Escolar Documentos

Profissional Documentos

Cultura Documentos

5626 Employee Benefit Plan Miscellaneous Provisions: (Worksheet Number 4 - Determination of Qualification)

Enviado por

IRSDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

5626 Employee Benefit Plan Miscellaneous Provisions: (Worksheet Number 4 - Determination of Qualification)

Enviado por

IRSDireitos autorais:

Formatos disponíveis

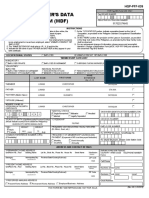

Employee Benefit Plan

Form 5626

(December 2006) Miscellaneous Provisions

(Worksheet Number 4 – Determination of Qualification)

INSTRUCTIONS — All items must be completed. A “Yes” answer generally indicates a The technical principles in this worksheet

favorable conclusion is waranted, while a “No” answer indicates a problem exists. Please use may be changed by future regulations or

the space on the worksheet to explain any “No” answer. See Publication 6392, Explanation guidelines.

Number 4, for guidance in completing this form. Note: Questions I.b. and II.a. and b. are not Name of Plan

applicable to government plans, nonelecting church plans, and other plans described in IRC

410(c).

I. Merger and Termination Provisions Plan Reference Yes No N/A

a. Does the plan expressly provide that upon plan termination or partial termination

(or, in the case of a profit-sharing, stock bonus, or other plan described in Code

section 412(h), a complete discontinuance of contributions), a participant’s interest

will be nonforfeitable? [0402]

b. Does the plan provide that after its merger, transfer of assets or liabilities, or

consolidation, benefits will be no less than before the merger or consolidation or transfer if

the plan then terminates? [0403]

c. If this plan is a defined benefit plan, have any of the participants in this plan been

covered by another defined benefit plan of the employer which has been, or is to be,

terminated with excess plan assets returned to the employer? [0405 or 0412 & 0413]

If the answer is “Yes,” complete (i) and (ii).

(i) Have cash distributions or guaranteed annuity contracts been provided for all

accrued benefits of all participants in the terminating plan? [0406 or 0412 & 0413]

(ii) If this plan grants credit for past service for the period during which an employee

was covered by the terminating plan, has the IRS granted approval for a change in

funding method in connection with the unfunded past service liability for this plan?

[0407 or 0412 & 0413]

Note: If (i) or (ii) is “No,” any favorable determination letter issued on this plan must be

caveated. (See Part I., lines c. and d. of Explanation No. 4.)

d. If this plan is a defined benefit plan, has it received or transferred assets or liabilities,

subject to Code section 414(i), in a transaction with another defined benefit plan which

has been, or is to be, terminated with excess plan assets having been, or to be, returned

to the employer? [0408 or 0412 & 0413]

If I.d. is “Yes,” complete (i) - (iii).

(i) Are the accrued benefits of all participants in this plan fully vested and nonfor-

feitable as of thte date of termination of the other plan? [0409 or 0412 & 0413]

(ii) Have guaranteed annuity contracts been purchased to provide for all accrued

benefits of all participants in this plan as of the date of termination of the other plan?

[0410 or 0412 & 0413]

Note: If (ii) is “No,”, any favorable determination letter issued on this plan must be

caveated. (See Part I., lines c. and d. of Explanation No. 4.)

(iii) Has the IRS granted approval for a change in funding method for this plan?

[0411 or 0412 & 0413]

Note: If (iii) is “No,” any favorable determination letter issued on this plan must be

caveated. (See Part I., lines c. and d. of Explanation No. 4.)

e. If I.c. or I.d. is “Yes,” has the employer, in the past 15 years, previously received a

reversion of assets upon termination of a defined benefit plan which covered some or all

of the same employees who are covered by this plan? [0415]

Cat. No. 42701W www.irs.gov Form 5626 (Rev. 12-2006)

