Escolar Documentos

Profissional Documentos

Cultura Documentos

Ohio Charitable Trust Act Information Sheet

Enviado por

Mary GallagherDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Ohio Charitable Trust Act Information Sheet

Enviado por

Mary GallagherDireitos autorais:

Formatos disponíveis

Charitable Law Section

Office 614.466.3181

Fax 614.466.9788

150 East Gay Street, 23rd Floor

Columbus, Ohio 43215-3130

www.OhioAttorneyGeneral.gov

OHIO CHARITABLE TRUST ACT

INFORMATION SHEET

(Sections l09.23-.33, Ohio Revised Code)

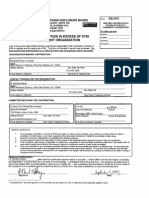

REGISTRATION

The term "trust" is broadly defined to include any 501(c)(3) tax exempt organization or any 501

(c)(4)charitable healthcare organization. Every charitable trust established or active in Ohio is required to

register with the Attorney General's Charitable Law Section. Exemptions from registration are described in

Attorney General Rules l09:l-l-02(B)(l)-(8) and can be found on the Charitable Law website. The Charitable

Trust Registration Form (CFR-l) is to be filed, along with a copy of the instrument creating the organization,

a copy of the Internal Revenue Service determination letter of exempt status, and an annual report for each of

the three most recent years. Any subsequent amendments to these instruments must also be filed with the

Attorney General.

ANNUAL REPORT

Each organization subject to registration shall also file an annual report with the Attorney General for each

calendar or fiscal year in which it has gross receipts of more than $25,000 or gross assets of more than

$25,000. The report shall be either the Annual Report of Charitable Organization form if the organization

does not file a 990, complete copies of all annual federal returns required to be filed by the organization with

the Internal Revenue Service and all attachments, (excluding the donor list), or the Verification of Filing with

the Internal Revenue Service form, as required by Attorney General Rule 109:1-1-04(A)(1)-(3). All annual

reports are required to be filed with the Attorney General on or before the fifteenth day of the fifth month

following the close of the organization's taxable year, or by the due date of any federal extension.

FILING FEES

The following fees are due with the annual financial report:

Assets Fees

Less than $25,000 $ -0-

$25,000 but less than $l00,000 $ 50

$l00,000 but less than $500,000 $100

$500,000 or more $200

Late fee $200

The term "assets" refers to the total current value of the trust's assets which are irrevocably devoted to

charitable purposes at the end of the taxable year. Please note that any charitable trust that fails to pay this fee

at the time required shall pay an additional fee of two hundred dollars. Any fee owed is not due until the

federal due date. We honor all federal extensions. Checks are to be made payable to "Treasurer, State of Ohio."

Always refer to your EIN when corresponding with this Office. Send all registration forms, annual financial

reports, and fees, and direct all questions and correspondence to:

Ohio Attorney General

Charitable Law Section

150 East Gay Street, 23rd Floor

Columbus, Ohio 43215-3130

(614) 466-3181

(revised 4/11)

Você também pode gostar

- Ag990 InstructionsDocumento3 páginasAg990 InstructionsDaniel_Johnson_1322100% (1)

- Aalfs Manufacturing 06 27 05Documento1 páginaAalfs Manufacturing 06 27 05Zach EdwardsAinda não há avaliações

- Palmer Candy 07 25 05Documento1 páginaPalmer Candy 07 25 05Zach EdwardsAinda não há avaliações

- Neumann Architects 06 60 05Documento1 páginaNeumann Architects 06 60 05Zach EdwardsAinda não há avaliações

- BILM Renovations - 2006 - Polk - OTCDocumento1 páginaBILM Renovations - 2006 - Polk - OTCZach EdwardsAinda não há avaliações

- Articles of Incorporation - OregonDocumento4 páginasArticles of Incorporation - OregonjohnhickernellAinda não há avaliações

- United Real Estate 08 01 05Documento1 páginaUnited Real Estate 08 01 05Zach EdwardsAinda não há avaliações

- Fact Sheet: Who Can Represent Aliens in Immigration ProceedingsDocumento5 páginasFact Sheet: Who Can Represent Aliens in Immigration Proceedingsapi-264953265Ainda não há avaliações

