Escolar Documentos

Profissional Documentos

Cultura Documentos

Negotiable Instruments: The Reserve Bank of India Act, 1934

Enviado por

sistla.suneethaDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Negotiable Instruments: The Reserve Bank of India Act, 1934

Enviado por

sistla.suneethaDireitos autorais:

Formatos disponíveis

Negotiable Instruments

There are certain documents which are freely used in commercial transactions and monetary dealings.

These documents, if they satisfy certain conditions, are known as "negotiable instruments". The word

"negotiable" means "transferable from one person to another in return for consideration" and

"instrument" means a "written document by which a right is created in favour of some person."

Thus, a negotiable instrument is a document which entitles a person to a sum of money and which is

transferable from one person to another by mere delivery or by indorsement and delivery. The terms

'delivery' and 'indorsement' have been explained in a subsequent Chapter.

The law relating to negotiable instruments is contained in the Negotiable Instruments Act, 1881,

which deals with promissory notes, bills of exchange and cheques, as also hundis (a bill of exchange

in a vernacular language). It is based, except where conditions in India require a departure, mainly

upon the English Law as to negotiable instruments and judicial decisions.

The Act extends to the whole of India. It does not affect any local usage relating to any instrument in a

vernacular language. The local usages may however be excluded by any words in the body of the

instrument (Sec.l).

The Act came into force on first day of March, 1882.

The latest amendment to the Act was made in 1988.

References to Sections in Chapters 6-1 to 6-10, unless otherwise indicated, are to the Negotiable

Instruments Act, 1881.

The Reserve Bank of India Act, 1934

The Negotiable Instruments Act does not affect the provisions of Sees. 31 and 32 of the Reserve Bank

of India Act, 1934. The object of Sec. 31 is to prevent private persons from infringing the monopoly

of the Government in note issue (paper currency) in India. The provisions of Sec. 31 are as follows :

1. No person (other than the Reserve Bank or the Central Government) can draw, accept, make, or

issue any bill of exchange, hundi, or promissory note payable to bearer on demand.

2. No person (other than the Reserve Bank or the Central Government) can make or issue any

promissory note payable to the bearer of the instrument. This renders the words 'or to bearer' in the

Q

efinition of a 'promissory note' in Sec. 4 of the Negotiable Instruments Act inoperative. But a bill or a

note, on being indorsed in blank, can become payable to bearer on demand. A cheque is also payable

to bearer °n demand. These are exceptions to the rules as contained in Sec. 31.

Sec. 32 of the Reserve Bank of India Act provides that if anybody 'ssues a bill or note payable to

bearer on demand, or a note payable to bearer, he shall be punishable with fine.

DEFINITION OF NEGOTIABLE INSTRUMENT

A negotiable instrument is a method of transferring a debt from one Person to another. The term

'negotiable instrument' as such is notdefined in the Negotiable Instruments Act. Sec. 13, however, says

that :'a' negotiable instrument means a promissory note, bill of exchange or cheque payable either to

order or to bearer." The definition, as it is, says that a negotiable instrument 'means' and not 'means

and iiicludes'. Therefore, any other instrument which satisfies the conditions of negotiability can be

added to the list of negotiable instruments.

Justice Willis defines a negotiable' instrument as "one the property in which is acquired by anyone

^who tah^s it bona fide and for value ' notwithstanding any defect of )title in the person from whom

he took it." [The Law-pf Negotiable Securities, 5th ed., p. 5J,

According to Thomas, a negotiable instrument is one which is, by a legally recognised custom of trade

or by law,

(a) transferable by delivery or by indorsement and delivery.

(b) without notice t<\ the party liable, in such a way that the holder of it for the time being-may sue

upon \t in his own name, and

(c) the property in it passes to a bona fide transferee for value free from equities and free from any

defect in the title of the person from whom he obtained it [Commerce, Its Theory and 'Practice by

Thomas, 8th

ed.,p.629].

This means that a person taking an instrument (1) bona fide, and (2) for value, known as a holder in

due course, gets a good title even though the title of the transferor may be defective. A rough and

ready test of negotiability" in case of bearer instruments is : Can a good title be Required through a

thief ? If yes, the, instrument is negotiable.

Negoitable instruments are a special class of contracts. Characteristics of a negotiable instrument

The characteristics of a negotiable instrument are as follows :

1. Freely transferable. -The property in a negotiable instrument passes from one person to another by

delivery, if the instrument is payable to ,bearer, and by indorsement and delivery if it is payable to

orcjfer.

2. Title of holder free from all defects. A person taking an instrument jbona fide and for value, known

as a holder in due course, gets the ' instrument free from, all defects in the title of the transferor. He is

not in any way affected by any defect in the title of the transferor or of any prior

party.

Example. S sells certain goods to B. B gives a promissory note to ;

S for the price. He refuses to pay the promissory note, claiming that |

the goods are not according to order. If S sues B on the note, B's'/

defence is good. But if he negotiates the note to 'H, a holder in due

course, B's defence will be of no avail. ,( ,

The holder in due course is also not affected by certain defences which |

might be available against previous holders, for example, fraud, provided^

he himself is not a party to it. i

3. Recovery. The-holder in due course can sue upon a negotiable!

Instrument in hip own name for the recovery of the amount. Further he|

need not give notice of transfer to the party liable on the instrument to 1

pay- .' .'.]

4. Ptesumpttons. pertain presumptions apply to all negotiable'' iristrume, ,ts. unless contrary is proved.

These presumptions are dealt j with in Sees. 118 and 119 and are as follows :'. |

NEGOTIABLE INSTRUMENTS 3J;

(a) (ionstderatton. Every negotiable instrument is presumed to hav been made, dawn, accepted,

indorsed, negotiated or transferred, ft consideration. This would help a holder 'to get a decree from a

cdur without any difficulty.

(b) Date. Every negotiable instrument bearing a date is presumed tc have been made or drawn on such

date.

(c) Time of acceptance. Whenabillofexchangehasbeenaccepted.it) presumed that it was accepted

within a reasonable time of its date an< before its maturity. s • •

(d) Time of transfer. Every transfer of a negotiable instrument Ji presumed to have been made before

its.maturity.

(e) Order of indorsements. The indorsements appearing upon £ negotiable instrument are presumed to

have been made in the order ii which they appear thereon.

(fl Stamp. When an 'instrument has been lost, it is presumed that 1 was duly stamped.'

(g) Holder presumed to be a holder in due course. Every holder of; negotiable instrument is presumed

to be a holder in due course (Sec. 118).

(h) Proof of protest. In a suit upon an instrument which has been dishonoured, the Court, on proof of

the protest, presumes the fact c dishonour, until such fact is disproved (Sec. 119).

The above presumptions are rebuttable, by evidence. If anyon* challenges any of these

presumptions, he has to prove his allegation Again, these presumptions would not arise where an

instrument has beei obtained by any offence, fraud or unlawful consideration. "TYPES OF

NEGOTIABLE INSTRUMENTS

Negotiable instruments may be :

1. Negotiable by Statute, or

2. Negotiable by custom or usage.

1. Instruments negotiable by Statute. The Negotiable Instruments Ac mentions only three kinds of

negotiable instruments (Sec. 13). These are promissory notes, bill of exchange and cheques. These

instruments an negotiable by Statute.

