Escolar Documentos

Profissional Documentos

Cultura Documentos

Consolidated Financial Report

Enviado por

Vineet DixitDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Consolidated Financial Report

Enviado por

Vineet DixitDireitos autorais:

Formatos disponíveis

Consolidated Statements of Income

Fiscal Years Ended January 31,

(Amounts in millions except per share data) 2010 2009 2008

Revenues:

Net sales $405,046 $401,087 $373,821

Membership and other income 3,168 3,287 3,202

408,214 404,374 377,023

Costs and expenses:

Cost of sales 304,657 304,056 284,137

Operating, selling, general and administrative expenses 79,607 77,520 70,934

Operating income 23,950 22,798 21,952

Interest:

Debt 1,787 1,896 1,863

Capital leases 278 288 240

Interest income (181) (284) (309)

Interest, net 1,884 1,900 1,794

Income from continuing operations before income taxes 22,066 20,898 20,158

Provision for income taxes:

Current 7,643 6,564 6,897

Deferred (504) 581 (8)

7,139 7,145 6,889

Income from continuing operations 14,927 13,753 13,269

Income (loss) from discontinued operations, net of tax (79) 146 (132)

Consolidated net income 14,848 13,899 13,137

Less consolidated net income attributable to noncontrolling interest (513) (499) (406)

Consolidated net income attributable to Walmart $ 14,335 $ 13,400 $ 12,731

Basic net income per common share:

Basic income per common share from continuing operations attributable to Walmart $ 3.73 $ 3.36 $ 3.16

Basic income (loss) per common share from discontinued operations attributable to Walmart (0.02) 0.04 (0.03)

Basic net income per common share attributable to Walmart $ 3.71 $ 3.40 $ 3.13

Diluted net income per common share:

Diluted income per common share from continuing operations attributable to Walmart $ 3.72 $ 3.35 $ 3.16

Diluted income (loss) per common share from discontinued operations attributable to Walmart (0.02) 0.04 (0.03)

Diluted net income per common share attributable to Walmart $ 3.70 $ 3.39 $ 3.13

Weighted-average number of common shares:

Basic 3,866 3,939 4,066

Diluted 3,877 3,951 4,072

Dividends declared per common share $ 1.09 $ 0.95 $ 0.88

See accompanying notes.

30 Walmart 2010 Annual Report

107077_L01_FIN_02.indd 30 4/6/10 12:10:52 AM

Consolidated Balance Sheets

January 31,

(Amounts in millions except per share data) 2010 2009

ASSETS

Current assets:

Cash and cash equivalents $ 7,907 $ 7,275

Receivables, net 4,144 3,905

Inventories 33,160 34,511

Prepaid expenses and other 2,980 3,063

Current assets of discontinued operations 140 195

Total current assets 48,331 48,949

Property and equipment:

Land 22,591 19,852

Buildings and improvements 77,452 73,810

Fixtures and equipment 35,450 29,851

Transportation equipment 2,355 2,307

Property and equipment 137,848 125,820

Less accumulated depreciation (38,304) (32,964)

Property and equipment, net 99,544 92,856

Property under capital leases:

Property under capital leases 5,669 5,341

Less accumulated amortization (2,906) (2,544)

Property under capital leases, net 2,763 2,797

Goodwill 16,126 15,260

Other assets and deferred charges 3,942 3,567

Total assets $170,706 $163,429

LIABILITIES AND EQUITY

Current liabilities:

Short-term borrowings $ 523 $ 1,506

Accounts payable 30,451 28,849

Accrued liabilities 18,734 18,112

Accrued income taxes 1,365 677

Long-term debt due within one year 4,050 5,848

Obligations under capital leases due within one year 346 315

Current liabilities of discontinued operations 92 83

Total current liabilities 55,561 55,390

Long-term debt 33,231 31,349

Long-term obligations under capital leases 3,170 3,200

Deferred income taxes and other 5,508 6,014

Redeemable noncontrolling interest 307 397

Commitments and contingencies

Equity:

Preferred stock ($0.10 par value; 100 shares authorized, none issued) — —

Common stock ($0.10 par value; 11,000 shares authorized, 3,786 and 3,925 issued

and outstanding at January 31, 2010 and January 31, 2009, respectively) 378 393

Capital in excess of par value 3,803 3,920

Retained earnings 66,638 63,660

Accumulated other comprehensive loss (70) (2,688)

Total Walmart shareholders’ equity 70,749 65,285

Noncontrolling interest 2,180 1,794

Total equity 72,929 67,079

Total liabilities and equity $170,706 $163,429

See accompanying notes.

