Escolar Documentos

Profissional Documentos

Cultura Documentos

Disney

Enviado por

Gerda AndrijunaiteDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Disney

Enviado por

Gerda AndrijunaiteDireitos autorais:

Formatos disponíveis

The Walt Disney Company

Company Profile

Publication Date: 23 Sep 2010

www.datamonitor.com

Europe, Middle East & Africa Americas Asia Pacific

119 Farringdon Road 245 5th Avenue Level 46

London 4th Floor 2 Park Street

EC1R 3DA New York, NY 10016 Sydney, NSW 2000

United Kingdom USA Australia

t: +44 20 7551 9000 t: +1 212 686 7400 t: +61 2 8705 6900

f: +44 20 7551 9090 f: +1 212 686 2626 f: +61 2 8088 7405

e: euroinfo@datamonitor.com e: usinfo@datamonitor.com e: apinfo@datamonitor.com

The Walt Disney Company

ABOUT DATAMONITOR

Datamonitor is a leading business information company specializing in industry analysis.

Through its proprietary databases and wealth of expertise, Datamonitor provides clients with unbiased

expert analysis and in depth forecasts for six industry sectors: Healthcare, Technology, Automotive,

Energy, Consumer Markets, and Financial Services.

The company also advises clients on the impact that new technology and eCommerce will have on

their businesses. Datamonitor maintains its headquarters in London, and regional offices in New

York, Frankfurt, and Hong Kong. The company serves the world's largest 5000 companies.

Datamonitor's premium reports are based on primary research with industry panels and consumers.

We gather information on market segmentation, market growth and pricing, competitors and products.

Our experts then interpret this data to produce detailed forecasts and actionable recommendations,

helping you create new business opportunities and ideas.

Our series of company, industry and country profiles complements our premium products, providing

top-level information on 10,000 companies, 2,500 industries and 50 countries. While they do not

contain the highly detailed breakdowns found in premium reports, profiles give you the most important

qualitative and quantitative summary information you need - including predictions and forecasts.

All Rights Reserved.

No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by any means, electronic,

mechanical, photocopying, recording or otherwise, without the prior permission of the publisher, Datamonitor plc.

The facts of this profile are believed to be correct at the time of publication but cannot be guaranteed. Please note that the

findings, conclusions and recommendations that Datamonitor delivers will be based on information gathered in good faith

from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such Datamonitor

can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect.

The Walt Disney Company Page 2

© Datamonitor

The Walt Disney Company

TABLE OF CONTENTS

TABLE OF CONTENTS

Company Overview..............................................................................................4

Key Facts...............................................................................................................4

SWOT Analysis.....................................................................................................5

The Walt Disney Company Page 3

© Datamonitor

The Walt Disney Company

Company Overview

COMPANY OVERVIEW

The Walt Disney Company (Walt Disney or “the company”), together with its subsidiaries, is a

diversified entertainment company. The company primarily operates in North America, Europe, Asia

Pacific and Latin America. It is headquartered in Burbank, California and employs about 144,000

people.

The company recorded revenues of $36,149 million during the financial year ended September 2009

(FY2009), a decrease of 4.5% as compared to FY2008. The operating profit of the company was

$5,547 million in FY2009, a decrease of 24.5% as compared to FY2008. The net profit was $3,307

million in FY2009, a decrease of 25.3% as compared to FY2008.

KEY FACTS

Head Office The Walt Disney Company

500 South Buena Vista Street

Burbank

California 91521

USA

Phone 1 818 560 1000

Fax 1 818 560 1930

Web Address http://www.disney.com

Revenue / turnover 36,149.0

(USD Mn)

Financial Year End September

Employees 144,000

New York Stock DIS

Exchange Ticker

The Walt Disney Company Page 4

© Datamonitor

The Walt Disney Company

SWOT Analysis

SWOT ANALYSIS

Walt Disney, together with its subsidiaries, is a diversified entertainment company. The breadth and

depth of Walt Disney's product and service portfolio provides it with considerable strength. The

company's offerings can be broadly classified into four segments: media networks, parks and resorts,

studio entertainment, and consumer products. A broad and diversified revenue base insulates the

company from economic cycles in one industry and diversifies the company's business risks. However,

intense competition threatens to erode the company's market share in its different lines of business.

