Escolar Documentos

Profissional Documentos

Cultura Documentos

Customer Identification Policy

Enviado por

rahul_anilDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Customer Identification Policy

Enviado por

rahul_anilDireitos autorais:

Formatos disponíveis

CUSTOMER IDENTIFICATION POLICY - NRI/PIO

AXIS Bank's customer identification policy for NRIs/PIO's strives to put in place sufficient and reasonable checks and documentation processes to establish the identity, location and NRI/PIO status of the customer. At pre-

relationship level the Bank relies mainly on documents for establishment of customer credentials ahead of setting up a Banker-Customer relationship with a prospect. The Bank's customer identification documents at point of

acceptance are intended to verify/substantiate the following basic details relating to a new customer.

1. Verification of identity 2. Verification of address 3. Verification of signature 4. Verification of NRI/PIO status

Accordingly, the following documents are required from new NRI/PIO customers at the time of signing up as a customer of the Bank using a remote channel (where the customer opens an account without having a face to face

interaction with one of the Bank's officers)

Non Resident Indians (NRI) Persons of Indian Origin (PIO)

Description Attestation formality When required Description Attestation formality When required

Identity cum NRI status proof To be attested by a Notary Public / Compulsory document. Basic Identity proof Current and valid To be attested by a Notary Public Compulsory document. Basic

Indian Passport and visa copy (pages containing Indian Embassy or Self * (self identify document for all NRI passport (Pakistan / Bangladesh / Indian Embassy/ or Self * (self identify document for all PIO

your basic details, family details, address, latest attestation permitted only FATF customers passport holders cannot apply for PIO attestation permitted only FATF customers

visa to be sent) member countries) # account) member countries) #

Address proof Original to be sent or copy to be When the communication PIO proof (any one of the following) Same as above Compulsory document for

(one of the following) attested by Notary Public / Indian address given in the account PIO card, OIC card, Indian driving providing PIO status. However,

Overseas Driving License, Embassy/ Self (for FATF country opening application is different license, Account statement from any it can be waived at the discretion

Social Security residents) # from passport address or when Bank in India, your personal cheque of the Bank when the customer

Card, Green Card your passport doesn't have an (check) drawn on any bank account in is able to give satisfactory

Utility/telephone bill, address India, Proof of title for any residential reference of any existing Axis

Bank statement / credit card statement etc. property owned by you in India Bank Customers or prominent

(Building tax receipt, Title Deed etc). citizens (with full postal

Birth Certificate, School/College address). Account will be

Certificate, Marriage Certificate, activated only after Bank cross-

Existing/expired Indian passport (of checks with the referees

you/ spouse /father /mother) Ration provided by the applicant

card / Pan card / Voter id card (of you

or spouse) or any other official

document proving your roots / existing

ties in India

Signature proof As above. In case of cheque no When signature in your Address proof (one of the following) Original to be sent (for When the communication

Any official document containing your current attestation is required as original Account Application varies Overseas Driving License, Social utility/bank statements) or copy address given in the account

specimen signature or cheque / paid cheque to be sent from your passport signature Security Card, Green Card to be attested by Notary Public / opening application is different

Self cheque drawn on your existing bank account Utility/telephone bill, Bank statement / Indian Embassy/ Self (for FATF from passport address or when

or original of paid cheque of your existing account credit card statement etc. member country# residents) your passport doesn't have an

address

Additional proof No attestation. Original statement Only when you are opting for Signature proof -Any official As above. In case of cheque no When signature in your Account

Original Bank statement/credit card statement not more than 6 months old to be self attestation of documents document containing your current attestation is required as original Application varies from your

from your existing bank account in India or abroad sent (or when it is being used as specimen signature or Self cheque cheque / paid cheque to be sent passport signature

address proof) drawn on your existing bank account or

original of paid cheque of your existing

account

Additional proof Not applicable When you want to activate the Additional proof Original Bank No attestation. Original Only when you are opting for

Cheque (check) drawn in favor of account immediately on statement/credit card statement statement not more than 6 self attestation of documents (or

Axis Bank a/c... (your name) on your existing opening and/or when you are from your existing bank account months old to be sent when it is being used as address

a/c in India or abroad opting for self attestation in India or abroad proof)

Two passport size photographs Not applicable Compulsory document Additional proof Cheque (check) drawn Not applicable When you want to activate the

in favor of Axis Bank a/c... (your name) account immediately on opening

on your existing a/c in India or abroad and/or when you are opting for

self attestation

Two passport size photos Not applicable Compulsory document

# FATF Member Countries

Argentina China Greece Italy Norway Spain

Australia Denmark Gulf Co-operation Council Japan Portugal Sweden

Austria European Commission Hong Kong, China Kingdom of the Netherlands* Republic of Korea Switzerland

