Escolar Documentos

Profissional Documentos

Cultura Documentos

Retirement Case Study

Enviado por

Eugene Jeffrey Von BrandisDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Retirement Case Study

Enviado por

Eugene Jeffrey Von BrandisDireitos autorais:

Formatos disponíveis

Case Study: Retirement

Personal Details:

NAME Brad Pitt

D.O.B. 5/9/1966

Retirement Age 55 {at which time he will commute all lump

sums from all sources}

MARITAL STATUS Married in community of property on

15/1/2005

PARTNER Angelina Jolie

PARTNER’S D.O.B. 12/11/1973

Adopted son Max (date of birth 1/2/1999)

DEPENDANT

ADDRESS Beverley Hills 90210, Sandton

EMPLOYER – BRAD Hollywood Film Producers

OCCUPATION – BRAD Manager

SALARY - BRAD R40 000

R35 000 {pensionable}

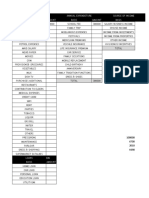

ASSETS OWNED BY BRAD

PENSION FUND Defined Contribution

DATE JOINED 1/1/1991

Employer: 9% of pensionable income

CONTRIBUTION

Employee: 7% of pensionable income

CURRENT FUND VALUE R680 000

DEATH BENEFIT {LUMP SUM} 4x annual salary

DISABILITY BENEFIT {LUMP SUM} 3 x annual salary

OTHER ASSETS OWNED BY BRAD

ASSET TYPE DATE OF ASSET VALUE ASSET ASSET TO BE

PURCHASE LIABILITY REALISED OR

FIXED @

RETIREMENT

Residential 22/12/2006 R2 000 000 R500 000 Realised

Property

Original R1 000 000

Purchase

Price

Holiday House 20/03/2002 R1 000 000 Fixed

Household 18/02/2001 R350 000 Fixed

Effects

4X4 Vehicle 10/03/2006 R 250 000 Fixed

Cash in 15/04/2000 R 500 000 Realised

Standard Bank

Assume 7%

growth

POLICIES OWNED BY BRAD

INSTITUTION Liberty Life

TYPE OF POLICY Endowment

DESCRIPTION Lifestyle Endowment

POLICY NUMBER 987654379

PREMIUM R250 p.m.

ENTRY DATE 01/02/1992

MATURITY DATE 01/28/2022

FUND VALUE R50 000

BENEFIT NAME Life Cover

BENEFIT AMOUNT R50 000

NOTE Nominated beneficiary: Wife

INSTITUTION Old Mutual

TYPE OF POLICY Whole Life

DESCRIPTION Greenlight Death Benefit

POLICY NUMBER 35465786

PREMIUM R200 p.m.

ENTRY DATE 01/07/1996

FUND VALUE R50 000

BENEFIT NAME Life Cover

BENEFIT AMOUNT R500 000

NOTE Nominated beneficiary: Wife

INSTITUTION Old Mutual

TYPE OF POLICY Retirement Annuity

DESCRIPTION FlexiPension

POLICY NUMBER 12409378

PREMIUM R250 p.m. with an annual escalating of CPI

@ 7%

ENTRY DATE 01/02/1992

MATURITY DATE 01/28/2022

FUND VALUE R55 000

BENEFIT NAME Life Cover

BENEFIT AMOUNT R55 000

NOTE Nominated beneficiary: Wife

Brad realises that he will have income from his pension fund and retirement annuity

policy but is not sure if this will be sufficient to meet their standard of living at retirement.

He would like to ensure that he will be able to provide for himself and Angelina in the

event of their retirement.

He has given you the following financial objectives:

He would like at least R30 000 income per month escalating at the inflation rate until the

age of 80.

He is keeping all his assets, except the Primary Residence as they plan to sell it and

move into the Beach House at retirement.

He says he is undecided about the R500 000 cash but at the moment he feels that he

will reinvest the money to generate an income.

He plans to spend the proceeds from the Endowment Policy to take him and Angelina on

a holiday as they enjoy travelling.

Você também pode gostar

- Form 12BBDocumento3 páginasForm 12BBAnonymous Gg6z0u9IBzAinda não há avaliações

- Payroll 2005Documento20 páginasPayroll 2005api-3740993Ainda não há avaliações

- Case Study - RamDocumento5 páginasCase Study - RamswathyAinda não há avaliações

- Policy Receipt for Life Insurance PlanDocumento51 páginasPolicy Receipt for Life Insurance PlanamylynnAinda não há avaliações

- Policy Receipt AcknowledgmentDocumento35 páginasPolicy Receipt AcknowledgmentKaren de LeonAinda não há avaliações

- Hitachi Solutions - ETIQA - Application Form (Signed)Documento1 páginaHitachi Solutions - ETIQA - Application Form (Signed)Bernard CasimiroAinda não há avaliações