Strengths Weaknesses

Diversified product and service portfolio Weak performance of studio entertainment

Portfolio of well known brands segment

Significant customer penetration of the Overdependence on the North American

cable networks operations markets

Strong brand equity enjoyed by parks and

resorts operations

Opportunities Threats

Acquisitions to strengthen the position in Intense competition keeps market share

the entertainment industry under check

Distribution agreement with DreamWorks Proliferation of piracy in entertainment

Studios industry

Regulatory risks

Strengths

Diversified product and service portfolio

The breadth and depth of Walt Disney's product and service portfolio provides it with considerable

strength. The company's offerings can be broadly classified into five segments: media networks,

parks and resorts, studio entertainment, consumer products, and interactive media.

The media networks segment owns television, radio and cable properties in the US and other

countries. Through the parks and resorts segment, the company owns and operates the Walt Disney

World Resort and Disney Cruise Line in Florida, the Disneyland Resort in California and ESPN Zone

facilities in several states. The studio entertainment segment produces and acquires live-action and

animated motion pictures, animated direct-to-video programming, musical recordings and live stage

plays. The consumer products segment partners with licensees, manufacturers, publishers and

retailers to design, promote and sell products based on existing and new Disney characters and

The Walt Disney Company Page 5

© Datamonitor

The Walt Disney Company

SWOT Analysis

other intellectual property. The interactive media segment of the company creates and delivers

Disney-branded entertainment and lifestyle content across interactive media platforms

The company has balanced revenue mix in terms of revenue generated from these segments. In

FY2009, the company generated 44.8% of the total revenue from the media network segment. This

was followed by parks and resorts (29.5%); studio entertainment (17.0%), consumer products (6.7%),

and interactive media accounted for the remaining 2.0% of the overall revenues. A broad and

diversified revenue base insulates the company from economic cycles in one industry and diversifies

the company's business risks.

Portfolio of well known brands

The company has a portfolio of globally recognized brands. For instance, the company owns one

of the most powerful brands, Disney, in the entertainment business. Disney brand was ranked 9th

in the Top 100 Global Brands ranking of the BusinessWeek magazine and Interbrand, with the brand

value of $28,731 million, in 2010. Apart from a strong corporate brand, the company has several

other brands such as ESPN within its portfolio. ESPN, for instance, is one of the largest and popular

sports channels in the world. Touchstone, and Pixar are other brands of Walt Disney, which have

strong brand equity. Strong brand image helps the company gain consumer acceptance of new

products easily. The company also has the option to leverage its strong brand image to enter new

businesses.

Significant customer penetration of the cable networks operations

The company has strong cable networks. The company's cable networks and international broadcast

operations are principally involved in the distribution of television programming, the licensing of

programming to domestic and international markets, and investing in foreign television broadcasting,

production, and distribution entities. The cable networks produce its own programs or acquire

programming rights from other producers and rights holders for network programming. Some of the

company's most significantly penetrated cable properties as of FY2008 include ESPN with 99 million

subscribers; ESPN Classic with 64 million subscribers; ESPNEWS with 70 million subscribers; Disney

Channel with 98 million subscribers; Toon Disney with 74 million subscribers; and ABC Family with

98 million subscribers.

The company also has made investments in international broadcast and cable properties. ESPN

operates six television sports networks, including ESPN, ESPN2, ESPN Classic, ESPNEWS, ESPN

Deportes (a Spanish language network) and ESPNU (a network devoted to college sports). ESPN

also operates four high-definition television simulcast services, including ESPN HD, ESPN2 HD,

ESPNEWS HD and ESPNU HD.

The strong market penetration in the cable networks lends greater stability to the company's

operations. The company leverages this platform to cross-sell its other businesses, leading to better

revenue growth prospects.

Strong brand equity enjoyed by parks and resorts operations

The Walt Disney Company Page 6

© Datamonitor

The Walt Disney Company

SWOT Analysis

Walt Disney has a strong presence in the parks and resorts business. About 29.5% of its revenue

amounting to $10,667.0 million comes from parks and resorts segment. The company's parks and

resorts segment consist of the Walt Disney World Resort, the Disneyland Resort, the Disney Vacation

Club, the Disney Cruise Line, Adventures by Disney, and ESPN Zone.

