Escolar Documentos

Profissional Documentos

Cultura Documentos

Fertilizer Sector: Numbers Spell Out An Upshot of Soaring Prices

Enviado por

Muhammad Sarfraz AbbasiTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Fertilizer Sector: Numbers Spell Out An Upshot of Soaring Prices

Enviado por

Muhammad Sarfraz AbbasiDireitos autorais:

Formatos disponíveis

Analyst:

Muhammad Sarfraz Abbasi

Summit Capital

Sarfraz.abbasi@atlascapital.com.pk

(+92-21)-111-226-100 Ext 404

Update Pulse March 30, 2011

(Formerly Atlas Capital Markets (Pvt.) Limited)

Fertilizer Sector: Numbers spell out

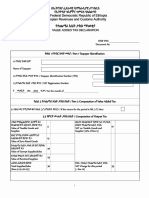

(k tons)

Ind ustr y Fer ti li zer O ffta k e

2M FY10 2M FY11 YoY

HOLD

an upshot of soaring prices… UREA 984 807 -18%

Market Snapshot

D AP 162 128 -21%

Synopsis… All Fertilizers 1272 1105 -13%

Index Chg %

KSE 30 11429.64 126.56 1.12

Urea and DAP offtake declined by 18% and 21% YoY

Pakistan Research

Ind ustr y Ur ea O ffta k e KSE 100 11711.40 128.37 1.11

respectively in 2MCY11. KSE ALL 8158.93 83.34 1.03

FFBL’s urea offtake witnessed the biggest decline of (k tons) 2M FY10 2M FY11 YoY

42% YoY. FFC 418 400 -4%

ENGRO’s DAP offtake declined by 36% whereas FFBL FFBL 47 27 -42%

Key Data

reported an upsurge of 7% YoY. EN GRO 167 154 -8%

In 2MCY11, average urea and DAP prices grew by D AW H 46 37 -19% 12M Avg. Volume (m) ENGRO 4.99

35% & 34% YoY respectively. Ind ustr y DA P O ffta k e 12M Avg. Volume (m) FFC 3.26

HOLD stance recommended on FFBL and FFC. (k tons) 2M FY10 2M FY11 Chg 12M Avg. Volume (m) FFBL 9.23

12M Avg. Volume (m) DAWH 0.20

FFC - 47 NA

Total fertilizer offtake declined by 13% YoY... FFBL 70 75 7%

Total fertilizer offtake in 2MCY11 declined by 13% YoY to EN GRO 71 45 -36%

1105k tons in comparison of 1272k tons in the 12M relative performance vs KSE

D AW H - - - 150%

corresponding period of last year due to lesser

DAWH KSE-100

FFBL FFC

So urce: N FD C , Summit C ap it al R esearch 125% ENGRO

availability owing to gas curtailment. In terms of

product, both Urea and DAP offtake reported a decline 100%

of 18% and 21% YoY respectively in 2MCY11. However, Future outlook and recommendations… 75%

on monthly basis, total fertilizer offtake were seen slightly The persistent gap between demand and supply of 50%

lower by 3% YoY to 565k tons as against 581k tons in Feb fertilizers has further widen as a consequence of gas

Apr-10

Aug-10

Feb-10

Oct-10

Feb-11

Jun-10

Dec-10

Sep-10

Jan-11

Nov-10

May-10

Mar-10

Jul-10

’10. On the other hand, average per bag price of Urea curtailment in the range of 12% to 20%. This prevailing

and DAP rose by 35% and 34% respectively due to gas gap ensures demand for the locally manufactured

curtailment and higher input cost. fertilizer products which are substantially discounted

(including subsidy) in comparison of international prices.

