Escolar Documentos

Profissional Documentos

Cultura Documentos

CS - Live Case Report - Final Report - Final Version - June 2, 2011

Enviado por

shaiq_farhan2175Descrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

CS - Live Case Report - Final Report - Final Version - June 2, 2011

Enviado por

shaiq_farhan2175Direitos autorais:

Formatos disponíveis

Live Case Report

Team Members Razia Khan Samina Yasmeen Ashfaque Ahmed Muhammad Farhan Muhammad Wahaj Hussain Waqas Murad Muzafar Ali Shahbaz Amir (BD-50/2008) (BD-53/2008) (BD-11/2007) (BD-35/2007) (BD-43/2007) (BD-83/2007) (BD-46/2007) (BD-62/2007)

June 3, 2011

Institute of Business Administration

Friday, June 3, 2011

Introduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Organizational Structure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 Industry Analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 Financial Analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Income Statement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 Balance Sheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

TABLE OF CONTENTS

Competitors Key Financial Figures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 Internal Environment Analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Organizational structure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 Cross Functional Assessment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 Sales department and Marketing department . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 Human Resource Department . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 R&D department . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

NFL Plant . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 External Environment Analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

PEST Analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 Political Factors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 Economic Factors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 Social Factors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 Technological Factors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 Porters Five Forces Analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 Bargaining Power of Buyers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 Bargaining Power of Suppliers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 Threat of New Entrants . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 Threat of Substitutes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 Intense Industry Rivalry (Competition) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

Strategic Mapping . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23 SWOT Analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24 List of Minor Problems . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27 Major Problem . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28 Strategic Alternatives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

1

Friday, June 3, 2011

Institute of Business Administration

Strategic Choice . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29 Cause and Effect Diagram . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30 Appendices . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

Appendix 1 Vision Statement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32 Appendix 2 Analysis of Vision Statement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33 Appendix 3 Financial Statements and Financial Analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34 Appendix 4 IFE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43 Appendix 5 EFE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44 Appendix 6 CPM . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45 Appendix 7 BCG Growth Share Matrix . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46 Appendix 8 Process Flow Diagram . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47 Appendix 9 Interview Summaries . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49 Interview Summary with CFO . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49 Interview Summary with Taxation Manager . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51 Interview Summary with Director HR, Training & Administration . . . . . . . . . . . . . . . . . . 52 Interview Summary with Plant Manager . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53 Interview Summary with Quality Control Manager . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54 Interview Summary with Supervisor Weighing Section . . . . . . . . . . . . . . . . . . . . . . . . . . 55 Interview Summary with Supervisor Package Section . . . . . . . . . . . . . . . . . . . . . . . . . . . 56 Interview Summary with COO . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57 Interview Summary with Head of Marketing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58 Appendix 9 Individual Contribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59

Institute of Business Administration

Friday, June 3, 2011

INTRODUCTION

National foods limited is a leading name in multi-category food industry in Pakistan and its presence in the Pakistani homes became conspicuous after it won five awards in major food category in National Brand Awards in 2010. With over 250 products in 12 categories NFL appears committed to attain a lofty target of becoming a 50 billion company by 2020. Founded on February 19, 19701 as private limited company with the name National food laboratories limited, the pioneers of this firm wanted to introduce the branded and packaged spices which were a novel idea at the time when the spice industry was mostly unstructured as unbranded and loose spices were order of the day. Identifying the silver line, NFL took a first-mover step to make inroads into packaged and branded spices with quality for its customers as its priority. Later on it became National Foods Limited and got listed on stock exchange on March 30, 19882. The reasons of initial success for NFL were their quality control in the selection, cleaning and processing of spices besides attractive packaging. Subsequently success also incorporated other attributes including technologically advanced production facilities both at Bin Qasim and SITE. Although NFL exercises due care in the selection of right suppliers of raw material, it lacks in aligning the CSR activities with its business objectives. Ineffective partnership with suppliers can make NFL prone to increase in lead times and subsequent raw material availability issues. With such a wide variety of product portfolio in such a quick span of time in the face of stiff competition on each front, NFL was caught napping when its much-hyped product RONAQ came boomerang. It was observed that due to over-occupation with enhancing

1 2

Annual Report Notes to Financial Statement: Note# 1 Annual Report Notes to Financial Statement: Note# 1

3

Friday, June 3, 2011

Institute of Business Administration

range of products with inadequate R&D NFL is finding hard to stick to its core competencies, which are its spices and pickles areas. Furthermore in the light of rising export demand, NFL seems not so well equipped to spread its tentacles all around the globe (presently 35 countries of 5 continents) which does not augur well for the future sales and to meet its 2020 target of 50 billion company. NFL has declared financial target as its reason for being as they see it like the companies who feel the pulse of the customers and knows their needs and wants and satisfy them end up accomplishing incredible financial targets but the vice-versa is bereft of a true vision. NFL does not have mission statement. Since the mission statement coalesces the immediate stakeholders of the organization, its absence is causing directionless and haphazard decision making at the top. The top management seems complacent to address the changes that are taking place in external environment to a large extent. The fundamentals of the company appear to be strong as against challenging economic times, low GDP growth, post impact of floods and high inflationary trends by showing 24% growth in half yearly sales compared to last year. The company is not focused on developing its product portfolio for improving its market share both domestically as well as globally. Although changing lifestyles locally has given an impetus to leading players like NFL and SHAN to enhance their product portfolio. Eating habits locally are also undergoing a sea change in the metropolitan cities. Recipes and ready-made meals are going to be the more preferred mode of cuisines due to rising number of working women who are gradually turning away from traditional way of time consuming cooking methodologies.

Institute of Business Administration

Friday, June 3, 2011

1.

ORGANIZATIONAL HEIRARCHY AS ON FEBRUARY 1, 2011

Friday, June 3, 2011

Institute of Business Administration

2.

INDUSTRY ANALYSIS

According to the American Spice Trade Association, today spices have become known as any dried plant product used primarily for seasoning purposes. This all-

inclusive definition seems to cover a wide range of plants like herbs, spice seeds and even dehydrated vegetables and spice blends.

There has always been demand for spice all over China Indian and subother

continent,

civilized nations of that time. Spice was one of the major commodity traded between 800AD and

1200AD globally and were bought by Arabian and other traders visiting India. In those days Indian sub-continent was one of the only place growing spices which is now been grown by many countries of the world. Spice was greatly introduce by British during their rule over Indian sub-continent and were exported to Britain and other parts of the world. India is the biggest

6

Institute of Business Administration

Friday, June 3, 2011

player in Spice market as they have more farming land with optimize per yield capabilities and exports $ globally as they have access to local community world over as compare to Pakistan3. In Pakistan, after independence loose spices captured the wholesale market till 1970s. After that companies like Shan, National Foods and small traders emerged and started delivering the spices directly to the shops. Currently 80% of market is controlled by loose spices and 20% is branded or packed spices market of 20 billion total spices market4. Today major industry players in spices and food market are National Foods, Shan, Mitchells, RafhanMaize, and Chefs Pride.

3 4

Food and Agriculture Organization of United Nation Spices Processing, Packing andMarketing: SMEDA

7

Friday, June 3, 2011

Institute of Business Administration

3.

FINANCIAL ANALYSIS

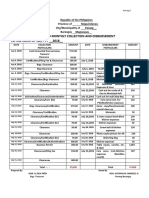

INCOME STATEMENT Sales increased 1.5 times during the

Profit & Loss Account

For The Year Ended June 30, 2006 - 10

2010

4,489,946 (3,163,199) 1,326,747 (909,818) (164,303) (17,295) 23,214 258,545 (99,364) 159,181 159,181 (72,622) 86,559 PKR2.09

2009

2008

2007

2006

1,847,700 (1,276,437) 571,263 (364,758) (73,112) (8,753) 6,681 131,321 (24,850) 106,471 106,471 (36,107) 70,364 PKR16.55

period of 5 years Sales from 2006 to 2010. Cost of sales and gross profit also increased almost by

Cost of Sales Gross Profit Distribution Costs Administrative Expenses Other Operating Expenses Other Operating Income Operating Profit Finance Costs

Rupees in Thousand 3,758,706 3,061,746 2,391,058 (2,632,255) (2,075,969) (1,572,254) 1,126,451 985,777 818,484 (665,664) (570,218) (513,902) (149,802) (129,868) (91,297) (20,448) (17,815) (19,094) 17,006 307,543 (86,841) 220,702 220,702 (81,241) 139,461 PKR3.37 22,309 290,185 (56,238) 233,947 233,947 (77,401) 156,546 PKR28.33 6,110 200,301 (32,675) 167,626 191,722 (62,430) 129,292 PKR23.40

same Profit before Taxation

Taxation

proportion. Costs Net Income of Sales and Gross Earnings per Share

Profit are around 70% and 30% of sales respectively throughout the 5 year period from 2006 to 2010 under analysis. In cost of sales, major expense is for raw material which remains 60% - 70% of cost of sales during the 5 year period.

