Escolar Documentos

Profissional Documentos

Cultura Documentos

Project On UBL

Enviado por

madnansajid8765Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Project On UBL

Enviado por

madnansajid8765Direitos autorais:

Formatos disponíveis

Final Project

Advance Performance Management

Company

Prepared for:-

Sir M.Gulzar

Group Members

Names ID#

Hafiz M.Imtiaz 100645-015

Where you come first

History of UBL

United Bank Limited was established in November 1959. The bank was sponsored by

the saigol Group of Companies, which were the mainstay of the textile industry in

Pakistan at that time. Within a short period of time, the bank emerged as the third

largest in the country after HBL and NBP. The bank was nationalized in 1974. Later on

another bank the commerce bank limited was merged into UBL.

UBL was the third bank to be offered for privatization. Initially, a Saudi based

financial institution; Bashrahil Group came up with the highest bid for the bank, and

deposited the first tranche for its consideration. However, due to flaws in the

transaction, the SBP cancelled the privatization and took over the bank in 1995.

The Bank’s total income including interest and non-interest income amounted

to RS.4935 million in 1995, its deposits were RS. 109 billion and investments were

RS.25 billion in 1995. UBL incurred a loss of RS.724 million in 1995.

In 1996 the management of the bank was changed and by mid 1997 the

financial and administrative discipline was restored. The interference of the

government was eliminated and the non-performing loans recovery was increased

and the liquidity position was brought up to the required level. About RS.6.3 billion

were recovered out of which about RS.5 billion were domestic and of this about Rs.

4.5 billion was recovered in cash.

A right sizing program was initiated as well as an aggressive branch

rationalization strategy by which 203 loss making branches were shut down and

profitable ones were opened in other areas. Surplus staff was removed which

amounted to 5416 employees. The entire audit system was revamped.

Where you come first

United Bank Limited Introduction

Mission Statement of UBL:

“To develop and deliver the most innovative

product, manage customer experience, deliver quality

service that contributes to brand strength, establish a

comparative advantage and enhance profitability,

providing value to the stakeholders of bank”

UBL Vision:

“To be the premier organizations operating

locally & internationally that provides the

complete range of financial services to all

segments under one roof”

Where you come first

SWOT Analysis

i. Strengths:

3rd largest Bank of Pakistan in term of deposits

2nd largest Privatized Bank of Pakistan

UBL offering Customized Products and services aggressively better

then its competitors

Improved operational efficiency as to its past

Courteous Customer service and fast delivery of online and offline

services

Marvelous Image and Reputation of the bank in the eyes of its

customers

Extensive Branch network

UBL Product positioning is very effective

UBL target the segment like salaried person, business people and self

employed person

UBL product positioning affect the life style of the people as they help

in improving standard of living

1056 Branches all over Pakistan

Stands in the list of Profitable bank in stock exchange

Largest number of corporate deals by any bank is Pakistan

Overseas Branches

Attractive Salaries and incentives for employees

Personnel of UBL are very well trained. Majority of employees have

many years of experience in banking sector and are an asset for the

bank.

Where you come first

ii. Weaknesses:

No standardization in terms of branches some of the branches are

very attractive and most of the branches are not very good like other

branches.

In some regions, urban areas of Pakistan service of UBL is not good as

compared to other privatized banks

The application time is also quite lengthy.

UBL is a step behind in using new technology as compared to other

banks

All branches need orientation for customer dealing.

Most of the employees are overload with the work and promotion is

also not timely.

Most of employees are experienced and they are not able to deal

customers well, adopt new culture and above all they are unable to

use of new technology like computers.

No separate training center to train their employees

Employees are not well dressed

Workforce is not diverse

Security system in most of the branches is not up to the mark.

iii. Opportunities:

Bank can extend its network in other cities of Pakistan like other 4

remote cities, it would increase their sales.

Proper orientation of employees in all branches can help them to

cope up with foreign banks

By bringing new technology and modern business processes will bring

the change and increase their profitability

Call centre services should be improved to enhance their network

iv. Threats:

Where you come first

ti

O

A

b

u

H

g

M

h

c

n

ra

B

e

k

o

p

S

l

Organization Chart:

Large and increasing competition.

