Escolar Documentos

Profissional Documentos

Cultura Documentos

Sail 10 Yr Digest

Enviado por

srimantDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Sail 10 Yr Digest

Enviado por

srimantDireitos autorais:

Formatos disponíveis

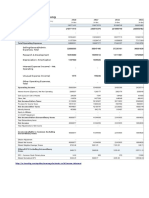

Ten Years at a glance

FINANCIALS (Rupees in crore) VALUE ADDED STATEMENT (Rs. in crore)

For the year 2007-08 2006-07

2007-08 2006-07 2005-06 2004-05 2003-04 2002-03 2001-02 2000-01 1999-2000 1998-99

Gross Sales 45555 39189 32280 31805 24178 19207 15502 16233 16250 14994

Value of own production 46385 39841

Net Sales 39508 33923 27860 28523 21297 16837 13519 14110 14311 13138

Other Revenues 1831 48216 1532 41373

Earnings before depreciation, interest & tax(EBIDTA) 12955 10966 7381 11097 4652 2165 1011 2167 1202 1503

Depreciation 1235 1211 1207 1127 1123 1147 1156 1144 1133 1104 Less: Cost of Raw Materials 12632 12262

Interest & Finance charges 251 332 468 605 901 1334 1562 1752 1789 2017 Stores and Spares 2845 2602

Profit Before Tax ( PBT ) 11469 9423 5706 9365 2628 -316 -1707 -729 -1720 -1618 Power and Fuel 2825 2574

Provision for tax/Income Tax Refund (-) 3932 3221 1693 2548 116 -12 - - - -44

Excise Duty 6047 5266

Profit After Tax ( PAT ) 7537 6202 4013 6817 2512 -304 -1707 -729 -1720 -1574

Freight Outward 718 692

Dividends 1528 1280 826 1363 - - - - - -

Equity Capital 4130 4130 4130 4130 4130 4130 4130 4130 4130 4130 Other Operating Cost 2275 27342 1927 25323

Reserves & Surplus (net of DRE) 18874 13054 8255 5881 529 -2141 -1878 33 635 2756 Total Value Added 20874 16051

Net Worth 23004 17184 12386 10011 4659 1989 2252 4163 4765 6886

Establishment Cost 7919 5084

(Equity Capital and Reserves & Surplus)

Financing Cost 251 332

Total Loans 3045 4181 4298 5770 8690 12928 14019 14251 15082 21017

Net Fixed Assets 11571 11598 12162 12485 13168 14036 14798 15177 15873 18307 Dividend 1528 1280

Capital Work-in-progress 2390 1199 758 366 382 361 556 1221 1475 2589 Corporate Income Tax 3932 3221

Current Assets (including short term deposits) 26318 20379 17384 14187 8075 7282 7107 8362 8259 11399 Dividend Tax 259 198

Current Liabilities & Provisions 9439 6500 8108 6608 6025 4777 4849 5274 5027 4880 Income Retained in Business

Working Capital 16879 13879 9276 7579 2050 2505 2258 3088 3232 6519 Depreciation 1235 1211

(Current Assets less Current Liabilities)

Retained in Business 5750 6985 4724 5935

Capital Employed 28450 25476 21782 20064 15218 16541 17056 18265 19105 24826

(Net Fixed Assets + Working Capital)

Market price per share (In Rs.) 185 113 83 63 32 9 5 6 8 6 Total Value Applied 20874 16050

(As at the end of the year)

Key Financial Ratios

EBDITA to average capital employed (%) 48.0 46.4 35.3 62.9 29.3 12.9 5.7 11.6 5.5 - SHAREHOLDING PATTERN (As on 31st March, 2008)

PBT to Net Sales (%) 29.03 27.78 20.48 32.83 12.34 - - - - - CATEGORY Number of Number of Amount % of

PBT to average capital employed (%) 42.54 39.88 27.27 53.09 16.55 - - - - - Equity Shares Held Holders (Rs. in Crore) Equity

Return on average net worth (%) 37.51 41.95 35.84 92.94 75.57 - - - - - Government of India 3544690285 1 3544.69 85.82