2. Instruments negotiable by custom or usage. There are certain other instruments which have

acquired the character of negotiability by the usage or custom of trade. In England, for example, the

followin' instruments have been held to be negotiable by custom, viz., txcheque bills, bank notes,

share warrants, circular notes, bearer debentures dividend warrants, share certificates with blank

transfer deeds» etc. TH list of negotiable instruments thus appears to be flexible and Inclusive The

Courts in India usually follow the practice of English Courtst i'i according the character of

negotiability to other instruments. Sec. 137 c '-the Transfer of Property Act also recognises the

negotiability- c instruments 'by law or custom'. Thus in India, Government promlssoi* notes, banker's

drafts and pay orders, hundts, delivery orders and railwi receipts for goods, have been held to be

negotiable by usage or custom.

Notes, Bills and Cheques

! PROMISSORY NOTE

A 'promissory note' is an instrument in writing (not being a bank note or a currency note) containing

an unconditional undertaking, signed by the maker, to pay a certain sum of money only to, or to order

of, a certain person, or to the bearer of the instrument (Sec. 4).

The person who makes the promissory note and promises to pay is , called the maker.

The person to whom the payment is to be made is called the payee. J Examples. A signs an

instrument in the following terms : ;" (a) "I promise to pay B or order Rs. 500."

f (b) "I acknowledge myself to be indebted to B in Rs. 1,000 to be paid on demand, for value

received."

"Mr. B, I.O.U. Rs. 500."

(c) (a)

(e)

"I promise to pay B Rs. 500 and all other sums which shall be due to him."

"I promise to pay B Rs. 500, first deducting thereout any money which he may owe me."

(fl "I promise to pay B'Rs. 500 seven days after my marriage with C."

[g] "I promise to pay B Rs. 500 on D's death, provided D leaves me enough to pay that sum."

(h) "I promise to pay B Rs. 500 and to deliver to him my black horse on 1st January next."

Of these only (1) and (2) are promissory notes. The specimen of a promissory note is given below :

Specimen of a promissory note

Rs. 1,000

Delhi, February 10,2000

Three months after date I promise to pay Shyam Sunder or order ; sum of one thousand rupees, for

value received.

To,

Shyam Sunder 222, Ashok Vihar Delhi-110052

Bential elements

For an instrument to become a promissory note, it must have the lowing essential elements :

1. Writing. The instrument must be in writing. Mere verbal hgagement to pay is not enough.

Writing includes print and typewriting ' ihd may also be in pencil or ink.

2. Promise to 'pay. The instrument must contain an express promise o pay. A mere acknowledgment of

indebtedness or implied undertaking >y the use of the word 'debt' or 'pronote', is not sufficient and it

does not cms titute 'a promissory note.

The following instruments signed by A are not promissory notes :

(a) "Mr. B, I.O.U. Rs. 100" or "Mr. B, I owe you Rs. 100".

(b) "I am liable to B. in a sum of Rs. 500 to be paid by instalments." , (d ..• "I am bound to pay the

sum of Rs, 500 which I received from you." '( A receipt for money, if it does not contain express

promise to pay, i^; tot a promissory note.

Example. "I of my own free will and accord approached B and borrowed from him the sum of Rs. ^00

bearing interest at the rate of 50 paise per cent per mensem. I have, therefore, executed these few

presents by way of a promissory note so that it may serve as'evidence ,and be of use when needed."

Signed by A. Held, the instrument is not a promissory note as it does not contain an express

undertaking to pay the airiount mentioned in it [Bal Mukand v. Munna Lal Ramjl Lal A.I.R. (1970) P.

& H. 516].

But if the receipt is coupled with a promise to pay, it is a promissory iote.

Example. "We have received the sum of Rs. 9,000 from Shri R.R.-Sharma. This amount will be

repaid on demand. We have received ; this amount in cash". Held, this is a promissory note [Surjit

Singh v, ^RamRatan,A.l.R. (1975) Gau. 15].

3. Definite and unconditional The promise to pay must be definite nd unconditional. If it is uncertain

or conditional, the instrument ii nvalid.

Thus the following instruments signed by A are not promissory! totes :

(a) "I promise to pay B a sum of Rs. 500, when convenient or able".

(b) "I promise to pay B Rs. 500 by instalments with a proviso that payment shall be made after my

death." "I promise to pay B Rs. 500 when he delivers the goods." "I promise to pay B Rs. 500 on D's

death, provided D leaves enough to pay that sum." [Robert v. Peake, (1757) 97 E.R 333). However*'

the promise to \pay may be subject to a condition wh: ccording to the ordinary experience of mankind

Is bound to hap] 'hus a promise (or order, In case of a bill of exchange) to pay is :onditional' if—

(1) It depends upon an event which is certain to happen though ime of Its happening may be uncertain.

Examples, (a) A promises to pay B a sum of Rs.' 500 after the of C. This is not a conditional promise

for it is certain that C die.

(b) "Iv promise to pay Rs. 1,000 to B, 30 days after his with C." Signed by A. This is not a

promissory note as it is pi that Bmay not marry C [Beardsley v. Baldwin. (1741) 93 E.R 1994J.

(d) (d)

NOTES, BILLS AND CHEQUES 3^9

(2) >the promise is to pay at a particular place or after a specified time.

4. Signed by the maker. The instrument must be signed by the maker, otherwise it is incomplete and of

no effect. Even if it Is written by the maker himself and his name appears in the Body of the

instrument, his signature must be thene^ Signature means the writing of a person's name in order to

authenticate and give effect to the contract contained in the instrument. It is. at the same time,

essential that the mind of the signer must accompany the signature., ' !

An agent of a trading firm can sign a promissory note on its behalf [Meenofcshiv. Chettiar, A.I.R

(1957) Mad. 8].

5. Certain parties. The instrument must point out with certainty" as to who the maker is and who the

payee, is. Where the maker and the payee cannot be identified with certainty from the instrument

itself, the instrument, even if it contains an unconditional promise to pay, is not a promissory note.^

The payee may sometimes be misnamed or designated by description only. In such a case, the note is

valid if the payee can be ascertained by evidence [Willts v. Barret, (1816) 2 Stark 29]. As such a

promissory note payable 'to the manager ofla certain bank' is payable to a certain person. '

A promissory note cannot be made payable to the maker (promisor) himself. Such a note is a nullity.

But if It is indorsed by the maker to some other person or indorsed in blank, it becomes a valid

promissory note [Coy v. Lan^oZ, (1848) 17 L.T.C.P. 286].

6. Certain sum qfmoney. The sum payable must be certain and must

not be capable of contingent additions or subtractions.

The following instruments signed by A are not promissory notes (as

the sum payable is not certain):

W "I promise to pay B Rs. 1.000 and all the other sums due to him." (9 "I promise to pay B Rs.

