Escolar Documentos

Profissional Documentos

Cultura Documentos

Advanta LKP 2009

Enviado por

Koushik BhattacharyyaDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Advanta LKP 2009

Enviado por

Koushik BhattacharyyaDireitos autorais:

Formatos disponíveis

Initiating Coverage

Advanta India Limited Rs 410

…best bet to play the agricultural productivity theme Buy

Industry : Agriculture -Hybrid Seeds BSE/NSE Code : 532840 / ADVANTA

Company P/E : 9xCY'10E 52 Week H/L (Rs) : 1100 / 310

Market Cap. (Rs) : 7bn Daily traded volumes : 8, 500 / 6,500

Face Value (Rs) : 10 Dividend (FY'08) : 10%

Investment Argument

• We believe that Advanta India Ltd - AIL is the most aggressive and geographically diversified hybrid seed play

available to investors to play the agricultural productivity improvement theme in key markets across the globe.

• Fox Paine LLC a private equity firm based in the US sold Advanta in bits and pieces and the United Phosphorus

Group acquired the Asia Pacific and Latin America business in March 2006 and Advanta India Ltd - AIL came

out with its IPO in March 2007 by raising Rs2.2bn by issuing shares of Rs10 each at a price of Rs640 per share.

AIL part of the UPL group is the holding company for the global business of Advanta spanning five major

geographies - Australia, USA, Thailand, Argentina and India. AIL has a leadership position in Sorghum Sunflower

and Corn and is a leading agronomic global seed company competing with Syngenta, Limagrain, Monsanto,

Pioneer (Dupont group) and Pro Agro (Bayer group) in most of the markets.

• Australia is a $35mn business and Sorghum is the focus crop accounting for close to 40% of the business. The

other key crops are corn, canola, sunflower, oats and pearl millet among others. Acquisition of Longreach Plant

Breeders, a wheat research company in Australia has reinforced its presence in the wheat market in Australia.

Exports of AIL are channeled out of Australia and the key countries where hybrids of sunflower and canola are

sold include Pakistan, Bangladesh, Sudan, Iran and Indonesia. However the profitability is not high as the

operating costs in Australia is high.

• US business was reinforced in sweet sorghum with the acquisition of Garrison and Townsend-GT, which essentially

is a private label business with no branding. AIL acquired the $10.5mn business at one time revenues and the

acquired companies have proprietary traits and a good germplasm in grain and forage sorghum and we expect

this crop to fill the gap arising due to corn in the bio-fuel market. AIL remains the third largest player in

Sorghum after Monsanto and Pioneer. It is among the few players in the world to have a quality sweet sorghum

germplasm and while GT is the vehicle in the US, AIL has tied up with the TATAS in India. Sweet sorghum

although a relatively small component in its portfolio would be a fast growing segment as the cost of production

is low and can develop into a preferred crop in the bio-fuel market. AIL also acquired the sunflower seed

business of Limagrain in the US last year which consolidated its position in the sunflower seed market. The

US business is expected to grow at the rate of 15% annually.

• Thailand is a $15mn business where Corn is the key crop and it has a 60% market share in corn. Thailand is

also a good market for vegetable seeds. AIL is a strong player in the Thai corn market in baby corn and sweet

corn and is now building a strong presence in the field corn market.

• India is a $30mn business and the focus crops include paddy, vegetables, corn and sunflower and we expect

the business to grow at 20% annually led by vegetables, paddy and mustard. With the acquisition of Golden

Seeds and Unicorn Seeds AIL now has a 10% market share in the Rs6bn vegetables seeds market in India. As

India is the second largest producer of vegetables in the world, AIL is looking to tap the opportunities in

vegetable seeds like cabbage, cauliflower, chillies and okra. Hybrid rice is a huge opportunity with 42 million

hectares of acreage under rice of which only 2 million is under hybrid and Bayer, Pioneer and Advanta are the

key players in this segment.

LKP Research 2612March, 2009 S. Ranganathan

Initiating Coverage

• Argentina is a $18mn business and Sunflower is the focus crop for AIL and has a market share of 17%. More

than 75% of the business in Argentina comes from Sunflower and Sorghum (both grain and forage). We expect

Sunflower and BT corn to be the growth drivers in Argentina. Healthy sunflower oil project - SUNSAT is on track

and globally regulators are working on banning the usage of trans-fats in foods and this provides a huge

opportunity for AIL's high oleic and high stearic sunflower oil branded as -NUTRISUN. AIL has targeted

chocolates in the initial phase as the product finds application as a cocoa butter equivalent - CBE. Although

this project is only beginning to evolve AIL has sold 250 tons of the product till date in CY'09 and we are

factoring a sale of 3,000 tons during the year and 10,000 tons in CY'10 in to our estimates. We expect this

product to be a hugely profitable product for AILS once the volumes gain traction from CY'11 onwards.

