Escolar Documentos

Profissional Documentos

Cultura Documentos

Docx

Enviado por

MingTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Docx

Enviado por

MingDireitos autorais:

Formatos disponíveis

Page | 1

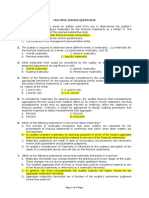

INTERNATIONAL SCHOOL OF ASIA AND THE PACIFIC

Peñablanca, Cagayan

ADVANCED FINANCIAL ACCOUNTING AND REPORTING

FIRST MOCKBOARD EXAMINATION

SET A

INSTRUCTIONS: Choose the best answer for each of the following. Fully shade only

one box for each item. Strictly no erasures allowed.

1. The following data pertain to a fixed-price long-term construction contract to

construct a concrete dike along a certain portion of the Angat River in Bulacan.

The contract price is P2,000,000. The contractor uses a cost-input-percentage

of completion for revenue recognition.

2014 2015 2016

Gross profit (loss) each yearP 50,000P175,000P (25,000)

Cost incurred each year450,000 ? 1,025,000

The journal entry for revenue recognition recorded at the end of 2015 will

include a

A. debt to CIP for P325,000

B. credit to CIP for P175,000

C. debit to Construction Cost of P325,000

D. credit to Construction Revenue of P750,000

2. Which of the following would be least likely to be used as a means of allocating

profits among partners who are active in the management of the partnership?

A. Salaries.

B. Interest on average capital balances.

C. Bonus as a percentage of net income before the bonus.

D. Bonus as a percentage of sales in excess of a targeted amount.

The next three questions are based on the following information

Solid Construction Company has started work on three long-term projects early in

2016. Relevant data on these projects as of December 31, 2016 follow:

Contract Billed thruCollected thruActual CostsAdditional Cost

Project Price 12/31/16 12/31/16to end of 2016to Complete

ManilaP1,920,000P1,920,000P1,760,000 P1,290,000 -

Cebu 2,160,000 900,000 600,000 720,000 P1,530,000

Davao1,960,000 1,140,000 1,060,000 1,350,000 450,000

3. Which of the following should be shown on the balance sheet at December 31,

2016 related to the Manila project?

A. Current asset, P0 C. Current liability, P160,000

B. Current asset, P160,000 D. Current liability, P630,000

4. Which of the following should be shown on the income statement for 2016

related to the Cebu project?

A. Gross loss, P28,800 C. Gross profit, P14,745.60

B. Gross loss, P90,000 D. Gross profit, P46,080

5. Which of the following should be shown on the balance sheet at December 31,

2016 related to the Davao project?

A. Inventory, P100,000 C. Inventory, P330,000

B. Inventory, P260,000 D. Inventory, P405,000

6. Assume that C has a P50,000 equity in the partnership of “A, B, and C.” Partner

C arranges to sell his entire interest to D for P80,000 Cash. Partners A and B

agree to the admission of D. At what amount will the equity of the incoming

partner, D, be shown in the balance sheet?

A. at P50,000.

B. at P80,000

ISAP CPALE Institutional Review – 2017

1st MOCKBOARD - AFAR

Page | 2

C. at P50,000 and the P30,000 will be divided equally among the original

partners.

D. at P80,000 and the P30,000 will represent Goodwill which will be

apportioned between the existing equities of A and B.

The next three questions are based on the following information.

DU30 BUILDERS, INC. has a contract to construct a P200 million cruise ship at an

estimated cost of P160 million. The company will begin construction of the cruise

ship in early January 2015 and expects to complete the project in about two and a

half years (2-1/2 years). DU30 has never constructed a cruise ship before, and the

customer has never operated a cruise ship. Due to this and other circumstances,

DU30 believes there are inherent hazards in the contract beyond the normal

recurring business risks. DU30 expects to recover all its costs under the contract.

7. Under these circumstances, DU30 should

A. use the cost recovery (zero-profit) method.

B. wait for the completion of construction before it recognizes revenue.

C. use the percentage of completion method and measure progress toward

completion using the cost-to-cost method.

D. use the percentage of completion method and measure progress toward

completion by actual surveys of work accomplishment.

8. In continuation above, during 2015 and 2016, the company has the following

activity:

(in millions) 2015 2016

Costs to date P39.20 P81.60

Estimated costs to complete 120.80 78.400

Progress billings during the year 40.00 40.00

Cash collected during the year 25.92 51.20

For the year ended December 31, 2016, how much revenue should DU30, INC.

recognize in its income statement?

A. P39.2 million C. P52.0 million

B. P42.4 million D. P81.6 million

9. On its statement of financial position at December 31, 2016, what amount is

reported in the cost of construction and billings presentation by DU30, INC.

A. P0.8 million billings in excess of costs. C. P1.6 million costs in excess of

billings.

B. P1.6 million billings in excess of costs. D. P4.08 million costs in excess of

billings.

10. When an investment of a new partner exceeds the new partners’ initial capital

balance and goodwill is not recorded, who will receive the bonus?

A. The new partner.

B. The old partners in their old profit or loss ratio.

C. The old partners in the new profit or loss ratio.

D. The old and the new partners in their new profit and loss ratio.

The next four questions are based on the following information.

BREXIT CORPORATION consigned 500 men’s suits to EURO GALLERY, Inc. at a

suggested retail price of P500 each. The freight cost of P2,000 for the consignment

was paid by EURO upon receipt of the consigned goods. The agreement between

BREXIT and EURO is that any sales in excess of the suggested retail price will accrue

to EURO. EURO paid delivery expenses of P2,100 for units sold, subject to

subsequent settlement. EURO submitted an account sales on the sale of 270 suits,

40% of which was sold at P640 each and the balance at P580 per suit. All these

sales were in cash. BREXIT’s cost is P375 each suit. BREXIT determines

consignment profit for each consignee and uses the Consignment-Out account.

EURO uses the Consignment-In account for all consignment sales transactions.

ISAP CPALE Institutional Review – 2017

1st MOCKBOARD - AFAR

Page | 3

11. How much should EURO remit to BREXIT for the aforementioned sales to

customers?

