Escolar Documentos

Profissional Documentos

Cultura Documentos

Business Rates For Working From Home in UK (England & Wales) - Valuation Office Agency

Enviado por

princessz_leo0 notas0% acharam este documento útil (0 voto)

37 visualizações2 páginasIf you are working from home in England & Wales, you may have to pay business rates as well as council tax to the local council. This official document from the UK Government Valuation Office Agency gives guidance with examples on whether your house is liable for business rates or not depending on the space you use for business, how the space is modified for business use and the amount of time it is used for business etc.

Título original

Business Rates for Working From Home in UK (England & Wales) - Valuation Office Agency

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoIf you are working from home in England & Wales, you may have to pay business rates as well as council tax to the local council. This official document from the UK Government Valuation Office Agency gives guidance with examples on whether your house is liable for business rates or not depending on the space you use for business, how the space is modified for business use and the amount of time it is used for business etc.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

37 visualizações2 páginasBusiness Rates For Working From Home in UK (England & Wales) - Valuation Office Agency

Enviado por

princessz_leoIf you are working from home in England & Wales, you may have to pay business rates as well as council tax to the local council. This official document from the UK Government Valuation Office Agency gives guidance with examples on whether your house is liable for business rates or not depending on the space you use for business, how the space is modified for business use and the amount of time it is used for business etc.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 2

Valuation Office Agency

Council tax and business rates

working at or from home

The Valuation Office Agency is responsible for Working from home

banding all domestic property (in England and If you work at or from home, the part of the property used

Wales) for council tax purposes. We value for work may be liable to business rates (also known as non-

dwellings, not used for any non-domestic purpose, domestic rates) whilst the remainder of the property will

continue to be liable to council tax (although an alteration may

according to our assessment of capital value on

be made to its banding).

the open market on 1 April 1991 in England and

1 April 2003 In Wales. To decide whether or not part of your property should be liable

to business rates there are a number of things we have to

All properties are placed in a band according to their value on consider, including the extent and frequency of the non-

the same date to ensure the system is fair to everyone. If your domestic (business) use of the room (or rooms) and any

property did not exist on the valuation date, staff in our local modifications made to the property to accommodate that use.

offices will have access to sufficient information about sales of Each case is considered on its own merits, and normally we will

similar properties to be able to work out what the value would visit your property to check the facts before an assessment is

have been at that date. made for non-domestic rates.

This fact sheet explains how you could be affected if you Business rates

use part of your property for something other than as living

If your property needs to be assessed for business rates we will

accommodation.

work out a rateable value for the part that is used for non-

domestic purposes. Rateable values are based in broad terms

on the annual rent for a building or part of a building if it was

available to let on the open market at a fixed valuation date.

Currently this is 1 April 2008.

It is important to note that rateable values are a key factor

in the calculation of business rates but they are not the

rates bill. An increase or decrease in rateable value does not

automatically lead to a smaller or larger bill because the final

calculation is based on a number of other factors. These

include transitional relief and the multiplier, (rate in the

pound) which is set by the Department for Communities and

Local Government (for England) and the National Assembly for

Wales. Local authorities are responsible for calculating actual

rates bill and for collecting rates.

For more information, please contact your local Valuation

Office - details are in the phone book - or visit www.voa.gov.

uk and www.mybusinessrates.gov.uk - both official

government websites

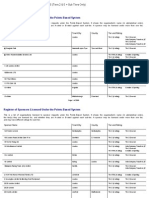

Below are some examples of assessments we might make where part of a property is used for both

domestic and non-domestic purposes.

The former dining room is used as an office equipped with

1 computer, dedicated fax and telephone line, filing cabinets,

desk and shelving stocked with law books. No domestic use

A detached Edwardian dwelling in a residential area owned

is made of this room. It is used by a part-time secretary when

and occupied by a self-employed solicitor who practices from

the solicitor is visiting clients or attending court.

the property, specialising in matrimonial law. The front room

on the ground floor is furnished with sofa and comfortable The ground floor kitchen is used for preparation of family

chairs, has a TV set, and ornaments/photos of a personal meals, but also to make tea or coffee for clients. The first

nature displayed around the room. It is used on an occasional floor accommodation of bedroom and bathroom is wholly

basis as a waiting room for clients during weekdays, and as used for domestic purposes.

the lounge by the solicitor during evenings and weekends.

