Escolar Documentos

Profissional Documentos

Cultura Documentos

Periodic Inventory Valuation Methods

Enviado por

MaryDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Periodic Inventory Valuation Methods

Enviado por

MaryDireitos autorais:

Formatos disponíveis

Periodic Inventory Valuation Methods

Chart 1 Inventory-listing chart in the order items were purchased during the year. Purchase Dates Beginning inventory (oldest material) First purchase of the year Second purchase Third purchase Fourth purchase (Newest Material) Units Available for sale and Goods Available for Sale (Total of all purchases plus beginning inventory) Less: Units Sold Units in ending inventory Number of units

20 40 30 20 30 140 80 60

Cost per unit

7 8 9 10 11 X

Total extended cost

140 320 270 200 330 $1,260

How to Create Chart 1- the Inventory-Listing Chart 1. Create the chart of items, which will display in order from oldest to newest the beginning inventory and all of the items in inventory that were purchased during the year. Start with the beginning inventory, which is any item(s) left in stock at the end of the prior year. Then list in order of purchase date items of inventory purchased during the year. You will start the chart with the four columns which will be labeled as follows: (b) Number of units (c) Cost per unit (d) Total extended cost (b) X (c) = (d)

(a) Purchase Dates

2. Fill in the information of how many purchases, the number of units per purchase, the cost per unit for each purchase. Multiply across the number of units times the cost per unit to get the total extended cost. 3. Total down the columns for number of units and total extended cost. This will give you total units and goods available for sale. There is no need to total column (c) Cost per unit because it provides no useful information. 4. Subtract the total units sold for the total units available for sell in column (b) Number of units to get the number of units in ending inventory.

*Note: This chart is used in calculating the cost of ending inventory and cost of goods sold under all threeinventory valuation methods.

MJC Revised 12/2010

Page 1

Periodic Inventory Valuation Methods

FIFO Method

Chart 1-Use chart 1 from page 1. Chart 2 the calculation for the value of ending inventory:

Purchase Date Number of units Cost per unit Total Extended Cost

Forth purchase Third purchase Second purchase Total ending cost

30 20 10 60

11 10 9

330 200 90 $620

Chart 3 the calculation for the value of Cost of Goods Sold: Item Title Amount Goods Available for Sale 1,260 Less: Cost of Ending Inventory 620 Equals: Cost of Goods Sold $640 Chart 4 the calculation for the value of Cost of Goods sold using the check method. Item Title Number of units Cost per unit Total Extended Cost Beginning Inventory 20 7 140 First purchase 40 8 320 Second purchase 20 9 180 Cost of Goods Sold 80 X 640

*Note that the total cost in chart 4 is the same as the total cost in chart 3.

MJC Revised 12/2010

Page 2

Periodic Inventory Valuation Methods

FIFO Method How to create chart 2 the cost of ending inventory chart for FIFO 1. For FIFO you will need to use these headings for chart 2:

(a) (b) (c) (d) Purchase Date Number of units Cost per unit Total Extended Cost

2. FIFO starts from the bottom of the inventory-listing chart, which is chart 1. Use number of units column (b) and count up until you reach the number of units in the ending inventory. On chart one each row is designated by the date those units were purchased. The rows have the number of units that were purchased on that date in time, the unit price paid for those units along with the total extended cost for all the units purchased on that date. You will find that in counting units in chart 1 from the bottom up that the number of ending units for the last row to complete the total number of units in ending inventory may not be completely used up because some of those units were sold during the year and therefore are no longer in the ending inventory. For the last row used, you will need to multiply the number of units that are needed to complete the total ending inventory times the cost per unit to get the correct value for the row. 3. Once you have the units counted out then multiply out the unit by the unit cost in each row to get the total extended cost. 4. Now total the columns for number of units and total extended cost. These two columns will give you ending inventory in units and ending inventory cost. Never total the column for cost per unit down because it has no useful meaning or value. How to create chart 3 Cost of Goods Sold chart for FIFO 1. For FIFO you will need to use this chart: Item Title Amount Goods Available for Sale Less: Cost of Ending Inventory Equals: Cost of Goods Sold 2. Goods Available for Sale in dollar amounts comes from chart 1 - the inventory-listing chart. You will find that information at the bottom of the chart on the right hand side of your page.