A. P105,400 C. P130,340

B. P107,500 D. P130,900

12. The balance of BREXIT’s Consignment-Out account after the adjustment for the

recognized profit or loss will be

A. P30,570 C. P81,700

B. P70,300 D. P87,170

13. The reclassification entry of the consignment profit for BREXIT’s income

statement will not include

A. A debit to delivery expense, P2,100.

B. A debit to consignment profit, P30,570.

C. A credit to consignment sales, P163,080.

D. A debit to cost of consignment sales, P102,330.

14. The summarized journal entry for the consignment sales by EURO will include

A. a debit to cash of P135,000.

B. a credit to Commissions, P28,080.

C. a debit to Consignment-In, P4,100.

D. a credit to Consignment-In of P130,900.

15. When a partner retires and receives cash less than his capital balance, how

should the difference be treated?

A. The difference should be debited to all the partners in their profit or loss

ratio.

B. The difference should be credited to all the partners in their profit or loss

ratio.

C. The difference should be debited to the remaining partners in their

remaining profit or loss ratio.

D. The difference should be credited to the remaining partners in their

remaining profit or loss ratio.

16. How much is the gain or loss on repossession for income statement purposes?

A. P6,240 loss. C. P6,240 gain

B. P0 D. P16,800 gain

17. Since there is no reasonable basis for estimating the degree of collectability,

Candy Company uses the installment method of revenue recognition for the

following sales:

2016 2016

Installment sales P2,700,000 P1,800,000

Collection from

2015 installment sales 300,000 600,000

2016 installment sales 900,000 --

Accounts defaulted

2015 installment sales 300,000 150,000

2016 installment sales 450,000

Value assigned to repossessed items

2015 installment sales 150,000 82,500

2016 installment sales 225,000

Gross profit rate 40% 30%

How much is the net realized gross profit in 2016?

A. P90,000 C. P450,000

B. P345,000 D. P540,000

18. State the proper order of partnership liquidation.

I. Outside creditors

II. Owners’ interests

III. Inside creditors

ISAP CPALE Institutional Review – 2017

1st MOCKBOARD - AFAR

Page | 4

A. I, II and III. C. II, I and III.

B. I, III, II. D. III, I and II.

19. Davao Corporation has two branches to which merchandise is transferred at

cost plus 20% plus freight charges. In November 30, 2016, Davao shipped

merchandise that cost P400,000 to its Maguindanao branch and the P12,000

shipping charges were paid by Davao. On December 15, 2016, the Zamboanga

branch encountered an inventory shortage, and the Maguindanao branch

shipped the merchandise to the Zamboanga branch at a freight cost of P9,600

paid by Zamboanga. Shipping charges from the home office to the Zamboanga

branch would have been P18,000.

As a result of the inter-branch inventory transfer, determine the total amount

debited to the Home Office account by the Maguindanao branch.

A. P462,000 C. P552,000

B. P540,000 D. P561,600

20. What conditions are to be met to determine franchisor’s services are

substantially performed?

A. No other material conditions or obligations exist.

B. The franchisor is not obligated in any ways to refund cash already received

or forgive unpaid debt.

C. The initial services required of the franchisor by contract or otherwise have

been substantially performed.

D. All of the above.

21. De Santos Co. opened its Alabang branch on October 1, 2016. Shipments of

merchandise to the branch during the month, billed at 120% of cost, amounted

to P375,000. The branch returned P46,860 of defective merchandise to the

home office. On October 31, the branch reported a net loss from its operation

of P6,810 and an inventory of P252,000.

The realized inventory profit to be taken up in the home office books would be

A. P(6,810) C. P5,880

B. P(5,070) D. P12,690

22. A partner’s maximum loss absorption is calculated by

A. multiplying distributable assets by the partners’ profit-sharing percentage.

B. dividing the partners’ capital balance by his or her percentage interest on

capital.

C. dividing the partner’s capital balance by his or her profit-and-loss-sharing

percentage.

D. multiplying the partner’s capital balance by his or her profit-and-loss-sharing

percentage.

23. The Pharma Branch of Driven Co. submitted the following trial balance as of

December 31, 2016 after its first year of operations

Debit Credit

Cash 31,200

Accounts receivable 189,600

Shipments from Home Office 504,000

Expenses 32,400

Sales P403,200

Home Office 354,000

The true net income of the Branch during 2016 was

A. P18,000 C. P118,800

B. P100,800 D. P162,000

24. Trial balances for the home office and the branch of Tripartite Company show

the following accounts before adjustments on December 31, 2016. The home

office policy of billing the branch for merchandise is 20% above cost.

Home Office Branch

Allowance for overvaluation P180,000

ISAP CPALE Institutional Review – 2017

1st MOCKBOARD - AFAR

Page | 5

Shipments to branch 720,000

Purchases (outsiders) P225,000

Shipments from home office 864,000

Merchandise inventory, December 1, 2016 300,000

The branch Merchandise inventory on December 31, 2016 of P150,000 includes

purchases from outsiders of P60,000.

The working paper entry to eliminate the profit in beginning inventory includes

a debit to

A. Branch income, P15,000.

B. Allowance for overvaluation, P36,000.

C. Allowance for overvaluation, P144,000.

D. Merchandise inventory, December 1, P36,000.

25. The entry on the books of the home office to recognize mark-up includes a

credit to

A. Branch income, P15,000.

B. Branch income, P165,000.

C. Allowance for over-valuation, P15,000.

D. Merchandise inventory, December 31, P15,000.

26. Which of the following is not a liability that has priority in a corporate

liquidation?

A. Payroll taxes due to government.

B. Salary payable owed to employees.

C. Administrative expenses incurred in the liquidation.

D. Advertising expense incurred before the company became insolvent.

27. W, X AND Y, partners of the W, X & Y Partnership, share net income and losses

in a 5:3:2 ratio, respectively. The capital account balances on April 1, 2016,

were: W, capital – P37,000; X, capital – P65,000; Y, capital – P48,000. The

carrying amount of the assets and liabilities of the partnership were the same

as their current fair values. Z is to be admitted to the partnership with a 20%

capital interest and a 20% share of net income and losses in exchange for a

cash investment. No goodwill or bonus is to be recorded.

The amount that Partner Z should invest in the partnership is

A. P30,000 C. P37,500

B. P36,000 D. P40,000

The next two questions are based on the following information.

The following balance sheet was prepared for the A, B, and C Partnership on July 1,

2016.

Assets Liabilities & Capital

Cash P 25,000 Accounts payableP52,000

Noncash assets 180,000 A, Capital (40%) 40,000

B, Capital (40%) 65,000

. C, Capital (20%) 48,000

Total Assets P205,000 Total Liab. & CapitalP205,000

The partnership is being liquidated on the installment basis. The first sale of

noncash assets with book value of P90,000 realized P50,000.