High operating costs

Lack of huge deposits

Where you come first

n

H

R

IC

A

S

M

F

tD

.g

s

v

fo

m

d

u

ti

k

ic

r

a

p

e

&

y

The organization design of UBL is Horizontal (which has low hierarchical level). There are

different Groups containing 10 to 12 people which are assigned different tasks to work

on each group has its own supervisor who supervise all employees in its group.

Organizational Values:

•Trust and Integrity

•Respect for people

UBL Structure

Where you come first

•Responsible corporate citizens

•Passion for business excellence

•Commitment to total customer’s satisfaction

Performance Appraisal:

In performance appraisal of employees UBL use Graphic Rating Scale Method (a

scale that lists a number of traits and a range of performance for each. Employee is then

rated by identifying the score that best describes his or her level of performance for

each trait) in which UBL measure the characteristics and previous performance of

employees and then rank them subsequently.

In the performance process UBL first discuss the job and duties assigned to the

each subordinate in the Groups. After that they compare their actual performance with

the standards which are set by the UBL. Then the performance reports of subordinates

are discussed with them and make plans if any development is required or not.

Customer satisfaction:

Satisfaction of customers:

By providing best services to the customers

Confidence of customers:

Bank provides quality services and understand the problems by attention, customers feel

relax because they know we can do as they want.

Accounts provides to the customers:

Fixed deposit account, current account, saving accounts

In case of any complaint:

Where you come first

Bank have a department of resolution to check the complaints and have treatment with in

an hour

Financial Measure:

Daily transactions:

Due to increase in the number of clients transaction are increased

UBL increase the number of branches in big and small cities of Pakistan

Market shares:

UBL in the 2nd largest commercial banking network in Pakistan

Have more than 17 overseas branches and profit in 2009 was

Rs 20,050,017 it increase in this year, in 2008 it was Rs 14,907,201

Earning per share:

In 2008 EPS Rs 3.09 and in 2009 EPS was Rs 2.72

Internal efficiency:

New products

More than 12 new products introduced recently like: visa, OMNI, Better life and much more

products

Employee’s performance

The measurement of employees performance by giving some targets, check their tasks

There is minor chance of error because all work is computerized no manually work done

Relationship with customers

Customers freely tell their problems with bank and bank provides best services as they

want. Some customers are very important for bank and the bank invite them on ceremonies

to encourage

Encouragement of employees

Some annually bonus, support awards, cash reward by these ways bank encourage the

employees also performance awards

Where you come first

Cards:

Prepaid cards, debit cards ,visa debit and visa credit and master cards

Productivity:

Technology used:

Secure technology used in banking.

Improvements in technology

Online secure banking, mobile banking you can billing by mobile at any time every where

Learning

Held some meetings in which lecture session helps to trained to understand the new

product and new service how to use are explain to the customers

Where you come first

Você também pode gostar

- Ubl Complete ReportDocumento30 páginasUbl Complete ReportSidra IdreesAinda não há avaliações

- Pre Production-Vintage Records: LO2.1/ LO3.2 Pre Production Meetings Team Meetings/ Discussions With Set and PerformerDocumento19 páginasPre Production-Vintage Records: LO2.1/ LO3.2 Pre Production Meetings Team Meetings/ Discussions With Set and PerformerMeganMcCleanAinda não há avaliações

- Writng Dialogue & Advice From The ProsDocumento4 páginasWritng Dialogue & Advice From The ProsHannah ArchihonAinda não há avaliações

- Behind T: He ScenesDocumento17 páginasBehind T: He ScenesSam BabingtonAinda não há avaliações

- Strategic Analysis of United Bank Limited. MS WordDocumento39 páginasStrategic Analysis of United Bank Limited. MS Wordshahid_pak1_26114364100% (2)

- Lesson 1 Unit 4 Pre-Production PortfolioDocumento31 páginasLesson 1 Unit 4 Pre-Production PortfolioJamie Collier100% (2)

- Pre-Production & ResearchDocumento8 páginasPre-Production & Researcha2mediahamdaaaliAinda não há avaliações

- Film Guide GreeceDocumento98 páginasFilm Guide GreeceΜΙΚΡΟ ΣωματείοAinda não há avaliações