- Polk County Employees AFSCME Local 1868 - 09-22-04 - ContributionDocumento1 páginaPolk County Employees AFSCME Local 1868 - 09-22-04 - ContributionZach EdwardsAinda não há avaliações

- Oaks Development 10 21 2004Documento1 páginaOaks Development 10 21 2004Zach EdwardsAinda não há avaliações

- Elder Corporation 12 29 2005Documento1 páginaElder Corporation 12 29 2005Zach EdwardsAinda não há avaliações

- Hubbell Realty 03 02 05Documento1 páginaHubbell Realty 03 02 05Zach EdwardsAinda não há avaliações

- 2009 - 2010 Charitable Law Annual Report Final 7-12-11Documento206 páginas2009 - 2010 Charitable Law Annual Report Final 7-12-11Mike DeWineAinda não há avaliações

- DR OtcDocumento2 páginasDR OtcZach EdwardsAinda não há avaliações

- Wells Fargo 02 17 2005Documento1 páginaWells Fargo 02 17 2005Zach EdwardsAinda não há avaliações

- Jebro Inc 08 29 05Documento1 páginaJebro Inc 08 29 05Zach EdwardsAinda não há avaliações

- Imt 02 21 2005Documento1 páginaImt 02 21 2005Zach EdwardsAinda não há avaliações

- rrf1 FormDocumento5 páginasrrf1 Formsalman_fbAinda não há avaliações

- Legacy Bank 12 16 05Documento1 páginaLegacy Bank 12 16 05Zach EdwardsAinda não há avaliações

- Filing Form Cover Letter: Name To The Attention ofDocumento6 páginasFiling Form Cover Letter: Name To The Attention ofMani KamaliAinda não há avaliações

- The Legacy Group 10 15 04Documento1 páginaThe Legacy Group 10 15 04Zach EdwardsAinda não há avaliações

- Iowa Realty 11 18 04Documento1 páginaIowa Realty 11 18 04Zach EdwardsAinda não há avaliações

- McAninch Corporation 12 22 05Documento1 páginaMcAninch Corporation 12 22 05Zach EdwardsAinda não há avaliações

- Cannon Moss 07 26 05Documento1 páginaCannon Moss 07 26 05Zach EdwardsAinda não há avaliações

- Neumann Brothers 10 25 2004Documento1 páginaNeumann Brothers 10 25 2004Zach EdwardsAinda não há avaliações

- Wells Fargo 10 15 04Documento1 páginaWells Fargo 10 15 04Zach EdwardsAinda não há avaliações

- Organization of California Nonprofit, Nonstock CorporationsDocumento6 páginasOrganization of California Nonprofit, Nonstock CorporationsRyan LeporeAinda não há avaliações

- Dissolving ChurchDocumento2 páginasDissolving ChurchRodAinda não há avaliações

- Annual Report of Charitable OrganizationDocumento9 páginasAnnual Report of Charitable OrganizationMary GallagherAinda não há avaliações

- First Federal Bank 06 24 05Documento1 páginaFirst Federal Bank 06 24 05Zach EdwardsAinda não há avaliações

- Iupat 2004 OtcDocumento1 páginaIupat 2004 OtcZach EdwardsAinda não há avaliações

- Heartland 2005 OTCDocumento1 páginaHeartland 2005 OTCZach EdwardsAinda não há avaliações

- Hubbell Realty Company - 09-09-04 - ContributionDocumento1 páginaHubbell Realty Company - 09-09-04 - ContributionZach EdwardsAinda não há avaliações

- AuditDocumento36 páginasAuditStewart BellAinda não há avaliações

- Jewish Guild For The Blind 2008 TaxesDocumento77 páginasJewish Guild For The Blind 2008 TaxesSteven ThrasherAinda não há avaliações

- Summitt 2004 OTCDocumento1 páginaSummitt 2004 OTCZach EdwardsAinda não há avaliações

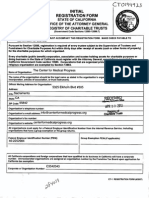

- CWCS AG RegistrationDocumento2 páginasCWCS AG RegistrationWilliamsburg GreenpointAinda não há avaliações

