Escolar Documentos

Profissional Documentos

Cultura Documentos

Annual Report 2011 Marks Hand Spencer

Enviado por

ALBERTO GUAJARDO MENESESDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Annual Report 2011 Marks Hand Spencer

Enviado por

ALBERTO GUAJARDO MENESESDireitos autorais:

Formatos disponíveis

AnnuaI report and nanciaI statements 2011

UnderIying

earnings per share

~.co

+16.0%

+5.5% |53 wks

|52 wks

Marks & Spencer is one of the UK's

Ieading retaiIers. We se|| h|gh qua||ty,

great va|ue c|oth|ng and home products

aswe|| as outstand|ng qua||ty food.

Around21m||||on customers v|s|t our stores

each week and we have 78,000 emp|oyees

across the K and 42 terr|tor|es g|oba||y.

Group

revenue

UnderIying Group

prot before tax

UnderIying Group

operating prot

Group prot

before tax

'.|.

']~.

'c.~. 'c.o

+4.2%

+12.9%

+5.9% +21.9%

+2.1%

+2.8%

-2.3%

lnterim +

naI dividend

o..o+].co

=].o

+11.1%

/|o \:'

..' 'g''g's .]]

|53 wks

|53 wks

|53 wks |53 wks

|52 wks

|52 wks

|52 wks |52 wks

The statutory resu|ts for the pr|or year are for the 53 weeks

ended 3 Apr|| 2010. ln order to be ab|e to compare these w|th

th|s year`s 52 week per|od, a|| comparat|ve revenue numbers

and growth rates are stated on a 52 week bas|s on pages 1 to

37 un|ess spec|ed otherw|se. The F|nanc|a| rev|ew on page 34

exp|a|ns the ca|cu|at|on of the 52 week resu|ts |n 2009/10.

The Group a|so uses under|y|ng prot measures, wh|ch are set

out on pages 35 and 36 of the F|nanc|a| rev|ew.

ln September 2010 Kantar Wor|dpane| changed |ts research

methodo|ogy and as a resu|t h|stor|ca| market share data was

reprocessed and adjusted. The market share data used |n th|s

report |s based on these updated gures. Th|s data |s not

comparab|e to any pub||shed before September 2010.

Our UK turnover of S.7bn has a broadIy even spIit between GeneraI

Merchandise (CIothing & Home) and Food.

P30

PIan A is our eco and ethicaI programme. Our commitments

heIp us to reduce our environmentaI impact. deveIop

sustainabIe products and improve the Iives of our empIoyees.

customers. suppIiers and peopIe in our IocaI communities.

''. /

152 who||y-owned and

part|y-owned stores

209 franch|ses

We have 361 whoIIy-owned. partIy-owned and

franchised stores in 42 territories across Europe. the

MiddIe East and Asia. We are growing our lnternationaI

business presence to reduce our dependency on

theUK economic cycIe and make the M&S brand

accessibIe to more customers around the worId.

'.e..o.'

P2S

os o. 'e ''

Customers shop with us in our stores. onIine and over

the phone. However they shop. we aim to deIiver

consistentIy high IeveIs of service throughout every

transaction ~ from purchase to deIivery.

\''..e'

M&S Direct

543m sa|es |+31%

M&S D|rect |s des|gned around

customer conven|ence and

serv|ce. lt |nc|udes the M&S

webs|te, Shop Your Way and

our new mob||e-enab|ed

webs|te.

E-commerce webs|te

and mob||e web

Home cata|ogue

F|owers and w|ne

Food to order

|unchtogo

Shop Your Way

P26

P14

CIothing & Home

4.2bn sa|es |+3.9%

M&S |s the K`s |argest c|oth|ng

reta||er, w|th someth|ng for

everyone. We se|| sty||sh, h|gh

qua||ty, great va|ue c|othes for a||

ages and are the K market

|eaders |n womenswear, ||nger|e

and menswear.

Food

4.5bn sa|es |+4.1%

We are the K`s |ead|ng

prov|der of h|gh qua||ty food.

Our products range from

fresh produce and grocer|es

to |nnovat|ve part-prepared

mea|s and a range of award

w|nn|ng w|nes.

Stores

703

We have 703 stores across the

K |n h|gh streets and reta||

parks as we|| as stat|ons,

a|rports and other |ocat|ons.

Our ongo|ng store

modern|sat|on programme |s

enhanc|ng the shopp|ng

env|ronment and broaden|ng

the range of hosp|ta||ty opt|ons.

Seven piIIars

1S0 commitments

lnvo|ve our customers |n P|an A

Make P|an A how

wedobus|ness

O||mate change

Waste

Natura| resources

Fa|r partner

Hea|th & we||be|ng

P16

Read about our

Womenswear

performance

+13.3%

P04

Overv|ew

lFC About M&S

02 Oha|rman`s statement

Strategy

Performance & Marketp|ace

10 Our performance

12 Our marketp|ace

Operat|ng rev|ew

F|nanc|a| rev|ew

34 F|nanc|a| rev|ew

Governance

3S Governance overv|ew

- Oha|rman`s overv|ew

- Board of d|rectors

40 Governance report

52 Remunerat|on report

6S Other d|sc|osures

73 lndependent aud|tors` report

F|nanc|a| statements & other |nformat|on

74 Oonso||dated |ncome statement

74 Oonso||dated statement of

comprehens|ve|ncome

75 Oonso||dated statement of nanc|a| pos|t|on

76 Oonso||date statement of changes |n equ|ty

77 Oonso||dated cash ow |nformat|on

7S Notes to the nanc|a| statements

107 Oompany statement of nanc|a| pos|t|on

107 Oompany statement of changes |n

shareho|ders` equ|ty

107 Oompany statement of cash ows

10S Oompany notes to the nanc|a| statements

110 Key performance measures

111 Shareho|der |nformat|on

lBC lndex

04 Oh|ef Execut|ve`s rev|ew - Bu||d|ng on success

- Focus on K

- Mu|t|-channe|

- lnternat|ona|

- |ook|ng ahead

- Our Management Oomm|ttee

14 Our brand

16 O|oth|ng and Home

20 Food

24 Our K stores

26 Mu|t|-channe|

2S lnternat|ona|

30 P|an A

32 Our peop|e

Read about our pIan for

the future |n Oh|ef Execut|ve

Marc Bo||and`s rev|ew.

v's . 's .eoo.

v' go o.'.e

lf you haven`t a|ready tr|ed |t, v|s|t

our easy-to-use, fu||y |nteract|ve

on||ne Annua| Report. Th|s year a|one

over 3,000 shareho|ders have s|gned

up for e|ectron|c commun|cat|ons

and are now benet|ng from more

access|b|e |nformat|on and he|p|ng

the env|ronment too.

- Reasons to sign up

- lt`s a more engag|ng and |nteract|ve exper|ence

- lt`s pr|ntab|e as |nd|v|dua| pages

- lt saves paper and costs

marksandspencer.com/

annua|report 2011

P0

O

v

e

r

v

i

e

w

S

t

r

a

t

e

g

y

P

e

r

f

o

r

m

a

n

c

e

&

M

a

r

k

e

t

p

I

a

c

e

O

p

e

r

a

t

i

n

g

r

e

v

i

e

w

F

i

n

a

n

c

i

a

I

r

e

v

i

e

w

G

o

v

e

r

n

a

n

c

e

F

i

n

a

n

c

i

a

I

s

t

a

t

e

m

e

n

t

s

&

o

t

h

e

r

i

n

f

o

r

m

a

t

i

o

n

D

|

r

e

c

t

o

r

s

`

r

e

p

o

r

t

To nd out more v|s|t marksandspencer.comIannuaIreport2011

lnterim dividend

pa|d on 8 Jan 2011

o..o

FinaI dividend

to be pa|d on

15 Ju| 2011

].co

TotaI dividend

2010/11

].o

l feeI very priviIeged to be Chairman of this unique company and

at such an exciting time in our evoIution.

S|nce jo|n|ng Marks & Spencer |n October and assum|ng the ro|e of Oha|rman

|n January, l have spent much of my t|me gett|ng to know the bus|ness better

- meet|ng our emp|oyees, shareho|ders, customers and supp||ers.

l rst became deep|y |nvo|ved w|th M&S dur|ng the unso||c|ted takeover

attempt |n 2004, when l |ed the adv|sory team that he|ped put the M&S case

to |ts shareho|ders. lt was then l |earned rst hand about th|s un|que company:

about the extraord|nar||y strong re|at|onsh|p |t has w|th |ts many stakeho|ders

and about |ts very spec|a| ethos.

Th|s ethos |s a reect|on of the h|gh standards our customers expect from

M&S - trust|ng us not on|y to de||ver great va|ue, great qua||ty products but

a|so to do the r|ght th|ng - soc|a||y, env|ronmenta||y and eth|ca||y. We know

that putt|ng P|an A at the heart of how we do bus|ness |s not just the r|ght th|ng

to do; |t |s a|so fundamenta| to our |ong-term success.

Performance

ln a cha||eng|ng marketp|ace M&S has cont|nued to grow, w|th under|y|ng

prots up 12.9% on the year. We de||vered th|s by stay|ng true to our her|tage

of qua||ty and |nnovat|on, rem|nd|ng our customers what makes M&S spec|a|.