• AIL has signed an MOU with leading oil formulators-TEAM and CALSA in Latin America for different applications

on NUTRISUN. It is a non GM healthy oil with 20% stearic and 60% oleic content. SUNSAT derived from

sunflower saturated and developed by AIL using plant breeding and molecular marker technology - modifying

the fatty acid profile through a non-GM technology has the propensity to lower bad cholesterol and is likely

to be a block buster product for AIL in applications like food, bakeries, ice-cream, chocolates, confectionery,

margarine and spreads as the product offers solid fat without transfat and is natural without hydrogenation.

The focus in on CBE and Spreads as Nutrisun is the most stable source of natural stearic acid. The product is

being sold in Latin America and is being launched in Argentina and Japan.

• AIL effective CY'09 has started to leverage the vast distribution strengths of UPL to distribute its seeds in India,

capitalize on the recent acquisitions made and exploit the synergies with the objective of growing its Rs1.5bn

India business at a rate of 20% annually led by growth in vegetable seeds, hybrid rice and hybrid mustard.

As a matter of fact India has more than 20 million acres under cultivation for mustard and AIL is the first seed

company in the world to launch the first hybrid mustard seed.

• Third quarter performance for AIL in India is traditionally weak as it is a lean period and sales return post peak

season sales impacts performance. Q2 and Q4 are the best quarters for the company due to peak sales in India

and Australia.

• Acquisition of Longreach Plant Breeders in Australia has enabled AIL to participate in the End Point Royalty

System - EPRS for wheat wherein wheat breeders licence the seed to producers who in turn produce seeds and

sell to farmers. Wheat breeders get a royalty on sales by the farmers and we expect AIL to capture a 25% share

of the Australian market as the EPRS would create an additional market worth $50mn AUD over the next five

years. Under this system AIL will not face any inventory or receivables risk in Australia and the end points would

start accruing from CY'11 onwards.

• AIL trading at 9xCY'10E earnings is the best way to play the agricultural productivity theme across multiple

geographies and despite the fact that the global shortage of corn and sunflower in 2008 made it an extraordinary

year we believe that AIL is a good investment bet. The key constraint is the poor liquidity in the stock (as

promoters and institutional holding is close to 93%)

Hybrid Seed Opportunity

• The global commercial seed market is worth $37bn while India is the fifth largest market in the world with

a size of $1500mn. Also the seed cost as a percentage of revenue per acre for a farmer in India is less than

5% as against 15% in other countries. Hybridisation is usually followed by Biotechnology and as genetic gains

and agronomic practices support yield increase the seeds market in India is one of the fastest growing markets

in the world.

LKP Research 2613March, 2009

Initiating Coverage

• Hybrid Seeds are a product of cross-pollination and are the first generation offshoot of different parental lines

and hence hybrid seeds are high performance seeds compared to naturally pollinated seeds. Hybrids are distinct

from Genetically Modified -GM seeds which involve artificial mutation of existing gene.

• We expect GM seeds to take center stage in the global agricultural input space and even in India we have seen

that within six years BT cotton now accounts for close to 85% of the cotton acreage in the country.

• Increasing Minimum Support Prices - MSP for agricultural crops in India should boost demand for hybrid seeds

in India, which is growing at the rate of 13% annually.

• Seed development cycles can last five to ten years prior to launching a commercially viable seed and this

requires development of proprietary differentiated germplasm, bioscience technologies, access to seed growers,

global distribution and brand building.

• Regulation in India disallows cultivation of Genetically Modified - GM seeds except cotton as BT cotton is the

only GM technology approved in India. Regulations in India permit selling of non-GM seeds at market-

determined prices.

Table 1: Profit and Loss A/c. Table 2: Balance Sheet

Financial Performance (Rs Mn) CY'07 CY'08E CY'09E Financial Performance (Rs Mn) CY'07 CY'08E CY'09E

India 1020 1428 1714 Share Capital 168 168 168

Australia 1400 1820 2275

Reserves 4364 4800 5450

Argentina 700 910 1225

Thailand 560 756 907 Net Worth 4532 4968 5618

USA 560 686 900 Total Debt 3183 3500 3500

Consolidated Revenues 4240 5600 7021

Deferred Tax 110 110 110

Total Expenditure 3420 4536 5617

EBIDTA 820 1064 1404 Capital Employed 7825 8578 9228

Margins (%) 19.33 19.00 20.00 Net Fixed Assets 1535 1793 2013

Other Income 115 115 115

Depreciation 124 180 210 Goodwill 3687 3687 3687

Net Interest 220 340 350 Deferred Tax 248 248 248

Taxation 148 150 215

Working Capital 2355 2850 3280

Net Profit 443 509 744

EPS (Rs) 26.34 30.30 44.30 Capital Deployed 7825 8578 9228

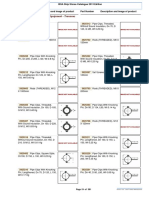

Shareholding Pattern Price Performance Chart

LKP Research 26 14

March, 2009 S. Ranganathan

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Spring 12 ECON-E370 IU Exam 1 ReviewDocumento27 páginasSpring 12 ECON-E370 IU Exam 1 ReviewTutoringZoneAinda não há avaliações

