Escolar Documentos

Profissional Documentos

Cultura Documentos

Block 8

Enviado por

Vinc PanDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Block 8

Enviado por

Vinc PanDireitos autorais:

Formatos disponíveis

bLo65447_formulacard_001-002.

qxd

2/23/09

11:05 AM

Page 1

Formulas Chapter 2

1. Earnings per share (e.p.s.) Earnings available to common shareholders Number of shares outstanding (23) 4. Dividend yield 1212 2. Payout ratio Dividend per share Earnings per share 5. Market value Book value (22) Market value per share Book value per share

3. P/E ratio

Market share price Earnings per share Net income Sales

Dividends per share Market share price

(24)

MV BV

(25)

Chapter 3

A. Profitability ratios 1. Profit margin

(31)

3. Return on equity (ROE) Net income a. Shareholders equity B. Asset utilization ratios 4. Receivables turnover 5. Inventory turnover

2. Return on assets (investment) (ROA) Sales Net income Net income a. b. Total assets Sales Total assets Total assets Equity c. ROA Equity multiplier (33) Accounts receivable Average daily credit sales Inventory Average daily COGS Accounts payable

(32)

b. Equity multiplier (34a) or

Sales 1credit2 Receivables Inventory

Average collection period (35a) (36a) Inventory holding period b. Accounts payable period

(34b) (35b) (36b)

Cost of goods sold

Sales Inventory

6. a. Accounts payable turnover 7. Capital asset turnover C. Liquidity ratios D. Debt Utilization Ratios 9. Current ratio

Cost of goods sold Accounts payable (37)

Average daily purchases 1COGS2 Sales (38) Total assets Current assets Inventory Current liabilities

Sales Capital assets (39)

8. Total asset turnover 10. Quick ratio

Current assets Current liabilities Total debt Total assets

(310) (312)

11. Debt to total assets 13. Fixed charge coverage

(311) (313)

12. Times interest earned

Income before interest and taxes Interest

Income before fixed charges and taxes Fixed charges PS2 (1 D) (41)

Chapter 4

1. RNF

A ( S) S1 P VC 1SB Q1P Q1P

L ( S) S1 (51) IA SB VC2 365 d SA SA VC2 FC (71a)

2. SGR

P 11 A S1 (54) P 11

D2 a1

DT b E DT D2 a1 b E

(42)

Chapter 5

1. CM 5. EBIT* 8. DOL

2. BE IB 2 (57) S S TVC TVC FC 2. r 365 d 1date2

FC CM

(52) 6. DCL 9. DFL DOL

3. DOL

CM EBIT

4. DFL 7. DCL CM EBT Q1P VC2 (72) VC2 FC

EBIT EBT (510)

(56)

DFL (59) 10. DCL 3. EOQ

EBIT EBIT I 1 (71b)

Chapter 7 Chapter 8

1. r 1. KDIS 4. RDIS

100 P P

a1 (81)

100 P b P

365 d

2SO B C Q1P

S TVC TVC FC SO Q I P CQ 2 365 d

I (73) (82)

4. TC 3. RANNUAL

d% 100% d% I P I 2

f 1date2

2. Amount to be borrowed 5. RCOMP 11 I c2 (84)

Amount needed 11 c2 6. RCOMP I P B

7. RINSTALL

1Total number of payments

365 (83) d Annual number of payments 12

365 d

(85)

I P

(86)

3rd Pass

bLo65447_formulacard_001-002.qxd

2/23/09

11:05 AM

Page 2

Chapter 9

1. FV

PV(1

i)n 11

(91) i2 n

1

2. (1 11 i2

i)n

Effective interest rate (92) 1 11 i i i2 n

1

3. PV 1 i2 n d

FV c

11

1 i2 n

(93)

4. FVA ABGN 11 i2

Ac

11 1

i2 n i i2 n

1

(94a)

5. FVA

ABGN c FVA c 11

i i i2 n d (96a)

(94b)

6. PVA FVA c

(95a)

7. PVA

11 i

(95b)

8. A

9. ABGN

11

11

i2

(96b)

10. A

PVA

i 1 11 A1a D1 Ke D4 Ke g g i 1 i2 n 1 g

(97a)

11. ABGN

PVA

It

i 11 Y2 t i2 11 11 Pn Y2 n 1 i2 n

1

(97b)

12. PV

A i DP KP

n

(99)

13. PV

A1 i DP PP g

(910)

14. PVn

bc1

1 1

g i

b d

n

(911)

Chapter 10

1. Pb 5. Ke

a t 1 11 D1 P0 Y(1 D1 P0 1

(101)

2. Pp 6. P0 Y11 1 T2 F (111b)

(103) Dt Ke 2 t DP /PP 1 Rf F Pn a

3. Kp 1 1 Ke b

n

(104)

4.