Page 2 of 4

II. Benefits Plan Reference Yes No N/A

a. Does the plan prohibit the assignment or alienation of an employee’s interest that is

more than the statutory limits? [0421]

b. Do benefits under the plan begin, unless the participant otherwise chooses in writing, no

later than the 60th day after the latest of the close of the plan year in which (1) the partici-

pant either reaches age 65 or the plan’s normal retirement age, whichever comes first, (2)

occurs the 10th anniversary of the year in which the participant began participation under

the plan, or (3) the participant terminates service with the employer? [0422]

c. If this is a pension plan, are distributions not to be made before the participant reaches

normal retirement age, terminates service, dies, or becomes disabled? [0424]

d. If the plan provides an early retirement benefit for participants who meet certain age and

service requirements, does it provide that a participant who meets the service requirement,

but separates from service before meeting the age requirement, will be entitled to receive

the benefit when the age requirement is satisfied? [0425]

e. Does the plan allow distributees to elect to have eligible rollover distributions

transferred directly to an eligible retirement plan? [0426]

f. (Complete only if the plan provides for mandatory distributions) Does the plan provide

that, in the event of a mandatory distribution greater than $1,000 where the participant

does not elect to have such distribution paid directly to an eligible retirement plan specified

by the participant in a direct rollover or to receive the distribution directly, that the plan

administrator will pay the distribution in a direct rollover to an individual retirement plan

designated by the plan administrator? [0427]

III. General Qualification Issues

a. Does the trust prohibit the trust funds’ diversion or a return of employer contributions

except for those permitted by the statute or Rev. Rul. 91-4? [0431]

b. Does the plan provide that an employee’s right to his or her normal retirement benefit is

nonforfeitable on attainment of normal retirement age (as defined in Code section

411(a)(8))? [0432]

c. If the plan is a profit-sharing plan, are employer contributions allocated to participants’

accounts under a predetermined formula? [0433]

d. If the plan is a pension plan, does it provide for definitely determinable benefits? [0434]

e. If the plan is a defined benefit plan, does it expressly state the actuarial assumptions

(for example, interest and mortality) or other methods (such as the conversion rates

applied in a particular insurance contract) that will be used to determine the amount or

level of any optional forms that are the actuarial equivalent of the normal retirement benefit

payable under the plan? [0436]

f. Are death benefits provided by the plan “incidental” within the meaning of section

1.401-1(b)(1) of the Income Tax Regulations, taking into account the qualified joint and

survivor annuity and the qualified preretirement survivor annuity, if required, under Code

section 401(a)(11)? [0437]

g. If the plan is a pension or annuity plan that includes a section 401(h) account for retiree

medical benefits, does the plan limit the amount of contributions to such account, when

added to actual contributions for life insurance, to the 25 percent of the total actual

contributions made to the plan (other than contributions to fund past service) after the later

of the adoption or effective date of the section 401(h) arrangement? [0438]

h. Has the plan requested consideration under section 420? (If “Yes,” see section 16 and

appendix of Rev. Proc. 2006-6, 2006-1 C.B. 204.)

i. If the plan is a defined contribution plan, is there a provision for valuation of the trust

assets annually and adjusting participant’s accounts accordingly? [0439]

j. If any corrective amendment made after the end of a plan year is being taken into

account for purposes of determining whether the plan satisfies the minimum coverage or

nondiscrimination requirements for such year, have the conditions permitting the

amendment to be given retroactive effect been satisfied? [0440]

Cat. No. 42701W www.irs.gov Form 5626 (Rev. 12-2006)

Page 3 of 4

III. General Qualification Issues (continued) Plan Reference Yes No N/A

k. If the plan allows employees to make voluntary employee contributions to a separate

account or annuity established under the plan which meets the applicable requirements of

section 408 (traditional IRA) or section 408A (Roth IRA), does the plan (i) restrict the

commingling of deemed IRA assets with non-plan assets and (ii) provide that the trust

must maintain a separate account for each deemed IRA, if deemed IRAs are held in a

single trust that includes the defined contribution plan? [0441]

IV. Compensation Limit

a. Does the plan limit the compensation that may be taken into account in determining

benefits or contributions on behalf of any employee to no more than the annual

compensation limit? [0442]

b. If this is a defined benefit plan, does the plan determine a section 401(a)(17)

employee’s accrued benefit by applying the fresh-start rules? [0445]

V. Amendments Relating to ESOPs

a. Does the plan document formally designate the plan as an ESOP and does the plan

state that it is designed to invest primarily in qualifying employer securities? Reg.