28. The amount of cash each partner should receive in the first installment is

A. B. C. D.

Partner A P 0 P 0 P12,000 P27,000

Partner B P 5,000 P 5,000 P 13,000 P 5,000

Partner C P18,000 P22,000 P22,000 P18,000

Assume that each partner properly received some cash after the second sale of

assets. The cash to be distributed amounts to P14,000 from the third sale of assets,

and unsold assets with a P6,000 book value remain.

29. How should the P14,000 be distributed to A, B and C, respectively?

ISAP CPALE Institutional Review – 2017

1st MOCKBOARD - AFAR

Page | 6

A. B. C. D.

Partner A P 5,000 P 5,500 P 5,600 P 5,600

Partner B P 5,000 P 5,500 P 5,600 P 6,500

Partner C P 4,000 P 3,000 P 2,800 P2,800

30. State whether the following is True or False

Statement 1: On a statement of affairs, liabilities are classified as current and

noncurrent.

Statement 2: On a statement of affairs, a company’s liabilities should be

valued at the amount required for settlement.

A. B. C. D.

Statement 1 True True False False

Statement 2 True False True False

31. Marvin admits Ancho as a partner in the business. Balance Sheet accounts of

Marvin on September 30, 2016 just before admission of Ancho, show

Cash P 2,600

Accounts receivable 12,000

Merchandise inventory 18,000

Accounts payable 6,200

Marvin, capital 26,400

It is agreed that for the purpose of establishing Marvin’s interest, the following

adjustments shall be made:

1. An allowance for doubtful accounts of 2% is to be established.

2. Merchandise inventory is to be valued at P20,200.

3. Prepaid expenses of P350 and accrued liabilities of P400 are to be

recognized.

Ancho is to invest sufficient cash to obtain 1/3 interest in the partnership.

The investment of Ancho should be in the amount of

A. P7,920 C. P14,305

B. P14,155 D. P17,600

32. On April 30, 2016, Atty. Manuel Malvar, trustee in bankruptcy liquidation for BPA

Company, paid P12,140 in full settlement of a BPA liability under product

warranty, which had been carried in Atty. Malvar’s accounting records at

P10,000.

The appropriate journal entry in Atty. Malvar’s records is

A. Liability under product warranty 12,140

Cash 12,140

B. Liability under product warranty 10,000

Estate equity 2,140

Cash 12,140

C. Liability under product warranty 10,000

Product warranty expense 2,140

Cash 12,140

D. Liability under product warranty 10,000

Retained earnings (PPA) 2,140

Cash 12,140

33. The following items were taken from the statement of affairs of Distressed

Company.

Assets pledged with fully-secured creditors P71,000

Assets pledged with partially secured creditors 12,500

Free assets 11,000

Preferred creditors 3,000

Fully secured creditors 69,000

Partially secured creditors 20,000

Unsecured creditors without priority 18,000

The estimated deficiency to unsecured creditors is

A. P5,000 C. P14,500

B. P12,500 D. P15,500

ISAP CPALE Institutional Review – 2017

1st MOCKBOARD - AFAR

Page | 7

34. Partners C and D share profits in the ratio of 6:4 respectively. On December 31,

2016, their respective accounts were C, P120,000 and D, P100,000. On that

date, A was admitted as partner with 1/3 interest in capital and profits for an

investment of P90,000. The new partnership began in 2016 with total capital of

P300,000.

Immediately after A’s admission, C’s capital should be

A. P108,000 C. P114,000

B. P110,000 D. P120,000

35. Determine the true statement under PFRS 11.

A. Joint arrangement is either joint venture or joint operation.

B. Joint operation is either joint arrangement or joint venture.

C. Joint venture is either joint arrangement or joint operation.

D. Joint arrangement, joint venture and joint operation are one and the same.

36. On January 1, 2016, Antipolo, Inc. granted a franchise to Ram de Leon to

operate a sales outlet for an initial fee of P4,000,000 and 5% monthly

continuing fee based on gross sales. Ram paid a downpayment of P1,000,000

and issued a promissory note for the balance payable in six (6) annual

installments starting December 31, 2016. Prevailing cost of money is 12%. (PV

of an annuity of P1 for six periods at 12% is 4.1114).

Ram commenced operations on August 1, 2016 and reported the following

monthly sales:

August P200,000

September 320,000

October 605,000

November 712,500

December 865,000

Assuming Ram issued an 18% interest-bearing note, how much will be the

amount of franchise revenue to be recognized for the year 2016?

A. P3,190,825 C. P4,000,000

B. P3,192,125 D. P4,135,125

37. What is the realized gross profit to be recognized on December 31, 2015?

A. P1,500,000 C. P2,000,000

B. P1,800,000 D. P5,000,000

38. On January 23, 2016, Mantequilla Ice Cream signed an agreement authorizing

G. Ramos to operate as a franchisee for an initial franchise fee of P500,000,

which was received upon signing of the agreement. G. Ramos commenced

operations on August 1, 2016, at which date all of the initial services required of

Mantequilla Ice Cream had been performed at a cost of P50,000. Indirect costs

were P30,000 and P25,000 for Mantequilla and G. Ramos, respectively. The

franchise agreement further provides that G. Ramos must pay a 10% monthly

continuing franchise fee. Franchisee sales reported from August 1 to December

31 amounted to P400,000.

What is the net income from franchise fees to be reported by Mantequilla Ice

Cream in 2016?

A. P435,000 C. P520,000

B. P460,000 D. P540,000

39. One of the important characteristics of a joint arrangement is

A. it should be notarized.

B. the rights of the parties are clearly specified.

C. the parties are bound by a contractual arrangement.

D. the activities of the joint arrangement should be specified.

40. The following summarized balance sheets were prepared for the Gold Company

and Silver Corporation.