P0

(108) (10B2) D1 P0 Kjn g (113) P0 Pn b (116)

g (109)(113)(115) T) g (111a) a 2. Kd D1 P0

a t 1 11 3. Kp

(10B1) 4. Kp DP Pp F

7. P3 (112b)

Chapter 11

1. Kd

(112a)

5. Ke Kj 1 F

6. Kn

or Kn

gb

P0 Pn

(114)

7. Kj

j (Rm

Rf )

(115)

8. Kjn

or

Kj a

9. X

Retained earnings % of equity in the capital structure

j

(117)

Size of the investments 10. Z that lower- cost debt will support 12. Kj 2 1D Rf

j (Rm

Amount of lower- cost debt % of equity in the capital structure

(118) EBIT Ka (Keu

11. Kj 14. Ka Kea

Rm

e (11A1)

Rf ) 16. VL

(11A2) VU TD (11B4)

2 2xA

13. V 17. KeL Keu

(11B1) I)(D/S)(1 T) (11B5)

(11B2)

Chapter 12 Chapter 13

PV of 1. [Cpv CCA tax shield 1. D DP (131) 6. rAB CovAB

A B

15. KeL Keu (Keu I )(D/S) dTc 1 0.5r Spv] a ba b (121) r d 1 r 2. 7.

2 2xA

(11B3)

D2 2P (132)

2 A 2 xB 2 B

3. V

(133) 8.

4. Dp

AB

xi Di

2 A

(134)

2 xB 2 B

5. CovAB 2rAB

A B A B

P1D (138)

Di 2 1F

Fi 2

(135)

(136)

AB

2CovABxAxB (137)

x x

Chapter 17

1.

Shares required Po N S 1

Number of directors desired Total number of shares outstanding Total number of directors to be elected 1 (173) 4. R Pe N S

(171)

2.

Number of directors that can be elected 1Shares owned 12 1Total number of directors to be elected

1Total number of shares outstanding2

12

(172)

3. R

(174) (191) Shares from conversion 12 Contract length 1months2 (211) (192) 3. I 4. S (M W E) N (193)

Chapter 19

1. Face value

Conversion price

Conversion ratio

2. Diluted earnings per share

Adjusted aftertax earnings Shares outstanding Forward Spot Spot

I (194)

Chapter 21

1. Forward premium (discount)

3rd Pass

Você também pode gostar

- Service Manual MFC-J5320DW J5520DW J5620DW J5625DW J5720DWDocumento31 páginasService Manual MFC-J5320DW J5520DW J5620DW J5625DW J5720DWcrod123456758% (12)

- Tacoma Wiring - Diagram PDFDocumento60 páginasTacoma Wiring - Diagram PDFAperc Taini Glbrt Rmx100% (1)

- 3ZZ FeDocumento1 página3ZZ FePatricio Valencia85% (20)

- Avanza - Wiring DiagramDocumento33 páginasAvanza - Wiring DiagramAnugrah Raden85% (41)

- Microfridge Marketing CaseDocumento5 páginasMicrofridge Marketing CaseSALONI CHOUDHARYAinda não há avaliações

- Lexus - GS300 - GS430 - Service - Manual 4Documento7 páginasLexus - GS300 - GS430 - Service - Manual 4seregap84Ainda não há avaliações

- MCQ On Financial Management For UGC NET With AnswersDocumento9 páginasMCQ On Financial Management For UGC NET With AnswersRajendra SinghAinda não há avaliações

- Consolidated Statement of Financial Position - Date of Acquisition AnalysisDocumento2 páginasConsolidated Statement of Financial Position - Date of Acquisition AnalysisKharen Valdez0% (1)

- American Home Products EssayDocumento7 páginasAmerican Home Products EssayYanbin CaoAinda não há avaliações

- Corporate Accounting NotesDocumento25 páginasCorporate Accounting NotesDr. Mohammad Noor Alam100% (1)

- Accounting Equation ExplainedDocumento9 páginasAccounting Equation ExplainedMunira AlfaizAinda não há avaliações