- Production & CostsDocumento175 páginasProduction & Costsmayuri0% (1)

- Part 3 Fluent Grammar For Ielts SpeakingDocumento14 páginasPart 3 Fluent Grammar For Ielts SpeakingNasim IkbalAinda não há avaliações

- Film FinancingDocumento2 páginasFilm Financingmattdalby100% (1)

- Scriptwriting: Danish MaqsoodDocumento21 páginasScriptwriting: Danish MaqsoodDanish MaqsoodAinda não há avaliações

- Social Enterprises: A Motivational Insight into Seven OrganisationsNo EverandSocial Enterprises: A Motivational Insight into Seven OrganisationsAinda não há avaliações

- The preparation, dyeing and finishing of cotton knit goodsDocumento67 páginasThe preparation, dyeing and finishing of cotton knit goods郭哲宏100% (1)

- The Pre Production Process Evaluation FinalDocumento12 páginasThe Pre Production Process Evaluation FinalMC_OnnellAinda não há avaliações

- Rating Global Film Rights SecuritizationsDocumento26 páginasRating Global Film Rights SecuritizationsAdrian Dascal100% (1)

- Fashion ForecastingDocumento80 páginasFashion ForecastingcuteevasanthAinda não há avaliações

- Online Retailing - Selling Electronics Accessories TipsDocumento2 páginasOnline Retailing - Selling Electronics Accessories TipsRISHIKESH ANANDAinda não há avaliações

- Sample Film BudgetDocumento35 páginasSample Film BudgetMilin Anik'sAinda não há avaliações

- Lemonade! Squeeze Your Challenging Life Experiences into a Successful BusinessNo EverandLemonade! Squeeze Your Challenging Life Experiences into a Successful BusinessAinda não há avaliações

- Cannes - A Festival Virgin's Guide (7th Edition): Attending the Cannes Film Festival, for Filmmakers and Film Industry ProfessionalsNo EverandCannes - A Festival Virgin's Guide (7th Edition): Attending the Cannes Film Festival, for Filmmakers and Film Industry ProfessionalsAinda não há avaliações

- VS Media Plan Targets Women 18-24Documento17 páginasVS Media Plan Targets Women 18-24Aumnaj KongjaroenthinAinda não há avaliações

- Branded Entertainment A New Advertising Technique or Product Placement in DisguiseDocumento17 páginasBranded Entertainment A New Advertising Technique or Product Placement in DisguiseondesmartAinda não há avaliações

- Overview of Apparel Manufacturing Industry in IndiaDocumento28 páginasOverview of Apparel Manufacturing Industry in Indiashreay12345Ainda não há avaliações

- Case23 The Movie Exhibition Industry PDFDocumento15 páginasCase23 The Movie Exhibition Industry PDFSyara KamisAinda não há avaliações

- UBL SWOT AnalysisDocumento4 páginasUBL SWOT AnalysisIdealeyes75% (4)

- Management UBL ReportDocumento20 páginasManagement UBL ReportWaleed Khan100% (1)

- United Bank LimitedDocumento13 páginasUnited Bank Limitedonkarmandhan mandhanAinda não há avaliações

- Swot Analysis: Internal StrengthsDocumento4 páginasSwot Analysis: Internal Strengthssara-bashir-8426Ainda não há avaliações

- Presentation On "Internet Banking With Reference To State Bank of India"Documento14 páginasPresentation On "Internet Banking With Reference To State Bank of India"Prince PurshiAinda não há avaliações

- UBL Operations ManagementDocumento18 páginasUBL Operations ManagementSaad HamidAinda não há avaliações

- Strategic Management of Sonali BankDocumento15 páginasStrategic Management of Sonali Bankjenefar lollyAinda não há avaliações

- Planning of HBLDocumento18 páginasPlanning of HBLAsad Ullah0% (1)

- UBLDocumento38 páginasUBLMuhammad Shahroz KafeelAinda não há avaliações

- UBL History I. Product Mix 1.1 Deposit Products 1.2 Loans and AdvancesDocumento8 páginasUBL History I. Product Mix 1.1 Deposit Products 1.2 Loans and AdvancesearnybirdyAinda não há avaliações