Gold Diamond

ISAP CPALE Institutional Review – 2017

1st MOCKBOARD - AFAR

Page | 8

Current assets P350,000 P185,000

Land 80,000 25,000

Buildings, net 250,000 325,000

Goodwill 120,000 100,000

P875,000 P560,000

Accounts payable P115,000 P 85,000

Bonds payable 170,000 150,000

Common stocks, P10 par 150,000 75,000

APIC 200,000 40,000

Retained earnings 240,000 210,000

P875,000 P560,000

The appraised values of the Diamond Corporation’s land and buildings are

P20,000 and P258,000, respectively. Gold issues 15,250 shares of common

stocks with a fair value of P12 each. Gold also pays out-of-pocket costs for the

following:

Broker’s fee P10,000

Professional fees to valuers 3,000

Legal fees 2,000

Indirect acquisition costs 5,000

Printing cost of stock certificates 3,000

Costs to issue and register the stocks 30,000

The stockholders’ equity balances of Gold for Capital stock, APIC, and Retained

Earnings, respectively, after the merger will be

A. P302,500; P200,000; P262,500. C. P302,500; P272,500; P280,000.

B. P302,500; P197,500; P265,000. D. P377,500; P197,500; P280,000.

41. the calculation of the income recognized in the third year of a five-year

construction contract accounted for using the percentage-of-completion method

includes the ratio of

A. total costs incurred to date to total billings to date.

B. costs incurred in year three to total billings to date.

C. total costs incurred to date to total estimated costs.

D. costs incurred in year three to total estimated costs.

The next two questions are based on the following information.

Summary information is given for SBMA, Inc. and PCIB Company at July 1, 2016.

The quoted market price of SBMA and PCIB shares are P36 and P40, respectively.

SBMA and PCIB are both SMEs.

SBMA, Inc. . PCIB Company .

Book value Fair value Book value Fair value

Current assets P 8,000,000P 9,000,000P24,000,000P24,000,000

Plant assets 22,000,000 26,000,000 26,000,000 25,000,000

Totals P30,000,000P35,000,000P50,000,000P49,000,000

Liabilities 5,000,000 5,000,00015,000,00015,500,000

Common stocks, P10 par10,000,000 20,000,000

APIC 1,000,000 3,000,000

Retained earnings 14,000,000 12,000,000

Totals P30,000,000 P50,000,000

PCIB Company acquires all the net assets of SMBA by issuing 1,000,000 of its own

shares. PCIB Company incurred the following out of pocket costs relating to the

acquisition.

Legal fees to arrange business combination P25,000

Cost of SEC registration 12,000

Cost of printing and issuing new stock certificates 3,000

Indirect cost of combination 20,000

Finder’s fees 35,000

42. Calculate the goodwill from the business combination.

A. P10,000,000 C. P10,040,000

B. P10,025,000 D. P10,060,000

ISAP CPALE Institutional Review – 2017

1st MOCKBOARD - AFAR

Page | 9

43. The total Retained Earnings of the surviving company after the combination is

A. P13,920,000 C. P11,920,000

B. P13,980,000 D. P11,980,000

44. A joint arrangement that is structured without a separate vehicle is a joint

venture.

Under PFRS 11, joint arrangements that are joint ventures are accounted for

under the proportionate consolidation method in accordance with PAS 31.

A. True, True C. False, True

B. True, False D. False, False

The next two questions are based on the following information.

SME RRR issued 120,000 shares of its P25 par ordinary shares for all the net assets

of CCC Company on July 1, 2015. RRR’s ordinary shares were selling at P30 per

share at the acquisition date. In addition, a cash payment of P200,000 was made

plus an agreed deferred cash payment of P990,000 payable on July 1, 2016. The

market rate of interest at the time is 10%.

RRR also agreed to pay additional cash consideration of P250,000 in the event

RRR’s net income falls below the current level within the next two years. RRR’s

financial officers were 99% sure the current level of income will at least be

sustained during the prescribed period.

The following out-of-pocket costs were paid in cash by RRR:

Legal and accounting fees paid to advisers P 8,000

Broker’s fees 4,000

Indirect acquisition costs 3,000

Costs to issue and register the shares 10,400

Total P25,400

45. Determine the cost of the investment for SME RRR

A. P4,702,500 C. P4,174,500

B. P4,147,500 D. P4,714,500

46. With respect to business combinations, PFRS 3 provides that

A. The purchase method must be used for all combinations.

B. The pooling of interest method must be used for all combinations.

C. The purchase method may be used only when specific requirements are met.

D. The pooling of interest method may be used only when specific requirements

are met.

47. On December 31, 2016, Shelll Corporation was merged into Petttron

Corporation. In the business combination, Petttron issued 200,000 shares of its

P10 par common stock, with a market price of P18 a share, for all of Shelll’s net

assets. The stockholders’ equity section of each company’s balance sheet

immediately before the combination was

Petttron Shelll

Ordinary shares P3,000,000 P1,500,000

Additional paid-in capital 1,300,000 150,000

Retained earnings 2,500,000 850,000

In the December 31, 2016 balance sheet, additional paid-in capital should be

reported as

A. P950,000 C. P1,450,000

B. P1,300,000 D. P2,900,000

48. Under this method of GP recognition on installment sales, cash collection is

regarded as a partial recovery of cost and a partial realization of profit

A. Cost recovery method. C. Profit recovery method.

B. Installment method. D. All of the above.

ISAP CPALE Institutional Review – 2017

1st MOCKBOARD - AFAR

Page | 10

49. Profit and loss data for Blue Sales Company, and its branch for 2016 follows:

H.O. Branch

Sales P1,060,000 P315,000

Inventory, January 1 115,000

Inventory, - from Home Office 50,000

- from other vendors 35,000

Purchase 820,000 120,000

Shipment to branch 110,000

Shipment from Hone Office 132,000

Inventory, December 31 142,000

Inventory – from Home Office 66,000

- from other vendors 70,000

Operating expenses 200,000 100,000

Records show that the Branch was billed for merchandise shipment as follows:

In 2015, cost + 25%

In 2016, cost + 20%

The combined net income of the Home Office and the Branch on December 31,

2016 is

A. P212,000 C. P247,000

B. P225,000 D. P269,000

50. Which of the following statements is (are) true regarding sales agency and

branch?

I. A sales agency is not a self-contained business but rather acts only on behalf

of the home office.

II. A branch is a self-contained business which acts independently, but within

the bounds of the company policy and subject to the control of the home

office.

A. I only. C. I and II.

B. II only. D. Neither I nor II.

51. Pacific Inc. a dealer of Harley motorcycles, sells on installment basis. One of its

customers, a Mr. Cruz, bought a motorcycle for P45,375. The cost to Pacific Inc.

is P25,410. After making an initial payment of P6,050, Mr. Cruz stopped paying

and defaulted on all subsequent payments. Pacific Inc. lost no time in

repossessing the motorcycle. By then it had an appraised value of P12,650 and

Pacific had to incur additional expenses of P1,650 on repairs and remodeling.

Pacific was able to sell the motorcycle to Mr. Bobadilla on installment for

P27,500 and initial down payment of P6,875.