The Walt Disney World Resort is located in Florida, on approximately 25,000 acres of company's

owned land.The resort includes theme parks (the Magic Kingdom, Epcot, Disney’s Hollywood Studios

and Disney’s Animal Kingdom), hotels, vacation club properties, retail, dining and entertainment

complex, sports complex, water parks and other recreational facilities.

The Disneyland Resort owns 461 acres and has the rights under long-term lease for use of an

additional 49 acres of land in Anaheim, California. It includes two theme parks (Disneyland and

Disney’s California Adventure), three hotels and Downtown Disney, a retail, dining and entertainment

district.

Further, the Disney Vacation Club (DVC) offers ownership interests in ten resort facilities located at

the Walt Disney World Resort; Vero Beach, Florida; and Hilton Head Island, South Carolina.

The company's Disney Cruise Line has two 85,000-ton ships, the Disney Magic and the Disney

Wonder. The Adventures by Disney offers a series of all inclusive guided vacation tour packages at

predominantly non-Disney sites around the world. Also, the company operates eight ESPN Zone

restaurants.

Furthermore, the company manages and has effective ownership interests of 51% and 43%,

respectively, in Disneyland Resort Paris and Hong Kong Disneyland Resort. The company also

licenses the operations of the Tokyo Disney Resort in Japan. An elaborate parks and resorts operation

enables the company to not only reach more customers but also reinforce its brand equity among

its target group.

Weaknesses

Weak performance of studio entertainment segment

The studio entertainment segment has witnessed a declining revenue growth in the last three years

(FY2007-09). The segment recorded revenues of $6,136.0 million in FY2009, a decrease of 16.5%

over FY2008. The segment's revenues have declined at a compounded annual rate of interest of

10% during FY2007-09. The percentage contribution of the segment to the total revenue has also

declined from 21.1% in FY2007 to 17.0% in FY2009. Furthermore, the segment has been contributing

the least operating profit, apart from the interactive media segment. Over the years the segments’

contribution to the company’s operating profit has declined from 15.2% in 2007 to 2.6% in 2009.

The declining revenues from the segment indicate the fact that the company might be losing its edge

to other competitors. While, the declining operating profit contribution indicate the cost management

problem at the company. Since the segment still constitute a major part of the company’s global

The Walt Disney Company Page 7

© Datamonitor

The Walt Disney Company

SWOT Analysis

operations, aggravating weak performance could have negative implications for the company’s

overall operations.

Overdependence on the North American markets

Walt Disney has its operations all across the world spanning North America, Europe, Asia Pacific

and Latin America. However, the company derives a majority of its revenues from the North American

market, which does not truly reflect its global presence. The company derived 76.1% of its revenues

from the US and Canada in FY2009. The company has a little presence in emerging markets like

Asia Pacific, Latin America and other, which accounted for only 7.3% of the company's total revenue.

Concentrating on matured markets like the US and Canada, which are already witnessing economic

slowdown, and not expanding in emerging markets would limit the company's overall revenue growth

and also weaken its market position in the international market.

Opportunities

Acquisitions to strengthen the position in the entertainment industry

Walt Disney has acquired several companies in the recent past to expand its position in the kids

and families media markets. In the FY2009, the company acquired Wideload Games, a Chicago-based

producer and developer of original interactive entertainment; Marvel Entertainment, renowned

character franchise company; and Playdom, one of the leading companies in the fast-growing

business of online social gaming.

Wideload Games, which was acquired by the company in 2009, is well known for its Bungie Software

label, the Marathon and Myth computer game series, and the extremely popular game franchise

Halo. Wideload Games is slated to develop original video games for Disney. Another acquired

company, Marvel, owns some of the strong global brand and world-renowned characters including

Iron Man, Spider-Man, X-Men, Captain America, Fantastic Four, Hulk and other 5,000 characters.

The acquisition has brought these popular characters under the Disney brand umbrella. Besides,

the acquisition of Playdom strengthens the company’s position in the fast-growing online social

gaming.