1.000 and the fine according to the rules." (d "I promise to pay B Rs. 500, first deducting thereout

any money

which he may owe me." The sum payable is certain—

(1) When it is payable with /interest. But if the rate of interest is not stated in the instrument, it is not a

promissory note.

(2) When it is payable at an indicated rate of exchange.

(3) When it is payable by Instalments, with a provision that on default being made in payment, the

balance unpaid shall become due (Sec. 5, para 3).

7. Promise to pay money only.; The payment to be made under the instrument must be in the legal

tender money of India. If the instrument contains a promise to pay something other than money or

something in addition to money, it cannot be a promissory note.

Thus the following Instruments signed by A are not promissory notes:

W "I promise to pay B Rs. 200 and deliver one quintal of paddy." x (fcj "I promise to pay B in 20

shares and 10 bonds of XVLtd." W "I promise to deliver to B 100 bap« of wheat"

8. Bank note or currency note is not a promissory note. This is because a bank note or a currency

note Is money itself.

9. Formalities like number, date, place, consideration, etc. These are usually found in an instrument

although they are not essential in law. The omission of the words 'for value received', the place where

the instrument is made or where it is payable or date (if the date of execution of the Instrument can*

be Independently proved) do not invalidate the instrument. The date of a promissory note is also not

necessary unless the amount is payable at a Certain time after date. But it must bear the necessary

stamp under the Indian Stamp Act, 1899.

10; It may. be payable on demand or after a definite period of time. The expression 'on demand'

means payable immediately or forthwith.

11. It cannot be made payable to bearer on demand. The Reserve Bank of Indi^ Act, 1934 prohibits

issue of such promissory notes' except by the Reserve Bank of India itself or the Central Government.

Lack of any of the requirements mentioned in Sec. 4 will not make a , document a promissory note

[Bapanna Krlshnayya V. Chaparala Baburao, A.I.R. (1977) AP. 42].

% BI£L OF EXCHANGE

A bill of exchange Is an instrument in writing containing an unconditional order, * sighed by the

maker, directing a certain person to pay a certain sum of money only to, or to the order of, a certain

person or to the bearer of the instrument (Sec. 5).

Parties to a bill. There are three parties to a bill of exchange, viz.. the drawer* the drawee and the

payee.

The person who gives the order to fay or who makes the bill is called the drawer.

The person who is directed to pay is called the drawee.

When the drawee accepts the bill, he is called the acceptor.

The person to whom the payment is to be made is called the payee. Where the payee named in a bill is

a fictitious or non-existing person, the bill is treated as/payable to bearer [Clhtton v. Attenborough,

(1897) A.C. \ 901. In some cases, the drawer and the payee, or when a principal draws on his agent,

the drawer and the drawee may be one and the same person.

The drawer or the payee who is in possession of the bill' is called the holder. The holder must present

the bill to the drawee for his acceptance.

When the holder indorses the bill, note or cheque, he is called the indorser. The, person to whom the

bill, note or cheque is indorsed Is called the indorsee.

When in the bill or in any indorsement thereon the name of anjNf person is given in addition to the

drawee to be referred to in case of need, ,i such person is called a drawee in case of need (Sec. 7, para

2). The name ofj the drawee in case of need may be given in the bill by the drawer at tbj time when it

is drawn or by some subsequent indorser. The resort is to be} had to the 'drawee in case of need' only

when the bill is dishonoured non-acceptance or non-payment.

Specimen of a bill of exchange

Sham of Delhi buys goods on credit from Krishan qf Bombay for 500 to be paid 3 months after date.

Krishan buys goods from Ram of Delh» for Rs. 500 on similar terms. Now Krishan may order Sham

to pay the f sum of Rs. 500 to Ram. This order will be a bill of exchange.

NOTES, BILLS AND CHEQUES

Rs. 500 Mumbai, Jan. 10, 2000 Three months after date pay to Ram or order the sum of five hundred

rupees, for value received. To,

Sham

235, Subhash Marg,

Delhi-110006.

In case of need with CanaraBank, Delhi

Accepted Sham

Sd/-

Stamp Krishan

Essential elements

1. It must be in writing.

2. It must contain an order to pay.

Example. "Mr. Little, Please let the bearer have & 7 and oblige." Signed by A . This is not a bill of

exchange as it contains a request and not an order [Littlev. Slackford, (1828) M. & W. 171).

3. The order must be unconditional.

4. It requires three parties, i.e., the drawer, the drawee and the payee.

5. The parties must be certain.

6. It must be signed by the drawer.

7. The sum payable must be certain .

8. It must contain an order to pay money.

9. The formalities relating to number, date, place and consideration, though usually found in bills, are

not essential in law. But a bill must be affixed with the necessary stamp.

A bill as originally drawn cannot be made payable to bearer on demand.

Distinction between a bill of exchange and a promissory note

1. In a note there are two parties—the maker and the payee. In a bill there are three parties—the

drawer, the drawee and the payee.

2. A note contains an unconditional promise to pay. A bill contains an unconditional order to pay.

3. The maker of a note is the debtor and he himself undertakes to Pay. The drawer of a bill is the

creditor who directs the drawee (his debtor) to pay.

4. The maker of a note corresponds in general to the acceptor of a °>11. But the maker of the note

cannot undertake to pay conditionally jvhereas the acceptor may accept the bill conditionally because

he is not the originator of the bill.

5. The liability of the maker of a note is primary and absolute, reas the liability of the drawer of a bill

is secondary and conditional.

6. A note cannot be mad^ "payable to the maker himself, whereas in a the drawer and the payee may

be one and the same person.

7. A note requires no acceptance as it is signed by the person who is liable to pay. A bill payable after

sight or after a certain period must be accepted by the drawee before it is presented for payment.

8. A note cannot be drawn payable to bearer. A bill can be so drawn. But in no case can a note or bill

be drawn 'payable to bearer on demand.'

9. The maker of a note stands in immediate relation with the payee. The drawer of a bill stands in

immediate relation with the acceptor and not the payee.

10. Certain provisions like (a) presentment for acceptance (Sec. 61),! (b) acceptance (Sec. 75), (c)

acceptance for honour (Sec. 108), and (d) bill! in sets (Sec. 132) apply to bills but not to notes.

1 1 . In case of dishonour of a bill either by non-acceptance or by nonpayment, due notice of

dishonour must be given to all the persons who are to be made liable to pay. This includes the drawer

and the prior indorsers. But in the case of dishonour of a note no such notice is required to be given to

the maker (Sec. 93).

12. Foreign bills must be protested for dishonour when such protest is required by the law of the place

where they are drawn (Sec. 104). No such protest is required in the case of a note.

CHEQUE

A cheque is a bill of exchange drawn upon a specified banker and payable on demand and it includes

the electronic image of a truncated cheque and a cheque in the electronic form.

A cheque in the electronic form means "cheque which contains the exact mirror image of a proper

cheque, and is generated, written and signed in a secure system ensuring the minimum safety

standards with the use of digital signature and asymmetric crypto system.