Net worth per share of Rs. 10 (Rs.) 55.69 41.60 29.99 24.24 11.28 4.82 5.45 10.08 11.54 16.67

Financial Institutions 191505961 30 191.51 4.64

Earnings per share of Rs. 10 (Rs.) 18.25 15.02 9.72 16.50 6.08 - - - - -

Price - earning ratio (times) 10.12 7.53 8.56 3.81 5.31 - - - - - Banks 8013743 48 8.01 0.19

Dividend per share of Rs. 10 (Rs.) 3.70 3.10 2.00 3.30 - - - - - - Mutual Funds 58421505 116 58.42 1.42

Effective dividend rate (%) 2.00 2.74 2.41 5.24 - - - - - - Foreign Institutional Investors (FII's) 223582002 293 223.58 5.41

Debt - Equity (times) 0.13 0.24 0.35 0.58 1.87 6.50 6.23 3.42 3.17 3.05 Global Depository Receipts (GDRs) 787050 2 0.79 0.02

Current ratio (times) 2.79 3.14 2.14 2.15 1.34 1.52 1.47 1.59 1.64 2.34 Companies (including Trusts & Clearing Members) 24391740 3546 24.39 0.59

Capital employed to turnover ratio (times) 1.60 1.54 1.48 1.59 1.59 1.16 0.91 0.89 0.85 0.60

Individuals (Including Employees & NRIs) 79008259 284907 79.01 1.91

Working capital turnover ratio (times) 2.70 2.82 3.48 4.20 11.79 7.67 6.87 5.26 5.03 2.30

Interest coverage ratio (times) 46.39 29.29 13.07 16.43 3.88 0.76 -0.09 0.56 0.04 0.17 TOTAL 4130400545 288943 4130.40 100.00

PRODUCTION TREND

(Thousand tonnes) SHAREHOLDING PATTERN (% of Equity)

Item 2007-08 2006-07 2005-06* 2004-05 2003-04 2002-03 2001-02 00-01 99-00 98-99

Main Integrated Steel Plants

(BSP, DSP, RSP, BSL, ISP)

Global Depository

Hot Metal 14981 14368 14398 12351 12749 12080 11327 11202 10939 11180 Receipts (GDRs) 0.02%

Crude Steel 13649 13194 13177 11827 11828 11087 10467 10306 9788 9858 Foreign Institutional

Investors (FII's)

Pig Iron 410 452 558 147 278 288 353 358 574 731 5.41% Companies (inculding Trusts &

Saleable Steel Clearing Members) 0.59%

Semi Finished 2243 2278 2273 1751 2146 2057 2149 2141 2592 2293

Finished 10288 9849 9351 8900 8581 8029 7315 7269 6637 6034

Mutual Funds Indviduals (Including

Total: Integrated Steel Plants 12531 12127 11624 10651 10727 10086 9464 9410 9229 8327 1.42% Banks Employees & NRIs)

Alloy & Special Plants 513 454 427 379 298 266 234 293 301 275 0.19% 1.91%

Financial Institutions

(ASP, SSP & VISL) 4.64%

Total Saleable Steel 13044 12581 12051 11030 11026 10352 9697 9703 9530 8602 Government of India

85.82%

* Includes IISCO, merged with SAIL from 2005-06

28 29

Você também pode gostar

- John M CaseDocumento10 páginasJohn M Caseadrian_simm100% (1)

- New Model of NetflixDocumento17 páginasNew Model of NetflixPencil ArtistAinda não há avaliações

- Particulars 2001 2002 2003 2004: Less LessDocumento7 páginasParticulars 2001 2002 2003 2004: Less LessrishabhaaaAinda não há avaliações

- Power Markets and Economics: Energy Costs, Trading, EmissionsNo EverandPower Markets and Economics: Energy Costs, Trading, EmissionsAinda não há avaliações

- Annual Report 2001-2002: Godrej Industries Limited - Financial HighlightsDocumento2 páginasAnnual Report 2001-2002: Godrej Industries Limited - Financial HighlightsRaakze MoviAinda não há avaliações

- Ramco Q3 2019-20Documento4 páginasRamco Q3 2019-20VIGNESH RKAinda não há avaliações