54.4975-11(a)(2) [0446] [0447]

b. Does the plan provide that the proceeds of an exempt loan must only be used for: (i)

the acquisition of qualifying employer securities, (ii) to repay such loan, and/or (iii) to repay

a prior loan? Reg. 54.4975-7(b)(4) [0448]

c. Does the plan provide that the exempt loan must be without recourse against the ESOP

and that the only assets that may be given as collateral on such loans are qualifying

employer securities of two classes, (i) those acquired with the proceeds of an exempt loan,

and (ii) those that were used as collateral on a prior exempt loan and repaid with the

proceeds of the current exempt loan? Reg. 54.4975-7(b)(5) [0449]

d. Does the plan provide that the exempt loan must bear a reasonable interest rate and

must be for a definite period of time and cannot be payable at the demand of any person,

except in the case of default? Reg. 54.4975-7(b)(7) & (13) [0450]

e. Does the plan provide that if a portion of the account is forfeited, qualifying securities

must be forfeited only after other assets? Reg. 54.4975-11(d)(4) [0451]

f. Does the plan provide that the employer securities acquired by the ESOP with the

proceeds of an exempt loan must be added to and maintained in a suspense account?

Reg. 54.4975-11(c) [0452]

g. Does the plan provide for the release from encumbrance qualifying employer securities

under either the “general rule” or “special rule”? Reg. 54.4975-7(b)(8) [0453]

h. Does the plan provide that each participant is entitled to direct the plan in the manner in

which securities allocated to his account are to be voted? [0454]

With regard to non-registration securities, does the plan provide that each participant is

entitled to direct the plan to vote the allocated securities with respect to the corporate

matters specified in section 409(e)(3)? [0455]

i. Does the plan, if sponsored by a C corporation, provide that a participant has a right to

demand distributions in the form of employer securities? [0456] Code §409(h)(1)(A)

In the case of an S corporation ESOP, if the plan does not give participants the right to

demand stocks, does it provide for a cash distribution instead? Code §409(h)(2)(B) [0457]

j. Does the plan provide that, where the employer is required to repurchase employer

securities distributed to a participant which are not readily tradable, the amount to be paid

for a total distribution is paid in substantially equal periodic payments over not more than 5

years after the exercise of the put option; and if distribution is made in installments, the

initial payment is made not later than 30 days after the exercise of the put option? Reg.

54.4975-7(b)(10) [0458]

Cat. No. 42701W www.irs.gov Form 5626 (Rev. 12-2006)

Page 4 of 4

V. Amendments Relating to ESOPs (continued) Plan Reference Yes No N/A

k. Does the plan provide that valuation of employer securities which are not readily

tradable are made by an independent appraiser pursuant to section 401(a)(28)(C)?

[0459]

l. Does the plan provide that a participant is entitled to diversify a portion of his or her

accounts’ investment in employer securities as required by section 401(a)(28)(B)? [0460]

m. Does the plan provide that a participant may elect to commence distribution of his or

her account balance after attaining normal retirement age, or after death, disability or

separation from service not later than required by section 409(o)? [0461]

n. If the employer (a C corporation) chooses to exclude forfeitures and interest from the

calculation of annual additions, does the plan provide that forfeitures and interest

payments may be excluded only if no more than 1/3 of the employer contributions

deductible under section 404(a)(9) for the year are allocated to highly compensated

employees? Code §415(c)(6) [0462]

o. If the plan is applying under section 409(n) with respect to transactions under section

1042, does the plan provide that the assets of the plan attributable to employer securities

acquired by the plan in a sale to which section 1042 applies cannot accrue for the benefit

of the persons specified in section 409(n) during the nonallocation period? [0463]

p. Does the ESOP, if holding stock in an S corporation, provide that no portion of the plan

attributable to (or allocable in lieu of) such stock may, during a nonallocation year (as

described in section 409(p)(3)), accrue (or be allocated directly or indirectly under any plan

of the employer qualified under section 401(a)) for the benefit of any disqualified person