Th|s year, Marc Bo||and set out a c|ear med|um-term p|an for the bus|ness,

after extens|ve d|scuss|ons w|th co||eagues and us, the Board. Th|s|s covered

|n deta|| |n Marc`s rev|ew on page 4.

From day one, l have been struck by the pass|on and comm|tment of our

peop|e. l am de||ghted that th|s year we are pay|ng a bonus to a|| emp|oyees

tothank them for the|r energy and enthus|asm |n what has been a d|fcu|t

trad|ng env|ronment.

Dividend

We are comm|tted to de||ver|ng cons|stent returns for our shareho|ders.

Toth|s end we have adopted a progress|ve d|v|dend po||cy, w|th d|v|dends

broad|y covered tw|ce by earn|ngs. We |ntend to pay a na| d|v|dend of 10.8p

per share ||ast year 9.5p |n respect of the 2010/11 nanc|a| year.

Governance

Th|s year we returned to the trad|t|ona| governance structure of a separate

Oha|rman and Oh|ef Execut|ve, prov|d|ng c|ar|ty between Marc Bo||and and

me, w|th regard to our respect|ve ro|es. Put s|mp|y, l run the Board and Marc

runs the bus|ness.

The Board has a w|de range of respons|b|||t|es. There are three that l th|nk are

part|cu|ar|y |mportant for the success of the bus|ness: rst, to debate and

agree our strategy and ho|d the execut|ve team accountab|e for |ts execut|on;

second, to ensure that we have the most ta|ented team to execute th|s

strategy and that we p|an effect|ve|y for success|on; and th|rd, to set the tone

for governance, wh|ch |s part|cu|ar|y |mportant at M&S where 'do|ng the r|ght

th|ng` |s an |ntegra| part of our ethos.

My job |s to ensure the Board has the r|ght m|x of sk|||s and ta|ents and to

ensure that |t works effect|ve|y as a team towards shared goa|s w|th the

r|ghtm|x of enqu|ry and support of the execut|ve d|rectors from the

non-execut|ve d|rectors.

\.'s : 'oe.e.

s ve. soe'

oo. .d ' |ee'

o.v'eged o |e s

C'.. s'

. e.g e.

Robert SwanneII Oha|rman

Marks and Spencer Group pIc Annua| report and nanc|a| statements 2011

02

C'..s

see.

For more |nfo see p50

Nomination & Governance

Committee

Chair Robert Swanne||

ResponsibiIities

Recommends Board appo|ntments, rev|ews

bus|ness success|on p|ans and makes sure our

governance |s t for purpose.

OperationaI Governance

Dur|ng the year we comm|ss|oned a forma| Board eva|uat|on from an

|ndependent consu|tant, the nd|ngs of wh|ch are out||ned |n the Governance

sect|on on page 44. Th|s process h|gh||ghted the rea| enthus|asm of the

d|rectors |n support|ng a shared amb|t|on: to gu|de M&S to the very

bestfuture. We know that you expect h|gh standards from M&S; |t`s our

respons|b|||ty to |earn how we can |mprove. Th|s rev|ew was an |mportant

partof that journey.

As stated |n our 2009/10 Annua| Report, we rev|ewed the sen|or remunerat|on

structure th|s year. Fo||ow|ng extens|ve shareho|der consu|tat|on, we be||eve

we now have a framework that |s both re|evant to today`s M&S and fu||y

a||gned w|th our strategy.

The Board

Over the |ast year the Board has been strengthened by a ser|es of execut|ve

appo|ntments. ln May 2010 Marc Bo||and jo|ned the bus|ness as Oh|ef

Execut|ve, assum|ng the day-to-day runn|ng of the bus|ness from S|r Stuart

Rose |n Ju|y. ln October A|an Stewart jo|ned as Oh|ef F|nance Ofcer and |n

February we announced the appo|ntment of |aura Wade-Gery as Execut|ve

D|rector, Mu|t|-channe| E-commerce; she w||| jo|n the Board |n Ju|y. Wh||st the

Board features some new faces, these changes have taken p|ace around a

core of execut|ve and non-execut|ve d|rectors that has rema|ned stab|e over

recent years.

l wou|d ||ke to pay part|cu|ar tr|bute to S|r Stuart Rose. When he became Oh|ef

Execut|ve |n 2004, M&S was at a |ow ebb. He restored condence |n M&S,

re-estab||shed |ts va|ues and bu||t a strong bus|ness. The so||d p|atform from

wh|ch Marc |s now |mp|ement|ng h|s p|an |s a cred|t to Stuart`s energy and

t|re|ess comm|tment to M&S over the |ast seven years.

The smooth management trans|t|on - the met|cu|ous handover to me and

the support of Marc - |s a|so a cred|t to Stuart. ln that connect|on, l wou|d

a|so ||ke to thank S|r Dav|d M|che|s, and the Nom|nat|ons & Governance

Oomm|ttee he |ed, for manag|ng a change of |eadersh|p over the past year

that was accomp||shed qu|et|y and effect|ve|y. Dav|d has dec|ded to step

down from the Board at the end of h|s second term |n February 2012, but

l am de||ghted that he w||| cont|nue h|s ro|e as Deputy Oha|rman unt|| then.

l must a|so thank |ou|se Patten for the s|gn|cant contr|but|on she has made

over the |ast ve years, p|ay|ng an |mportant ro|e |n each of our Board

Oomm|ttees. As |ou|se reaches the end of her second three year term on

the Board, she has dec|ded not to seek re-e|ect|on at the upcom|ng AGM.

Looking ahead

Our pr|or|t|es for the year ahead are c|ear. We have a p|an and |t |s now our

co||ect|ve job to make |t happen. The Board w||| concentrate on de||ver|ng

exemp|ary governance at the h|ghest |eve| to enab|e our execut|ve team to

dr|ve th|s strategy forward.

The economy st||| g|ves us reason to be caut|ous. Yet |n d|fcu|t t|mes, our

core va|ues of Qua||ty, va|ue, Serv|ce, lnnovat|on and Trust matter more than

ever to M&S customers. These va|ues rema|n at the heart of our strategy and

ltherefore |ook forward to the future w|th condence.

Robert Swanne||

Oha|rman

How we're governed

Group Board

The Board monitors what management

are doing. hoIding them accountabIe for

performance against our targets and

standards and chaIIenging their thinking

to make sure we are on the right track.

Execut|ve Board

Management

Oomm|ttee

Property Board

Oustomer lns|ght n|t

How We Do Bus|ness

Oomm|ttee

Bus|ness lnvo|vement

Group

F|re, Hea|th and Safety

Oomm|ttee

Bus|ness Oont|nu|ty

Oomm|ttee

For more |nfo see p40

For more |nfo see p51

Audit Committee

Chair Jeremy Darroch

ResponsibiIities

Mon|tors the |ntegr|ty of nanc|a| statements

and rev|ews effect|veness of |nterna| contro|s,

r|sk management and aud|t.

For more |nfo see p52

Remuneration Committee

Chair Steven Ho|||day

ResponsibiIities

Recommends remunerat|on strategy and

framework to recru|t, reta|n and reward sen|or

execut|ves for the|r |nd|v|dua| performance.

O

v

e

r

v

i

e

w

S

t

r

a

t

e

g

y

P

e

r

f

o

r

m

a

n

c

e

&

M

a

r

k

e

t

p

I

a

c

e

O

p

e

r

a

t

i

n

g

r

e

v

i

e

w

F

i

n

a

n

c

i

a

I

r

e

v

i

e

w

G

o

v

e

r

n

a

n

c

e

F

i

n

a

n

c

i

a

I

s

t

a

t

e

m

e

n

t

s

&

o

t

h

e

r

i

n

f

o

r

m

a

t

i

o

n

To nd out more v|s|t marksandspencer.comIannuaIreport2011 D|rectors` report

03

ln 2010I11 we deIivered a good performance with saIes up 4.2%.

ln chaIIenging trading conditions we grew our market share in

both CIothing and Food. We did this by continuing to offer great

quaIity and vaIue ~ as weII as innovative new products ~ every time

customers shopped with us.

S|nce jo|n|ng Marks & Spencer l have |mmersed myse|f |n the bus|ness. l`ve

v|s|ted our stores to meet our customers and our emp|oyees. l have seen rst

hand the strength of our re|at|onsh|ps w|th our supp||ers and the |engths we

go to together to make M&S tru|y spec|a|; from respons|b|y sourc|ng the nest

qua||ty |ngred|ents to p|oneer|ng new techno|og|es to meet our customers`

chang|ng needs.

Our bus|ness |s |n good shape and we have strong foundat|ons on wh|ch

tobu||d. ln November l set out our p|an to grow M&S through evo|ut|on

notrevo|ut|on.

We have started by focus|ng on our K bus|ness - enhanc|ng the env|ab|e

strength of our brand, |mprov|ng our core offer of O|oth|ng, Home and Food

and mak|ng our stores eas|er to shop. Over the rst three years we are a|so

deve|op|ng what l ca|| our bu||d|ng b|ocks for our future. We are:

lncreas|ng our K space growth, w|th the a|m of reduc|ng dr|ve t|mes

for our customers.