Our assessment: The office is the only non-domestic part In the room itself there is an examination couch which is

and will be assessed for business rates. The main purpose essentially a single bed with a cotton sheet thrown over it. A

of the front room is to serve as a lounge. In this instance, paper sheet is added and removed after use by each patient.

the non-domestic use is sufficiently minimal so as not to

There is no office desk as such but there is a computer, table

warrant assessment for business rates. The lounge and the

and chair in a corner of the room, which are used by the

remainder of the dwelling will be banded for council tax

doctor during his consultations.

purposes.

No patient’s records are held at the house, nor are there any

medicines. Basic medical equipment is kept in the doctor’s

2 medical bag or stored in a drawer after use.

There is planning consent for use as a branch surgery and

An integral garage of an estate house is converted to an part of the front garden has been surfaced to accommodate

office with plastered walls, electric power points, solid front, two to three extra private vehicles. There are parking

suspended ceiling and floor screed suitable for carpeting. A restrictions in the street.

separate telephone line has been installed. Access is through

the hallway of the house. All toilet facilities are in the main On the walls of the consulting room the doctor has attached

house. pictures painted by his young children, and there are toys

in the corner of the room, which belong to his children but

The room is used by the family in the evenings and can be played with by young patients. There is a brass sign

occasionally at weekends. During the day the occupier outside the front door to advertise surgery hours.

designs computer software. He is employed by a major

company to work at home, because of a physical disability. The remainder of the week the doctor attends surgeries at

All of the equipment has been provided by his company and the main premises, and in the afternoons he makes house

is specially adapted for his needs. He visits his employer’s calls. Other than for consultations the room is often unused,

office on an occasional basis for meetings with colleagues but when friends come to stay it can be used as a spare

and customers. bedroom. At weekends, and some evenings the doctor uses

the room to read professional papers or watch a portable TV

Our assessment: The former garage is no longer domestic away from the children.

property. It has been adapted for office use and should be

assessed for business rates. The remainder is domestic. Our assessment: The principal use of this room is as a

doctor’s surgery, and occasional use for domestic purposes

is minor. The room should be separately assessed for

business rates, and the remainder of the dwelling banded

3 for council tax.

The occupier is employed as a site finder by a major building

company, and travels across most of the southern part of

the country, using her home as a base, but calling into the 5

company office once a week to pick up new instructions, for

meetings, and to leave completed work. A teleworker formerly employed by a large national company

in a call centre now works for the company five days a week

She has a four drawer cabinet in the corner of a dining room, at home, using a spare bedroom to house an office desk,

which also functions as an ‘office’ for the family computer, telephone consul, computer terminal and chair all supplied

and there is no dedicated telephone line for business by her employer. Her hours are flexible but generally the

purposes. room is used for the purposes of work at least 40 hours

The occupier is out visiting sites four days a week, and does each week. During evenings and weekends it is used by

‘writing up’ at home on the dining room table in the evenings other members of the family for leisure purposes, and by

and at weekends. No clients or members of the public visit the taxpayer for doing domestic chores such as ironing. No

the house for business purposes. physical alterations have been made to the property other

than installation of new telephone lines, and no members

Our assessment: Dwelling is domestic property, and should of the public or work colleagues visit the house for business

be banded for council tax. purposes.

4 Our assessment: Rateability will not arise unless

equipment of a non-domestic sort is installed or the

A doctor uses a room in his house as a consulting room three property is physically adapted for the business use.

days a week. The main practice surgery is situated some This is because the character of the room remains as

three miles away near the town centre. The house is more domestic living accommodation, and the purposes of living

convenient for patients who live locally. accommodation may include recreational and leisure use

and work. Also the taxpayer uses furniture and equipment

A concrete ramp has been added to the front door and the

of the kinds that are commonly found in domestic

door opening to the hall and the consulting room has been

property.

widened to accommodate a wheelchair. No one in the

doctor’s family is disabled.