A truncated cheque means a cheque which is truncated during the, course of a clearing cycle, either by

the clearing house or by the bank whether paying or receiving payment, immediately on generation of

an electronic image for transmission, substituting the further physical' movement of the cheque in

writing. "®

"Clearing house" means the clearing house managed by the Reserve^ Bank of India or a clearing

house recognised as such by the Reserve Bank of India [Sec. 6 as substituted by the Negotiable

Instruments (Amendment and Miscellaneous Provisions) Act, 2002] ''s'/

A cheque is a species of a bill of exchange two additional qualifications, viz.,

but it has the foil

owing-

(1) It is always drawn on a specified banker, and

(2) It is always payable on demand.

rflv

All cheques are bills of exchange, but all bills of exchange are n< cheques. A cheque must have all the

essential requisites of a bill exchange. It must be signed by the drawer. It must contain

unconditional order on a specified banker to pay a certain sum of mon1 to or to the order of a

specified person or the bearer of the cheque. it does not require acceptance as it is intended for

immediate payment

NOTES, BILLS AND CHEQUES

The usual form of bank cheque is as follows :

323

No......

Pay..

Date .

..2000

PUNJAB NATIONAL BANK Subzi Mandi, Delhi-110007

..or bearer the sumofRs.

Rs.

Sd/-

Distinction between a bill of exchange and a cheque

1. A bill of exchange may be drawn on any person, including a banker, but a cheque is always drawn

on a banker. Thus all bills are not cheques whereas all cheques are necessarily bills.

2. A bill must be accepted before the drawee can be called upon to make payment upon it. A cheque

requires no acceptance.

3. A bill which is not expressed to be payable on demand is entitled to three days of grace. A cheque is

not entitled to any days of grace.

4. A bill may be payable on demand or after the expiry of a certain period after date or sight. A cheque

is always payable on demand.

5. A bill must be duly presented for payment to the acceptor or else the drawer of the bill will be

discharged from liability. The drawer of a cheque is not necessarily discharged from his liability by

delay of the holder in presenting it for payment. He is discharged only to the extent of the damage, if

any, suffered by him.

6. A cheque may be crossed but not a bill.

7. A cheque does not require any stamp whereas a bill, except in certain cases, must be stamped.

8. The payment of a cheque may be countermanded by the drawer but the payment of a bill cannot be

countermanded.

9. A cheque is not required to be noted or protested for dishonour. A bill may be noted or protested for

dishonour. Marking of cheques

A cheque does not require acceptance in ordinary course of business as it is intended for immediate

payment. The custom among bankers to mark cheques as 'good for payment' does not amount to an

acceptance. Marking is the writing on a cheque by the drawee banker that it would be honoured when

it is duly presented for payment. The effect of marking a cheque as good by the drawee banker is that

it cannot be countermanded by the drawer subsequently and the payee is certain of getting the money.

In India, no such practice of marking of cheques has been established either by judicial decisions or by

Statutes [Bank of Borodav. Punjab National Bank, (1944) A.C. 176).

Cheques may be marked as good by the drawee banker at the instance of

(1) the drawer, or

(2) the holder, or

(3) the collecting banker.

(1) Marking at drawer's instance. When a cheque is marked good at the instance of the

drawer, the drawee banker earmarks sufficient funds in the account to meet the cheque

when it will be presented for payment. The drawer cannot afterwards countermand

payment of such cheque' The banker is entitled to dishonour other cheques if their

encashment would leave the banker with insufficient funds to meet the cheque marked

good.

(2) Marking'at holder's instance. When a cheque is marked good at the holder's instance,

it is an intimation to the holder that at the time of marking, the banker has sufficient funds

of the drawer in his hands. The banker may refuse to honour the cheque when it is

subsequently presented for payment if in due course the drawer has withdrawn funds or

stopped payment of the cheque.

(3) Marking at collecting banker's instance. Where a cheque is received by a collecting

banker too late for inclusion in the clearing, he may, to safeguard the interest of the

customer, present such cheque for marking by the drawee banker. When a cheque is

marked at the collecting banker's instance, the marking is treated as 'constructive

payment' because the banking custom is that such cheque shall be honoured when it is

presented through the next clearing.

Crossing of cheques

There are two types of cheques, open cheques and crossed cheques. A cheque which is

payable in cash across the counter of a bank is called, an open cheque. When such a

cheque is in circulation, a great risk, attends it, If its holder loses it, its finder may go to

the bank and get payment unless its payment has already been stopped. It was to prevent

the losses incurred by open cheques getting into the hands of wrong persons that the

custom of crossing was introduced.

A crossed cheque is one on which two parallel transverse lines with or without the words

'& Co.' are drawn. The payment of such a cheque can be obtained only through a banker.

Thus crossing is a direction to the drawee banker to pay the amount of money on a

crossed cheque generally to a banker or a particular banker so that the party who obtains

the payment of the cheque can be easily traced. The crossing compels the holder to

present the cheque through a "quarter of known^ respectability and credit" and affords

security and protection to the1: owner of the cheque, as the cheque is payable only

through a banker.

Types of crossing. There are two types of crossing, viz., (I) general crossing, and (2)

special crossing.

Another type of crossing known as 'restrictive crossing' has developed out of business

usage.

1. General crossing. A cheque is said to be crossed generally where it bears across its face

an addition of—

(0 the words 'and company' or any abbreviation thereof, between two parallel transverse

lines, either with or without the words 'not negotiable' ; or

(ill two parallel transverse lines simply, either with or without the words 'not negotiable'

(Sec. 123).

NOTES, BILLS AND CHEQUES

Specimens of general crossing :

Where a cheque is crossed generally, the drawee banker shall not pay it unless it is

presented by a banker (Sec. 126, para 1).

2. Special crossing. Where a cheque bears across its face an addition of the name of a

banker, either with or without the words 'not negotiable', the cheque is deemed to be

crossed specially (Sec. 124). Transverse lines are not necessary in case of a special

crossing. The payment of a specially crossed cheque can be obtained only through the

particular banker whose name appears across the face of the cheque or between the

transverse lines, if any.

Specimens of special crossing :

Where a cheque is crossed specially the banker on whom it is drawn shall pay it only to

the banker on whom it is crossed, or his agent for collection (Sec. 126, para 2)

3. Restrictive crossing. In addition to the two statutory types of crossing discussed above,

there is another type which has been adopted by commercial and banking usage. In this

type of crossing the words 'A/c Payee' are added to the general or special crossing.

Specimens of restrictive crossing :

The words 'A/c Payee' on a cheque are a direction to the collecting banker that the

amount collected on the cheque is to be credited to the account of the payee. If he credits

the proceeds to a different account, he is prima facie guilty of negligence and will be

liable to the true owner for the amount of the cheque. It should however be noted that

'A/c Payee' cheques are negotiable [British Bank of Middle East v. Almal Bros QR CWN

2851.

Not negotiable crossing (Sec. 130). The effect of the words 'not negotiable' on a crossed

cheque is that the title of the transferee of such a cheque cannot be better than that of its

transferor. The addition of the words 'not negotiable' does not restrict the further

transferability of the cheque. It only takes away the main feature of negotiability, which

Is that a holder with a defective title can give a good title to a subsequent holder in due

course. Anyone who takes a cheque marked 'not negotiable' takes it at his own risk.