Bu||d|ng our mu|t|-channe| capab|||t|es to create best |n c|ass operat|ons

that support our growth amb|t|ons.

Becom|ng a more |nternat|ona| company w|th a more g|oba| out|ook

and |nternat|ona| capab|||t|es.

Our a|m |s to make M&S a tru|y |nternat|ona|, mu|t|-channe| reta||er -

access|b|e to even more customers around the wor|d. S|x months |n and

weare a|ready bu||d|ng momentum |n the de||very of our p|an.

''d.g

o. sess

. s o gve

soe.s o.e

'oe eve. e

'e s'oo .' s.

Marc BoIIand Oh|ef Execut|ve Ofcer

Our PIan 2013-2015

By 2015

2010-2013

os o. ''

K space and

||ke-for-||ke growth

Dr|ve K

||ke-for-||ke growth

A |ead|ng K

mu|t|-channe| reta||er

lnternat|ona|

mu|t|-channe| reta||er

lnternat|ona|

company

Dr|ve |nternat|ona|

presence

- Brand

- O|oth|ng

- Home

- Food

- Stores

Marks and Spencer Group pIc Annua| report and nanc|a| statements 2011

04

Oh|ef Execut|ve`s rev|ew

Conran ExcIusive Design onIy

atM&S Th|s partnersh|p w||| form the

bas|s of our 'Oontemporary` home

offer, prov|d|ng customers w|th the

qua||ty and va|ue they expect from

M&S, coup|ed w|th the un|que Oonran

des|gn s|gnature.

lnvestment in our

UK business by 2013I14

Focus on UK revenue growth

by 2013I14

'o

']].|.

S

t

r

a

t

e

g

y

F

i

n

a

n

c

i

a

I

s

t

a

t

e

m

e

n

t

s

&

o

t

h

e

r

i

n

f

o

r

m

a

t

i

o

n

G

o

v

e

r

n

a

n

c

e

F

i

n

a

n

c

i

a

I

r

e

v

i

e

w

O

p

e

r

a

t

i

n

g

r

e

v

i

e

w

P

e

r

f

o

r

m

a

n

c

e

&

M

a

r

k

e

t

p

I

a

c

e

O

v

e

r

v

i

e

w

D|rectors` report

05

Focus on UK Our immediate priority is the enhancement of our

capabiIities in the UK. We wiII achieve this through deveIoping the

M&S brand. improving our stores and focusing on our CIothing.

Home and Food businesses.

Brand

Together w|th our peop|e, the M&S brand |s one of our strongest assets -

reected by the extraord|nary trust our customers p|ace |n |t. But what makes

M&S tru|y spec|a| |s be|ng spec|a|. lf you |ook back |nto our h|story we have

been successfu| by do|ng th|ngs d|fferent|y and not by copy|ng others.

We have a|ways |nvested |n |nnovat|on but we have not a|ways shouted about

|t. So |n November we |aunched our new brand pos|t|on|ng - 'On|y at Your

M&S` - to sh|ne a ||ght on the 'h|dden treasures` across our ranges. F|rst used

|n our January advert|s|ng, 'On|y at Your M&S` has made us ra|se the bar for

|nnovat|on, creat|ng a new benchmark - constant|y ask|ng ourse|ves 'ls th|s

good enough?`

'On|y at Your M&S` |s now the key message of our market|ng campa|gns.

Further deta||s of our brand strategy are set out by Steve Sharp on page 14.

CIothing

M&S |s the K`s |ead|ng c|oth|ng reta||er and th|s year we extended our

|ead, grow|ng market share across a|| areas. Sa|es |ncreased by 4.2%.

Th|s performance was dr|ven by offer|ng more cho|ce, exce||ent qua||ty

and appropr|ate adaptat|ons of the year`s key sty|es - a|| at great M&S va|ue.

We de||vered except|ona| performances |n ||nger|e and Menswear as

deta||ed by Kate Bostock on page 16.

We are bu||d|ng on th|s market |ead|ng pos|t|on by strengthen|ng our sty|e

credent|a|s and mak|ng our c|oth|ng ranges eas|er to shop. Our customers

have to|d us they nd the pos|t|on|ng of M&S c|oth|ng and our sub-brands

unc|ear. We know the h|gh |eve|s of qua||ty and un|que |nnovat|ons that ex|st |n

our core range are not a|ways not|ced by our customers. So we are re|aunch|ng

our core M&S c|oth|ng, mak|ng |t a brand |n |ts own r|ght and promot|ng the

range`s sty|e, |nnovat|ons and P|an A credent|a|s.

We are a|so deve|op|ng our sub-brands to g|ve them the|r own d|st|nct

|dent|t|es. W|th the support of ded|cated brand managers, we are turn|ng them

from '|abe|s` to rea| brands that w||| trans|ate |nternat|ona||y.

Home

ln our Home bus|ness, sa|es were up 1.6% desp|te d|fcu|t trad|ng cond|t|ons.

As customers |mproved and updated the|r homes rather than move, we saw

good sa|es |n accessor|es and soft furn|sh|ngs.

W|th on|y 20% of our customers shopp|ng |n Home, we have a rea| opportun|ty

to grow th|s bus|ness further. Our p|an |s to offer greater cho|ce and make

our core Home offer more access|b|e |n |arger stores and on||ne. We are

a|so mak|ng |t eas|er to shop - d|v|d|ng our offer |nto O|ass|c, Oontemporary

and Des|gn categor|es so that customers can eas||y |dent|fy wh|ch ||festy|e

best ts them. Our w|thdrawa| from Techno|ogy |s enab||ng us to focus on

growth departments such as k|tchenware and bedd|ng. We are a|ready

bu||d|ng momentum through our exc|t|ng new des|gn co||aborat|on w|th

S|r Terence Oonran.

Trad|ng up to qua||ty Our 'Good`, 'Better` and 'Best`

ph||osophy offers a breadth of pr|ce po|nts. As

customers managed the|r budgets carefu||y th|s year

they |nvested |n qua||ty. |ast year the strongest

performers |n |ad|es footwear were our 'Good` ranges,

but th|s year our 'Best` ranges were the most popu|ar,

w|th sa|es up 126%.

Marks and Spencer Group pIc Annua| report and nanc|a| statements 2011

06

Oh|ef Execut|ve`s rev|ew

''d.g

o. sess

cont|nued

Food

Our Food bus|ness cont|nues to grow, w|th sa|es up 4.1% th|s year. Trust|ng |n

our qua||ty, customers cont|nued to turn to us for |nnovat|ve products,

recogn|s|ng the great va|ue M&S offers. Desp|te ||tt|e space growth we have

ga|ned market share th|s year. Deta||s of our performance are out||ned by John

D|xon on page 20.

We are grow|ng our Food bus|ness by focus|ng on our core strengths of

freshness, spec|a||ty and conven|ence. Bu||d|ng on our her|tage of qua||ty and

|nnovat|on we are d|fferent|at|ng ourse|ves from the supermarkets, better

showcas|ng our |atest products to customers through 'D|ne ln` promot|ons.

ln ||ne w|th 'On|y at Your M&S` we are reduc|ng the number of non-M&S

branded ||nes from 400 to around 100. Better space p|ann|ng |n our Food Ha||s

|s enab||ng us to g|ve customers more cho|ce - |ncreas|ng our range to |nc|ude

more new M&S product ||nes, as we|| as 100 d|st|nct|ve |nternat|ona| brands

that w||| be exc|us|ve to M&S |n the K.

We cont|nue to prov|de great va|ue on our core ||nes, |mprov|ng the qua||ty

w|thout |ncreas|ng the pr|ces.

UK stores

Th|s year we began work to make our stores eas|er to shop. We have started

by better segment|ng our stores accord|ng to |oca| demograph|cs. Th|s he|ps

us ensure we are offer|ng the opt|ma| product m|x for each and every

customer pro|e and a||ocat|ng the r|ght space |n store to |nd|v|dua| ranges

and products.

We are a|so |mprov|ng the way customers can nd th|ngs |n our stores, w|th

anew, c|earer s|gnage scheme. Oustomers w||| start to see the changes from

September 2011. Th|s w||| be supported by a new cons|stent packag|ng

arch|tecture across O|oth|ng, Home and Food. Our a|m |s to create a better

and more |nsp|r|ng shopp|ng env|ronment, wh|ch encourages our customers

to shop across our d|fferent departments.

UK space growth Though we have 703 stores in Iocations across

the UK. in recent years we have Iagged behind the retaiI market

interms of space growth.

Our a|m |s for 95% of the K popu|at|on to be w|th|n a 30 m|nute dr|ve of

a fu||-||ne M&S store by 2015. To ach|eve th|s we have comm|tted to de||ver|ng

space growth of 3% per annum unt|| 2015/16.

As part of th|s space growth programme, we w||| a|so |ncrease the number of

S|mp|y Food stores, ta||or|ng them to meet the needs of the|r |oca| customers.

Grow|ng our presence across the K w||| he|p us max|m|se the opportun|ty

presented by our Shop Your Way serv|ce, creat|ng even more conven|ent

customer co||ect|on po|nts.

Susta|nab|e |earn|ng store Bu||t on a former browne|d

s|te, our new eco-|earn|ng store |n at Ecc|esa|| Road,

Shefe|d |ncorporates a host of |nnovat|ve features.