(as described in section 409(p)(4))? Code §409(p) [0464]

q. For an S corporation ESOP, does such plan define the following terms: nonallocation

year (in accordance with section 409(p)(3) and the associated regulations) [0465],

disqualified person (in accordance with section 409(p)(4) and the associated regulations)

]0466], deemed-owned shares (in accordance with section 409(p)(4)(C) and the

associated regulations) [0467] and synthetic equity (in accordance with section

409(p)(6)(C) and the associated regulations)? [0468] Code §409(p)

r. If the plan, sponsored by a C corporation, provides for the reinvestment of dividends on

employer securities allocated to participant accounts for purposes of taking the deduction

described in section 404(k), does it provide an election for the participants between

(a)either (i) the payment of dividends in cash to participants or (ii) the payment to the plan

and distribution in cash to participants not later than 90 days after the close of the plan

year in which the dividends are paid by the employer and the payment of dividends to the

plan and reinvestment in employer securities? The plan may also offer participants a

choice among both of the options described in (a) and reinvestment in employer securities.

In addition, are the participants fully vested in the reinvested dividends? Code §404(k)

[0469]

Cat. No. 42701W www.irs.gov Form 5626 (Rev. 12-2006)

Clear Form Fields

Você também pode gostar

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Roles of HR GeneralistDocumento12 páginasRoles of HR GeneralistSals777100% (12)

- Accounting For Non-AccountantsDocumento15 páginasAccounting For Non-AccountantsMarlou Paige CortesAinda não há avaliações

- Consortium Agreement for (Acronym) ProjectDocumento6 páginasConsortium Agreement for (Acronym) ProjectTwesigye AnthonyAinda não há avaliações

- Notes IAS 19Documento18 páginasNotes IAS 19Nasir IqbalAinda não há avaliações

- Occupational Safety and Health STDDocumento65 páginasOccupational Safety and Health STDKirk Corales100% (3)

- Ias 19Documento41 páginasIas 19mohedAinda não há avaliações

- Ias 19 - Employee Benefits QUESTION 57-17Documento9 páginasIas 19 - Employee Benefits QUESTION 57-17Janella Gail ArenasAinda não há avaliações

- ToA.1822 Employee Benefits OnlineDocumento3 páginasToA.1822 Employee Benefits OnlineJolina ManceraAinda não há avaliações

- PAS 26 Retirement Benefit Plans Reporting StandardDocumento25 páginasPAS 26 Retirement Benefit Plans Reporting Standardrena chavezAinda não há avaliações

- Lecture Notes Employee Benefits: Page 1 of 16Documento16 páginasLecture Notes Employee Benefits: Page 1 of 16fastslowerAinda não há avaliações

- Cold Call - Updates - VijayDocumento16 páginasCold Call - Updates - Vijaysatendra singh100% (1)

- Managerial Theories of Firms - PPTX MeDocumento26 páginasManagerial Theories of Firms - PPTX MeNachiket Hanmantgad100% (3)

- Pas 26 Accounting and Reporting by Retirement Benefit PlansDocumento2 páginasPas 26 Accounting and Reporting by Retirement Benefit PlansR.A.Ainda não há avaliações

- Managing Corporate Alumni Networks FinalDocumento21 páginasManaging Corporate Alumni Networks FinalNiyam HariaAinda não há avaliações

- Organizing and Preparing The Supervisory ProgramDocumento19 páginasOrganizing and Preparing The Supervisory ProgramEdgardo M. delacruz100% (13)

- Tratamentul Total Al CanceruluiDocumento71 páginasTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocumento71 páginasTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocumento71 páginasTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocumento71 páginasTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocumento71 páginasTratamentul Total Al CanceruluiAntal98% (98)

- Publication: Employee Benefit Plan Joint and Survivor (Worksheet Number 3 - Determination of Qualification)Documento2 páginasPublication: Employee Benefit Plan Joint and Survivor (Worksheet Number 3 - Determination of Qualification)IRSAinda não há avaliações