Walmart 2010 Annual Report 31

107077_L01_FIN_02.indd 31 4/6/10 12:10:52 AM

Consolidated Statements of Shareholders’ Equity

Accumulated Total

Capital in Other Walmart

Number Common Excess of Retained Comprehensive Shareholders’ Noncontrolling Total

(Amounts in millions except per share data) of Shares Stock Par Value Earnings Income (Loss) Equity Interest Equity

Balances — February 1, 2007 4,131 $413 $ 2,834 $ 55,818 $ 2,508 $ 61,573 $ 2,160 $ 63,733

Consolidated net income 12,731 12,731 406 13,137

Other comprehensive income 1,356 1,356 8 1,364

Cash dividends ($0.88 per share) (3,586) (3,586) (3,586)

Purchase of company stock (166) (17) (190) (7,484) (7,691) (7,691)

Other 8 1 384 385 (635) (250)

Adoption of accounting for

uncertainty in income taxes (160) (160) (160)

Balances — January 31, 2008 3,973 $397 $3,028 $57,319 $ 3,864 $ 64,608 $ 1,939 $ 66,547

Consolidated net income 13,400 13,400 499 13,899

Other comprehensive income (6,552) (6,552) (371) (6,923)

Cash dividends ($0.95 per share) (3,746) (3,746) (3,746)

Purchase of company stock (61) (6) (95) (3,315) (3,416) (3,416)

Other 13 2 987 2 991 (273) 718

Balances — January 31, 2009 3,925 $393 $3,920 $63,660 $(2,688) $65,285 $1,794 $67,079

Consolidated net income

(excludes redeemable

noncontrolling interest) 14,335 14,335 499 14,834

Other comprehensive income 2,618 2,618 64 2,682

Cash dividends ($1.09 per share) (4,217) (4,217) (4,217)

Purchase of company stock (145) (15) (246) (7,136) (7,397) (7,397)

Purchase of redeemable

noncontrolling interest (288) (288) (288)

Other 6 417 (4) 413 (177) 236

Balances — January 31, 2010 3,786 $378 $3,803 $66,638 $ (70) $70,749 $2,180 $72,929

Fiscal Years Ended January 31,

2010 2009 2008

Comprehensive Income:

Consolidated net income (1) $14,848 $13,899 $13,137

Other comprehensive income:

Currency translation (2) 2,854 (6,860) 1,226

Net change in fair values of derivatives 94 (17) —

Minimum pension liability (220) (46) 138

Total comprehensive income 17,576 6,976 14,501

Less amounts attributable to the noncontrolling interest:

Net income (1) (513) (499) (406)

Currency translation (2) (110) 371 (8)

Amounts attributable to the noncontrolling interest (623) (128) (414)

Comprehensive income attributable to Walmart $16,953 $ 6,848 $14,087

(1) Includes $14 million in fi scal 2010 that is related to the redeemable noncontrolling interest.

(2) Includes $46 million in fi scal 2010 that is related to the redeemable noncontrolling interest.

See accompanying notes.

