Escolar Documentos

Profissional Documentos

Cultura Documentos

Problem On Wealth Tax

Enviado por

Pankaj ShuklaDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Problem On Wealth Tax

Enviado por

Pankaj ShuklaDireitos autorais:

Formatos disponíveis

Problem on wealth Tax

Problem-1: Explain the taxability of the following in the net wealth computation of Mr. A

a) Gifts of jewellery made to wife Rs 60,000, Market value on valuation date is Rs 2, 00,000.

b) He gifted cash Rs. 2, 00,000 to his son’s wife without consideration, which she deposited in

bank.

c) Urban land transferred by him to his minor handicapped child.

d) A minor son of Mr. A receives income by acting in films. Out of this income, he purchased a

Car and a residential house; value of these on valuation date is Rs 50 Lacs.

e) He transferred a house valued at Rs 20 Lacs to his married daughter but he has reserved the

right to live in that house for whole life

Problem-2: How would you treat the following items under the wealth tax Act?

(i) Mr. Gupta is a managing trustee of an educational society. The society is a public charitable

trust. The value of trust property is Rs 50 Lacs, which is held by Mr. Gupta in his name as

managing director.

(ii) Mr. G, an Indian repatriate came to India on 1st Oct’2007. The balance in his Non-Resident

External Account is Rs 10 Lacs on that day, out of which he purchased a car for Rs 4 Lacs.

(iii) Mr. X is a former ruler; his jewellery was recognized by Central Govt. as his heirloom in

1956.

(iv) Interest of Mr. Z in the HUF to which he is a member.

v) Mr. Shyam owns only one house valued at Rs. 12 Lacs, the house has been build on a land

area of 450 sq. meter

Problem-3: R, an Indian citizen has been residing in USA for several years, returned to India on

21.10.07with an intention of permanently residing here. Discuss his wealth tax liability in the

following cases:

a. He brought Rs.25,00,000 along with him and purchased a Mercedes car.

b. He had sent Rs, 40,00,000 to India on 5.11.06. This money was utilized for purchase of gold

on 28.11.06.

c. He sent Rs. 20,00,000 on 5.08.06 and purchased a residential plot of land in Delhi on 16.08.06.

What would be the answer if the plot was purchased on 15.11.06?

d. He sent Rs.50,00,000 on 5.07.06 and purchased a residential house in Delhi on 17.07.06.

e. On his return he brought with him diamond jewellery worth Rs. 22,00,000.

f. He had sent Rs. 31,00,000 on 4.11.06 which was deposited in his Non Resident External

Account with a Bank. Out of this Rs. 20,00,000 was withdrawn from the bank for purchase of

urban land but he could not purchase the same till 31.03.08.

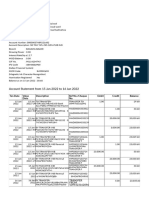

Problem-4: Mr. Gupta has the following assets and liabilities on the valuation date:

Compute his net wealth.

1 Residential House Rs. 40,00,000

2 Cars for personal use Rs.10,00,000

3 Jewellery Rs.16,00,000

4 Aircrafts and boats for personal use Rs.1,30,00,000

5 Farm house 15 Kms away from local limits of Mumbai Rs.12,00,000

6 Cash in hand Rs.2,20,000

7 Shops given on rent Rs.12,00,000

8 Loan taken to purchase aircrafts Rs.50,00,000

9 Loan taken to purchase residential house Rs.22,00,000

Problem-5: Mr. A owns a house built on a lease hold kind (unexpired period of lease is 60

years) in Mumbai which is let out to a tenant for Rs. 1200 p.m. Other terms are:

• Tenant pays all repair expenses

• Tenant has paid Rs. 300000 in advance refundable at the time of vacating the house.

• Tenant has paid Rs. 100000 on premium for taking sub-lease of property for 5 years.

The annual value assessed by local authority is Rs. 240000 and municipal tax is 20000. The

tenant spent Rs. 15,000 on repairs of the house, difference between specified area and unbuilt

area is 4 %. Compute value of house assuming. Cost of acquisition is Rs. 10, 00,000

Answer: value of house Rs.1840000

Problem-6: A Ltd. is the owner of a house, which is constructed on a leasehold land. Unexpired

period of lease is 40 years. It has been let out this house to X for Rs.21000 p.m, other terms one.

(i) X is to pay 3/4th of municipal taxes and bear the cost of repairs.

(ii) X paid interest free advance of Rs. 1 lac. Refundable at the time of

vacating the house. The annual value assessed by local authority is Rs. 2 Lacs and taxes

levied are Rs. 24000, X spent Rs. 10000 on the repairs of the house.

The difference between the ‘unbuilt area’ and ‘specified area’ is 8% of the

aggregate area. Find value of house assuming cost of the building including land

was Rs. 1200000. A Ltd. had paid Rs. 5 lakh to DDA for lease of land but now

value of land is Rs.5 lakh, DDA charges 50% of un-earned increase on transfer of

house.

Answer: Value of house = 1583680

Problem-7: Mr. Mahesh is the owner of a house, which is constructed on freehold land. He has

let out this house to a tenant for Rs.5800 p.m., The other terms are as under:-

(i) Tenant will pay 3/4th the municipal taxes and bear the cost of repair

(ii) He will pay Rs.50, 000 as interest free deposit. The annual value as assessed by the local

authority is Rs.100, 000 and taxes levied Rs. 12,000.