How much is the realized gross profit on the sale to Mr. Bobadilla?

A. P3,025 C. P3,575

B. P3,300 D. P3,850

52. A Company uses the percentage-of-completion method to account for a four-

year construction contract. Which of the following would be used in the

calculation of the income recognized in the first year?

A. B. C. D.

Progress billings Yes Yes No No

Collection on progress Yes No Yes No

billings

53. On January 1, 2016, Kimchi Inc. signed an agreement authorizing Mr. Castro to

operate as a franchise for an initial franchise fee of P5,000,000. Of this amount,

P2,000,000 was received upon signing of the agreement and the balance

evidenced by a 25% promissory note which is due in three annual installments

of P1,000,000 each beginning December 31, 2016. Mr. Castro started franchise

operations on September 1, 2016, after Kimchi rendered initial services required

at total cost of P1,500,000. The first installment was collected on due date.

The collectability of the note is not reasonably assured.

What is the realized gross profit to be recognized on December 31, 2016?

ISAP CPALE Institutional Review – 2017

1st MOCKBOARD - AFAR

Page | 11

A. P2,100,000 C. P4,500,000

B. P2,700,000 D. P5,000,000

54. Which costs should be included in the consideration transferred in a

combination?

A. Fees paid to accountants.

B. Cost of maintaining an acquisition department.

C. Both cost of maintaining an acquisition department and fees paid to

accountants.

D. Neither cost of maintaining an acquisition department nor fees paid to

accountants.

The next two questions are based on the following information.

On April 1, 2016 DDD, EEE, FFF and GGG became joint operators of a joint

arrangement. They contributed equal amounts and agreed to share equally control

over the relevant activities of the undertaking. The contributions were all in cash

except for GGG’s equipment with a fair value of P180,000 and a carrying cost in

GGG’s accounting records at P164,000. The equipment had an estimated remaining

life of 5 years at the date it was contributed.

55. At what amount will DDD and GGG show this equipment at its individual balance

sheet at April 1, 2016, respectively?

A. P45,000 and P38,250 C. P34,450 and P32,800

B. P38,250 and P41,000 D. P45,000 and P41,000

56. At what amount will EEE and GGG show this equipment at its individual balance

sheet at December 31, 2016?

A. P38,250 and P34,850 C. P36,000 and P34,450

B. P34,450 and P36,000 D. P36,000 and P34,850

57. Under the cost-recovery method, no revenue is recognized until

A. The selling price is collected.

B. Collections are less than the cost of goods sold.

C. Collections are equal to the amount of cost of goods sold

D. All of the above.

58. HHH and III are venturers in a joint arrangement sharing control and profits

equally. They contributed P625,000 each to establish Joint Venture JJJ early in

2016. The Joint Venture paid cash dividends of P45,000 and reported a net

income of P180,000 during the year.

On the other hand, HHH paid cash dividends of P22,500 and reported a net

income of P90,000 during the year. Its Retained Earnings at the beginning of

the year is P125,000.

At what amounts will HHH report in its December 31, 2016 balance sheet the

Investment in Joint Venture and Retained Earnings accounts, respectively?

A. P625,900 and P250,000 C. P652,900 and P201,500

B. P629,500 and P251,000 D. P692,500 and P282,500

The next two questions are based on the following information.

On January 1, 2016 KKK Enterprises, an SME, acquired a 35% equity of LLL

Corporation, a Joint Venture. KKK will share with other venturers control and profits

in their respective participation ratios. KKK paid P116,000 for its interest and also

paid P5,800 transaction costs. KKK’s only investment in equity is this Joint

Arrangement.

During the year, LLL Corporation reported the following transactions:

a. Declared and paid a cash dividend of P30,000.

b. Reported a loss of P84,000 during the year.

The fair value of KKK’s investment is determined by appropriate valuation

techniques at P130,000. Costs to sell are estimated at P11,700.

ISAP CPALE Institutional Review – 2017

1st MOCKBOARD - AFAR

Page | 12

59. What is the amount of Investment in LLL Corporation will SME KKK report in its

2016 balance sheet if it uses the EQUITY MODEL?

A. P81,900 C. P118,300

B. P116,000 D. P130,000

60. What is the profit (loss) to be recognized by SME KKK in 2016 from Joint Venture

LLL under the FAIR VALUE MODEL?

A. P4,500 C. P16,500

B. P12,000 D. P18,700

61. Which of the following projects should be accounted for as a construction

contract under PAS 11?

A. A warehouse being constructed as an investment property.

B. An item of plant and machinery being constructed to be sold as inventory.

C. A building being constructed for a third party under a specifically negotiated

contract.

D. All of the above.

62. On January 2, 2016 Baguio Company sold a machine to Cagayan Valley

Enterprises for P900,000, resulting in a gain of P270,000. On that date Cagayan

Valley paid P150,000 cash and signed a P750,000 note bearing interest at 10%.

The note was payable in three annual installments beginning January 2, 2017.

Baguio accounted for the sale under the installment method. Cagayan Valley

made a timely payment of the first installment on January 2, 2017, of P325,000,

which included accrued interest. What amount of deferred gross profit should

Baguio report at December 31, 2017?

A. P150,000 C. P180,000

B. P172,500 D. P225,000

63. Contract revenue in construction contract comprises

A. The initial amount of revenue agreed in the contract.

B. Variation in the contract, claim and incentive payment.

C. The initial amount of revenue agreed in the contract and progress billings.

D. The initial amount of revenue agreed in the contract, variation in the control,

claim and incentive payment.

64. On December 31, 2016, Greyhound Bread Co. authorized Bakers, Inc. to operate

as a franchisee for an initial franchise fee of P150,000. Of this amount, P60,000

was received upon signing the agreement and the balance, represented by a

note, is due in three annual payments of P30,000 each beginning December 31,

2017. The present value on December 31, 2016, of the three annual payments

appropriately discounted is P72,000. According to the agreement, the

nonrefundable down payment represents a fair measure of the services already

performed by Greyhound; however, substantial future services are required by

Greyhound. Collectibility of the note is reasonably certain.