Harvested ra|nwater reduces water costs by 40% and

expe||ed warmth from refr|gerat|on un|ts heats the

store, reduc|ng carbon output by 20%. A sedum roof

and green '||v|ng wa||` a|so create w||d||fe hab|tats.

Award w|nn|ng w|nes M&S was awarded W|ne

Supermarket of the Year at the lnternat|ona| W|ne

Oha||enge 2010 for the th|rd year |n a row: someth|ng

no other reta||er has ach|eved. Our |n-store w|ne

adv|ser programme, W|ne D|rect webs|te and tast|ng

events a|| came |n for h|gh pra|se. Our env|ronmenta|

|n|t|at|ves such as the convers|on of our sma|| g|ass

bott|esto p|ast|c were a|so acknow|edged, not to

ment|on our fantast|c range of un|que|y b|ended

award-w|nn|ng w|nes.

MuIti-channeI M&S has buiIt a strong MuIti-channeI business.

SaIes in our M&S Direct business have increased by 31% to 543m

and Shop Your Way has grown in popuIarity. with customers now

abIe to pIace orders via the mobiIe web. as weII as in stores. onIine

or by phone for deIivery to their choice of address or IocaI store.

Our partnersh|p w|th Amazon has worked we|| but g|ven the sca|e of our

mu|t|-channe| amb|t|ons, we w||| end our agreement w|th Amazon when

|t exp|res |n 2013/14. We are now creat|ng our own |nternat|ona| webs|te

p|atform, capab|e of se|||ng |n mu|t|p|e countr|es |n |oca| currency. Our rst

fu||y transact|ona| |nternat|ona| s|te w||| |aunch to the French market at the

end of 2011.

Through our space growth programme, we are creat|ng a store portfo||o

thatw||| enab|e us to de||ver a |ead|ng mu|t|-channe| shopp|ng exper|ence

throughout the K. We are extend|ng Shop Your Way further and cont|nue

to|ead the way |n deve|op|ng new channe|s such as mob||e techno|ogy,

touchscreens and product persona||sat|on on the web.

The appo|ntment of |aura Wade-Gery, as Execut|ve D|rector Mu|t|-channe|

E-commerce, reects the |mportance of mu|t|-channe| |n our overa|| growth

strategy for M&S.

lnternationaI Despite operating in some chaIIenging markets.

ourlnternationaI business deIivered a strong performance with

saIes up 6.1%. The detaiIs of our 2010I11 performance are set out

on page 2S.

Though we have 361 stores |n 42 terr|tor|es, M&S has essent|a||y been

aKreta||er that exports. Over the next three years, we w||| become a tru|y

|nternat|ona| company - bu||d|ng an organ|sat|ona| structure w|th a more

g|oba| out|ook and |nternat|ona| capab|||t|es.

We now have a c|ear strategy for market entry. We w||| avo|d 'ag p|ant|ng` and

w||| |nstead adopt the appropr|ate ownersh|p mode|s for each market, a|m|ng

to bu||d a |eadersh|p pos|t|on wherever we operate. We are focus|ng on a

number of pr|or|ty markets |n Europe, the M|dd|e East, lnd|a and Shangha|.

Th|s |s the |og|ca| route and w||| enab|e us to take fu|| advantage of ex|st|ng

M&S brand awareness and d|str|but|on |nfrastructure.

TotaI investment in our

muIti-channeI capabiIities

by2013I14

TotaI investment in our

internationaI capabiIities

MuIti-channeI revenue

growth by 2013I14

lnternationaI revenue

growth by 2013I14

']

']

''

''

M&S Home Our Home sourcebook

prov|ded |nsp|rat|on to over 1.6 m||||on

customers. The most recent ed|t|on

featured photography of beaut|fu||y-sty|ed

roomsets to showcase our products |n a

||festy|e context.

Shop Your Way Th|s year we ce|ebrated

the rst ann|versary of the fu|| Shop

Your Way ro||-out. Th|s serv|ce |s now

ava||ab|e |n 444 stores across the K.

Pr|or|ty markets The Shangha| reg|on |n Oh|na

|s a pr|or|ty market for M&S and we are focused

on bu||d|ng our presence here w|th four stores

and p|ans for another two conrmed.

Ournewest store - |n Oentury Or|enta| P|aza,

N|ngbo - opened |n January 2011.

S

t

r

a

t

e

g

y

F

i

n

a

n

c

i

a

I

s

t

a

t

e

m

e

n

t

s

&

o

t

h

e

r

i

n

f

o

r

m

a

t

i

o

n

G

o

v

e

r

n

a

n

c

e

F

i

n

a

n

c

i

a

I

r

e

v

i

e

w

O

p

e

r

a

t

i

n

g

r

e

v

i

e

w

P

e

r

f

o

r

m

a

n

c

e

&

M

a

r

k

e

t

p

I

a

c

e

O

v

e

r

v

i

e

w

To nd out more v|s|t marksandspencer.comIannuaIreport2011 D|rectors` report

07

|aura Wade-Gery w||| be jo|n|ng the bus|ness on 4 Ju|y 2011

as Execut|ve D|rector, Mu|t|-channe| E-commerce.

lnvesting in our pIan To deIiver our pIan we wiII make an additionaI

capitaI investment of S50m to 900m over the next three years.

Th|s |nvestment w||| strengthen our K bus|ness and he|p bu||d both our

mu|t|-channe| and |nternat|ona| capab|||t|es. lt w||| be funded by our ex|st|ng

cash ows and we are condent |t w||| de||ver benets for the bus|ness and

ourshareho|ders.

We are bu||d|ng an efc|ent bus|ness - acce|erat|ng our programme to

restructure the M&S supp|y cha|n and dr|v|ng out |nefc|enc|es. Further deta||s

of our |nvestment and expected returns are exp|a|ned by A|an Stewart |n the

F|nanc|a| rev|ew on page 34.

PIan A M&S is a Ieader in the eId of sustainabiIity and PIan A

~ our eco and ethicaI pIan ~ continues to set us apart.

lt makes us a more efc|ent bus|ness too, and |n 2010/11 P|an A generated

a net benet of over 70m.

Our a|m |s to become the wor|d`s most susta|nab|e major reta||er by 2015.

Th|s year we have cont|nued to dr|ve P|an A throughout the bus|ness and

make |t more re|evant to our customers w|th new |n|t|at|ves, such as our

'OneDay Wardrobe O|ear-out`, wh|ch has ra|sed over 2.2m for Oxfam.

Our Management Committee

Marc BoIIand

Oh|ef Execut|ve Ofcer

Steven Sharp

Execut|ve D|rector, Market|ng

John Dixon

Execut|ve D|rector, Food

Amanda MeIIor

Group Secretary and Head

of Oorporate Governance

AIan Stewart

Oh|ef F|nance Ofcer

Kate Bostock

Execut|ve D|rector,

Genera| Merchand|se

One Day Wardrobe O|ear-out The events he|d |n

September and March attracted around 300,000

extra customers |nto our stores, donat|ng more than

750,000 |tems of c|oth|ng to Oxfam.

Supp|y cha|n Our new d|str|but|on centre |n Bradford

opened |n Ju|y. The |argest warehouse |n our network,

and one of the b|ggest |n the K, |t supp||es a|| our stores

w|th furn|ture, store equ|pment and amb|ent food.

When fu||y operat|ona| |t w||| emp|oy 1,200 peop|e.

Marks and Spencer Group pIc Annua| report and nanc|a| statements 2011

0S

Oh|ef Execut|ve`s rev|ew

''d.g

o. sess

cont|nued

Do Your Th|ng ln Apr|| we |aunched our rst ever

standa|one k|ds` mu|t|-med|a ad campa|gn |n

partnersh|p w|th lTv and |con|c fash|on photographer

Rank|n. The nat|onw|de compet|t|on a|ms to nd four

ta|ented young peop|e to be the faces of our next

autumn/w|nter k|dswear campa|gn.

The M&S team lt's not just the products that make M&S speciaI.

it's the peopIe.

l`m a great be||ever |n teamwork and we have an exce||ent team |n p|ace

atM&S. Our job now |s to work together and put our p|an |nto act|on.

l wou|d ||ke to take th|s opportun|ty to thank a|| of my co||eagues for the|r hard

work th|s year. The more of our emp|oyees l meet, the more |mpressed

l am w|th the|r enthus|asm and comm|tment to the bus|ness.

Looking ahead ln 2011I12 we expect trading conditions to be

chaIIenging due to rising pressure on consumers' disposabIe

incomes and higher commodity prices. As a resuIt. we are

cautious about the outIook.

Wh||e the short-term econom|c out|ook rema|ns cha||eng|ng, we are

condent |n the |ong-term growth prospects of the bus|ness. ln a c||mate

ofeconom|c uncerta|nty, our pr|or|ty rema|ns to de||ver except|ona| va|ue

andunr|va||ed qua||ty.

We w||| cont|nue to focus on de||ver|ng aga|nst our p|an, ensur|ng that - as we

grow - we cont|nue to meet and exceed our customers` expectat|ons,

|nvest|ng |n the |nnovat|on that sets M&S apart.