- Employee Benefit Plans 13: Section 401 (H) Determination of QualificationDocumento7 páginasEmployee Benefit Plans 13: Section 401 (H) Determination of QualificationpdizypdizyAinda não há avaliações

- CYCLE B Submission Period Limits on Contributions and BenefitsDocumento23 páginasCYCLE B Submission Period Limits on Contributions and BenefitspdizypdizyAinda não há avaliações

- Employee Benefit Plan Required Distributions: (Worksheet Number 9 - Determination of Qualification)Documento2 páginasEmployee Benefit Plan Required Distributions: (Worksheet Number 9 - Determination of Qualification)IRSAinda não há avaliações

- Bab 1-6 ArtikelDocumento31 páginasBab 1-6 ArtikelChristina BanuareahAinda não há avaliações

- US Internal Revenue Service: p7001Documento11 páginasUS Internal Revenue Service: p7001IRSAinda não há avaliações

- Adoption Agreement (AA) ERISA 403 (B) - 1206Documento18 páginasAdoption Agreement (AA) ERISA 403 (B) - 1206John AcardoAinda não há avaliações

- Employee Benefit Plans 12: Section 401 (K) RequirementsDocumento38 páginasEmployee Benefit Plans 12: Section 401 (K) RequirementspdizypdizyAinda não há avaliações

- NAS24Documento10 páginasNAS24Gemini_0804Ainda não há avaliações

- Module 12 - PAS 19 Employee BenefitsDocumento6 páginasModule 12 - PAS 19 Employee BenefitsAKIO HIROKIAinda não há avaliações

- 080103Documento7 páginas080103Franklin JungcoAinda não há avaliações

- MASB Standard 29 Employee Benefits: Malaysian Accounting Standards BoardDocumento78 páginasMASB Standard 29 Employee Benefits: Malaysian Accounting Standards BoardSTUDYBIZAinda não há avaliações

- FARAP-4413 (Post-Employment Benefits)Documento5 páginasFARAP-4413 (Post-Employment Benefits)Dizon Ropalito P.Ainda não há avaliações

- Employee Benefit Plans 7: Top-Heavy RequirementsDocumento13 páginasEmployee Benefit Plans 7: Top-Heavy RequirementspdizypdizyAinda não há avaliações

- Adoption AgreementDocumento51 páginasAdoption Agreementspades24kAinda não há avaliações

- US Internal Revenue Service: n-07-08Documento6 páginasUS Internal Revenue Service: n-07-08IRSAinda não há avaliações

- Employee Benefit Plan Minimum Participation Standards (Worksheet Number 1 - Determination of Qualification)Documento2 páginasEmployee Benefit Plan Minimum Participation Standards (Worksheet Number 1 - Determination of Qualification)IRSAinda não há avaliações

- Chapter 4 - Accounting For Other Liabilities: A. Post Employment BenefitsDocumento50 páginasChapter 4 - Accounting For Other Liabilities: A. Post Employment BenefitsLovely AbadianoAinda não há avaliações

- CH 3 U 5 NAS 26Documento4 páginasCH 3 U 5 NAS 26Krishna AdhikariAinda não há avaliações

- Accounting and Reporting by Retirement Benefit PlansDocumento6 páginasAccounting and Reporting by Retirement Benefit PlansTanvir PrantoAinda não há avaliações

- IAS 26 - Accounting and Reporting by Retirement BenefitDocumento18 páginasIAS 26 - Accounting and Reporting by Retirement Benefitiqbal.ais152Ainda não há avaliações

- Tax Exempt and Government October 22, 2004 Entities DivisionDocumento5 páginasTax Exempt and Government October 22, 2004 Entities DivisionIRSAinda não há avaliações

- IAS 26 Accounting and Reporting by Retirement Benefit Plans: ScopeDocumento5 páginasIAS 26 Accounting and Reporting by Retirement Benefit Plans: ScopevicsAinda não há avaliações

- Employee Benefits Explained: Short-Term, Postemployment, Defined PlansDocumento37 páginasEmployee Benefits Explained: Short-Term, Postemployment, Defined PlansNinjo senpaiAinda não há avaliações