Vertical Analysis - Profit & Loss Account

For The Yea r Ended June 30, 2006 - 10 2010 Sales 100% Cos t of Sales 70.5% Gross Profit 29.5% Dis tributi on Cos ts 20.3% Administra ti ve Expenses 3.7% Other Opera ting Expenses 0.4% Other Opera ting Income 0.5% Opera ting Profi t 5.8% Fi nance Cos ts 2.2% 3.5% Profi t before Ta xa tion 3.5% Ta xa tion 1.6% Net Income 1.9% 2009 100% 70.0% 30.0% 17.7% 4.0% 0.5% 0.5% 8.2% 2.3% 5.9% 5.9% 2.2% 3.7% 2008 100% 67.8% 32.2% 18.6% 4.2% 0.6% 0.7% 9.5% 1.8% 7.6% 7.6% 2.5% 5.1% 2007 100% 65.8% 34.2% 21.5% 3.8% 0.8% 0.3% 8.4% 1.4% 7.0% 8.0% 2.6% 5.4% 2006 100% 69.1% 30.9% 19.7% 4.0% 0.5% 0.4% 7.1% 1.3% 5.8% 5.8% 2.0% 3.8%

There is slight increase in Distribution increased cost which

from 19.7% to

20.3% of sales from 2006 to 2010. expenses, Administrative other operating

expenses, and other operating

income almost remained same as a percentage of sales throughout the 5 years. Distribution

Institute of Business Administration

Friday, June 3, 2011

costs constitute major portion of operating expenses during the period under study. Distribution costs on average remain around 83% of total operating costs for National Foods. Operating Profit eroded from 7.1% in 2006 to 5.8% in 2010. However operating profits were 8.2% last year in 2009 due to decrease in distribution cost. Net deteriorated margin

Horizontal Analysis - Profit & Loss Account

from 3.8% in 2006 to 1.9% in 2010 which represents a 100% decrease in 5-year period. reason for Major this

For The Year Ended June 30, 2006 - 10 2010 Sales 243% Cos t of Sales 247.81% Gross Profit 232% Dis tribution Cos ts 249.43% Administrative Expenses 224.73% Other Operating Expenses 197.59% Other Operating Income 347.46% Operating Profit 196.88% Finance Cos ts 399.86% 149.51% Profit before Taxation 149.51% Taxation 201.13% Net Income 123.02% Earnings per Share 12.63% 2009 203.43% 206.22% 197.19% 182.49% 204.89% 233.61% 254.54% 234.19% 349.46% 207.29% 207.29% 225.00% 198.20% 20.36% 2008 165.71% 162.64% 172.56% 156.33% 177.63% 203.53% 333.92% 220.97% 226.31% 219.73% 219.73% 214.37% 222.48% 171.18% 2007 129.41% 123.18% 143.28% 140.89% 124.87% 218.14% 91.45% 152.53% 131.49% 157.44% 180.07% 172.90% 183.75% 141.39% 2006 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100%

decline is increased distribution costs. EPS was Rs. 28.33 in 2008. However, we observed a sharp decline in EPS which is Rs. 3.37 and Rs. 2.09 in 2009 and 2010 respectively.

Friday, June 3, 2011

Institute of Business Administration

BALANCE SHEET Since last five years noncurrent assets are showing declining trend being lowest in 2009 with only 2% change from preceding year. Year 2010 has although seen improvement and have

Balance Sheet

As on June 30, 2006 - 10 2010 ASSETS Non-Current Assets Property, plant and equipment Intangibles Long term deposi ts Current Assets Stores , spa res and loose tools Stock-in-trade Trade debts Adva nces Trade deposits and prepa yments Accrued interes t & Ma rkup Other recei va bles Ta x refund due Cash and bank balances 2009 2008 Rupees in Thousand 2007 2006

794,771 25,688 4,509 824,968 5,360 1,502,232 253,050 43,867 10,118 _ 20,664 _ 14,101 1,849,392 2,674,360

614,004 35,668 5,163 654,835 5,432 846,977 274,556 29,044 6,660 _ 2,632 _ 15,205 1,180,506 1,835,341

635,325 2,194 4,444 641,963 7,499 755,259 259,091 18,965 2,333 _ 1,446 46,603 13,496 1,104,692 1,746,655

493,444 2,779 2,766 498,989 4,322 477,007 112,585 11,794 2,520 _ 25,393 37,702 18,146 689,469 1,188,458

365,874 4,064 2,504 372,442 3,463 367,235 101,940 13,586 4,290 1,637 1,063 19,279 83,025 595,518 967,960

SHARE CAPITAL & RESERVES Equity Issued, Subs cribed & Paid up capi tal Unappropria ted Profi t Capi tal Reserve -Sha re Premium Non-Current Liabilities Long term financing Liabilities a gainst assets subject to fi nance lease Deferred Ta x Reti rement benefi ts obliga tions Current Liabilities Trade & Other pa yables Accrued Interes t/Ma rkup Short term borrowi ngs Current maturi ty of: Long term financing Liabilities a gainst assets subject to fi nance lease Ta xa tion-Provision less pa yment Due to the government

414,427 327,518 _ 741,945 20,000 2,260 72,621 10,707 105,588 530,063 28,319 1,189,769 40,000 10,238 12,407 16,031 1,826,827 2,674,360

331,542 323,844 _ 655,386 60,000 13,700 59,999 6,780 140,479 460,626 17,764 485,536 40,000 12,510 8,397 14,643 1,039,476 1,835,341

55,257 454,566 6,102 515,925 100,000 26,262 70,758 _ 197,020 369,565 17,186 536,341 43,000 12,341 42,000 13,277 1,033,710 1,746,755

42,505 319,273 6,102 367,880 143,000 15,406 35,357 _ 193,763 306,359 10,184 211,272 46,000 6,041 38,000 8,959 626,815 1,188,458

42,505 198,482 6,102 247,089 189,000 5,694 11,467 _ 206,161 244,988 8,491 195,925 26,000 2,306 37,000 _ 514,710 967,960

10

Institute of Business Administration

Friday, June 3, 2011

increased by 26% with respect to previous year. Of these noncurrent assets long term deposits have shown consistent decrease since last five years and show -13% changes with preceding year.

Vertical Analysis - Balance Sheet

As on June 30, 2006 - 10 2010 ASSETS Non-Current Assets Property, plant and equipment Intangibles Current Assets Stock-in-trade Trade debts Advances Other receivables Tax refund due Cash and bank balances 2009 2008 2007 2006

Current

assets

historically

depict alternative movements of increase and decrease in last five years. Of these assets Stock in Trade has increased 77% which is highest level of five years. This shows that company is facing problem of inadequate supply of finished

30% 1% 31% 56% 9% 2% 1% 0% 1% 69% 100%

33% 2% 36% 46% 15% 2% 0% 0% 1% 64% 100%

36% 0% 37% 43% 15% 1% 0% 3% 1% 63% 100%

42% 0% 42% 40% 9% 1% 2% 3% 2% 58% 100%

38% 0% 38% 38% 11% 1% 0% 2% 9% 62% 100%

SHARE CAPITAL & RESERVES Equity Issued, Subscribed & Paid up capital Unappropriated Profit Capital Reserve- Share Premium Non-Current Liabilities Long term financing Liabilities against assets subject to finance lease Deferred Tax Current Liabilities Trade & Other payables Accrued Interest / Markup Short term borrowings Current maturity of: Long term financing Liabilities against assets subject to finance lease Taxation- Provision less payment Due to the government

15% 12% 0% 28% 1% 0% 3% 4% 20% 1% 44% 1% 0% 0% 1% 68% 100%

18% 18% 0% 36% 3% 1% 3% 8% 25% 1% 26% 2% 1% 0% 1% 57% 100%

3% 26% 0% 30% 6% 2% 4% 11% 21% 1% 31% 2% 1% 2% 1% 59% 100%

4% 27% 1% 31% 12% 1% 3% 16% 26% 1% 18% 4% 1% 3% 1% 53% 100%

4% 21% 1% 26% 20% 1% 1% 21% 25% 1% 20% 3% 0% 4% 0% 53% 100%

goods to the market resulting in lower inventory turnover and lower account receivable turnover. Cash and bank

balances also show a declining trend and have decreased by 7% from preceding year

indicating towards companys inadequate financial position to cater its expansionary plan.