If Greyhound’s December 31, 2016 balance sheet, unearned franchise fees from

Baker’s franchise should be reported as

A. P72,000 C. P100,000

B. P90,000 D. P132,000

65. Upon signing of the franchise contract, the franchisee is required to pay the

A. Brokers fee. C. Initial franchise fee.

B. Continuing franchise fee. D. Professional fee.

66. INSOLBENT, INC. has had severe financial difficulties and is considering the

possibility of liquidation. At this time, the distressed company has the following

assets (stated at net realizable value) and liabilities:

Assets (pledged against debts of P70,000) P116,000

Assets (pledged against debts of P130,000) 50,000

Other assets 80,000

Liabilities with priority 42,000

ISAP CPALE Institutional Review – 2017

1st MOCKBOARD - AFAR

Page | 13

Unsecured creditors 200,000

In the event of liquidation at this point, how much is the estimated amount

recoverable by partially-secured creditors?

A. P50,000 C. P130,000

B. P74,000 D. P200,000

67. When it is probable that contract costs exceed contract revenue, the expected

loss should be

A. recognized as an expense immediately.

B. set off against profit of other contracts where available.

C. apportioned to the years of the contract according to the stage of

completion.

D. recognized as an expense immediately, unless revenue to date exceeds

costs to date.

68. Ante, Bert, and Carl have decided to liquidate their partnership. At this time,

the partnership has cash of P105,000, non-cash assets of P700,000 and

liabilities of P460,000. The partners’ capital balances, loan balances, and profit

and loss ratios are as follows:

Ante Bert Carl

Capital balances P120,000 P80,000 P110,000

Loan balances 15,000 20,000

Profit and loss ratio 60% 20% 20%

The results of liquidation are summarized below:

January February March

Proceeds from sale of assetsP500,000P90,000 P70,000

Payment of liabilities 280,000 100,000remaining balance

Liquidation expenses paid12,00010,000 5,000

Payment to partners 120,000 90,000remaining cash

How much is the cash withhold in January for future liquidation expenses?

A. P11,000 C. P13,000

B. P12,000 D. P15,000

69. RMV Corp., a consignee, paid the freight costs for goods shipped from ABACA

Corp., a consignor. These freight costs are to be deducted from RMV’s payment

to ABACA when the consigned goods are sold. Until RMV sells the goods, the

freight costs should be included in RMV’s

A. Accounts receivable C. Freight-out costs

B. Cost of goods sold D. Selling expenses

70. The freight on shipments to branch paid by the home office is recorded by the

home office as

A. Credit to cash C. Credit to Investment in Branch.

B. Credit to freight-in D. Debit to Freight-in

------- END OF EXAMINATION -------

ISAP CPALE Institutional Review – 2017

1st MOCKBOARD - AFAR

Você também pode gostar

- 01 x01 Basic ConceptsDocumento10 páginas01 x01 Basic ConceptsAzureBlazeAinda não há avaliações

- Applied Auditing Review Course Pre-Board - Answer KeyDocumento13 páginasApplied Auditing Review Course Pre-Board - Answer KeyROMAR A. PIGAAinda não há avaliações

- Practice Exam - Part 3: Multiple ChoiceDocumento4 páginasPractice Exam - Part 3: Multiple ChoiceAzeem TalibAinda não há avaliações

- Bus Combination 2Documento8 páginasBus Combination 2Angelica AllanicAinda não há avaliações

- Module 2 - Strat ManDocumento4 páginasModule 2 - Strat ManElla MaeAinda não há avaliações

- Far - Pre BoardDocumento17 páginasFar - Pre BoardClene DoconteAinda não há avaliações

- Partnership Dissolution and Liquidation DrillsDocumento6 páginasPartnership Dissolution and Liquidation DrillsMa. Yelena Italia TalabocAinda não há avaliações

- FIRST INTEGRATION EXAM - 3rd Term 20-21Documento14 páginasFIRST INTEGRATION EXAM - 3rd Term 20-21Dominic Dela VegaAinda não há avaliações

- AFAR - Part 1Documento18 páginasAFAR - Part 1Myrna LaquitanAinda não há avaliações

- Midterm Exam Part 2 Short ProblemsDocumento5 páginasMidterm Exam Part 2 Short Problemsdagohoy kennethAinda não há avaliações

- Quiz 9 A6Documento20 páginasQuiz 9 A6Lara FloresAinda não há avaliações

- Acctg 2Documento2 páginasAcctg 2Shayne EsmeroAinda não há avaliações

- 03 ACCTNG-FOR-BUSINESS-COMBINATION-MERGER-AND-CONSOLIDATION-Problems-Part-1Documento5 páginas03 ACCTNG-FOR-BUSINESS-COMBINATION-MERGER-AND-CONSOLIDATION-Problems-Part-1Ma Jessa Kathryl Alar IIAinda não há avaliações

- Planning an Audit of Financial StatementsDocumento10 páginasPlanning an Audit of Financial StatementsTrixie Pearl TompongAinda não há avaliações

- Activity 3 - CAATsDocumento4 páginasActivity 3 - CAATsPaupauAinda não há avaliações

- APCAS Advanced Financial Accounting I ExamDocumento12 páginasAPCAS Advanced Financial Accounting I ExamGemine Ailna Panganiban NuevoAinda não há avaliações

- Quiz BeeDocumento15 páginasQuiz Beejoshua100% (1)

- 9101 - Partnership FormationDocumento2 páginas9101 - Partnership FormationGo FarAinda não há avaliações

- Chapter 16Documento36 páginasChapter 16manjunk25Ainda não há avaliações

- CPA Review Batch 6 Exam SolutionsDocumento15 páginasCPA Review Batch 6 Exam SolutionsCharilyn RemigioAinda não há avaliações

- PRACTICAL ACCOUNTING 1 Part 2Documento9 páginasPRACTICAL ACCOUNTING 1 Part 2Sophia Christina BalagAinda não há avaliações

- Quiz 1Documento24 páginasQuiz 1Marwin AceAinda não há avaliações

- MAS-42E (Budgeting With Probability Analysis)Documento10 páginasMAS-42E (Budgeting With Probability Analysis)Fella GultianoAinda não há avaliações

- Prelim Exam PDFDocumento6 páginasPrelim Exam PDFPaw VerdilloAinda não há avaliações

- Partnership Operations: Problem CDocumento3 páginasPartnership Operations: Problem CJoeneil DamalerioAinda não há avaliações

- CW6 - MaterialityDocumento3 páginasCW6 - MaterialityBeybi JayAinda não há avaliações

- AndrewDocumento1 páginaAndrewCristine Salvacion Pamatian50% (2)

- Chapter 11 AISDocumento4 páginasChapter 11 AISMyka ManalotoAinda não há avaliações

- Elimination RoundDocumento11 páginasElimination RoundDeeAinda não há avaliações