- IRS Publication 4531Documento1 páginaIRS Publication 4531Francis Wolfgang UrbanAinda não há avaliações

- US Internal Revenue Service: f5500 - 1991Documento6 páginasUS Internal Revenue Service: f5500 - 1991IRSAinda não há avaliações

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocumento5 páginasDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaAinda não há avaliações

- Application For Determination For Adopters of Master or Prototype or Volume Submitter PlansDocumento4 páginasApplication For Determination For Adopters of Master or Prototype or Volume Submitter PlansIRSAinda não há avaliações

- Ias 19Documento59 páginasIas 19Leonardo BritoAinda não há avaliações

- Employee BenefitsDocumento9 páginasEmployee BenefitstinydmpAinda não há avaliações

- PAS 19r Test BankDocumento7 páginasPAS 19r Test BankJake ScotAinda não há avaliações

- Ind AS 19 Employee Benifit ExpensesDocumento81 páginasInd AS 19 Employee Benifit ExpensesHarsh BavishiAinda não há avaliações

- Chapter 4, Special Inclusions 2023 StudentDocumento39 páginasChapter 4, Special Inclusions 2023 StudentGimbaZAAinda não há avaliações

- Accounting and Reporting by Retirement Benefit Plans (AS 36Documento13 páginasAccounting and Reporting by Retirement Benefit Plans (AS 36ratiAinda não há avaliações

- Employee Benefits Overview and Accounting for Postretirement BenefitsDocumento6 páginasEmployee Benefits Overview and Accounting for Postretirement BenefitsDivine CuasayAinda não há avaliações

- Handouts PDFDocumento129 páginasHandouts PDFRomulus GarciaAinda não há avaliações

- Pas-26 FarDocumento8 páginasPas-26 FarMarie dela sernaAinda não há avaliações

- US Internal Revenue Service: n-02-3Documento22 páginasUS Internal Revenue Service: n-02-3IRSAinda não há avaliações

- US Internal Revenue Service: I5500sb - 1992Documento4 páginasUS Internal Revenue Service: I5500sb - 1992IRSAinda não há avaliações

- IA2 10 01 Employee Benefits PDFDocumento17 páginasIA2 10 01 Employee Benefits PDFAzaria MatiasAinda não há avaliações

- Employee BenefitsDocumento9 páginasEmployee BenefitstinydmpAinda não há avaliações

- Ap12a Finalisation of Agenda DecisionDocumento6 páginasAp12a Finalisation of Agenda DecisionmarhadiAinda não há avaliações

- US Internal Revenue Service: n-06-44Documento6 páginasUS Internal Revenue Service: n-06-44IRSAinda não há avaliações

- LKAS 19 2021 UploadDocumento31 páginasLKAS 19 2021 Uploadpriyantha dasanayake100% (1)

- PAS 19 - Employee Benefits & PAS 26 - Reporting and Accounting For Retirement Benefit PlanDocumento6 páginasPAS 19 - Employee Benefits & PAS 26 - Reporting and Accounting For Retirement Benefit Pland.pagkatoytoyAinda não há avaliações

- PAS 19 Employee BenefitsDocumento62 páginasPAS 19 Employee BenefitsBenj FloresAinda não há avaliações

- US Internal Revenue Service: rp-02-21Documento18 páginasUS Internal Revenue Service: rp-02-21IRSAinda não há avaliações

- Form 5500 Employee Benefit Plan AuditsDocumento13 páginasForm 5500 Employee Benefit Plan AuditsCA Rajendra Prasad AAinda não há avaliações

- Examination: Subject ST4 Pensions and Other Benefits Specialist TechnicalDocumento185 páginasExamination: Subject ST4 Pensions and Other Benefits Specialist TechnicalPatrick MugoAinda não há avaliações

- ObligationDocumento2 páginasObligationJustine Airra OndoyAinda não há avaliações

- IAS 19 Employee Benefits (2021)Documento6 páginasIAS 19 Employee Benefits (2021)Tawanda Tatenda Herbert100% (1)

- 2008 Data DictionaryDocumento260 páginas2008 Data DictionaryIRSAinda não há avaliações