MJC Revised 12/2010

Page 3

Periodic Inventory Valuation Methods

3. Next is Less Cost of Ending Inventory, which comes from chart 2 at the bottom of that chart. 4. Now subtract cost of ending inventory from goods available for sale to arrive at cost of goods sold. How to create chart 4 Cost of Goods Sold Chart Using the Check Method for FIFO 1. For FIFO you will need to use this chart: (a) (b) (c) (d) Item Title Number of units Cost per unit Total Extended Cost Beginning Inventory First purchase Second purchase Cost of Goods Sold X 2. For the check method, you start at the top of chart 1. List items down until you complete the number of units sold during the year. As in counting up for ending inventory their will most likely be units in the last row where some units were sold and some units are still in ending inventory. You will have to recalculate the total extended cost for that row with only the units you are using. 3. Next, recalculate out the total extended cost for each row to make sure that you have rechecked your calculations. Failure to do this recheck could lead to unwanted errors. 4. Finally total the columns down for number of units and total extended cost this will give you units sold and cost of goods sold. 5. Now check your total for chart 4 against the total in chart 3 if the totals match then you have a correct ending total for cost of goods sold.

MJC Revised 12/2010

Page 4

Periodic Inventory Valuation Methods

LIFO Method

Chart 1-Use chart 1 from page 1. Chart 2 the calculation for the value of ending inventory:

Purchase Date Number of units Cost per unit Total Extended Cost

Beginning Inventory First purchase Total ending cost

20 40 60

7 8 X

140 320 460

Chart 3 the calculation for the value of Cost of Goods Sold: Item Title Amount Goods Available for Sale 1,260 Less: Cost of Ending Inventory 460 Equals: Cost of Goods Sold $800 Chart 4 the calculation for the value of Cost of Goods sold using the check method. Item Title Number of units Cost per unit Total Extended Cost Fourth purchase 30 11 330 Third purchase 20 10 200 Second purchase 30 9 270 Cost of Goods Sold 80 X $800

*Note that the total cost in chart 4 is the same as the total cost in chart 3.

MJC Revised 12/2010

Page 5

Periodic Inventory Valuation Methods

LIFO Method How to create chart 2 The Cost of Ending Inventory Chart for LIFO 1. For LIFO you will need to use these headings for chart 2

(a) (b) (c) (d) Purchase Date Number of units Cost per unit Total Extended Cost

2. LIFO starts from the top of the inventory-listing chart, which is chart 1. Use the number of units column (b) count down until you reach the number of units in the ending inventory. In chart one each row is designated by the date those units were purchased. The rows have the number of units that were purchased on that date in time, the unit price paid for those units along with the total extended cost for all of the units purchased on that date. You will find that in counting units in chart one from the top down that the number of ending units for the last row to complete the total number of units in ending inventory may not be completely used up because some of those units were sold during the year and therefore are no longer in the ending inventory. For the last row used, you will need to multiply the number of units that are needed to complete the total ending inventory times the cost per unit to get the correct value for the row. 3. Once you have the units counted out then multiply out the units by the unit cost in each row to get the total extended cost. 4. Now total the column for number of units and total extended cost. These two columns will give you ending inventory in units and ending inventory cost. Never total the column for cost per unit down because it has no useful meaning or value. How to create chart 3 Cost of Goods Sold chart for LIFO 1. For LIFO you will need to use this chart: Item Title Amount Goods Available for Sale Less: Cost of Ending Inventory Equals: Cost of Goods Sold 2. Goods Available for Sale in dollars comes from chart 1 the inventory-listing chart. You will find that information at the bottom of the chart on the right hand side of your page.