11

Friday, June 3, 2011

Institute of Business Administration

Although current liabilities of the company are continuously increasing since last five years,

Horizontal Analysis - Balance Sheet

As on June 30, 2006 - 10 2010 ASSETS Non-Current Assets Property, plant and equipment Intangibles Long term deposits Current Assets Stores, spares and loose tools Stock-in-trade Trade debts Advances Trade deposits and prepayments Accrued interest & Markup Other receivables Tax refund due Cash and bank balances 2009 2008 2007 2006

the point to worry is sudden and major increase of 145% in short term borrowings of the company in 2010. This amount was used as working capital to introduce two new product lines in the market. Having troubled years and inflationary push on consumer side

29% -28% -13% 26% -1% 77% -8% 51% 52% 0% 685% 0% -7% 57% 83%

-3% 1526% 16% 2% -28% 12% 6% 53% 185% 0% 82% -100% 13% 7% 9%

29% -21% 61% 29% 74% 58% 130% 61% -7% 0% -94% 24% -26% 60% 89%

35% -32% 10% 34% 25% 30% 10% -13% -41% -100% 2289% 96% -78% 16% 50%

61% -5% 17% 60% 5% 3% 34% -3% 135% 100% 16% 10% 1388% 25% 85%

introduction of new products in the market depicts a poor planning decision company. and uncoordinated in the

SHARE CAPITAL & RESERVES Equity Issued, Subscribed & Paid up capital Unappropriated Profit Capital Reserve- Share Premium Non-Current Liabilities Long term financing Liabilities against assets subject to finance lease Deferred Tax Retirement benefits obligations Current Liabilities Trade & Other payables Accrued Interest / Markup Short term borrowings Current maturity of: Long term financing Liabilities against assets subject to finance lease Taxation- Provision less payment Due to the government

25% 1% 0% 13% -67% -84% 21% 58% -25% 15% 59% 145% 0% -18% 48% 9% 76% 64%

500% -29% -100% 27% -40% -48% -15% 100% -29% 25% 3% -9% -7% 1% -80% 10% 1% -1%

30% 42% 0% 40% -30% 70% 100% 0% 2% 21% 69% 154% -7% 104% 11% 48% 65% 107%

0% 61% 0% 49% -24% 171% 208% 0% -6% 25% 20% 8% 77% 162% 3% 100% 22% 65%

0% 48% 0% 35% 149% 144% -3% 0% 129% 74% 81% -28% 333% 42% 208% 0% 18% 182%

making

12

Institute of Business Administration

Friday, June 3, 2011

4.

COMPETITORS KEY FINANCIAL FIGURES

Mitchells is a Pakistani food company with international credentials having product lines in grocery and confectionary segments. In 2010, the company has net sales of Rs. 1,376 million with profits after tax reaching 46 million. The company has the gross margin of 22% while EPS of the company is Rs. 9.22. The net profit margin for Mitchells was 3.4% in 2010 while NFL had net profit margin of 2% for the same period. Another competitor of NFL in food industry is Rafhan Maize Products Co. Ltd. The companys net sales in 2010 were Rs. 13,913 Millions while net profit after tax was Rs. 1,838 Millions. The gross profit percentage for Rafhan Maize is 24% as compared to 30% for NFL in 2010. EPS in 2010 is Rs. 198.99. Other competitors like Shan, Ahmed, and Chefs pride are privately owned therefore there data is not available.

13

Friday, June 3, 2011

Institute of Business Administration

5.

INTERNAL ENVIRONMENT ANALYSIS

Organizational structure The organization structure at NFL is practically a matrix one weher major departments like Human Resource, operations, marketing and sales all report directly to CEO. An interesting fact to note here is that the entire sales team directly reports to CEO although its not apparent from NFLs Organogram5. Communication flow is usually from top to bottom, however in case of creative ideas and budgeting process it works from bottom to top as well (One example is once a junior worker at shipment level got the entire packaging of a certain category changed). Decision making is mostly centralized6. Department heads like Director Finance, Chief Commercial Officer, and Manager IT have resigned recently and these positions are still vacant. This is the one internal problem NFL is uncomfortable in talking about. According to the HR head these people left for greener pastures. However this comment is in contrast of current job market situation which is facing recession for some years. Board of Directors: Abdul Majeed, Chairman and Zahid Majeed, BOD, Waqar Hasan Chief Executive and Abrar Hassan: A blood relation at key post of Chairman and BOD, CEO and BOD is quiet obvious. Decision can obviously take a partial tilt when organizations key posts are held among the blood relatives. Other key posts like Manager IT, Chief Commercial Officer and Director Finance is vacant for at least 8 months. Decision making

5 6

Refer Organogram Interview with Shahid Hussain - Taxation Manager

14

Institute of Business Administration

Friday, June 3, 2011

in absence of such key posts is done by some other executives which not efficient and effective in any way. Cross Functional Assessment A holistic view of all departments including Commercial, HR, MIS, R&D, Production, Finance, and Marketing is missing altogether as per our research. Below are some of the reasons of this observation of our analysis. Sales department and Marketing department separated in 2008, since then the Head of Sales and the Head of Marketing are working individually and reporting directly to CEO. These two departments added to Export division form the Commercial" Department, located at Forum. The Marketing campaigns as per guidance from Regional Managers are presented to Brand Manager and Head of Marketing and then put into practice if subsequently approved by Chief Executive Officer. Consumer demand is measured by data provided by AC Neilson. It includes population growth, category growth, consumer income, and nuclear family statistics. It is based on past two months consumer trend. Hence we can say that strategy formulation and forecasting are substantially obsessed with past trends. Due to which NFL sometimes faces unexpected response from the market for which they are not prepared since their projections are totally based on historical facts and they do not take into consideration the present trends and recent changes in market and consumer preferences with in their forecasts7. To overcome this situation NFL has implemented SAP system two years ago to ensure true forecasting of demand by keeping a log sheet of stock level of their production as well as distributors stock. Hence organization is Type 3, "reactive organization".

7

Interview with Production Manager

15

Friday, June 3, 2011

Institute of Business Administration

Human Resource Department8 provides very generic/beginner level trainings to the sales force like negotiation and customer handling rather than any specialized training. Career paths are not clearly defined for them, many sales officers do not know where they will end up after two years as the promotion is subject to the approval of senior managers who judge by the criteria of 'merit'. The word 'merit' could not be put much light on by Head of Marketing and HR except "high level performance" and "hard working". Performance appraisal system is not clear; KPIs and objectives assigned are not well defined. The issue of vacant key positions puts question mark on the effectiveness on HR policies and functioning. The recruitment process is not transparent and majority of the hiring is done under the influence of higher management.

6.

R&D department presents its reports to CEO through COO. Apparently it would appear as if there is no coordination between R&D and Commercial department. The suggestions are sent to CEO which are then implemented downward. The outcome of latest R&D is the product RONAQ engraved by the idea of "convenient food/ready to eat" proved a complete failure (in local and foreign market both). The reason of failure was 'taste' that was not according to consumer needs coupled with distribution issues. This depicts lack of coordination among R&D, Marketing department and Supply Chain9. Research and development is being done on only product level/taste. As far as the product demand is concerned data is received from AC Neilson. R&D and marketing department has never conducted any survey or research to get first hand knowledge of consumer needs, though they have faced brand failure of RONAQ but still they have no plans to give more focus on research.

8 9

Interview with Waqas Abrar Khan - HR Director Interview with Adnan Malik - Marketing Head

16

Institute of Business Administration

Friday, June 3, 2011

7.