32 Walmart 2010 Annual Report

107077_L01_FIN_02.indd 32 4/6/10 12:10:52 AM

Consolidated Statements of Cash Flows

Fiscal Years Ended January 31,

(Amounts in millions) 2010 2009 2008

Cash flows from operating activities:

Consolidated net income $ 14,848 $ 13,899 $ 13,137

Loss (income) from discontinued operations, net of tax 79 (146) 132

Income from continuing operations 14,927 13,753 13,269

Adjustments to reconcile income from continuing operations to net cash

provided by operating activities:

Depreciation and amortization 7,157 6,739 6,317

Deferred income taxes (504) 581 (8)

Other operating activities 301 769 504

Changes in certain assets and liabilities, net of effects of acquisitions:

Increase in accounts receivable (297) (101) (564)

Decrease (increase) in inventories 2,265 (220) (775)

Increase (decrease) in accounts payable 1,052 (410) 865

Increase in accrued liabilities 1,348 2,036 1,034

Net cash provided by operating activities 26,249 23,147 20,642

Cash flows from investing activities:

Payments for property and equipment (12,184) (11,499) (14,937)

Proceeds from disposal of property and equipment 1,002 714 957

Proceeds from (payments for) disposal of certain international operations, net — 838 (257)

Investment in international operations, net of cash acquired — (1,576) (1,338)

Other investing activities (438) 781 (95)

Net cash used in investing activities (11,620) (10,742) (15,670)

Cash flows from financing activities:

Increase (decrease) in short-term borrowings, net (1,033) (3,745) 2,376

Proceeds from issuance of long-term debt 5,546 6,566 11,167

Payment of long-term debt (6,033) (5,387) (8,723)

Dividends paid (4,217) (3,746) (3,586)

Purchase of company stock (7,276) (3,521) (7,691)

Purchase of redeemable noncontrolling interest (436) — —

Payment of capital lease obligations (346) (352) (343)

Other financing activities (396) 267 (622)

Net cash used in financing activities (14,191) (9,918) (7,422)

Effect of exchange rates on cash and cash equivalents 194 (781) 252

Net increase (decrease) in cash and cash equivalents 632 1,706 (2,198)

Cash and cash equivalents at beginning of year (1) 7,275 5,569 7,767

Cash and cash equivalents at end of year (2) $ 7,907 $ 7,275 $ 5,569

Supplemental disclosure of cash flow information

Income tax paid $ 7,389 $ 6,596 $ 6,299

Interest paid 2,141 1,787 1,622

Capital lease obligations incurred 61 284 447

(1) Includes cash and cash equivalents of discontinued operations of $51 million at February 1, 2007.

(2) Includes cash and cash equivalents of discontinued operations of $77 million at January 31, 2008.

See accompanying notes.

Walmart 2010 Annual Report 33

107077_L01_FIN_02.indd 33 4/6/10 12:10:53 AM

Você também pode gostar

- Walmart Financial Statements AnalysisDocumento5 páginasWalmart Financial Statements AnalysisAhmad IqbalAinda não há avaliações

- Microsoft Corporation Financial Statements and Supplementary DataDocumento43 páginasMicrosoft Corporation Financial Statements and Supplementary DataDylan MakroAinda não há avaliações

- Quarter1 2010Documento2 páginasQuarter1 2010DhruvRathoreAinda não há avaliações

- Bestbuy Income StatementDocumento1 páginaBestbuy Income Statementmeverick_leeAinda não há avaliações

- Devon Q4-2019-DVN-Supplemental-TablesDocumento11 páginasDevon Q4-2019-DVN-Supplemental-TablesMiguel RamosAinda não há avaliações

- Att-Ar-2012-Financials Cut PDFDocumento5 páginasAtt-Ar-2012-Financials Cut PDFDevandro MahendraAinda não há avaliações

- Walt Disney Corporation FSDocumento6 páginasWalt Disney Corporation FSJannefah Irish SaglayanAinda não há avaliações

- Walt Disney Corporation FSDocumento6 páginasWalt Disney Corporation FSJannefah Irish SaglayanAinda não há avaliações

- The Procter & Gamble Company Consolidated Statements of EarningsDocumento5 páginasThe Procter & Gamble Company Consolidated Statements of EarningshummatafiqueAinda não há avaliações

- 审计年报2010316Documento35 páginas审计年报2010316yf zAinda não há avaliações

- The Procter & Gamble Company Consolidated Statements of EarningsDocumento5 páginasThe Procter & Gamble Company Consolidated Statements of EarningsJustine Maureen AndalAinda não há avaliações