MJC Revised 12/2010

Page 6

Periodic Inventory Valuation Methods

3. Next is less cost of ending inventory, which comes from chart 2 at the bottom of that chart. 4. Now subtract cost of ending inventory from goods available for sale to arrive at the cost of goods sold. How to create chart 4 Cost of Goods Sold chart using the Check Method for LIFO 1. For LIFO you will need to use this chart: Item Title Number of units Cost per unit Total Extended Cost Fourth purchase Third purchase Second purchase Cost of Goods Sold X 2. For the check method, you will start at the bottom of chart 1 and list items up until you complete the number of units sold during the year. As in counting down for ending inventory their will most likely be units in the last row where some units were sold and some units are still in ending inventory so you will have to recalculate that total extended cost for the row with only the units you are using. 3. Next recalculate out the total extended cost for each row to make sure that you have rechecked your calculations and that they are correct. Failure to do this recheck could lead to unwanted errors. 4. Finally total the columns down for number of units and total extended cost this will give you units sold and cost of goods sold. 5. Now check your total for chart 4 against the total in chart 3 if the totals match then you have a correct ending total for cost of goods sold.

MJC Revised 12/2010

Page 7

Periodic Inventory Valuation Methods

Weighted-average Inventory Method

The average cost per unit is equal to the goods available for sale divided by total units available for sale. Chart 1-Use chart 1 from page 1. Chart 2 the calculation for Average Cost per Unit chart: Goods Available for Sale Total units available for Sale Average cost per unit 1,260 140 9 Chart 3 the calculation for the value of ending inventory: Ending units Average Cost per unit Total Cost 60 9 540 Chart 4 the calculation for the value of Cost of goods sold: Item Title Amount Goods Available for Sale 1,260 Less: Cost of Ending Inventory 540 Equals: Cost of Goods Sold $720 Chart 5 the calculation for the value of Cost of Goods Sold using the Check Method: Ending Units Average Cost per unit Total Cost 80 9 720 Total ending cost 720

MJC Revised 12/2010

Page 8

Periodic Inventory Valuation Methods

Weighted Average Method How to create chart 2 Average cost per unit using the Weighted Average Method 1. For the Weighted Average Method the charts will be different from those of FIFO and LIFO. The second chart for this method will calculate the average cost per unit for the inventory. (a) (b) (c) Goods Available for Sale Total units available for Sale Average cost per unit (a) / (b) = (c) 2. You will find the goods available for sale in dollars at the bottom of chart 1. Divided that total dollar amount by the total units available for sale from chart 1 this will result in the average cost per unit. How to create chart 3 ending inventory in dollars using the Weighted Average Method 1. Start with these headers: (a) (b) Ending units Average Cost per unit (c) Total Cost (a) X (b) = (c)

2. For this chart, you will take the average cost per unit from chart 2 and multiply that dollar amount by the total number of units in ending inventory to get the total cost of ending inventory in dollars. How to create chart 4 cost of goods sold using the Weighted Average Method 1. You can use the chart that will provide you with the cost of goods sold which is just like chart 3 in the FIFO and LIFO methods: Item Title Amount Goods Available for Sale Less: Cost of Ending Inventory Equals: Cost of Goods Sold 2. Goods Available for Sale in dollar amounts comes from chart 1 the Inventory-Listing chart. You will find the information at the bottom of the chart on the right hand side of your page.

MJC Revised 12/2010

Page 9

Periodic Inventory Valuation Methods

3. Next, is Less: Cost of Ending Inventory which comes from chart 3 at the bottom of that chart. 4. Now subtract cost of ending inventory from goods available for sales to get the cost of goods sold. How to create chart 5 Cost of Goods Sold using the Check Method for Weighted Average Method 1. Using these chart headings:

(a) Ending Units Total ending cost

(b) Average Cost per unit

(c) Total Cost (a) X (b) = (c)

2. You will get the total average cost per unit from chart 2 and then multiply that dollar amount times the total number of units sold during the year, which comes from chart 1 to get the cost of goods sold. 3. Now check your total for chart 5 against the total in chart 4 if the totals match then you have a correct ending total for cost of goods sold.