Você também pode gostar

- Handbook Peugeot 107Documento140 páginasHandbook Peugeot 107Bocage4xAinda não há avaliações

- Pseudo Trader's Unique Reference Number (TURN) ApplicationDocumento4 páginasPseudo Trader's Unique Reference Number (TURN) Applicationprincessz_leoAinda não há avaliações

- Guide To Incorporating A Company in The UK - Business LinkDocumento8 páginasGuide To Incorporating A Company in The UK - Business Linkprincessz_leoAinda não há avaliações

- Guide To Incorporating A Company in The UK and Naming It - Companies HouseDocumento65 páginasGuide To Incorporating A Company in The UK and Naming It - Companies Houseprincessz_leoAinda não há avaliações

- Company ActDocumento761 páginasCompany ActNicquainCTAinda não há avaliações

- Bravia KDL 5100Documento119 páginasBravia KDL 5100djdr0Ainda não há avaliações

- 2010 Statistics On Businesses in The UK - Office of National StatisticsDocumento410 páginas2010 Statistics On Businesses in The UK - Office of National Statisticsprincessz_leoAinda não há avaliações

- Guide To Business Names For UK Businesses - Department of Enterprise Trade and InvestmentDocumento28 páginasGuide To Business Names For UK Businesses - Department of Enterprise Trade and Investmentprincessz_leoAinda não há avaliações

- Drayton Lifestyle Time Switch User Manual For Model LP111, LP711, LP LP112, LP241, LP522, LP722Documento2 páginasDrayton Lifestyle Time Switch User Manual For Model LP111, LP711, LP LP112, LP241, LP522, LP722princessz_leo67% (3)

- Inward Processing Relief How To Obtain Duty Relief On Goods Imported From Outside The EC For Re-ExportDocumento123 páginasInward Processing Relief How To Obtain Duty Relief On Goods Imported From Outside The EC For Re-Exportprincessz_leoAinda não há avaliações

- UK Border Agency Register of Sponsors Licensed Under The Points-Based System To Employee Foreign CitizensDocumento2.068 páginasUK Border Agency Register of Sponsors Licensed Under The Points-Based System To Employee Foreign Citizensprincessz_leoAinda não há avaliações

- UK Company - Short Tax Return Form - CT600Documento4 páginasUK Company - Short Tax Return Form - CT600princessz_leoAinda não há avaliações

- Importing To The UK Customs Procedures and Customs DebtDocumento24 páginasImporting To The UK Customs Procedures and Customs Debtprincessz_leoAinda não há avaliações

- How To File Accounts To Companies House UK - A Guide BookDocumento36 páginasHow To File Accounts To Companies House UK - A Guide Bookprincessz_leoAinda não há avaliações

- Olympus Digital Voice Recorder WS-311M WS-321M Manual EnglishDocumento102 páginasOlympus Digital Voice Recorder WS-311M WS-321M Manual Englishprincessz_leoAinda não há avaliações

- What Is Share CapitalDocumento18 páginasWhat Is Share Capitalprincessz_leoAinda não há avaliações

- Corporate Tax Self Assessment GuideDocumento36 páginasCorporate Tax Self Assessment Guideprincessz_leoAinda não há avaliações

- UK Trade Imports by Post - How To Complete Customs DocumentsDocumento11 páginasUK Trade Imports by Post - How To Complete Customs Documentsprincessz_leoAinda não há avaliações

- UK Trade and Investment Department Forming A Company in UK LeafletDocumento7 páginasUK Trade and Investment Department Forming A Company in UK Leafletprincessz_leoAinda não há avaliações

- Zanussi Washer Dryer Manual English WJS 55 W, WJS 1455 W, WJS 1655 WDocumento32 páginasZanussi Washer Dryer Manual English WJS 55 W, WJS 1455 W, WJS 1655 Wprincessz_leoAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Researc H Paper ScaffoldDocumento10 páginasResearc H Paper ScaffoldClementine SmithAinda não há avaliações

- Bem-Transforming The Debate On Sexual InequalityDocumento7 páginasBem-Transforming The Debate On Sexual InequalityTristan_loverAinda não há avaliações

- A People's History of The University of Washington - Zine 2013Documento56 páginasA People's History of The University of Washington - Zine 2013Peter Fowler50% (2)