- Fundamentals of Corporate Finance: Formula SheetDocumento7 páginasFundamentals of Corporate Finance: Formula SheetSunny KabraAinda não há avaliações

- Checklist of Key Figures: Kieso Intermediate Accounting: IFRS EditionDocumento2 páginasChecklist of Key Figures: Kieso Intermediate Accounting: IFRS EditionMike WarrelAinda não há avaliações

- Appb DFDocumento5 páginasAppb DFfgdhgcAinda não há avaliações

- Homework Solution Set #1 - Comprehensive SolutionsDocumento3 páginasHomework Solution Set #1 - Comprehensive SolutionsNasr CheaibAinda não há avaliações

- Power Source Engine Control (2AZ-FSE, 1AZ-FSE) Engine Control (2AZ-FSE, 1AZ-FSE) Engine Control (2AZ-FSE, 1AZ-FSE) Engine Control (2AZ-FSE, 1AZ-FSE) Cruise Control (2AZ-FSE, 1AZ-FSE)Documento1 páginaPower Source Engine Control (2AZ-FSE, 1AZ-FSE) Engine Control (2AZ-FSE, 1AZ-FSE) Engine Control (2AZ-FSE, 1AZ-FSE) Engine Control (2AZ-FSE, 1AZ-FSE) Cruise Control (2AZ-FSE, 1AZ-FSE)Alexander Neyra100% (1)

- Cash Flow Statement Model Example - ToptalDocumento5 páginasCash Flow Statement Model Example - ToptalAlbert AtengAinda não há avaliações

- Power Supply Unit: 9000pro Overall Circuit Diagram 5/5 (TG, PW)Documento1 páginaPower Supply Unit: 9000pro Overall Circuit Diagram 5/5 (TG, PW)iraklitospAinda não há avaliações

- Toshiba 20hl67 20hlk67Documento45 páginasToshiba 20hl67 20hlk67SNOWBALL2008Ainda não há avaliações

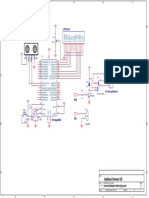

- PIC Micro Project BoardDocumento1 páginaPIC Micro Project BoardOkiPetrus Hutauruk LumbanBaringinAinda não há avaliações

- Skematik CVAVRDocumento1 páginaSkematik CVAVRFarraziAinda não há avaliações

- DCP J562DW - J785DW - MFC J460DW J480DW J485DW J680DW J880DW J885DW J985DW PDFDocumento31 páginasDCP J562DW - J785DW - MFC J460DW J480DW J485DW J680DW J880DW J885DW J985DW PDFfefotroncitoAinda não há avaliações

- DOP7Documento2 páginasDOP7Nghia Do100% (1)

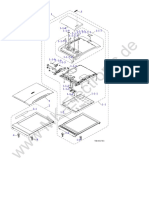

- Parts Reference List: MODEL: DCP-J4110DW/ MFC-J2310/J2510/J4410DW/ J4510DW/J4610DW/J4710DWDocumento32 páginasParts Reference List: MODEL: DCP-J4110DW/ MFC-J2310/J2510/J4410DW/ J4510DW/J4610DW/J4710DWfefotroncitoAinda não há avaliações

- Operating System AssessmentsDocumento12 páginasOperating System AssessmentsMaria MercadoAinda não há avaliações

- ZachDocumento17 páginasZachapi-242784130Ainda não há avaliações

- Digital logic ICs and displaysDocumento4 páginasDigital logic ICs and displaysDaryl ScottAinda não há avaliações

- Parts manualMFC-J5910DW PDFDocumento29 páginasParts manualMFC-J5910DW PDFidellytecAinda não há avaliações

- Brother DCP j100 j105 j132w j152w j172w j200 j245 Parts ManualDocumento31 páginasBrother DCP j100 j105 j132w j152w j172w j200 j245 Parts Manuallyndell culturaAinda não há avaliações

- Monthly Statistical Digest January 2012Documento43 páginasMonthly Statistical Digest January 2012Kyren GreiggAinda não há avaliações

- LM2576 DC-DC converter module power supplyDocumento1 páginaLM2576 DC-DC converter module power supplycold_stone101Ainda não há avaliações

- I2C LCD Module Schematic DiagramDocumento1 páginaI2C LCD Module Schematic DiagramVasi ValiAinda não há avaliações