The company can capitalize on the synergies from each of these acquired companies to further

enhance its business operations and revenues.

Distribution agreement with DreamWorks Studios

The Walt Disney Studios, a motion picture arm of Walt Disney, entered into a long-term distribution

agreement with DreamWorks Studios, in 2009. Under the terms of this agreement, Walt Disney will

distribute 30 DreamWorks films over five years. Disney will also handle DVD sales and distribution

on Starz, the premium cable channel with which Disney has a long-term deal. The first DreamWorks

motion picture is expected to be released under the Walt Disney's Touchstone Pictures banner in

The Walt Disney Company Page 8

© Datamonitor

The Walt Disney Company

SWOT Analysis

2010. Furthermore, DreamWorks, for instance, will pay Disney a fee of 10% of the revenues. The

above agreement enables the company to further enhance its quality of motion picture offerings and

expand its customer base.

Threats

Intense competition keeps market share under check

There is strong competition in many of Disney's key segments. Its broadcasting services compete

for viewers with other television networks, cable television, satellite television, videocassettes, DVDs,

and internet. This high level of competition is particularly important with respect to advertising

revenues, where it also competes with other media such as newspapers, magazines, radio and

billboards. Disney's broadcasting division competes with organizations such as CBS and Fox, with

strong market presence and technical expertise to challenge it in every aspect of business. The

parks and resorts segment competes with other parks and resorts operators like Xanterra Parks &

Resorts and smaller local US based amusement parks for visitors. Intense competition threatens to

erode the company's market share in its different lines of business.

Proliferation of piracy in entertainment industry

The proliferation of piracy in the entertainment industry is a significant and rapidly growing

phenomenon. New technologies such as the convergence of computing, communication, and

entertainment devices, the falling prices of devices incorporating such technologies, and increased

broadband internet speed and penetration have made the unauthorized digital copying and distribution

of films, television productions and other creative works easier and faster and enforcement of

intellectual property rights more challenging. This facilitates the creation, transmission and sharing

of high quality unauthorized copies of Disney's content. The proliferation of unauthorized copies and

piracy of these products has an adverse effect on the company's businesses and profitability as

these products reduce the revenue that the company could potentially receive from legitimate sale

and distribution of its products and services. Thus, increasing instances of piracy will have an adverse

effect on the company's businesses and profitability.

Regulatory risks

The company's television and radio broadcasting are highly regulated, and each of its other

businesses is subject to a variety of US and overseas regulations. These regulations include the

US Federal Communications Commission (FCC) regulation of its television and radio networks and

owned stations, including licensing of stations, ownership limits, prohibitions on 'indecent' programming

and restrictions on commercial time in children's programming. These regulations are also in the

form of federal, state and foreign privacy and data protection laws and regulations and regulation

of the safety of consumer products and theme park operations. Changes in any of these regulatory

areas may require the company to spend additional amounts to comply with the regulations.

The Walt Disney Company Page 9

© Datamonitor

Copyright of Walt Disney Company SWOT Analysis is the property of Datamonitor Plc and its content may not

be copied or emailed to multiple sites or posted to a listserv without the copyright holder's express written

permission. However, users may print, download, or email articles for individual use.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Filipino ValuesDocumento26 páginasFilipino ValuesDan100% (14)

- CA CHP555 Manual 2 2003 ch1-13Documento236 páginasCA CHP555 Manual 2 2003 ch1-13Lucas OjedaAinda não há avaliações

- Maple Ridge Pitt Meadows News - December 31, 2010 Online EditionDocumento24 páginasMaple Ridge Pitt Meadows News - December 31, 2010 Online EditionmapleridgenewsAinda não há avaliações

- Office of The Punong Barangay: Executive Order No. 04Documento1 páginaOffice of The Punong Barangay: Executive Order No. 04Pao LonzagaAinda não há avaliações

- Ang vs. TeodoroDocumento2 páginasAng vs. TeodoroDonna DumaliangAinda não há avaliações

- MOFCOM SCHOLARSHIP(2019 Enrollment Guide) - Scholarships - 留学中国Documento9 páginasMOFCOM SCHOLARSHIP(2019 Enrollment Guide) - Scholarships - 留学中国qweku jayAinda não há avaliações

