V Board of Governors Defendant Motion For Summary Judgment (Lawsuit #3a)Vern McKinleyAinda não há avaliações

- McKinley V FHFA, Appellant McKinley Reply Brief (Lawsuit #4)Documento18 páginasMcKinley V FHFA, Appellant McKinley Reply Brief (Lawsuit #4)Vern McKinleyAinda não há avaliações

- McKinley V FHFA, Appellee FHFA Brief, USCA DC CircuitDocumento37 páginasMcKinley V FHFA, Appellee FHFA Brief, USCA DC CircuitVern McKinleyAinda não há avaliações

- McKinley V Board of Governors AIG Production 4 January 2013 Heavily Redacted (Lawsuit #3a)Documento908 páginasMcKinley V Board of Governors AIG Production 4 January 2013 Heavily Redacted (Lawsuit #3a)Vern McKinleyAinda não há avaliações

- McKinley V CFTC SEC, Defendant Answer (Lawsuit #5)Documento5 páginasMcKinley V CFTC SEC, Defendant Answer (Lawsuit #5)Vern McKinleyAinda não há avaliações

- McKinley V FDIC Wachovia Package of Regulatory Documents and Board Materials (Lawsuit #1)Documento129 páginasMcKinley V FDIC Wachovia Package of Regulatory Documents and Board Materials (Lawsuit #1)Vern McKinleyAinda não há avaliações

- McKinley V FHFA McKinley Brief US Court of Appeals For The DC Circuit (Lawsuit #4)Documento29 páginasMcKinley V FHFA McKinley Brief US Court of Appeals For The DC Circuit (Lawsuit #4)Vern McKinleyAinda não há avaliações

- McKinley v. Board of Governors Scheduling Conference Order (Lawsuit #3a)Documento4 páginasMcKinley v. Board of Governors Scheduling Conference Order (Lawsuit #3a)Vern McKinleyAinda não há avaliações

- McKinley V FHFA Briefing Schedule US Court of Appeals DC Circuit (Lawsuit #4)Documento1 páginaMcKinley V FHFA Briefing Schedule US Court of Appeals DC Circuit (Lawsuit #4)Vern McKinleyAinda não há avaliações

- McKinley V Board of Governors Vaughn Index 16 October 2012 (Lawsuit #3a)Documento44 páginasMcKinley V Board of Governors Vaughn Index 16 October 2012 (Lawsuit #3a)Vern McKinleyAinda não há avaliações

- McKinley V CFTC SEC Plaintiff Opposition To Extend Time (Lawsuit #5)Documento3 páginasMcKinley V CFTC SEC Plaintiff Opposition To Extend Time (Lawsuit #5)Vern McKinley100% (1)

- McKinley V CFTC SEC Documents From MF Global SEC Compelled To Disclose (Lawsuit #5)Documento7 páginasMcKinley V CFTC SEC Documents From MF Global SEC Compelled To Disclose (Lawsuit #5)Vern McKinleyAinda não há avaliações

- McKinley V CFTC Documents From MF Global CFTC Compelled To Disclose (Lawsuit #5)Documento36 páginasMcKinley V CFTC Documents From MF Global CFTC Compelled To Disclose (Lawsuit #5)Vern McKinleyAinda não há avaliações

- Letter From Justice Department On 906 Withheld Pages On AIG New York Fed (Lawsuit #3a)Documento2 páginasLetter From Justice Department On 906 Withheld Pages On AIG New York Fed (Lawsuit #3a)Vern McKinleyAinda não há avaliações

- McKinley v. CFTC, Letter On MF Global Documents (Lawsuit #5)Documento1 páginaMcKinley v. CFTC, Letter On MF Global Documents (Lawsuit #5)Vern McKinleyAinda não há avaliações

- McKinley V CFTC SEC Defendant Motion To Extend Time (Lawsuit #5)Documento3 páginasMcKinley V CFTC SEC Defendant Motion To Extend Time (Lawsuit #5)Vern McKinleyAinda não há avaliações

- Order by Judge Kessler On Briefing Schedule (Lawsuit #3a)Documento2 páginasOrder by Judge Kessler On Briefing Schedule (Lawsuit #3a)Vern McKinleyAinda não há avaliações

- McKinley V Board of Governors Defendant Answer (Lawsuit #3a)Documento4 páginasMcKinley V Board of Governors Defendant Answer (Lawsuit #3a)Vern McKinleyAinda não há avaliações

- Joint Proposed Case Management Plan (Lawsuit #3a)Documento4 páginasJoint Proposed Case Management Plan (Lawsuit #3a)Vern McKinleyAinda não há avaliações

- Notice of Appeal of Judgment On Attorney Fees and Cost FHFA (Lawsuit #4)Documento1 páginaNotice of Appeal of Judgment On Attorney Fees and Cost FHFA (Lawsuit #4)Vern McKinleyAinda não há avaliações