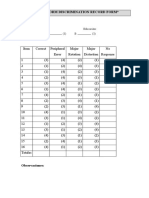

- Visual Form Discrimination and Judgment of Line Orientation Test RecordDocumento3 páginasVisual Form Discrimination and Judgment of Line Orientation Test RecordAnna EmeAinda não há avaliações

- SkematikDocumento1 páginaSkematikFarraziAinda não há avaliações

- Compact Circuit Diagram of an Inverter Bypass Switching BoardDocumento1 páginaCompact Circuit Diagram of an Inverter Bypass Switching BoardOmarAinda não há avaliações

- Financial ratios and formulasDocumento3 páginasFinancial ratios and formulasLi Jean TanAinda não há avaliações

- General Ledger Accounting GuideDocumento102 páginasGeneral Ledger Accounting GuideAbdul QaiyoumAinda não há avaliações

- R13 VCC5V 220 D2 A K LED-BLUE_DACDocumento1 páginaR13 VCC5V 220 D2 A K LED-BLUE_DACJuan Galarza100% (1)

- 1GR Fe Motor PDFDocumento5 páginas1GR Fe Motor PDFMiguel Angel Capia TintaAinda não há avaliações

- Liebertwolkwitz 131014Documento4 páginasLiebertwolkwitz 131014jhawkesAinda não há avaliações

- NATOPS Flight Operations 2017Documento408 páginasNATOPS Flight Operations 2017LouisAinda não há avaliações

- M57TE Block DiagramDocumento9 páginasM57TE Block DiagramjmkcbeAinda não há avaliações

- Ivar Aasen Field Development Project - PDQ: V FD For Utility Supply Fans - Circuit DiagramDocumento16 páginasIvar Aasen Field Development Project - PDQ: V FD For Utility Supply Fans - Circuit DiagramayemyothantAinda não há avaliações

- brother-dcp-j140w-parts-manualDocumento27 páginasbrother-dcp-j140w-parts-manualjosecarvalenciaAinda não há avaliações

- 16f887 DoublemeternosimDocumento1 página16f887 DoublemeternosimSan Lug Oma100% (1)

- Mills' 2Q12 Result: Ebitda Financial Indicators Per Division Income StatementDocumento16 páginasMills' 2Q12 Result: Ebitda Financial Indicators Per Division Income StatementMillsRIAinda não há avaliações

- DCP-J125 Part ListDocumento27 páginasDCP-J125 Part Listleo_lnetoAinda não há avaliações

- Syria Forecast PolicyDocumento2 páginasSyria Forecast PolicychbatlatAinda não há avaliações

- 2015 Paper BankDocumento8 páginas2015 Paper BankBrian DhliwayoAinda não há avaliações

- GSM - TX ANT: Model: Dated Drawn Sheet ofDocumento10 páginasGSM - TX ANT: Model: Dated Drawn Sheet ofAlpin PbcsAinda não há avaliações

- Schem AnticDocumento1 páginaSchem Anticthanhv_25100% (1)

- IO Door Board SchematicDocumento2 páginasIO Door Board Schematicvilla1960Ainda não há avaliações

- LAB-X1 SchematicDocumento2 páginasLAB-X1 SchematicRenato MirandaAinda não há avaliações

- Labx 1 SCHDocumento2 páginasLabx 1 SCHercervantesAinda não há avaliações

- Financial Accounting Assignment 1 (Chapter 1&2) Prepared by Abraam Fahmy & Amany FayekDocumento6 páginasFinancial Accounting Assignment 1 (Chapter 1&2) Prepared by Abraam Fahmy & Amany FayekabraamAinda não há avaliações

- The Investor's Dilemma Decoded: Recognize Misinformation, Filter the Noise, and Reach Your GoalsNo EverandThe Investor's Dilemma Decoded: Recognize Misinformation, Filter the Noise, and Reach Your GoalsAinda não há avaliações

- Discrete Wavelet Transform: A Signal Processing ApproachNo EverandDiscrete Wavelet Transform: A Signal Processing ApproachNota: 5 de 5 estrelas5/5 (2)

- Flat Panel Display ManufacturingNo EverandFlat Panel Display ManufacturingJun SoukAinda não há avaliações

- Physics and Technology of Crystalline Oxide Semiconductor CAAC-IGZO: Application to DisplaysNo EverandPhysics and Technology of Crystalline Oxide Semiconductor CAAC-IGZO: Application to DisplaysAinda não há avaliações

- Multicore DSP: From Algorithms to Real-time Implementation on the TMS320C66x SoCNo EverandMulticore DSP: From Algorithms to Real-time Implementation on the TMS320C66x SoCAinda não há avaliações