NFL PLANT

NFL has two manufacturing plants; one in North Nazimabad SITE, the second at Port Qasim (Manufactured in 2002). 70% of the production is done at the Port Qasim plant, where major products pickles, readymade spices and custard are manufactured. Other products like ketchup, jellies and Salt are manufactured at SITE plant. The labor at the plant is hired on contractual basis. So no long term association and commitment of labor with organization can be expected. However, the production department is run by individuals with substantial experience in their respective fields10. It was evident from the female workers cutting mangos and carrots through their prescribed and well explained procedure. This labor, working at lower stages of assembly has proper knowledge and skills, however lacks education. They are totally unaware of the organization vision. NFL makes sure everyone single member of the organization follow the prescribed hygiene procedure. Raw materials delivered by farmers at warehouse, are tested manually/technically and then passed to production department. NFL is right by saying that they are producing pure product11, as we did not witness any artificial product mixing while inspecting their plant. Over all 60% of plant operations were manual. NFLS Recipe dept keeps the ratio of recipe mixing confidential. Quality control is monitored manually at every stage of the production process, hence has some chance of human error. NFL achieved ISO9000 in 1998, whereas SAP was implemented in 200912. This shows a passive response to external environment.

10 11

Interview with Plant Manager Mr. Younus Khan NFL pioneer philosophy http://www.nfoods.com/ 12 Interview with Waqas Naseem - Officer Industrial Relation Welfare

17

Friday, June 3, 2011

Institute of Business Administration

8.

EXTERNAL ENVIRONMENT ANALYSIS

PEST Analysis

POLITICAL FACTORS:

Since joining of Pakistan in the war against terrorism in 2001 the retaliatory forces of terrorism have played havoc with the security image of the country. Enormous resources have been utilized over this war and subsequent devastating flood of 2010 restricted the developmental projects and resulted in worse performance by state enterprises, important of them all is WAPDA/PEPCO. Due to power shortage, production industry has suffered serious setbacks. With rehabilitation of flood IDPs and a weakening economy; the situation is aggravated by chronic and continuous tug of war within Pakistans political environment. This has adversely affected the consistent policy formulation process. These events have made International Investors skeptic which is evident by the fact that in year 2010 no single organization was privatized13. This has created a systemic risk that can create problems for any business, with food industry and NFL as no exception. Further stringent quality requirements from existing as well as potential importers from gulf countries, Canada, and USA are creating challenges for the industry.

ECONOMIC FACTORS:

Pakistan has continuously been facing several issues which are negatively affecting all micro units of economy. The issues, namely energy and gas shortage, high inflation, gaping trade deficits, continuous depreciation of PKR against the USD i.e. on average 5% per annum14, high interest rate environment, inadequate infrastructure, lack of consistent policies, high energy cost, high labor cost and unskilled labor force, has also adversely affected NFLs

13

http://www.privatisation.gov.pk/about/Completed%20Transactions%20%28new%29.htm accessed on 28 May 2011. 14 InvestCap Reseach

18

Institute of Business Administration

Friday, June 3, 2011

competitive position. These factors especially high energy cost, high inflation and interest rate has tremendously increased the cost of doing business in Pakistan. However one positive factor for NFL is the growing middle class in Pakistan the main target market for NFLs products. Measured by purchasing power, Pakistan has a 30 million strong middle class, according to Dr. Ishrat Husain, Ex-Governor (2 December 1999 - 1 December 2005) of the State Bank of Pakistan15. It is a figure that correlates with research by Standard Chartered Bank which estimates that Pakistan possesses a "a middle class of 30 million people that Standard Chartered estimates now earn an average of about $10,000 a year."16 Latest figures put Pakistan's Middle Class at 35 million strong.17 In addition, Pakistan has a growing upper and upper middle class, which was estimated at 6.8 million in 200218 and has now grown to 17 million people as of 2010, with relatively high per capita incomes. 19 Lastly statistics have shown 10% reduction in poverty since 200120. Foreign Companies which cater their products to Pakistani middle classes have been very successful. For example, demand for Unilever products have recently been so high that even after doubling production, the Anglo-Dutch company struggled to meet demand and its Chairman stated "Pakistanis cant seem to have enough".21

SOCIAL FACTORS:

With the changing times the consumer needs and perceptions have also evolved and so has the food industry. There is a growing trend of dining out in Pakistani households. People in

15 16

Ishrat Husnain - Economy of Pakistan Article by the Governor of State Bank of Pakistan. Bloomberg.com: Asia 17 http://www.thenews.com.pk/print1.asp?id=100155 18 Jawaid Abdul Ghani (2005-09-01). "Consolidation In Pakistan's Retail Sector* Asian Journal of Management Cases". Ajc.sagepub.com. Retrieved on 2010-07-29. 19 "Columnists | The rise of Mehran man". Dawn.Com. 2010-04-17. Retrieved on 2010-07-29. 20 "Business | South Asian economies gather pace". BBC News. 2005-08-12. Retrieved 2010-07-29. 21 http://www.thenews.com.pk/print1.asp?id=100155

19

Friday, June 3, 2011

Institute of Business Administration

urban areas are more and more inclined to eating out individually, with friends, and with their families. This also applies on social gatherings/family small get-togethers. These outof-the-home eating tends to decrease the use of National Foods spices and cooking recipes which are primarily used by households. Furthermore, households and individuals today are also going for other than traditional foods options like fast food, Italian cuisine, Chinese dishes etc. Furthermore, the change in the buying pattern arises from changing demographic with more representation of working women in the middle and upper segments of the society and high disposable income within and outside the country which is increasing the readymade foods products demands in Pakistan. These factors pose strong threats and challenges for NFL in future and demands swift adjustment in Business strategy.

TECHNOLOGICAL FACTORS

Technological forces are also playing vital role in competitive advantage of companies operating in this sector. Although NFL is paying attention towards technological enhancements, it still lacks in few crucial areas of production. The storage monitoring, sorting, cleaning, and cutting of ingredients used in pickles are all manual. Furthermore, in the spices section the sorting and cleaning is performed manually. Company has sufficient technological resources in the boiling, grinding, and packaging functions. Expected growing demands in future and worlds emphasis on quality, NFL will have to consider further investment in technology.

20

Institute of Business Administration

Friday, June 3, 2011

Porters Five Forces Analysis

BARGAINING POWER OF BUYERS

The main drivers for spices demand are population growth and child to adult conversion rate, ratio of younger population, urbanization, trends towards readymade curries 22. Other factors affecting the demand are inflation and income levels. Usage of packed spices in Pakistan is highly price elastic23. Any upward change in inflation directly affects the usage level of packed spices. International export market is relatively price inelastic due to their hygiene benchmarks. Asian communities consider the spices compulsory part of their food because of their traditional cooking habits which makes this market a relatively price inelastic market.

BARGAINING POWER OF SUPPLIERS

Pakistan is an agrarian economy. The inputs used in spice manufacturing (Ginger, Salt, Turmeric, Garlic, Chilies) are abundant and their production is increasing progressively24. The growers are getting good prices of these crops. Further companys CSR activities, although not adequate, aligned with business objectives keep these growers engaged with the company reducing abnormal shift of power to suppliers. Any adverse happenings with agriculture sector affect the prices and supplier may exploit these conditions to fetch abnormal profits.

THREAT OF NEW ENTRANTS

Currently packed spice market of the country is estimated at around 3 billion which is 20% of total market size (remaining is open spices, available in markets like Jodia Bazaar). Of this

22 23

Spices processing, packaging, and Marketing: SMEDA Interview with Adnan Malik, Head of Marketing 24 Agricultural Statistics of Pakistan 2008-09

21

Friday, June 3, 2011

Institute of Business Administration

market 80% is equally shared by NFL and Shan 25. The venture is capital intensive and a very basic structure costs more than 5 million26 (if land and equipment is on rental basis). The competition from loose spices market which is around 80% 27 of total spices market of the country coupled with professional players in the packaged spices sector make sure the barriers to new entry are strong enough.

THREAT OF SUBSTITUTES

There is a growing trend of dining out in Pakistani households. People in urban areas are more and more inclined to eating out individually, with friends, and with their families. This also applies on social gatherings/family small get-togethers. These out-of-the-home eating tends to decrease the use of National Foods spices and cooking recipes which are primarily used by households. Furthermore, households and individuals today are also going for other than traditional foods options like fast food, Italian cuisine, Chinese dishes etc. Growing number of restaurants are also acting as strong substitutes of NFLs products.