- Profit and Loss Account: Budget 2007-2008: (Rs. in Lakhs)Documento8 páginasProfit and Loss Account: Budget 2007-2008: (Rs. in Lakhs)grimm312Ainda não há avaliações

- Steel Authority of India Limited: Performance HighlightsDocumento37 páginasSteel Authority of India Limited: Performance HighlightsSingh ArjunAinda não há avaliações

- Beml Limited: Annual Report 2012-2013Documento162 páginasBeml Limited: Annual Report 2012-2013Nihit SandAinda não há avaliações

- Kohat Cement Company LTD: Profit and Loss Account For The Year Ended On . Rupees in (''000'') Gross Sales 1958321 2800130Documento54 páginasKohat Cement Company LTD: Profit and Loss Account For The Year Ended On . Rupees in (''000'') Gross Sales 1958321 2800130Sohail AdnanAinda não há avaliações

- Complete Spreadsheet - From 2020Documento233 páginasComplete Spreadsheet - From 2020cpacpacpaAinda não há avaliações

- GCMMF Balance Sheet 1994 To 2009Documento37 páginasGCMMF Balance Sheet 1994 To 2009Tapankhamar100% (1)

- Group 14 - Bata ValuationDocumento43 páginasGroup 14 - Bata ValuationSUBHADEEP GUHA-DM 20DM218Ainda não há avaliações

- 65th Annual Report 2014-2015: VakilsDocumento110 páginas65th Annual Report 2014-2015: VakilsDarrylAinda não há avaliações

- Century Enka Limited: 50th Annual Report 2015-2016Documento52 páginasCentury Enka Limited: 50th Annual Report 2015-2016Juke LastAinda não há avaliações

- KO Income Statement: Total RevenueDocumento4 páginasKO Income Statement: Total RevenueSadiya Basheer Sadiya BasheerAinda não há avaliações

- L&T Standalone FinancialsDocumento4 páginasL&T Standalone FinancialsmartinajosephAinda não há avaliações

- Balance de AppleDocumento2 páginasBalance de AppleDaniAinda não há avaliações

- BEML's 54th Annual Report and AGM NoticeDocumento244 páginasBEML's 54th Annual Report and AGM Noticethirsheel balajiAinda não há avaliações

- Coca-Cola (KO) Balance Sheet AnalysisDocumento2 páginasCoca-Cola (KO) Balance Sheet AnalysisKhmao Sros67% (3)

- Microsoft Corporation ComputationsDocumento7 páginasMicrosoft Corporation ComputationsxzeekAinda não há avaliações

- PDF Fin1 25-May-2007Documento2 páginasPDF Fin1 25-May-2007Mufeed UbaidAinda não há avaliações

- Yearly Revenue and Cost Data for 2022-2019Documento8 páginasYearly Revenue and Cost Data for 2022-2019Danniel MtAinda não há avaliações

- Exhibit 1Documento1 páginaExhibit 1Vijendra Kumar DubeyAinda não há avaliações

- Amazon vs Wal-MartDocumento21 páginasAmazon vs Wal-MartunveiledtopicsAinda não há avaliações

- Group wise statementDocumento60 páginasGroup wise statementnibha0705Ainda não há avaliações

- Sales and Cost Plan (Income Statement)Documento4 páginasSales and Cost Plan (Income Statement)Ramira EdquilaAinda não há avaliações

- Mayes 8e CH01 Problem SetDocumento12 páginasMayes 8e CH01 Problem SetRamez AhmedAinda não há avaliações

- Atlas Honda: Financial ModellingDocumento19 páginasAtlas Honda: Financial ModellingSaqib NasirAinda não há avaliações

- FINANCIAL HIGHLIGHTS OF COMPANY FROM 2011-2016Documento1 páginaFINANCIAL HIGHLIGHTS OF COMPANY FROM 2011-2016Anushka SinhaAinda não há avaliações

- Allahabad Bank:, Ill IutuiDocumento17 páginasAllahabad Bank:, Ill IutuiAnupamdwivediAinda não há avaliações

- Annual ReportDocumento171 páginasAnnual ReportKshatrapati SinghAinda não há avaliações