- Charitable Fund Raising Ohio by Professional Solicitors ReportDocumento91 páginasCharitable Fund Raising Ohio by Professional Solicitors ReportMike DeWineAinda não há avaliações

- Michigan Nonprofit Corporation Filing Information: P. O. Box 30054 Lansing, Michigan 48909Documento5 páginasMichigan Nonprofit Corporation Filing Information: P. O. Box 30054 Lansing, Michigan 48909Oliver KlozeoffAinda não há avaliações

- Southeast Missouri (SEMO) Drug Task Force (2012)Documento3 páginasSoutheast Missouri (SEMO) Drug Task Force (2012)raydownsrftAinda não há avaliações

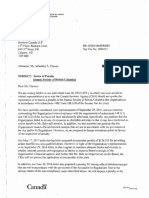

- CRA Letter of Intention To Revoke Charitable Status of The Canadian Islamic Trust FoundationDocumento112 páginasCRA Letter of Intention To Revoke Charitable Status of The Canadian Islamic Trust FoundationsdbcraigAinda não há avaliações

- Municipal - Laborers Union - 10 - 28 - 04Documento1 páginaMunicipal - Laborers Union - 10 - 28 - 04Zach EdwardsAinda não há avaliações

- Everytown Support Fund 2017Documento67 páginasEverytown Support Fund 2017Stephen GutowskiAinda não há avaliações

- Mercy Medical Center 10 28 04Documento1 páginaMercy Medical Center 10 28 04Zach EdwardsAinda não há avaliações

- Center For Medical Progress California RegistrationDocumento10 páginasCenter For Medical Progress California RegistrationelicliftonAinda não há avaliações

- Ohio LLC Articles of OrganizationDocumento6 páginasOhio LLC Articles of OrganizationRocketLawyerAinda não há avaliações

- Master Builders 07 20 05Documento1 páginaMaster Builders 07 20 05Zach EdwardsAinda não há avaliações

- Cedar Valley Corp - 2005 - Black Hawk - OTCDocumento1 páginaCedar Valley Corp - 2005 - Black Hawk - OTCZach EdwardsAinda não há avaliações

- Checklist For Starting A Kentucky NonprofitDocumento19 páginasChecklist For Starting A Kentucky NonprofitNancy Slonneger HancockAinda não há avaliações

- OHN Shcroft: S S S MDocumento5 páginasOHN Shcroft: S S S MSeele HeilerAinda não há avaliações

- Oakland Community Land Trust - Founding Documents 1999Documento75 páginasOakland Community Land Trust - Founding Documents 1999auweia1Ainda não há avaliações

- CCTCP ProgramoverviewDocumento7 páginasCCTCP Programoverviewapi-205889977Ainda não há avaliações

- Florida LLC Formation FormDocumento5 páginasFlorida LLC Formation FormJuanFer Alvarez100% (1)

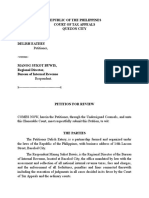

- Republic of The Philippines Court of Tax Appeals Quezon CityDocumento6 páginasRepublic of The Philippines Court of Tax Appeals Quezon CityKevin Patrick Magalona Degayo100% (1)

- Citizens For Smart GrowthDocumento1 páginaCitizens For Smart GrowthZach EdwardsAinda não há avaliações

- Fomtnp RRF 2013Documento2 páginasFomtnp RRF 2013L. A. PatersonAinda não há avaliações

- California Articles of OrganizationDocumento4 páginasCalifornia Articles of OrganizationRocketLawyer100% (1)

- Zielger 2006 Polk OTCDocumento1 páginaZielger 2006 Polk OTCZach EdwardsAinda não há avaliações

- Student Notice 2023-07-15 Attention All StudentsDocumento1 páginaStudent Notice 2023-07-15 Attention All StudentsTanmoy SinghaAinda não há avaliações

- Section 6 in The Hindu Succession Act, 1956Documento2 páginasSection 6 in The Hindu Succession Act, 1956Sathish KumarAinda não há avaliações