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsNo EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsAinda não há avaliações

- Models for Life: An Introduction to Discrete Mathematical Modeling with Microsoft Office ExcelNo EverandModels for Life: An Introduction to Discrete Mathematical Modeling with Microsoft Office ExcelAinda não há avaliações

- Location Strategies and Value Creation of International Mergers and AcquisitionsNo EverandLocation Strategies and Value Creation of International Mergers and AcquisitionsAinda não há avaliações

- Project WorkDocumento83 páginasProject Worknagamohan22Ainda não há avaliações

- Client Assistance ScheduleDocumento9 páginasClient Assistance SchedulesefanitAinda não há avaliações

- Latihan Soal AF 2Documento11 páginasLatihan Soal AF 2Reza MuhammadAinda não há avaliações

- Equity Share and Its TypesDocumento4 páginasEquity Share and Its TypeslakshmibabymaniAinda não há avaliações

- YatharthDocumento8 páginasYatharthCp918315Ainda não há avaliações

- NEDFi Project Financing GuideDocumento3 páginasNEDFi Project Financing GuideangelsrivastavaAinda não há avaliações

- Pdfcoffee - FABM2: Business and Marketing (AMA Computer University)Documento43 páginasPdfcoffee - FABM2: Business and Marketing (AMA Computer University)Dexter Alvaro GarciaAinda não há avaliações

- Annual Report: Crown Energy Ab (Publ)Documento25 páginasAnnual Report: Crown Energy Ab (Publ)Prateek PandeyAinda não há avaliações

- Alliance 2019Documento364 páginasAlliance 2019Bill LyeAinda não há avaliações

- Entrepreneurship: Chapter Four: From The Business Plan To Funding The VentureDocumento6 páginasEntrepreneurship: Chapter Four: From The Business Plan To Funding The VentureScarlet TaverioAinda não há avaliações

- Model Solutions: Cma December, 2020 Examination Professional Level - I Subject: 101. Intermediate Financial AccountingDocumento7 páginasModel Solutions: Cma December, 2020 Examination Professional Level - I Subject: 101. Intermediate Financial AccountingTaslima AktarAinda não há avaliações

- E-Portfolio (PAS 1)Documento6 páginasE-Portfolio (PAS 1)Kaye NaranjoAinda não há avaliações

- Prospective Analysis - ForecastingDocumento17 páginasProspective Analysis - ForecastingqueenbeeastAinda não há avaliações

- About Financial Account V2 PDFDocumento465 páginasAbout Financial Account V2 PDFStar69 Stay schemin2100% (1)

- Name of The Business: Egreen Shop Nature of Business: Online Grossary ShopDocumento7 páginasName of The Business: Egreen Shop Nature of Business: Online Grossary ShopShakil AhsanAinda não há avaliações

- Gunkul Engineering's Strictly Private & Confidential Presentation on Renewable Energy GrowthDocumento41 páginasGunkul Engineering's Strictly Private & Confidential Presentation on Renewable Energy GrowthvishansAinda não há avaliações

- Shareholders EquityDocumento6 páginasShareholders EquityLhea VillanuevaAinda não há avaliações

- Cash Flow Statement for 2016 and 2017Documento2 páginasCash Flow Statement for 2016 and 2017AnikaAinda não há avaliações

- Entrepreneurship The Art Science and Process For Success 2nd Edition Bamford Solutions Manual DownloadDocumento39 páginasEntrepreneurship The Art Science and Process For Success 2nd Edition Bamford Solutions Manual DownloadRyan Barrett100% (19)

- Preview of Chapter 17: ACCT2110 Intermediate Accounting II Weeks 8 & 9Documento91 páginasPreview of Chapter 17: ACCT2110 Intermediate Accounting II Weeks 8 & 9Chi IuvianamoAinda não há avaliações

- Day 6 P2 MockDocumento8 páginasDay 6 P2 MockAbdul HaseebAinda não há avaliações

- WILCON Business Case Written ReportDocumento15 páginasWILCON Business Case Written ReportjeffreytoledoAinda não há avaliações

- ECN 102 (8), Introduction To Money and BankingDocumento33 páginasECN 102 (8), Introduction To Money and BankingArleen Joy Cuevas Bito-onAinda não há avaliações

- 1 Significant AccountsDocumento15 páginas1 Significant AccountsPat TabujaraAinda não há avaliações