Belgium Finland Iceland Luxembourg Russian Federation Turkey

Brazil France India Mexico Singapore United Kingdom

Canada Germany Ireland New Zealand South Africa United States

For latest / Updated list, kindly refer www.fatf-gafi.org

Você também pode gostar

- Sponsor StatementDocumento1 páginaSponsor Statementanhhungdacop9xAinda não há avaliações

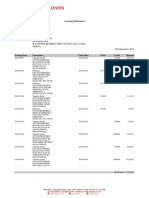

- Transaction Details Amount in PKR Closing Balance DateDocumento2 páginasTransaction Details Amount in PKR Closing Balance DateraisAinda não há avaliações

- CardStatement 2016-11-19Documento6 páginasCardStatement 2016-11-19manjuAinda não há avaliações

- Main Acct Statemetn Jan To Dec 17Documento11 páginasMain Acct Statemetn Jan To Dec 17Col RajAinda não há avaliações

- Credit Card Mini StatementDocumento1 páginaCredit Card Mini StatementWaifubot 2.1Ainda não há avaliações

- Premium Payment Instruction For Credit Card DeductionDocumento2 páginasPremium Payment Instruction For Credit Card DeductioninabansAinda não há avaliações

- Denise Navarro PDFDocumento1 páginaDenise Navarro PDFELben RescoberAinda não há avaliações

- Credit Card Oct 16 PDFDocumento2 páginasCredit Card Oct 16 PDFR.Prabath100% (1)

- Credit Card StatementDocumento2 páginasCredit Card StatementGanesh NAinda não há avaliações

- Standard Checking Summary PDFDocumento2 páginasStandard Checking Summary PDFBobby BakerAinda não há avaliações

- Statement of Account: Credit Limit Rs Available Credit Limit RsDocumento4 páginasStatement of Account: Credit Limit Rs Available Credit Limit RsSayiram GAinda não há avaliações

- 6388r13 Uk PC Order FRM FinalDocumento2 páginas6388r13 Uk PC Order FRM Finalapi-307674357Ainda não há avaliações

- Yogesh Kumar PDFDocumento4 páginasYogesh Kumar PDFPrashant GargAinda não há avaliações

- James Honeyman Danielle R Honeyman 25409 Via Pacifica Valencia Ca 91355-2616Documento6 páginasJames Honeyman Danielle R Honeyman 25409 Via Pacifica Valencia Ca 91355-2616Dani HoneymanAinda não há avaliações

- LoanApplicationFormDocumento4 páginasLoanApplicationFormMohit DeshpandeAinda não há avaliações

- Statement of Account: Penyata AkaunDocumento4 páginasStatement of Account: Penyata AkaunseelanshathiaAinda não há avaliações

- Get A DSTV Explora + DSTV Premium + Access Fee For Only R849 Pmx24Documento2 páginasGet A DSTV Explora + DSTV Premium + Access Fee For Only R849 Pmx24Phumlani Zuma0% (1)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento5 páginasStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSayiram GAinda não há avaliações

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocumento1 páginaE-Return Acknowledgment Receipt: Personal Information and Return Filing Detailssimon kinuthiaAinda não há avaliações

- Bank@Campus Account - ICICI Bank LTDDocumento1 páginaBank@Campus Account - ICICI Bank LTDKumar RanjanAinda não há avaliações

- View / Print Statement: Select Your Account / Credit Card Statement View SettingsDocumento2 páginasView / Print Statement: Select Your Account / Credit Card Statement View Settingskhadeerabk7925Ainda não há avaliações

- The Insured: Mr. Chandrashekhar Policy No: Policy Type: Issue Date: Occupation: 35101031166338793061Documento4 páginasThe Insured: Mr. Chandrashekhar Policy No: Policy Type: Issue Date: Occupation: 35101031166338793061Anonymous 0zM3YAZVAinda não há avaliações

- PaymentDocumento42 páginasPaymentapi-26670747Ainda não há avaliações

- Creditcard StatementDocumento3 páginasCreditcard StatementPadma NayakAinda não há avaliações

- PDF StatementDocumento3 páginasPDF StatementVikram KumarAinda não há avaliações

- Statement of Account: Credit Limit Rs Available Credit Limit RsDocumento3 páginasStatement of Account: Credit Limit Rs Available Credit Limit RsAbhishek goyalAinda não há avaliações

- Demand Deposit Account Transaction History: Histórico de Movimentos de Conta À OrdemDocumento4 páginasDemand Deposit Account Transaction History: Histórico de Movimentos de Conta À Ordemshahid2opuAinda não há avaliações

- First Tech Credit Union Fees ScheduleDocumento3 páginasFirst Tech Credit Union Fees ScheduleNamtien UsAinda não há avaliações