- Manatal Multi-Purpose Cooperative: Membership Checklist Confirmation FormDocumento2 páginasManatal Multi-Purpose Cooperative: Membership Checklist Confirmation FormKing Ruben Delos SantosAinda não há avaliações

- FinancialDocumento2 páginasFinancialRenato SallomanAinda não há avaliações

- Barrick Enrollment Form Apr 2022Documento3 páginasBarrick Enrollment Form Apr 2022jorge ordinolaAinda não há avaliações

- Life PlannerDocumento27 páginasLife Plannersailesh daveyAinda não há avaliações

- Investment Account Application ( - Application - ) and Client Profile Form ( - Profile Form - )Documento10 páginasInvestment Account Application ( - Application - ) and Client Profile Form ( - Profile Form - )Adam PothierAinda não há avaliações

- Application Form: General Information: Selection Criteria For AccommodationDocumento5 páginasApplication Form: General Information: Selection Criteria For AccommodationSIDDIG HASSAN SALAMAMAinda não há avaliações

- Reliance Travel Care Policy ScheduleDocumento5 páginasReliance Travel Care Policy ScheduleNikhil Visa ServicesAinda não há avaliações

- Superannuation Checklist for Raymond Lesli ClaphamDocumento2 páginasSuperannuation Checklist for Raymond Lesli ClaphamRose Cano-AmbuloAinda não há avaliações

- Detailed Buyer'S Information Sheet: Jeannete Diezmo BanalDocumento4 páginasDetailed Buyer'S Information Sheet: Jeannete Diezmo BanalEttevy B OcgnaicnasAinda não há avaliações

- Full List: 2017 Parliamentary Register of Members InterestsDocumento327 páginasFull List: 2017 Parliamentary Register of Members InterestsSundayTimesZAAinda não há avaliações

- Travel Care Policy Schedule for Study AbroadDocumento5 páginasTravel Care Policy Schedule for Study AbroadNikhil Visa ServicesAinda não há avaliações

- Your Personal and Financial Information SummaryDocumento14 páginasYour Personal and Financial Information SummaryMedha SinghAinda não há avaliações

- Pete Linda EllisDocumento14 páginasPete Linda EllisFinancial SenseAinda não há avaliações

- PNB Aplication FormDocumento2 páginasPNB Aplication Formrodrigo p. kito100% (1)

- Health Wallet: Proposal FormDocumento5 páginasHealth Wallet: Proposal FormKanchan ChoudhuryAinda não há avaliações

- Register of Members' InterestsDocumento13 páginasRegister of Members' InterestsAdam MastersAinda não há avaliações

- Trump Staff Public Financial Disclosure - Cordish, Reed PDFDocumento66 páginasTrump Staff Public Financial Disclosure - Cordish, Reed PDFMonte AltoAinda não há avaliações

- Policy Owner Service Review - J774022099Documento2 páginasPolicy Owner Service Review - J774022099mertra246Ainda não há avaliações

- Sahiljeet InsDocumento5 páginasSahiljeet InsGaurav MishraAinda não há avaliações

- Profamily FormDocumento4 páginasProfamily FormChrissy SabellaAinda não há avaliações

- Do You Have Disaster Insurance?: Lifetime IncomeDocumento14 páginasDo You Have Disaster Insurance?: Lifetime IncomeFinancial SenseAinda não há avaliações

- Screenshot 2022-06-07 at 11.51.38Documento2 páginasScreenshot 2022-06-07 at 11.51.38Valentino RonnethAinda não há avaliações

- Member'S Public Disclosure StatementDocumento4 páginasMember'S Public Disclosure StatementKaren KleissAinda não há avaliações

- Tax CertificateDocumento3 páginasTax Certificatechristal KennedyAinda não há avaliações

- R June 6 Prakash Bari HealthDocumento6 páginasR June 6 Prakash Bari HealthRohit PatilAinda não há avaliações

- Renew Your Optima Restore Floater Insurance PolicyDocumento4 páginasRenew Your Optima Restore Floater Insurance PolicyNaga MurthyAinda não há avaliações

- Samel Kalpana Rajan - 907333944 - PresentattionDocumento3 páginasSamel Kalpana Rajan - 907333944 - PresentattionUnmesh AdarkarAinda não há avaliações

- Insurance Plan for Marriage and EducationDocumento5 páginasInsurance Plan for Marriage and EducationSaurabh GargAinda não há avaliações

- Personal Accident Policy: Kristy Edgie Dingal AlburoDocumento6 páginasPersonal Accident Policy: Kristy Edgie Dingal AlburoJames BastatasAinda não há avaliações

- HDFC ERGO General Insurance Company Limited: Date: 27/07/2017Documento6 páginasHDFC ERGO General Insurance Company Limited: Date: 27/07/2017rajupetalokesh100% (1)