- Quarter1 2008Documento2 páginasQuarter1 2008Raghavendra DevadigaAinda não há avaliações

- Consolidated 11-Year Summary: Financial / Data SectionDocumento60 páginasConsolidated 11-Year Summary: Financial / Data SectionMUHAMMAD ISMAILAinda não há avaliações

- Q4 16 Website Data PDFDocumento11 páginasQ4 16 Website Data PDFAnggun SetyantoAinda não há avaliações

- Eerr EnronDocumento5 páginasEerr EnronCamila PeñaAinda não há avaliações

- Wal-Mart Stores, Inc.: Notes To Consolidated Financial Statements 7 Stock-Based Compensation PlansDocumento5 páginasWal-Mart Stores, Inc.: Notes To Consolidated Financial Statements 7 Stock-Based Compensation PlansNamitAinda não há avaliações

- Of The Securities Exchange Act of 1934Documento67 páginasOf The Securities Exchange Act of 1934Camille AglionesAinda não há avaliações

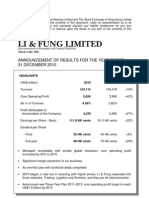

- Announcement of Results For The Year Ended 31 DECEMBER 2010: (Incorporated in Bermuda With Limited Liability)Documento25 páginasAnnouncement of Results For The Year Ended 31 DECEMBER 2010: (Incorporated in Bermuda With Limited Liability)shiyeegohAinda não há avaliações

- Revenue and earnings analysis of public company from 2005 to 2008Documento8 páginasRevenue and earnings analysis of public company from 2005 to 2008Marc StephanickAinda não há avaliações

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Documento3 páginasColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Upendra GuptaAinda não há avaliações

- Starbucks Fiscal 2021 Annual ReportDocumento1 páginaStarbucks Fiscal 2021 Annual ReportLeslie GuillermoAinda não há avaliações

- The Procter & Gamble Company Consolidated Statements of EarningsDocumento5 páginasThe Procter & Gamble Company Consolidated Statements of EarningsJustine Maureen AndalAinda não há avaliações

- Ramco Annual Report 2014Documento2 páginasRamco Annual Report 2014nithinAinda não há avaliações

- Published Results 31 March 2010Documento2 páginasPublished Results 31 March 2010Ravi ChaturvediAinda não há avaliações

- 2022 Form 10-K consolidated balance sheetDocumento1 página2022 Form 10-K consolidated balance sheetYashasvi RaghavendraAinda não há avaliações

- Net Revenue $ 15,301 $ 16,883 $ 14,950 Operating Expenses: Consolidated Statement of OperationsDocumento1 páginaNet Revenue $ 15,301 $ 16,883 $ 14,950 Operating Expenses: Consolidated Statement of OperationsMaanvee JaiswalAinda não há avaliações

- HPQ Q1 31012014Documento8 páginasHPQ Q1 31012014Tran HongAinda não há avaliações

- Larsen & Toubro Infotech Ltd Income Statement AnalysisDocumento140 páginasLarsen & Toubro Infotech Ltd Income Statement AnalysisNishant SharmaAinda não há avaliações

- Annual Report 2016: Financial SectionDocumento39 páginasAnnual Report 2016: Financial SectionAlezNgAinda não há avaliações

- Ar-2019 JKTL141060 2Documento1 páginaAr-2019 JKTL141060 2Alfian Nur HudaAinda não há avaliações

- NetflixDocumento3 páginasNetflixNikkii SharmaAinda não há avaliações

- Sri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 31 December 2019Documento14 páginasSri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 31 December 2019Nilupul BasnayakeAinda não há avaliações

- Unaudited Consolidated Financial Results For The Quarter Ended 31 March 2010Documento4 páginasUnaudited Consolidated Financial Results For The Quarter Ended 31 March 2010poloAinda não há avaliações

- Financial Overview and Regulation G Disclosure Q2 2014Documento10 páginasFinancial Overview and Regulation G Disclosure Q2 2014Christopher TownsendAinda não há avaliações

- 4Q 2018 Match Group Earnings ReleaseDocumento11 páginas4Q 2018 Match Group Earnings ReleaseDIanaAinda não há avaliações