- EmiratesNBD DirectRemit FAQsDocumento4 páginasEmiratesNBD DirectRemit FAQsJuanita SegundoAinda não há avaliações

- Shoprite Checkers Gift CardDocumento2 páginasShoprite Checkers Gift CardchanellkistenAinda não há avaliações

- Applicant Consent Form: Date of BirthDocumento1 páginaApplicant Consent Form: Date of BirthQuin MooreAinda não há avaliações

- Passbookstmt PDFDocumento4 páginasPassbookstmt PDFLaxman NadariAinda não há avaliações

- May AccountStatementDocumento2 páginasMay AccountStatementharikylm536Ainda não há avaliações

- Hi Edson Munyongani: May 2022 - StatementDocumento2 páginasHi Edson Munyongani: May 2022 - StatementedsonAinda não há avaliações

- English Form For DB Account Opening Form For StudentsDocumento7 páginasEnglish Form For DB Account Opening Form For StudentsFelly M. LogioAinda não há avaliações

- YES Prosperity Credit Card MITC - 14052021Documento8 páginasYES Prosperity Credit Card MITC - 14052021Prinshu TrivediAinda não há avaliações

- Test Doc 2Documento3 páginasTest Doc 2Kor KortAinda não há avaliações

- Titular Xiad en 402 Howard St. South Bend INDIANA 46617 0000 00 01 0000 07003 00 0100 VPN 100 07/17Documento2 páginasTitular Xiad en 402 Howard St. South Bend INDIANA 46617 0000 00 01 0000 07003 00 0100 VPN 100 07/17Gerson ChirinosAinda não há avaliações

- Statement of Account: MR Ranjit RoyDocumento1 páginaStatement of Account: MR Ranjit RoyRanjit RoyAinda não há avaliações

- New Balance CR$46.79 Amount Due $0.00 Payment Not Required: American Express® Gold CardDocumento10 páginasNew Balance CR$46.79 Amount Due $0.00 Payment Not Required: American Express® Gold CardJohn RoyAinda não há avaliações

- ActivityDocumento245 páginasActivityCourtney CampbellAinda não há avaliações

- PDS Business Credit Card I Facility 131016Documento3 páginasPDS Business Credit Card I Facility 131016Megat KamarulAinda não há avaliações

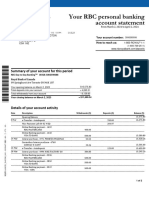

- My RBC Bank Statement CHRISTOPHER REVINGTONDocumento2 páginasMy RBC Bank Statement CHRISTOPHER REVINGTONعبد الالهAinda não há avaliações

- IRDDocumento6 páginasIRDKKAinda não há avaliações

- StatementDocumento17 páginasStatementNacyfa AhmedAinda não há avaliações

- E-Receipt: Transaction Reference Number: 658741278Documento2 páginasE-Receipt: Transaction Reference Number: 658741278Sanoj MaveliAinda não há avaliações

- CreditCardStatement 3Documento4 páginasCreditCardStatement 3rwl s.r.lAinda não há avaliações

- Statment of Account 10.2013Documento1 páginaStatment of Account 10.2013yarlsiddhastutrustAinda não há avaliações

- Su20190130220826x154 966087598 2196703199 PDFDocumento3 páginasSu20190130220826x154 966087598 2196703199 PDFkhamini dilly kannanAinda não há avaliações

- Ooccmkn01 PDFDocumento1 páginaOoccmkn01 PDFnnuuyy 22Ainda não há avaliações

- 1562774110979Documento7 páginas1562774110979Sree ValsanAinda não há avaliações

- State Bank of IndiaDocumento1 páginaState Bank of IndiaGovind RanaAinda não há avaliações

- 2012 Ontario Tax FormDocumento2 páginas2012 Ontario Tax FormHassan MhAinda não há avaliações

- AC 371396871 636910165546741147 Apr STMT PDFDocumento6 páginasAC 371396871 636910165546741147 Apr STMT PDFAbdul Ola IBAinda não há avaliações

- CreditCardStatement PDFDocumento3 páginasCreditCardStatement PDFManoranjan DashAinda não há avaliações

- Final REVISED KMS Redevelopment Agreement 06.19.2019Documento165 páginasFinal REVISED KMS Redevelopment Agreement 06.19.2019GrafixAvengerAinda não há avaliações

- Stock InventoryDocumento2 páginasStock Inventoryzakie rodoalAinda não há avaliações

- Sbi Nre CheklistDocumento2 páginasSbi Nre CheklistwaseemAinda não há avaliações

- Mandatory: Indian Passport HolderDocumento3 páginasMandatory: Indian Passport HolderwaseemAinda não há avaliações