The object of crossing a cheque 'not negotiable' is to afford protection to the drawer or

holder of the cheque against miscarriage or dishonesty in the course of transit by making

it difficult to get the cheque so crossed cashed, until it reaches its destination.

Example. W drew a cheque crossed 'not negotiable' in blank and, handed it to his clerk to

fill in the amount and the name of the payei. ] The clerk inserted a sum in excess of her

authority and delivered the cheque to P in payment of a debt of her own. Held, the clerk

had nO title to the cheque and as such Phad no better title, and thereforeW^ was not

liable [Wilson & Meeson v. Pikering, (1946) K.B. 422]. Who may cross a checque (Sec.

126). A cheque may be crossed by- ;

(1) The drawer. He may cross the cheque generally or specially. •• f.;

(2) The holder. Where the cheque is uncrossed, the holder may cross! it generally or

specially. Where it is crossed generally, he may cross It specially. Where it is crossed

generally or specially, he may add the; words 'Not Negotiable'.

(3) The banker. Where a cheque is crossed specially, the banker to j whom it is crossed

may again cross it specially to another banker agent) for collection.

CLASSIFICATION OF NEGOTIABLE INSTRUMENTS

The negotiable instruments may be classified as : Bearer and order instruments " if |

Bearer instruments. A negotiable instrument is payable to bearer— ,.,

(1) when it is expressed to be so payable, or

(2) when the only or last indorsement on the instrument Is indorsement in blank.

[Explanation (ii) to Sec. 13]

Any person who is in lawful possession of an instrument payabtej bearer, as a holder, is

entitled to enforce payment due on it. He ~ when he receives money, be required to

acknowledge receipt of money < the instrument by signing on it.

A promissory note and a bill of exchange cannot be made payable 1 bearer on demand. A

promissory note cannot be payable to bearer due restrictions imposed by the Reserve

Bank of India Act, 1934.

Order instruments. A negotiable instrument is payable to order—

(1) when it is expressed to be payable to order, e.g., 'Pay to

NOTES, BILLS AND CHEQUES 327

order' or 'Pay to the order of A. In both these cases, the bill is payable to A or his order at

his option.

(2) when it is expressed to be payable to a particular person, and does not contain words

prohibiting or restricting its transfer, e.g ., 'Pay A one hundred rupees.' [Explanation (i) to

Sec. 13]

Inland and foreign instruments

Inland instruments. A promissory note, bill of exchange or cheque which is (1) both

drawn or made in India and made payable in India, or (2) drawn upon any person resident

in India, is deemed to be an inland instrument (Sec. 11). A bill of exchange drawn upon a

resident in India is an inland bill irrespective of the place where it was drawn.

Examples of inland bill, (a) A bill is drawn in Delhi on a merchant in Bombay and

accepted payable in Calcutta or London.

(b) A bill is drawn^in Delhi on a merchant in London and accepted payable in Calcutta.

(c) The above bills are indorsed in New York.

Foreign instruments. An instrument, which is not an inland instrument, is deemed to be a

foreign instrument (Sec. 12).

Foreign bills must be protested for dishonour if such protest is required by the law of the

place where they are drawn. But protest in case of inland bills is optional (Sec. 104).

Usance. Usance is the time fixed for the payment of bills drawn in one country and

payable in another. It is fixed by the custom of the countries and the length of the usance

varies in different countries.

Instruments payable on demand

A cheque is always payable on demand and it cannot be expressed to be payable

otherwise than on demand (Sec. 6). A promissory note or bill of exchange is payable on

demand—

(a) when no time for payment is specified in it (Sec. 19) ; or

(b) when it is expressed to be payable 'on demand', or 'at sight' or 'on presentment'. The

words 'on demand' are usually in a promissory note, the words 'at sight' are in a bill of

exchange.

In a promissory note or bill of exchange, the expressions 'at sight ' and 'on presentation'

mean 'on demand' (Sec. 21).

Time instruments

A bill or note which is payable (a) after a fixed period, or (b) after sight, or (c) on a

specified day, or (d) on the happening of an event which is certain to happen, is known as

a time instrument. If the event is such as is bound to happen, even though the actual time

of its happening is uncertain as, for example, the death of a certain person, there is a valid

bill or note. But if the event is probable but not certain to happen, the instrument does not

become valid if the event happens. Likewise an order to pay on or before a specified date

is not a bill IWilliamsonv. Rider, (1963) 1 Q.B. 89].

The expression 'after sight' in a promissory note means after

resentment for sight. This means that payment cannot be demanded on

* note till it has been shown to the maker. The expression 'after sight' in

Dill of exchange means after acceptance, or noting for non-acceptance,

r Protest for non-acceptance (Sec. 21).

Accommodation bill

A bill may be—

(1) a genuine trade bill, or

(2) an accommodation bill.

When a bill is drawn, accepted, or indorsed for consideration, called a 'genuine trade bill'.

When it is drawn, accepted or inde without any consideration, it is called an

'accommodation bill'.

Example. A is in need of Rs. 1,000. He approaches his friend for borrowing the amount.

B is not in a position to lend, but j| suggests that A might draw a bill on him which he

would acceptij the credit of A is good, he would get the bill discounted w] banker. On the

due date, A would pay Rs. 1,000 to Bwho meet the bill. This bill is an accommodation

bill.

In this case, B is the 'accommodating party', or 'accommodation! party', and A is the

'accommodated party'. The accommodating pai' signs the 'accommodation bill' as drawer,

acceptor, or indorser withe receiving value therefor and for the purpose of lending his

name to so other person. He is liable on the bill'to the holder, and it is immat __ whether,

when such holder took the bill, he knew such party to be anl accommodating party or not.

The rules regarding accommodation bills are as follows :

1. The accommodated party cannot, after he has paid the amount| the bill, recover the

amount from any person who became a party to i bill for his accommodation (Exception

1 to Sec. 43).

Example. A bill is drawn and accepted for the accommodation <

B, the payee. B indorses the bill to C. The bill is dishonoured

pays the amount of the bill. B cannot sue the drawer or the acce

to recover the amount.

2. An accommodation bill can even be negotiated after provided the person to whom it is

negotiated takes it in good faith for consideration (Sec. 59).

3. Non-presentment of an accommodation bill to the acceptor ; payment does not

discharge the drawer.

4. When an accommodation bill is dishonoured, failure to give no of dishonour does not

discharge the prior parties from the liability. Fictitious bill

When the name of the drawer or the payee or both is fictitious : bill, the b'll is called a

fictitious bill. Where both the drawer and payee of a bill are fictitious persons, the

acceptor is liable to a holtf due course, if the holder in due course can show that the

signat the supposed drawer and that of the first indorser (payee) are same handwriting

(Sec. 42). If, however, the holder knows or has : to believe that the drawer or the payee is

a fictitious person, he is : holder in due course as he is not getting the bill in good faith

such cannot claim the money. Documentary bill and clean bill

When documents of title to the goods and other documents^ invoice, marine insurance

policy, etc., are annexed to a bill, the called a documentary bUl. Such documents are

delivered to the only on acceptance or payment of the bill. When no documents

to the goods represented by the bill are attached to it, it is called a clean

bill Escrow

When a negotiable instrument is delivered conditionally or for a special purpose as a

collateral security or for safe custody only, and not for the purpose of transferring

absolutely properly therein, it is called ah escrow. As between immediate parties, when

an instrument is delivered conditionally, there is no liability to pay unless the conditions

agreed upon are fulfilled. The liability to pay in case of an escrow does not arise if the

conditions agreed upon are not fulfilled, or the purpose for which the instrument was

delivered is not satisfied. This, however, does not affect the rights of a holder in due

course and the defence that the instrument was delivered conditionally as between

immediate parties cannot be set up against a holder in due course (Sec. 46, para 3).