- SBIDocumento12 páginasSBIHemlata Kale50% (2)

- Banking Industry: Group MembersDocumento7 páginasBanking Industry: Group MembersmaryamAinda não há avaliações

- Habib Bank Limited, Final Report (Abid)Documento6 páginasHabib Bank Limited, Final Report (Abid)Ansab KhanAinda não há avaliações

- HR Management at ICICI BankDocumento10 páginasHR Management at ICICI BanknavreenAinda não há avaliações

- INTERNSHIP REPORT On UBLDocumento22 páginasINTERNSHIP REPORT On UBLNour E HuddaAinda não há avaliações

- A Presentation On Punjab National BankDocumento16 páginasA Presentation On Punjab National BankRahul KumarAinda não há avaliações

- Mission and Vision of OrganizationsDocumento11 páginasMission and Vision of OrganizationsAnas MohammadAinda não há avaliações

- BBA Internship ReportsDocumento33 páginasBBA Internship ReportsVivek Lal KarnaAinda não há avaliações

- HR PoliciesDocumento4 páginasHR PoliciesAbdullah MithaniAinda não há avaliações

- Uti BankDocumento71 páginasUti BankRuishabh RunwalAinda não há avaliações

- Internship ReportDocumento65 páginasInternship ReportPakassignmentAinda não há avaliações

- Punjab National Bank 1-Amit Kumar SrivastavaDocumento66 páginasPunjab National Bank 1-Amit Kumar SrivastavaAwanish Kumar MauryaAinda não há avaliações

- Performance Evaluation of Eastern Bank LimitedDocumento28 páginasPerformance Evaluation of Eastern Bank LimitedMd. LikhonAinda não há avaliações

- Organizational Analysis of United Bank Limited: Ms. Sima Kamil President & CEODocumento7 páginasOrganizational Analysis of United Bank Limited: Ms. Sima Kamil President & CEOHamza ButtAinda não há avaliações

- Ubl Swot & Pest AnalysisDocumento6 páginasUbl Swot & Pest AnalysisChaudhry Salman WarraichAinda não há avaliações

- Project Report On HSBC 2Documento38 páginasProject Report On HSBC 2Mayuri NaikAinda não há avaliações

- OB Union BankDocumento6 páginasOB Union BankArka Goswami100% (1)

- NCC Bank LTDDocumento69 páginasNCC Bank LTDZaman's ZarineAinda não há avaliações

- Marketing Management: A Case Study of National Bank of Pakistan (NBP)Documento38 páginasMarketing Management: A Case Study of National Bank of Pakistan (NBP)babar2620% (1)

- HRM370-CASE 1-NCC BankDocumento16 páginasHRM370-CASE 1-NCC BankOishee AhmedAinda não há avaliações

- Corporate Governance of EBLDocumento18 páginasCorporate Governance of EBLAhAd SAmAinda não há avaliações

- The Impact of Mergers and Acquisitions On Acquirer PerformanceDocumento10 páginasThe Impact of Mergers and Acquisitions On Acquirer Performancemadnansajid87650% (1)

- Impact of Risk Management On Non-Performing Loans and Profitability of Banking Sector of PakistanDocumento9 páginasImpact of Risk Management On Non-Performing Loans and Profitability of Banking Sector of Pakistanmadnansajid8765Ainda não há avaliações

- Liquidity Risk, Credit Risk, Market Risk and Bank CapitalDocumento39 páginasLiquidity Risk, Credit Risk, Market Risk and Bank Capitalmadnansajid8765Ainda não há avaliações

- HRMDocumento21 páginasHRMmadnansajid8765Ainda não há avaliações

- Bank Al - Falah Internship ReportDocumento92 páginasBank Al - Falah Internship Reportmadnansajid8765Ainda não há avaliações

- PIA Quantitative and Quality AnalysisDocumento62 páginasPIA Quantitative and Quality Analysismadnansajid876525% (4)

- Fast Food Industry Complete AnalysisDocumento32 páginasFast Food Industry Complete Analysismadnansajid8765100% (1)

- "Develop The Scenario of Financial Transaction Which Reflects at Least Five Types of Risk and Discuss Their Interrelation As Well.Documento2 páginas"Develop The Scenario of Financial Transaction Which Reflects at Least Five Types of Risk and Discuss Their Interrelation As Well.madnansajid8765Ainda não há avaliações