- NRI Account Opening Check ListDocumento2 páginasNRI Account Opening Check ListMehboob100% (1)

- Business Ethics Session 5Documento9 páginasBusiness Ethics Session 5EliaQazilbashAinda não há avaliações

- ASME - Lessens Learned - MT or PT at Weld Joint Preparation and The Outside Peripheral Edge of The Flat Plate After WDocumento17 páginasASME - Lessens Learned - MT or PT at Weld Joint Preparation and The Outside Peripheral Edge of The Flat Plate After Wpranav.kunte3312Ainda não há avaliações

- 140933Documento86 páginas140933D27Ainda não há avaliações

- TNPSC Group 1,2,4,8 VAO Preparation 1Documento5 páginasTNPSC Group 1,2,4,8 VAO Preparation 1SakthiAinda não há avaliações

- CD 116. Villaflor v. Summers, 41 Phil. 62 (1920)Documento1 páginaCD 116. Villaflor v. Summers, 41 Phil. 62 (1920)JMae MagatAinda não há avaliações

- Squatting Problem and Its Social Ills in MANILADocumento10 páginasSquatting Problem and Its Social Ills in MANILARonstar Molina TanateAinda não há avaliações

- Week 4, 5, 6 Adjustments and Financial Statement Prep - ClosingDocumento61 páginasWeek 4, 5, 6 Adjustments and Financial Statement Prep - ClosingAarya SharmaAinda não há avaliações

- UHF Integrated Long-Range Reader: Installation and User ManualDocumento24 páginasUHF Integrated Long-Range Reader: Installation and User ManualARMAND WALDOAinda não há avaliações

- Riverside County FY 2020-21 First Quarter Budget ReportDocumento50 páginasRiverside County FY 2020-21 First Quarter Budget ReportThe Press-Enterprise / pressenterprise.comAinda não há avaliações

- CFS Session 1 Choosing The Firm Financial StructureDocumento41 páginasCFS Session 1 Choosing The Firm Financial Structureaudrey gadayAinda não há avaliações

- Ikyase & Olisah (2014)Documento8 páginasIkyase & Olisah (2014)Dina FitrianiAinda não há avaliações

- Group 4 Written ReportDocumento21 páginasGroup 4 Written ReportEm Bel100% (1)

- Cunanan V CA and BasaranDocumento6 páginasCunanan V CA and BasaranMarielle ReynosoAinda não há avaliações

- LCIA Vs UNCITRAL - WEIGHING THE PROS AND CONSDocumento1 páginaLCIA Vs UNCITRAL - WEIGHING THE PROS AND CONSShahrukh NawazAinda não há avaliações

- Parents Consent AY 2022 2023Documento2 páginasParents Consent AY 2022 2023Jayloid AlteaAinda não há avaliações

- US vs. TANDOCDocumento2 páginasUS vs. TANDOCRay MondAinda não há avaliações

- Kajian 24 KitabDocumento2 páginasKajian 24 KitabSyauqi .tsabitaAinda não há avaliações

- Employment in IndiaDocumento51 páginasEmployment in IndiaKartik KhandelwalAinda não há avaliações

- Short Term FinancingDocumento4 páginasShort Term FinancingMd Ibrahim RubelAinda não há avaliações

- Nichols V Governor Kathy Hochul (2022-02301)Documento3 páginasNichols V Governor Kathy Hochul (2022-02301)Luke ParsnowAinda não há avaliações

- Digest NegoDocumento9 páginasDigest NegoMichael RentozaAinda não há avaliações

- Payroll AuditDocumento11 páginasPayroll AuditJerad KotiAinda não há avaliações

- Practice Tests Electrical Potential Energy PDFDocumento9 páginasPractice Tests Electrical Potential Energy PDFFirdausia Rahma Putri100% (2)

- CPC Foriegn JudgmentDocumento13 páginasCPC Foriegn JudgmentmehakAinda não há avaliações

- Motion For Preliminary InjunctionDocumento4 páginasMotion For Preliminary InjunctionElliott SchuchardtAinda não há avaliações

- HW1Documento4 páginasHW1hung hoangAinda não há avaliações

- Delo Protecion CATERPILLARDocumento1 páginaDelo Protecion CATERPILLARjohnAinda não há avaliações

- Legal Separation - Grounds For DenialDocumento5 páginasLegal Separation - Grounds For DenialAnonymous o9q5eawTAinda não há avaliações

- Rawls TheoryDocumento4 páginasRawls TheoryAcademic ServicesAinda não há avaliações

- Judicial Affidavit For Unlawful DetainerDocumento2 páginasJudicial Affidavit For Unlawful DetainerHannief Ampa21Ainda não há avaliações