- Sri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 June 2019Documento13 páginasSri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 June 2019Nilupul BasnayakeAinda não há avaliações

- As at April 30: MKS Inc. Consolidated Balance SheetsDocumento12 páginasAs at April 30: MKS Inc. Consolidated Balance Sheetszeeshan655Ainda não há avaliações

- BGDocumento1 páginaBGCamila PeñaAinda não há avaliações

- Q2 2023 Financial SchedulesDocumento30 páginasQ2 2023 Financial SchedulesVinieboy De mepperAinda não há avaliações

- Pfizer Income StatementDocumento1 páginaPfizer Income Statementsean_jaggernauth@philliouselwanes.comAinda não há avaliações

- Engro Corporation LTDDocumento3 páginasEngro Corporation LTDaveshrajAinda não há avaliações

- Jamna Auto Industries Limited Unaudited ResultsDocumento4 páginasJamna Auto Industries Limited Unaudited ResultspoloAinda não há avaliações

- Estado de Resultados 2000-1999Documento2 páginasEstado de Resultados 2000-1999Camila PeñaAinda não há avaliações

- CH 1 Exhibit 1 Q 1-5Documento6 páginasCH 1 Exhibit 1 Q 1-5ЭниЭ.Ainda não há avaliações

- Sri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 September 2019Documento14 páginasSri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 September 2019Nilupul BasnayakeAinda não há avaliações

- Balance Sheet P&G 2009Documento5 páginasBalance Sheet P&G 2009Saad BukhariAinda não há avaliações

- FIN 422-Midterm AssDocumento43 páginasFIN 422-Midterm AssTakibul HasanAinda não há avaliações

- Bharti Airtel Limited Financial Statements 2015Documento1 páginaBharti Airtel Limited Financial Statements 2015Abhilash JackAinda não há avaliações

- 1st Quarter Report - tcm391-593715Documento1 página1st Quarter Report - tcm391-593715Ahm FerdousAinda não há avaliações

- Period Ended 2/1/2020 2/2/2019 2/3/2018: Diluted Shares OutstandingDocumento4 páginasPeriod Ended 2/1/2020 2/2/2019 2/3/2018: Diluted Shares Outstandingso_levictorAinda não há avaliações

- Enron Corp. Consolidated Income Statement and Balance Sheet (2000-1999Documento4 páginasEnron Corp. Consolidated Income Statement and Balance Sheet (2000-1999Camila PeñaAinda não há avaliações

- Dilip BuildconDocumento59 páginasDilip BuildconNishant SharmaAinda não há avaliações

- Teikoku Electric Mfg. Co., LTD.: Consolidated Statement of Income Year Ended March 31, 2016Documento1 páginaTeikoku Electric Mfg. Co., LTD.: Consolidated Statement of Income Year Ended March 31, 2016LymeParkAinda não há avaliações

- 中期报告2011614Documento54 páginas中期报告2011614yf zAinda não há avaliações

- Jollibee Foods Corporation: Consolidated Statements of IncomeDocumento9 páginasJollibee Foods Corporation: Consolidated Statements of Incomearvin cleinAinda não há avaliações

- Ratio - Tesco AssignmentDocumento11 páginasRatio - Tesco AssignmentaXnIkaran100% (1)

- Balaji Published Results 28-102010Documento2 páginasBalaji Published Results 28-102010Saurabh YadavAinda não há avaliações

- Consolidated Financial Statements As of December 31 2020Documento86 páginasConsolidated Financial Statements As of December 31 2020Raka AryawanAinda não há avaliações

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisAinda não há avaliações

- Define Ngo, Types of Ngo, Difference Between National Ngo and International NgoDocumento8 páginasDefine Ngo, Types of Ngo, Difference Between National Ngo and International NgoPRIYANKAAinda não há avaliações

- Got - Hindi S04 480pDocumento49 páginasGot - Hindi S04 480pT ShrinathAinda não há avaliações

- Paper On Society1 Modernity PDFDocumento13 páginasPaper On Society1 Modernity PDFferiha goharAinda não há avaliações