- Robert Sue CrowderDocumento14 páginasRobert Sue CrowderFinancial SenseAinda não há avaliações

- Assignment 2 2Documento2 páginasAssignment 2 2roopeshvarma579Ainda não há avaliações

- Direct Axis Loans Under 40Documento3 páginasDirect Axis Loans Under 40Kennedy SimumbaAinda não há avaliações

- Mr. Anish ThapaDocumento5 páginasMr. Anish ThapaNikhil Visa ServicesAinda não há avaliações

- Bonds PayableDocumento7 páginasBonds PayableCarl Yry BitengAinda não há avaliações

- Phil Krista BrownDocumento14 páginasPhil Krista BrownFinancial SenseAinda não há avaliações

- Member'S Public Disclosure StatementDocumento6 páginasMember'S Public Disclosure StatementKaren KleissAinda não há avaliações

- Open Pearl Holding Group - Both InsDocumento3 páginasOpen Pearl Holding Group - Both Inseleggua03Ainda não há avaliações

- HDFC 3Documento37 páginasHDFC 3System SinghAinda não há avaliações

- Confiential Financial ReviewDocumento30 páginasConfiential Financial ReviewVictoria SanteAinda não há avaliações

- OIlsDocumento5 páginasOIlsdprosenjitAinda não há avaliações

- Rashmi 2MDocumento1 páginaRashmi 2MRobert OtienoAinda não há avaliações

- Mitigating The Rising Costs of Healthcare: Lifetime IncomeDocumento14 páginasMitigating The Rising Costs of Healthcare: Lifetime IncomeFinancial SenseAinda não há avaliações

- ACC117Documento9 páginasACC117Hantuzz 03Ainda não há avaliações

- Declaration & Warranty On Behalf of All Persons Proposed To Be InsuredDocumento2 páginasDeclaration & Warranty On Behalf of All Persons Proposed To Be InsuredMenagapriyaAinda não há avaliações

- The High Stakes of Leaving A High-Tax State: Lifetime Income Case StudyDocumento16 páginasThe High Stakes of Leaving A High-Tax State: Lifetime Income Case StudyFinancial SenseAinda não há avaliações

- Golf Membership DetailsDocumento7 páginasGolf Membership DetailsAndrew LoganAinda não há avaliações

- Financial Planing: Personal InformetionDocumento5 páginasFinancial Planing: Personal Informetiontazin786Ainda não há avaliações

- Tutorial PFPDocumento20 páginasTutorial PFPGAW KAH YAN KITTYAinda não há avaliações

- Insurance Adil Khan 08-08-23Documento5 páginasInsurance Adil Khan 08-08-23Sachin MeenaAinda não há avaliações

- Taking Steps To Protect Your Lifestyle: Lifetime IncomeDocumento14 páginasTaking Steps To Protect Your Lifestyle: Lifetime IncomeFinancial SenseAinda não há avaliações

- FWDDocumento57 páginasFWDLawrence SagabaenAinda não há avaliações

- HDFC ERGO General Insurance Company LimitedDocumento4 páginasHDFC ERGO General Insurance Company LimitedHIMANSHU MEHTAAinda não há avaliações

- Buy Now: The Ultimate Guide to Owning and Investing in PropertyNo EverandBuy Now: The Ultimate Guide to Owning and Investing in PropertyNota: 5 de 5 estrelas5/5 (1)

- Maizy Goes On HolidayDocumento14 páginasMaizy Goes On HolidayEugene Jeffrey Von BrandisAinda não há avaliações

- Spend It!Documento23 páginasSpend It!Eugene Jeffrey Von BrandisAinda não há avaliações

- A Sparklin Space CraftDocumento11 páginasA Sparklin Space CraftEugene Jeffrey Von BrandisAinda não há avaliações

- The Haunted HouseDocumento17 páginasThe Haunted HouseEugene Jeffrey Von BrandisAinda não há avaliações

- All Trough My TownDocumento14 páginasAll Trough My TownEugene Jeffrey Von BrandisAinda não há avaliações

- MR Happy Finds A HobbyDocumento17 páginasMR Happy Finds A HobbyEugene Jeffrey Von BrandisAinda não há avaliações

- Peter The Cat I Love My White ShoesDocumento24 páginasPeter The Cat I Love My White ShoesEugene Jeffrey Von BrandisAinda não há avaliações

- Where Are You ?Documento13 páginasWhere Are You ?Eugene Jeffrey Von BrandisAinda não há avaliações

- Where's My MummyDocumento15 páginasWhere's My MummyEugene Jeffrey Von BrandisAinda não há avaliações

- I'm Not ScaredDocumento15 páginasI'm Not ScaredEugene Jeffrey Von BrandisAinda não há avaliações