INTENSE INDUSTRY RIVALRY (COMPETITION)

National foods today is facing competition from two sides one from traditional loose/open spices, cooking recipes, and pickles manufacturers and secondly from strong professionally managed players recently emerging in market. Now National Foods faces competition from Shan, Rafhan Maize, Mitchells, Ahmed, Shezan, and Shangrilla all these were not present a decade back.

25 26

Spices processing, packaging, and Marketing: SMEDA Spices processing, packaging, and Marketing: SMEDA 27 Spices processing, packaging, and Marketing: SMEDA

22

Institute of Business Administration

Friday, June 3, 2011

9.

STRATEGIC MAPPING

23

Friday, June 3, 2011

Institute of Business Administration

10.

SWOT ANALYSIS

NFL is among the major companies with fully integrated operation having loyal chain of raw material suppliers/growers. Recently they have entered into an agreement with a land owner at Kunri (highest producing land of red chilly) under which NFL will train the farmers to improve the quality of crop. This shows their concern for the quality of their supply chain and raw materials. It also indicates NFLs focus on long term relationship with its supplier as farmers are suppliers as well their partners through these kind of agreements. With abundance of raw material, company has taken advantage of the export encouraging policies of Government of Pakistan and exporting its products to over 35 countries and 5 continents.28 However, high cost of energy, high inflation, and interest rates have rendered cost of doing business very high for NFL as compared to its global competitors especially from India. NFL is also facing the rippling affects of falling image of Pakistan throughout the world. It has tried to overcome this hurdle by certification of ISO-9001, ISO-2001, and ISO-14001 to raise its credibility in the eyes of international consumer. One major threat for NFL and other branded spices manufacturers is from loose spice manufacturers. Pakistani loose spice manufacturers still have a significant 80% market share.29 Regardless of loose spices being considered unhygienic, households are using them and not the branded spices. To change this buying pattern of majority of consumers, there is a need of a strong awareness marketing promotion from NFL in collaboration with other industry players. We have seen similar kind of awareness promotion from Tetra packaged milk producers. NFL however does not agree with this. As per them this is highly

28 29

http://nfoods.com/contents/exports/ Spices Processing, Packaing, and Marketing Report by SMEDA.

24

Institute of Business Administration

Friday, June 3, 2011

unachievable and futile as they are happy with the current target market and do not want to have any kind of collaboration with competitors30. We have yet to see a rigorous awareness advertising campaign from branded food manufacturers led by NFL. With inflation of 13.4% and food prices skyrocketing, NFL is still gaining advantage of low labor cost. The data as received in various discussions is as follows:31 Wages: daily wages employee Rs. 100 to 200. Salary of Plant administrative employee: Rs. 6,000 to 20,000 per month Salary of plant managers at various levels Rs. 40,000 to 65,000 per month. There are only 7 managers in plant. There is no proper training of workers at plant. The reason is that overall operation does not need any sophisticated procedure. However, labor is being hired on contractual basis so they can never become precious asset of the organization as they never perceive themselves as part of company. No long term commitment and loyalty can be foreseen. NFL assembly, sieving, filling, packing and stamping are being operated on industrial machines. However, packing and filling of various food like pickle, jams are being done manually. This can lead to increase of error or substandard quantity and quality issues. Since they are also exporter of food product, they should focus more on standardization and automation of their processes. NFL is industry leader in terms of long range and quality of its products. They have 110 product and 300 SKUs. Each of their products is no doubt a pure product as NFL claims. We did not observe any artificial food mixing during our visit to plant.

30 31

Interview with M. Adnan Malik Head of Marketing Interview with Yunus Khan Plant Manager

25

Friday, June 3, 2011

Institute of Business Administration

Lack of cross functional efforts amongst departments (like R&D and Marketing) is one big weakness at NFL. Product failure of RONAQ is evident that organization has performance gaps at various levels. NFL does not have any reactive measures to overcome such performance gaps. There are no reward/motivation criteria specially to motivate plant workers. Though performance reward system exists at head office and branches but they are not clear to employees, and are totally on discretion of managers. This is leading to low morale and demotivation in employees. Food industry in Pakistan is growing today with many professional players in the market. The existence of Shan, Mitchells, Rafhan Unilever, RafhanMaize, Youngs, and so on has made the food industry extremely competitive. Shan is the closest competitor having market share of 40% in branded manufactures. NFL also has a market share of 40%. However we have observed in our discussions with NFLs executives in various interviews that they are not taking the competition very seriously. Their approach towards competition is very narrow and they do not think the magnitude of competition is high enough32. This may lead to falling behind as Shans products as well as their marketing efforts are very strong. Pakistani households expenditure on food has increased in last couple of years. This creates an opportunity for food companies especially NFL as a pioneer and a reliable name. The need is to develop food products as per consumers needs and demands. On the other on threat is that there is a growing trend of dining out in Pakistani households. People in urban areas are more and more inclined to eating out individually, with friends, and with their families. This is true for social gatherings/family small get-togethers as well. These out-of32

Interview with Plant Manager Mr. Younus Khan/Head of Marketing Mr. Adnan Malick

26

Institute of Business Administration

Friday, June 3, 2011

the-home eating tends to decrease the use of National Foods spices and cooking recipes which are primarily used by households not by restaurants and professional caterers. Furthermore, households and individuals today are also going for other than traditional foods options like fast food, Italian cuisine, Chinese dishes. Growing number of restaurants are also acting as strong substitutes of NFLs products. These factors pose strong threats and challenges for NFL in future and demands swift adjustment in Business strategy.

11.

LIST OF MINOR PROBLEMS: NFL follows Strategic planning rather than strategic management which hinders its

proactive approach towards achieving vision that leads to ineffective external environmental scanning for forecasting future trends.

One of the issues faced by NFL is the ineffectiveness of HR department which is not

duly empowered for critical decision making i.e., hiring, training and development, and succession planning.

The level of complacency towards vertical and horizontal integration for future

expansion plans is alarming. NFL is content with its current size and speed of expansion.

National Foods is unable to identify and capture the right target market and keeps its

horizon very limited. Ironically, at one hand they consider rural market as their target which is the biggest consumer market for open spices, but on other hand they do not believe open spices market is their competitor.

There is lack of cross functional collaboration amongst departments and communication

generally flow top to bottom with a few exceptions. For instance failure of product Ronaq is due to the lack of coordination between R&D and marketing department.

27

Friday, June 3, 2011

Institute of Business Administration

12.

MAJOR PROBLEM

The major problem for NFL in our view is the lack of 'mission' (mission statement neither written anywhere, nor communicated orally). Due to this NFL is neither proactive nor exercises strategic management approach in dealing with external environmental forces and predicting the course of action taken by competitors. The complacent attitude of senior management becomes apparent when it trickles down to the lack of passion in vital departments like HR and R & D and further precipitating down to lower levels.

28

Institute of Business Administration

Friday, June 3, 2011

13.

STRETEGIC ALTERNATIVES Design a mission statement, which gives a holistic view of how organization plans to

achieve its intended vision. This view must be compiled after a thorough analysis at each operation and management level. Once that is achieved NFL needs to communicate the mission statement and educate everyone in organization about its objectives and imbue commitment. Higher management should aggressively support developed mission and depict walk the talk attitude.

NFL needs to impart the basic organizational vision at organizational level. Once

everyone in organization is clear about the ultimate target and horizon, they should then relate it to the task of formulating a mission statement which will then only be as easy as putting it on paper.

NFL has to redesign its systems to create an environment that will enhance the flow of

information and facilitate faster decision-making. The senior management has to change its attitude and provide conducive environment to employees making them proactive so that they can steer the organizations future in the right strategic direction.

14.

STRATEGIC CHOICE

Design a mission statement, which gives a holistic view of how organization plans to achieve its intended vision. This view must be compiled after a thorough analysis at each operation and management level. Once that is achieved NFL needs to communicate the mission statement and educate everyone in organization about its objectives and imbue commitment. Higher management should aggressively support developed mission and depict walk the talk attitude.

29

Friday, June 3, 2011

Institute of Business Administration

15.