Example. A, the holder of a bill, indorses it to 'B or order' for the

express purpose that B irtay get it discounted. B negotiates the bill to

C who takes it bonafide and for value. C is a holder in due course,

and he acquires a good title to the bill. Ambiguous instrument

When an instrument owing to its faulty drafting may be interpreted either as a promissory

note or a bill of exchange, it is called an ambiguous instrument. Its holder has to elect

once for all whether he wants to treat it as a promissory note or a bill of exchange (Sec.

17). Once he does so, he must abide by his election.

Examples, (a) A bill is drawn by A, an agent, acting within the

scope of his authority upon his principal, P. The holder may, at his

option, treat it as a note or bill because the drawer (A) and the

drawee (f. are the same person.

(b) A draws a bill on B and negotiates it himself. B is a fictitious

drawee. The holder may treat the bill as a note made by A.

If the amount undertaken or ordered to be paid is stated differently in figures and in

words, the amount stated in words is the amount undertaken or ordered to be paid (Sec.

18).

Example. A bill is drawn "Pay A or order the sum of one

thousand rupees". In the margin, the amount stated is Rs. 100. This

is a bill for Rs. 1,000. Inchoate instrument (Sec. 20)

An inchoate instrument is an incomplete instrument in some respect. When a person signs

and delivers to another a blank or incomplete stamped paper, he authorises the other

person to make or complete upon it a negotiable instrument for any amount not exceeding

the amount covered by the stamp. The person so signing is liable upon such instrument,

in the capacity in which he signed the same, to any "older in due course for such amount.

But a person other than a holder n due course cannot recover from the person delivering

the instrument ^ything in excess of the amount intended by him to be paid thereunder.

Examples, (a) A bill is drawn "payable to... or order". Any holdei

in due course may write his own name as payee in the blank and

sue upon the instrument.

(b) A owes B Rs. 1,000. He gives B a blank acceptance on a bill

which is sufficiently stamped to co 'er any amount upto Rs. 2 O(XV

Você também pode gostar

- Contoh InvoisDocumento1 páginaContoh InvoisIdea Fokus75% (4)

- Articles of Organization Limited-Liability Company: (Pursuant To Nrs Chapter 86)Documento9 páginasArticles of Organization Limited-Liability Company: (Pursuant To Nrs Chapter 86)RocketLawyer100% (1)

- Study of Customer Perception Towards Electric VehiclesDocumento52 páginasStudy of Customer Perception Towards Electric Vehiclessistla.suneetha100% (1)

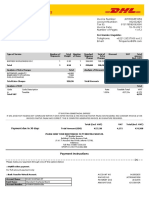

- InvoiceDocumento2 páginasInvoiceAndrei OctavianAinda não há avaliações

- Title 18 Pa Crimes CodeDocumento507 páginasTitle 18 Pa Crimes CodeLeon Goodman100% (1)

- Duane Lilien'Scomplaintfor Breach Ofcontract-Case NoDocumento9 páginasDuane Lilien'Scomplaintfor Breach Ofcontract-Case NoADSJDAinda não há avaliações

- Foreclosure Case Killer!-An Allonge Is Not Admissable Evidence of Bank's OwnershipDocumento1 páginaForeclosure Case Killer!-An Allonge Is Not Admissable Evidence of Bank's OwnershipMark Anaya100% (1)

- I Am An Attorney So I Decided To Sue My Lender... (Conclusion: Failed) Mills v. First Horizon HomeDocumento6 páginasI Am An Attorney So I Decided To Sue My Lender... (Conclusion: Failed) Mills v. First Horizon Homejga30328Ainda não há avaliações

- Imperium Mandate Ref. (IMO2020 25) Copy Not OriginalDocumento3 páginasImperium Mandate Ref. (IMO2020 25) Copy Not OriginalempressAinda não há avaliações

- Repudiation of ContractsDocumento22 páginasRepudiation of ContractsLionel MukwenaAinda não há avaliações

- Negotiable Instrument ActDocumento44 páginasNegotiable Instrument ActpothigaiselvansAinda não há avaliações

- Pronunciation Guide for Common Mathematical SymbolsDocumento15 páginasPronunciation Guide for Common Mathematical Symbolsall4uclubAinda não há avaliações

- National Insurance Company Limited v. Boghara Polyfab Private LimitedDocumento5 páginasNational Insurance Company Limited v. Boghara Polyfab Private LimitedSandeep Singh BhandariAinda não há avaliações

- Commercial Liens: A Most Potent Weapon: Home Search Guest Book Contact What'S New Disclaimer Source AreaDocumento74 páginasCommercial Liens: A Most Potent Weapon: Home Search Guest Book Contact What'S New Disclaimer Source AreaMicheal Lee100% (1)

- Negotiable LawDocumento24 páginasNegotiable LawMahesh JagadaleAinda não há avaliações

- Moortsb Uutfonu (Republic Gobernmert Rspublirge: MuurthuilodDocumento10 páginasMoortsb Uutfonu (Republic Gobernmert Rspublirge: MuurthuilodYarod YisraelAinda não há avaliações

- Robert's Justice, US Courts - Rules of CourtDocumento102 páginasRobert's Justice, US Courts - Rules of CourtRobertsJusticeAinda não há avaliações

- Petition For Judicial Review 1Documento9 páginasPetition For Judicial Review 1Lisa SorgAinda não há avaliações

- Deed of ExchangeDocumento9 páginasDeed of ExchangeVandana JogAinda não há avaliações

- Amer. Surety Co. v. Bethlehem Bank, 314 U.S. 314 (1941)Documento9 páginasAmer. Surety Co. v. Bethlehem Bank, 314 U.S. 314 (1941)Scribd Government DocsAinda não há avaliações

- The Story of The Buck Act: Security Number"Documento4 páginasThe Story of The Buck Act: Security Number"Bálint Fodor100% (1)

- Negotiable InstrumentsDocumento9 páginasNegotiable InstrumentsAndrolf CaparasAinda não há avaliações

- Breaking NewsDocumento1 páginaBreaking NewsanticorruptionAinda não há avaliações

- Advisors Mortgage V Real Source Title, John C. Povejsil, Jason E. Fischer, Frank T. Griebenow, New Millennium GroupDocumento24 páginasAdvisors Mortgage V Real Source Title, John C. Povejsil, Jason E. Fischer, Frank T. Griebenow, New Millennium GroupCamdenCanaryAinda não há avaliações