- IBRO 2011 Inter Regional PosterDocumento1 páginaIBRO 2011 Inter Regional PosterInternational Brain Research OrganizationAinda não há avaliações

- ЛексикологіяDocumento2 páginasЛексикологіяQwerty1488 No nameAinda não há avaliações

- Petersen S 4 Wheel Off Road December 2015Documento248 páginasPetersen S 4 Wheel Off Road December 20154lexx100% (1)

- CPAR FLashcardDocumento3 páginasCPAR FLashcardJax LetcherAinda não há avaliações

- Price Build UpsDocumento22 páginasPrice Build UpsFirasAlnaimiAinda não há avaliações

- I YOU HE SHE IT WE YOU They: Personal Pronouns in Your Language (In Limba Ta)Documento1 páginaI YOU HE SHE IT WE YOU They: Personal Pronouns in Your Language (In Limba Ta)Alina SardariuAinda não há avaliações

- The Customary of The House of Initia Nova - OsbDocumento62 páginasThe Customary of The House of Initia Nova - OsbScott KnitterAinda não há avaliações

- Vespers Conversion of Saint PaulDocumento7 páginasVespers Conversion of Saint PaulFrancis Carmelle Tiu DueroAinda não há avaliações

- Udom Selection 2013Documento145 páginasUdom Selection 2013Kellen Hayden100% (1)

- Eternal Generation What Is Eternal Generation?Documento2 páginasEternal Generation What Is Eternal Generation?Jake DavilaAinda não há avaliações

- SahilDocumento4 páginasSahilayushpundri914Ainda não há avaliações

- Quote For 1.83x3m Ball Mill - FTM JerryDocumento13 páginasQuote For 1.83x3m Ball Mill - FTM JerryChristian HuamanAinda não há avaliações

- Ancient Greek LanguageDocumento35 páginasAncient Greek LanguageGheşea Georgiana0% (1)

- Art10 PDFDocumento10 páginasArt10 PDFandreea_zgrAinda não há avaliações

- John Carroll University Magazine Winter 2008Documento69 páginasJohn Carroll University Magazine Winter 2008johncarrolluniversityAinda não há avaliações

- Dreaded Homework Crossword ClueDocumento9 páginasDreaded Homework Crossword Clueafnahsypzmbuhq100% (1)

- Contribution of Tourism Industry in Indian Economy: An AnalysisDocumento8 páginasContribution of Tourism Industry in Indian Economy: An AnalysisHarsh GuptaAinda não há avaliações

- S 1 SdresourceswalkthroughDocumento57 páginasS 1 SdresourceswalkthroughJanine Marcos75% (4)

- Duke, Managing The Learning UniversityDocumento17 páginasDuke, Managing The Learning UniversityOgarrio RojasAinda não há avaliações

- Qualified Written RequestDocumento9 páginasQualified Written Requestteachezi100% (3)

- Pearbudget: (Easy Budgeting For Everyone)Documento62 páginasPearbudget: (Easy Budgeting For Everyone)iPakistan100% (3)

- Sencor-Scooter-One-App-EN YeaaDocumento7 páginasSencor-Scooter-One-App-EN Yeaaeh smrdimAinda não há avaliações

- Sama Vedi Upakarma Mantra 2019Documento12 páginasSama Vedi Upakarma Mantra 2019ramdausAinda não há avaliações

- Bishal BharatiDocumento13 páginasBishal Bharatibishal bharatiAinda não há avaliações

- Automatic Site PositioningDocumento1 páginaAutomatic Site PositioningDenmark Wilson0% (1)

- Principles of PR Measurement 0 PDFDocumento15 páginasPrinciples of PR Measurement 0 PDFVisai_kitasAinda não há avaliações

- 55WeekScheduleforFOUNDATION Pouyrogram-CrackiasDocumento21 páginas55WeekScheduleforFOUNDATION Pouyrogram-CrackiasThowheedh MahamoodhAinda não há avaliações

- MBA621-SYSTEM ANALYSIS and DESIGN PROPOSAL-Bryon-Gaskin-CO - 1Documento3 páginasMBA621-SYSTEM ANALYSIS and DESIGN PROPOSAL-Bryon-Gaskin-CO - 1Zvisina BasaAinda não há avaliações