Marc Bo||and Oh|ef Execut|ve Ofcer

Tanith Dodge

D|rector of Human Resources

Andrew Skinner

GM Merchand|s|ng D|rector

CIem Constantine

D|rector of Property

Dominic Fry

D|rector of Oommun|cat|ons

and lnvestor Re|at|ons

Steve Rowe

D|rector of Reta||

DarreII Stein

D|rector of lT and |og|st|cs

Nayna Mclntosh

D|rector of Store Market|ng

and Des|gn

Jan Heere

D|rector of lnternat|ona|

S

t

r

a

t

e

g

y

F

i

n

a

n

c

i

a

I

s

t

a

t

e

m

e

n

t

s

&

o

t

h

e

r

i

n

f

o

r

m

a

t

i

o

n

G

o

v

e

r

n

a

n

c

e

F

i

n

a

n

c

i

a

I

r

e

v

i

e

w

O

p

e

r

a

t

i

n

g

r

e

v

i

e

w

P

e

r

f

o

r

m

a

n

c

e

&

M

a

r

k

e

t

p

I

a

c

e

O

v

e

r

v

i

e

w

To nd out more v|s|t marksandspencer.comIannuaIreport2011 D|rectors` report

09

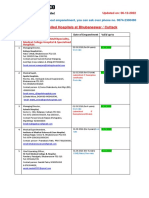

Financial performance

Drive UK space growth

Performance against our plan

Group revenue

'.|.

+2.1% (53 wks)

+4.2% (52 wks)

-2.3% (53 wks)

+5.9% (52 wks)

Underlying Group operating prot

'c.~.

UK market share clothing and footwear UK market share food

Value

]]./

Volume

]../

./

+0.5%pts +0.3%pts +0.1%pts

Focusing on the UK

Analysis This year we grew market share across all areas of our clothing

business, as we offered customers greater choice at the same unrivalled

quality and value. More information on our clothing performance is set out

on page 16.

5o|ce. |an|a| Ho||ooane| C|o|||ng ano /oo|wea| s|a|e 52 w/e 17 /o||| 2011

Analysis Our food market share increased this year as customers did more

of their shopping with M&S, recognising the great value and quality we offer.

Our performance in this area is detailed on page 20.

5o|ce. |an|a| Ho||ooane| Fooo ano D||n| s|a|e 52 w/e 17 /o||| 2011

P16

Annual space growth

].~/

Analysis This year we have set out a commitment

to deliver c.3% UK space growth per annum

until2015/16. This programme will help us

createa store portfolio that delivers a leading

multi-channel shopping experience.

Average weekly footfall

..

-0.3%

Analysis Customer visits to our stores were broadly stable in 2010/11.

Concerns about rising petrol prices meant footfall slowed slightly in the

second half of the year. However, we remained ahead of the overall market

gure of -1.4%.

20.7m

21.0m

21.6m

21.8m

10/11

09/10

08/09

07/08

824.9m

843.9m

768.9m

1,089.3m

10/11

09/10

08/09

07/08

m 07/08 08/09 09/10 10/11

UK 8,309.1 8,164.3 8,567.9 8,733.0

International 712.9 897.8 968.7 1,007.3

Total 9,022.0 9,062.1 9,536.6 9,740.3

m 07/08 08/09 09/10 10/11

UK 972.9 652.8 701.2 677.9

International 116.4 116.1 142.7 147.0

Total 1,089.3 768.9 843.9 824.9

UK mystery shopping programme

Average score is

c/

Analysis In April 2010 we rebased our mystery shopping scores to help us target even

higher standards of customer service. This year we conducted around 6,800 visits to

stores and have seen a steady improvement in performance over the course of the

year, with average scores increasing by 11%.

70

75

80

85

90

Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar

83

78

79

76 76

74

72

77

79

81

82

79

In November 2010 we set out plans to invest an

additional 850m to 900m over the next three

years to enhance our UK business and develop

our multi-channel and international capabilities.

As a result, we have set a target to grow Group

revenue to between 11.5bn and 12.5bn

by2013/14.

Marks and Spencer Group plc Annual report and nancial statements 2011

10

.

oe.|o..e

Underlying Group prot before tax

M&S Direct sales*

Percentage of population within a 30 minute

drive of a full line store

International sales*

Improve carbon efciency

in tonnes CO

2

e per 1,000 sq ft of salesoor

Improve store energy efciency

in kWh per sq ft of salesoor

Send no operational waste to landll

in tonnes

543m

93%

1,007.3m

Becoming a leading multi-channel retailer

Building an international company

Making Plan A how we do business

Group prot before tax

09/10 702.7m

08/09 706.2m

07/08 1,129.1m

09/10 694.6m

08/09 604.4m

07/08 1,007.1m

09/10 33.0p

08/09 28.0p

07/08 43.6p

09/10 413m

08/09 324m

07/08 220m

09/10 949.4m

08/09 897.8m

07/08 712.9m

Underlying earnings per share

Analysis Our Multi-channel business continues to grow as we introduce

new and more convenient ways to shop with M&S. This year we announced

plans to invest 150m in our multi-channel capabilities and have targeted

sales growth of 300m to 500m by 2013/14.

* 52 week comparative

Analysis Under our space growth programme, our aim is for 95% of the

population to be within a 30 minute drive of a full line store by 2015. Thiswill

help to ensure we can deliver a leading multi-channel shopping experience

throughout the UK.

Analysis Over the next three years we will invest 150m to strengthen

our international capabilities and make M&S a truly international company.

In line with these plans we have set a target to increase International sales

by 300 to 500m by 2013/14.

* 52 week comparative

Store, ofce, warehouse, business travel and logistics carbon dioxide

emissions in tonnes CO

2

e per 1,000 sq ft of salesoor. Residual emissions

will be offset by 2012.

Why carbon efciency? Improving carbon efciency reduces greenhouse

emissions and costs.

Store energy usage in kWh/sq ft of salesoor

Why energy efciency? Improving energy efciency reduces costs and

helps to meet the requirements of new legislation effective from 2011.

Waste sent to landll from M&S stores, ofces and warehouses in tonnes.

Why no waste to landll? Sending no waste to landll will reduce costs in the

longer term and help reduce carbon emissions.

P26

P28

P30

714.3m

+2.8% (53 wks)

+12.9% (52 wks)

+11.1% (53 wks)

+21.9% (52 wks)

+5.5% (53 wks)

+16.0% (52 wks)

780.6m 34.8p

+31%

The statutory results for the prior year are for the 53 weeks ended 3 April

2010. In order to be able to compare these with this years 52 week period,

where appropriate, the 52 week comparative results have been stated.

The Financial review on page 35 explains the calculation of the 52 week

results in 2009/10. The underlying prot measures are consistent with

how the underlying business is measured internally. For more details see

page 36 of the Financial review.

+6.1%

2006/07

51

2012 target

0

2010/11

38

Improvement

25%

2006/07

67.9

2012 target

51

2010/11

52

Improvement

23%

2008/09

69,000

2012 target

0

2010/11

5,000

Improvement

93%

S

t

r

a

t

e

g

y

O

p

e

r

a

t

i

n

g

r

e

v

i

e

w

F

i

n

a

n

c

i

a

l

r

e

v

i

e

w

G

o

v

e

r

n

a

n

c

e

F

i

n

a

n

c

i

a

l

s

t

a

t

e

m

e

n

t

s

&

o

t

h

e

r

i

n

f

o

r

m

a

t

i

o

n

P

e

r

f

o

r

m

a

n

c

e

&

M

a

r

k

e

t

p

l

a

c

e

O

v

e

r

v

i

e

w

To nd out more visit marksandspencer.com/annualreport2011 Directors report

11

In June 2010 we established our

Consumer Barometer. Our CIU now

conducts a monthly online survey of a

changing sample of 4,000 people,

comprising non-M&S customers as well

as those who shop with us. We ask them a

range of questions: from how they feel

about their lives to spending patterns and

future plans. We complement these

ndings with additional qualitative

research from a smaller group, which

provides us with more detailed insights.

This information helps ensure customers

are at the heart of all our business

decisions and this section shares some of

what our CIU has told us this year.

Market overview

2010/11 was another challenging year for

retailers and consumer condence

remained fragile. Following a sharp

slowdown and then recovery during 2009,

condence levels have uctuated over the

last 12 months, as illustrated in the index

opposite.

This fragility was driven by a prevailing

sense of uncertainty. As we moved

towards 2011, consumers became

increasingly cautious about the economic

outlook as they considered the potential

implications of the new Governments

spending cuts, VAT increases and rising

fuel prices.

Our Consumer Barometer shows

optimism is more buoyant, with

consumers showing a determination to

stay positive in the face of adversity.

Though the Governments austerity

measures were widely anticipated and, in

the main viewed as necessary, consumers

reacted differently according to age. Mid

age groups felt their budgets have been

most squeezed, with families feeling there

was little room left for manoeuvre.

Pressure on household budgets meant

consumers remained selective in their

spending determined to take control and

prioritise the things that matter to them

most. In this climate consumers turned

tothe brands they trust seeking the

reassurance that they are making sound,

quality purchases.

Clothing

This year the overall clothing market

remained broadly stable. There was

growth in the mid-market, but the top end

and value sectors suffered, as customers

sought out affordable quality,

demonstrating they were prepared to

trade up. They adopted a buy once, buy

well attitude preferring to invest in quality

pieces they know will last.