- Annual Report 2015-16: Beml LimitedDocumento154 páginasAnnual Report 2015-16: Beml LimitedNihit SandAinda não há avaliações

- MRF QTR 1 14 15 PDFDocumento1 páginaMRF QTR 1 14 15 PDFdanielxx747Ainda não há avaliações

- Profitability Recap: ROE Dupont AnalysisDocumento7 páginasProfitability Recap: ROE Dupont AnalysisSiddharth PujariAinda não há avaliações

- Result Statement SamsungDocumento1 páginaResult Statement SamsungmariaAinda não há avaliações

- Uflex Audited Consolidated Results 31st March 2019Documento4 páginasUflex Audited Consolidated Results 31st March 2019markelonnAinda não há avaliações

- SFAD Case SolutionDocumento6 páginasSFAD Case SolutionMuhammad Shariq SiddiquiAinda não há avaliações

- Performance Highlights and Financials of The Supreme Industries Limited from 2007-2017Documento152 páginasPerformance Highlights and Financials of The Supreme Industries Limited from 2007-2017adoniscalAinda não há avaliações

- Itc Key RatioDocumento1 páginaItc Key RatioAbhishek AgarwalAinda não há avaliações

- ABC Ltd balance sheet and income statement analysis 2016Documento4 páginasABC Ltd balance sheet and income statement analysis 2016Aanchal MahajanAinda não há avaliações

- Comparing tax calculations over multiple yearsDocumento4 páginasComparing tax calculations over multiple yearsAanand SharmaAinda não há avaliações

- MRF Limited: (Rs. in Lakhs)Documento2 páginasMRF Limited: (Rs. in Lakhs)danielxx747Ainda não há avaliações

- Annual Report 2022Documento512 páginasAnnual Report 2022JohnAinda não há avaliações

- Financial Profile Region4aDocumento1 páginaFinancial Profile Region4aJose ManaloAinda não há avaliações

- Schedules To Profit and Loss Account For The Year Ended 31.03.2007Documento20 páginasSchedules To Profit and Loss Account For The Year Ended 31.03.2007api-3708931100% (2)

- Assignment On Financial StatementDocumento11 páginasAssignment On Financial StatementHamza IqbalAinda não há avaliações

- MARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodayDocumento2 páginasMARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodaydidwaniasAinda não há avaliações

- Fourth Quarter 2021 Financial ResultsDocumento12 páginasFourth Quarter 2021 Financial ResultsWinnie LaraAinda não há avaliações

- Report F.MDocumento12 páginasReport F.MMuhammad Waseem Anjum Muhammad Waseem AnjumAinda não há avaliações

- ITC Key RatiosDocumento1 páginaITC Key RatiosHetAinda não há avaliações

- BAV AssignmentDocumento8 páginasBAV AssignmentTanisha GuptaAinda não há avaliações

- Aqua Pure Water Refilling Station Financial StatementsDocumento22 páginasAqua Pure Water Refilling Station Financial StatementsCukeeAinda não há avaliações

- Balance Sheet of HDFC STANDARD LIFE As at March 31 For Five Years1Documento3 páginasBalance Sheet of HDFC STANDARD LIFE As at March 31 For Five Years1Sunil RAYALASEEMA GRAPHICSAinda não há avaliações

- Alok Indsutry: Notes Consolidated Figures in Rs. Crores / View StandaloneDocumento7 páginasAlok Indsutry: Notes Consolidated Figures in Rs. Crores / View StandaloneJatin NandaAinda não há avaliações

- ACME Corp Monthly Financial ReportDocumento4 páginasACME Corp Monthly Financial ReportSaravananAinda não há avaliações

- Assets Non-Current AssetsDocumento9 páginasAssets Non-Current AssetsswapnilAinda não há avaliações

- Income Statement For Group and SegmentsDocumento1 páginaIncome Statement For Group and Segmentstry6y6hmhbAinda não há avaliações

- NTPC - Analysis of Cash Flows: (Rs. in Crores)Documento2 páginasNTPC - Analysis of Cash Flows: (Rs. in Crores)Lalit NarayanAinda não há avaliações

- Central Bank of IndiaDocumento1 páginaCentral Bank of IndiaRohit bitpAinda não há avaliações