(iii) Tenant spent Rs.16000 on the repairs of the hose.

(iv) The difference between un-built and specified area is 8% of the aggregate area.

Find out the value of the house for wealth tax purposes if cost of building including land in 1980

was Rs. 500000.

ANSWER Value of the house=Rs.8, 76,000

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Rental ApplicationDocumento2 páginasRental ApplicationTracy Dunton0% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- NPO Financial Policies TemplateDocumento13 páginasNPO Financial Policies TemplateNyril Tamayo0% (1)

- Engagement Letter ExampleDocumento3 páginasEngagement Letter ExamplemerrillvanAinda não há avaliações

- Chapter 10Documento32 páginasChapter 10Josua Mondol80% (5)

- San Diego County Sheriff's Detention Service Policy and Procedure ManualDocumento640 páginasSan Diego County Sheriff's Detention Service Policy and Procedure Manualsilverbull8Ainda não há avaliações

- Issue Date Issue Type Issuer Industry: US$ Bond Issues From High Grade Companies in US (Mar-09) - (Hypothetical Data)Documento10 páginasIssue Date Issue Type Issuer Industry: US$ Bond Issues From High Grade Companies in US (Mar-09) - (Hypothetical Data)ayush jainAinda não há avaliações

- Someone Elses Pay Off I Put The Link Here N A TexDocumento3 páginasSomeone Elses Pay Off I Put The Link Here N A Texjulianthacker100% (1)

- Nov Unlocked PDFDocumento4 páginasNov Unlocked PDFDeshraj SehraAinda não há avaliações

- World-Class Banking For Indians Who Are Conquering The WorldDocumento6 páginasWorld-Class Banking For Indians Who Are Conquering The WorldRanvir RajAinda não há avaliações

- Batch 17 1st Preboard (P1) No AnswerDocumento6 páginasBatch 17 1st Preboard (P1) No AnswerAngelica manaoisAinda não há avaliações

- Financial Control of Public FundsDocumento136 páginasFinancial Control of Public FundsDavid Abbam AdjeiAinda não há avaliações

- Allied Bank ReportDocumento53 páginasAllied Bank ReportAli HassanAinda não há avaliações

- PDFDocumento14 páginasPDFBeboy Paylangco EvardoAinda não há avaliações

- Form Rekening & ID Tentor (Jogja)Documento14 páginasForm Rekening & ID Tentor (Jogja)Cut Ummu FathimahAinda não há avaliações

- Insta Loan On Card TCDocumento3 páginasInsta Loan On Card TCpavanivinAinda não há avaliações

- BNI Mobile Banking: Histori TransaksiDocumento7 páginasBNI Mobile Banking: Histori TransaksiErwin NasrullahAinda não há avaliações

- 1307174808status of Microfinance in India 2016-17Documento278 páginas1307174808status of Microfinance in India 2016-17Om PrakashAinda não há avaliações

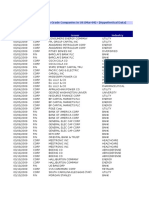

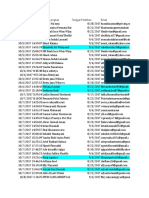

- 03-Sep. Followup Call and LeadDocumento5 páginas03-Sep. Followup Call and Leadkrishna vermaAinda não há avaliações

- Card Holder Dispute FormDocumento1 páginaCard Holder Dispute Formcool3420Ainda não há avaliações

- 1642335769414loosciwbpgxnvjdbpdf Original-3Documento1 página1642335769414loosciwbpgxnvjdbpdf Original-3Gopichand YadavAinda não há avaliações

- S. 604 Federal Reserve Sunshine Act - Senate Contact InfoDocumento5 páginasS. 604 Federal Reserve Sunshine Act - Senate Contact InfojofortruthAinda não há avaliações

- Tips WaccDocumento4 páginasTips WaccAfran KhalidAinda não há avaliações

- Dec 2021. VattamDocumento11 páginasDec 2021. VattamsadaSivaAinda não há avaliações

- Credit Rationing and Repayment Performance (Problems) in The Case of Ambo Woreda Eshet Microfinance InstitutionDocumento18 páginasCredit Rationing and Repayment Performance (Problems) in The Case of Ambo Woreda Eshet Microfinance InstitutionImpact JournalsAinda não há avaliações

- Heuristic Analysis of "Growth of PayTM"Documento10 páginasHeuristic Analysis of "Growth of PayTM"Sumit BasantrayAinda não há avaliações

- Vero Profin Professional Indemnity GlossaryDocumento9 páginasVero Profin Professional Indemnity GlossaryMichel DAinda não há avaliações

- Mba ProjectDocumento53 páginasMba Projectjignay85% (13)

- Enter Amount To Be Added in Wallet: Search For A Product, Brand or CategoryDocumento1 páginaEnter Amount To Be Added in Wallet: Search For A Product, Brand or CategoryHowaxAinda não há avaliações

- 7110 w10 QP 01Documento12 páginas7110 w10 QP 01iisjafferAinda não há avaliações

- Private Bank JobsDocumento7 páginasPrivate Bank JobsAbhj SaAinda não há avaliações