CAUSE AND EFFECT DIAGRAM

Follows Strategic Planning Rather than Strategic Management

Reactive rather than proactive approach in responding/adjusting to external changes

Decision Making done by top management with no involvement of employees

Key positions at NFL lying vacant Ineffective HR Department

No Proper Training & Compensation structures Leading to Employee Demotivation

Lack/Absence of Mission Statement

Complacency towards vertical /horizontal Integration

Taking Competition too lightly

No focus on making Supply Chain strong by Vertical Integration

Unable to identify right target Markets and future forecasts

Not Recognizing the changing trends of Consumer Needs Future Forecasting done on Past Trends based on Secondary Research

Lack of cross functional Collaboration

No co-ordination between R&D & Marketing for product development No co-ordination between Marketing & Supply Chain in Distribution

30

Institute of Business Administration

Friday, June 3, 2011

Appendices

31

Friday, June 3, 2011

Institute of Business Administration

Appendix 1

NFLs Vision

To be a Rs. 50 billion food company by the year 2020 in the convenience food segment by launching products and services in the domestic and international markets that enhance lifestyle and create value for our customers through management excellence at all levels.

32

Institute of Business Administration

Friday, June 3, 2011

Appendix 2

Analysis of Vision A vision statement is termed as picture of the company in the future. It is the inspiration and framework for all the strategic planning. A good vision statement: 1. Emerges from core values 2. Is grounded in mission 3. Paints a word picture of a desired future state 4. Is compelling 5. Is memorable 6. Is understandable 7. Inspires action The vision Statement of NFL states the purpose of the organization in terms of financial targets, with the mention of services offered by the organization. The vision statement does not assert the core values of the company. In absence of Mission statement the Vision does not compel the workers to stick to the Vision of the organization and ownership of the values.

33

Friday, June 3, 2011

Institute of Business Administration

Appendix 3

Financial Statements & Financial Analysis

Profit and Loss Account

For The Year Ended June 30, 2006 - 10 2010 2009 2008 2007 2006

Rupees in Thousand

Sales Cost of Sales Gross Profit

4,489,946 (3,163,199) 1,326,747

3,758,706 (2,632,255) 1,126,451

3,061,746

2,391,058

1,847,700

(2,075,969) (1,572,254) (1,276,437) 985,777 818,484 571,263

Distribution Costs Administrative Expenses Other Operating Expenses Other Operating Income Operating Profit Finance Costs

(909,818) (164,303) (17,295) 23,214 258,545 (99,364) 159,181

(665,664) (149,802) (20,448) 17,006 307,543 (86,841) 220,702

(570,218) (129,868) (17,815) 22,309 290,185 (56,238) 233,947

(513,902) (91,297) (19,094) 6,110 200,301 (32,675) 167,626

(364,758) (73,112) (8,753) 6,681 131,321 (24,850) 106,471

Claim Recovery against Raw Material Supply

159,181 (72,622) 86,559

PKR2.09

220,702 (81,241) 139,461

PKR3.37

233,947 (77,401) 156,546

PKR28.33

24,096 191,722 (62,430) 129,292

PKR23.40

106,471 (36,107) 70,364

PKR16.55

Profit before Taxation Taxation Net Income Earnings per Share 34

Institute of Business Administration

Friday, June 3, 2011

Balance Sheet

As on June 30, 2006 - 10 2010 ASSETS Non-Current Assets Property, plant and equipment Intangibles Long term deposits 794,771 25,688 4,509 824,968 614,004 35,668 5,163 654,835 635,325 2,194 4,444 641,963 493,444 2,779 2,766 498,989 365,874 4,064 2,504 372,442 2009 2008 Rupees in Thousand 2007 2006

Current Assets Stores, spares and loose tools Stock-in-trade Trade debts Advances Trade deposits and prepayments Accrued interest and Markup Other receivables Tax refund due Cash and bank balances 5,360 1,502,232 253,050 43,867 10,118 _ 20,664 _ 14,101 1,849,392 2,674,360 5,432 846,977 274,556 29,044 6,660 _ 2,632 _ 15,205 1,180,506 1,835,341 7,499 755,259 259,091 18,965 2,333 _ 1,446 46,603 13,496 1,104,692 4,322 477,007 112,585 11,794 2,520 _ 25,393 37,702 18,146 689,469 3,463 367,235 101,940 13,586 4,290 1,637 1,063 19,279 83,025 595,518 967,960 35

1,746,655 1,188,458

Friday, June 3, 2011 SHARE CAPITAL and RESERVES Equity Issued, Subscribed and Paid up capital Unappropriated Profit Capital Reserve-Share Premium Non-Current Liabilities Long term financing Liabilities against assets subject to finance lease Deferred Tax Retirement benefits obligations

Institute of Business Administration

414,427 327,518 _ 741,945 20,000 2,260 72,621 10,707 105,588

331,542 323,844 _ 655,386 60,000 13,700 59,999 6,780 140,479

55,257 454,566 6,102 515,925 100,000 26,262 70,758 _ 197,020

42,505 319,273 6,102 367,880 143,000 15,406 35,357 _ 193,763

42,505 198,482 6,102 247,089 189,000 5,694 11,467 _ 206,161

Current Liabilities Trade and Other payables Accrued Interest/Markup Short term borrowings Current maturity of: Long term financing Liabilities against assets subject to finance lease Taxation-Provision less payment Due to the government Commitments 40,000 10,238 12,407 16,031 _ 1,826,827 2,674,360 36 40,000 12,510 8,397 14,643 _ 1,039,476 1,835,341 43,000 12,341 42,000 13,277 _ 1,033,710 46,000 6,041 38,000 8,959 _ 626,815 26,000 2,306 37,000 _ _ 514,710 967,960 530,063 28,319 1,189,769 460,626 17,764 485,536 369,565 17,186 536,341 306,359 10,184 211,272 244,988 8,491 195,925

1,746,755 1,188,458

Institute of Business Administration

Friday, June 3, 2011

Trend Analysis

Vertical Analysis

Profit and Loss Account

For The Year Ended June 30, 2006 - 10 2010 2009 2008 2007 2006

Sales Cost of Sales Gross Profit Distribution Costs Administrative Expenses Other Operating Expenses Other Operating Income Operating Profit Finance Costs

100% 70.5% 29.5% 20.3% 3.7% 0.4% 0.5% 5.8% 2.2% 3.5%

100% 70.0% 30.0% 17.7% 4.0% 0.5% 0.5% 8.2% 2.3% 5.9%

100% 67.8% 32.2% 18.6% 4.2% 0.6% 0.7% 9.5% 1.8% 7.6%

100% 65.8% 34.2% 21.5% 3.8% 0.8% 0.3% 8.4% 1.4% 7.0%

100% 69.1% 30.9% 19.7% 4.0% 0.5% 0.4% 7.1% 1.3% 5.8%

Claim Recovery against Raw Material Supply

0.0% 3.5% 1.6% 1.9%

0.0% 5.9% 2.2% 3.7%

0.0% 7.6% 2.5% 5.1%

1.0% 8.0% 2.6% 5.4%

0.0% 5.8% 2.0% 3.8%

Profit before Taxation Taxation Net Income

37

Friday, June 3, 2011

Institute of Business Administration

Balance Sheet

As on June 30, 2006 - 10 2010 ASSETS Non-Current Assets Property, plant and equipment Intangibles Long term deposits

30% 1% 0% 31% 33% 2% 0% 36% 36% 0% 0% 37% 42% 0% 0% 42% 38% 0% 0% 38%

2009

2008

2007

2006

Current Assets Stores, spares and loose tools Stock-in-trade Trade debts Advances Trade deposits and prepayments Accrued interest and Markup Other receivables Tax refund due Cash and bank balances

0% 56% 9% 2% 0% 0% 1% 0% 1% 69% 0% 46% 15% 2% 0% 0% 0% 0% 1% 64% 0% 43% 15% 1% 0% 0% 0% 3% 1% 63% 0% 40% 9% 1% 0% 0% 2% 3% 2% 58% 0% 38% 11% 1% 0% 0% 0% 2% 9% 62%

100%

38

100%

100%

100%

100%

Institute of Business Administration

SHARE CAPITAL and RESERVES Equity Issued, Subscribed and Paid up capital Unappropriated Profit Capital Reserve- Share Premium

15% 12% 0% 28% 18% 18% 0% 36% 3% 26% 0% 30%

Friday, June 3, 2011

4% 27% 1% 31%

4% 21% 1% 26%

Non-Current Liabilities Long term financing Liabilities against assets subject to finance lease Deferred Tax Retirement benefits obligations

1% 0% 3% 0% 4% 3% 1% 3% 0% 8% 6% 2% 4% 0% 11% 12% 1% 3% 0% 16% 20% 1% 1% 0% 21%

Current Liabilities Trade and Other payables Accrued Interest / Markup Short term borrowings Current maturity of: Long term financing Liabilities against assets subject to finance lease Taxation- Provision less payment Due to the government Commitments