- Mulla Nasiruddin and The TruthDocumento3 páginasMulla Nasiruddin and The TruthewfsdAinda não há avaliações

- The War Against Sleep - The Philosophy of Gurdjieff by Colin Wilson (1980) PDFDocumento50 páginasThe War Against Sleep - The Philosophy of Gurdjieff by Colin Wilson (1980) PDFJosh Didgeridoo0% (1)

- The Value of EquityDocumento42 páginasThe Value of EquitySYAHIER AZFAR BIN HAIRUL AZDI / UPMAinda não há avaliações

- Disadvantages of PrivatisationDocumento2 páginasDisadvantages of PrivatisationumamagAinda não há avaliações

- Turnabout AirportDocumento100 páginasTurnabout AirportBogdan ProfirAinda não há avaliações

- Dean Divina J Del Castillo and OtherDocumento113 páginasDean Divina J Del Castillo and OtheracolumnofsmokeAinda não há avaliações

- Prospero'sDocumento228 páginasProspero'sIrina DraganescuAinda não há avaliações

- The Art of Tendering - A Global Due Diligence Guide - 2021 EditionDocumento2.597 páginasThe Art of Tendering - A Global Due Diligence Guide - 2021 EditionFrancisco ParedesAinda não há avaliações

- 50Documento3 páginas50sv03Ainda não há avaliações

- Reading Literature and Writing Argument 6th Edition Ebook PDFDocumento33 páginasReading Literature and Writing Argument 6th Edition Ebook PDFsamantha.ryan702100% (33)

- Phoenix Journal 042Documento128 páginasPhoenix Journal 042CITILIMITSAinda não há avaliações

- Arvind Goyal Final ProjectDocumento78 páginasArvind Goyal Final ProjectSingh GurpreetAinda não há avaliações

- IMMI Refusal Notification With Decision Record-4Documento6 páginasIMMI Refusal Notification With Decision Record-4SHREYAS JOSHIAinda não há avaliações

- Class: 3 LPH First Term English Test Part One: Reading: A/ Comprehension (07 PTS)Documento8 páginasClass: 3 LPH First Term English Test Part One: Reading: A/ Comprehension (07 PTS)DjihedAinda não há avaliações

- General Banking LawsDocumento140 páginasGeneral Banking LawsedreaAinda não há avaliações

- Different Kinds of ObligationsDocumento13 páginasDifferent Kinds of ObligationsDanica QuinacmanAinda não há avaliações

- 3-D Secure Vendor List v1 10-30-20181Documento4 páginas3-D Secure Vendor List v1 10-30-20181Mohamed LahlouAinda não há avaliações

- 1964 Letter From El-Hajj Malik El-ShabazzDocumento2 páginas1964 Letter From El-Hajj Malik El-Shabazzkyo_9Ainda não há avaliações

- MNC diversity factors except expatriatesDocumento12 páginasMNC diversity factors except expatriatesGanesh Devendranath Panda100% (1)

- Exercise of Caution: Read The Text To Answer Questions 3 and 4Documento3 páginasExercise of Caution: Read The Text To Answer Questions 3 and 4Shantie Susan WijayaAinda não há avaliações

- The First Return To The PhilippinesDocumento28 páginasThe First Return To The PhilippinesDianne T. De JesusAinda não há avaliações

- Installation and repair of fibre optic cable SWMSDocumento3 páginasInstallation and repair of fibre optic cable SWMSBento Box100% (1)

- Varifuel2 300-190 30.45.300-190D: Technical Reference Material Created by DateDocumento1 páginaVarifuel2 300-190 30.45.300-190D: Technical Reference Material Created by DateRIGOBERTO LOZANO MOLINAAinda não há avaliações

- Admin Project1 RecuitmentDocumento18 páginasAdmin Project1 Recuitmentksr131Ainda não há avaliações

- AZ 104 - Exam Topics Testlet 07182023Documento28 páginasAZ 104 - Exam Topics Testlet 07182023vincent_phlAinda não há avaliações

- Bid for Solar Power Plant under Institute for Plasma ResearchDocumento10 páginasBid for Solar Power Plant under Institute for Plasma ResearchDhanraj RaviAinda não há avaliações

- Cross Culture Management & Negotiation IBC201 Essay TestDocumento2 páginasCross Culture Management & Negotiation IBC201 Essay TestVu Thi Thanh Tam (K16HL)Ainda não há avaliações

- History of Brunei Empire and DeclineDocumento4 páginasHistory of Brunei Empire and Declineたつき タイトーAinda não há avaliações

- Defining Corporate Social ResponsibilityDocumento12 páginasDefining Corporate Social ResponsibilityYzappleAinda não há avaliações

- 27793482Documento20 páginas27793482Asfandyar DurraniAinda não há avaliações