- Plaintiff-Appellee Vs Vs Defendants-Appellants Claro M. Recto Solicitor General Pompeyo Diaz Solicitor Meliton G. SolimanDocumento9 páginasPlaintiff-Appellee Vs Vs Defendants-Appellants Claro M. Recto Solicitor General Pompeyo Diaz Solicitor Meliton G. Solimanvienuell ayingAinda não há avaliações

- Cameron, Et Al v. Apple - Proposed SettlementDocumento37 páginasCameron, Et Al v. Apple - Proposed SettlementMikey CampbellAinda não há avaliações

- People vs. BartolayDocumento6 páginasPeople vs. BartolayPrince CayabyabAinda não há avaliações

- Solicitor General LetterDocumento6 páginasSolicitor General LetterFallon FischerAinda não há avaliações

- Practice in The Trial of Civil SuitsDocumento54 páginasPractice in The Trial of Civil SuitsCool dude 101Ainda não há avaliações

- Maint BriefingDocumento4 páginasMaint BriefingWellington RamosAinda não há avaliações

- Kojin Karatani - Isonomia and The Origins of PhilosophyDocumento165 páginasKojin Karatani - Isonomia and The Origins of PhilosophyRafael Saldanha100% (1)

- Narcotrafico: El Gran Desafío de Calderón (Book Review)Documento5 páginasNarcotrafico: El Gran Desafío de Calderón (Book Review)James CreechanAinda não há avaliações

- MSF Tire and Rubber V CA (Innocent Bystander Rule-Labor LawDocumento4 páginasMSF Tire and Rubber V CA (Innocent Bystander Rule-Labor Lawrina110383Ainda não há avaliações

- The Criminal Procedure (Identification) Act, 2022 A Constitutional CritiqueDocumento28 páginasThe Criminal Procedure (Identification) Act, 2022 A Constitutional CritiqueArunAinda não há avaliações

- Social Justice Society v. Atienza, JR CASE DIGESTDocumento1 páginaSocial Justice Society v. Atienza, JR CASE DIGESTJuris Poet100% (1)

- Carl Schmitt and Donoso CortésDocumento11 páginasCarl Schmitt and Donoso CortésReginaldo NasserAinda não há avaliações

- Tecno Spark Power 2 Misty Grey, 64 GB: Grand Total 9999.00Documento2 páginasTecno Spark Power 2 Misty Grey, 64 GB: Grand Total 9999.00Lucky KumarAinda não há avaliações

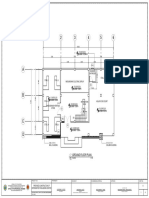

- Ground Floor Plan: Office of The Provincial EngineerDocumento1 páginaGround Floor Plan: Office of The Provincial EngineerAbubakar SalikAinda não há avaliações

- Jamii Cover: Type of PlansDocumento2 páginasJamii Cover: Type of PlansERICK ODIPOAinda não há avaliações

- Econ Essay On Royal Mail Between PrivitisationDocumento2 páginasEcon Essay On Royal Mail Between PrivitisationAhila100% (1)

- Ecm Type 5 - 23G00019Documento1 páginaEcm Type 5 - 23G00019Jezreel FlotildeAinda não há avaliações

- Cambodia vs. RwandaDocumento2 páginasCambodia vs. RwandaSoksan HingAinda não há avaliações

- International Finance - Questions Exercises 2023Documento5 páginasInternational Finance - Questions Exercises 2023quynhnannieAinda não há avaliações

- Cypherpunk's ManifestoDocumento3 páginasCypherpunk's ManifestoevanLeAinda não há avaliações

- OCA v. DANILO P. GALVEZDocumento11 páginasOCA v. DANILO P. GALVEZFaustina del RosarioAinda não há avaliações

- Memorial On Behalf of AppellentDocumento16 páginasMemorial On Behalf of Appellenttopperslibrary001Ainda não há avaliações

- LT Bill Dec16Documento2 páginasLT Bill Dec16nahkbceAinda não há avaliações

- Exclusion Clause AnswerDocumento4 páginasExclusion Clause AnswerGROWAinda não há avaliações