Key players’ performance… However, we believe fertilizer affordability of farmers

Urea offtake: All the listed players posted a decline in might get hurt due to higher prices of fertilizers despite of

urea offtake where highest decline of 42% was observed higher agri income and availability of agri loans.

in FFBL to 27k tons while the lowest decline of 4% was At current levels, we recommend HOLD for FFBL (Fair

seen in FFC over 2MCY10. ENGRO’s urea offake also value of PKR45) and FFC (Fair value of PKR128).

went down by 8% to 154k tons in 2MCY11. Summit Capital (Pvt.) Ltd

DAP offtake: DAP offtake of the listed players also

B-209, Park Towers, Clifton, Karachi

remained dull as ENGRO’s DAP offtake posted a

Equity Research: Equity Sales:

substantial drop of 36% YoY to 45k tons in 2MCY11 Tel: 92 (21) 5376125 Tel: 92 (21) 5368261-8

against 71k tons in 2MCY10. On the other hand, FFBL’s Fax: 92 (21) 5376126 Fax: 92 (21) 5376122

DAP offtake increased by 7% YoY in 2MCY11. Money Market: Corporate Finance:

Tel: 92 (21) 5376128 Tel: 92 (21) 5824991

Fax: 92 (21) 5376129 Fax: 92 (21) 5376122

Disclaimer: All information contained in this publication has been researched and compiled from sources believed to be accurate and reliable at the time

Financial Products Distribution:

of publishing. However, in view of the natural scope for human and/or mechanical error, either at source or during production, Summit Capital (Pvt.) Limited

Tel: 92 (21) 5376125

accepts no liability whatsoever for any loss or damage resulting from errors, inaccuracies or omissions affecting any part of the publication. All information is

Fax: 92 (21) 5376126

provided without warranty and Summit Capital (Pvt.) Limited makes no representation of warranty of any kind as to the accuracy or completeness of any

information hereto contained.

Você também pode gostar

- Cement Sector: LUCK - FY11 Result ExpectationDocumento1 páginaCement Sector: LUCK - FY11 Result ExpectationMuhammad Sarfraz AbbasiAinda não há avaliações

- Fertilizer Sector: FFC Result PreviewDocumento1 páginaFertilizer Sector: FFC Result PreviewMuhammad Sarfraz AbbasiAinda não há avaliações

- Automotive Sector: May - Not A Holy MonthDocumento1 páginaAutomotive Sector: May - Not A Holy MonthMuhammad Sarfraz AbbasiAinda não há avaliações

- Cement Sector: Poor Demand Continues To Hamper DispatchesDocumento2 páginasCement Sector: Poor Demand Continues To Hamper DispatchesMuhammad Sarfraz AbbasiAinda não há avaliações

- Automotive Sector: June'11 - Car Sales Fall For A Good ReasonDocumento1 páginaAutomotive Sector: June'11 - Car Sales Fall For A Good ReasonMuhammad Sarfraz AbbasiAinda não há avaliações

- Cement Sector: Poor Demand Continues To Hamper DispatchesDocumento2 páginasCement Sector: Poor Demand Continues To Hamper DispatchesMuhammad Sarfraz AbbasiAinda não há avaliações

- Fertilizer Sector: Urea Production Witnessed A Five Year LowDocumento2 páginasFertilizer Sector: Urea Production Witnessed A Five Year LowMuhammad Sarfraz AbbasiAinda não há avaliações

- Fertilizer Sector: FFBL Result PreviewDocumento1 páginaFertilizer Sector: FFBL Result PreviewMuhammad Sarfraz AbbasiAinda não há avaliações

- Cement Sector: FY2011 - A Year Dominated by Devils of Poor Demand and Rise in Input CostsDocumento2 páginasCement Sector: FY2011 - A Year Dominated by Devils of Poor Demand and Rise in Input CostsMuhammad Sarfraz AbbasiAinda não há avaliações

- Cement Sector: ACPL - Easing Coal Prices Expected To Bode WellDocumento1 páginaCement Sector: ACPL - Easing Coal Prices Expected To Bode WellMuhammad Sarfraz AbbasiAinda não há avaliações

- Fertilizer Sector - Yet Another Episode of Substantial Growth in EarningsDocumento2 páginasFertilizer Sector - Yet Another Episode of Substantial Growth in EarningsMuhammad Sarfraz AbbasiAinda não há avaliações