- Applying The Rome Statute of The International Criminal Court - ADocumento67 páginasApplying The Rome Statute of The International Criminal Court - AArun Barkat100% (1)

- Obligation and Contract Art 1157 CasesDocumento9 páginasObligation and Contract Art 1157 CasesMaricar BautistaAinda não há avaliações

- Negotiable Instruments Case DigestDocumento5 páginasNegotiable Instruments Case DigestCazzandhra BullecerAinda não há avaliações

- Federal Reserve Banks Act-Public Law 63-43,38 STAT 251 - 1913-12-23 PDFDocumento2 páginasFederal Reserve Banks Act-Public Law 63-43,38 STAT 251 - 1913-12-23 PDFStar Gazon0% (1)

- Asset Securitisation What Is SecuritisationDocumento7 páginasAsset Securitisation What Is SecuritisationVaishali Jhaveri100% (1)

- Banking Working Capital & Term Loan Water Case StudyDocumento2 páginasBanking Working Capital & Term Loan Water Case Studyanon_652192649Ainda não há avaliações

- An Overview of Article 78 Practice and Procedure 05-21-09Documento81 páginasAn Overview of Article 78 Practice and Procedure 05-21-09test123456789123456789Ainda não há avaliações

- Bank of America, NT & SA, Petitioner, vs. COURT OF Appeals, Inter-Resin Industrial Corporation, Francisco Trajano, John Doe and Jane DOE, RespondentsDocumento29 páginasBank of America, NT & SA, Petitioner, vs. COURT OF Appeals, Inter-Resin Industrial Corporation, Francisco Trajano, John Doe and Jane DOE, Respondentseasa^belleAinda não há avaliações

- Lawful RebellionDocumento2 páginasLawful RebellionHelen Walker Private PersonAinda não há avaliações

- Defendants Motion To StayDocumento5 páginasDefendants Motion To StayAndrea RaelAinda não há avaliações

- A Little Bit of LachesDocumento21 páginasA Little Bit of LachesJoe RealAinda não há avaliações

- Acceptance means when the person to whom the proposal is made signifies his assent theretoDocumento40 páginasAcceptance means when the person to whom the proposal is made signifies his assent theretovijay vighnesh100% (1)

- Media RentHelpMN Dec 2021Documento12 páginasMedia RentHelpMN Dec 2021Lindsey PetersonAinda não há avaliações

- Notice of Submission Date For Determination of AppealDocumento1 páginaNotice of Submission Date For Determination of AppealD B Karron, PhDAinda não há avaliações

- Yusuf Ahmed Alghanim & Sons, W.L.L. v. Toys "R" Us, Inc. Tru (HK) Limited, 126 F.3d 15, 2d Cir. (1997)Documento16 páginasYusuf Ahmed Alghanim & Sons, W.L.L. v. Toys "R" Us, Inc. Tru (HK) Limited, 126 F.3d 15, 2d Cir. (1997)Scribd Government DocsAinda não há avaliações

- Ashwander v. TVA, 297 U.S. 288 (1936)Documento45 páginasAshwander v. TVA, 297 U.S. 288 (1936)Scribd Government DocsAinda não há avaliações

- United States Court of Appeals, First CircuitDocumento8 páginasUnited States Court of Appeals, First CircuitScribd Government DocsAinda não há avaliações

- How To Complete Certified DocumentsDocumento1 páginaHow To Complete Certified DocumentsDeannaAinda não há avaliações

- Black Diamond SS Corp. v. Robert Stewart & Sons, LTD., 336 U.S. 386 (1949)Documento17 páginasBlack Diamond SS Corp. v. Robert Stewart & Sons, LTD., 336 U.S. 386 (1949)Scribd Government DocsAinda não há avaliações

- Holton v. Reed, 193 F.2d 390, 10th Cir. (1951)Documento7 páginasHolton v. Reed, 193 F.2d 390, 10th Cir. (1951)Scribd Government DocsAinda não há avaliações

- HandBook of Practical Forms PDFDocumento424 páginasHandBook of Practical Forms PDFEtheleneAinda não há avaliações

- Court Rules NO Evidence MERS May Assign NoteDocumento6 páginasCourt Rules NO Evidence MERS May Assign NotejohngaultAinda não há avaliações

- Affidavit Summary JudgmentDocumento2 páginasAffidavit Summary JudgmentAdrian ReyesAinda não há avaliações

- In The Matter of FL AG Nationwide Title Clearing L10!3!027Documento12 páginasIn The Matter of FL AG Nationwide Title Clearing L10!3!027larry-612445Ainda não há avaliações

- Trust ReceiptDocumento3 páginasTrust ReceiptMaFatimaP.LeeAinda não há avaliações

- NJ Debt Collection LawsDocumento10 páginasNJ Debt Collection LawsfdarteeAinda não há avaliações

- The Chains Negotiable Instrument "Indorsements": Public RecordsDocumento4 páginasThe Chains Negotiable Instrument "Indorsements": Public RecordsA. CampbellAinda não há avaliações

- Bankruptcy - Louisiana TIPS SpeechDocumento68 páginasBankruptcy - Louisiana TIPS SpeechRicharnellia-RichieRichBattiest-CollinsAinda não há avaliações

- Apus Theory, Part 1 PDFDocumento81 páginasApus Theory, Part 1 PDFHenoAlambreAinda não há avaliações

- Enforcement of Security Interests in Banking TransactionsDocumento20 páginasEnforcement of Security Interests in Banking TransactionsAbhjeet Kumar Sinha100% (1)

- Contracts Notes. 2.27.2013Documento14 páginasContracts Notes. 2.27.2013Jairus AntonyAinda não há avaliações

- SummonsDocumento8 páginasSummonssampichardoAinda não há avaliações

- SuretyDocumento2 páginasSuretyNiño Rey LopezAinda não há avaliações

- Gpo-Conan-1992 The Constitution Analysis and InterpretationDocumento2.466 páginasGpo-Conan-1992 The Constitution Analysis and InterpretationAlex VaubelAinda não há avaliações

- Downes vs. BidwellDocumento4 páginasDownes vs. BidwelljeiromeAinda não há avaliações

- Fed. Sec. L. Rep. P 99,404 First Heritage Corporation v. Prescott, Ball & Turben, 710 F.2d 1205, 1st Cir. (1983)Documento8 páginasFed. Sec. L. Rep. P 99,404 First Heritage Corporation v. Prescott, Ball & Turben, 710 F.2d 1205, 1st Cir. (1983)Scribd Government DocsAinda não há avaliações

- DuressDocumento5 páginasDuressTimothy SiuAinda não há avaliações

- Rights vs Liabilities in Contracts and Legal ClaimsDocumento1 páginaRights vs Liabilities in Contracts and Legal ClaimsNat WilliamsAinda não há avaliações

- Civil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithNo EverandCivil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithAinda não há avaliações

- Study of Customer Perception Towards Electric VehiclesDocumento46 páginasStudy of Customer Perception Towards Electric Vehiclessistla.suneetha100% (1)