At the same time, restricted budgets

meant consumers wanted retailers to

inspire them to spend on their wardrobe.

They searched for something new and

exciting to update their look and make

them feel special. Customers were

prepared to build their wardrobe with great

quality staples, like knitwear and denims.

However, they wanted clothing with a point

of difference; complementary to their

existing wardrobe but not multiple

versions of what they already owned.

Responding to this, we delivered unique

innovations and the latest styles. High

impact advertising campaigns and strong

visual merchandising helped attract

customers, adding interest and excitement

and conrming in their minds that M&S

offered great quality, exclusive products.

To give customers more of what they want we must understand the

way they think and how they behave. Our Customer Insight Unit (CIU)

uses a combination of customer analytics and research feedback

to spot trends and examine the issues that affect our customers and

the decisions they make.

Killer heels that dont kill

OurInsolia

footwear technology

helps you to dance the night away by

reducing the pressure on your feet.

Ourlatest advertising campaign

highlighted this M&S point of

difference and sales of Insolia

increased 186%.

Building the basics Good quality wardrobe staples

performed well this year as customers invested in

products that last.

Marks and Spencer Group plc Annual report and nancial statements 2011

12

. .'eo'e

Home

The housing market remained slow for the

third consecutive year. Consumers chose

to spruce up their homes rather than

move, updating looks using elements

such as cushions, bedding, towels and

smaller accessories. Big ticket furniture

items were less sought after. We

responded with more innovation, more

colour and more contemporary inuences,

adding less expensive items to our ranges

for quick and easy updates.

Food

The food market has been slow this year,

with the majority of growth coming

through price ination. Supermarkets

engaged in heavy discounting to draw

customers from each other. However,

though price remained a consideration,

consumers were not enticed by the

concept of cheap food. Instead they

wanted to feel as though they were

getting a good deal on quality food.

After more than two years of austerity

consumers wanted to treat themselves,

especially on important occasions like

Christmas and Valentines Day. Food was

seen as an affordable treat, with more

indulgent products such as steaks and

desserts proving popular.

At M&S we continued to differentiate

ourselves from the supermarkets by

constantly offering innovation through

introducing numerous new and updated

lines. We also used bigger promotions,

such as our Roast Dinner for 5, to help

our customers get more of the food they

love at great value.

Multi-channel

The market expanded rapidly this year,

with new transactional websites appearing

through media such as Facebook and

new players entering the online market.

Customers no longer regard e-commerce

as new technology; consequently their

expectations are high and they expect to

be able to access brands at any time of

day from any location. Shoppers are

looking for an enhanced buying

experience, not just a solution to a

problem.

This year we used our website to engage

new customers, showcase more product

and run unique promotions. The

introduction of our mobile web and the

increased exibility of Shop Your Way

made our products even more accessible

to customers.

Future trends

Throughout the year customers told us

that if they are going to spend they want

their money to be well spent on brands

that they trust. We expect this to continue,

with customers seeking out meaningful

purchases that make a difference to their

lives.

In an uncertain environment, shoppers are

looking for condent retailers who will

deliver choice, quality, value and something

extra special. Our Only at Your M&S

messaging will reinforce our authority,

showcase our innovations and differentiate

us further from the competition.

Treat yourself This Valentines Day over 500,000

couples enjoyed a romantic night in with our gourmet

Dine In menu.

Move not improve Customers turned to M&S for

on trend accessories to brighten their homes.

-45

10

-40

-35

-30

-25

-20

-15

-10

-5

0

5

Consumer condence index (GfK)

0

4

J

u

n

S

e

p

D

e

c

J

u

n

S

e

p

D

e

c

J

u

n

S

e

p

D

e

c

J

u

n

S

e

p

D

e

c

J

u

n

S

e

p

D

e

c

J

u

n

S

e

p

D

e

c

J

u

n

S

e

p

D

e

c

1

1

M

a

r

1

0

M

a

r

0

9

M

a

r

0

8

M

a

r

0

7

M

a

r

0

6

M

a

r

0

5

M

a

r

S

t

r

a

t

e

g

y

O

p

e

r

a

t

i

n

g

r

e

v

i

e

w

F

i

n

a

n

c

i

a

l

r

e

v

i

e

w

G

o

v

e

r

n

a

n

c

e

F

i

n

a

n

c

i

a

l

s

t

a

t

e

m

e

n

t

s

&

o

t

h

e

r

i

n

f

o

r

m

a

t

i

o

n

P

e

r

f

o

r

m

a

n

c

e

&

M

a

r

k

e

t

p

l

a

c

e

O

v

e

r

v

i

e

w

To nd out more visit marksandspencer.com/annualreport2011 Directors report

13

Our campaigns

As customers rema|ned caut|ous about

the|r spend|ng, we worked hard to g|ve

them a reason to keep shopp|ng w|th us.

Through our c|oth|ng advert|s|ng we

h|gh||ghted the seasons` key trends,

co|ours and cuts |n an upbeat, fresh and

|nsp|r|ng way. Our ||ne-up of Tw|ggy, Dann||

M|nogue, Ana Beatr|z Barros, vv Brown

and ||sa Snowdon showed the broad

appea| of M&S c|oth|ng, demonstrat|ng

how our sty|es can work for every age

group. An add|t|ona| 1.8 m||||on customers

were attracted |nto store by the fash|ons

showcased |n our autumn campa|gn and

the featured ||nes were among our best

se|||ng |tems.

|ast year we took M&S Food back |nto the

heart of fam||y ||fe, w|th a campa|gn fronted

by actress Oaro||ne Quent|n. Oustomers

responded we|| to the warm and |nc|us|ve

tone of the advert|s|ng and the focus on

great va|ue honest food.

Our spr|ng campa|gn |aunched w|th a

renewed focus on the product |tse|f -

show|ng the |engths we go to, to produce

our de||c|ous food so customers don`t

have to. As a resu|t, sa|es of our featured

B|stro range |ncreased by 195%.

OnIy at Your M&S

Throughout |ts 127 year h|story M&S has

taken pr|de |n des|gn|ng, deve|op|ng and

de||ver|ng |ts own un|que c|oth|ng, home

and food products. ln November 2010

we set out to encapsu|ate th|s exc|us|v|ty

through 'On|y at Your M&S`. The message

reects the efforts put |nto creat|ng

|nnovat|ve, qua||ty 'M&S on|y` products.

Ooup|ed w|th our |ncreased rate of

|nnovat|on, we be||eve 'On|y at Your M&S`

w||| he|p d|fferent|ate us even more c|ear|y

from the compet|t|on.

The new brand message was rst featured

|n our January campa|gn for our un|que

S|mp|y Fu||er |onger range and was

|ntroduced to c|oth|ng as part of our spr|ng

campa|gn. Th|s |nc|uded our rst ever

|nnovat|on-|ed ads, h|gh||ght|ng the un|que

techno|ogy bu||t |nto M&S c|oth|ng such as

our water repe||ent Stormwear

TM

nish.

Oustomers reacted pos|t|ve|y and

recogn|t|on of our spr|ng 2011 Tv

campa|gn |ncreased on the prev|ous year.

New channeIs

We |ncreased our |nvestment |n on||ne

advert|s|ng th|s year. s|ng the momentum

of the major of|ne act|v|ty we created

more |ntegrated campa|gns, g|v|ng us a

stronger presence across a|| med|a, from

ma|nstream Tv through to soc|a| med|a.

New channe|s have enab|ed us to engage

more effect|ve|y w|th customers and offer

more targeted promot|ons. Th|s year we

|ncreased the number of peop|e on our

SMS database by 90% and are now

send|ng out over four m||||on ema||s a week

to customers.

Looking ahead

The M&S brand |s one of our strongest

assets and we w||| cont|nue to |nvest |n

creat|ng re|evant and engag|ng

campa|gns. We w||| promote 'On|y at Your

M&S` across Tv, press and on||ne formats,

extend|ng |t to |nc|ude |nnovat|ons |n Home

and K|dswear. ln ||ne w|th the p|ans set out

|n November, we w||| deve|op the |dent|t|es

of our sub-brands - and w||| for the rst

t|me |aunch brand advert|s|ng.

We w||| cont|nue to exp|ore new

commun|cat|on channe|s and take a more

cons|stent approach to |nternat|ona|

market|ng act|v|ty, support|ng our p|ans to

make M&S an |nternat|ona|, mu|t|-channe|

reta||er.

Our marketing activity ensures the M&S brand remains visibIe and

frontofmind with our customers. Throughout the year we taiIored our

campaigns to reect changing customer needs. ensuring our messages

were reIevant and provided compeIIing reasons to visit our stores.

Thisyear we have highIighted our innovation. with the Iaunch of 'OnIy at

Your M&S' reminding our customers ofthe extraordinary Iengths we go to.

to deIiver unique products.

'e \:' |..d

s o.e o| o.

s.o.ges sses.

o. og.s

e.s.e .e.s

|o' .e'ev.

.d.so..g.

Steven Sharp Execut|ve D|rector, Market|ng

M&S Money: Oustomers cont|nue to turn to trusted

brands such as M&S for the|r nanc|a| serv|ces. W|th

more than two m||||on act|ve cardho|ders, M&S Money

he|ps foster customer |oya|ty by offer|ng benets such

as money-off vouchers. The basket s|ze at th|s year`s

spec|a| Ohr|stmas cardho|der event was 70%h|gher

than our average.