- Letter Response From Board of Governors 707 Pages Withheld AIG & FRBNY (Lawsuit #3a)Documento2 páginasLetter Response From Board of Governors 707 Pages Withheld AIG & FRBNY (Lawsuit #3a)Vern McKinleyAinda não há avaliações

- Fannie Mae and Freddie Mac Receivership Contingency Contract by FHFA With PWC (FOIA Request)Documento177 páginasFannie Mae and Freddie Mac Receivership Contingency Contract by FHFA With PWC (FOIA Request)Vern McKinley100% (1)

- As Two Economists Debate Markets, The Tide ShiftsDocumento4 páginasAs Two Economists Debate Markets, The Tide ShiftsSkyvalley81Ainda não há avaliações

- Comparative Analysis On Non Performing Assets of Private and Public Sector BanksDocumento32 páginasComparative Analysis On Non Performing Assets of Private and Public Sector Bankssai thesis33% (3)

- Project ProposalDocumento8 páginasProject ProposalParth PatelAinda não há avaliações

- Introducing Overnight Indexed SwapsDocumento6 páginasIntroducing Overnight Indexed SwapsShi PengyongAinda não há avaliações

- Financial ManagementDocumento201 páginasFinancial Managementprashanth kAinda não há avaliações

- 10K 123106Documento175 páginas10K 123106anon-764084100% (2)

- SMSF Investment Master Plan v1.0Documento42 páginasSMSF Investment Master Plan v1.0Christina BongAinda não há avaliações

- Financial Markets and InstitutionsDocumento1 páginaFinancial Markets and InstitutionsBea3Ainda não há avaliações

- Management of Funds Entire SubjectDocumento85 páginasManagement of Funds Entire SubjectMir Wajahat Ali100% (1)

- Chap 012Documento77 páginasChap 012sucusucu3Ainda não há avaliações

- Theory of Market-1Documento259 páginasTheory of Market-1Adel TaarabtyAinda não há avaliações

- Lecture Note Law of Banking andDocumento59 páginasLecture Note Law of Banking andEmebet DebissaAinda não há avaliações

- 4 - The Principles of Banking MSC Module CourseDocumento337 páginas4 - The Principles of Banking MSC Module Courseprasjk100% (1)

- XII BST Oswaal SQPs Sample Papers 12 2024 @CUETCBSEDocumento162 páginasXII BST Oswaal SQPs Sample Papers 12 2024 @CUETCBSEjapgunkaur1Ainda não há avaliações

- Midterm Exam PDFDocumento4 páginasMidterm Exam PDFAleandro NierreAinda não há avaliações

- Deutsche Bank - Global Banking Trends After The GFCDocumento24 páginasDeutsche Bank - Global Banking Trends After The GFClelaissezfaire100% (2)

- Peregrine Presentation FinalDocumento15 páginasPeregrine Presentation FinalTanya SokolovaAinda não há avaliações

- Around The World With Kennedy WilsonDocumento48 páginasAround The World With Kennedy WilsonBroyhill Asset ManagementAinda não há avaliações

- Still Searching For Optimal Capital StructureDocumento26 páginasStill Searching For Optimal Capital Structureserpent222Ainda não há avaliações

- UBL Operations ManagementDocumento18 páginasUBL Operations ManagementSaad HamidAinda não há avaliações

- Finance A Quantitative IntroductionDocumento442 páginasFinance A Quantitative IntroductionabhiAinda não há avaliações

- Smartshares Exchange Traded Funds - Other Material InformationDocumento23 páginasSmartshares Exchange Traded Funds - Other Material Informationamy g dalaAinda não há avaliações

- First Draft PaperDocumento30 páginasFirst Draft PaperthanhhoangcAinda não há avaliações

- EC3065 Financial EngineeringDocumento2 páginasEC3065 Financial EngineeringAnonymous s6gDZo7lXAinda não há avaliações

- SBI POS Acceptability in JewelleryDocumento83 páginasSBI POS Acceptability in JewelleryTarun Kathiriya75% (4)

- D Ifta Journal 04Documento44 páginasD Ifta Journal 04fredAinda não há avaliações

- Mcgraw-Hill/Irwin Corporate Finance, 7/EDocumento16 páginasMcgraw-Hill/Irwin Corporate Finance, 7/EDamatAinda não há avaliações

- Financial Market NotesDocumento7 páginasFinancial Market NotesKishhaan IlangoAinda não há avaliações

- Global Economic Slowdown-ITDocumento42 páginasGlobal Economic Slowdown-ITRaghuram SeshabhattarAinda não há avaliações

- Final Project Report On Religare SecuritiesDocumento57 páginasFinal Project Report On Religare Securitiessunytomar1950% (6)