- Cement Sector: Dispatches Slow Down ContinuesDocumento1 páginaCement Sector: Dispatches Slow Down ContinuesMuhammad Sarfraz AbbasiAinda não há avaliações

- Fertilizer Sector: FFC Result PreviewDocumento1 páginaFertilizer Sector: FFC Result PreviewMuhammad Sarfraz AbbasiAinda não há avaliações

- Fertilizer Sector - Yet Another Episode of Substantial Growth in EarningsDocumento2 páginasFertilizer Sector - Yet Another Episode of Substantial Growth in EarningsMuhammad Sarfraz AbbasiAinda não há avaliações

- Cement: DGKC - 9MFY11 Financial Performance PreviewDocumento1 páginaCement: DGKC - 9MFY11 Financial Performance PreviewMuhammad Sarfraz AbbasiAinda não há avaliações

- Cement: DGKC - 9MFY11 Financial Performance PreviewDocumento1 páginaCement: DGKC - 9MFY11 Financial Performance PreviewMuhammad Sarfraz AbbasiAinda não há avaliações

- Fertilizer Sector: FFBL Result PreviewDocumento1 páginaFertilizer Sector: FFBL Result PreviewMuhammad Sarfraz AbbasiAinda não há avaliações

- Fertilizer Sector: FFBL Result PreviewDocumento1 páginaFertilizer Sector: FFBL Result PreviewMuhammad Sarfraz AbbasiAinda não há avaliações

- Fertilizer Sector: FFBL - A Good BUYDocumento1 páginaFertilizer Sector: FFBL - A Good BUYMuhammad Sarfraz AbbasiAinda não há avaliações

- Cement Sector: All Eyes On 2HFY11Documento1 páginaCement Sector: All Eyes On 2HFY11Muhammad Sarfraz AbbasiAinda não há avaliações

- Fertilizer Sector - CY10 Ended Up With Rock Solid EarningsDocumento2 páginasFertilizer Sector - CY10 Ended Up With Rock Solid EarningsMuhammad Sarfraz AbbasiAinda não há avaliações

- Cement Sector: Export Demand Bounces BackDocumento1 páginaCement Sector: Export Demand Bounces BackMuhammad Sarfraz AbbasiAinda não há avaliações

- Cement Sector: ACPL - 1HFY11 Financial Performance ReviewDocumento1 páginaCement Sector: ACPL - 1HFY11 Financial Performance ReviewMuhammad Sarfraz AbbasiAinda não há avaliações

- Cement Sector: DGKC - Subdued Demand and Rising Input Costs Hurting Core BusinessDocumento2 páginasCement Sector: DGKC - Subdued Demand and Rising Input Costs Hurting Core BusinessMuhammad Sarfraz AbbasiAinda não há avaliações

- Cement: DGKC - 1HY11 Financial Performance PreviewDocumento1 páginaCement: DGKC - 1HY11 Financial Performance PreviewMuhammad Sarfraz AbbasiAinda não há avaliações

- Cement Sector: LUCK - 1H/FY11 Results PreviewDocumento2 páginasCement Sector: LUCK - 1H/FY11 Results PreviewMuhammad Sarfraz AbbasiAinda não há avaliações

- Fertilizer Sector: Offtake Dropped by 22% YoYDocumento1 páginaFertilizer Sector: Offtake Dropped by 22% YoYMuhammad Sarfraz AbbasiAinda não há avaliações

- Cement Sector: The War of Survival Is Still OnDocumento2 páginasCement Sector: The War of Survival Is Still OnMuhammad Sarfraz AbbasiAinda não há avaliações

- Cement Sector: LUCK Missing Luck As Volumes Remain DoomedDocumento2 páginasCement Sector: LUCK Missing Luck As Volumes Remain DoomedMuhammad Sarfraz AbbasiAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- MB m.2 Amd 9series-GamingDocumento1 páginaMB m.2 Amd 9series-GamingHannaAinda não há avaliações