Don`t put a foot wrong th|s Ohr|stmas Th|s year`s

dance-themed advert|sement starr|ng comed|an

Peter Kay a|ongs|de our M&S mode| ||ne-up ach|eved

exce||ent customer recogn|t|on. lt appea|ed to both

regu|ar and occas|ona| shoppers who depend on

M&S for the most |mportant occas|ons. M&S a|so

scooped the top spot |n Ohanne| 5`s 'Greatest

Ohr|stmas Tv Advert|s|ng Ever`, wh|ch a|red on

Ohr|stmas Day.

Marks and Spencer Group pIc Annua| report and nanc|a| statements 2011

14

Operat|ng rev|ew

. |..d

Star sty|e Our products p|ay a starr|ng ro|e

|n our advert|s|ng, so we ensure the featured

||nes are c|ear|y s|gnposted |n store and on||ne.

Our 'As seen on Tv` products are a|ways our

fastest se|||ng ||nes.

. og.s 'g''g' 'o.

.e do 'e seso.s 'es

.e.ds |o. '' o. soe.s.

O

p

e

r

a

t

i

n

g

r

e

v

i

e

w

Overview

Over the |ast 12 months more customers

turned to M&S, recogn|s|ng that our

attent|on to |nnovat|on and |ast|ng qua||ty

g|ves them rea| va|ue for money.

Oaut|on about persona| spend|ng

preva||ed and customers |ooked to

reta||ers to prov|de them w|th |nsp|rat|on

and a rea| reason to buy. ln response we

offered customers more cho|ce than ever

before w|th new sty|es, fabr|cs and

co|ours; prov|d|ng someth|ng to su|t every

taste and budget. Our customers |oved

our d|fferent |nterpretat|ons of the seasons`

key sty|es, wh||e cont|nu|ng to shop w|th

us for the|r qua||ty wardrobe essent|a|s.

||ke a|| reta||ers, the r|s|ng costs of raw

mater|a|s - cotton |n part|cu|ar - proved

cha||eng|ng dur|ng the year. However, we

have ma|nta|ned open|ng pr|ce po|nts

wherever poss|b|e and rema|n comm|tted

to de||ver|ng exce||ent va|ue across our

'good`, 'better` and 'best` pr|c|ng structure.

Womenswear

Dur|ng 2010/11 we grew our market share

by va|ue to 10.8%, as we gave our

customers better fash|ons, greater cho|ce

and exce||ent va|ue. Throughout the year

we were we|| pos|t|oned to address

customers` 'buy once, buy we||` m|ndset;

demonstrated by stronger sa|es of 'better`

|tems such as cashmere kn|twear up 11%

and /|og|ao| boots, where sa|es treb|ed.

We kept our ranges fash|onab|e and

fresh. Our des|gn team`s |nterpretat|ons

of catwa|k trends such as |ace and

'MadMen` sty|e 1940s ch|c meant that

there was someth|ng for a|| our customers,

whatever the|r age or shape. Dresses

|n part|cu|ar performed strong|y, as we

prov|ded a broader range of des|gns.

We saw cons|stent|y strong sa|es |n

women`s footwear, up 16% w|th market

share |mprov|ng. We extended our

|nnovat|ve Footg|ove

TM

comfort so|ut|on

|nto contemporary footwear and

encouraged more customers to shop by

offer|ng more cho|ce |n terms of sty|es

and pr|c|ng.

Our brands

Our fash|on sub-brands he|p us cater for

our customers` d|verse tastes, enab||ng us

to attract new younger shoppers, wh||st

reta|n|ng the trust and |oya|ty of our

trad|t|ona| core customers.

Oontemporary and soph|st|cated,

our /|og|ao| range showcased the

grown-up co|our pa|ettes that dom|nated

the autumn/w|nter catwa|k, prov|d|ng

customers w|th a modern sty||sh |ook

for work, weekends or occas|ons.

The co||ect|on featured |uxur|ous fabr|cs

and a h|gh |eve| of deta|||ng and our

/|og|ao| Exc|s|.e |eather sk|rt was

a rea| h|t w|th the fash|on press.

Our C|ass|c co||ect|on, wh|ch |s focused

on atter|ng, comfortab|e c|othes for our

more mature customer, de||vered

cons|stent|y strong sa|es |ast year.

|aunched |n 2009, our |no|go Co||ec||on of

easy-to-wear sty||sh casua|s aga|n grew |n

popu|ar|ty, attract|ng customers across a

broad age range and strengthen|ng our

market pos|t|on |n casua|wear.

Our ||m||eo Co||ec||on 'fast fash|on` range

reects the season`s key catwa|k trends.

By regu|ar|y updat|ng the co||ect|on, we

cont|nue to offer customers someth|ng

new and exc|t|ng each t|me they shop w|th

us.

|e| Una rema|ns our best perform|ng

brand, w|th a bo|d and co|ourfu| s|gnature

|ook. The oe| na 5oez|a|e co||ect|on,

wh|ch |s |nsp|red by lta|y, performed

part|cu|ar|y strong|y and we are

cap|ta||s|ng on th|s success w|th an

extended range.

Th|s year we conducted a rev|ew of our

sub-brands ahead of our November

bus|ness update. As part of th|s, we

announced p|ans to ama|gamate |o||/o||o

|nto the core M&S range to he|p reduce

dup||cat|on and further strengthen

the M&S c|oth|ng brand. We are now

work|ng to g|ve our sub-brands c|earer

|dent|t|es, mov|ng them from '|abe|s` to

estab||sh|ng them as stand-out brands

|n the|r own r|ght.

M&S remains the nation's favourite cIothing retaiIer. with our CIothing and

Home business deIivering a good performance in 2010I11. Market share by

vaIue increased to 11.7% and we experienced growth across aII areas as

customers sought out M&S quaIity. A focus on innovation heIped drive

particuIarIy strong performances in both Lingerie and Menswear. Heritage

departments such as knitwear and sIeepwear gained market share. as

customers continued to reIy on us for the wardrobe stapIes that make M&S

famous.

Csoe.s ..

o\:' |o. 's.g

o'. ee''e.

v'e .d g.e

s'e.

Kate Bostock Execut|ve D|rector,

Genera| Merchand|se

VaIue

market share

].c/

+0.1% pts

VoIume

market share

./

+0.4% pts

Fashion with a conscience

Th|s year we |aunched |no|go G|een.

our capsu|e range of casua|wear for

women and g|r|s. Both co||ect|ons

feature garments made from organ|c,

recyc|ed or Fa|rtrade cotton as we|| as

susta|nab|y sourced Moda| or Tence|

den|m.

Marks and Spencer Group pIc Annua| report and nanc|a| statements 2011

16

Operat|ng rev|ew

C'o'.g

.d 'oe

Dress to |mpress As customers |ooked for new and

exc|t|ng ways to update the|r wardrobe we offered

them more cho|ce than ever on dresses, such as our

sty||sh oe| na dress above.

1940s ch|c Our on-trend ora| bra he|ped g|ve women

the much des|red 1940s sty|e s||houette.

Near|y Naked We scanned the sk|n co|our of over

1,000 customers and staff to he|p us create the

four shades for our Near|y Naked range. W|th a

soft, seam|ess n|sh he|p|ng to create the perfect

s||houette, the garments are a|most |nv|s|b|e under

c|oth|ng.

Lingerie and Beauty

More than one |n ve Br|t|sh women

choose M&S for the|r ||nger|e. 2010/11 was

another exce||ent year, w|th va|ue market

share up 0.8% to 27.1% and vo|ume

market share |ncreas|ng to 21.6%.

The |ast 12 months saw a renewed focus

on |nnovat|on, w|th an emphas|s on new

fabr|cs such as washab|e s||k and cotton

Moda|s, new des|gns and techno|og|es.

ln Ju|y we |aunched the rst ever bra that

boosts the appearance of the wearer`s

c|eavage by two cup s|zes. Based on |ts

success we extended the techno|ogy to

a body format |n March.

Our |nnovat|on was |n tune w|th fash|on

trends and our new Near|y Naked range,

des|gned to 'd|sappear` under c|oth|ng,

offered the |dea| so|ut|on for women to

wear under summer wh|tes and neutra|s.

Our great va|ue stap|es cont|nued to dr|ve

footfa|| across our stores and we

exper|enced record sa|es |n both hos|ery

and s|eepwear. We broadened our range

of therma| 'warmwear`, |ncorporat|ng new

heat generat|ng techno|ogy |nto more

versat||e |ayer|ng sty|es, w|th sa|es up 45%

th|s w|nter.

Reect|ng current des|gn trends, our

||nger|e co||ect|ons featured g|amorous

|nuences from both contemporary and

v|ntage d|rect|ons. We a|so catered for the

grow|ng '|ounger|e` trend - offer|ng new

easy to wear |tems such as a||-|n-ones

and 'card|gowns` |n |uxur|ous super soft

fabr|cs.

ln November we announced p|ans to

|ntegrate our Beauty department |nto

||nger|e. Th|s w||| he|p us max|m|se the

natura| synerg|es and cross-se|||ng

opportun|t|es that ex|st between these

areas. Th|s move g|ves us s|gn|cant

opportun|t|es to deve|op the growth areas

|n Beauty such as persona| care and

fragrance.