- Audit of Inventory PDFDocumento7 páginasAudit of Inventory PDFMae-shane SagayoAinda não há avaliações

- MAS-FinPB 05.22+Documento11 páginasMAS-FinPB 05.22+Luis Martin PunayAinda não há avaliações

- PROBLEMsDocumento3 páginasPROBLEMsHancel NageraAinda não há avaliações

- PARTNERSHIP LIQUIDATION INSTALLMENT CASH DISTRIBUTIONDocumento3 páginasPARTNERSHIP LIQUIDATION INSTALLMENT CASH DISTRIBUTIONCharles GainAinda não há avaliações

- 9201 - Partnership FormationDocumento4 páginas9201 - Partnership FormationBrian Dave OrtizAinda não há avaliações

- Quiz Chapter-2 Partnership-Operations 2020-EditionDocumento7 páginasQuiz Chapter-2 Partnership-Operations 2020-EditionShaz NagaAinda não há avaliações

- Regulatory Framework For Business TransactionsDocumento13 páginasRegulatory Framework For Business TransactionsNash VelisanoAinda não há avaliações

- Revenue Recognition: Installment ContractDocumento11 páginasRevenue Recognition: Installment ContractJean Ysrael MarquezAinda não há avaliações

- MAC Material 2Documento33 páginasMAC Material 2Blessy Zedlav LacbainAinda não há avaliações

- Chap 8 Responsibility AccountingDocumento51 páginasChap 8 Responsibility AccountingXel Joe BahianAinda não há avaliações

- ICare First Preboard Examination-MSDocumento14 páginasICare First Preboard Examination-MSLeo M. SalibioAinda não há avaliações

- CHAPTER 9 Auditing-Theory-MCQs-Continuation-by-Salosagcol-with-answersDocumento1 páginaCHAPTER 9 Auditing-Theory-MCQs-Continuation-by-Salosagcol-with-answersMichAinda não há avaliações

- Partnership ExercisesDocumento37 páginasPartnership ExercisesAuroraAinda não há avaliações

- AFAR02-06 JOINT-ARRANGEMENT-iCARE-March-2021 - EncryptedDocumento5 páginasAFAR02-06 JOINT-ARRANGEMENT-iCARE-March-2021 - EncryptedSophia PerezAinda não há avaliações

- ACCY 303 Midterm Exam ReviewDocumento12 páginasACCY 303 Midterm Exam ReviewCORNADO, MERIJOY G.Ainda não há avaliações

- 07 - Revenue - Consignment Sales PDFDocumento17 páginas07 - Revenue - Consignment Sales PDFCarla MarieAinda não há avaliações

- PINTO - Razmen R. (MASECO MT EXAM)Documento4 páginasPINTO - Razmen R. (MASECO MT EXAM)Razmen Ramirez PintoAinda não há avaliações

- LTCCDocumento2 páginasLTCCN JoAinda não há avaliações

- Diagnostic Test CashDocumento2 páginasDiagnostic Test CashJoannah maeAinda não há avaliações

- Practice Quiz NonFinlLiabDocumento15 páginasPractice Quiz NonFinlLiabIsabelle GuillenaAinda não há avaliações

- TBCH08Documento8 páginasTBCH08Butternut23Ainda não há avaliações

- Chapter 1 - Overview of Government AccountingDocumento4 páginasChapter 1 - Overview of Government AccountingChris tine Mae MendozaAinda não há avaliações

- SCRC 3 CorporationDocumento18 páginasSCRC 3 CorporationChristine Yedda Marie AlbaAinda não há avaliações

- MULTIPLE CHOICE - Capital BudgetingDocumento9 páginasMULTIPLE CHOICE - Capital BudgetingMarcuz AizenAinda não há avaliações

- Logo Here Auditing Theory Philippine Accountancy Act of 2004Documento35 páginasLogo Here Auditing Theory Philippine Accountancy Act of 2004KathleenCusipagAinda não há avaliações

- 9105 - Corporate LiquidationDocumento4 páginas9105 - Corporate LiquidationGo FarAinda não há avaliações

- Op Aud Quizzes 9 Files MergedDocumento166 páginasOp Aud Quizzes 9 Files MergedAlliahDataAinda não há avaliações

- Discuss The Components and Characteristics of Maximization and Minimization ModelDocumento5 páginasDiscuss The Components and Characteristics of Maximization and Minimization ModelNicole AutrizAinda não há avaliações

- Quiz On Partnership LiquidationDocumento4 páginasQuiz On Partnership LiquidationTrisha Mae AlburoAinda não há avaliações

- Chapter 2 Partnership OperationsDocumento24 páginasChapter 2 Partnership OperationsChelsy SantosAinda não há avaliações

- AFAR MOCK BOARD MULTIPLE CHOICEDocumento16 páginasAFAR MOCK BOARD MULTIPLE CHOICEBryle EscosaAinda não há avaliações

- Module 3 LeasesDocumento22 páginasModule 3 LeasesFujoshi BeeAinda não há avaliações

- Analyze Incremental Costs & Revenues for Better DecisionsDocumento80 páginasAnalyze Incremental Costs & Revenues for Better DecisionsJoshAinda não há avaliações

- Practice With Similar Questions: Continue To PostDocumento1 páginaPractice With Similar Questions: Continue To PostMingAinda não há avaliações

- Three Point Charges Lie Along The X Axis As Shown ...Documento1 páginaThree Point Charges Lie Along The X Axis As Shown ...MingAinda não há avaliações

- Interpreting Carrying Capacity Graphs PDFDocumento5 páginasInterpreting Carrying Capacity Graphs PDFMingAinda não há avaliações

- Relevant Costing by A BobadillaDocumento43 páginasRelevant Costing by A BobadillaAngelu Amper56% (18)

- Answered - The Aluminum Rod AB (Gal 27 GPa) Is - BartlebyDocumento1 páginaAnswered - The Aluminum Rod AB (Gal 27 GPa) Is - BartlebyMingAinda não há avaliações

- Module 3 LeasesDocumento22 páginasModule 3 LeasesFujoshi BeeAinda não há avaliações

- The Difference Between Material and Non-Material Culture in Your WorldDocumento10 páginasThe Difference Between Material and Non-Material Culture in Your WorldMingAinda não há avaliações

- SOC124 Research 2Documento6 páginasSOC124 Research 2MingAinda não há avaliações

- Boeings Assignment MaterialDocumento4 páginasBoeings Assignment MaterialMingAinda não há avaliações