MJC Revised 12/2010

Page 10

Você também pode gostar

- Basic Instructions For LIFO Inventory MethodDocumento4 páginasBasic Instructions For LIFO Inventory MethodMary100% (4)

- Gross Profit Section of Income Statement-Periodic SystemDocumento3 páginasGross Profit Section of Income Statement-Periodic SystemMary67% (3)

- Perpetual Inventory System MethodsDocumento13 páginasPerpetual Inventory System MethodsMary100% (10)

- Unit Costs Under Traditional Costing MethodDocumento2 páginasUnit Costs Under Traditional Costing MethodMary67% (3)

- Basic Instructions On How To Create A Sum-of-the-Years'-Digits Depreciation ScheduleDocumento4 páginasBasic Instructions On How To Create A Sum-of-the-Years'-Digits Depreciation ScheduleMary100% (1)

- Basic Everyday Journal Entries Retained Earnings and Stockholders EquityDocumento2 páginasBasic Everyday Journal Entries Retained Earnings and Stockholders EquityMary100% (2)

- Partial PaymentsDocumento1 páginaPartial PaymentsMaryAinda não há avaliações

- Labor Variance FormulasDocumento2 páginasLabor Variance FormulasMaryAinda não há avaliações

- Calendars For Sales TermsDocumento2 páginasCalendars For Sales TermsMaryAinda não há avaliações

- Materials Variance FormulasDocumento2 páginasMaterials Variance FormulasMary100% (1)

- Instructions On How To Create A Units of Production Depreciation ScheduleDocumento2 páginasInstructions On How To Create A Units of Production Depreciation ScheduleMary100% (3)

- Owners Equity Statement Form InstructionsDocumento2 páginasOwners Equity Statement Form InstructionsMary100% (4)

- Journal Entries For Long Lived AssetsDocumento2 páginasJournal Entries For Long Lived AssetsMary100% (20)

- Instructions On How To Create A MACRS Depreciation ScheduleDocumento4 páginasInstructions On How To Create A MACRS Depreciation ScheduleMary100% (2)

- FIT-Percentage Method ChartsDocumento4 páginasFIT-Percentage Method ChartsMary67% (3)

- Journal Entry Format PDFDocumento1 páginaJournal Entry Format PDFMaryAinda não há avaliações

- SUTA and FUTA CalculationsDocumento2 páginasSUTA and FUTA CalculationsMary83% (12)

- Federal Insurance Contributions ActDocumento3 páginasFederal Insurance Contributions ActMaryAinda não há avaliações

- Gross Pay CalculationsDocumento2 páginasGross Pay CalculationsMary100% (3)

- Accounting CycleDocumento1 páginaAccounting CycleMary100% (3)

- Analyzes of A Business TransactionDocumento13 páginasAnalyzes of A Business TransactionMary100% (1)

- Cost Sheet FormatDocumento2 páginasCost Sheet FormatAMIN BUHARI ABDUL KHADERAinda não há avaliações

- Final Exam - 2020Documento10 páginasFinal Exam - 2020mshan lee100% (1)

- Basic Instructions For A Cash Budget StatementDocumento4 páginasBasic Instructions For A Cash Budget StatementMary100% (6)

- Unit Cost Under ABC Costing MethodDocumento4 páginasUnit Cost Under ABC Costing MethodMary100% (5)

- For Bookkeeping ProblemDocumento2 páginasFor Bookkeeping ProblemDanica TomasAinda não há avaliações

- The Accounting Cycle ExplainedDocumento61 páginasThe Accounting Cycle ExplainedHottie-Hot SoniAinda não há avaliações

- How To Create A WorksheetDocumento3 páginasHow To Create A WorksheetMary100% (2)

- Transaction AnalysisDocumento14 páginasTransaction AnalysisMaryAinda não há avaliações

- Accounting TheoryDocumento6 páginasAccounting TheoryAPRIL ROSE YOSORESAinda não há avaliações

- Basic Instructions For Retained Earnings StatementDocumento1 páginaBasic Instructions For Retained Earnings StatementMary100% (5)

- Stockholders' Equity Accounts With Normal BalancesDocumento3 páginasStockholders' Equity Accounts With Normal BalancesMary67% (3)

- Periodic Inventory System Journal EntriesDocumento1 páginaPeriodic Inventory System Journal EntriesMary100% (3)

- Basic Instructions For A Simple Income StatementDocumento1 páginaBasic Instructions For A Simple Income StatementMary100% (4)

- How To Create Corporation WorksheetDocumento4 páginasHow To Create Corporation WorksheetMaryAinda não há avaliações