VaIue Iingerie

market share

VoIume Iingerie

market share

..]/

+0.8% pts

.].o/

+0.4% pts

F

i

n

a

n

c

i

a

I

s

t

a

t

e

m

e

n

t

s

&

o

t

h

e

r

i

n

f

o

r

m

a

t

i

o

n

G

o

v

e

r

n

a

n

c

e

F

i

n

a

n

c

i

a

I

r

e

v

i

e

w

P

e

r

f

o

r

m

a

n

c

e

&

M

a

r

k

e

t

p

I

a

c

e

S

t

r

a

t

e

g

y

O

v

e

r

v

i

e

w

O

p

e

r

a

t

i

n

g

r

e

v

i

e

w

To nd out more v|s|t marksandspencer.comIannuaIreport2011 D|rectors` report

17

Menswear

We had a very strong year |n Menswear

w|th market share up 0.7% to 11.5% by

va|ue. Th|s performance was dr|ven

by|mprov|ng our sty|e credent|a|s and

de||ver|ng except|ona| qua||ty at great

va|ue.

Over the |ast 12 months we de||vered

better adaptat|ons of the key fash|on

trends that worked for our d|fferent types

of customers. For examp|e, we recorded

part|cu|ar|y good sa|es of Fa|r ls|e kn|twear

- a strong |ook th|s w|nter. We were we||

p|aced to serve the grow|ng popu|ar|ty of

more trad|t|ona|, her|tage fash|ons, such

as Worsted pure woo| ta||ored jackets.

Our reputat|on for qua||ty he|ped dr|ve

strong performance |n our heart|and

areas, such as day to day essent|a|s ||ke

socks and forma|wear. We a|so saw a

sa|es up||ft |n key growth areas, w|th

|mprovements to our men`s footwear

range boost|ng our market pos|t|on |n

th|s category.

We gave customers greater cho|ce

|n terms of t and sty|e and extended

s||m t across more sh|rts and |nto

other departments, such as ta||or|ng.

The stream||ned cut has proved popu|ar

and s||m t sa|es have treb|ed th|s year.

lnnovat|on cont|nues to set our menswear

apart from the compet|t|on, w|th 35% of

our su|ts featur|ng |nnovat|ons |nc|ud|ng

our un|que water repe||ent Stormwear

TM

nish, natura| stretch and crease

res|stance. ln March, we |aunched the

Super||te su|t, wh|ch we|ghed 20% |ess

than our trad|t|ona| Sartor|a| su|t, and met

customers` demands for a smart summer

|ook that he|ped them keep coo|.

Our brands

S|e |a|oo| |s focused on our core

customer and th|s year |t reta|ned |ts

pos|t|on as our b|ggest brand, desp|te the

strong growth of ^o||| Coas|.

The |ntroduct|on of ^o||| Coas| |n 2008

||ed a gap |n our men`s casua|wear offer,

much as |no|go Co||ec||on has |n

Womenswear. lt de||vered an outstand|ng

performance |n 2010/11 and we grew our

casua|wear market share for the second

year runn|ng.

The re|aunched Co||ez|one range was a

great success, appea||ng strong|y to our

core customers. W|th |ts emphas|s on

soph|st|cated lta||an sty||ng, ne fabr|cs

and |mpeccab|e cuts the expanded range

a|so |nc|udes |e|surewear and

accessor|es, mak|ng |t easy for customers

to shop for a coord|nated |ook.

Fo||ow|ng a successfu| on||ne |aunch, we

ro||ed out ||m||eo Co||ec||on for men |nto

se|ected stores across the K. Bu||d|ng on

our trad|t|ona| strengths |n ta||or|ng, but

w|th a s||mmer t and contemporary

sty||ng, the range has attracted a younger

customer |nto our Menswear department.

VaIue

market share

VoIume

market share

]]./

+0.7% pts

]../

+0.1% pts

Ohunky kn|ts Fa|r ls|e was a key fash|on trend

th|s w|nter and we |nterpreted the |ook across our

kn|twear and accessor|es. Dur|ng the Ohr|stmas

season we so|d over 120,000 Fa|r ls|e kn|ts and

accessor|es.

Emp|oy|ng ta|ent ln September we |aunched the rst

M&S ||m||eo Co||ec||on for boys, and re|aunched

||m||eo Co||ec||on for g|r|s, w|th a campa|gn shot by

|con|c fash|on photographer, Rank|n.

No sweatI s|ng the |atest fabr|c

techno|ogy our Dry Extreme Sh|rt

he|ps men stay dry and smart a|| day.

lt draws persp|rat|on away from the

sk|n and |nto the |nner fabr|c, wh||st

the outer bres reect mo|sture and

prevent d|sco|ourat|on. W|th|n days

of |aunch, |t had become our fastest

se|||ng forma| men`s sh|rt on||ne.

Marks and Spencer Group pIc Annua| report and nanc|a| statements 2011

1S

Operat|ng rev|ew

C'o'.g

.d 'oe

cont|nued

Fun fash|on Our /|og|ao| str|ped summer

dressoffered great on-trend sty|e at great va|ue

fromjust 25.

|atest |ook ||nen lnject|ng more cho|ce and greater

sty|e credent|a|s |nto our bedd|ng boosted sa|es as

customers |ooked for qu|ck and easy ways to update

the|r home.

Kidswear

ln 2010/11 we grew our market share by

0.4% to 6.6% by va|ue and to 7.1% by

vo|ume, and ga|ned ground towards the

number three spot for k|dswear |n the K.

We exper|enced strong growth across our

newborn, todd|er and younger boys and

g|r|s ranges and rema|ned top of the c|ass

for back to schoo| wear.

va|ue rema|ns a key dr|ver for growth |n

th|s market and parents trust M&S to

de||ver. That trust he|ped us grow our va|ue

market share |n schoo|wear to 16.4%,

desp|te |ntense compet|t|on. Keen pr|c|ng

was underp|nned by cont|nued |nnovat|on

|n areas such as fabr|c qua||ty, durab|||ty

and t.

We worked espec|a||y hard dur|ng the year

to |mprove our K|dswear sty|e credent|a|s.

The speed and ex|b|||ty of our Turk|sh

supp|y base enab|ed us to de||ver fresh,

on-trend co||ect|ons throughout the year

- grow|ng market share |n the fash|on

consc|ous o|der g|r|s` category and

attract|ng younger mums to shop w|th

M&S.

On the back of th|s success, we see

further growth opportun|t|es |n K|dswear,

part|cu|ar|y |n essent|a|s such as

underwear and s|eepwear. ln the year

ahead we w||| make our sub-brands, such

as /|og|ao|. |no|go Co||ec||on and

||m||eo Co||ec||on more d|st|nct|ve and w|||

cont|nue to deve|op a more sty||sh and

re|evant offer for o|der ch||dren.

Home

ln a d|fcu|t trad|ng env|ronment, M&S

Home performed we||, w|th sa|es up 1.6%.

Over the |ast 12 months we took severa|

steps to dr|ve the bus|ness forward,

|mprov|ng the way we showcase our

Home range and draw|ng on our natura|

strengths |n fash|on.

We |ntegrated our O|oth|ng and Home

des|gn teams more c|ose|y, br|ng|ng a

keener sty|e e|ement |nto our soft

furn|sh|ng and w|der accessor|es ranges

such as k|tchenware. We a|so |ntroduced

20% more pattern cho|ce |n our bedd|ng

ranges, resu|t|ng |n an 11% sa|es |ncrease.

lnnovat|on p|ays a key ro|e |n product

deve|opment. From easy-care ||nens to the

'extra c|ean` non-smear g|ass range, we

cont|nued to prov|de new, pract|ca|

so|ut|ons to t our customers` ||festy|es.

Notab|e among our key |aunches |n 2010

was the revo|ut|onary Sonoma fo|d-out

wardrobe wh|ch can be assemb|ed |n just

four m|nutes.

Wh||st some 45% of our furn|ture sa|es

|ast year were on||ne, space constra|nts |n

stores rema|ned a cha||enge. ln November,

we announced our |ntent|on to w|thdraw

our techno|ogy range from stores to free

up add|t|ona| space to expand our growth

departments such as k|tchenware and

d|n|ng, bedd|ng and bath.

We see s|gn|cant growth potent|a|

|n Home, as current|y on|y 20% of our

customers shop |n th|s department.

Th|s year we set out c|ear p|ans to make

our Home offer eas|er to shop by better

segment|ng |t under three d|st|nct|ve

||festy|e categor|es - C|ass|c.

Con|emoo|a|v and Des|gn. ln ||ne w|th

th|s, we recent|y |aunched an exc|t|ng

new co||aborat|on w|th Oonran, to

des|gn an exc|us|ve contemporary

homeware range that w||| be ava||ab|e

|n store from September.

AvaiIabiIity

Th|s year we ro||ed out a new stock

management system across O|oth|ng and

Home to g|ve us better v|s|b|||ty of our rate

of sa|e. Th|s has |mproved ava||ab|||ty and

|n November we set a target to de||ver 9%