- Forecasting PDFDocumento87 páginasForecasting PDFSimple SoulAinda não há avaliações

- Rethinking Monetary Policy After the CrisisDocumento23 páginasRethinking Monetary Policy After the CrisisAlexDuarteVelasquezAinda não há avaliações

- Forest Restoration and Rehabilitation in PHDocumento45 páginasForest Restoration and Rehabilitation in PHakosiwillyAinda não há avaliações

- Bhattacharyya2013 PDFDocumento24 páginasBhattacharyya2013 PDFFermando CamposAinda não há avaliações

- Foreign Employment and Remittance in NepalDocumento19 páginasForeign Employment and Remittance in Nepalsecondarydomainak6Ainda não há avaliações

- VAT Declaration FormDocumento2 páginasVAT Declaration FormWedaje Alemayehu67% (3)

- Capital Market InstrumentsDocumento6 páginasCapital Market Instrumentsgeet_rawat36Ainda não há avaliações

- High Potential Near MissDocumento12 páginasHigh Potential Near Missja23gonzAinda não há avaliações

- (Nielsen) Macroeconomy - FMCG Q2 2021 For UNZADocumento37 páginas(Nielsen) Macroeconomy - FMCG Q2 2021 For UNZAalibasukiAinda não há avaliações

- We Are All ImmigrantsDocumento106 páginasWe Are All ImmigrantsHerman Legal Group, LLCAinda não há avaliações

- Crop Insurance - BrazilDocumento3 páginasCrop Insurance - Brazilanandekka84Ainda não há avaliações

- Corporation Law - Atty. Zarah Villanueva (Case List)Documento3 páginasCorporation Law - Atty. Zarah Villanueva (Case List)leizzhyAinda não há avaliações

- Ecotourism Visitor Management Framework AssessmentDocumento15 páginasEcotourism Visitor Management Framework AssessmentFranco JocsonAinda não há avaliações

- Silver Producers A Call To ActionDocumento5 páginasSilver Producers A Call To Actionrichardck61Ainda não há avaliações

- Thyrocare Technologies Ltd. - IPODocumento4 páginasThyrocare Technologies Ltd. - IPOKalpeshAinda não há avaliações

- Bichar BigyanDocumento25 páginasBichar Bigyanrajendra434383% (12)

- KctochiDocumento5 páginasKctochitradingpithistoryAinda não há avaliações

- Frame6 UserNetworks p2-30Documento29 páginasFrame6 UserNetworks p2-30jasonAinda não há avaliações

- Legal NoticeDocumento7 páginasLegal NoticeRishyak BanavaraAinda não há avaliações

- IAS 2 InventoriesDocumento13 páginasIAS 2 InventoriesFritz MainarAinda não há avaliações

- KjujDocumento17 páginasKjujMohamed KamalAinda não há avaliações

- RS Cashless India Projuct PDFDocumento90 páginasRS Cashless India Projuct PDFRAJE100% (1)

- Alifian Faiz NovendiDocumento5 páginasAlifian Faiz Novendialifianovendi 11Ainda não há avaliações

- Ex 400-1 1ST BLDocumento1 páginaEx 400-1 1ST BLkeralainternationalAinda não há avaliações

- Soft Power by Joseph S NyeDocumento19 páginasSoft Power by Joseph S NyemohsinshayanAinda não há avaliações

- Josh Magazine NMAT 2007 Quest 4Documento43 páginasJosh Magazine NMAT 2007 Quest 4Pristine Charles100% (1)

- Find payment channels in Aklan provinceDocumento351 páginasFind payment channels in Aklan provincejhoanAinda não há avaliações

- A Bank Statement - Requirement 2020-21Documento26 páginasA Bank Statement - Requirement 2020-21Satyam KumarAinda não há avaliações

- Provident Fund InformationDocumento2 páginasProvident Fund Informationsk_gazanfarAinda não há avaliações