- HRMDocumento37 páginasHRMmadnansajid8765Ainda não há avaliações

- PTCLDocumento88 páginasPTCLmadnansajid8765Ainda não há avaliações

- Muslim Commercial Bank Internship ReportDocumento69 páginasMuslim Commercial Bank Internship Reportmadnansajid8765Ainda não há avaliações

- Mitchell's Ratio AnalysisDocumento3 páginasMitchell's Ratio Analysismadnansajid8765Ainda não há avaliações

- Dnan Ajid: Address: Asad Colony Sheikhupura Road Gujranwala, Pakistan. Contact #: 0312-6150001 Email AddressDocumento2 páginasDnan Ajid: Address: Asad Colony Sheikhupura Road Gujranwala, Pakistan. Contact #: 0312-6150001 Email Addressmadnansajid8765Ainda não há avaliações

- National Bank of PakistanDocumento44 páginasNational Bank of Pakistanmadnansajid8765Ainda não há avaliações

- Culture of An Organization ..... BOSS Moulded FurnitureDocumento31 páginasCulture of An Organization ..... BOSS Moulded Furnituremadnansajid8765Ainda não há avaliações

- Managerial Finance Basic TermsDocumento11 páginasManagerial Finance Basic Termsmadnansajid8765Ainda não há avaliações

- 3rd Quarter Report 2009-10Documento22 páginas3rd Quarter Report 2009-10madnansajid8765Ainda não há avaliações

- Kinnow Processing Plant (Sitrus Fruit)Documento26 páginasKinnow Processing Plant (Sitrus Fruit)madnansajid8765Ainda não há avaliações

- Final ProjectDocumento33 páginasFinal Projectmadnansajid8765Ainda não há avaliações

- Online Recruitment in Telenor PakistanDocumento38 páginasOnline Recruitment in Telenor Pakistanmadnansajid8765Ainda não há avaliações

- Telenor Human Resource ManagementDocumento55 páginasTelenor Human Resource ManagementRaheela MuhammadAinda não há avaliações

- Telenor Pakistan Training and DevelopmentDocumento28 páginasTelenor Pakistan Training and Developmentmadnansajid8765100% (1)

- Project On Macro PakistanDocumento8 páginasProject On Macro Pakistanmadnansajid8765Ainda não há avaliações

- Project On NestleDocumento7 páginasProject On Nestlemadnansajid8765Ainda não há avaliações

- Project On Allied Bank of PakistanDocumento23 páginasProject On Allied Bank of Pakistanmadnansajid8765Ainda não há avaliações

- Project On PESPIDocumento13 páginasProject On PESPImadnansajid8765Ainda não há avaliações

- Report On Telenor (Human Resource Management)Documento21 páginasReport On Telenor (Human Resource Management)madnansajid8765Ainda não há avaliações

- Company MeetingDocumento9 páginasCompany Meetingmadnansajid8765Ainda não há avaliações

- IMF & Developing CountriesDocumento6 páginasIMF & Developing Countriesmadnansajid8765Ainda não há avaliações

- Roll 3 - 269128 Class Class 9 - N Name Hamza Abdul RehmanDocumento1 páginaRoll 3 - 269128 Class Class 9 - N Name Hamza Abdul Rehmanfloppaedits752Ainda não há avaliações

- UBL-04-Jan-2023 11 - 26 - 53Documento2 páginasUBL-04-Jan-2023 11 - 26 - 53Mueen HassanAinda não há avaliações

- Online Challan For Admission BZU MultanDocumento1 páginaOnline Challan For Admission BZU MultanTalhaAinda não há avaliações

- Bank Deposit Slip for Police Constable TestDocumento1 páginaBank Deposit Slip for Police Constable TestMUNEEBAinda não há avaliações

- United Bank Internship Report InsightsDocumento61 páginasUnited Bank Internship Report InsightsRana HaseebAinda não há avaliações

- UBL-12-Dec-2023 07 - 52 - 43Documento89 páginasUBL-12-Dec-2023 07 - 52 - 43zhd3870Ainda não há avaliações