20% 1% 44% 1% 0% 0% 1% 0% 68% 25% 1% 26% 2% 1% 0% 1% 0% 57% 21% 1% 31% 2% 1% 2% 1% 0% 59% 26% 1% 18% 4% 1% 3% 1% 0% 53% 25% 1% 20% 3% 0% 4% 0% 0% 53%

100%

100%

100%

100%

100%

39

Friday, June 3, 2011

Institute of Business Administration

Horizontal Analysis

Profit and Loss Account

For The Year Ended June 30, 2006 - 10 2010 2009 2008 2007 2006

Sales Cost of Sales Gross Profit Distribution Costs Administrative Expenses Other Operating Expenses Other Operating Income Operating Profit Finance Costs

243% 247.81% 232% 249.43% 224.73% 197.59% 347.46% 196.88% 399.86% 149.51%

203.43% 206.22% 197.19% 182.49% 204.89% 233.61% 254.54% 234.19% 349.46% 207.29%

165.71% 162.64% 172.56% 156.33% 177.63% 203.53% 333.92% 220.97% 226.31% 219.73%

129.41% 123.18% 143.28% 140.89% 124.87% 218.14% 91.45% 152.53% 131.49% 157.44%

100% 100% 100% 100% 100% 100% 100% 100% 100% 100%

Claim Recovery against Raw Material Supply

Profit before Taxation Taxation Net Income Earnings per Share

149.51% 201.13% 123.02% 12.63%

207.29% 225.00% 198.20% 20.36%

219.73% 214.37% 222.48% 171.18%

180.07% 172.90% 183.75% 141.39%

100% 100% 100% 100%

40

Institute of Business Administration

Friday, June 3, 2011

Balance Sheet

As on June 30, 2006 - 10 2010 ASSETS Non-Current Assets Property, plant and equipment Intangibles Long term deposits

29% -28% -13% 26% -3% 1526% 16% 2% 29% -21% 61% 29% 35% -32% 10% 34% 61% -5% 17% 60%

2009

2008

2007

2006

Current Assets Stores, spares and loose tools Stock-in-trade Trade debts Advances Trade deposits and prepayments Accrued interest and Markup Other receivables Tax refund due Cash and bank balances

-1% 77% -8% 51% 52% 0% 685% 0% -7% 57% -28% 12% 6% 53% 185% 0% 82% -100% 13% 7% 74% 58% 130% 61% -7% 0% -94% 24% -26% 60% 25% 30% 10% -13% -41% -100% 2289% 96% -78% 16% 5% 3% 34% -3% 135% 100% 16% 10% 1388% 25%

83%

9%

89%

50%

85%

41

Friday, June 3, 2011 SHARE CAPITAL and RESERVES Equity

Institute of Business Administration

Issued, Subscribed and Paid up capital Unappropriated Profit Capital Reserve- Share Premium

25% 1% 0% 13%

500% -29% -100% 27%

30% 42% 0% 40%

0% 61% 0% 49%

0% 48% 0% 35%

Non-Current Liabilities Long term financing Liabilities against assets subject to finance lease Deferred Tax Retirement benefits obligations

-67% -40% -30% -24% 149%

-84%

-48%

70%

171%

144%

21% 58% -25%

-15% 100% -29%

100% 0% 2%

208% 0% -6%

-3% 0% 129%

Current Liabilities Trade and Other payables Accrued Interest / Markup Short term borrowings Current maturity of: Long term financing Liabilities against assets subject to finance lease Taxation- Provision less payment Due to the government Commitments

15% 59% 145% 0% -18% 48% 9% 0% 76% 25% 3% -9% -7% 1% -80% 10% 0% 1% 21% 69% 154% -7% 104% 11% 48% 0% 65% 25% 20% 8% 77% 162% 3% 100% 0% 22% 74% 81% -28% 333% 42% 208% 0% 0% 18%

64%

42

-1%

107%

65%

182%

Institute of Business Administration

Friday, June 3, 2011

Appendix 4

IFE

43

Friday, June 3, 2011

Institute of Business Administration

Appendix 5

EFE

44

Institute of Business Administration

Friday, June 3, 2011

Appendix 6

CPM

45

Friday, June 3, 2011

Institute of Business Administration

Appendix 7

BCG Growth Share Matrix

46

Institute of Business Administration

Friday, June 3, 2011

Appendix 8

Process Flow Diagram

PROCESS FLOW FOR PICKLE

Fully grown and fresh raw mangoes, lemons and other fruits and vegetables are washed in water and then cut into the standardized sizes. Then they are cured by bringing them for about 7-8 hours & are then dehydrated in dryer. Simultaneously dry spices like red chilies, turmeric, mustard etc. are grounded separately and are mixed with cured and dried pieces of mangoes, lemons or other fruits and vegetables. Finally, they are packed in polythene bags as per predetermined quantity (sales-mix) and sealed. Weight loss due to dehydration would be in the range of 10% to 15%. The worker has to soak this dry mixture with the suggested quantity of water and oil for around 8 hours and the pickle is ready. The process flow chart of Pickle is as under:

47

Friday, June 3, 2011

Institute of Business Administration

SPICES PROCESS FLOW CHART

48

Institute of Business Administration Interview Summaries Interview # 1 Name: Kashif Iqbal Designation: CFO Phone Number: +92 (21) 257-7707-10 Date of Meeting: 24th March 2011 Place of Meeting: Factory Office Duration: 60 minutes Address: F-160/C, F-133, S.I.T.E., Karachi

Friday, June 3, 2011

Appendix 9

Summary: In our meeting with CFO we mostly discussed about the declined profitability of NFL on which he commented that during the year in question, profit from operations decreased due to rising costs, particularly agro materials. This was further aggravated by increase in financing cost. Further, during the same year company launched two additional brands in the market (i.e. Instant Drink and Rice). An investment was needed for brand awareness, stock in trade and extension in plant facility. These all facts resulted in reduced operating profit. However, next year company developed a multi focus strategy. This included rationalization of costs on one hand and reducing costs that can be avoided. This strategy delivered its results and during the first six months period, Sales of the company increased by 24.9%, however, overheads as a percentage of sales decreased which resulted in a 4.1% increase in operating profit. He said that we endeavor to make our consumer feel kinship and camaraderie through our strong, brand equity and portfolio, accordingly, all key categories are delivering excellent results. Our

49

Friday, June 3, 2011

Institute of Business Administration

marketing campaign Hamara Khane Hamare Tehwaar has been a great success and received an overwhelming response from the consumers which has helped in growing the top line. Side by side, the company has undertaken various cost savings initiatives across all the company which has yielded savings33. On rising cost question he stated that a number of initiatives were taken during the current year, in order to control increasing costs. The major initiatives included rationalizing of selling and distribution expenses by selectively spending on advertisement and promotion, increasing in-store displays, transfer of order bookers force to distributors and other cost control and cost management initiatives. The results of these initiatives are apparent from the results for the first six months period ended December 31, 2010. The Company performed excellent in all areas. There was a decrease of around 3.12% in administrative and selling and distribution costs of the company during the first six months of this financial year as compared to last financial year. Finally he added that it is National Foods history that it distributes its profit every year either in the form of Dividend or Bonus Shares. In order to maximize shareholders wealth, the company every year sets targets for return on equity. Average return on equity for last six years has been over 25%.

33

Appendix 3 Financial Statements & Financial Analysis

50

Institute of Business Administration Interview # 2 Name: Shahid Hussain Designation: Taxation Manager Phone Number: +92 (21) 257-7707- (Ext: 361) Cell Phone: 0321 - 2579843 Date of Meeting: 24th March 2011 Place of Meeting: Factory Office Duration: 30 minutes Address: F-160/C, F-133, S.I.T.E., Karachi

Friday, June 3, 2011

Summary: In our meeting with Mr. Shahid Hussain Taxation Manager of NFL, we discussed about NFLs contribution to national exchequer as to how the contribution of the company towards national exchequer in terms of taxes and so on? Mr. Shahid commented that NFL is very responsive to its duties towards Government and it pays their taxes regularly to GOP as this is the prime responsibility of an organization towards the country so that the money received as tax can be used for the developmental activities in the country. He mentioned during the financial year ended June 30, 2010, the contribution to national exchequer was Rs. 888.442 million [as compared to 765 million in 2009]. Further, foreign exchange of Rs. 594 million was also generated through exports during the same year.