- CH 05Documento14 páginasCH 05amitcmsAinda não há avaliações

- CH 03Documento15 páginasCH 03amitcmsAinda não há avaliações

- Developed by Cool Pictures and MultiMedia PresentationsDocumento15 páginasDeveloped by Cool Pictures and MultiMedia Presentationsmusa-mbhele-9081Ainda não há avaliações

- MJM-029: Process, Research and Evaluation - Corporate CommunicationDocumento86 páginasMJM-029: Process, Research and Evaluation - Corporate Communicationsistla.suneethaAinda não há avaliações

- Sales Distribution ManagementDocumento217 páginasSales Distribution Managementsistla.suneethaAinda não há avaliações

- CH 01Documento13 páginasCH 01amitcmsAinda não há avaliações

- Developed by Cool Pictures and MultiMedia PresentationsDocumento15 páginasDeveloped by Cool Pictures and MultiMedia Presentationsmusa-mbhele-9081Ainda não há avaliações

- Introduction To PRDocumento148 páginasIntroduction To PRTí ĐẹtAinda não há avaliações

- American Express Innovates With Social Media Marketing CaseDocumento2 páginasAmerican Express Innovates With Social Media Marketing Casesistla.suneethaAinda não há avaliações

- American Express Innovates With Social Media Marketing CaseDocumento2 páginasAmerican Express Innovates With Social Media Marketing Casesistla.suneethaAinda não há avaliações

- Introduction To Social Media Optimization: Setting The Foundation For Building CommunityDocumento4 páginasIntroduction To Social Media Optimization: Setting The Foundation For Building Communitysistla.suneethaAinda não há avaliações

- Keegan Globalmktg6e 01Documento25 páginasKeegan Globalmktg6e 01Ömer DoganAinda não há avaliações

- Theory of Constraints - 2nd UnitDocumento7 páginasTheory of Constraints - 2nd Unitsistla.suneethaAinda não há avaliações

- Lecture Sales and Distribution Management - Chapter 13 - Krishna K Havaldar, Vasant M Cavale - 1199696Documento31 páginasLecture Sales and Distribution Management - Chapter 13 - Krishna K Havaldar, Vasant M Cavale - 1199696sistla.suneethaAinda não há avaliações

- Consumer Behvior Database UNIT 1 &2Documento9 páginasConsumer Behvior Database UNIT 1 &2sistla.suneethaAinda não há avaliações

- Information Technology A Key For Business Process Re EngineeringDocumento25 páginasInformation Technology A Key For Business Process Re Engineeringsistla.suneethaAinda não há avaliações

- Contract Act 1872 Bare ActDocumento28 páginasContract Act 1872 Bare ActnoopuranandAinda não há avaliações

- TIMES CENTRE FOR LEARNING PVT LTD Airtel statementDocumento3 páginasTIMES CENTRE FOR LEARNING PVT LTD Airtel statementutkarsh rajawatAinda não há avaliações

- Tax Invoice Bill of Supply Cash MemoDocumento1 páginaTax Invoice Bill of Supply Cash MemoSajid PatelAinda não há avaliações

- Ashwin Steel Traders account statement from Apr 2022 to Aug 2022Documento31 páginasAshwin Steel Traders account statement from Apr 2022 to Aug 2022Apeksha GuptaAinda não há avaliações

- Credit Note: Morgan Stanley 12 Floor 25 Cabot Square Canary Wharf London E14 4QADocumento1 páginaCredit Note: Morgan Stanley 12 Floor 25 Cabot Square Canary Wharf London E14 4QAapi-3701571Ainda não há avaliações

- AR Category We Have in GLDocumento4 páginasAR Category We Have in GLwangwongAinda não há avaliações

- Sr. No Date Trans. Code / CHQ No. Particulars Balanced Amount Credit Amount Debit AmountDocumento8 páginasSr. No Date Trans. Code / CHQ No. Particulars Balanced Amount Credit Amount Debit Amountaktaruzzaman bethuAinda não há avaliações

- Impresión de Orden de Compra: Generado El: A Las: Usuario: BZTYZ1 34N40393 00000Documento12 páginasImpresión de Orden de Compra: Generado El: A Las: Usuario: BZTYZ1 34N40393 00000Sal TargarienAinda não há avaliações

- Invoice Happy 1-7Documento12 páginasInvoice Happy 1-7tri ekklesia primaAinda não há avaliações

- Invoice: Depo Pasir SedoganDocumento1 páginaInvoice: Depo Pasir SedoganChandra PriatamaAinda não há avaliações

- Interview Excel Test - ExecutiveDocumento867 páginasInterview Excel Test - Executivesamiksha goyalAinda não há avaliações

- FORM 1932 - 1.Xlsx 2023.Xlsx Mby - xlsx123.Xlsx 12Documento14 páginasFORM 1932 - 1.Xlsx 2023.Xlsx Mby - xlsx123.Xlsx 12mbyedithAinda não há avaliações

- Torrent SssDocumento30 páginasTorrent SssAryan AkashAinda não há avaliações

- SAP Voucher CodesDocumento2 páginasSAP Voucher CodesNiken Jobanputra100% (1)

- L33 10 PDFDocumento1 páginaL33 10 PDF魏釨洋Ainda não há avaliações

- 3655529342Documento2 páginas3655529342Kartigesan999Ainda não há avaliações

- Diadora Utility-239 Order Sales ContactDocumento1 páginaDiadora Utility-239 Order Sales Contactshadman souravAinda não há avaliações

- Sub Order LabelsDocumento163 páginasSub Order LabelsHitzz LalwaniAinda não há avaliações

- Deep Red-07!06!2023 DigitalDocumento29 páginasDeep Red-07!06!2023 DigitalPallavi PandeyAinda não há avaliações

- SK Acknowlegdement ReceiptDocumento2 páginasSK Acknowlegdement ReceiptZednanref Tnek TnecnivAinda não há avaliações

- Purchase OrderDocumento1 páginaPurchase Ordercetak uangAinda não há avaliações

- DBBL EicherAug20 - Final SortDocumento31 páginasDBBL EicherAug20 - Final Sortzannatul zoyaAinda não há avaliações

- Business Plan EssentialsDocumento7 páginasBusiness Plan Essentialsabdul fahim najafiAinda não há avaliações

- Bashid 29Documento34 páginasBashid 294 SEASONS DISCOUNTAinda não há avaliações

- JK Tir 00451058Documento3 páginasJK Tir 00451058Fanny SofiaAinda não há avaliações

- Onnorokom Solutions LTDDocumento3 páginasOnnorokom Solutions LTDYeamin KaziAinda não há avaliações

- Simple Invoice TemplateDocumento8 páginasSimple Invoice Templateuni docAinda não há avaliações

- Addr Sec 3, Sanpa: Doct: Dr.V.V. KrishnanDocumento3 páginasAddr Sec 3, Sanpa: Doct: Dr.V.V. KrishnanravindraraulAinda não há avaliações

- 1.5'' CS Pipe SCH160 Pipe With 3.1 CertificateDocumento12 páginas1.5'' CS Pipe SCH160 Pipe With 3.1 Certificatemahesh mahadkarAinda não há avaliações