- Closing Journal Entries-Sole ProprietorshipDocumento1 páginaClosing Journal Entries-Sole ProprietorshipMary100% (3)

- Costing FormulaesDocumento8 páginasCosting FormulaesNItesh GawasAinda não há avaliações

- BVA CheatsheetDocumento3 páginasBVA CheatsheetMina ChangAinda não há avaliações

- Cash DiscountsDocumento1 páginaCash DiscountsMaryAinda não há avaliações

- Sales Journal and Accounts Receivable Subsidiary LedgerDocumento4 páginasSales Journal and Accounts Receivable Subsidiary LedgerMary100% (5)

- Midterm Cheat SheetDocumento4 páginasMidterm Cheat SheetvikasAinda não há avaliações

- Ratio CalculationDocumento8 páginasRatio CalculationSohel MahmudAinda não há avaliações

- How To Create A PivotTable To Analyze Worksheet DataDocumento23 páginasHow To Create A PivotTable To Analyze Worksheet DataAhsin Khan100% (1)

- Flash Card SlidesDocumento29 páginasFlash Card SlidesMary100% (2)

- Problem Solving With Spreadsheet Programs (MS-Excel)Documento35 páginasProblem Solving With Spreadsheet Programs (MS-Excel)Zegera MgendiAinda não há avaliações

- Module 2 Introducting Financial Statements - 6th EditionDocumento7 páginasModule 2 Introducting Financial Statements - 6th EditionjoshAinda não há avaliações

- Continue or Eliminate AnalysisDocumento3 páginasContinue or Eliminate AnalysisMaryAinda não há avaliações

- Cuck Cost Accounting PDFDocumento119 páginasCuck Cost Accounting PDFaponojecy50% (2)

- Basic Everyday Journal Entries For A Sole Propietorship-Colored BackgroundDocumento2 páginasBasic Everyday Journal Entries For A Sole Propietorship-Colored BackgroundMary100% (4)

- Financial Accounting For ICWADocumento944 páginasFinancial Accounting For ICWAAmit Kumar100% (2)

- Using Microsoft Excel With Oracle 11gDocumento69 páginasUsing Microsoft Excel With Oracle 11gMallikarjun RaoAinda não há avaliações

- f5 Smart NotesDocumento98 páginasf5 Smart Notessakhiahmadyar100% (1)

- Accounting Adjusting Entries SummaryDocumento6 páginasAccounting Adjusting Entries Summarysweetyraj100% (1)

- ACCOUNTINGDocumento31 páginasACCOUNTINGCHARAK RAYAinda não há avaliações

- Asset Accounts With Normal BalancesDocumento2 páginasAsset Accounts With Normal BalancesMary100% (2)

- Job Order Costing Quiz AnswerDocumento7 páginasJob Order Costing Quiz AnswerElaine Joyce GarciaAinda não há avaliações

- Basic Instructions For FIFO Inventory MethodDocumento4 páginasBasic Instructions For FIFO Inventory MethodMary83% (12)

- Basic Instructions For Weighted Average Inventory MethodDocumento4 páginasBasic Instructions For Weighted Average Inventory MethodMary100% (7)

- Fifo Method of Process CostingDocumento17 páginasFifo Method of Process CostingPrateek DubeyAinda não há avaliações

- Practice Exercise #6-Table-AssessmentDocumento3 páginasPractice Exercise #6-Table-Assessmentevelyn.samsonAinda não há avaliações

- Basic Impact of Everyday Journal Entries On The Income StatementDocumento2 páginasBasic Impact of Everyday Journal Entries On The Income StatementMary100% (1)

- Circle of LifeDocumento1 páginaCircle of LifeMaryAinda não há avaliações

- Diagram of Accounting EquationDocumento1 páginaDiagram of Accounting EquationMary100% (3)

- Basic Everyday Journal Entries Retained Earnings and Stockholders EquityDocumento2 páginasBasic Everyday Journal Entries Retained Earnings and Stockholders EquityMary100% (2)

- ARCS Method of MotivationDocumento1 páginaARCS Method of MotivationMaryAinda não há avaliações