- Neo-Liberal Globalization in The Philippines: Its Impact On Filipino Women and Their Forms of ResistanceDocumento27 páginasNeo-Liberal Globalization in The Philippines: Its Impact On Filipino Women and Their Forms of Resistancekyel.munozAinda não há avaliações

- Keith Hitchins-Rumania 1866-1947 (Oxford History of Modern Europe) - Clarendon Press (1994)Documento955 páginasKeith Hitchins-Rumania 1866-1947 (Oxford History of Modern Europe) - Clarendon Press (1994)Radulescu StefanAinda não há avaliações

- IC Talk Usain Bolt TextDocumento2 páginasIC Talk Usain Bolt TextThiagosAinda não há avaliações

- The End of Civilization and The Rise of Human Rights: The Mid-Twentieth-Century DisjunctureDocumento16 páginasThe End of Civilization and The Rise of Human Rights: The Mid-Twentieth-Century DisjunctureOlympiad OlympiadAinda não há avaliações

- Change To Chains (Federer) PDFDocumento300 páginasChange To Chains (Federer) PDFBernhard Suppan100% (2)

- National History Bee Study GuideDocumento11 páginasNational History Bee Study GuideElmer YangAinda não há avaliações

- How To Make A Position PaperDocumento4 páginasHow To Make A Position PaperGabriela LorenaAinda não há avaliações

- Lemkin R., Soviet Genocide in The UkraineDocumento5 páginasLemkin R., Soviet Genocide in The UkrainePiotr SzlagowskiAinda não há avaliações

- Act 167 Plant Quarantine Act 1976Documento21 páginasAct 167 Plant Quarantine Act 1976Adam Haida & CoAinda não há avaliações

- Mukamunana Role (2005)Documento12 páginasMukamunana Role (2005)Aida ChiauAinda não há avaliações

- 2017-12-14 Revised Implementing Guidelines of Joint Communique May 6 2002 PDFDocumento4 páginas2017-12-14 Revised Implementing Guidelines of Joint Communique May 6 2002 PDFOffice of the Presidential Adviser on the Peace ProcessAinda não há avaliações

- Of Mimicry and Man PresentationDocumento6 páginasOf Mimicry and Man PresentationAnU Atrî100% (2)

- National University of Study and Research in Law: Submitted To-Ekta Singh Submitted By-Vijay Rohan KrishnaDocumento4 páginasNational University of Study and Research in Law: Submitted To-Ekta Singh Submitted By-Vijay Rohan KrishnaRohan VijayAinda não há avaliações

- Dragons of God Vincent CoppolaDocumento212 páginasDragons of God Vincent CoppolaBryan Christopher Sawyer100% (2)

- Pearl Harbor PDFDocumento12 páginasPearl Harbor PDFapi-288770061Ainda não há avaliações

- France On NegotiationDocumento16 páginasFrance On Negotiationsid3286Ainda não há avaliações

- Approval LetterDocumento4 páginasApproval LetterRoger RanigoAinda não há avaliações

- A Bright Room Called DayDocumento38 páginasA Bright Room Called DayMaria Silvia BettiAinda não há avaliações

- Accounting Technologies and SustainabilityDocumento13 páginasAccounting Technologies and Sustainabilitycharme4109Ainda não há avaliações

- Steel Structures Design and Behavior 5E Solution Manual CHUA PDFDocumento131 páginasSteel Structures Design and Behavior 5E Solution Manual CHUA PDFMarlo AngolluanAinda não há avaliações

- Mun Preparation PDFDocumento27 páginasMun Preparation PDFJAIAinda não há avaliações

- Slave FormDocumento7 páginasSlave FormMartin ErinAinda não há avaliações

- PlaintDocumento2 páginasPlaintMian Bazaf100% (1)

- Pak Us RelationDocumento21 páginasPak Us RelationYou know NothingAinda não há avaliações

- Memeology PDFDocumento5 páginasMemeology PDFAnonymous qHfpqspGDUAinda não há avaliações

- Lari Constituency Fake FormsDocumento3 páginasLari Constituency Fake FormskepheroAinda não há avaliações

- Commercial Dispatch Eedition 11-5-19Documento12 páginasCommercial Dispatch Eedition 11-5-19The DispatchAinda não há avaliações