51

Friday, June 3, 2011

Institute of Business Administration

Interview # 3 Name: Waqar Abrar Khan Designation: Director HR, Training and Administration Phone Number: +92 (21) 021 566-2687, 567-0793, 567-0646 Date of Meeting: 6th April 2011 Place of Meeting: Corporate Office Duration: 30 minutes Address: Corporate office 12/CL - 6, Claremont Road, Civil Lines, Karachi Summary: Mr Waqas Abrar Khan-HR Director informed us that HR provides basic level training to the sales force: just as communication, negotiation and customer handling skills. However we concluded during our interview that career paths are not clearly defined for them, many sales officers do not know where they will end up after two years as the promotion is subject to the approval of senior managers who judge by the criteria of 'merit'. The word 'merit' could not be well defined by Head of Marketing and HR except "high level performance" and "hard working". It hires low level workers from third party contractors, due to the seasonal variations in the demand and supply of labor. Just as in pickle department, labor is needed in summer only to cut out mangoes, which are stored in large tanks. It is the policy of National Foods Limited that no person shall be denied the right to work solely because of age. There is no mandatory retirement age except for those occupations which have limitations established by law as per factorys act, 1934. In National Foods Limited the employee evaluation is done on yearly basis. The employee is evaluated on the basis of its KPI. The employee then has a meeting with his line manager in which the problems are discussed and efforts are appreciated

52

Institute of Business Administration Interview # 4 Name: Younus Khan Designation: Plant Manager Phone Number: +92 (21) 347503737 Date of Meeting: 15th April 2011 Place of Meeting: Head office and Factory Duration: 60 minutes Address: A-13, North Western Industrial Zone, Bin Qasim, Karachi

Friday, June 3, 2011

Summary: Younus Khan, the plant manager at Bin Qasim gave us the detail of the plant layout and its working environment. He showed a keen interest in our live case study in his company as we briefed him about the nature of the study and the importance of its outcome for the company. After our thorough visit of the plant we had a comprehensive discussion with him about the mode of supplier selections, the maintenance of plant equipment, and availability of the labor. He was very excited to discuss that they follow stringent benchmarks with no compromise on quality of the ingredients specially the spices and fruits needed for making pickles and recipes.

53

Friday, June 3, 2011

Institute of Business Administration

Interview # 5 Name: M. Gulfam Designation: Quality Control Manager Phone Number: +92 (21) 347503737 Date of Meeting: 15th April 2011 Place of Meeting: Factory Duration: 15 minutes Address: A-13, North Western Industrial Zone, Bin Qasim, Karachi Summary: The manager of quality control briefed us on the various certifications of ISOs in place and how they are adhering to them in letter and in spirit. Not only the workers but the entire machineries and assembly line followed the procedures strictly. Since the spices have to pass through different stages he explained us how the other stage supervisor inspects the processed materials before accepting them as though they are the internal buyers of the products. Hence the onus of quality gets transferred to the next stage supervisors. Since cleaning, weighing, initial packing and final packaging are mostly done by machines the quality controller performs random checks on the processed materials throughout. The quality controller assures that the quality remains the hallmark of NFL products and if it is compromised they cant claim the position of brand leader in many food categories.

54

Institute of Business Administration Interview # 6 Name: Mr. Sajjad Farooq Designation: Supervisor - Weighing Section Phone Number: +92 (21) 347503737 Date of Meeting: 15th April 2011 Place of Meeting: Factory Duration: 10 minutes Address: A-13, North Western Industrial Zone, Bin Qasim, Karachi

Friday, June 3, 2011

Summary: The manager weighing department explained how the machines were automated to weigh the defined amount with precision. Since both spices and recipes involve powders hence they require skillful handling of the weighing machines as the flow line production work on perfections. In order to assure that weighing is done in accurate fashion he even told us to check ourselves the quantity assigned so that we can be assured of its accuracy. Besides this, some machineries were imported apart from bulk of the local made products, the technicians are always available there to mitigate any snag that may develop in any of the stages.

55

Friday, June 3, 2011

Institute of Business Administration

Interview # 7 Name: Muhammad Behram Khan Designation: Supervisor Package Section Phone Number: +92 (21) 347503737 Date of Meeting: 15th April 2011 Place of Meeting: Factory Duration: 15 minutes Address: A-13, North Western Industrial Zone, Bin Qasim, Karachi Summary: The supervisor of this section gave the detail of the section by demonstrating us how they maintain a strict protocol and procedure of final packaging in different variants of the spices and they also have trained workforce at different stations where we found many female workers busy in placing the packages in their proper places. He told us about the glue of packaging which they import and it assures tight packing as packages have to go through several physical movements.

56

Institute of Business Administration Interview # 8 Name: Shakaib Arif Designation: Chief Operating Officer Phone Number: +92 (21) 35662687 Date of Meeting: 28th April 2011 Place of Meeting: Corporate office Duration: 30 minutes Address: 12/CL-6 Claremont Road Civil Lines Karachi

Friday, June 3, 2011

Summary: The chief operating officer mainly explained about the changes that have occurred in the last two to three years in the plant pertaining to the selection of suppliers from rural areas, selecting the right contractors for manual work at the plant and changes of machinery at the assembling line with respect to availability of technology worldwide. He mentioned that since technologies are changing in the industry at the rate of knots which are very costly to be applied at the moment. They have got the certifications of ISO 9001 and because of this many procedures and processes have become strict. He explained that strict quality control is necessary as even slight deviation often result into rejections of entire batch from local and international buyers. Excessive compliance and controls measures have resulted into high input cost. Besides, the enterprise resource planning has also resulted in keeping in contact many stakeholders of value chain. But what we found through this discussion is that he was much more concerned with high cost rather than how it affects the various stakeholders of the firm.

57

Friday, June 3, 2011

Institute of Business Administration

Interview # 9 Name: Adnan Malick Designation: Head of marketing Phone Number: 0301 8251384 Land Line 02135821243-46 Date of Meeting: 20th April 2011 Place of Meeting: Forum office Duration: 30 minutes Address: 219, The Forum G-20, Block 9, Khaban-e-Jami Summary: R&D department does not liaise with the marketing department and bye-passes the marketing department by directly presenting its reports to CEO through COO. The suggestions are sent to CEO then are implemented downward. This can result in product failures and brand dilution, as the objectives of marketing and R&D department does not seem to be aligned. The main drivers for spices demand are population growth and child to adult conversion rate, ratio of younger population, urbanization, trends towards readymade curries. Other factors affecting the demand are inflation and income levels. Usage of packed spices in Pakistan is highly price elastic. Any upward change in inflation directly affects the usage level of packed spices. International export market is relatively price inelastic due to their health conscious standards. Asian communities consider the spices compulsory part of their food because of their traditional cooking habits which makes this group a relatively price inelastic market.

58

Institute of Business Administration

Friday, June 3, 2011

Appendix 10

Individual Contribution INDIVIDUAL WORK EFFORT REPORT: RAZIA KHAN

NFL Plant visit at Port Qasim Meeting with COO Meeting with Plant Manager at Port Qasim Meeting with Quality control Manager at Port Qasim Meeting with Head of Marketing Meeting with HR Head Liaison between the Project Team and the NFL Management for the interviews scheduled and factory visit. Coordinated with NFL HR and Marketing Department for provision of reports and documents. Provided organogram Composed Organization Structure Composed & analyzed Strategic Alternatives Composed & finalized Major Problem. Proof reading of SWOT analysis. Participated in identification and finalizing Minor problems. Signature: _____________________

59

Friday, June 3, 2011

Institute of Business Administration

MUHAMMAD FARHAN

NFL Plant visit at Port Qasim Meeting with COO Meeting with Plant Manager at Port Qasim Meeting with Pickle In-charge at Port Qasim Meeting with Supervisor Package Section at Port Qasim Meeting with CFO Meeting with Taxation Manager Strategic Map PEST analysis Balance Sheet Analysis Key Competitors Financial Comparative Analysis Opportunities and Threat Analysis Participated in identifying and finalizing Minor problems. Participated in identifying and finalizing Major problems.

Signature: _____________________

60

Institute of Business Administration

Friday, June 3, 2011

MUZAFAR ALI