- Answered - 1. The Following Interior Angles of A - BartlebyDocumento1 páginaAnswered - 1. The Following Interior Angles of A - BartlebyMingAinda não há avaliações

- Chapter 1: The Changing Role of Managerial Accounting in A Dynamic Business EnvironmentDocumento17 páginasChapter 1: The Changing Role of Managerial Accounting in A Dynamic Business EnvironmentMingAinda não há avaliações

- Answered - The Distance of Line AB Was Measured - BartlebyDocumento1 páginaAnswered - The Distance of Line AB Was Measured - BartlebyMingAinda não há avaliações

- MAS D Strategic Cost ManagementDocumento6 páginasMAS D Strategic Cost ManagementMingAinda não há avaliações

- DocxDocumento2 páginasDocxMingAinda não há avaliações

- Soc124 Week 8Documento6 páginasSoc124 Week 8MingAinda não há avaliações

- Acc768 5661Documento4 páginasAcc768 5661MingAinda não há avaliações

- SOC124 Lab 2Documento4 páginasSOC124 Lab 2MingAinda não há avaliações

- SOC124 Report 9Documento6 páginasSOC124 Report 9MingAinda não há avaliações

- SOC124 Infomation 1Documento5 páginasSOC124 Infomation 1MingAinda não há avaliações

- SOC124 Image 3Documento3 páginasSOC124 Image 3MingAinda não há avaliações

- Acc768 5658Documento4 páginasAcc768 5658MingAinda não há avaliações

- SOC124 Module 7Documento4 páginasSOC124 Module 7MingAinda não há avaliações

- Acc768 5654Documento4 páginasAcc768 5654MingAinda não há avaliações

- Acc768 5665Documento4 páginasAcc768 5665MingAinda não há avaliações

- SOC124 Homework Help 2Documento4 páginasSOC124 Homework Help 2MingAinda não há avaliações

- Acc768 5648Documento4 páginasAcc768 5648MingAinda não há avaliações

- Acc768 5664Documento4 páginasAcc768 5664MingAinda não há avaliações

- Acc768 5667Documento4 páginasAcc768 5667MingAinda não há avaliações

- BIM For Civil and Structural Engineers: Tom Bartley, Senior Engineer, WSPDocumento15 páginasBIM For Civil and Structural Engineers: Tom Bartley, Senior Engineer, WSPMartinAinda não há avaliações

- Moving Toward An Integrated Marketing Communications Model - Heckler PowerpointDocumento26 páginasMoving Toward An Integrated Marketing Communications Model - Heckler Powerpointpopye007Ainda não há avaliações

- SAP ImplementationDocumento11 páginasSAP Implementationabhisai84Ainda não há avaliações

- 4 Financial Management ND2020Documento4 páginas4 Financial Management ND2020Srikrishna DharAinda não há avaliações

- Assignment: Financial Management: Dividend - MeaningDocumento4 páginasAssignment: Financial Management: Dividend - MeaningSiddhant gudwaniAinda não há avaliações

- Agbo Emmanuel ObandeDocumento3 páginasAgbo Emmanuel ObandeObande AgboAinda não há avaliações

- 4 5931462806300787575Documento16 páginas4 5931462806300787575Waad MajidAinda não há avaliações

- Environmental and Occupational Health & SafetyDocumento14 páginasEnvironmental and Occupational Health & SafetySarangKambleAinda não há avaliações

- Midterm Acctg 213 exam reviewDocumento3 páginasMidterm Acctg 213 exam reviewLiza Magat MatadlingAinda não há avaliações

- Tatmeen Onboarding Presentation For MAH, Licensed Agents, and 3PLsDocumento53 páginasTatmeen Onboarding Presentation For MAH, Licensed Agents, and 3PLsJaweed SheikhAinda não há avaliações

- The Cable ContractDocumento1 páginaThe Cable Contractsakshita palAinda não há avaliações

- ConstructionDocumento184 páginasConstructionMohd Yazid Mohamad YunusAinda não há avaliações

- Njau - Challenges Facing Human Resource Management Function at Kenyatta National HospitalDocumento64 páginasNjau - Challenges Facing Human Resource Management Function at Kenyatta National HospitalAdrahAinda não há avaliações

- Ihe680 053111Documento21 páginasIhe680 053111cecsdistancelabAinda não há avaliações

- Third Quiz Accounting ProcessDocumento6 páginasThird Quiz Accounting Processibrahim haniAinda não há avaliações

- CA. Ranjay Mishra (FCA)Documento14 páginasCA. Ranjay Mishra (FCA)ZamanAinda não há avaliações

- 01 Laboratory Exercise 1 1Documento3 páginas01 Laboratory Exercise 1 1Christian PapaAinda não há avaliações

- Current Principal Place of Business: Entity Name: United States Corporation CompanyDocumento1 páginaCurrent Principal Place of Business: Entity Name: United States Corporation Companysalim beyAinda não há avaliações

- COMPANY PROFILEDocumento6 páginasCOMPANY PROFILEHortencia RodriguezAinda não há avaliações

- Fundamentals To Lodging Industry MIDTERMDocumento3 páginasFundamentals To Lodging Industry MIDTERMHany Dyanne Andica TeopeAinda não há avaliações

- Qualifying Exam Taxation SET ADocumento11 páginasQualifying Exam Taxation SET AChina ReyesAinda não há avaliações

- Extract From The Best Advice I Ever Got by Siya MapokoDocumento29 páginasExtract From The Best Advice I Ever Got by Siya MapokoSA Books50% (2)

- ADVANCED COST ACCOUNTINGDocumento2 páginasADVANCED COST ACCOUNTINGpooja sainiAinda não há avaliações

- Supplier Questionnaire - Supplier FormDocumento5 páginasSupplier Questionnaire - Supplier FormSunday Augustine Chibuzo100% (1)

- Statement PDFDocumento7 páginasStatement PDFGovardhanGurramAinda não há avaliações

- Bus MathDocumento12 páginasBus MathSky MontezidesAinda não há avaliações

- Chapter 2 - Analyzing External Environment: Minglana, Mitch T. BSA 201Documento2 páginasChapter 2 - Analyzing External Environment: Minglana, Mitch T. BSA 201Mitch Tokong MinglanaAinda não há avaliações

- Javondre JDocumento1 páginaJavondre Japi-598278439Ainda não há avaliações

- Organization Development in Global SettingDocumento3 páginasOrganization Development in Global Settinghijkayelmnop50% (2)