- Republic of The Philippines Manila First DivisionDocumento10 páginasRepublic of The Philippines Manila First DivisionDino Bernard LapitanAinda não há avaliações

- Shakespeare and The Middle Ages 2009 PDFDocumento310 páginasShakespeare and The Middle Ages 2009 PDFgianiAinda não há avaliações

- Order Dated - 18-08-2020Documento5 páginasOrder Dated - 18-08-2020Gaurav LavaniaAinda não há avaliações

- Apple Strategic Audit AnalysisDocumento14 páginasApple Strategic Audit AnalysisShaff Mubashir BhattiAinda não há avaliações

- Catalogueofsanfr00sanfrich PDFDocumento310 páginasCatalogueofsanfr00sanfrich PDFMonserrat Benítez CastilloAinda não há avaliações

- Project Management of World Bank ProjectsDocumento25 páginasProject Management of World Bank ProjectsDenisa PopescuAinda não há avaliações

- Pay rates for Miscellaneous Award 2010Documento8 páginasPay rates for Miscellaneous Award 2010JoshAinda não há avaliações

- Oblicon SampleDocumento1 páginaOblicon SamplelazylawatudentAinda não há avaliações

- Volunteer Background Check FormDocumento1 páginaVolunteer Background Check FormStanley ChuAinda não há avaliações

- Common SealDocumento3 páginasCommon SealPrav SrivastavaAinda não há avaliações

- Annex 3 Affidavit of Undertaking DO 3 2018Documento1 páginaAnnex 3 Affidavit of Undertaking DO 3 2018Anne CañosoAinda não há avaliações

- Chapter 3 - Statement of Financial Position and Income StatementDocumento28 páginasChapter 3 - Statement of Financial Position and Income Statementshemida75% (4)

- Major League Baseball v. CristDocumento1 páginaMajor League Baseball v. CristReid MurtaughAinda não há avaliações

- Organizational ManagementDocumento7 páginasOrganizational ManagementMacqueenAinda não há avaliações

- 07 Making Disciples 2020 (For Study Purposes)Documento72 páginas07 Making Disciples 2020 (For Study Purposes)Kathleen Marcial100% (6)

- Torts For Digest LISTDocumento12 páginasTorts For Digest LISTJim ParedesAinda não há avaliações

- Tax RTP May 2020Documento35 páginasTax RTP May 2020KarthikAinda não há avaliações

- But I Was Never There!: Feel As Though You Left EgyptDocumento4 páginasBut I Was Never There!: Feel As Though You Left Egyptoutdash2Ainda não há avaliações

- QO-D-7.1-3 Ver-4.0 - Withdrawal of Specification of ItemsDocumento3 páginasQO-D-7.1-3 Ver-4.0 - Withdrawal of Specification of ItemsSaugata HalderAinda não há avaliações

- 2016 Gcrsport enDocumento398 páginas2016 Gcrsport enDeewas PokhAinda não há avaliações

- KSA Salary Guide 2023: Emerging Sectors & Mega-Projects to Drive 3% Pay RiseDocumento29 páginasKSA Salary Guide 2023: Emerging Sectors & Mega-Projects to Drive 3% Pay Riseدحوم ..100% (8)

- Democratization and StabilizationDocumento2 páginasDemocratization and StabilizationAleah Jehan AbuatAinda não há avaliações

- DENR confiscation caseDocumento347 páginasDENR confiscation caseRyan BalladaresAinda não há avaliações

- Islamic Mangement Vs Conventional ManagementDocumento18 páginasIslamic Mangement Vs Conventional Managementlick100% (1)

- Pre-Trial Brief of ProsecutionDocumento3 páginasPre-Trial Brief of ProsecutionJoan PabloAinda não há avaliações

- CFPB Your Money Your Goals Choosing Paid ToolDocumento6 páginasCFPB Your Money Your Goals Choosing Paid ToolJocelyn CyrAinda não há avaliações

- Final Sociology Project - Dowry SystemDocumento18 páginasFinal Sociology Project - Dowry Systemrajpurohit_dhruv1142% (12)