- 483 APPLICATION FORM Post 02. Lady Assistant Sub-Inspector (BS-09)Documento6 páginas483 APPLICATION FORM Post 02. Lady Assistant Sub-Inspector (BS-09)Saima YameenAinda não há avaliações

- Annual Report 2019 - f1j09Documento25 páginasAnnual Report 2019 - f1j09haya.noor11200Ainda não há avaliações

- Instructions Eligibility CriteriaDocumento3 páginasInstructions Eligibility CriteriaMalik Mansoor AhmedAinda não há avaliações

- Simra Mohsin Dec 2023Documento1 páginaSimra Mohsin Dec 2023mohsinmushtaq1963Ainda não há avaliações

- CSR Assignment of UBL BankDocumento6 páginasCSR Assignment of UBL BankZubair AhmedAinda não há avaliações

- Payment Procedure: Important!Documento3 páginasPayment Procedure: Important!Iqra AyeshaAinda não há avaliações

- Bank: UNITED BANK LIMITED - Analysis of Financial Statements Financial Year 2004 - Financial Year 2009Documento5 páginasBank: UNITED BANK LIMITED - Analysis of Financial Statements Financial Year 2004 - Financial Year 2009Muhammad MuzammalAinda não há avaliações

- INTERNSHIP REPORT ON UNITED BANK LIMITEDDocumento88 páginasINTERNSHIP REPORT ON UNITED BANK LIMITEDjaved khokhar123Ainda não há avaliações

- Correction ChallanDocumento1 páginaCorrection ChallanGHS 89F HSPAinda não há avaliações

- MobileAppOnlineTxnReceipt 676771941Documento1 páginaMobileAppOnlineTxnReceipt 676771941Ali CheemaAinda não há avaliações

- Money and BankingDocumento20 páginasMoney and BankingFAH EEMAinda não há avaliações

- Muhammad Kamran ArshadDocumento27 páginasMuhammad Kamran ArshadKamran ArshafAinda não há avaliações

- NBP Internship ReportDocumento46 páginasNBP Internship ReportNoor Nabi ShaikhAinda não há avaliações

- Challan Form For Written Test Fee Payment (POLICE CONSTABLE)Documento1 páginaChallan Form For Written Test Fee Payment (POLICE CONSTABLE)Rashid Abbas0% (1)

- Online Challan For Admission BZU MultanDocumento1 páginaOnline Challan For Admission BZU MultanTayyab SaleemAinda não há avaliações

- PMAS ARID AGRICULTURE UNIVERSITY SWOT ANALYSISDocumento5 páginasPMAS ARID AGRICULTURE UNIVERSITY SWOT ANALYSISMoieenAinda não há avaliações

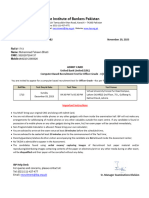

- The Institute of Bankers Pakistan: IBP/Recruitment/UBL/OG-4/2023/B2 November 29, 2023Documento1 páginaThe Institute of Bankers Pakistan: IBP/Recruitment/UBL/OG-4/2023/B2 November 29, 2023Mohammad Adeel BhattiAinda não há avaliações

- Chapter 1: Introduction of The Project: (A) UBLDocumento6 páginasChapter 1: Introduction of The Project: (A) UBLRamzanAinda não há avaliações

- PM Part IiDocumento3 páginasPM Part Iimariahassan77789Ainda não há avaliações

- 0930-BH-BAF-19 Sem #8 Fee ChallanDocumento1 página0930-BH-BAF-19 Sem #8 Fee Challanmuhammad sajjadAinda não há avaliações

- Schedule of Charges 2024 January To JuneDocumento84 páginasSchedule of Charges 2024 January To Junemoazrasheed744Ainda não há avaliações

- Ubl ReportDocumento6 páginasUbl ReportmuhammadvaqasAinda não há avaliações

- UBL-01-Jun-2023 14:21:09Documento1 páginaUBL-01-Jun-2023 14:21:09Muhammad AbubakarAinda não há avaliações

- Training Plan Presiding & SR Apos (Male)Documento133 páginasTraining Plan Presiding & SR Apos (Male)Malikh FakharAinda não há avaliações