- Product Cost AnalysisDocumento10 páginasProduct Cost AnalysisMaryAinda não há avaliações

- Cash Flows Statement Indirect MethodDocumento2 páginasCash Flows Statement Indirect MethodMary100% (1)

- Adjusting Entries For Bank ReconciliationDocumento1 páginaAdjusting Entries For Bank ReconciliationMaryAinda não há avaliações

- End of The Year Adjustment For Allowance For Doubtful AccountsDocumento1 páginaEnd of The Year Adjustment For Allowance For Doubtful AccountsMary100% (1)

- Make or Buy AnalysisDocumento4 páginasMake or Buy AnalysisMaryAinda não há avaliações

- Analysis of Financial Statements RatiosDocumento2 páginasAnalysis of Financial Statements RatiosMaryAinda não há avaliações

- Chunking Method DiagramDocumento1 páginaChunking Method DiagramMaryAinda não há avaliações

- Kirkpatrick + ModelDocumento1 páginaKirkpatrick + ModelMaryAinda não há avaliações

- Horizontal Analysis of A Balance SheetDocumento3 páginasHorizontal Analysis of A Balance SheetMary100% (6)

- Continue or Eliminate AnalysisDocumento3 páginasContinue or Eliminate AnalysisMaryAinda não há avaliações

- Special Order AnalysisDocumento2 páginasSpecial Order AnalysisMaryAinda não há avaliações

- Partial Income Statement For Manufacturing CompanyDocumento1 páginaPartial Income Statement For Manufacturing CompanyMary50% (2)

- Scaffolding MethodDocumento1 páginaScaffolding MethodMaryAinda não há avaliações

- Materials Variance FormulasDocumento2 páginasMaterials Variance FormulasMary100% (1)

- Labor Variance FormulasDocumento2 páginasLabor Variance FormulasMaryAinda não há avaliações

- Journal Entry Format PDFDocumento1 páginaJournal Entry Format PDFMaryAinda não há avaliações

- Current Assets, Liabilities, and Stockholders' Equity Normal BalancesDocumento1 páginaCurrent Assets, Liabilities, and Stockholders' Equity Normal BalancesMaryAinda não há avaliações

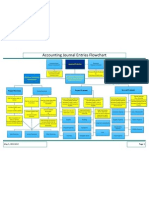

- Accounting Journal Entries Flowchart PDFDocumento1 páginaAccounting Journal Entries Flowchart PDFMary75% (4)

- Table Factors For Present and Future Value of One DollarDocumento6 páginasTable Factors For Present and Future Value of One DollarMaryAinda não há avaliações

- Transaction Analyzes For A CorporationDocumento2 páginasTransaction Analyzes For A CorporationMaryAinda não há avaliações

- Calendars For Sales TermsDocumento2 páginasCalendars For Sales TermsMaryAinda não há avaliações

- Simplified Charts - Percentage Method Income Tax Withholding 2012Documento4 páginasSimplified Charts - Percentage Method Income Tax Withholding 2012MaryAinda não há avaliações

- Simplified Charts-Percentage Method Income Tax Withholding 2008Documento4 páginasSimplified Charts-Percentage Method Income Tax Withholding 2008MaryAinda não há avaliações

- Financial StatementsDocumento1 páginaFinancial StatementsMary100% (4)

- (自练) Telco startup market expansion - Lucy - 20210731Documento10 páginas(自练) Telco startup market expansion - Lucy - 20210731VictoriaAinda não há avaliações

- Intangible Assets NotesDocumento6 páginasIntangible Assets NotesRaizel RamirezAinda não há avaliações

- Techical Education and Skills Development Authority Regional Training Center - I Trainees'/Learners' Attendance Sheet Masonry NC IiDocumento3 páginasTechical Education and Skills Development Authority Regional Training Center - I Trainees'/Learners' Attendance Sheet Masonry NC IiKaJong JaclaAinda não há avaliações

- Companies Act 1956 Multiple Choice QuestionsDocumento5 páginasCompanies Act 1956 Multiple Choice QuestionsKaran Veer Singh100% (5)

- CplusINDO 05Documento108 páginasCplusINDO 05mas zak danielAinda não há avaliações