- NHL DB Rulebook ENGLISHDocumento6 páginasNHL DB Rulebook ENGLISHAdhika WidyaparagaAinda não há avaliações

- Xii Mathematics CH 01 Question BankDocumento10 páginasXii Mathematics CH 01 Question BankBUNNY GOUDAinda não há avaliações

- Chapter 10 OutlineDocumento3 páginasChapter 10 OutlineFerrari75% (4)

- Categories of Cargo and Types of ShipsDocumento14 páginasCategories of Cargo and Types of ShipsVibhav Kumar100% (1)

- MMB & DFT 2012 Workshop ProceedingsDocumento44 páginasMMB & DFT 2012 Workshop ProceedingsFelipe ToroAinda não há avaliações

- NOV23 Nomura Class 6Documento54 páginasNOV23 Nomura Class 6JAYA BHARATHA REDDYAinda não há avaliações

- Genie PDFDocumento277 páginasGenie PDFOscar ItzolAinda não há avaliações

- Lesson 23 Career PathwaysDocumento34 páginasLesson 23 Career PathwaysAlfredo ModestoAinda não há avaliações

- The Chulalongkorn Centenary ParkDocumento6 páginasThe Chulalongkorn Centenary ParkJack FooAinda não há avaliações

- PP Checklist (From IB)Documento2 páginasPP Checklist (From IB)Pete GoodmanAinda não há avaliações

- Purification of Dilactide by Melt CrystallizationDocumento4 páginasPurification of Dilactide by Melt CrystallizationRaj SolankiAinda não há avaliações

- MSDS Formic AcidDocumento3 páginasMSDS Formic AcidChirag DobariyaAinda não há avaliações

- Family Factors: Its Effect On The Academic Performance of The Grade 6 Pupils of East Bayugan Central Elementary SchoolDocumento11 páginasFamily Factors: Its Effect On The Academic Performance of The Grade 6 Pupils of East Bayugan Central Elementary SchoolGrace Joy AsorAinda não há avaliações

- New Text DocumentDocumento13 páginasNew Text DocumentJitendra Karn RajputAinda não há avaliações

- International Business ManagementDocumento3 páginasInternational Business Managementkalaiselvi_velusamyAinda não há avaliações

- YhhjjDocumento52 páginasYhhjjSam CunananAinda não há avaliações

- Weekly Lesson Plan: Pry 3 (8years) Third Term Week 1Documento12 páginasWeekly Lesson Plan: Pry 3 (8years) Third Term Week 1Kunbi Santos-ArinzeAinda não há avaliações

- Ep Docx Sca SMSC - V2Documento45 páginasEp Docx Sca SMSC - V290007Ainda não há avaliações

- Exercise-3 (B) : Linear EquationsDocumento3 páginasExercise-3 (B) : Linear EquationsVRUSHABHAinda não há avaliações

- Star Wars Galactic Connexionstm Galactic Beckett Star Wars Story Connexions CallingDocumento4 páginasStar Wars Galactic Connexionstm Galactic Beckett Star Wars Story Connexions CallingJuan TorresAinda não há avaliações

- Case Study Managerial EconomicsDocumento4 páginasCase Study Managerial EconomicsZaza Afiza100% (1)

- ISSA2013Ed CabinStores v100 Часть10Documento2 páginasISSA2013Ed CabinStores v100 Часть10AlexanderAinda não há avaliações

- Aashirwaad Notes For CA IPCC Auditing & Assurance by Neeraj AroraDocumento291 páginasAashirwaad Notes For CA IPCC Auditing & Assurance by Neeraj AroraMohammed NasserAinda não há avaliações

- HG32High-Frequency Welded Pipe Mill Line - Pakistan 210224Documento14 páginasHG32High-Frequency Welded Pipe Mill Line - Pakistan 210224Arslan AbbasAinda não há avaliações

- Iit-Jam Mathematics Test: Modern Algebra Time: 60 Minutes Date: 08-10-2017 M.M.: 45Documento6 páginasIit-Jam Mathematics Test: Modern Algebra Time: 60 Minutes Date: 08-10-2017 M.M.: 45Lappy TopAinda não há avaliações

- Java Edition Data Values - Official Minecraft WikiDocumento140 páginasJava Edition Data Values - Official Minecraft WikiCristian Rene SuárezAinda não há avaliações

- Technical DescriptionDocumento2 páginasTechnical Descriptioncocis_alexandru04995Ainda não há avaliações

- MikoritkDocumento6 páginasMikoritkChris Jonathan Showip RouteAinda não há avaliações

- Albert-Einstein-Strasse 42a, D-63322 Roedermark, Germany Tel.: 0049 (0) 6074-7286503 - Fax: 0049 (0) 6074-7286504Documento19 páginasAlbert-Einstein-Strasse 42a, D-63322 Roedermark, Germany Tel.: 0049 (0) 6074-7286503 - Fax: 0049 (0) 6074-7286504Ilias Asimakis100% (1)