- US Internal Revenue Service: 2290rulesty2007v4 0Documento6 páginasUS Internal Revenue Service: 2290rulesty2007v4 0IRSAinda não há avaliações

- 2008 Credit Card Bulk Provider RequirementsDocumento112 páginas2008 Credit Card Bulk Provider RequirementsIRSAinda não há avaliações

- 2008 Objectives Report To Congress v2Documento153 páginas2008 Objectives Report To Congress v2IRSAinda não há avaliações

- Radical: Needed in WorkplacesDocumento3 páginasRadical: Needed in WorkplacesAnonymous ZIx886Ainda não há avaliações

- HR Policies Implementation at Deepak NitriteDocumento8 páginasHR Policies Implementation at Deepak Nitritepandey_hariom12Ainda não há avaliações

- Why Is Performance Management ImportantDocumento9 páginasWhy Is Performance Management ImportantDaisy Joy SalavariaAinda não há avaliações

- Arc GateDocumento6 páginasArc GateAmit DuhanAinda não há avaliações

- Human Resurce ManagementDocumento61 páginasHuman Resurce ManagementrinnimaruAinda não há avaliações

- Selecting Employees: Fundamentals of Human Resource Management, 10/E, Decenzo/RobbinsDocumento22 páginasSelecting Employees: Fundamentals of Human Resource Management, 10/E, Decenzo/RobbinsAAinee Awais100% (1)

- Mid Day Meal Workers in Himachal Pradesh Are Getting Lowest Salary in The WorldDocumento2 páginasMid Day Meal Workers in Himachal Pradesh Are Getting Lowest Salary in The WorldVIJAY KUMAR HEERAinda não há avaliações

- Executive Human Resources Business Partner in Salt Lake City UT Resume Joseph HudakDocumento2 páginasExecutive Human Resources Business Partner in Salt Lake City UT Resume Joseph HudakJosephHudakAinda não há avaliações

- Job Satisfaction and AttitudesDocumento16 páginasJob Satisfaction and AttitudesPaupauAinda não há avaliações

- Job Analysis ModuleDocumento40 páginasJob Analysis ModulepriAinda não há avaliações

- Why It's So Hard To Be Fair by Joel BrocknerDocumento2 páginasWhy It's So Hard To Be Fair by Joel Brocknerhaonanzhang100% (2)

- CV Summary for HR ProfessionalDocumento3 páginasCV Summary for HR ProfessionalSupriya ShindeAinda não há avaliações

- Review Questions: Cost Concepts and ClassificationsDocumento6 páginasReview Questions: Cost Concepts and ClassificationsArah Opalec64% (11)

- JOIN INDIAN COAST GUARD AS NAVIK 10TH ENTRY COOK STEWARDDocumento7 páginasJOIN INDIAN COAST GUARD AS NAVIK 10TH ENTRY COOK STEWARDRanjan tiwariAinda não há avaliações

- Member'S Data Form (MDF) : HQP-PFF-039Documento2 páginasMember'S Data Form (MDF) : HQP-PFF-039LiDdy Cebrero BelenAinda não há avaliações

- Chapter 9 Managing Compensation HRDocumento5 páginasChapter 9 Managing Compensation HRRajan ManchandaAinda não há avaliações

- INTRODUCTION, Reflection, Recommendation and ConclusionDocumento2 páginasINTRODUCTION, Reflection, Recommendation and ConclusionBongcawel Bragat-Saugubac Linny LynAinda não há avaliações

- Analisis de Hilton HotelDocumento2 páginasAnalisis de Hilton HotelLore SuntaxiAinda não há avaliações

- HR Practices in Indian Telecom IndustryDocumento15 páginasHR Practices in Indian Telecom IndustryAanchalArora46Ainda não há avaliações

- HBR Case Study - HUNSK AutomobilesDocumento5 páginasHBR Case Study - HUNSK AutomobilesGaurav Kumar100% (1)

- Discussion 6Documento1 páginaDiscussion 6dreiAinda não há avaliações

- History of HRM LatestDocumento8 páginasHistory of HRM Latestabdullah1996Ainda não há avaliações