- Logistics JD - Management Trainee - Intern @fraazoDocumento2 páginasLogistics JD - Management Trainee - Intern @fraazoPratima MukherjeeAinda não há avaliações

- Bed Bug Addendum: 1321 Dolce MidtownDocumento33 páginasBed Bug Addendum: 1321 Dolce MidtowncemekaobiAinda não há avaliações

- London Examinations GCE: Accounting (Modular Syllabus) Advanced SubsidiaryDocumento16 páginasLondon Examinations GCE: Accounting (Modular Syllabus) Advanced SubsidiaryHassan MuntasirAinda não há avaliações

- University of The Cordilleras College of Accountancy Quiz On Partnership Formation 1Documento6 páginasUniversity of The Cordilleras College of Accountancy Quiz On Partnership Formation 1Ian Ranilopa100% (1)

- Coercive Offers and Defence Strategies from a Shareholder PerspectiveDocumento5 páginasCoercive Offers and Defence Strategies from a Shareholder PerspectiveVijay Mahantesh SulibhaviAinda não há avaliações

- Business-Model-Canvas - 2 - XenithDocumento2 páginasBusiness-Model-Canvas - 2 - XenithSwarup PottaAinda não há avaliações

- Chapter 8 InventoriesDocumento56 páginasChapter 8 InventoriesHeerlina PariuryAinda não há avaliações

- Chapter 6 Math of FinanceDocumento10 páginasChapter 6 Math of FinanceEmmanuel Santos IIAinda não há avaliações

- Rate Contract Fabrication Tanks Tender DocumentsDocumento1 páginaRate Contract Fabrication Tanks Tender DocumentsANIMESH JAINAinda não há avaliações

- FAT Intern TestDocumento23 páginasFAT Intern TestLismalathiAinda não há avaliações

- Corporate & Other Laws: Ca-InterDocumento15 páginasCorporate & Other Laws: Ca-IntersonuAinda não há avaliações

- Bankruptcy Court to Decide Discharge of Student DebtDocumento19 páginasBankruptcy Court to Decide Discharge of Student DebtKen DesormesAinda não há avaliações

- RTO Programme Pitchbook 20191213Documento7 páginasRTO Programme Pitchbook 20191213Kung FooAinda não há avaliações

- Opec Momr May 2023Documento92 páginasOpec Momr May 2023Rheza DestraAinda não há avaliações

- INTERMEDIATE ACCOUNTING - MIDTERM - 2019-2020 - 2nd SemesterDocumento12 páginasINTERMEDIATE ACCOUNTING - MIDTERM - 2019-2020 - 2nd SemesterRenalyn ParasAinda não há avaliações

- Ratio Analysis Balance SheetDocumento6 páginasRatio Analysis Balance SheetFalak Falak fatimaAinda não há avaliações

- CIPLADocumento10 páginasCIPLAMAGOMU DAN DAVIDAinda não há avaliações

- LPP AssignmentDocumento3 páginasLPP AssignmentMohammed Marfatiya100% (1)

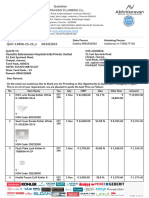

- Plumbing Quote FeebacksDocumento13 páginasPlumbing Quote Feebacksarchventure projectsAinda não há avaliações

- Student life amid high inflationDocumento2 páginasStudent life amid high inflationNgaymai TrongxanhAinda não há avaliações

- Bank Statement 2Documento6 páginasBank Statement 2Iseay100% (1)

- Demat and Remat: Key DifferencesDocumento38 páginasDemat and Remat: Key DifferencesBhuvi100% (1)

- Petition to Declare Debtor InsolventDocumento2 páginasPetition to Declare Debtor InsolventSathya Mandya100% (1)

- Bangladesh's Fastest Growing Economy and Lessons from East AsiaDocumento10 páginasBangladesh's Fastest Growing Economy and Lessons from East AsiaMuhammad NasirAinda não há avaliações

- Movers and Packers Bill ReceiptDocumento12 páginasMovers and Packers Bill ReceiptGaurav ChoudharyAinda não há avaliações